false000178173000017817302024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 25, 2024 |

THIRD COAST BANCSHARES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Texas |

001-41028 |

46-2135597 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

20202 Highway 59 North Suite 190 |

|

Humble, Texas |

|

77338 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 281 446-7000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $1.00 per share |

|

TCBX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 25, 2024, Third Coast Bancshares, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and year ended December 31, 2023. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

THIRD COAST BANCSHARES, INC. |

|

|

|

|

Date: |

January 25, 2024 |

By: |

/s/ R. John McWhorter |

|

|

|

R. John McWhorter

Chief Financial Officer |

Exhibit 99.1

|

|

|

News Release |

Contact: Ken Dennard / Natalie Hairston Dennard Lascar Investor Relations (713) 529-6600 TCBX@dennardlascar.com |

FOR IMMEDIATE RELEASE

THIRD COAST BANCSHARES, INC. REPORTS RECORD

2023 FOURTH QUARTER AND FULL YEAR FINANCIAL RESULTS

Year over Year Book Value grew 9.0% and Tangible Book Value(1) grew 9.7%

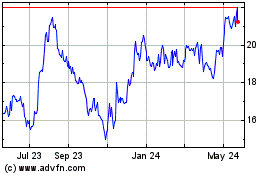

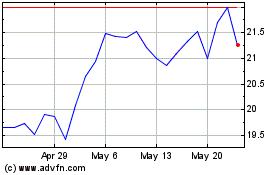

HOUSTON, TX – January 25, 2024 – Third Coast Bancshares, Inc. (NASDAQ: TCBX) (the “Company,” “Third Coast,” “we,” “us,” or “our”), the bank holding company for Third Coast Bank, SSB, today reported its 2023 fourth quarter and full year financial results.

2023 Fourth Quarter Financial Highlights

•Total assets increased $180.3 million to a record $4.40 billion as of December 31, 2023, or 4.3% over the $4.22 billion reported as of September 30, 2023.

•Gross loans grew $78.8 million to $3.64 billion as of December 31, 2023, 2.2% more than the $3.56 billion reported as of September 30, 2023.

•Deposits increased $156.3 million to $3.80 billion as of December 31, 2023, or 4.3% over the $3.65 billion reported as of September 30, 2023.

•Book value per share and tangible book value per share(1) increased to $25.41 and $24.02, respectively, as of December 31, 2023, compared to $24.57 and $23.17, respectively, as of September 30, 2023.

•Net income for the fourth quarter of 2023 totaled $9.7 million, or $0.57 per diluted share, compared to $5.6 million, or $0.32 per diluted share, for the third quarter of 2023.

2023 Full Year Financial Highlights

•Total assets increased $622.9 million to $4.40 billion as of December 31, 2023, or 16.5% over the $3.77 billion reported as of December 31, 2022.

•Gross loans grew $531.2 million to $3.64 billion as of December 31,2023, 17.1% more than the $3.11 billion reported as of December 31, 2022.

•Deposits increased $567.0 million to $3.80 billion as of December 31, 2023, or 17.5% over the $3.24 billion reported as of December 31, 2022.

•Book value per share and tangible book value per share(1) increased to $25.41 and $24.02, respectively, as of December 31, 2023, compared to $23.32 and $21.90, respectively, as of December 31, 2022.

____________________________

(1)Non-GAAP financial measure. Please refer to the table titled “GAAP Reconciliation and Management's Explanation of Non-GAAP Financial Measures” at the end of this press release for a reconciliation of these non-GAAP financial measures.

•Net income totaled $33.4 million, or $1.98 per diluted share, and $18.7 million, or $1.25 per diluted share, for the years ended December 31, 2023 and 2022, respectively, an increase of 79.0%.

“We are very pleased with our fourth quarter and full year 2023 results,” said Bart Caraway, Chairman, President, and CEO of Third Coast. “Despite headwinds that included a lackluster economy and persistent interest rate hikes, the Third Coast team worked diligently to boost profitability by managing expenses and enhancing operational efficiencies. These efforts resulted in record performance, particularly, a 79% increase in net income over 2022. Moreover, our assets, loans, and deposits grew 17%, 17% and 18%, respectively, over the prior year, creating positive operating leverage.

“Looking ahead, we look forward to the possibilities and opportunities awaiting us in 2024. We will continue to focus on innovation, amplify the passion of our lenders and staff to offer our customers exceptional banking services across the largest metropolitan areas in Texas, and seek to deliver shareholder value by achieving above average growth in book value,” Mr. Caraway concluded.

Operating Results

Net Income and Earnings Per Share

Net income totaled $9.7 million for the fourth quarter of 2023, compared to $5.6 million for the third quarter of 2023 and $7.5 million for the fourth quarter of 2022. Net income available to common shareholders totaled $8.5 million for the fourth quarter of 2023, compared to $4.4 million for the third quarter of 2023 and $6.1 million for the fourth quarter of 2022. The quarter-over-quarter increase was primarily due to an increase in net interest income resulting from higher loan rates, a reduction in provision expense for credit losses for the quarter, and noninterest expense savings related to implementation of cost reduction plans in prior quarters. Dividends on our Series A Convertible Non-Cumulative Preferred Stock totaled $1.2 million for each of the quarters ended December 31, 2023 and September 30, 2023. Basic earnings per share and diluted earnings per share were $0.62 per share and $0.57 per share, respectively, in the fourth quarter of 2023 compared to $0.32 per share each, in the third quarter of 2023 and $0.45 per share and $0.44 per share, respectively, in the fourth quarter of 2022.

Net Interest Margin and Net Interest Income

The net interest margin for the fourth quarter of 2023 was 3.61%, compared to 3.71% for the third quarter of 2023 and 3.75% for the fourth quarter of 2022. The yield on loans for the fourth quarter of 2023 was 7.75%, compared to 7.57% for the third quarter of 2023 and 6.27% for the fourth quarter of 2022. The increase in yield on loans during the fourth quarter of 2023 was primarily due to the increase in the Prime Rate in previous quarters.

Net interest income totaled $37.3 million for the fourth quarter of 2023, an increase of 5.8% from $35.3 million for the third quarter of 2023 and an increase of 16.1% from $32.2 million for the fourth quarter of 2022. Interest income totaled $77.1 million for the fourth quarter of 2023, an increase of 11.1% from $69.4 million for the third quarter of 2023 and an increase of 50.7% from $51.2 million for the fourth quarter of 2022. Interest and fees on loans increased $4.9 million, or 7.6%, compared to the third quarter of 2023, and increased $22.2 million, or 46.3%, compared to the fourth quarter of 2022. Interest expense was $39.7 million for the fourth quarter of 2023, an increase of $5.6 million, or 16.5%, from $34.1 million for the third quarter of 2023 and an increase of $20.7 million, or 109.1%, from $19.0 million for the fourth quarter of 2022. The increase in interest expense during the fourth quarter of 2023 was primarily due to interest-bearing deposit growth and increases in interest rates paid on interest-bearing deposit accounts.

Noninterest Income and Noninterest Expense

Noninterest income totaled $2.2 million for the fourth quarter of 2023, compared to $1.9 million for the third quarter of 2023 and $1.8 million for the fourth quarter of 2022. The increase in noninterest income from the third

2

quarter of 2023 was primarily due to increased fees from derivative transactions and Small Business Investment Company income.

Noninterest expense totaled $26.4 million for the fourth quarter of 2023, down from $27.5 million for the third quarter of 2023 and up from $22.6 million for the fourth quarter of 2022. The year-over-year increase was primarily attributed to increased salary expenses, investment in new technology and software, increased professional fees related to growth and regulatory compliance, increased expenses related to four locations opened in 2022, and increased other expenses such as franchise taxes, fraud losses, and deposit related fees.

The efficiency ratio was 66.89% for the fourth quarter of 2023, compared to 74.07% for the third quarter of 2023 and 66.74% for the fourth quarter of 2022.

Balance Sheet Highlights

Loan Portfolio and Composition

For the quarter ended December 31, 2023, gross loans increased to $3.64 billion, an increase of $78.8 million, or 2.2%, from $3.56 billion as of September 30, 2023, and an increase of $531.2 million, or 17.1%, from $3.11 billion as of December 31, 2022. Real estate and municipal loans accounted for most of the loan growth for the fourth quarter of 2023, with real estate loans increasing $76.3 million and municipal loans increasing $23.6 million from September 30, 2023.

Asset Quality

Non-performing loans were $17.3 million at December 31, 2023, compared to $16.4 million at September 30, 2023, and $12.3 million at December 31, 2022.

The provision for credit loss recorded for the fourth quarter of 2023 was $1.1 million and related to provisioning for new loans and commitments. The allowance for credit losses of $37.0 million represented 1.02% of the $3.64 billion in gross loans outstanding as of December 31, 2023.

As of December 31, 2023, the nonperforming loans to loans held for investment ratio remained low at 0.48%, compared to 0.46% as of September 30, 2023, and 0.39% as of December 31, 2022. During the three months ended December 31, 2023, and 2022, the Company recorded net charge-offs of $1.5 million and $708,000, respectively. On a full year basis, net charge-offs were $1.2 million and $1.1 million in 2023 and 2022, respectively.

Deposits and Composition

Deposits totaled $3.80 billion as of December 31, 2023, an increase of 4.3% from $3.65 billion as of September 30, 2023, and an increase of 17.5% from $3.24 billion as of December 31, 2022. Noninterest-bearing demand deposits decreased from $500.2 million as of September 30, 2023, to $459.6 million as of December 31, 2023 and represented 12.1% of total deposits as of December 31, 2023, compared to 13.7% of total deposits as of September 30, 2023. As of December 31, 2023, interest-bearing demand deposits increased $325.1 million, or 12.9%, and time deposits and savings accounts decreased $127.5 million, or 21.1%, and $639,000, or 2.5%, respectively, from September 30, 2023.

The average cost of deposits was 4.07% for the fourth quarter of 2023, representing a 34-basis point increase from the third quarter of 2023 and a 190-basis point increase from the fourth quarter of 2022 due primarily to interest-bearing demand deposit growth and the increase in rates paid on interest-bearing demand deposits.

3

Earnings Conference Call

Third Coast has scheduled a conference call to discuss its 2023 fourth quarter and fiscal year results, which will be broadcast live over the Internet, on Friday, January 26, 2024, at 11:00 a.m. Eastern Time / 10:00 a.m. Central Time. To participate in the call, dial 201-389-0869 and ask for the Third Coast Bancshares, Inc. call at least 10 minutes prior to the start time, or access it live over the Internet at https://ir.tcbssb.com/events-and-presentations/events. For those who cannot listen to the live call, a replay will be available through February 2, 2024, and may be accessed by dialing 201-612-7415 and using passcode 13743555#. Also, an archive of the webcast will be available shortly after the call at https://ir.tcbssb.com/events-and-presentations/events for 90 days.

About Third Coast Bancshares, Inc.

Third Coast Bancshares, Inc. is a commercially focused, Texas-based bank holding company operating primarily in the Greater Houston, Dallas-Fort Worth, and Austin-San Antonio markets through its wholly owned subsidiary, Third Coast Bank, SSB. Founded in 2008 in Humble, Texas, Third Coast Bank, SSB conducts banking operations through 16 branches encompassing the four largest metropolitan areas in Texas. Please visit https://www.tcbssb.com for more information.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “looking ahead,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: interest rate risk and fluctuations in interest rates; market conditions and economic trends generally and in the banking industry; our ability to maintain important deposit relationships; our ability to grow or maintain our deposit base; our ability to implement our expansion strategy; credit risk associated with our business; and changes in key management personnel. For a discussion of additional factors that could cause our actual results to differ materially from those described in the forward-looking statements, please see the risk factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”), and our other filings with the SEC.

The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this press release. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future

4

developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures, including Tangible Common Equity, Tangible Book Value Per Share, Tangible Common Equity to Tangible Assets and Return on Average Tangible Common Equity, which are supplemental measures that are not required by, or are not presented in accordance with GAAP. Please refer to the table titled “GAAP Reconciliation and Management’s Explanation of Non-GAAP Financial Measures” at the end of this press release for a reconciliation of these non-GAAP financial measures.

5

Third Coast Bancshares, Inc. and Subsidiary

Financial Highlights

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

(Dollars in thousands) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

296,926 |

|

|

$ |

142,122 |

|

|

$ |

244,813 |

|

|

$ |

309,153 |

|

|

$ |

329,864 |

|

Federal funds sold |

|

|

114,919 |

|

|

|

144,408 |

|

|

|

23,206 |

|

|

|

1,789 |

|

|

|

2,150 |

|

Total cash and cash equivalents |

|

|

411,845 |

|

|

|

286,530 |

|

|

|

268,019 |

|

|

|

310,942 |

|

|

|

332,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities available-for-sale |

|

|

178,087 |

|

|

|

201,035 |

|

|

|

194,467 |

|

|

|

180,376 |

|

|

|

176,067 |

|

Loans held for investment |

|

|

3,638,788 |

|

|

|

3,559,953 |

|

|

|

3,334,277 |

|

|

|

3,213,326 |

|

|

|

3,107,551 |

|

Less: allowance for credit losses |

|

|

(37,022 |

) |

|

|

(38,067 |

) |

|

|

(37,243 |

) |

|

|

(35,915 |

) |

|

|

(30,351 |

) |

Loans, net |

|

|

3,601,766 |

|

|

|

3,521,886 |

|

|

|

3,297,034 |

|

|

|

3,177,411 |

|

|

|

3,077,200 |

|

Accrued interest receivable |

|

|

23,120 |

|

|

|

22,821 |

|

|

|

19,579 |

|

|

|

19,026 |

|

|

|

18,340 |

|

Premises and equipment, net |

|

|

28,554 |

|

|

|

29,010 |

|

|

|

28,720 |

|

|

|

28,504 |

|

|

|

28,662 |

|

Bank-owned life insurance |

|

|

65,861 |

|

|

|

65,303 |

|

|

|

64,762 |

|

|

|

64,235 |

|

|

|

60,761 |

|

Non-marketable securities, at cost |

|

|

16,041 |

|

|

|

15,799 |

|

|

|

20,687 |

|

|

|

14,751 |

|

|

|

14,618 |

|

Deferred tax asset, net |

|

|

9,227 |

|

|

|

8,335 |

|

|

|

7,808 |

|

|

|

7,146 |

|

|

|

6,303 |

|

Derivative assets |

|

|

8,828 |

|

|

|

10,889 |

|

|

|

9,372 |

|

|

|

8,793 |

|

|

|

9,213 |

|

Right-of-use assets - operating leases |

|

|

21,439 |

|

|

|

21,192 |

|

|

|

21,778 |

|

|

|

19,328 |

|

|

|

17,872 |

|

Core Deposit Intangible, net |

|

|

969 |

|

|

|

1,009 |

|

|

|

1,050 |

|

|

|

1,090 |

|

|

|

1,131 |

|

Goodwill |

|

|

18,034 |

|

|

|

18,034 |

|

|

|

18,034 |

|

|

|

18,034 |

|

|

|

18,034 |

|

Other assets |

|

|

12,303 |

|

|

|

13,949 |

|

|

|

12,172 |

|

|

|

10,021 |

|

|

|

12,933 |

|

Total assets |

|

$ |

4,396,074 |

|

|

$ |

4,215,792 |

|

|

$ |

3,963,482 |

|

|

$ |

3,859,657 |

|

|

$ |

3,773,148 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest bearing |

|

$ |

459,553 |

|

|

$ |

500,187 |

|

|

$ |

529,474 |

|

|

$ |

516,909 |

|

|

$ |

486,114 |

|

Interest bearing |

|

|

3,343,595 |

|

|

|

3,146,635 |

|

|

|

2,878,807 |

|

|

|

2,805,624 |

|

|

|

2,750,032 |

|

Total deposits |

|

|

3,803,148 |

|

|

|

3,646,822 |

|

|

|

3,408,281 |

|

|

|

3,322,533 |

|

|

|

3,236,146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued interest payable |

|

|

4,794 |

|

|

|

4,318 |

|

|

|

3,522 |

|

|

|

1,636 |

|

|

|

2,545 |

|

Derivative liabilities |

|

|

10,687 |

|

|

|

10,519 |

|

|

|

9,177 |

|

|

|

7,271 |

|

|

|

9,221 |

|

Lease liability - operating leases |

|

|

22,280 |

|

|

|

21,958 |

|

|

|

22,439 |

|

|

|

19,845 |

|

|

|

18,209 |

|

Other liabilities |

|

|

23,763 |

|

|

|

15,467 |

|

|

|

12,792 |

|

|

|

10,054 |

|

|

|

14,024 |

|

Line of credit - Senior Debt |

|

|

38,875 |

|

|

|

35,875 |

|

|

|

30,875 |

|

|

|

30,875 |

|

|

|

30,875 |

|

Note payable - Subordinated Debentures, net |

|

|

80,553 |

|

|

|

80,502 |

|

|

|

80,451 |

|

|

|

80,399 |

|

|

|

80,348 |

|

Total liabilities |

|

|

3,984,100 |

|

|

|

3,815,461 |

|

|

|

3,567,537 |

|

|

|

3,472,613 |

|

|

|

3,391,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A Convertible Non-Cumulative Preferred Stock |

|

|

69 |

|

|

|

69 |

|

|

|

69 |

|

|

|

69 |

|

|

|

69 |

|

Series B Convertible Perpetual Preferred Stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Common stock |

|

|

13,683 |

|

|

|

13,679 |

|

|

|

13,688 |

|

|

|

13,658 |

|

|

|

13,610 |

|

Common stock - non-voting |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Additional paid-in capital |

|

|

319,613 |

|

|

|

319,134 |

|

|

|

318,769 |

|

|

|

318,350 |

|

|

|

318,033 |

|

Retained earnings |

|

|

78,775 |

|

|

|

70,283 |

|

|

|

65,889 |

|

|

|

58,182 |

|

|

|

53,270 |

|

Accumulated other comprehensive income (loss) |

|

|

933 |

|

|

|

(1,735 |

) |

|

|

(1,371 |

) |

|

|

(2,116 |

) |

|

|

(2,103 |

) |

Treasury stock, at cost |

|

|

(1,099 |

) |

|

|

(1,099 |

) |

|

|

(1,099 |

) |

|

|

(1,099 |

) |

|

|

(1,099 |

) |

Total shareholders' equity |

|

|

411,974 |

|

|

|

400,331 |

|

|

|

395,945 |

|

|

|

387,044 |

|

|

|

381,780 |

|

Total liabilities and shareholders' equity |

|

$ |

4,396,074 |

|

|

$ |

4,215,792 |

|

|

$ |

3,963,482 |

|

|

$ |

3,859,657 |

|

|

$ |

3,773,148 |

|

6

Third Coast Bancshares, Inc. and Subsidiary

Financial Highlights

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

(Dollars in thousands, except per share data) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

|

December 31 |

|

|

December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTEREST INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

70,325 |

|

|

$ |

65,380 |

|

|

$ |

59,295 |

|

|

$ |

53,911 |

|

|

$ |

48,081 |

|

|

$ |

248,911 |

|

|

$ |

146,425 |

|

|

Investment securities available-for-sale |

|

|

2,746 |

|

|

|

1,990 |

|

|

|

2,029 |

|

|

|

1,548 |

|

|

|

1,388 |

|

|

|

8,313 |

|

|

|

3,925 |

|

|

Federal funds sold and other |

|

|

3,996 |

|

|

|

2,015 |

|

|

|

1,389 |

|

|

|

1,920 |

|

|

|

1,682 |

|

|

|

9,320 |

|

|

|

3,596 |

|

|

Total interest income |

|

|

77,067 |

|

|

|

69,385 |

|

|

|

62,713 |

|

|

|

57,379 |

|

|

|

51,151 |

|

|

|

266,544 |

|

|

|

153,946 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposit accounts |

|

|

37,671 |

|

|

|

30,345 |

|

|

|

24,936 |

|

|

|

22,092 |

|

|

|

15,682 |

|

|

|

115,044 |

|

|

|

30,696 |

|

|

FHLB advances and other borrowings |

|

|

2,065 |

|

|

|

3,772 |

|

|

|

3,681 |

|

|

|

2,457 |

|

|

|

3,318 |

|

|

|

11,975 |

|

|

|

6,796 |

|

|

Total interest expense |

|

|

39,736 |

|

|

|

34,117 |

|

|

|

28,617 |

|

|

|

24,549 |

|

|

|

19,000 |

|

|

|

127,019 |

|

|

|

37,492 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

37,331 |

|

|

|

35,268 |

|

|

|

34,096 |

|

|

|

32,830 |

|

|

|

32,151 |

|

|

|

139,525 |

|

|

|

116,454 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for credit losses |

|

|

1,100 |

|

|

|

2,620 |

|

|

|

1,400 |

|

|

|

1,200 |

|

|

|

1,950 |

|

|

|

6,320 |

|

|

|

12,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income after credit loss expense |

|

|

36,231 |

|

|

|

32,648 |

|

|

|

32,696 |

|

|

|

31,630 |

|

|

|

30,201 |

|

|

|

133,205 |

|

|

|

104,254 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges and fees |

|

|

850 |

|

|

|

884 |

|

|

|

720 |

|

|

|

779 |

|

|

|

706 |

|

|

|

3,233 |

|

|

|

2,714 |

|

|

Gain on sale of SBA loans |

|

|

326 |

|

|

|

114 |

|

|

|

- |

|

|

|

- |

|

|

|

123 |

|

|

|

440 |

|

|

|

950 |

|

|

Gain on sale of securities |

|

|

21 |

|

|

|

364 |

|

|

|

- |

|

|

|

97 |

|

|

|

- |

|

|

|

482 |

|

|

|

- |

|

|

Earnings on bank-owned life insurance |

|

|

559 |

|

|

|

541 |

|

|

|

526 |

|

|

|

475 |

|

|

|

497 |

|

|

|

2,101 |

|

|

|

1,312 |

|

|

Derivative fees |

|

|

358 |

|

|

|

159 |

|

|

|

247 |

|

|

|

(1 |

) |

|

|

117 |

|

|

|

763 |

|

|

|

1,259 |

|

|

Other |

|

|

43 |

|

|

|

(196 |

) |

|

|

787 |

|

|

|

552 |

|

|

|

310 |

|

|

|

1,186 |

|

|

|

988 |

|

|

Total noninterest income |

|

|

2,157 |

|

|

|

1,866 |

|

|

|

2,280 |

|

|

|

1,902 |

|

|

|

1,753 |

|

|

|

8,205 |

|

|

|

7,223 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

16,119 |

|

|

|

17,353 |

|

|

|

15,033 |

|

|

|

13,712 |

|

|

|

14,473 |

|

|

|

62,217 |

|

|

|

56,510 |

|

|

Data processing and network expense |

|

|

987 |

|

|

|

1,284 |

|

|

|

1,261 |

|

|

|

1,203 |

|

|

|

837 |

|

|

|

4,735 |

|

|

|

3,947 |

|

|

Occupancy and equipment expense |

|

|

2,875 |

|

|

|

2,925 |

|

|

|

2,852 |

|

|

|

2,633 |

|

|

|

2,591 |

|

|

|

11,285 |

|

|

|

8,526 |

|

|

Legal and professional |

|

|

2,305 |

|

|

|

2,001 |

|

|

|

1,547 |

|

|

|

1,930 |

|

|

|

1,887 |

|

|

|

7,783 |

|

|

|

6,987 |

|

|

Loan operations and other real estate owned |

|

|

134 |

|

|

|

272 |

|

|

|

302 |

|

|

|

(35 |

) |

|

|

144 |

|

|

|

673 |

|

|

|

988 |

|

|

Advertising and marketing |

|

|

614 |

|

|

|

515 |

|

|

|

812 |

|

|

|

686 |

|

|

|

580 |

|

|

|

2,627 |

|

|

|

1,912 |

|

|

Telephone and communications |

|

|

125 |

|

|

|

117 |

|

|

|

129 |

|

|

|

139 |

|

|

|

175 |

|

|

|

510 |

|

|

|

496 |

|

|

Software purchases and maintenance |

|

|

839 |

|

|

|

729 |

|

|

|

455 |

|

|

|

352 |

|

|

|

295 |

|

|

|

2,375 |

|

|

|

1,012 |

|

|

Regulatory assessments |

|

|

942 |

|

|

|

532 |

|

|

|

458 |

|

|

|

666 |

|

|

|

863 |

|

|

|

2,598 |

|

|

|

3,464 |

|

|

Loss on sale of other real estate owned |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

350 |

|

|

Other |

|

|

1,474 |

|

|

|

1,777 |

|

|

|

986 |

|

|

|

758 |

|

|

|

782 |

|

|

|

4,995 |

|

|

|

4,117 |

|

|

Total noninterest expense |

|

|

26,414 |

|

|

|

27,505 |

|

|

|

23,835 |

|

|

|

22,044 |

|

|

|

22,627 |

|

|

|

99,798 |

|

|

|

88,309 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME BEFORE INCOME TAX

EXPENSE |

|

|

11,974 |

|

|

|

7,009 |

|

|

|

11,141 |

|

|

|

11,488 |

|

|

|

9,327 |

|

|

|

41,612 |

|

|

|

23,168 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

2,285 |

|

|

|

1,431 |

|

|

|

2,250 |

|

|

|

2,245 |

|

|

|

1,802 |

|

|

|

8,211 |

|

|

|

4,509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME |

|

|

9,689 |

|

|

|

5,578 |

|

|

|

8,891 |

|

|

|

9,243 |

|

|

|

7,525 |

|

|

|

33,401 |

|

|

|

18,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock dividends declared |

|

|

1,197 |

|

|

|

1,184 |

|

|

|

1,184 |

|

|

|

1,171 |

|

|

|

1,418 |

|

|

|

4,736 |

|

|

|

1,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME AVAILABLE TO COMMON

SHAREHOLDERS |

|

$ |

8,492 |

|

|

$ |

4,394 |

|

|

$ |

7,707 |

|

|

$ |

8,072 |

|

|

$ |

6,107 |

|

|

$ |

28,665 |

|

|

$ |

17,241 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

$ |

0.62 |

|

|

$ |

0.32 |

|

|

$ |

0.57 |

|

|

$ |

0.60 |

|

|

$ |

0.45 |

|

|

$ |

2.11 |

|

|

$ |

1.28 |

|

|

Diluted earnings per share |

|

$ |

0.57 |

|

|

$ |

0.32 |

|

|

$ |

0.53 |

|

|

$ |

0.55 |

|

|

$ |

0.44 |

|

|

$ |

1.98 |

|

|

$ |

1.25 |

|

|

7

Third Coast Bancshares, Inc. and Subsidiary

Financial Highlights

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

(Dollars in thousands, except share and per share data) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

|

December 31 |

|

|

December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share, basic |

|

$ |

0.62 |

|

|

$ |

0.32 |

|

|

$ |

0.57 |

|

|

$ |

0.60 |

|

|

$ |

0.45 |

|

|

$ |

2.11 |

|

|

$ |

1.28 |

|

Earnings per share, diluted |

|

$ |

0.57 |

|

|

$ |

0.32 |

|

|

$ |

0.53 |

|

|

$ |

0.55 |

|

|

$ |

0.44 |

|

|

$ |

1.98 |

|

|

$ |

1.25 |

|

Dividends on common stock |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

Dividends on Series A Convertible

Non-Cumulative Preferred Stock |

|

$ |

17.25 |

|

|

$ |

17.06 |

|

|

$ |

17.06 |

|

|

$ |

16.88 |

|

|

$ |

20.44 |

|

|

$ |

68.25 |

|

|

$ |

20.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (A) |

|

|

0.90 |

% |

|

|

0.56 |

% |

|

|

0.96 |

% |

|

|

1.02 |

% |

|

|

0.84 |

% |

|

|

0.86 |

% |

|

|

0.58 |

% |

Return on average common equity (A) |

|

|

9.86 |

% |

|

|

5.19 |

% |

|

|

9.44 |

% |

|

|

10.28 |

% |

|

|

7.69 |

% |

|

|

8.66 |

% |

|

|

5.62 |

% |

Return on average tangible common

equity (A) (B) |

|

|

10.44 |

% |

|

|

5.50 |

% |

|

|

10.02 |

% |

|

|

10.93 |

% |

|

|

8.19 |

% |

|

|

9.19 |

% |

|

|

6.00 |

% |

Net interest margin (A) (C) |

|

|

3.61 |

% |

|

|

3.71 |

% |

|

|

3.82 |

% |

|

|

3.79 |

% |

|

|

3.75 |

% |

|

|

3.73 |

% |

|

|

3.82 |

% |

Efficiency ratio (D) |

|

|

66.89 |

% |

|

|

74.07 |

% |

|

|

65.52 |

% |

|

|

63.47 |

% |

|

|

66.74 |

% |

|

|

67.55 |

% |

|

|

71.40 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Coast Bancshares, Inc. (consolidated): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total common equity to total assets |

|

|

7.86 |

% |

|

|

7.93 |

% |

|

|

8.32 |

% |

|

|

8.31 |

% |

|

|

8.36 |

% |

|

|

7.86 |

% |

|

|

8.36 |

% |

Tangible common equity to tangible

assets (B) |

|

|

7.46 |

% |

|

|

7.51 |

% |

|

|

7.88 |

% |

|

|

7.86 |

% |

|

|

7.90 |

% |

|

|

7.46 |

% |

|

|

7.90 |

% |

Common equity tier 1 (to risk weighted

assets) |

|

|

8.06 |

% |

|

|

8.01 |

% |

|

|

7.75 |

% |

|

|

7.89 |

% |

|

N/A |

|

|

|

8.06 |

% |

|

N/A |

|

Tier 1 capital (to risk weighted assets) |

|

|

9.70 |

% |

|

|

9.68 |

% |

|

|

9.39 |

% |

|

|

9.61 |

% |

|

N/A |

|

|

|

9.70 |

% |

|

N/A |

|

Total capital (to risk weighted assets) |

|

|

12.66 |

% |

|

|

12.72 |

% |

|

|

12.31 |

% |

|

|

12.63 |

% |

|

N/A |

|

|

|

12.66 |

% |

|

N/A |

|

Tier 1 capital (to average assets) |

|

|

9.23 |

% |

|

|

9.79 |

% |

|

|

10.17 |

% |

|

|

10.14 |

% |

|

N/A |

|

|

|

9.23 |

% |

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Coast Bank, SSB: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common equity tier 1 (to risk weighted

assets) |

|

|

12.52 |

% |

|

|

12.48 |

% |

|

|

12.06 |

% |

|

|

12.32 |

% |

|

|

12.95 |

% |

|

|

12.52 |

% |

|

|

12.95 |

% |

Tier 1 capital (to risk weighted assets) |

|

|

12.52 |

% |

|

|

12.48 |

% |

|

|

12.06 |

% |

|

|

12.32 |

% |

|

|

12.95 |

% |

|

|

12.52 |

% |

|

|

12.95 |

% |

Total capital (to risk weighted assets) |

|

|

13.49 |

% |

|

|

13.49 |

% |

|

|

12.99 |

% |

|

|

13.25 |

% |

|

|

13.79 |

% |

|

|

13.49 |

% |

|

|

13.79 |

% |

Tier 1 capital (to average assets) |

|

|

11.91 |

% |

|

|

12.62 |

% |

|

|

13.06 |

% |

|

|

13.00 |

% |

|

|

13.11 |

% |

|

|

11.91 |

% |

|

|

13.11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

13,603,149 |

|

|

|

13,608,718 |

|

|

|

13,588,747 |

|

|

|

13,532,545 |

|

|

|

13,528,504 |

|

|

|

13,583,553 |

|

|

|

13,465,196 |

|

Diluted |

|

|

16,890,381 |

|

|

|

13,873,187 |

|

|

|

16,855,822 |

|

|

|

16,801,815 |

|

|

|

13,760,076 |

|

|

|

16,877,891 |

|

|

|

13,754,610 |

|

Period end shares outstanding |

|

|

13,604,665 |

|

|

|

13,600,211 |

|

|

|

13,609,697 |

|

|

|

13,579,498 |

|

|

|

13,531,736 |

|

|

|

13,604,665 |

|

|

|

13,531,736 |

|

Book value per share |

|

$ |

25.41 |

|

|

$ |

24.57 |

|

|

$ |

24.23 |

|

|

$ |

23.63 |

|

|

$ |

23.32 |

|

|

$ |

25.41 |

|

|

$ |

23.32 |

|

Tangible book value per share (B) |

|

$ |

24.02 |

|

|

$ |

23.17 |

|

|

$ |

22.82 |

|

|

$ |

22.22 |

|

|

$ |

21.90 |

|

|

$ |

24.02 |

|

|

$ |

21.90 |

|

___________

(A) Interim periods annualized.

(B) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures on pages 12 and 13 of this News Release.

(C) Net interest margin represents net interest income divided by average interest-earning assets.

(D) Represents total noninterest expense divided by the sum of net interest income plus noninterest income. Taxes and provision for credit losses are not part of this calculation.

8

Third Coast Bancshares, Inc. and Subsidiary

Financial Highlights

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

December 31, 2023 |

|

September 30, 2023 |

|

December 31, 2022 |

(Dollars in thousands) |

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Paid(3) |

|

|

Average

Yield/

Rate(4) |

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Paid(3) |

|

|

Average

Yield/

Rate(4) |

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Paid(3) |

|

|

Average

Yield/

Rate(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earnings assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities |

|

$ |

203,376 |

|

|

$ |

2,746 |

|

|

5.36% |

|

$ |

198,305 |

|

|

$ |

1,990 |

|

|

3.98% |

|

$ |

170,463 |

|

|

$ |

1,388 |

|

|

3.23% |

Loans, gross |

|

|

3,600,980 |

|

|

|

70,325 |

|

|

7.75% |

|

|

3,424,738 |

|

|

|

65,380 |

|

|

7.57% |

|

|

3,041,923 |

|

|

|

48,081 |

|

|

6.27% |

Federal funds sold and other

interest-earning assets |

|

|

299,165 |

|

|

|

3,996 |

|

|

5.30% |

|

|

146,965 |

|

|

|

2,015 |

|

|

5.44% |

|

|

185,887 |

|

|

|

1,682 |

|

|

3.59% |

Total interest-earning assets |

|

|

4,103,521 |

|

|

|

77,067 |

|

|

7.45% |

|

|

3,770,008 |

|

|

|

69,385 |

|

|

7.30% |

|

|

3,398,273 |

|

|

|

51,151 |

|

|

5.97% |

Less allowance for loan losses |

|

|

(38,274 |

) |

|

|

|

|

|

|

|

(37,421 |

) |

|

|

|

|

|

|

|

(29,563 |

) |

|

|

|

|

|

Total interest-earning assets, net of

allowance |

|

|

4,065,247 |

|

|

|

|

|

|

|

|

3,732,587 |

|

|

|

|

|

|

|

|

3,368,710 |

|

|

|

|

|

|

Noninterest-earning assets |

|

|

194,659 |

|

|

|

|

|

|

|

|

190,670 |

|

|

|

|

|

|

|

|

203,834 |

|

|

|

|

|

|

Total assets |

|

$ |

4,259,906 |

|

|

|

|

|

|

|

$ |

3,923,257 |

|

|

|

|

|

|

|

$ |

3,572,544 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

3,202,462 |

|

|

$ |

37,671 |

|

|

4.67% |

|

$ |

2,756,305 |

|

|

$ |

30,345 |

|

|

4.37% |

|

$ |

2,354,990 |

|

|

$ |

15,682 |

|

|

2.64% |

Note payable and line of credit |

|

|

118,816 |

|

|

|

2,065 |

|

|

6.90% |

|

|

112,765 |

|

|

|

1,919 |

|

|

6.75% |

|

|

111,199 |

|

|

|

1,761 |

|

|

6.28% |

FHLB advances |

|

— |

|

|

— |

|

|

— |

|

|

129,585 |

|

|

|

1,853 |

|

|

5.67% |

|

|

166,783 |

|

|

|

1,557 |

|

|

3.70% |

Total interest-bearing liabilities |

|

|

3,321,278 |

|

|

|

39,736 |

|

|

4.75% |

|

|

2,998,655 |

|

|

|

34,117 |

|

|

4.51% |

|

|

2,632,972 |

|

|

|

19,000 |

|

|

2.86% |

Noninterest-bearing deposits |

|

|

472,738 |

|

|

|

|

|

|

|

|

473,282 |

|

|

|

|

|

|

|

|

517,075 |

|

|

|

|

|

|

Other liabilities |

|

|

57,918 |

|

|

|

|

|

|

|

|

49,271 |

|

|

|

|

|

|

|

|

41,226 |

|

|

|

|

|

|

Total liabilities |

|

|

3,851,934 |

|

|

|

|

|

|

|

|

3,521,208 |

|

|

|

|

|

|

|

|

3,191,273 |

|

|

|

|

|

|

Shareholders’ equity |

|

|

407,972 |

|

|

|

|

|

|

|

|

402,049 |

|

|

|

|

|

|

|

|

381,271 |

|

|

|

|

|

|

Total liabilities and shareholders’

equity |

|

$ |

4,259,906 |

|

|

|

|

|

|

|

$ |

3,923,257 |

|

|

|

|

|

|

|

$ |

3,572,544 |

|

|

|

|

|

|

Net interest income |

|

|

|

|

$ |

37,331 |

|

|

|

|

|

|

|

$ |

35,268 |

|

|

|

|

|

|

|

$ |

32,151 |

|

|

|

Net interest spread (1) |

|

|

|

|

|

|

|

2.70% |

|

|

|

|

|

|

|

2.79% |

|

|

|

|

|

|

|

3.11% |

Net interest margin (2) |

|

|

|

|

|

|

|

3.61% |

|

|

|

|

|

|

|

3.71% |

|

|

|

|

|

|

|

3.75% |

___________

(1) Net interest spread is the average yield on interest earning assets minus the average rate on interest-bearing liabilities.

(2) Net interest margin represents net interest income divided by average interest-earning assets.

(3) Interest earned/paid includes accretion of deferred loan fees, premiums and discounts.

(4) Annualized.

9

Third Coast Bancshares, Inc. and Subsidiary

Financial Highlights

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

December 31, 2023 |

|

December 31, 2022 |

(Dollars in thousands) |

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Paid(3) |

|

|

Average

Yield/

Rate |

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Paid(3) |

|

|

Average

Yield/

Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earnings assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities |

|

$ |

197,286 |

|

|

$ |

8,313 |

|

|

4.21% |

|

$ |

129,507 |

|

|

$ |

3,925 |

|

|

3.03% |

Loans, gross |

|

|

3,366,180 |

|

|

|

248,911 |

|

|

7.39% |

|

|

2,694,428 |

|

|

|

146,425 |

|

|

5.43% |

Federal funds sold and other interest-earning

assets |

|

|

181,782 |

|

|

|

9,320 |

|

|

5.13% |

|

|

223,781 |

|

|

|

3,596 |

|

|

1.61% |

Total interest-earning assets |

|

|

3,745,248 |

|

|

|

266,544 |

|

|

7.12% |

|

|

3,047,716 |

|

|

|

153,946 |

|

|

5.05% |

Less allowance for loan losses |

|

|

(36,750 |

) |

|

|

|

|

|

|

|

(25,600 |

) |

|

|

|

|

|

Total interest-earning assets, net of allowance |

|

|

3,708,498 |

|

|

|

|

|

|

|

|

3,022,116 |

|

|

|

|

|

|

Noninterest-earning assets |

|

|

188,514 |

|

|

|

|

|

|

|

|

178,135 |

|

|

|

|

|

|

Total assets |

|

$ |

3,897,012 |

|

|

|

|

|

|

|

$ |

3,200,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

2,785,605 |

|

|

$ |

115,044 |

|

|

4.13% |

|

$ |

2,377,079 |

|

|

$ |

30,696 |

|

|

1.29% |

Note payable and line of credit |

|

|

113,552 |

|

|

|

7,657 |

|

|

6.74% |

|

|

77,317 |

|

|

|

4,605 |

|

|

5.96% |

FHLB advances and other |

|

|

79,546 |

|

|

|

4,318 |

|

|

5.43% |

|

|

81,083 |

|

|

|

2,191 |

|

|

2.70% |

Total interest-bearing liabilities |

|

|

2,978,703 |

|

|

|

127,019 |

|

|

4.26% |

|

|

2,535,479 |

|

|

|

37,492 |

|

|

1.48% |

Noninterest-bearing deposits |

|

|

473,558 |

|

|

|

|

|

|

|

|

313,972 |

|

|

|

|

|

|

Other liabilities |

|

|

47,527 |

|

|

|

|

|

|

|

|

27,115 |

|

|

|

|

|

|

Total liabilities |

|

|

3,499,788 |

|

|

|

|

|

|

|

|

2,876,566 |

|

|

|

|

|

|

Shareholders’ equity |

|

|

397,224 |

|

|

|

|

|

|

|

|

323,685 |

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

$ |

3,897,012 |

|

|

|

|

|

|

|

$ |

3,200,251 |

|

|

|

|

|

|

Net interest income |

|

|

|

|

$ |

139,525 |

|

|

|

|

|

|

|

$ |

116,454 |

|

|

|

Net interest spread (1) |

|

|

|

|

|

|

|

2.86% |

|

|

|

|

|

|

|

3.57% |

Net interest margin (2) |

|

|

|

|

|

|

|

3.73% |

|

|

|

|

|

|

|

3.82% |

___________

(1) Net interest spread is the average yield on interest earning assets minus the average rate on interest-bearing liabilities.

(2) Net interest margin represents net interest income divided by average interest-earning assets.

(3) Interest earned/paid includes accretion of deferred loan fees, premiums and discounts.

10

Third Coast Bancshares, Inc. and Subsidiary

Financial Highlights

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

2023 |

|

|

2022 |

|

|

(Dollars in thousands) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period-end Loan Portfolio: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-farm non-residential owner occupied |

|

$ |

520,822 |

|

|

$ |

517,917 |

|

|

$ |

513,934 |

|

|

$ |

508,936 |

|

|

$ |

493,791 |

|

|

Non-farm non-residential non-owner occupied |

|

|

586,626 |

|

|

|

566,973 |

|

|

|

547,120 |

|

|

|

511,546 |

|

|

|

506,012 |

|

|

Residential |

|

|

342,589 |

|

|

|

326,354 |

|

|

|

310,842 |

|

|

|

286,358 |

|

|

|

308,775 |

|

|

Construction, development & other |

|

|

693,553 |

|

|

|

655,822 |

|

|

|

595,601 |

|

|

|

627,143 |

|

|

|

567,851 |

|

|

Farmland |

|

|

30,396 |

|

|

|

30,646 |

|

|

|

24,219 |

|

|

|

22,512 |

|

|

|

22,820 |

|

|

Commercial & industrial |

|

|

1,263,077 |

|

|

|

1,288,320 |

|

|

|

1,164,624 |

|

|

|

1,112,638 |

|

|

|

1,058,910 |

|

|

Consumer |

|

|

2,555 |

|

|

|

2,665 |

|

|

|

2,891 |

|

|

|

3,280 |

|

|

|

3,872 |

|

|

Municipal and other |

|

|

199,170 |

|

|

|

171,256 |

|

|

|

175,046 |

|

|

|

140,913 |

|

|

|

145,520 |

|

|

Total loans |

|

$ |

3,638,788 |

|

|

$ |

3,559,953 |

|

|

$ |

3,334,277 |

|

|

$ |

3,213,326 |

|

|

$ |

3,107,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual loans |

|

$ |

16,649 |