ValueAct Capital Takes Larger Stake in Seagate

10 September 2016 - 2:10AM

Dow Jones News

Seagate Technology PLC said Friday that ValueAct Capital will

increase its stake in the company, making it one of the disk drive

maker's largest shareholders and giving it a look at the company's

inner workings.

ValueAct Capital and Seagate are together buying 12.5 million

shares of Seagate stock in a so-called block transaction. About 9.5

million of those shares will go to ValueAct, which already holds

about 3 million shares of the company, according to FactSet data.

The transaction is expected to close within the month.

With the stock purchase, ValueAct has been invited to serve as

an observer on Seagate's board of directors.

Seagate Chief Executive Steve Luczo said the company approached

ValueAct given their track record "in creating long-term value for

the companies in which they invest."

Seagate has been suffering due to decreased demand for personal

computers that use its products. In addition, computer makers are

adopting storage devices based on flash memory chips rather than

magnetic disks, a shift that has affected Seagate and other drive

makers.

In July, it said it is cutting about 6,500 jobs globally,

roughly 14% of its workforce, less than two weeks after it

announced a reduction of 1,600 positions.

Last month, Seagate reported its earnings fell 49% in the latest

quarter as the bottom line was hit by expenses related to the

cost-cutting efforts and other items.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

September 09, 2016 11:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

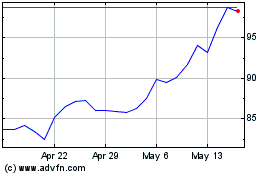

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

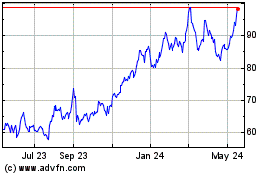

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024