ReShape Lifesciences Inc. (Nasdaq:

RSLS), the premier physician-led weight loss and metabolic

health-solutions company, and Vyome Therapeutics, Inc. (“Vyome”), a

private clinical-stage company targeting immuno-inflammatory and

rare diseases, today provided an update on the definitive merger

agreement under which ReShape and Vyome will combine in an

all-stock transaction. The combined company will focus on advancing

the development of Vyome’s immuno-inflammatory assets and on

identifying additional opportunities between the world-class Indian

innovation corridor and the U.S. market. ReShape also provided an

update on the asset purchase agreement with Biorad Medisys.

On July 9, 2024, ReShape Lifesciences Inc.

entered into a definitive merger agreement with Vyome, under which

ReShape and Vyome will combine in an all-stock transaction. At the

closing of the merger, ReShape will be renamed Vyome Holdings, Inc.

and expects to trade under the Nasdaq ticker symbol "HIND,"

representing the company’s alignment with the U.S.-India

relationship. The board of directors of the combined company will

be comprised of six directors designated by Vyome and one director

designated by ReShape, and executive management of the combined

company will consist of Vyome’s executive officers.

Simultaneously with the execution of the merger

agreement, ReShape entered into an asset purchase agreement with

Biorad, which is party to a previously disclosed exclusive license

agreement with ReShape for ReShape’s Obalon® Gastric Balloon

System. Pursuant to the asset purchase agreement, ReShape will sell

substantially all of its assets to Biorad (or an affiliate

thereof), including ReShape’s Lap-Band® System, Obalon® Gastric

Balloon System and the Diabetes Bloc-Stim Neuromodulation™ (DBSN™)

System (but excluding cash), and Biorad will assume substantially

all of ReShape’s liabilities. The cash purchase price under the

asset purchase agreement will count toward ReShape’s net cash for

purposes of determining the post-merger ownership allocation

between ReShape and Vyome stockholders under the merger

agreement.

On October 1, 2024, ReShape filed a Form S-4

registration statement with the U.S. Securities and Exchange

Commission (SEC), for the merger with Vyome and on December 6, 2024

ReShape filed an amendment to that Form S-4 registration

statement.

On December 20, 2024, ReShape filed a Form S-1

registration statement for the previously announced Equity Line of

Credit (ELOC) with Ascent Partners Fund LLC.

“As previously reported, in July, we coordinated

a merger agreement with Vyome and a concurrent asset purchase

agreement with Biorad, successfully maximizing value for our

stockholders. Since entering into the agreement, both the ReShape

and Vyome teams have worked diligently to answer comments from the

SEC on the S-4. We are currently in the process of responding to

comments from the SEC,” stated Paul F. Hickey, President and Chief

Executive Officer of ReShape Lifesciences®. “Once the S-4 filing is

declared effective, we will set the record date for the subsequent

shareholder meeting. It is important to note that our board

unanimously recommended merging with Vyome and concurrently selling

assets to Biorad. We believe this merger will unlock significant

value for our shareholders in the newly combined entity.

Additionally, we are working to finalize the S-1 resale

registration statement for the ELOC, which is intended to provide

capital for our general operations and also expenses related to the

closing of the merger and asset purchase agreements. I am truly

excited about the value we are delivering to our stockholders and

the growth potential resulting from these transactions.”

“We believe this transaction will allow us to

unlock the full potential of Vyome’s pipeline as a publicly listed

company following the merger with ReShape, as we continue to

address the unmet needs of patients suffering from

immune-inflammatory diseases and building a broader platform that

leverages our comparative advantage in the U.S.-India innovation

corridor,” added Krishna K. Gupta, current director of Vyome and to

be appointed Chairman of the combined company. “Our vision for

Vyome is to build a world-class company leveraging the best of

talent and capital between the U.S. and India to develop new

therapies for unmet chronic immune-inflammatory conditions in a

highly-cost efficient manner. We also have a broader vision of

augmenting our portfolio along the three pillars of biopharma,

medical devices, and healthcare artificial intelligence. It is

important to note that we have no debt and a clean capital

structure, positioning Vyome for success in the public

markets.”

About Vyome Vyome Therapeutics

is building a healthcare platform spanning the US-India innovation

corridor. Vyome’s immediate focus is leveraging its clinical-stage

assets to transform the lives of patients with immune-inflammatory

conditions. By applying groundbreaking science and its unique

positioning across the US-India innovation corridor, Vyome seeks to

deliver lasting value to shareholders in a hyper cost-efficient

manner while upholding global standards of quality and safety.

Based in Cambridge, MA, the company has announced its intent to be

listed on the Nasdaq exchange under the ticker ‘HIND’ pursuant to a

reverse merger with ReShape Lifesciences Inc. (Nasdaq: RSLS) in

early 2025. To learn more, please visit www.vyometx.com.

About Biorad MedisysBiorad

Medisys Pvt. Ltd.® is a rapidly growing med-tech company dedicated

to redefining healthcare standards with precision-engineered

medical devices backed by rigorous scientific research. It operates

three business units – Indovasive, Orthovasive and Neurovasive.

Indovasive offers consumables and equipment in Urology and

Gastroenterology. The Orthovasive segment sells a complete range of

Knee and Hip implants for both Primary and Revision surgeries. It

has recently forayed into Neurovascular BU for selling a wide

portfolio of products in peripheral vascular, neurovascular and

rehabilitation segments. It has two manufacturing facilities in

India and is currently exporting to 50+ countries. To realize its

global expansion strategy, it recently acquired a Swiss based

company, Marflow, which specializes in commercialization of

products in Urology & Gastroenterology.

About ReShape Lifesciences®

ReShape Lifesciences® is America’s premier weight loss and

metabolic health-solutions company, offering an integrated

portfolio of proven products and services that manage and treat

obesity and metabolic disease. The FDA-approved Lap-Band® System

provides minimally invasive, long-term treatment of obesity and is

an alternative to more invasive surgical stapling procedures such

as the gastric bypass or sleeve gastrectomy. The investigational

Diabetes Bloc-Stim Neuromodulation™ (DBSN™) system utilizes a

proprietary vagus nerve block and stimulation technology platform

for the treatment of type 2 diabetes and metabolic disorders. The

Obalon® balloon technology is a non-surgical, swallowable,

gas-filled intra-gastric balloon that is designed to provide

long-lasting weight loss. For more information, please visit

www.reshapelifesciences.com.

Additional Information

In connection with the proposed Merger and Asset

Sale, ReShape has filed with the Securities and Exchange Commission

(the “SEC”) and plans to mail or otherwise provide to its

stockholders a joint proxy statement/prospectus and other relevant

documents. Before making a voting decision, ReShape’s stockholders

are urged to read the joint proxy statement/prospectus and any

other documents filed by ReShape with the SEC in connection with

the proposed Merger and Asset Sale or incorporated by reference

therein carefully and in their entirety when they become available

because they will contain important information about ReShape,

Vyome and the proposed transactions. Investors and stockholders may

obtain a free copy of these materials (when they are available) and

other documents filed by ReShape with the SEC at the SEC’s website

at www.sec.gov, at ReShape’s website at

www.reshapelifesciences.com, or by sending a written request to

ReShape at 18 Technology Drive, Suite 110, Irvine, California

92618, Attention: Corporate Secretary.

Participants in the Solicitation

This document does not constitute a solicitation

of proxy, an offer to purchase or a solicitation of an offer to

sell any securities of ReShape and its directors, executive

officers and certain other members of management and employees may

be deemed to be participants in soliciting proxies from its

stockholders in connection with the proposed Merger and Asset Sale.

Information regarding the persons who may, under the rules of the

SEC, be considered to be participants in the solicitation of

ReShape’s stockholders in connection with the proposed Merger and

Asset Sale will be set forth in joint proxy statement/prospectus if

and when it is filed with the SEC by ReShape and Vyome. Security

holders may obtain information regarding the names, affiliations

and interests of ReShape’s directors and officers in ReShape’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2023, which was filed with the SEC on April 1, 2024. To the extent

the holdings of ReShape securities by ReShape’s directors and

executive officers have changed since the amounts set forth in

ReShape’s proxy statement for its most recent annual meeting of

stockholders, such changes have been or will be reflected on

Statements of Change in Ownership on Form 4 filed with the SEC.

Additional information regarding these individuals and any direct

or indirect interests they may have in the proposed Merger and

Asset Sale has been set forth in the joint proxy

statement/prospectus filed with the SEC in connection with the

proposed Merger and Asset Sale, at ReShape’s website at

www.reshapelifesciences.com.

Forward-Looking Statements

Certain statements contained in this filing may

be considered forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding the Merger and Asset Sale and the ability to

consummate the Merger and Asset Sale. These forward-looking

statements generally include statements that are predictive in

nature and depend upon or refer to future events or conditions, and

include words such as “believes,” “plans,” “anticipates,”

“projects,” “estimates,” “expects,” “intends,” “strategy,”

“future,” “opportunity,” “may,” “will,” “should,” “could,”

“potential,” or similar expressions. Statements that are not

historical facts are forward-looking statements. Forward-looking

statements are based on current beliefs and assumptions that are

subject to risks and uncertainties. Forward-looking statements

speak only as of the date they are made, and ReShape undertakes no

obligation to update any of them publicly in light of new

information or future events. Actual results could differ

materially from those contained in any forward-looking statement as

a result of various factors, including, without limitation: (1)

ReShape may be unable to obtain stockholder approval as required

for the proposed Merger and Asset Sale; (2) conditions to the

closing of the Merger or Asset Sale may not be satisfied; (3) the

Merger and Asset Sale may involve unexpected costs, liabilities or

delays; (4) ReShape’s business may suffer as a result of

uncertainty surrounding the Merger and Asset Sale; (5) the outcome

of any legal proceedings related to the Merger or Asset Sale; (6)

ReShape may be adversely affected by other economic, business,

and/or competitive factors; (7) the occurrence of any event, change

or other circumstances that could give rise to the termination of

the Merger Agreement or Asset Purchase Agreement; (8) the effect of

the announcement of the Merger and Asset Purchase Agreement on the

ability of ReShape to retain key personnel and maintain

relationships with customers, suppliers and others with whom

ReShape does business, or on ReShape’s operating results and

business generally; and (9) other risks to consummation of the

Merger and Asset Sale, including the risk that the Merger and Asset

Sale will not be consummated within the expected time period or at

all. Additional factors that may affect the future results of

ReShape are set forth in its filings with the SEC, including

ReShape’s most recently filed Annual Report on Form 10-K,

subsequent Quarterly Reports on Form 10-Q, Current Reports on Form

8-K and other filings with the SEC, which are available on the

SEC’s website at www.sec.gov, specifically under the heading “Risk

Factors.” The risks and uncertainties described above and in

ReShape’s most recent Annual Report on Form 10-K are not exclusive

and further information concerning ReShape and its business,

including factors that potentially could materially affect its

business, financial condition or operating results, may emerge from

time to time. Readers are urged to consider these factors carefully

in evaluating these forward-looking statements, and not to place

undue reliance on any forward-looking statements. Readers should

also carefully review the risk factors described in other documents

that ReShape files from time to time with the SEC. The

forward-looking statements in these materials speak only as of the

date of these materials. Except as required by law, ReShape assumes

no obligation to update or revise these forward-looking statements

for any reason, even if new information becomes available in the

future.

CONTACTS:

ReShape Lifesciences

Contact: Paul

F. HickeyPresident and Chief Executive

Officer949-276-7223ir@ReShapeLifesci.com

Investor Relations Contact:Rx

Communications GroupMichael

Miller(917)-633-6086mmiller@rxir.com

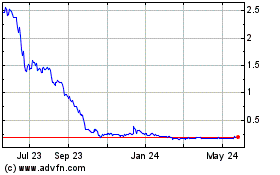

ReShape Lifesciences (NASDAQ:RSLS)

Historical Stock Chart

From Dec 2024 to Jan 2025

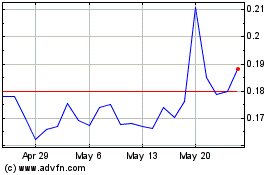

ReShape Lifesciences (NASDAQ:RSLS)

Historical Stock Chart

From Jan 2024 to Jan 2025