false

--12-30

2023

FY

0001856608

0001856608

2023-01-01

2023-12-30

0001856608

2023-06-30

0001856608

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

| (Mark One) |

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2023

| |

| OR |

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period

from __________ to __________.

|

Commission File Number: 001-40837

Sovos

Brands, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

81-5119352 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

168 Centennial Parkway, Suite 200

Louisville,

CO 80027

(Address of principal

executive offices) (zip code)

(720) 316-1225

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

SOVO |

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Securities registered

pursuant to section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted

electronically every Interactive Date File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such

files). Yes x No ¨

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

Emerging growth company |

¨ |

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. x

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in

the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

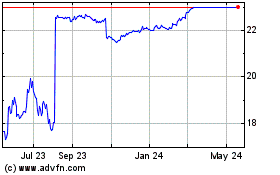

The aggregate

market value of the common stock held by non-affiliates of the registrant as of June 30, 2023, the last trading day of the

registrant’s most recently completed second fiscal quarter was approximately $1.07

billion based on the closing price of $19.56 for one share of common stock, as reported on the Nasdaq Global Select Market on that

date. For the purpose of the foregoing calculation only, all directors and executive officers of the registrant and owners of more

than 10% of the registrant’s common stock are assumed to be affiliates of the registrant. This determination of affiliate

status is not necessarily conclusive for any other purpose.

As of February 23,

2024, there were 101,856,379 shares of common stock, $0.001 par value per share outstanding.

| Auditor Name: Deloitte & Touche LLP | Auditor Location: Denver, Colorado | Auditor Firm ID: 34 |

EXPLANATORY

NOTE

This

Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Sovos Brands, Inc. Annual Report on Form 10-K

for the fiscal year ended December 30, 2023 filed with the Securities and Exchange Commission (the “SEC”) on February 28,

2024 (the “Original 10-K Filing”).

This

Amendment is being filed to update Part III to provide the information required by such items and not included in the Original 10-K

Filing. As a result of this Amendment, the Company is filing as exhibits to this Amendment the certifications required under Section 302

of the Sarbanes-Oxley Act of 2002. Because no financial statements are contained within this Amendment, the Company is not including certifications

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Except

for the changes to Part III and the filing of related certifications added to the list of Exhibits in Part IV, this Amendment

makes no changes to the Original 10-K Filing. This Amendment does not reflect events occurring after the filing of the Original 10-K Filing

or modify disclosures affected by subsequent events. Terms used but not otherwise defined in the Amendment have such meaning as ascribed

to them in the Original 10-K Filing.

Unless

the context otherwise requires, “we,” “us,” “our,” the “Company” and “Sovos Brands”

refer to Sovos Brands, Inc. and its subsidiaries.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

Executive

Officers

Information

regarding executive officers of the Company is set forth under “Information About Our Executive Officers” in Part I of

the Original 10-K Filing.

Directors

Our

board of directors (the “Board”) currently consists of eight members. Our Board is currently divided into three classes of

approximately equal size with staggered, three-year terms. Our amended and restated certificate of incorporation provides that at any

annual meeting of stockholders following December 30, 2023, at which fiscal year end Advent International, L.P. (“Advent”)

and its affiliates beneficially owned less than 50% of our outstanding shares of common stock, our directors will be elected for a one-year

term expiring at the next annual meeting of stockholders and until the election and qualification of their respective successors in office

or until their earlier death, resignation or removal, beginning with our Class III directors who would be up for re-election at our

2024 annual meeting of stockholders with our Board being fully declassified following our 2026 annual meeting. As discussed in the “Business

Highlights” of our Compensation Discussion and Analysis in Item 11 below, the Company has entered into the Merger Agreement with

Campbell Soup Company. The Company does not expect to hold an annual meeting of stockholders prior to the closing of the Merger.

The

names, ages (as of February 28, 2024) and background information of our directors are included below:

Tamer

Abuaita, age 51, a Class III director, has served as a director since July 2022. Mr. Abuaita has served as the

Senior Vice President of Operations and Chief Supply Chain Officer of Stanley Black & Decker since January 2022. Previously,

Mr. Abuaita served as the Senior Vice President, Global Supply Chain at SC Johnson from March 2018 to January 2022, and

held multiple operational and supply leadership positions in a number of regions around the world at The Kraft Heinz Company from February 2008

to July 2017. Prior to February 2008, Mr. Abuaita held multiple positions at Nestle and Sonoco. Mr. Abuaita earned

his B.S. from California Polytechnic State University – San Luis Obispo and his M.B.A. from Vanderbilt University. We believe Mr. Abuaita’s

experience leading global supply chains and extensive CPG experience make him well qualified to serve as a director.

Jefferson

M. Case, age 46, a Class III director, has served as a director since January 2017. Mr. Case has been a managing

director at Advent since January 2014 and served in various positions at Advent since August 2001. Mr. Case also previously

served as a director of Party City Holdco Inc., a party goods and Halloween specialty retailer, and a director of Noosa Yoghurt and currently

serves as a director on the boards of various private companies. He earned his B.A. in economics from Davidson College and his M.B.A.

from Harvard Business School. We believe Mr. Case’s experience serving as a director of various companies and his affiliation

with Advent, our largest stockholder as of the filing of this Amendment, make him well qualified to serve as a director.

William

R. Johnson, age 75, a Class III director, has served as Chairman of the Board and a director since January 2017.

Mr. Johnson has served as an operating partner of Advent since June 2014. Prior to June 2014, Mr. Johnson held various

management and executive positions, including chairman, president and chief executive officer, for H.J. Heinz Company, a global packaged

foods manufacturer. Previously, Mr. Johnson also held various positions for Drackett Company, a manufacturer of household cleaning

products, Ralston Purina Company, an animal feed, food and pet food company, and Anderson-Clayton & Co., a food products company.

Mr. Johnson currently serves as chairman of the board of United Parcel Service, Inc. Mr. Johnson has also served as a director

on the boards of other publicly traded CPG companies, including The Clorox Company and PepsiCo, Inc. He earned his B.A. in political

science from the University of California, Los Angeles and his M.B.A. from the University of Texas. We believe Mr. Johnson’s

significant senior management experience gained through over 13 years of service as the chairman and over 15 years as chief executive

officer of the H.J. Heinz Company, a corporation with significant international operations and a large, labor intensive workforce, as

well as his deep experience in operations, marketing, brand development and logistics make him well qualified to serve as a director.

Todd

R. Lachman, age 60, a Class I director, has served as our Chief Executive Officer and as a director since January 2017

and served as our President from January 2017 to December 2023. Prior to joining Sovos Brands, Mr. Lachman served as operating

partner of Altamont Capital Partners, a private equity firm, from May 2015 to March 2016 and a senior advisor to Advent from

March 2016 to January 2017. For over 30 years, Mr. Lachman has delivered growth and value creation for some of the largest

CPG companies in the United States. Prior to May 2015, Mr. Lachman served as global president of Mars Petcare, served as president

of Mars Chocolate North America and Latin America and held various positions at Del Monte Foods Company, the H.J. Heinz Company and The

Procter & Gamble Company. Mr. Lachman currently serves on the board of a private company. He earned his B.A. in economics

and art history from Colby College and his M.B.A. from the Northwestern University Kellogg School of Management. We believe Mr. Lachman’s

experience and perspective as our founder and Chief Executive Officer as well as his extensive CPG experience make him well qualified

to serve as a director.

Neha

U. Mathur, age 32, a Class I director, has served as a director since September 2021. Ms. Mathur has been a

Vice President at Advent since June 2020. Previously, Ms. Mathur co-founded and served on the board of directors of Nom Pot

Company from January 2019 to May 2020. From June 2019 to August 2020, she was a summer vice president at Bain Capital,

LP and an associate at Advent from August 2016 to July 2018. Prior to August 2016, Ms. Mathur was a business analyst

at McKinsey & Company. She earned her B.S. in economics from The Wharton School of the University of Pennsylvania, her B.S.E.

in systems engineering from the University of Pennsylvania School of Engineering and Applied Science and her MBA from Harvard Business

School. We believe Ms. Mathur’s experience as a director of a food delivery service company and her affiliation with Advent,

our largest stockholder as of the filing of this Amendment, make her well qualified to serve as a director.

David

W. Roberts, age 40, a Class II director, has served as a director since January 2017. Mr. Roberts has served

as a Managing Director at Great Hill Partners since May 2023. Mr. Roberts was a principal at Advent from January 2017 through

March 2023 and served in various other positions at Advent from July 2012 through December 2016. Mr. Roberts has served

as a director on the board of various companies, including Noosa Yoghurt from 2014 to 2018. He earned his B.A. in economics from Princeton

University and his M.B.A. from The Wharton School of the University of Pennsylvania. We believe Mr. Roberts’s experience as

a director of various companies and long-standing experience with and understanding of the Company make him well qualified to serve as

a director.

Valarie

L. Sheppard, age 60, a Class I director, has served as a director since September 2021. Prior to retiring in March 2021,

Ms. Sheppard served as treasurer, controller and group vice president, company transition leader of The Procter & Gamble

Company, a multinational consumer goods company, and served as senior vice president, treasurer, comptroller of The Procter &

Gamble Company from October 2013 to April 2019. Prior to October 2013, Ms. Sheppard held various management positions

for The Procter & Gamble Company, where she had been employed since 1986. Ms. Sheppard previously served as compensation

committee chair on the board of directors of Anixter, Inc., a provider of business-to-business distribution logistics services and

supply chain solutions, until it was sold in 2020. She earned her B.S. in accounting from Purdue University and her M.S. in industrial

administration from the Purdue University Krannert School of Management. We believe Ms. Sheppard’s experience with The Procter &

Gamble Company, including as its treasurer and controller, as well as her substantial finance and accounting experience, which makes her

an “audit committee financial expert,” make her well qualified to serve as a director.

Vijayanthimala

(Mala) Singh, age 53, a Class II director, has served as a director since September 2021. Ms. Singh has served

as Chief People Officer of Electronic Arts, Inc., a video game company, since November 2016. Previously, Ms. Singh served

as Chief People Officer of minted, LLC, an online marketplace of independent artists and designers, from January 2014 to October 2016.

Prior to January 2014, Ms. Singh held various positions for Electronic Arts, Inc., Bristol-Myers Squibb Company and Cigna

Corporation. Ms. Singh currently serves on the executive advisory board of a private venture capital firm. She earned her B.A. in

organization psychology from Rutgers University and her M.H.R.M. from Rutgers University. We believe Ms. Singh’s experience

as a chief people officer of Electronic Arts Inc., including her experience developing compensation programs and talent for a growing

company, and her experience as an advisory board member of a venture capital firm make her well qualified to serve as a director.

Audit

Committee

The

members of our Audit Committee are Mr. Abuaita, Mr. Johnson and Ms. Sheppard. Each of Mr. Johnson and Ms. Sheppard

qualifies as an “audit committee financial expert” as such term has been defined by the SEC in Item 407(d) of Regulation

S-K. The Board has affirmatively determined that Ms. Sheppard, Mr. Johnson and Mr. Abuaita each meet the definition of

an “independent director” for the purposes of serving on the Audit Committee under applicable Nasdaq rules and Rule 10A-3

under the Exchange Act. The Audit Committee is governed by a charter that complies with the rules of Nasdaq and provides that the

primary purposes of the Audit Committee include overseeing:

| ● | audits of the financial statements of the Company; |

| ● | the integrity of the Company’s financial statements; |

| ● | the Company’s processes relating to risk management; |

| ● | management’s design and maintenance of the Company’s internal control over financial reporting

and disclosure controls and procedures including with respect to cybersecurity; |

| ● | the qualifications, engagement, compensation, independence and performance of the Company’s independent

auditor, and the auditor’s conduct of the annual audit of the Company’s financial statements and any other services provided

to the Company; |

| ● | the performance of the Company’s internal audit function (as applicable); |

| ● | compliance, code of business conduct and ethics, discussing our risk management and risk assessment policies,

including with respect to cybersecurity risk; |

| ● | production of the annual report of the Committee required by applicable SEC rules; and |

| ● | the review and approval or ratification of any related person transactions. |

Delinquent

Section 16(a) Reports

Under

U.S. securities laws, directors, certain officers and persons holding more than 10% of our common stock must report their initial ownership

of our common stock and any changes in their ownership to the SEC. The SEC has designated specific due dates for these reports and we

must identify in this Amendment those persons who did not file these reports when due. Based solely on our review of copies of the reports

filed with the SEC and the written representations of our directors and executive officers, we believe that all reporting requirements

for fiscal 2023 were satisfied by each person who at any time during fiscal 2023 was a director or an executive officer or held more than

10% of our common stock, except for one late filing reporting one transaction by Mr. Hermida relating to the automatic sale of common

stock to cover taxes upon the vesting of an equity award.

ITEM 11. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (CD&A) discusses our

executive compensation philosophy and programs, decisions the Compensation Committee made under those programs, and the factors considered

in making those decisions. This CD&A focuses on the compensation paid in fiscal 2023 to our Chief Executive Officer (CEO), Chief Financial

Officer (CFO), and our other three most highly compensated executive officers serving at the end of fiscal 2023, whom we refer to collectively

as our “named executive officers” or “NEOs” and who are listed below:

| Name | |

Position |

| Todd R. Lachman | |

Founder and Chief Executive Officer |

| Christopher W. Hall | |

Chief Financial Officer |

| E. Yuri Hermida | |

President |

| Kirk A. Jensen | |

Chief Operating Officer |

| Risa Cretella | |

Chief Sales Officer |

Although the discussion in the CD&A is focused on our NEOs, many

of our executive compensation programs apply broadly to our executive officers.

2023 Business Highlights

2023 was a momentous year for Sovos Brands. The Company surpassed $1

billion in net sales and significantly over-delivered on its annual operating plan with respect to adjusted EBITDA and net working capital

(discussed in more detail below with respect to the Company’s Annual Incentive Plan), while meaningfully reducing its net leverage.

Notably, the Company’s net sales growth was driven primarily by volumes.

On August 7, 2023, the Company entered into an Agreement and Plan

of Merger (the “Merger Agreement”) with Campbell Soup Company (“Campbell’s”) and Premium Products Merger

Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Campbell’s (“Merger Sub”). The Merger Agreement

provides, among other things, that subject to the satisfaction or waiver of the conditions set forth therein, including the expiration

or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR

Act”), Merger Sub will merge with and into the Company (the “Merger”) with the Company surviving as a wholly owned subsidiary

of Campbell’s. The Merger consideration of $23 per share reflects a 92% return for stockholders from the Company’s September 2021

IPO price.

Our Executive Compensation Philosophy

We have designed our executive compensation program to attract, motivate,

and retain high caliber talent who drive our success and industry leadership while considering Company performance measured over short-

and long-term periods. Each year the Compensation Committee reviews the incentive structure, taking into consideration market data, business

performance, and our strategic and human capital objectives. In order to attract and retain the talent required to fulfill our mission,

accelerate growth, and promote stockholder value, the Compensation Committee’s goal is to implement an executive compensation program

that is built upon the following objectives:

| ● | Attracting and Retaining the Right Talent. Executive compensation should be market-competitive to attract and retain highly

motivated talent with a performance-driven mindset. |

| ● | Pay for Performance. A material portion of an executive’s target compensation should be at-risk and directly aligned

with Company performance, with short-term (annual performance-based bonus) and long-term (equity awards) incentive programs that appropriately

balance business objectives. |

| ● | Alignment with Stockholder Interests. A substantial portion of the NEOs’ total compensation is in equity. Our incentive

compensation program focuses on a combination of short- and long-term metrics which motivate the achievement of our Company’s performance

targets. We further align the interests of our executive officers and stockholders through our use of stock ownership guidelines and prohibitions

on hedging or pledging of common stock. |

How We Determine Executive Compensation

Oversight Responsibilities for Executive Compensation

The Compensation Committee is primarily responsible for assisting the

Board in overseeing the Company’s employee compensation policies and practices, including, among other things:

| ● | establishing and overseeing the overall compensation philosophy and compensation programs for the Company, CEO and other executive

officers; |

| ● | reviewing and approving the corporate goals and objectives relevant to the compensation of the CEO and other executive officers, including

annual and long-term performance goals and objectives; |

| ● | evaluating at least annually the performance of the CEO and other executive officers against the relevant corporate goals and objectives;

and |

| ● | reviewing and discussing with management the “Compensation Discussion and Analysis” disclosure required by SEC regulations. |

To fulfill these responsibilities, the Compensation Committee reviews

recommendations and materials and engages in extensive executive compensation discussions, including with Frederic W. Cook &

Co., Inc. (“FW Cook”), our independent compensation consultant, to review best practices and receive a competitive assessment

of executive compensation compared to our peers, as discussed further below. The Compensation Committee reviews total compensation and

approves each of the elements of executive compensation, and reviews whether compensation programs and practices carry undue risk. The

Compensation Committee also solicits the views of our CEO when making compensation decisions for the other executive officers, including

the other NEOs. None of our NEOs participate in their own compensation discussion.

Role of the Compensation Consultant

In 2023, the Compensation Committee continued to engage FW Cook as

its independent compensation consultant to consult on the design of the Company’s executive compensation program in support of our

business strategy. FW Cook also reviews the competitiveness of the compensation of the NEOs and certain other executive officers, evaluates

market pay data and competitive-positioning, provides analyses and inputs on program structure, performance measures and goals, provides

updates on market trends and the regulatory environment as it relates to executive compensation, reviews various management proposals

presented to the Compensation Committee related to executive compensation and provides objective analysis and recommendations relating

to such proposals. FW Cook also consults on the design and structure of our non-employee director compensation program. FW Cook does not

perform other services for the Company and will not do so without the prior consent of the Compensation Committee. FW Cook meets with

the Compensation Committee, outside the presence of management, in executive sessions. After taking into consideration the Nasdaq independence

standards and SEC rules as they relate to FW Cook, the Compensation Committee determined that FW Cook’s work does not raise

a conflict of interest.

Market Data

When setting executive compensation, the Compensation Committee considers

competitive comparison of executive pay levels, program design and related compensation governance practices at similarly sized consumer

packaged goods peers identified by FW Cook, with direction from the Compensation Committee. Each year the compensation peer group is reviewed

and modified as circumstances warrant. For 2023, our peer group used to inform decisions on executive pay opportunities was comprised

of the following 15 companies with which we may compete for business and/or talent:

| 2022-2023

Compensation Peer Group |

| B&G

Foods |

Hain Celestial |

Landec |

| |

|

|

| BellRing Brands |

Hostess Brands |

Seneca Foods |

| |

|

|

| Beyond Meat |

J&J Snack Foods |

Simply Good Foods |

| |

|

|

| Flowers Foods |

Lamb Weston |

Utz Brands |

| |

|

|

| FreshPet |

Lancaster Colony |

Vital Farms |

When establishing each NEO’s target total direct compensation

opportunity for 2023, the Compensation Committee considered the competitive market for the compensation peer group. Market comparison

information for the NEOs was sourced from publicly available peer group information as well as third-party survey data. Both data sources

served as important reference points in assessing the competitiveness of base salary, incentive targets, and total direct compensation,

as well as on overall market design practices.

2023

Named Executive Officer Compensation

The primary components of our NEO compensation

program include base salary, annual performance-based cash incentives and long-term equity compensation. The components of our fiscal

2023 compensation program are described in more detail below.

Base Salary

Base salary is paid to attract and retain qualified

talent and is set at a level that is commensurate with the executive’s duties and authorities, contributions, prior experience and

sustained performance. Base salary is reviewed annually and adjusted as appropriate. Our NEOs are not eligible for automatic annual base

salary increases. For 2023, the Compensation Committee approved an increase to Mr. Lachman’s base salary to $875,000 from $800,000

and Ms. Cretella’s base salary to $450,000 from $435,000, in recognition of their individual performance, role and responsibilities,

and after considering market data presented by FW Cook. See the “Summary Compensation Table” below for the fiscal 2023 base

salary of each of our NEOs.

Annual Cash Incentive Awards

We award annual cash incentive opportunities to

each of our NEOs under the Sovos Brands, Inc. Annual Cash Incentive Plan (the “Annual Incentive Plan” or “AIP”).

The Annual Incentive Plan is an important part of our total compensation as it encourages participants to work proficiently toward improving

operating performance at the Company by providing performance-based annual cash incentive awards to motivate and reward eligible employees

for the achievement of, meeting and/or exceeding pre-determined performance objectives. Performance objectives are established annually

by our Compensation Committee and aim to focus on achieving annually established financial targets that are key indicators of ongoing

operational performance and support our business strategy.

The Compensation Committee reviews our target

annual bonus opportunities each year to ensure they are competitive. For 2023, each NEO had an annual incentive opportunity expressed

as a percentage of the NEO’s base salary as of October 1. Earned cash incentives could range from 0% to 200% of target bonus

opportunity.

| Name |

|

2023 Target Bonus

Opportunity As Percent of

Base Salary |

|

| Todd R. Lachman |

|

|

135 |

% |

| Christopher W. Hall |

|

|

75 |

% |

| E. Yuri Hermida |

|

|

100 |

% |

| Kirk A. Jensen |

|

|

75 |

% |

| Risa Cretella |

|

|

75 |

% |

The AIP for 2023 was structured around the Company’s

performance against three financial metrics: net sales (weighted 40%), adjusted EBITDA (weighted 50%), and net working capital as a percentage

of net sales (weighted 10%). At the beginning of fiscal 2023, our Compensation Committee approved the performance targets under our AIP

for each metric, which targets were applicable to our NEOs. Performance targets were set to be challenging but attainable based on the

expectations for the business at the time that the goals were set. In each case, the AIP targets of $915.5 million for net sales, $131.0

million for adjusted EBITDA, and 8.0% for net working capital as a percentage of net sales were derived from the Company’s fiscal

year 2023 annual operating plan (AOP) financial objectives. These targets put the Company in the top quartile as compared to calendar

year 2023 Wall Street consensus growth expectations for 20 market-leading consumer packaged goods companies used by the Company for purposes

of setting AIP targets. Under the AIP for fiscal 2023, in order for the annual incentive pool to begin to be funded, the Company had to

achieve a minimum threshold of 92% of the established adjusted EBITDA performance target. If the minimum performance threshold for adjusted

EBITDA was not satisfied, the pool would not have been funded and no annual cash incentive payments would have been payable to participants

– even if the Company met or exceeded threshold performance for the other two performance metrics. Additionally, the maximum performance

goal for net sales and adjusted EBITDA was established at 120% of the target goal, compared to 2022 when the maximum goal corresponded

to 110% of the target goal.

Performance

Metric

(dollars in

millions) | |

Threshold

(50% payout) | | |

Target

(100%

payout) | | |

Maximum

(200% payout) | | |

Weighting | | |

Actual

Performance | | |

Payout

Percentage per

Metric Based

on Actual

Performance | | |

Overall

Payout

Percentage

Based on

Actual

Performance

(1) | |

| Net Sales | |

$ | 878.9 | | |

$ | 915.5 | | |

$ | 1,098 | | |

| 40% | | |

$ | 1,020.4 | | |

| 157.3% | | |

| | |

| | |

| (96%

of target) | | |

| | | |

| (120%

of target) | | |

| | | |

| | | |

| | | |

| | |

| Adjusted

EBITDA(2) | |

$ | 120.5 | | |

$ | 131.0 | | |

$ | 157.2 | | |

| 50% | | |

$ | 157.8 | | |

| 200.0% | | |

| 183% | |

| | |

| (92%

of target) | | |

| | | |

| (120%

of target) | | |

| | | |

| | | |

| | | |

| | |

| Net

Working Capital (3) | |

| 9.0% | | |

| 8.0% | | |

| 7.0% | | |

| 10% | | |

| 6.1% | | |

| 200.0% | | |

| | |

| (1) | The Compensation Committee approved the payment of the 2023 AIP at 200% in recognition of significant efforts as discussed below.

See table below for payouts to each NEO. |

| (2) | For purposes of the 2023 Annual Incentive Plan, the Company’s performance metric for adjusted EBITDA was based on the Company’s

calculation of adjusted EBITDA reported in the Original Form 10-K. Adjusted EBITDA is calculated as EBITDA with add-back adjustments

for: (i) non-cash equity-based compensation expense, (ii) non-recurring costs, (iii) unrealized loss (gain) on foreign

currency contracts, (iv) supply chain optimization, and (v) transaction and integration costs. See reconciliation of adjusted

EBITDA to net income on page 55 of the Original 10-K under section titled “Non-GAAP Financial Measures.” The Compensation

Committee’s decision to pay AIP at 200% reduced our reported adjusted EBITDA by $1.7 million to $156.1 million. |

| (3) | Our net working capital performance metric is calculated as the difference between short-term assets (accounts receivable, inventory

and prepaid expenses) and short-term liabilities (accounts payable and accrued expenses), divided by (or as a percent of) net sales. |

Based on the above, cash incentives were earned

at 183% of target against financial targets under the AIP. However, in light of numerous achievements in 2023, the Compensation Committee

exercised discretion to increase overall payouts under the AIP, including for each NEO, from 183% of target to 200% of target. The Compensation

Committee’s determination was made primarily to recognize the Company’s significant overachievement against targets in 2023,

particularly in light of the stretch nature of the original target and maximum goals. Such overachievement included the Company’s

over-delivery of adjusted EBITDA and net working capital, which in each case exceeded the amount necessary for a maximum 2023 AIP payout

with respect to such metric. Additionally, the Committee desired to recognize execution of the Merger Agreement; recognize and reward

employees’ continued execution despite the uncertainty created by the pending Merger; and provide additional retention until the

payments of the 2023 AIP. The Compensation Committee further considered that the Company had also driven an extremely healthy cash position

of $232 million in 2023, up almost $100 million from 2022.

The target bonus opportunities and resulting payout

approved by our Compensation Committee for each NEOs for fiscal 2023 were:

| Name |

|

2023 Target Bonus

Opportunity As

Percent of Base

Salary |

|

|

2023

Target

Bonus |

|

|

2023

AIP %

Earned |

|

|

2023 AIP

Amount

Earned |

|

|

Approved

Payout

Percentage |

|

|

2023 AIP

Payment |

|

| Todd R. Lachman |

|

|

135% |

|

|

$ |

1,181,250 |

|

|

|

183% |

|

|

$ |

2,161,688 |

|

|

|

200% |

|

|

$ |

2,362,500 |

|

| Christopher W. Hall |

|

|

75% |

|

|

$ |

348,750 |

|

|

|

183% |

|

|

$ |

638,213 |

|

|

|

200% |

|

|

$ |

697,500 |

|

| E. Yuri Hermida |

|

|

100% |

|

|

$ |

550,000 |

|

|

|

183% |

|

|

$ |

1,006,500 |

|

|

|

200% |

|

|

$ |

1,100,000 |

|

| Kirk A. Jensen |

|

|

75% |

|

|

$ |

337,500 |

|

|

|

183% |

|

|

$ |

617,625 |

|

|

|

200% |

|

|

$ |

675,000 |

|

| Risa Cretella |

|

|

75% |

|

|

$ |

337,500 |

|

|

|

183% |

|

|

$ |

617,625 |

|

|

|

200% |

|

|

$ |

675,000 |

|

Additionally,

Mr. Hermida was eligible for a sign-on, performance-based cash bonus of $1,100,000 in order to compensate him for potential payouts

forgone when he left his prior company. Such performance bonus became payable on June 1, 2023 if the Company was on-track to meet

or exceed the threshold net sales and adjusted EBITDA performance metrics in the Company’s 2023 AOP as established by the Compensation

Committee under the AIP for fiscal 2023. This performance-based cash bonus was paid on June 1, 2023, because the Company

was on-track to meet or exceed such thresholds.

Equity Compensation

Annual long-term incentive compensation is intended

to align the interests of our leadership, including our NEOs, with those of our stockholders, reward the achievement of long-term value

creation, and promote retention of key talent. We adopted the Sovos Brands, Inc. 2021 Equity Incentive Plan (the “2021

Plan”) in September 2021 in connection with our IPO, pursuant to which we have generally granted annual equity awards in the

form of time-based restricted stock units (RSUs) and performance-based restricted stock units (PSUs). The 2021 Plan is administered

by our Compensation Committee.

We also have a legacy incentive plan, the Sovos

Brands Limited Partnership 2017 Equity Incentive Plan (the “2017 Plan”), under which Sovos Brands Limited Partnership (the

Company’s sole stockholder prior to the Company’s IPO) issued incentive unit awards. In connection with the Company’s

IPO, Sovos Brands Limited Partnership distributed its shares of Sovos Brands, Inc. common stock to its limited partners, including

holders of such incentive unit awards, in accordance with the applicable terms of its partnership agreement. Holders of unvested incentive

unit awards received shares of restricted common stock of Sovos Brands, Inc. in respect of their incentive unit awards. Such unvested

restricted stock is described below. We have not granted any awards under the 2017 Plan since the IPO.

2023 Annual Equity Awards

Our 2023 LTI program consists of RSUs and PSUs

granted under the 2021 Plan with the following weighting and vesting terms:

Award

Type |

Weighting |

Description / Objective |

| RSUs |

40% |

·

Vest one-half on each of the first two anniversaries of the grant date, other than for Mr. Lachman, whose Annual RSUs vest one-third

on each of the first three anniversaries of the grant date.

· Realized value linked to TSR while promoting retention of talent. |

| PSUs |

60% |

· Vest based on the Company’s TSR relative to the TSRs of the companies

in the compensation peer group, over a three-year performance period: |

| |

|

|

|

|

|

|

|

| |

|

|

Performance

Level (payout

% of target

PSUs) |

Threshold (50% of

target payout) |

Target (100% of

target payout) |

Maximum (200%

of target payout) |

|

| |

|

|

Relative TSR Percentile Rank |

30th percentile vs compensation peers |

60th percentile vs compensation peers |

90th percentile vs compensation peers |

|

| |

|

|

|

|

|

|

|

| |

|

- Straight-line interpolation applies between achievement levels.

- Regardless of the relative TSR achieved, if the Company’s TSR over the

performance period is negative, the maximum vesting shall be 100% of the target Annual PSUs.

· Realized

value linked to both absolute and relative TSR while promoting retention of key talent

|

| |

|

|

|

|

|

|

|

The table below summarizes intended target value of equity awards made

to our named executive officers in 2023:

| | |

2023 Equity Awards | |

| | |

Annual RSUs | | |

Annual Target PSUs | | |

Total | |

| Name | |

Intended Target

Value | | |

Intended Target

Value(1) | | |

Intended Target

Value | |

| Todd R. Lachman | |

$ | 1,320,000 | | |

$ | 1,980,000 | | |

$ | 3,300,000 | |

| Christopher W. Hall | |

$ | 400,000 | | |

$ | 600,000 | | |

$ | 1,000,000 | |

| E. Yuri Hermida | |

$ | 440,000 | | |

$ | 660,000 | | |

$ | 1,100,000 | |

| Kirk A. Jensen | |

$ | 200,000 | | |

$ | 300,000 | | |

$ | 500,000 | |

| Risa Cretella | |

$ | 300,000 | | |

$ | 450,000 | | |

$ | 750,000 | |

| (1) | Grant-date fair value of PSUs as reported in the Grants of Plan Based Awards Table and Summary Compensation Table differs from the

target values in this table because the grant date fair value is calculated using a Monte-Carlo model for each award on the date of grant,

as determined under FASB ASC 718 based on the probable outcome of the relative TSR vesting hurdles as of the grant date. |

The number of RSUs and the target number of PSUs

granted to each executive was determined by taking the intended target value divided by the closing price of our common stock on the date

prior to the grant date.

Additionally, $100,000 in RSUs were awarded to

Mr. Hermida upon his promotion to President in December 2023.

IPO Equity Grants

In connection with the IPO on September 23,

2021, our Board granted RSUs (the “IPO RSUs”) under the 2021 Plan to our salaried employees, including our NEOs who were then

employees. The IPO RSUs cliff vest in full upon the third anniversary of the date of grant subject to continued service on such date,

except as otherwise provided below in “Potential Payments upon Termination of Employment or Change in Control.”

In connection with the IPO, the Board also granted

PSUs (the “IPO PSUs”) under the 2021 Plan to our vice presidents, senior vice presidents and senior executive team members,

including our NEOs who were then employees. The Compensation Committee also granted IPO PSUs to Mr. Hermida when he joined the Company

in October 2022 to compensate him for equity awards forgone when he left his prior company.

The IPO PSUs vest based on the highest 20-day

volume weighted average price of our stock during the three-year period following the grant date as compared to the 20-day volume weighted

average price of our stock immediately following the IPO (the “baseline stock price”), with 25% vesting upon achievement of

a stock price increase of 25% over the baseline stock price and 100% vesting upon achievement of a stock price increase of 100% over the

baseline stock price, with linear interpolation between achievement levels, generally subject to continued service on such date, except

as otherwise provided below in “Potential Payments upon Termination of Employment or Change in Control.” Upon a change in

control (as defined in the 2021 Plan), the performance condition is deemed satisfied at 100% and the IPO PSUs remain subject solely to

time-based vesting over the remainder of the three-year period, subject to continued service on such date except as otherwise provided

below in “Potential Payments upon Termination of Employment or Change in Control.”

In February 2023, to improve executive retention,

the Compensation Committee determined to modify the IPO PSUs, including for each of our NEOs, to provide that the IPO PSUs instead vest

(i) 50% on September 23, 2024 and 50% on September 23, 2025, subject to continued service on such date except as otherwise

provided below in “Potential Payments upon Termination of Employment or Change in Control,” or (ii) upon achievement

of the original vesting criteria, if earlier. The incremental expense associated with this modification is reflected in the Summary Compensation

Table below for fiscal 2023.

Restricted Stock

Prior to our IPO, awards were issued to Mr. Lachman,

Mr. Hall, Mr. Jensen, and Ms. Cretella under the 2017 Plan, which provided for grants of incentive units (the “Time-Based

Incentive Units” and the “Performance-Based Incentive Units”) in Sovos Brands Limited Partnership, our parent entity

prior to our IPO, to our employees, independent directors and other service providers, as well as to directors, employees and other service

providers of our subsidiaries or affiliates.

In connection with our IPO, Mr. Lachman,

Mr. Hall, Mr. Jensen, and Ms. Cretella received shares of common stock in respect of their vested Time-Based Incentive

Units. Additionally, pursuant to a restricted stock award agreement with us and Sovos Brands Limited Partnership, these NEOs received

shares of restricted common stock in respect of their unvested Time-Based Incentive Units (such shares, the “Time-Based Restricted

Stock”) and their unvested Performance-Based Incentive Units (such shares, the “Performance-Based Restricted Stock”).

Under their applicable restricted stock agreements, the Time-Based Restricted Stock continued to vest on the same schedule as the Time-Based

Incentive Units with respect to which such Time-Based Restricted Stock was distributed. As of the end of fiscal 2023, all of Mr. Lachman’s,

Mr. Hall’s, Mr. Jensen’s, and Ms. Cretella’s Time-Based Restricted Stock was vested. Following the IPO,

we have not granted and will not grant any further awards under the 2017 Plan.

The Performance-Based Restricted Stock vests based

on Advent’s receipt of aggregate cash amounts (including marketable securities as such term is defined in the Incentive Unit award

agreements) representing at least a multiple of invested capital (“MOIC”) of 2.0 MOIC, 2.5 MOIC, 3.0 MOIC, and 4.0 MOIC, as

applicable, with linear interpolation between MOIC achievement levels. Performance will be measured on a change in control or as Advent

sells shares of our common stock following our IPO. Performance will also be measured on the earlier of (i) the 30 month anniversary

of our IPO and (ii) the point in time when Advent owns 25% or less of the shares it held before our IPO, with, in each case, all

shares still held by Advent at such time valued at the average trading price over a period of 30 consecutive days. Pursuant to their respective

restricted stock award agreements, certain holders of Performance-Based Restricted Stock awards, including Mr. Lachman, Mr. Hall,

Mr. Jensen, and Ms. Cretella, have the opportunity to elect to have performance measured at the point in time when Advent owns

25% or less of the shares it held before the IPO rather than upon the 30-month anniversary of the IPO. The Performance-Based Restricted

Stock awards eligible for vesting on the achievement of 2.0 MOIC were also eligible to vest if Advent’s receipt of aggregate cash

amounts, including the value of our shares held by Advent following the IPO (valued for such purposes at the average trading price over

the first 30 consecutive days after the IPO) would result in Advent’s achievement of 2.0 MOIC. Based on the foregoing, such 2.0

MOIC Performance-Based Restricted Stock awards vested effective November 3, 2021. Vesting of Performance-Based Restricted Stock awards

is subject to continued employment on the applicable measurement date, except as described in the section titled “Potential Payments

upon Termination of Employment or Change in Control” below. See the “Outstanding Equity Awards as of December 30, 2023”

below.

The foregoing description reflects modifications

to vesting terms of the Performance-Based Incentive Units that were made in connection with the IPO. The incremental expense associated

with these modifications is reflected in the Summary Compensation Table below for fiscal 2021. Following the IPO, in November 2021,

the Compensation Committee determined to further modify a portion of the Performance-Based Restricted Stock awards, including for Mr. Lachman,

Mr. Hall, Mr. Jensen, and Ms. Cretella, to provide that a portion of the shares that would have vested based upon a 4.0

MOIC (including any related linear interpolation) instead vest on the last day of fiscal 2022 or on the last day of fiscal 2023, generally

subject to continued service on such date except as otherwise provided below in “Potential Payments upon Termination of Employment

or Change in Control,” or upon achievement of the 4.0 MOIC vesting criteria, if earlier. The incremental expense associated with

these modifications is also reflected in the Summary Compensation Table for fiscal 2021. Such modified Performance-Based Restricted Stock

awards were vested in full as of the last day of fiscal 2023.

In February 2023, to improve executive retention,

the Compensation Committee determined to modify half of the Performance-Based Restricted Stock that would have vested solely based upon

a 3.0 MOIC or 4.0 MOIC (including any related linear interpolation) to provide that such Restricted Stock instead vests (i) 50% on

September 23, 2024 and 50% on September 23, 2025 or (ii) upon achievement of the applicable 3.0 MOIC or 4.0 MOIC vesting

criteria, if earlier, subject to continued service on such date except as otherwise provided below in “Potential Payments upon Termination

of Employment or Change in Control.” The incremental expense associated with this modification is reflected in the Summary Compensation

Table for fiscal 2023. The shares that vest upon achievement of the 2.5 MOIC vesting criteria are unaffected by this modification.

The terms of the applicable restricted stock agreements

provide that any such Restricted Stock that does not vest forfeits to Sovos Brands Limited Partnership.

Other Benefits

Our NEOs are also entitled to certain other benefits,

subject to their enrollment, including a 401(k) plan with matching contributions, life insurance and group health insurance. We cover

the tax payments for our NEOs with respect to their life and health insurance premiums.

Other

Compensation and Governance Matters

Employment Arrangements and Severance

Other than our CEO who has an employment agreement

with us, we provided offer letters to each of our NEOs that set forth the basic terms of at-will employment and establish the individual’s

base salary, eligibility to participate in the annual bonus plan and receive equity awards, and eligibility to participate in standard

employee benefits. Mr. Lachman’s employment agreement, in addition to setting forth the basic terms of employment as provided

under our offer letters, provides for certain benefits under qualifying terminations. See “NEO Employment Arrangements” below

for a description of the terms of such agreements.

We also maintain the Sovos Brands, Inc. 2023

Amended and Restated Executive Severance Plan (the “Executive Severance Plan”) that applies to our executive officers, other

than Mr. Lachman, who is entitled to severance under his employment agreement, and Mr. Jensen, who is entitled to severance

under the Executive Severance Plan as augmented by his letter agreement (as described below). The Executive Severance Plan, including

certain amendments approved during 2023 following benchmarking by FW Cook, is further described below under “Potential Payments

Upon Termination or Change in Control – Executive Severance Plan.”

The Compensation Committee believes that these

arrangements are important to attracting and retaining key talent and promoting focus on achievement of long-term strategic objectives

because they provide financial protection in the event of certain involuntary termination scenarios. In particular, our severance arrangements

are intended to align executive and stockholder interests by enabling executives to evaluate corporate transactions that may be in the

best interests of stockholders without undue concern over whether the transactions may jeopardize the executives’ own employment

and promoting retention during the pendency of any transaction (see “Potential Payments Upon Termination or Change in Control”

for further detail).

Stock Ownership Guidelines

Upon the recommendation of the Compensation Committee,

the Board adopted the following stock ownership guidelines applicable to our executive officers:

| | |

Ownership Requirement | |

| Position | |

(multiple of cash retainer/base

salary) | |

| Chief Executive Officer | |

| 6x | |

| All Other Executive Officers | |

| 3x | |

In addition to shares held outright (whether

directly or indirectly), unvested restricted stock and restricted stock units that vest based on time (including any that vest based

on time but may vest sooner based on performance) count towards the ownership threshold. Restricted stock and restricted stock units

that vest only based on performance do not count. Although we do not currently grant stock options, the stock ownership guidelines provide

that unexercised stock options (whether vested or unvested) also do not count.

Until the applicable multiple is achieved, an

executive officer is expected to retain 75% of the shares received under any Company equity plan, net of shares for taxes on such awards.

As of the date of this Amendment, all executive officers meet or exceed their ownership requirement or comply with the retention ratio.

Anti-Hedging and Anti-Pledging Policies

Under our Insider Trading Policy, our directors

and executive officers as well as our senior vice presidents, certain vice presidents, assistant controller, director of internal audit

and SEC reporting manager and others identified from time to time, are not permitted to purchase a financial instrument or enter into

any transaction that is designed to hedge, establish downside price protection or otherwise offset declines in the market value of our

common stock, including puts, calls, prepaid variable forward contracts, equity swaps, collars, exchange funds (excluding broad-based

index funds) and other financial instruments that are designed to or have the effect of hedging or offsetting any decrease in the market

value of our common stock. Additionally, such persons also may not pledge Company securities, including as collateral for a margin loan.

Clawback

In November 2023, the Board, upon the recommendation

of the Compensation Committee, approved the Sovos Brands, Inc. Clawback Policy pursuant to, and consistent with, the listing requirements

of Nasdaq. The policy applies to the Company’s current and former executive officers and provides for the mandatory recovery of

certain erroneously awarded incentive-based compensation in the event that the Company is required to prepare an accounting restatement

due to material noncompliance with any financial reporting requirement under the federal securities laws.

Compensation Risk Assessment

Pursuant to the Compensation Committee’s

charter, at least annually, the committee reviews the Company’s compensation policies and practices for executives, management employees

and employees generally to assess whether such policies and practices could lead to excessive risk taking behavior and the manner in which

any risks arising out of the Company’s compensation policies and practices are monitored and mitigated and adjustments necessary

to address changes in the Company’s risk profile. Based on such review, the Compensation Committee believes that our compensation

program does not create risks that are reasonably likely to have a materially adverse effect on the Company.

Compensation

Committee Report

Our Compensation Committee has reviewed and discussed

the section entitled “Compensation Discussion and Analysis” with management. Based upon this review and discussion, the Compensation

Committee recommended to the Board of Directors that the section entitled “Compensation Discussion and Analysis” be included

in this Amendment No. 1 on Form 10-K/A to the Company’s Annual Report on Form 10-K for the fiscal year ended December 30,

2023.

| Jefferson M. Case, Chair | David W.

Roberts | |

| William R. Johnson | Vijayanthimala (Mala) Singh | |

Summary compensation table

The following table sets forth summary information concerning the compensation

of our NEOs for each of the last three completed fiscal years.

| | |

| | |

| | |

| | |

| | |

Non-Equity | | |

| | |

| |

| | |

| | |

| | |

| | |

Stock | | |

Incentive Plan | | |

All Other | | |

| |

| Name and principal | |

| | |

Salary | | |

Bonus | | |

Awards | | |

Compensation | | |

Compensation | | |

Total | |

| position | |

Year | | |

($) | | |

($)(1) | | |

($)(2) | | |

($)(3) | | |

($)(4) | | |

($) | |

| Todd R. Lachman | |

| 2023 | | |

| 875,000 | | |

| 200,813 | | |

| 8,408,689 | | |

| 2,161,688 | | |

| 140,694 | | |

| 11,786,883 | |

| Chief Executive | |

| 2022 | | |

| 800,000 | | |

| — | | |

| 3,060,959 | | |

| 1,490,400 | | |

| 416,543 | | |

| 5,767,902 | |

| Officer | |

| 2021 | | |

| 725,000 | | |

| 294,230 | | |

| 11,762,837 | | |

| 643,413 | | |

| 157,841 | | |

| 13,583,321 | |

| Christopher W. Hall | |

| 2023 | | |

| 465,000 | | |

| 59,288 | | |

| 2,090,939 | | |

| 638,213 | | |

| 230,666 | | |

| 3,484,106 | |

| Chief Financial Officer | |

| 2022(5) | | |

| 465,000 | | |

| — | | |

| 1,138,733 | | |

| 481,275 | | |

| 130,018 | | |

| 2,215,026 | |

| | |

| 2021 | | |

| 440,000 | | |

| 79,363 | | |

| 2,234,321 | | |

| 173,549 | | |

| 28,629 | | |

| 2,955,862 | |

| E. Yuri Hermida(6) | |

| 2023 | | |

| 550,000 | | |

| 93,500 | | |

| 1,873,044 | | |

| 2,106,500 | | |

| 71,922 | | |

| 4,694,966 | |

| President | |

| 2022 | | |

| 102,291 | | |

| — | | |

| 3,928,226 | | |

| 141,403 | | |

| 4,626 | | |

| 4,176,546 | |

| Kirk A. Jensen(7) | |

| 2023 | | |

| 450,000 | | |

| 57,375 | | |

| 1,160,162 | | |

| 617,625 | | |

| 61,620 | | |

| 2,346,782 | |

| Chief Operating Officer | |

| 2022 | | |

| 450,000 | | |

| — | | |

| 1,569,362 | | |

| 434,700 | | |

| 99,047 | | |

| 2,553,109 | |

| Risa Cretella(8) | |

| 2023 | | |

| 450,000 | | |

| 57,375 | | |

| 1,355,225 | | |

| 617,625 | | |

| 57,154 | | |

| 2,537,379 | |

| Chief Sales Officer | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) | For fiscal 2023, represents the amount under the 2023 Annual Incentive Plan that the Compensation Committee determined in its discretion

to be paid out above the 183% achievement level attained under the plan disclosed in this table under “Non-Equity Incentive Plan

Compensation.” See footnote 3 to this table and the discussion under “Annual Cash Incentive Awards” in CD&A above. |

| (2) | For fiscal 2023, represents (i) the aggregate grant date fair value of RSUs and PSUs that were granted in fiscal 2023, (ii) the

incremental value of the IPO PSUs that were modified in February 2023 as discussed under “Equity Compensation—IPO Equity

Grants” in CD&A above, and (iii) the incremental value of the Performance-Based Restricted Stock that was modified in February 2023

as discussed under “Equity Compensation – Restricted Stock” in CD&A above. The grant date fair value of the PSUs

is computed based on the probable outcome of the performance conditions as of the grant date at target. The aggregate grant date fair

value of the PSUs at maximum performance as computed in accordance with FASB ASC Topic 718 for each NEO is as follows: Mr. Lachman

– $4,962,819; Mr. Hall – $1,510,403; Mr. Hermida – $1,654,273; Mr. Jensen – $751,917; and Ms. Cretella

– $1,127,910. The foregoing amounts are consistent with the estimate of aggregate compensation cost to be recognized by the Company

over the performance period of the award determined as of the grant date under FASB ASC Topic 718, excluding the effect of estimated forfeitures.

The assumptions used in calculating the valuations are set forth in Note 16 to the Original 10-K Filing. |

| (3) | For fiscal 2023, represents performance-based amounts earned at 183% of target under our 2023 Annual Incentive Plan as described in

CD&A under “Annual Cash Incentive Awards.” For Mr. Hermida, also includes $1,100,000 for his performance-based cash

bonus that was payable on June 1, 2023, which was intended to compensate him for amounts forgone when he left his prior company.

See discussion in CD&A above. |

| (4) | For fiscal 2023, payments to our NEOs included in the “All Other Compensation” column include the following: |

| | |

Long

term | | |

| | |

| | |

| | |

| | |

Dividend | | |

| | |

| |

| | |

| Disability | | |

| Life | | |

| | | |

| 401

(k) | | |

| Health | | |

| Holdback | | |

| Tax | | |

| | |

| | |

| Insurance | | |

| Insurance | | |

| Cell

Phone | | |

| Matching | | |

| Insurance | | |

| Payments | | |

| Reimbursements | | |

| | |

| Name | |

| Premiums | | |

| Premiums | | |

| Allowance | | |

| Contributions | | |

| Premiums | | |

| (a) | | |

| (b) | | |

| Total | |

| Todd

R. Lachman | |

$ | 11,231 | | |

$ | 38,746 | | |

$ | 1,200 | | |

$ | 7,673 | | |

$ | 36,661 | | |

$ | — | | |

$ | 45,183 | | |

$ | 140,694 | |

| Christopher

W. Hall | |

$ | 650 | | |

$ | 1,171 | | |

$ | 1,200 | | |

$ | — | | |

$ | 24,213 | | |

$ | 203,432 | | |

$ | — | | |

$ | 230,666 | |

| E.

Yuri Hermida | |

$ | 9,625 | | |

$ | 5,496 | | |

$ | 1,200 | | |

$ | 13,200 | | |

$ | 36,661 | | |

$ | — | | |

$ | 5,740 | | |

$ | 71,922 | |

| Kirk

A. Jensen | |

$ | 4,605 | | |

$ | 3,896 | | |

$ | 1,200 | | |

$ | 13,200 | | |

$ | 36,661 | | |

$ | — | | |

| 2,058 | | |

$ | 61,620 | |

| Risa

Cretella | |

$ | 2,926 | | |

$ | 2,496 | | |

$ | 1,200 | | |

$ | 13,200 | | |

$ | 36,661 | | |

$ | — | | |

$ | 671 | | |

$ | 57,154 | |

(a) In June 2021, the Company paid a one-time

cash dividend to Sovos Brands Limited Partnership, its ultimate parent at the time. The limited partnership distributed the dividend

to its limited partners; however, distribution amounts associated with time-based incentive units of the limited partnership that were

unvested as of June 30, 2022 were withheld until such limited partnership interests vested based on continued service with the Company.

Dividend Holdback Payments reflect the amounts distributed by the limited partnership to the executive in fiscal 2023.

(b) Represents reimbursements by the Company for taxes

relating to payments of insurance premiums on behalf of the executive.

| (5) | Mr. Hall was a NEO for fiscal 2021 and fiscal 2023, but not for fiscal 2022; however, compensation for fiscal 2022 is being provided

pursuant to applicable SEC Staff guidance. |

| (6) | Mr. Hermida joined the Company in October 2022 as its Chief Growth Officer and first became a NEO for fiscal 2022. IPO PSUs

were granted to Mr. Hermida when he joined the Company to compensate him for equity awards forgone when he left his prior company.

Mr. Hermida was promoted to President in December 2023. |

| (7) | Mr. Jensen first became a NEO for fiscal 2022. |

| (8) | Ms. Cretella first became a NEO for fiscal 2023. |

Grants of Plan Based Awards

The following

table specifies the grants of awards made under our cash bonus and equity incentive plans to the NEOs during and for fiscal 2023.

| |

|

Type

of |

|

|

|

|

Estimated

Future Payouts

Under Non-Equity Incentive

Plan Awards (1) |

|

|

Estimated

Future Payouts Under

Equity Incentive Plan Awards (2) |

|

|

All

Other

Stock Awards:

Number of

Shares of

Stock

Underlying

Units |

|

|

Grant

Date Fair

Value of Stock |

| Name |

|

Award |

|

Grant

Date |

|

|

Threshold |

|

|

Target |

|

|

Maximum |

|

|

Threshold |

|

|

Target |

|

|

Maximum |

|

|

(3)(4)(5)(6) |

|

|

Awards (7) |

| |

|

|

|

|

|

|

|

|

($) |

|

|

|

($) |

|

|

|

($) |

|

|

|

(#) |

|

|

|

(#) |

|

|

|

(#) |

|

|

|

(#) |

|

|

($) |

| Todd R. Lachman |

|

AIP |

|

|

— |

|

|

|

295,313 |

|

|

|

1,181,250 |

|

|

|

2,362,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

| |

|

Annual RSU(3) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

94,964 |

|

|

1,320,000 |

| |

|

Annual PSU (2) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

71,223 |

|

|

|

142,446 |

|

|

|

284,892 |

|

|

|

— |

|

|

2,481,409 |

| |

|

IPO PSU Modification(4) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

280,000 |

|

|

1,783,600 |

| |

|

MOIC Modification(5) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

259,224 |

|

|

3,489,155 |

| Christopher W. Hall |

|

AIP |

|

|

— |

|

|

|

87,188 |

|

|

|

348,750 |

|

|

|

697,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

| |

|

IPO PSU Modification (4) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

83,333 |

|

|

530,831 |

| |

|

MOIC Modification (5) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36,495 |

|

|

755,201 |

| |

|

Annual RSU(3) |

|

|

6/7/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,378 |

|

|

399,982 |

| |

|

Annual PSU(2) |

|

|

6/7/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16,034 |

|

|

|

32,068 |

|

|

|

64,136 |

|

|

|

— |

|

|

755,201 |

| E. Yuri Hermida |

|

AIP |

|

|

— |

|

|

|

137,500 |

|

|

|

550,000 |

|

|

|

1,100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

| |

|

Annual RSU(3) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,654 |

|

|

439,991 |

| |

|

Annual PSU(2) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

23,741 |

|

|

|

47,482 |

|

|

|

94,964 |

|

|

|

— |

|

|

827,136 |

| |

|

IPO PSU Modification(4) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

79,422 |

|

|

505,918 |

| |

|

One-Time Promotion Award(6) |

|

|

12/4/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,562 |

|

|

99,999 |

| Kirk A. Jensen |

|

AIP |

|

|

— |

|

|

|

84,375 |

|

|

|

337,500 |

|

|

|

675,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

| |

|

Annual RSU(3) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,388 |

|

|

199,993 |

| |

|

Annual PSU(2) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10,791 |

|

|

|

21,582 |

|

|

|

43,164 |

|

|

|

— |

|

|

375,958 |

| |

|

IPO PSU Modification(4) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,250 |

|

|

199,063 |

| |

|

MOIC Modification(5) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35,544 |

|

|

478,422 |

| Risa Cretella |

|

AIP |

|

|

— |

|

|

|

84,375 |

|

|

|

337,500 |

|

|

|

675,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

| |

|

Annual RSU(3) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21,582 |

|

|

299,990 |

| |

|

Annual PSU(2) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16,187 |

|

|

|

32,374 |

|

|

|

64,748 |

|

|

|

— |

|

|

563,955 |

| |

|

IPO PSU Modification(4) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,916 |

|

|

145,975 |

| |

|

MOIC Modification(5) |

|

|

2/10/2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|