UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT

OF 1934

Date of Report (Date of earliest event reported):

December 1, 2023

RF ACQUISITION CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41332 |

|

61-1991323 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

111 Somerset, #05-06

Singapore 238164

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: +65 6904 0766

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on

which registered |

| Units, each consisting of one share of Class A Common Stock, one redeemable warrant, and one right to receive one-tenth of one share of Class A Common Stock |

|

RFACU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Share of Class A Common Stock, par value $0.0001 per share |

|

RFAC |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

RFACW |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Rights, each right receives one-tenth of one share of Class A Common Stock |

|

RFACR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement

Amendment to Merger Agreement

As

previously disclosed in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”)

on October 23, 2023, RF Acquisition Corp., a Delaware corporation (“SPAC”) entered into an agreement and

plan of merger, dated October 18, 2023, (as it may be amended, supplemented or otherwise modified from time to time, the “Merger

Agreement”) with GCL Global Holdings Ltd, a Cayman Islands exempted company (“PubCo”), Grand Centrex Limited,

a British Virgin Islands business company (“GCL BVI”), GCL Global Limited, a Cayman Islands exempted company limited

by shares (“GCL Global” or the “Company”), and, for the limited purposes set forth therein, RF Dynamic

LLC, a Delaware limited liability company (the “Sponsor”).

On

December 1, 2023, the parties to the Merger Agreement entered into that certain First Amendment to Merger Agreement (the “Amendment”)

pursuant to which the parties agreed to amend certain defined terms, including but not limited to the definition of “Restructuring”,

included in the Merger Agreement.

The

foregoing description of the Amendment is not complete and is subject to and qualified in its entirety by reference to the Amendment,

a copy of which is filed with this Current Report on Form 8-K as Exhibit 2.1, and the terms of which are incorporated by reference

herein.

Important Information for Investors and Shareholders

This document relates to a

proposed transaction among SPAC, PubCo and the Company. This document does not constitute an offer to sell or exchange, or the solicitation

of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale

or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. PubCo intends

to file a registration statement on Form F-4 with the SEC, which will include a document that serves as a prospectus and proxy statement,

referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all SPAC Shareholders. SPAC and PubCo also will

file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders

of SPAC are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will

be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information

about the proposed transaction.

Investors and security holders

will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed

or that will be filed with the SEC by SPAC through the website maintained by the SEC at www.sec.gov.

Participants in the Solicitation

SPAC, PubCo, the Company and

their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from SPAC’s stockholders

in connection with the proposed transaction. A list of the names of the respective directors and executive officers of SPAC, PubCo and

the Company, and information regarding their interests in the business combination, will be contained in the proxy statement/prospectus

when available. You may obtain free copies of these documents as described in the preceding paragraph.

This communication does not

constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall

there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of such other jurisdiction.

Forward-Looking Statements

All statements contained in

this Current Report on Form 8-K other than statements of historical facts, contain certain statements that are forward-looking statements.

Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target,” “continue,” “may” or other similar expressions that predict or indicate

future events or trends or that are not statements of historical matters, but the absence of these words does not mean a statement is

not forward looking. Indications of, and guidance or outlook on, future earnings, dividends or financial position or performance are also

forward-looking statements.

These forward-looking statements

involve significant risks and uncertainties that could cause the actual results to differ materially, and potentially adversely, from

those expressed or implied in the forward-looking statements. Forward-looking statements are predictions, projections and other statements

about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Most

of these factors are outside SPAC’s and the Company’s control and are difficult to predict. Factors that may cause such differences

include, but are not limited to: (i) the occurrence of any event, change, or other circumstances that could give rise to the termination

of the Merger Agreement; (ii) the outcome of any legal proceedings that may be instituted against SPAC and/or the Company following

the announcement of the Merger Agreement and the transactions; (iii) the inability to complete the proposed transactions, including

due to failure to obtain approval of the stockholders of SPAC, certain regulatory approvals, or the satisfaction of other conditions to

Closing in the Merger Agreement; (iv) the occurrence of any event, change, or other circumstance that could give rise to the termination

of the Merger Agreement or could otherwise cause the transaction to fail to close; (v) the inability to maintain the listing of SPAC

shares on the Nasdaq Stock Market following the proposed transactions; (vi) the risk that the proposed transactions disrupt the Company’s

current plans and operations as a result of the announcement and consummation of the proposed transactions; (vii) the ability to

recognize the anticipated benefits of the proposed transactions, which may be affected by, among other things, competition, the ability

of the Company to grow and manage growth profitably, and the ability of the Company to retain its key employees; (viii) costs related

to the proposed transactions; (ix) changes in applicable laws or regulations; and (x) the possibility that the Company or SPAC

may be adversely affected by other economic, business, and/or competitive factors. The foregoing list of factors is not exclusive. Additional

information concerning certain of these and other risk factors is included under the heading “Risk Factors” in the Registration

Statement to be filed by PubCo with the SEC and those included under the heading “Risk Factors” in SPAC’s Annual Report

on Form 10-K filed with the SEC on April 26, 2023, and the Quarterly Reports on Form 10-Q filed with the SEC on May 26,

2023, August 23, 2023 and November 14, 2023, respectively. These filings identify and address other important risks and uncertainties

that could cause actual events and results to differ materially from those contained herein. All subsequent written and oral forward-looking

statements concerning SPAC, PubCo and the Company, the transactions or other matters attributable to SPAC, PubCo, the Company or any person

acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place

undue reliance upon any forward-looking statements, which speak only as of the date made. Each of SPAC, PubCo and the Company expressly

disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein

to reflect any change in their expectations with respect thereto or any change in events, conditions, or circumstances on which any statement

is based, except as required by law.

Item 9.01 Exhibits.

* Certain exhibits and schedules to this Exhibit have been omitted

in accordance with Regulation S-K Item 601(b)(2). SPAC agrees to furnish supplementally a copy of all omitted exhibits and schedules to

the SEC upon its request.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| StoneBridge Acquisition Corporation |

|

| |

|

| By: |

/s/ Tse Meng Ng |

|

| Name: |

Tse Meng Ng |

|

| Title: |

Chief Executive Officer |

|

Date: December 7, 2023

Exhibit 2.1

FIRST

Amendment to Merger Agreement

This FIRST Amendment

to Merger Agreement (this “Amendment”), dated as of December 1, 2023, is entered into by and among (i) RF

Acquisition Corp., a Delaware corporation (“SPAC”), (ii) GCL Global Holdings LTD, a Cayman Islands exempted company

limited by shares (“PubCo”), (iii) Grand Centrex Limited, a British Virgin Islands business company (“GCL

BVI”), (iv) GCL Global Limited, a Cayman Islands exempted company limited by shares (“GCL Global”) and

(v) for the limited purposes set forth herein, RF Dynamic LLC, a Delaware limited liability company (the “Sponsor”).

RECITALS

WHEREAS, SPAC, PubCo, GCL

BVI, GCL Global and Sponsor entered into that certain Agreement and Plan of Merger dated as of October 18, 2023 (the “Merger

Agreement”); and

WHEREAS, in accordance with

Section 11.11 of the Merger Agreement, the parties hereto wish to make certain amendments to the Merger Agreement as set forth in

this Amendment.

NOW, THEREFORE, in consideration

of the premises, the mutual covenants set forth herein, and for other good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Definitions.

Capitalized terms used herein and not otherwise defined herein shall have the meaning ascribed to them in the Merger Agreement.

2. Amendment

to Section 1.1 of the Merger Agreement. The following definitions in Section 1.1 of the Merger Agreement are hereby deleted

and replaced with the following:

“Group Subsidiaries”

means (a) Titan Digital Media Pte. Ltd., a Singapore company (“Titan SG”), (b) Epicsoft Hong Kong Limited,

a Hong Kong company (“Epic HK”), (c) Epicsoft Malaysia Sdn. Bhd., a Malaysia company (“Epic MY”),

(d) Epicsoft Asia Pte. Ltd., a Singapore company (“Epic SG”), (e) 4Divinity Pte. Ltd. (“4Divinity

SG”), a Singapore company, (f) 2Game Digital Limited, a Hong Kong company (“2Game HK”), (g) Starry

Jewelry Pte Ltd., a Singapore company (“Starry Jewelry”), (h) Martiangear Pte Ltd., a Singapore company (“Martiangear”)

and (i) 2 Game Pro Ltda (“2Game Pro”), a Brazilian company.

“Restructuring” means

a sequential two-step transaction involving (a) sale by GCL BVI of all its equity interests in GCL Global SG (representing 100% of

the total issued and outstanding shares of GCL Global SG) to GCL Global in return for GCL Global shares being issued to the GCL Shareholders

(defined below), resulting in (i) GCL Global SG (which in turn holds equity interests in the Group Subsidiaries, except for Epic

MY, as depicted on Annex I attached hereto) becoming a wholly-owned subsidiary of GCL Global; and (ii) GCL Shareholders holding all

issued and outstanding shares in GCL Global; and (b) sale by GCL BVI shareholders holding a total of 99.8% of the total outstanding

shares of GCL BVI (“GCL Shareholders”) of their equity interests in GCL BVI to GCL Global, resulting in GCL BVI (which in

turn holds 100% of the total issued and outstanding shares of Epic MY) becoming a 99.8%-owned subsidiary of GCL Global.”

3. Amendment

to Annex I. “Annex I – Restructuring Diagram” attached to the Merger Agreement is hereby deleted and replaced with

Annex I hereto.

4. No

Other Amendments; Effect of Amendment. Except for the amendments expressly set forth in this Amendment, the Merger Agreement shall

remain unchanged and in full force and effect. This Amendment shall form a part of the Merger Agreement for all purposes, and the parties

thereto and hereto shall be bound hereby. From and after the execution of this Amendment by the parties hereto, any reference to the Merger

Agreement shall be deemed a reference to the Merger Agreement as amended hereby. This Amendment shall be deemed to be in full force and

effect from and after the execution of this Amendment by the parties hereto.

5. Further

Assurance. Each party hereto shall execute and deliver such documents and take such action, as may reasonably be considered within

the scope of such party’s obligations hereunder, necessary to effectuate the transactions and matters contemplated by this Amendment.

6. Miscellaneous.

Sections 11.1, 11.7, 11.13, 11.14, 11.15 and 11.16 of the Merger Agreement shall apply, mutatis mutandis, to this Amendment.

[The remainder of this page intentionally

left blank; signature pages to follow]

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be duly executed as of the day and year first above written.

| |

“SPAC” |

| |

|

| |

RF ACQUISITION CORP. |

| |

|

| |

By: |

/s/ Tse Meng Ng |

| |

|

Name: Tse Meng Ng |

| |

|

Title: Chief Executive Officer |

| |

|

| |

“SPONSOR” |

| |

|

| |

RF DYNAMIC LLC. |

| |

|

| |

By: |

/s/ Tse Meng Ng |

| |

|

Name: Tse Meng Ng |

| |

|

Title: Manager |

Signature Page to First Amendment to Merger

Agreement

| |

“PUBCO” |

| |

|

| |

GCL GLOBAL HOLDINGS LTD |

| |

|

| |

By: |

/s/ Choo See Wee |

| |

|

Name: Choo See Wee |

| |

|

Title: Director |

| |

|

| |

“GCL BVI” |

| |

|

| |

GRAND CENTREX LIMITED |

| |

|

| |

By: |

/s/ Choo See Wee |

| |

|

Name: Choo See Wee |

| |

|

Title: Director |

| |

|

| |

“GCL GLOBAL” |

| |

|

| |

GCL GLOBAL LIMITED |

| |

|

| |

By: |

/s/ Choo See Wee |

| |

|

Name: Choo See Wee |

| |

|

Title: Director |

Signature Page to First Amendment to Merger

Agreement

Annex I

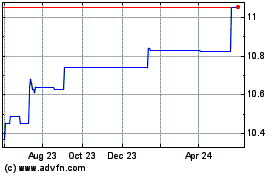

RF Acquisition (NASDAQ:RFACU)

Historical Stock Chart

From Nov 2024 to Dec 2024

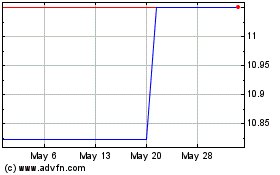

RF Acquisition (NASDAQ:RFACU)

Historical Stock Chart

From Dec 2023 to Dec 2024