false

0001386301

0001386301

2024-08-19

2024-08-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report:

(Date of earliest event reported)

August 19, 2024

Research

Solutions, Inc.

(Exact name of registrant as specified in its

charter)

Nevada

(State or other Jurisdiction of Incorporation)

1-39256 |

|

11-3797644 |

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

N/A

(Address of Principal Executive

Offices and zip code)

(310)

477-0354

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each Class |

Trading Symbol(s) |

Name of each Exchange on which registered |

| Common

stock, $0.001 par value |

RSSS |

The

Nasdaq

Capital Market |

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On August 19, 2024, the Registrant

announced preliminary results for its fourth quarter and fiscal year ended June 30, 2024. A copy of the press release is being furnished

as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item

2.02 and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor

shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as

expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

RESEARCH SOLUTIONS, INC. |

| |

|

| Date: August 19, 2024 |

By: |

/s/ William Nurthen |

| |

|

William Nurthen |

| |

|

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Research Solutions Reports Preliminary Fourth

Quarter and Fiscal Year 2024 Results

Expects Record Revenue and Income from Operations,

Continued Strong Cash Flow

HENDERSON, Nev., August 19, 2024 —

Research Solutions, Inc. (NASDAQ: RSSS), a trusted partner providing cloud-based workflow solutions

to accelerate research for R&D-driven organizations, announced selected preliminary financial results for its fiscal fourth quarter

and fiscal year ended June 30, 2024.

Based on preliminary unaudited information, Research

Solutions expects the following results for its fiscal fourth quarter 2024:

| · | Total revenue to increase 22% to approximately

$12.1 million |

| · | Platform revenue to be up 86% to approximately

$4.3 million; Annual recurring revenue ("ARR") to increase approximately 85% to $17.4 million |

| · | Positive income from operations of approximately

$0.7M. The Company expects to incur a GAAP net loss in the quarter primarily due to a charge of approximately $4.3M related to increasing

its projected earn-out assumptions with respect to the Scite acquisition. |

| · | Adjusted EBITDA of approximately $1.4 million,

a 70% increase from the prior-year quarter |

| · | Cash flow from operations near $2.0 million and

ending cash balance above $6 million |

The Company also expects the following results

for the full year Fiscal 2024:

| · | Total revenue to increase 18% to approximately

$44.6 million |

| · | Platform revenue to be up 61% to approximately

$14 million |

| · | GAAP net loss of approximately $3.8 million;

Adjusted EBITDA to increase 11% to approximately $2.2 million |

| · | Cash flow from operations in excess of $3.5 million |

"Our preliminary fourth quarter and fiscal

year 2024 results reflect the strong momentum in our business, particularly within our Platforms segment. In addition, the continued growth

in Platform revenue is improving our overall gross margin, Adjusted EBITDA and cash flow," said Roy W. Olivier, President and

CEO of Research Solutions. "The early success of Scite has contributed to this performance as ARR growth for this product has exceeded

our initial expectations. For this reason, we increased our earn-out assumptions for the acquisition, as we continue to expect strong

performance as we move into our fiscal year 2025."

Research Solutions expects to report its full

fiscal fourth quarter 2024 results on September 19, 2024. Information on the conference call details will be provided in a separate

press release.

Annual Recurring Revenue

The company defines annual recurring revenue (“ARR”) as

the value of contracted Platform subscription recurring revenue normalized to a one-year period. For B2C ARR, this includes the annualized

value of monthly subscriptions, meaning their monthly value multiplied by twelve.

Use of Non-GAAP Measure – Adjusted EBITDA

Research Solutions’ management evaluates and makes operating

decisions using various financial metrics. In addition to the company’s GAAP results, management also considers the non-GAAP measure

of Adjusted EBITDA. Management believes that this non-GAAP measure provides useful information about the company’s operating results.

Adjusted EBITDA is defined as net income (loss), plus interest expense,

other income (expense), foreign currency transaction loss, provision for income taxes, depreciation and amortization, stock-based compensation,

gain on sale of discontinued operations, and other potential adjustments that may arise.

About Research Solutions

Research Solutions, Inc. (NASDAQ: RSSS) provides

cloud-based technologies to streamline the process of obtaining, managing, and creating intellectual property. Founded in 2006 as Reprints

Desk, the company was a pioneer in developing solutions to serve researchers. Today, more than 70 percent of the top pharmaceutical companies,

prestigious universities, and emerging businesses rely on Article Galaxy, the company's SaaS research platform, to streamline access to

the latest scientific research and data with 24/7 customer support. For more information and details, please visit www.researchsolutions.com

Important Cautions Regarding Forward-Looking Statements

Certain statements in this press release may contain "forward-looking

statements" regarding future events and our future results. All statements other than statements of historical facts are statements

that could be deemed to be forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections

about the markets in which we operate and the beliefs and assumptions of our management. Words such as "expects," "anticipates,"

"targets," "goals," "projects", "intends," "plans," "believes," "seeks,"

"estimates," "endeavors," "strives," "may," or variations of such words, and similar expressions

are intended to identify such forward-looking statements. Readers are cautioned that these forward-looking statements are subject to a

number of risks, uncertainties and assumptions that are difficult to predict, estimate or verify. Therefore, actual results may differ

materially and adversely from those expressed in any forward-looking statements. Such risks and uncertainties include those factors described

in the Company's most recent annual report on Form 10-K, as such may be amended or supplemented by subsequent quarterly reports on Form

10-Q, or other reports filed with the Securities and Exchange Commission. Examples of forward-looking statements in this release include

statements regarding our expected results for our fiscal fourth quarter and fiscal year ended June 30, 2024, earnout assumptions related

to acquisitions and the Company’s expected operational performance. The preliminary financial and operating results presented herein

are an estimate and subject to the completion of the Company’s financial closing and other procedures and finalization of the Company’s

consolidated financial statements for its year ended June 30, 2024, including the completion of the audit of the Company’s financial

statements. Accordingly, actual financial and operating results that will be reflected in the Company’s Annual Report on Form 10-K

for the year ended June 30, 2024, including its audited financial statements, when they are completed and publicly disclosed may differ

from these preliminary results. In addition, any statements regarding the Company’s estimated financial performance for the fourth

fiscal quarter 2024 do not present all information necessary for an understanding of the Company’s financial condition and results

of operations as of and for the quarterly period ended June 30, 2024. Although we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances

reflected in the forward-looking statements will occur. Readers are cautioned not to place undue reliance on these forward-looking statements.

The forward-looking statements are made only as of the date hereof, and the Company undertakes no obligation to publicly release the result

of any revisions to these forward-looking statements. For more information, please refer to the Company's filings with the Securities

and Exchange Commission.

Contact

Steven Hooser or John Beisler

Three Part Advisors

(214) 872-2710

shooser@threepa.com;

jbeisler@threepa.com

# # #

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

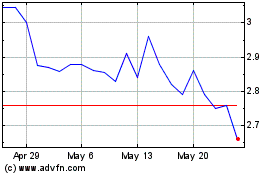

Research Solutions (NASDAQ:RSSS)

Historical Stock Chart

From Oct 2024 to Nov 2024

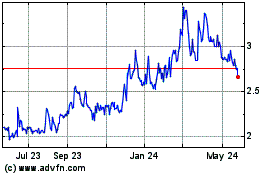

Research Solutions (NASDAQ:RSSS)

Historical Stock Chart

From Nov 2023 to Nov 2024