Safe Harbor Financial Originates $4.6 Million Secured Credit Facility for Michigan Cannabis Operator

12 March 2024 - 11:30PM

SHF Holdings, Inc., d/b/a/

Safe Harbor

Financial (“Safe Harbor” or the “Company”)

(

NASDAQ: SHFS), a leader in facilitating banking,

payments and financial services to the regulated cannabis industry,

announced today that it originated a $4.6 million credit facility

for a Michigan cannabis operator secured by a four-dispensary real

estate portfolio. Structured with a market-leading rate and terms,

the credit facility will allow the vertically integrated operator

to expand its cultivation and retail operations in the Great Lake

State.

With this new credit facility, Safe Harbor’s total loan book

will exceed $60 million in outstanding loans and commitments,

showcasing the rapid growth of its robust and highly diversified

loan portfolio, which is comprised of 25 cannabis real estate

assets across 10 states covering every segment of the cannabis

value chain.

“Our ability to support emerging cannabis operators across the

country with competitive rates and structures demonstrates the

significant role Safe Harbor continues to play in supporting the

unique and evolving financial needs of cannabis operators,” said

Safe Harbor Financial Chief Operating Officer and Executive Vice

President, Dan Roda. “In just over a year, we

have increased our loan book from just under $20 million to over

$60 million, successfully creating a powerful new customer

acquisition tool and revenue channel for Safe Harbor. By increasing

our high margin loan origination activity, not only have we

diversified and introduced new revenue streams to the business, we

have become less dependent on our deposit-related fees. As we

advance more opportunities to serve our existing and new clients

with our expanding credit product portfolio, we are strategically

positioned to further scale our business with new lending-related

revenue.”

About Safe HarborSafe Harbor is among the first

service providers to offer compliance, monitoring and validation

services to financial institutions, providing traditional banking

services to cannabis, hemp, CBD, and ancillary operators, making

communities safer, driving growth in local economies, and fostering

long-term partnerships. Safe Harbor, through its financial

institution clients, implements high standards of accountability,

transparency, monitoring, reporting and risk mitigation measures

while meeting Bank Secrecy Act obligations in line with FinCEN

guidance on cannabis-related businesses. Over the past eight years,

Safe Harbor has facilitated more than $21 billion in deposit

transactions for businesses with operations spanning over 41 states

and US territories with regulated cannabis markets. For more

information, visit www.shfinancial.org.

Forward-Looking StatementsCertain statements

contained in this press release constitute "forward-looking

statements'' within the meaning of federal securities laws.

Forward-looking statements may include, but are not limited to,

statements with respect to trends in the cannabis industry,

including proposed changes in U.S. and state laws, rules,

regulations and guidance relating to Safe Harbor's services; Safe

Harbor's growth prospects and Safe Harbor's market size; Safe

Harbor's projected financial and operational performance, including

relative to its competitors and loan performance; new product and

service offerings Safe Harbor may introduce in the future; the

impact of recent volatility in the capital markets, which may

adversely affect the price of the Company's securities; Safe

Harbor’s ability to make the same or similar loans in the future;

the outcome of any legal proceedings that may be instituted against

Safe Harbor; other statements regarding Safe Harbor's expectations,

hopes, beliefs, intentions or strategies regarding the future; and

the other risk factors discussed in Safe Harbor's filings from time

to time with the Securities and Exchange Commission. In addition,

any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements. The words

"anticipate," "believe," "continue," "could," "estimate," "expect,"

"intends," "outlook," "may," "might," "plan," "possible,"

"potential," "predict," "project," "should," "would," and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject, are subject to risks and uncertainties. These

forward-looking statements involve a number of risks and

uncertainties (some of which are beyond the control of Safe

Harbor), and other assumptions, that may cause the actual results

or performance to be materially different from those expressed or

implied by these forward-looking statements.

Media Contact InformationSafe Harbor MediaEllen

Mellody570-209-2947safeharbor@kcsa.com

Investor Relations Contact InformationSafe

Harbor Investor Relationsir@SHFinancial.org

KCSA Strategic CommunicationsPhil Carlsonsafeharbor@kcsa.com

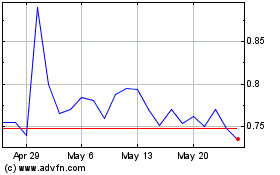

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Nov 2024 to Dec 2024

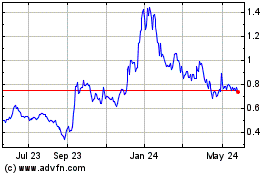

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Dec 2023 to Dec 2024