Safe Harbor Financial Originates $1.07 Million Secured Credit Facility for Missouri Cannabis Operator

29 October 2024 - 11:00PM

SHF Holdings, Inc., d/b/a/ Safe Harbor Financial

(“Safe Harbor” or the “Company”) (NASDAQ: SHFS), a leader in

facilitating financial services and credit facilities to the

regulated cannabis industry, announced that it has originated a

$1.07 million secured credit facility for a Missouri-based cannabis

operator, the first tranche of a $5 million commitment to refinance

existing senior debt. The loan further solidifies Safe Harbor’s

position as a key partner for cannabis operators seeking

competitive financial solutions in the rapidly evolving cannabis

financial sector.

The facility is secured by a portfolio that includes four retail

dispensaries and a manufacturing facility in Missouri. The

refinancing reduces the operator's borrowing costs and will enable

them to optimize their operations within the state’s growing

cannabis market.

“Our competitively-priced financing solutions provide cannabis

operators — who are often underserved by traditional banking

institutions — with the means to achieve their business goals,”

said John Foley, Senior Vice President of Commercial Lending at

Safe Harbor. “Our ability to offer competitive rates and tailored

lending solutions is a key differentiator for Safe Harbor, and this

transaction highlights our commitment to fostering growth in the

cannabis sector by providing access to bank-quality financial

services. We are building on our credibility and expertise in

cannabis underwriting, with the goal of helping more operators

achieve financial stability and growth.”

Mr. Foley added, “Offering cannabis operators access to capital

is a major component of Safe Harbor’s long term strategy to support

the evolving needs of the cannabis industry, to grow our credit

portfolio and deliver value to our investors.”

About Safe HarborSafe Harbor is among the first

service providers to offer compliance, monitoring and validation

services to financial institutions, providing traditional banking

services to cannabis, hemp, CBD, and ancillary operators, making

communities safer, driving growth in local economies, and fostering

long-term partnerships. Safe Harbor, through its financial

institution clients, implements high standards of accountability,

transparency, monitoring, reporting and risk mitigation measures

while meeting Bank Secrecy Act obligations in line with FinCEN

guidance on cannabis-related businesses. Over the past eight years,

Safe Harbor has facilitated more than $23 billion in deposit

transactions for businesses with operations spanning over 41 states

and US territories with regulated cannabis markets. For more

information, visit www.shfinancial.org.

Cautionary Statement Regarding Forward-Looking

StatementsCertain statements contained in this press

release constitute “forward-looking statements'' within the meaning

of federal securities laws. Forward-looking statements may include,

but are not limited to, statements with respect to trends in the

cannabis industry, including proposed changes in U.S and state

laws, rules, regulations and guidance relating to Safe Harbor’s

services; Safe Harbor’s growth prospects and Safe Harbor’s market

size; Safe Harbor’s projected financial and operational

performance, including relative to its competitors and historical

performance; new product and service offerings Safe Harbor may

introduce in the future; the impact volatility in the capital

markets, which may adversely affect the price of the Company’s

securities; the outcome of any legal proceedings that may be

instituted against Safe Harbor; other statements regarding Safe

Harbor’s expectations, hopes, beliefs, intentions or strategies

regarding the future; and the other risk factors discussed in Safe

Harbor’s filings from time to time with the Securities and Exchange

Commission. In addition, any statements that refer to projections,

forecasts or other characterizations of future events or

circumstances, including any underlying assumptions, are

forward-looking statements. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “outlook,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,”

“project,” “should,” “would,” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. Forward-looking

statements are predictions, projections and other statements about

future events that are based on current expectations and

assumptions and, as a result, are subject, are subject to risks and

uncertainties. These forward-looking statements involve a number of

risks and uncertainties (some of which are beyond the control of

Safe Harbor), and other assumptions, that may cause the actual

results or performance to be materially different from those

expressed or implied by these forward-looking statements.

Contact InformationSafe Harbor MediaNick

Callaio, Marketing Manager720.951.0619Nick@SHFinancial.org

Safe Harbor Investor Relationsir@SHFinancial.org

KCSA Strategic CommunicationsEllen

Mellodysafeharbor@kcsa.com

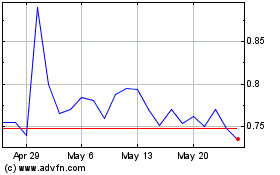

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Feb 2025 to Mar 2025

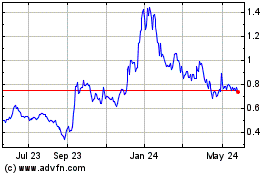

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Mar 2024 to Mar 2025