SpringBig Holdings, Inc. (“Springbig” or the “Company”) (OTCQX:

SBIG), a leading provider of SaaS-based marketing solutions,

consumer mobile app experiences, and omnichannel loyalty programs,

today announced its financial results for the first quarter ended

March 31, 2024.

The Company also announced that Mark Silver,

President of Optus Capital Corporation, has joined the board of

directors with effect from May 10, 2024.

“We have continued to make good progress in a

challenging macroenvironment. Our newer offerings, such as

‘subscriptions by Springbig’ and ‘gift cards by Springbig’ are

gaining traction as is our objective of diversification into

regulated markets beyond cannabis” said Jeffrey Harris, CEO and

Chairman of Springbig who also added “I am both honored and

delighted that Mark has agreed to join our board of directors. He

brings invaluable experience and acumen, particularly in the area

of sales and marketing, to the board at a time when the Company is

nicely positioned, following the recent debt financing in which

Mark participated, to accelerate our development.”

Paul Sykes, Springbig’s CFO, added “We are

pleased to be reporting a quarter with positive Adjusted EBITDA*

for the first time, and our sixth consecutive quarter of improving

Adjusted EBITDA*. After completing our $8 million debt financing in

January, we have a much stronger and cleaner balance sheet. We

continue to manage the optimization of our operating expenses,

which have reduced by 34% year-on-year and expect a continuing

positive trend in our Adjusted EBITDA* margins as the year

progresses.”

First Quarter 2023 Financial

Highlights:

- Revenue was $6.5

million, compared to $7.2 million in the prior year.

- Subscription revenue represents 83%

of total revenue at $5.4 million, compared to $5.7 million in the

prior year.

- Gross profit was $4.7 million,

representing a gross profit margin of 72%.

- Operating expenses reduced by 34%

year-on-year to $5.0 million.

- Net income was $0.4 million,

including a gain of $1.6 million on the repurchase of convertible

debt, compared to a net loss of $(2.3) million in the prior

year.

- Adjusted EBITDA* positive $0.2

million compared to a loss of $(1.3) million in the prior

year.

- Basic and diluted net income per

share was $0.01.

Key Operational Highlights:

- $8.0 million debt financing,

comprising $6.4 million 8% Convertible Notes due 2026 and a $1.6

million 12% Term Loan due 2026, both completed in January 2024. The

proceeds were utilized to repurchase entirely existing Senior

Secured Convertible Notes due 2025 for a discounted amount of $2.9

million and for general corporate purposes.

- Strong momentum in newer

initiatives with clients encompassing both “subscriptions by

Springbig”, a subscription-based VIP loyalty program, and “gift

cards by Springbig”, enabling loyalty rewards and gift cards to be

combined uniquely as an efficient method of in store payment within

a consumer’s loyalty wallet.

Financial Outlook

For the second quarter of 2024, Springbig

currently expects:

- Revenue in the

range of $6.5 - $7.0 million.

- Adjusted

EBITDA* positive in the range of $0.3 - $0.6 million.

For the year ending December 31, 2024,

Springbig’s guidance is unchanged and currently expects:

- Revenue in the

range of $29 - $32 million.

- Adjusted

EBITDA* positive in the range of $3.5 - $5.0 million.

* Adjusted EBITDA is a

non-GAAP (as defined below) financial measure. For more

information, see “Use of Non-GAAP Financial Measures” below.

Additionally, reconciliations of GAAP to non-GAAP financial

measures have been provided in the tables included in this

release.

Adjusted EBITDA is a non-GAAP financial measure

provided in this “Financial Outlook” section on a forward-looking

basis. The Company does not provide a reconciliation of such

forward-looking measure to the most directly comparable financial

measure calculated and presented in accordance with GAAP because to

do so would be potentially misleading and not practical given the

difficulty of projecting event-driven transactional and other

non-core operating items in any future period. The magnitude of

these items, however, may be significant.

Appointment of Mark Silver to the board

of directors

Mark Silver is President of Optus Capital Corporation, one of

the lead investors in the Company’s $8 million debt financing

previously announced on January 24, 2024. Mark has made significant

real estate investments in both development stage and income

producing properties in the residential, commercial, and industrial

sectors over his 36-year business career. He was a founding partner

and Chief Executive Officer of Universal Energy which was sold in

2009 to Just Energy Group Inc and co-founded Direct Energy

Marketing growing the company to over $1.3 billion in revenues

before selling to Centrica PLC (also known as British Gas) in 2000.

Mark is Chairman and Chief Executive Officer of Eddy Smart Home

Solutions Ltd.

The board of directors now comprises Sergey Sherman, Matt Sacks,

Shawn Dym and Mark Silver along with Jeffrey Harris, Chairman and

CEO. The Audit Committee remains unchanged and comprises Shawn Dym,

Chairman, and Sergey Sherman.

About Springbig

Springbig is a market-leading software platform

providing customer loyalty and marketing automation solutions to

retailers and brands in the U.S. and Canada. Springbig’s platform

connects consumers with retailers and brands, primarily through SMS

marketing, as well as emails, customer feedback system, and loyalty

programs, to support retailers’ and brands’ customer engagement and

retention. Springbig offers marketing automation solutions that

provide for consistency of customer communication, thereby driving

customer retention and retail foot traffic. Additionally,

Springbig’s reporting and analytics offerings deliver valuable

insights that clients utilize to better understand their customer

base, purchasing habits and trends. For more information, visit

https://springbig.com/.

Forward Looking Statements

Certain statements contained in this press

release constitute “forward-looking statements” within the meaning

of the “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“outlook,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “would,” and similar expressions

may identify forward-looking statements, but the absence of these

words does not mean that a statement is not forward-looking.

Forward-looking statements are predictions, projections and other

statements about future events and financial results that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. In particular, these include

but are not limited to statements relating to the Company’s

business strategy, future offerings and programs and expected

financial performance for the second quarter of 2024 and the year

ending December 31, 2024. Many factors could cause actual future

events to differ materially from the forward-looking statements in

this press release, including but not limited to the fact that we

have a relatively short operating history in a rapidly evolving

industry, which makes it difficult to evaluate our future prospects

and may increase the risk that we will not be successful; that if

we do not successfully develop and deploy new software, platform

features or services to address the needs of our clients, if we

fail to retain our existing clients or acquire new clients, and/or

if we fail to expand effectively into new markets, our revenue may

decrease and our business may be harmed; and the other risks and

uncertainties described under “Risk Factors” of the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the Securities and Exchange Commission (“SEC”) on April

1, 2024. These forward-looking statements involve a number of risks

and uncertainties (some of which are beyond the control of

Springbig), and other assumptions, which may cause the actual

results or performance to be materially different from those

expressed or implied by these forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and the Company assumes no obligation and does not

intend to update or revise these forward-looking statements other

than as required by applicable law. The Company does not give any

assurance that it will achieve its expectations.

Use of Non-GAAP Financial

Measures

In addition to the results reported in

accordance with accounting principles generally accepted in the

United States (GAAP) included throughout this press release, we

have disclosed EBITDA and Adjusted EBITDA, both of which are

non-GAAP financial measures that we calculate as net income before

interest, taxes, depreciation and amortization, in the case of

EBITDA, and further adjustments to exclude unusual and/or

infrequent costs, in the case of Adjusted EBITDA, which are

detailed in the reconciliation table that follows, in order to

provide investors with additional information regarding our

financial results. Below we have provided a reconciliation of net

loss (the most directly comparable GAAP financial measure) to

EBITDA and Adjusted EBITDA.

We present EBITDA and Adjusted EBITDA because

these metrics are key measures used by our management to evaluate

our operating performance, generate future operating plans and make

strategic decisions regarding the allocation of investment

capacity. Accordingly, we believe that EBITDA and Adjusted EBITDA

provide useful information to investors and others in understanding

and evaluating our operating results in the same manner as our

management. Management also believes that these measures provide

improved comparability between fiscal periods.

EBITDA and Adjusted EBITDA have limitations as

analytical tools, and you should not consider them in isolation or

as a substitute for analysis of our results as reported under GAAP.

Some of these limitations are as follows:

- Although

depreciation and amortization are non-cash charges, the assets

being depreciated and amortized may have to be replaced in the

future, and neither EBITDA nor Adjusted EBITDA reflect cash capital

expenditure requirements for such replacements or for new capital

expenditure requirements;

- EBITDA and Adjusted EBITDA do not

reflect changes in, or cash requirements for, our working capital

needs; and

- EBITDA and

Adjusted EBITDA do not reflect tax payments that may represent a

reduction in cash available to us.

Because of these limitations, you should

consider EBITDA and Adjusted EBITDA alongside other financial

performance measures, including net income and our other GAAP

results. Also, these non-GAAP financial measures, as determined and

presented by the Company, may not be comparable to related or

similarly titled measures reported by other companies.

Investor Relations

ContactClaire BollettieriVP of Investor

Relationsir@springbig.com

| Springbig

Holding, Inc |

| Condensed

Consolidated Balance Sheets |

|

(in thousands) |

| |

March 31, 2024 |

|

December 31, 2023 |

| |

(unaudited) |

|

(audited) |

| |

|

|

ASSETS |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

1,668 |

|

|

$ |

331 |

|

|

Accounts receivable, net |

|

3,211 |

|

|

|

2,948 |

|

|

Contract assets |

|

255 |

|

|

|

273 |

|

|

Prepaid expenses and other current assets |

|

588 |

|

|

|

893 |

|

| Total

current assets |

|

5,722 |

|

|

|

4,445 |

|

|

Operating lease asset |

|

3,031 |

|

|

|

340 |

|

|

Property and equipment, net |

|

325 |

|

|

|

320 |

|

|

Total assets |

$ |

9,078 |

|

|

$ |

5,105 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

Liabilities |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

$ |

2,040 |

|

|

$ |

2,925 |

|

|

Accrued expenses and other current liabilities |

|

1,767 |

|

|

|

1,951 |

|

|

Short-term cash advances |

|

1,195 |

|

|

|

1,925 |

|

|

Current maturities of long-term debt |

|

- |

|

|

|

4,360 |

|

|

Deferred payroll tax credits |

|

1,751 |

|

|

|

1,751 |

|

|

Deferred revenue |

|

2 |

|

|

|

- |

|

|

Related party payable |

|

- |

|

|

|

540 |

|

|

Operating lease liability, current |

|

329 |

|

|

|

99 |

|

| Total

current liabilities |

|

7,084 |

|

|

|

13,551 |

|

|

Long-term debt, non-current |

|

7,198 |

|

|

|

- |

|

|

Operating lease liability, non-current |

|

2,815 |

|

|

|

225 |

|

|

Warant liabilities |

|

6 |

|

|

|

3 |

|

| Total

liabilities |

|

17,103 |

|

|

|

13,779 |

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

Common stock par value $0.0001 per shares, 300,000,000 authorized

at March 31, 2024; 45,594,864 issued and outstanding as of March

31, 2024; (300,000,000 authorized at December 31, 2023; 45,339,762

issued and outstanding as of December 31, 2023) |

$ |

4 |

|

|

$ |

4 |

|

|

Additional paid-in-capital |

|

28,119 |

|

|

|

27,887 |

|

|

Accumulated deficit |

|

(36,148 |

) |

|

|

(36,565 |

) |

| Total

stockholders’ equity |

|

(8,025 |

) |

|

|

(8,674 |

) |

|

Total liabilities and stockholders’ equity |

$ |

9,078 |

|

|

$ |

5,105 |

|

| |

|

|

|

| Springbig

Holding, Inc |

| Condensed

Consolidated Statement of Operations (unaudited) |

| (in

thousands, except share and per share data) |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues |

$ |

6,474 |

|

|

$ |

7,157 |

|

| Cost of

revenues |

|

1,794 |

|

|

|

1,350 |

|

| Gross

Profit |

|

4,680 |

|

|

|

5,807 |

|

|

Expenses |

|

|

|

|

Selling, servicing and marketing |

|

1,527 |

|

|

|

2,478 |

|

|

Technology and software development |

|

1,666 |

|

|

|

2,300 |

|

|

General and administrative |

|

1,769 |

|

|

|

2,757 |

|

| Total

operating expenses |

|

4,962 |

|

|

|

7,535 |

|

|

|

|

|

|

| Loss from

operations |

|

(282 |

) |

|

|

(1,728 |

) |

|

Interest income |

|

4 |

|

|

|

10 |

|

|

Interest Expense |

|

(875 |

) |

|

|

(391 |

) |

|

Gain on note repurchase |

|

1,573 |

|

|

|

- |

|

|

Change in fair value of warrants |

|

(3 |

) |

|

|

(153 |

) |

| Income

(loss) before income taxes |

$ |

417 |

|

|

$ |

(2,262 |

) |

| Income taxes

expense |

|

- |

|

|

|

- |

|

| Net income

(loss) |

$ |

417 |

|

|

$ |

(2,262 |

) |

| |

|

|

|

| Net income

(loss) per common share: |

|

|

|

| Basic |

$ |

0.01 |

|

|

$ |

(0.08 |

) |

| Diluted |

$ |

0.01 |

|

|

$ |

(0.08 |

) |

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

| Basic |

|

45,432,272 |

|

|

|

26,803,839 |

|

| Diluted |

|

77,315,056 |

|

|

|

26,803,839 |

|

| Springbig

Holding, Inc |

| Statement of

Cash Flows (unaudited) |

| (in

thousands) |

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash

flows from operating activities |

|

|

|

| Net income

(loss) |

$ |

417 |

|

|

$ |

(2,262 |

) |

| Adjustments

to reconcile net income (loss) income to net cash used in operating

activities: |

|

|

|

|

Gain on note repurchase |

|

(1,573 |

) |

|

|

- |

|

|

Non-cash interest expense |

|

108 |

|

|

|

- |

|

|

Depreciation and amortization |

|

54 |

|

|

|

66 |

|

|

Discount amortization on convertible note |

|

- |

|

|

|

259 |

|

|

Amortization of debt financing costs |

|

116 |

|

|

|

- |

|

|

Stock-based compensation expense |

|

195 |

|

|

|

162 |

|

|

Bad debt expense |

|

87 |

|

|

|

169 |

|

|

Accrued interest on convertible notes |

|

117 |

|

|

|

22 |

|

|

Amortization of operating lease right of use assets |

|

90 |

|

|

|

123 |

|

|

Change in fair value of warrants |

|

3 |

|

|

|

153 |

|

| Changes in

operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(351 |

) |

|

|

(448 |

) |

|

Prepaid expenses and other current assets |

|

305 |

|

|

|

474 |

|

|

Contract assets |

|

18 |

|

|

|

10 |

|

|

Accounts payable and other liabilities |

|

(1,505 |

) |

|

|

363 |

|

|

Operating lease liabilities |

|

39 |

|

|

|

(126 |

) |

|

Deferred payroll tax credits |

|

- |

|

|

|

1,442 |

|

|

Deferred revenue |

|

2 |

|

|

|

(28 |

) |

| Net

cash used in operating activities |

|

(1,878 |

) |

|

|

379 |

|

| |

|

|

|

| Cash flows

from investing activities |

|

|

|

|

Purchase of convertible note |

|

- |

|

|

|

(3 |

) |

|

Purchases of property and equipment |

|

(59 |

) |

|

|

(9 |

) |

| Net

cash used in investing activities |

|

(59 |

) |

|

|

(12 |

) |

| |

|

|

|

| Cash flows

from financing activities |

|

|

|

|

Proceeds from issuance of convertible notes |

|

6,400 |

|

|

|

- |

|

|

Repayment of convertible notes |

|

(2,895 |

) |

|

|

(1,457 |

) |

|

Proceeds from the issuance of term notes |

|

1,600 |

|

|

|

- |

|

|

Repayment of short-term cash advances |

|

(730 |

) |

|

|

- |

|

|

Repayment of related party payable |

|

(540 |

) |

|

|

- |

|

|

Cost of convertible and term note issuance |

|

(561 |

) |

|

|

- |

|

|

Proceeds from exercise of stock options |

|

- |

|

|

|

- |

|

|

Proceeds from common stock |

|

- |

|

|

|

113 |

|

| Net

cash (used in) provided by financing activities |

|

3,274 |

|

|

|

(1,344 |

) |

| |

|

|

|

| Net

increase/(decrease) in cash and cash equivalents |

|

1,337 |

|

|

|

(977 |

) |

| Cash and

cash equivalents, at beginning of the period |

|

331 |

|

|

|

3,546 |

|

| Cash and

cash equivalents, at end of the period |

$ |

1,668 |

|

|

$ |

2,569 |

|

| |

|

|

|

|

Supplemental cash flows disclosures |

|

|

|

| Interest

paid |

$ |

720 |

|

|

$ |

132 |

|

| Common stock

issued for services rendered relating to debt financing |

$ |

37 |

|

|

$ |

- |

|

| Accrued cost

of debt issuance |

$ |

319 |

|

|

$ |

- |

|

| Obtaining a

right-of-use asset in exchange for a lease liability |

$ |

2,781 |

|

|

$ |

- |

|

| Springbig

Holding, Inc |

|

Reconciliation of net loss to non-GAAP EBITDA and Adjusted

EBITDA |

| (in

thousands) |

| |

|

|

|

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

| Net income

(loss) |

|

417 |

|

|

|

(2,262 |

) |

| Interest

income |

|

(4 |

) |

|

|

(10 |

) |

| Interest

expense |

|

875 |

|

|

|

391 |

|

| Depreciation

expense |

|

54 |

|

|

|

66 |

|

| |

|

|

|

| EBITDA |

|

1,342 |

|

|

|

(1,815 |

) |

| |

|

|

|

| Stock-based

compensation |

|

195 |

|

|

|

162 |

|

| Bad debt

expense |

|

87 |

|

|

|

169 |

|

| Gain on

repurchase of convertible debt |

|

(1,573 |

) |

|

|

- |

|

| Severance

and related payments |

|

96 |

|

|

|

- |

|

| Change in

fair value of warrants |

|

3 |

|

|

|

153 |

|

| |

|

|

|

| Adjusted

EBITDA |

|

150 |

|

|

|

(1,331 |

) |

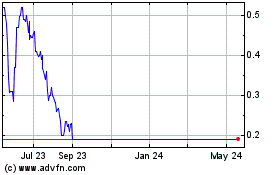

SpringBig (NASDAQ:SBIG)

Historical Stock Chart

From Dec 2024 to Jan 2025

SpringBig (NASDAQ:SBIG)

Historical Stock Chart

From Jan 2024 to Jan 2025