RCI Hospitality Holdings, Inc. (Nasdaq: RICK) today reported

results for the fiscal 2025 first quarter ended December 31, 2024.

The Company also filed its Form 10-Q today.

Summary Financials (in millions, except

EPS)

1Q25

1Q24

Total revenues

$71.5

$73.9

EPS

$1.01

$0.77

Non-GAAP EPS1

$0.80

$0.87

Other gains, net

$(2.2)

$0.0

Net cash provided by operating

activities

$13.3

$13.6

Free cash flow1

$12.1

$12.7

Net income attributable to RCIHH common

stockholders

$9.0

$7.2

Adjusted EBITDA1

$15.7

$17.5

Weighted average shares used in computing

EPS – basic and diluted

8.92

9.37

1 See “Non-GAAP Financial Measures”

below.

1Q25 Summary (Comparisons are to the year-ago period

unless indicated otherwise)

Eric Langan, President and CEO, said: "Nightclubs total and

same-store sales increased, while GAAP and non-GAAP segment

operating profit were approximately level with last year, despite

the absence of a club due to fire in July. Bombshells total sales

declined as expected with the sale/closure of underperforming

locations, but GAAP and non-GAAP segment operating profit and

margin improved. Consolidated net cash provided by operating

activities and free cash flow nearly matched year-ago levels, and

we continued to make progress with our Back to Basics 5-Year

Capital Allocation Plan."

Back to Basics 5-Year Capital Allocation Plan

(FY25-29)

- 1Q25: Sale/closure of four underperforming Bombshells segment

locations, for a total of five since September 2024.

- 1Q25: Repurchased 66,000 common shares for $3.2 million ($48.76

average per share), with 8,889,000 shares outstanding at December

31, 2024.

- 2Q25: Acquired Flight Club, the premier gentlemen's club in the

Detroit market ($8.0 million for the club and $3.0 million for the

real estate). The location is expected to generate an estimated

$2.0 million in annualized EBITDA.

- 2Q25: Opened an 8,500 square-foot Bombshells in downtown

Denver.

X Spaces Conference Call at 4:30 PM ET Today

- Hosted by RCI President and CEO Eric Langan, CFO Bradley Chhay,

and Mark Moran of Equity Animal.

- Call link: https://x.com/i/spaces/1zqKVjQVzjLKB (X log in

required).

- Presentation link:

https://www.rcihospitality.com/investor-relations/.

- To ask questions: Participants must join the X Space using a

mobile device.

- To listen only: Participants can access the X Space from a

computer.

- There will be no other types of telephone or webcast

access.

1Q25 Results (Comparisons are to the year-ago period

unless indicated otherwise)

Nightclubs segment: Revenues of $61.7 million increased

by 1.1%. Sales primarily reflected a 3.7% increase in same-store

sales, three new and reformatted clubs in Texas, and the absence of

Baby Dolls Fort Worth due to fire in July.2 By type of revenue,

food, merchandise and other increased by 8.6%; alcoholic beverages

increased by 3.0%; and service declined by 3.7%.

The quarter included a gain of $1.0 million from additional cash

insurance proceeds related to the July fire. Operating income was

$20.9 million (33.8% of segment revenues) compared to $20.4 million

(33.4%). Non-GAAP operating income, which does not include the

gain, was $20.6 million (33.4% of segment revenues) compared to

$21.0 million (34.3%).

Bombshells segment: Revenues of $9.6 million declined

24.7%. Sales primarily reflected the sale/closure of

underperforming locations, a 7.5% decline in SSS, and a full

quarter of the Stafford, TX location, which opened in mid-November

2023.2

The quarter included a gain of $1.3 million for a Bombshells

that was sold. Operating income was $2.0 million (20.6% of segment

revenues) compared to $86,000 (0.7%). Non-GAAP operating income,

which does not include the gain, was $642,000 (6.7% of segment

revenues) compared to $149,000 (1.2%).

Corporate segment: Expenses totaled $8.8 million (12.3%

of total revenues) compared to $7.1 million (9.6%). Non-GAAP

expenses totaled $8.4 million (11.7% of total revenues) compared to

$6.6 million (9.0%). The increase reflected an expense of

approximately $1.7 million to establish a self-insurance

reserve.

Other gains, net of $2.2 million within

consolidated operations included the fire insurance proceeds and

the gain on sale as discussed in the Nightclubs and Bombshells

paragraphs above, respectively.

Income tax expense was $1.85 million compared to $1.80

million. The effective tax rate was 16.9% compared to 19.9%.

Weighted average shares outstanding of 8.92 million

decreased 4.8% due to share buybacks.

Debt was $235.5 million at December 31, 2024, compared to

$238.2 million at September 30, 2024. The difference primarily

reflected scheduled pay downs.

2 See our January 8, 2025, news release on 1Q25 sales for more

details.

Non-GAAP Financial Measures

In addition to our financial information presented in accordance

with GAAP, management uses certain non-GAAP financial measures,

within the meaning of the SEC Regulation G, to clarify and enhance

understanding of past performance and prospects for the future.

Generally, a non-GAAP financial measure is a numerical measure of a

company’s operating performance, financial position or cash flows

that excludes or includes amounts that are included in or excluded

from the most directly comparable measure calculated and presented

in accordance with GAAP. We monitor non-GAAP financial measures

because it describes the operating performance of the Company and

helps management and investors gauge our ability to generate cash

flow, excluding (or including) some items that management believes

are not representative of the ongoing business operations of the

Company, but are included in (or excluded from) the most directly

comparable measures calculated and presented in accordance with

GAAP. Relative to each of the non-GAAP financial measures, we

further set forth our rationale as follows:

Non-GAAP Operating Income and Non-GAAP Operating Margin. We

calculate non-GAAP operating income and non-GAAP operating margin

by excluding the following items from income from operations and

operating margin: (a) amortization of intangibles, (b) settlement

of lawsuits, (c) gains or losses on sale of businesses and assets,

(d) gains or losses on insurance, and (e) stock-based compensation.

We believe that excluding these items assists investors in

evaluating period-over-period changes in our operating income and

operating margin without the impact of items that are not a result

of our day-to-day business and operations.

Non-GAAP Net Income and Non-GAAP Net Income per Diluted Share.

We calculate non-GAAP net income and non-GAAP net income per

diluted share by excluding or including certain items to net income

or loss attributable to RCIHH common stockholders and diluted

earnings per share. Adjustment items are: (a) amortization of

intangibles, (b) settlement of lawsuits, (c) gains or losses on

sale of businesses and assets, (d) gains or losses on insurance,

(e) stock-based compensation, (f) gains or losses on lease

termination, and (g) the income tax effect of the above-described

adjustments. Included in the income tax effect of the above

adjustments is the net effect of the non-GAAP provision for income

taxes, calculated at 17.7% and 19.9% effective tax rate of the

pre-tax non-GAAP income before taxes for the three months ended

December 31, 2024, and 2023, respectively, and the GAAP income tax

expense (benefit). We believe that excluding and including such

items help management and investors better understand our operating

activities.

Adjusted EBITDA. We calculate adjusted EBITDA by excluding the

following items from net income or loss attributable to RCIHH

common stockholders: (a) depreciation and amortization, (b) income

tax expense, (c) net interest expense, (d) settlement of lawsuits,

(e) gains or losses on sale of businesses and assets, (f) gains or

losses on insurance, (g) stock-based compensation, and (h) gains or

losses on lease termination. We believe that adjusting for such

items helps management and investors better understand our

operating activities. Adjusted EBITDA provides a core operational

performance measurement that compares results without the need to

adjust for federal, state and local taxes which have considerable

variation between domestic jurisdictions. The results are,

therefore, without consideration of financing alternatives of

capital employed. We use adjusted EBITDA as one guideline to assess

our unleveraged performance return on our investments. Adjusted

EBITDA is also the target benchmark for our acquisitions of

nightclubs.

We also use certain non-GAAP cash flow measures such as free

cash flow. Free cash flow is derived from net cash provided by

operating activities less maintenance capital expenditures. We use

free cash flow as the baseline for the implementation of our

capital allocation strategy.

About RCI Hospitality Holdings, Inc. (Nasdaq: RICK) (X:

@RCIHHinc)

With more than 60 locations, RCI Hospitality Holdings, Inc.,

through its subsidiaries, is the country’s leading company in adult

nightclubs and sports bars-restaurants. See all our brands at

www.rcihospitality.com.

Forward-Looking Statements

This press release may contain forward-looking statements that

involve a number of risks and uncertainties that could cause the

Company's actual results to differ materially from those indicated,

including, but not limited to, the risks and uncertainties

associated with (i) operating and managing an adult entertainment

or restaurant business, (ii) the business climates in cities where

it operates, (iii) the success or lack thereof in launching and

building the Company's businesses, (iv) cyber security, (v)

conditions relevant to real estate transactions, and (vi) numerous

other factors such as laws governing the operation of adult

entertainment or restaurant businesses, competition and dependence

on key personnel. For more detailed discussion of such factors and

certain risks and uncertainties, see RCI's annual report on Form

10-K for the year ended September 30, 2024, as well as its other

filings with the U.S. Securities and Exchange Commission. The

Company has no obligation to update or revise the forward-looking

statements to reflect the occurrence of future events or

circumstances.

RCI HOSPITALITY HOLDINGS,

INC.

CONSOLIDATED STATEMENTS OF

INCOME

(in thousands, except per share,

number of shares, and percentage data)

For the Three Months

Ended

December 31, 2024

December 31, 2023

Amount

% of Revenue

Amount

% of Revenue

Revenues

Sales of alcoholic beverages

$

32,188

45.0

%

$

33,316

45.1

%

Sales of food and merchandise

10,106

14.1

%

10,802

14.6

%

Service revenues

24,181

33.8

%

25,119

34.0

%

Other

5,008

7.0

%

4,670

6.3

%

Total revenues

71,483

100.0

%

73,907

100.0

%

Operating expenses

Cost of goods sold

Alcoholic beverages sold

5,846

18.2

%

6,281

18.9

%

Food and merchandise sold

3,563

35.3

%

4,038

37.4

%

Service and other

72

0.2

%

40

0.1

%

Total cost of goods sold (exclusive of

items shown below)

9,481

13.3

%

10,359

14.0

%

Salaries and wages

20,564

28.8

%

21,332

28.9

%

Selling, general and administrative

26,207

36.7

%

25,201

34.1

%

Depreciation and amortization

3,569

5.0

%

3,853

5.2

%

Other gains, net

(2,244

)

(3.1

)%

(3

)

—

%

Total operating expenses

57,577

80.5

%

60,742

82.2

%

Income from operations

13,906

19.5

%

13,165

17.8

%

Other income (expenses)

Interest expense

(4,152

)

(5.8

)%

(4,216

)

(5.7

)%

Interest income

179

0.3

%

94

0.1

%

Gain on lease termination

979

1.4

%

—

—

%

Income before income taxes

10,912

15.3

%

9,043

12.2

%

Income tax expense

1,847

2.6

%

1,799

2.4

%

Net income

9,065

12.7

%

7,244

9.8

%

Net income attributable to noncontrolling

interests

(41

)

(0.1

)%

(18

)

—

%

Net income attributable to RCIHH common

shareholders

$

9,024

12.6

%

$

7,226

9.8

%

Earnings per share

Basic and diluted

$

1.01

$

0.77

Weighted average shares used in computing

earnings per share

Basic and diluted

8,920,774

9,367,151

RCI HOSPITALITY HOLDINGS,

INC.

SEGMENT INFORMATION

(in thousands)

For the Three Months

Ended

December 31, 2024

December 31, 2023

Revenues

Nightclubs

$

61,724

$

61,033

Bombshells

9,587

12,731

Other

172

143

$

71,483

$

73,907

Income (loss) from operations

Nightclubs

$

20,882

$

20,369

Bombshells

1,971

86

Other

(171

)

(196

)

Corporate

(8,776

)

(7,094

)

$

13,906

$

13,165

RCI HOSPITALITY HOLDINGS,

INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

For the Three Months

Ended

December 31, 2024

December 31, 2023

CASH FLOWS FROM OPERATING ACTIVITIES

Net income

$

9,065

$

7,244

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

3,569

3,853

Deferred income tax benefit

(389

)

—

Gain on sale of businesses and assets

(1,463

)

(3

)

Amortization and writeoff of debt discount

and issuance costs

63

163

Doubtful accounts expense on notes

receivable

—

22

Gain on insurance

(1,150

)

—

Noncash lease expense

658

762

Stock-based compensation

470

470

Changes in operating assets and

liabilities, net of business acquisitions:

Receivables

2,373

1,229

Inventories

(4

)

(218

)

Prepaid expenses, other current, and other

assets

(598

)

(9,029

)

Accounts payable, accrued, and other

liabilities

750

9,140

Net cash provided by operating

activities

13,344

13,633

CASH FLOWS FROM INVESTING ACTIVITIES

Proceeds from sale of businesses and

assets

129

—

Proceeds from insurance

1,150

—

Proceeds from notes receivable

71

55

Payments for property and equipment and

intangible assets

(5,754

)

(5,135

)

Net cash used in investing activities

(4,404

)

(5,080

)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from debt obligations

2,963

701

Payments on debt obligations

(5,694

)

(6,352

)

Purchase of treasury stock

(3,218

)

(2,072

)

Payment of dividends

(623

)

(562

)

Payment of loan origination costs

—

(136

)

Net cash used in financing activities

(6,572

)

(8,421

)

NET INCREASE IN CASH AND CASH

EQUIVALENTS

2,368

132

CASH AND CASH EQUIVALENTS AT BEGINNING OF

PERIOD

32,350

21,023

CASH AND CASH EQUIVALENTS AT END OF

PERIOD

$

34,718

$

21,155

RCI HOSPITALITY HOLDINGS,

INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands)

December 31, 2024

September 30, 2024

ASSETS

Current assets

Cash and cash equivalents

$

34,718

$

32,350

Receivables, net

3,519

5,832

Inventories

4,640

4,676

Prepaid expenses and other current

assets

4,226

4,427

Total current assets

47,103

47,285

Property and equipment, net

282,621

280,075

Operating lease right-of-use assets,

net

25,573

26,231

Notes receivable, net of current

portion

4,103

4,174

Goodwill

61,911

61,911

Intangibles, net

162,881

163,461

Other assets

2,026

1,227

Total assets

$

586,218

$

584,364

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

$

5,010

$

5,637

Accrued liabilities

20,514

20,280

Current portion of debt obligations,

net

17,788

18,871

Current portion of operating lease

liabilities

3,008

3,290

Total current liabilities

46,320

48,078

Deferred tax liability, net

22,304

22,693

Debt, net of current portion and debt

discount and issuance costs

217,741

219,326

Operating lease liabilities, net of

current portion

27,471

30,759

Other long-term liabilities

3,611

398

Total liabilities

317,447

321,254

Commitments and contingencies

Equity

Preferred stock

—

—

Common stock

89

90

Additional paid-in capital

58,731

61,511

Retained earnings

210,160

201,759

Total RCIHH stockholders' equity

268,980

263,360

Noncontrolling interests

(209

)

(250

)

Total equity

268,771

263,110

Total liabilities and equity

$

586,218

$

584,364

RCI HOSPITALITY HOLDINGS,

INC.

NON-GAAP FINANCIAL

MEASURES

(in thousands, except per share

and percentage data)

For the Three Months

Ended

December 31, 2024

December 31, 2023

Reconciliation of GAAP net income to

Adjusted EBITDA

Net income attributable to RCIHH common

stockholders

$

9,024

$

7,226

Income tax expense (benefit)

1,847

1,799

Interest expense, net

3,973

4,122

Depreciation and amortization

3,569

3,853

Settlement of lawsuits

179

—

Gain on sale of businesses and assets

(1,406

)

(3

)

Gain on insurance

(1,017

)

—

Stock-based compensation

470

470

Gain on lease termination

(979

)

—

Adjusted EBITDA

$

15,660

$

17,467

Reconciliation of GAAP net income to

non-GAAP net income

Net income attributable to RCIHH common

stockholders

$

9,024

$

7,226

Amortization of intangibles

580

659

Settlement of lawsuits

179

—

Stock-based compensation

470

470

Gain on sale of businesses and assets

(1,406

)

(3

)

Gain on insurance

(1,017

)

—

Gain on lease termination

(979

)

—

Net income tax effect

310

(220

)

Non-GAAP net income

$

7,161

$

8,132

Reconciliation of GAAP diluted earnings

per share to non-GAAP diluted earnings per share

Diluted shares

8,920,774

9,367,151

GAAP diluted earnings per share

$

1.01

$

0.77

Amortization of intangibles

0.07

0.07

Settlement of lawsuits

0.02

0.00

Stock-based compensation

0.05

0.05

Gain on sale of businesses and assets

(0.16

)

0.00

Gain on insurance

(0.11

)

0.00

Gain on lease termination

(0.11

)

0.00

Net income tax effect

0.03

(0.02

)

Non-GAAP diluted earnings per share

$

0.80

$

0.87

Reconciliation of GAAP operating income

to non-GAAP operating income

Income from operations

$

13,906

$

13,165

Amortization of intangibles

580

659

Settlement of lawsuits

179

—

Stock-based compensation

470

470

Gain on sale of businesses and assets

(1,406

)

(3

)

Gain on insurance

(1,017

)

—

Non-GAAP operating income

$

12,712

$

14,291

Reconciliation of GAAP operating margin

to non-GAAP operating margin

GAAP operating margin

19.5

%

17.8

%

Amortization of intangibles

0.8

%

0.9

%

Settlement of lawsuits

0.3

%

0.0

%

Stock-based compensation

0.7

%

0.6

%

Gain on sale of businesses and assets

(2.0

)%

0.0

%

Gain on insurance

(1.4

)%

0.0

%

Non-GAAP operating margin

17.8

%

19.3

%

Reconciliation of net cash provided by

operating activities to free cash flow

Net cash provided by operating

activities

$

13,344

$

13,633

Less: Maintenance capital expenditures

1,276

983

Free cash flow

$

12,068

$

12,650

RCI HOSPITALITY HOLDINGS,

INC.

NON-GAAP SEGMENT

INFORMATION

($ in thousands)

For the Three Months Ended

December 31, 2024

Nightclubs

Bombshells

Other

Corporate

Total

Income (loss) from operations

$

20,882

$

1,971

$

(171

)

$

(8,776

)

$

13,906

Amortization of intangibles

574

1

—

5

580

Settlement of lawsuits

179

—

—

—

179

Stock-based compensation

—

—

—

470

470

Loss (gain) on sale of businesses and

assets

16

(1,330

)

—

(92

)

(1,406

)

Gain on insurance

(1,017

)

—

—

—

(1,017

)

Non-GAAP operating income (loss)

$

20,634

$

642

$

(171

)

$

(8,393

)

$

12,712

GAAP operating margin

33.8

%

20.6

%

(99.4

)%

(12.3

)%

19.5

%

Non-GAAP operating margin

33.4

%

6.7

%

(99.4

)%

(11.7

)%

17.8

%

For the Three Months Ended

December 31, 2023

Nightclubs

Bombshells

Other

Corporate

Total

Income (loss) from operations

$

20,369

$

86

$

(196

)

$

(7,094

)

$

13,165

Amortization of intangibles

591

63

—

5

659

Stock-based compensation

—

—

—

470

470

Gain on sale of businesses and assets

(1

)

—

—

(2

)

(3

)

Non-GAAP operating income (loss)

$

20,959

$

149

$

(196

)

$

(6,621

)

$

14,291

GAAP operating margin

33.4

%

0.7

%

(137.1

)%

(9.6

)%

17.8

%

Non-GAAP operating margin

34.3

%

1.2

%

(137.1

)%

(9.0

)%

19.3

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250208891367/en/

Media & Investor Contacts Gary Fishman and Steven

Anreder at 212-532-3232 or gary.fishman@anreder.com and

steven.anreder@anreder.com.

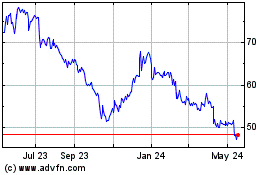

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Jan 2025 to Feb 2025

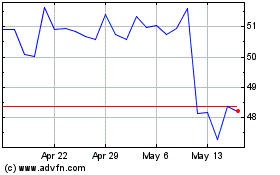

RCI Hospitality (NASDAQ:RICK)

Historical Stock Chart

From Feb 2024 to Feb 2025