Telos Corporation (NASDAQ: TLS), a leading provider of cyber, cloud

and enterprise security solutions for the world’s most

security-conscious organizations, today announced financial results

for the second quarter of 2024.

“Telos exceeded the high end of our guidance range

for the second quarter on key financial metrics including total

company revenue, margin and profit. While GAAP gross margin

contracted 349 basis points compared to the second quarter of 2023

primarily due to higher amortization, we expanded cash gross margin

326 basis points to 42.0%,” said John B. Wood, chairman and CEO,

Telos. “I am also pleased to report we have accelerated expansion

of our TSA PreCheck® enrollment locations in the second quarter and

expect to reach 500 locations in 2025. We look forward to

continuing to work with TSA and grow this important national

security program throughout the remainder of 2024 and into

2025.”

|

Second Quarter 2024 Financial

Highlights |

|

|

Three Months Ended |

|

|

June 30, 2024 |

|

June 30, 2023 |

|

|

(in millions, except per share data) |

|

Revenue |

$28.5 |

|

$32.9 |

|

Gross Profit |

$9.7 |

|

$12.4 |

|

Gross Margin |

34.1% |

|

37.6% |

|

Cash Gross Profit1 |

$12.0 |

|

$12.8 |

|

Cash Gross Margin1 |

42.0% |

|

38.8% |

|

GAAP Net Loss |

$(7.8) |

|

$(8.0) |

|

Adjusted Net Loss1 |

$(6.6) |

|

$(1.9) |

|

EBITDA1 |

$(5.2) |

|

$(7.8) |

|

Adjusted EBITDA1 |

$(2.9) |

|

$— |

|

Adjusted EBITDA Margin1 |

(10.3)% |

|

(0.1)% |

|

GAAP EPS |

$(0.11) |

|

$(0.12) |

|

Adjusted EPS1 |

$(0.09) |

|

$(0.03) |

|

Weighted-average Shares of Common Stock Outstanding |

72.0 |

|

69.4 |

|

Cash Flow from Operations |

$(8.0) |

|

$(4.1) |

|

Free Cash Flow1 |

$(11.3) |

|

$(8.6) |

1 Cash Gross Profit, Cash Gross Margin, Adjusted

Net Loss, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

EPS, and Free Cash Flow are non-GAAP financial measures. Refer to

"Non-GAAP Financial Measures" below.

Selected Second Quarter Business

Highlights:

- TSA

PreCheck

-

Successfully expanded network of enrollment locations from 28

locations to 83 locations over the past three months.

-

Locations geographically distributed across key markets in 23

states including Arizona, California, Colorado, Florida, Georgia,

Illinois, Indiana, Iowa, Louisiana, Maryland, Michigan, Minnesota,

Missouri, Nevada, North Carolina, Ohio, Oregon, Pennsylvania, South

Carolina, Tennessee, Texas, Virginia, and Washington.

-

Expect to reach 500 enrollment locations in 2025.

-

Continue to successfully process renewals at

https://tsaprecheckbytelos.tsa.dhs.gov/

-

Other notable events

- Awarded Xacta® new orders include the

New Zealand Government, Five9, and a Fortune 100 technology company

as well as renewals from the Government Publishing Office, National

Endowment for the Arts, National Archives, several other U.S.

federal government customers, and a Fortune 100 company in the

technology sector.

- Key

cyber services new orders include a commercial space technology

company and a U.S. federal government customer.

-

Telos AMHS™ achieved a new order from the New Zealand Defence

Force as well as renewals from the Federal Aviation Administration,

several other U.S. government customers and a foreign government

customer.

|

Financial Outlook |

|

|

3Q 2024 |

|

Revenue |

$22 - $24 Million |

|

YoY Growth |

(39%) - (34%) |

|

Adjusted EBITDA1 |

($8.0) - ($6.5) Million |

1Adjusted EBITDA is a non-GAAP financial measure.

Refer to "Non-GAAP Financial Measures" below.

This guidance consists of forward-looking

statements and actual results may differ materially. Refer to the

Forward-Looking Statements section below for information on the

factors that could cause the Company’s actual results to differ

materially from these forward-looking statements. Adjusted EBITDA

is a non-GAAP financial measure. The Company has not provided the

most directly comparable GAAP measure to this forward-looking

non-GAAP financial measure because certain items are out of the

Company’s control or cannot be reasonably predicted. Accordingly, a

reconciliation for forward-looking Adjusted EBITDA is not available

without unreasonable effort.

Webcast Information

Telos will host a live webcast to discuss its

second quarter 2024 financial results at 8:30 a.m. Eastern

Time today, August 9, 2024. To access the webcast,

visit

https://register.vevent.com/register/BI1cecd4daaeaf4c4e9dee956488799ddf.

Related presentation materials will be made available on the

Investors section of the Company’s website

at https://investors.telos.com. In addition, an archived

webcast will be available approximately two hours after the

conclusion of the live event on the Investors section of the

Company’s website.

Forward-Looking Statements

This press release contains forward-looking

statements which are made under the safe harbor provisions of the

federal securities laws. These statements are based on the

Company’s management’s current beliefs, expectations and

assumptions about future events, conditions, and results and on

information currently available to them. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future. The Company believes that these risks and

uncertainties include, but are not limited to, those described

under the captions “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” set

forth from time to time in the Company’s filings and reports with

the U.S. Securities and Exchange Commission (“SEC”), including

its Annual Report on Form 10-K for the year ended December 31,

2023 and its Quarterly Reports on Form 10-Q, as well as future

filings and reports by the Company, copies of which are available

at https://investors.telos.com and on the SEC’s website

at www.sec.gov.

Although the Company bases these forward-looking

statements on assumptions that its management believes are

reasonable when made, the Company cautions the reader that

forward-looking statements are not guarantees of future performance

and that the Company’s actual results of operations, financial

condition and liquidity, and industry developments may differ

materially from statements made in or suggested by the

forward-looking statements contained in this release. Given these

risks, uncertainties, and other factors, many of which are beyond

its control, the Company cautions the reader not to place undue

reliance on these forward-looking statements. Any forward-looking

statement speaks only as of the date of such statement and, except

as required by law, the Company undertakes no obligation to update

any forward-looking statement publicly, or to revise any

forward-looking statement to reflect events or developments

occurring after the date of the statement, even if new information

becomes available in the future. Comparisons of results for current

and any prior periods are not intended to express any future trends

or indications of future performance, unless specifically expressed

as such, and should only be viewed as historical data.

Non-GAAP Financial Measures

In addition to Telos' results determined in

accordance with U.S. GAAP, Telos believes the non-GAAP financial

measures of EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA

Margin, Adjusted Net Income (Loss), Adjusted Earnings Per Share

("EPS"), Cash Gross Profit, Cash Gross Margin, and Free Cash Flow

are useful in evaluating operating performance. Telos believes that

this non-GAAP financial information, when taken collectively with

GAAP results, may be helpful to readers of the financial statements

because it provides consistency and comparability with past

financial performance and assists in comparisons with other

companies, some of which use similar non-GAAP financial information

to supplement their GAAP results. The non-GAAP financial

information is presented for supplemental informational purposes

only, should not be considered a substitute for financial

information presented in accordance with GAAP, and may be different

from similarly-titled non-GAAP measures used by other companies. A

reconciliation is provided below for each of these non-GAAP

financial measures to the most directly comparable financial

measure stated in accordance with GAAP.

Telos believes that EBITDA, EBITDA Margin, Adjusted

EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss) and

Adjusted EPS provide the Board, management and investors with a

clear representation of the Company’s core operating performance

and trends, provide greater visibility into the long-term financial

performance of the Company, and eliminate the impact of items that

do not relate to the ongoing operating performance of the business.

Further, Adjusted EBITDA and Adjusted EBITDA Margin are used by the

Board and management to prepare and approve the Company’s annual

budget and to evaluate the performance of certain management

personnel when determining incentive compensation. Cash Gross

Profit and Cash Gross Margin provide management and investors a

clear representation of the core economics of gross profit and

gross margin without the impact of non-cash expenses and sunk costs

expended. Telos uses Free Cash Flow to understand the cash flows

that directly correspond with our operations and the investments

the Company must make in those operations, using a methodology that

combines operating cash flows and capital expenditures. Further,

Free Cash Flow may be useful to management and investors in

evaluating the Company's operating performance and liquidity, and

to the Board to evaluate the performance of certain management

personnel when determining incentive compensation. Telos believes

these non-GAAP financial measures facilitate the comparison of the

Company’s operating performance on a consistent basis between

periods by excluding certain items that may, or could, have a

disproportionately positive or negative impact on the Company’s

results of operations in any particular period. When viewed in

combination with the Company’s results prepared in accordance with

GAAP, these non-GAAP financial measures help provide a broader

picture of factors and trends affecting the Company’s results of

operations.

EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted

EBITDA Margin, Adjusted Net Income (Loss), Adjusted EPS, Cash Gross

Profit, Cash Gross Margin, and Free Cash Flow are supplemental

measures of operating performance that are not made under GAAP and

do not represent, and should not be considered as an alternative

to, Net Income (Loss), Net Income (Loss) Margin, Earnings per

Share, Gross Profit, Gross Margin, or Net Cash Flows provided by

(used in) operating activities, as determined by GAAP.

The Company defines EBITDA as net (loss) income,

adjusted for non-operating (income) expense, interest expense,

provision for/(benefit from) income taxes, and depreciation and

amortization. The Company defines Adjusted EBITDA as EBITDA,

adjusted for stock-based compensation expense and restructuring

expenses. The Company defines EBITDA Margin, as EBITDA as a

percentage of total revenue. The Company defines Adjusted EBITDA

Margin as Adjusted EBITDA as a percentage of total revenue. The

Company defines Adjusted Net Income (Loss) as net income (loss),

adjusted for non-operating (income) expense, stock-based

compensation expense and restructuring expenses. The Company

defines Adjusted EPS as Adjusted Net Income (Loss) divided by the

weighted-average number of common shares outstanding for the

period. The Company defines Cash Gross Profit as gross profit, plus

noncash charges for stock-based compensation expense, depreciation

and amortization, as well as non-recurring items (such as

restructuring expenses) charged under cost of sales. The Company

defines Cash Gross Margin as Cash Gross Profit as a percentage of

total revenue. Free Cash Flow is defined as net cash provided by

(used in) operating activities, less purchases of property and

equipment, and capitalized software development costs.

EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted

EBITDA Margin, Adjusted Net Income (Loss), Adjusted EPS, Cash Gross

Profit, Cash Gross Margin, and Free Cash Flow each has limitations

as an analytical tool, and you should not consider any of them in

isolation, or as a substitute for analysis of results as reported

under GAAP. Among other limitations, EBITDA, Adjusted EBITDA,

EBITDA Margin, Adjusted EBITDA Margin, Adjusted Net Income (Loss),

Adjusted EPS, Cash Gross Profit, Cash Gross Margin, and Free Cash

Flow each does not reflect our cash expenditures, or future

requirements, for capital expenditures or contractual commitments,

does not reflect the impact of certain cash and non-cash charges

resulting from matters considered not to be indicative of ongoing

operations, and does not reflect income tax expense or benefit.

Other companies in the Company’s industry may calculate Adjusted

EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss),

Adjusted EPS, Cash Gross Profit, Cash Gross Margin, and Free Cash

Flow differently than Telos does, which limits its usefulness as a

comparative measure. Because of these limitations, neither EBITDA,

Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Adjusted

Net Income (Loss), Adjusted EPS, Cash Gross Profit, Cash Gross

Margin nor Free Cash Flow should be considered as a replacement for

Gross Profit, Gross Margin, Net Income (Loss), Net Income (Loss)

Margin, Earnings per Share, or Net Cash Flows Provided by Operating

Activities, as determined by GAAP, or as a measure of

profitability. Telos compensates for these limitations by relying

primarily on the Company’s GAAP results and using non-GAAP measures

only for supplemental purposes.

About Telos Corporation

Telos Corporation (NASDAQ: TLS) empowers and

protects the world’s most security-conscious organizations with

solutions for continuous security assurance of individuals,

systems, and information. Telos’ offerings include cybersecurity

solutions for IT risk management and information security; cloud

security solutions to protect cloud-based assets and enable

continuous compliance with industry and government security

standards; and enterprise security solutions for identity and

access management, secure mobility, organizational messaging, and

network management and defense. The Company serves commercial

enterprises, regulated industries and government customers around

the world.

Media:

media@telos.com

Investors:

InvestorRelations@telos.com

|

TELOS CORPORATION |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(Unaudited) |

| |

| |

For the Three Months Ended |

|

For the Six Months Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

|

| |

(in thousands, except per share amounts) |

|

Revenue – Security Solutions |

$ |

17,867 |

|

|

$ |

17,196 |

|

|

$ |

36,507 |

|

|

$ |

36,969 |

|

|

Revenue – Secure Networks |

|

10,631 |

|

|

|

15,715 |

|

|

|

21,610 |

|

|

|

31,164 |

|

|

Total revenue |

|

28,498 |

|

|

|

32,911 |

|

|

|

58,117 |

|

|

|

68,133 |

|

|

Cost of sales – Security Solutions (excluding depreciation and

amortization) |

|

8,565 |

|

|

|

7,477 |

|

|

|

17,304 |

|

|

|

16,806 |

|

|

Cost of sales – Secure Networks (excluding depreciation and

amortization) |

|

8,187 |

|

|

|

12,905 |

|

|

|

16,828 |

|

|

|

25,140 |

|

|

Depreciation and amortization |

|

2,039 |

|

|

|

170 |

|

|

|

3,317 |

|

|

|

346 |

|

|

Total cost of sales |

|

18,791 |

|

|

|

20,552 |

|

|

|

37,449 |

|

|

|

42,292 |

|

|

Gross profit |

|

9,707 |

|

|

|

12,359 |

|

|

|

20,668 |

|

|

|

25,841 |

|

|

Research and development expenses |

|

1,459 |

|

|

|

2,646 |

|

|

|

4,629 |

|

|

|

5,479 |

|

|

Selling, general and administrative expenses |

|

16,892 |

|

|

|

19,180 |

|

|

|

33,121 |

|

|

|

42,799 |

|

|

Operating loss |

|

(8,644 |

) |

|

|

(9,467 |

) |

|

|

(17,082 |

) |

|

|

(22,437 |

) |

|

Other income |

|

1,064 |

|

|

|

1,649 |

|

|

|

2,316 |

|

|

|

4,145 |

|

|

Interest expense |

|

(160 |

) |

|

|

(184 |

) |

|

|

(335 |

) |

|

|

(433 |

) |

|

Loss before income taxes |

|

(7,740 |

) |

|

|

(8,002 |

) |

|

|

(15,101 |

) |

|

|

(18,725 |

) |

|

Provision for income taxes |

|

(17 |

) |

|

|

(22 |

) |

|

|

(34 |

) |

|

|

(45 |

) |

|

Net loss |

$ |

(7,757 |

) |

|

$ |

(8,024 |

) |

|

$ |

(15,135 |

) |

|

$ |

(18,770 |

) |

| |

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.11 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.27 |

) |

|

Diluted |

$ |

(0.11 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.27 |

) |

| |

|

|

|

|

|

|

|

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

72,017 |

|

|

|

69,424 |

|

|

|

71,323 |

|

|

|

68,804 |

|

|

Diluted |

|

72,017 |

|

|

|

69,424 |

|

|

|

71,323 |

|

|

|

68,804 |

|

|

TELOS CORPORATION |

|

CONSOLIDATED BALANCE SHEETS |

|

(Unaudited) |

| |

| |

June 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

| |

(in thousands, except per share and share data) |

|

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

80,104 |

|

|

$ |

99,260 |

|

|

Accounts receivable, net |

|

17,178 |

|

|

|

30,424 |

|

|

Inventories, net |

|

1,369 |

|

|

|

1,420 |

|

|

Prepaid expenses |

|

10,446 |

|

|

|

7,520 |

|

|

Other current assets |

|

1,088 |

|

|

|

1,367 |

|

|

Total current assets |

|

110,185 |

|

|

|

139,991 |

|

|

Property and equipment, net |

|

2,876 |

|

|

|

3,457 |

|

|

Finance lease right-of-use assets, net |

|

6,002 |

|

|

|

6,612 |

|

|

Operating lease right-of-use assets, net |

|

723 |

|

|

|

216 |

|

|

Goodwill |

|

17,922 |

|

|

|

17,922 |

|

|

Intangible assets, net |

|

40,718 |

|

|

|

39,616 |

|

|

Other assets |

|

3,954 |

|

|

|

885 |

|

|

Total assets |

$ |

182,380 |

|

|

$ |

208,699 |

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

Liabilities: |

|

|

|

|

Accounts payable and other accrued liabilities |

$ |

5,793 |

|

|

$ |

13,750 |

|

|

Accrued compensation and benefits |

|

8,113 |

|

|

|

14,569 |

|

|

Contract liabilities |

|

5,783 |

|

|

|

6,728 |

|

|

Finance lease obligations – current portion |

|

1,802 |

|

|

|

1,730 |

|

|

Operating lease obligations – current portion |

|

200 |

|

|

|

97 |

|

|

Other current liabilities |

|

1,467 |

|

|

|

2,324 |

|

|

Total current liabilities |

|

23,158 |

|

|

|

39,198 |

|

|

Finance lease obligations – non-current portion |

|

8,604 |

|

|

|

9,518 |

|

|

Operating lease obligations – non-current portion |

|

525 |

|

|

|

123 |

|

|

Deferred income taxes |

|

837 |

|

|

|

813 |

|

|

Other liabilities |

|

107 |

|

|

|

44 |

|

|

Total liabilities |

|

33,231 |

|

|

|

49,696 |

|

|

Commitments and contingencies |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Common stock, $0.001 par value, 250,000,000 shares authorized,

72,223,328 shares and 70,239,890 shares issued and outstanding as

of June 30, 2024 and December 31, 2023, respectively |

|

111 |

|

|

|

109 |

|

|

Additional paid-in capital |

|

439,146 |

|

|

|

433,781 |

|

|

Accumulated other comprehensive loss |

|

(146 |

) |

|

|

(60 |

) |

|

Accumulated deficit |

|

(289,962 |

) |

|

|

(274,827 |

) |

|

Total stockholders’ equity |

|

149,149 |

|

|

|

159,003 |

|

|

Total liabilities and stockholders’ equity |

$ |

182,380 |

|

|

$ |

208,699 |

|

|

TELOS CORPORATION |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(Unaudited) |

| |

| |

For the Three Months Ended |

|

For the Six Months Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

|

| |

(in thousands) |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(7,757 |

) |

|

$ |

(8,024 |

) |

|

$ |

(15,135 |

) |

|

$ |

(18,770 |

) |

|

Adjustments to reconcile net loss to cash used in operating

activities: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

2,219 |

|

|

|

7,745 |

|

|

|

5,203 |

|

|

|

17,244 |

|

|

Depreciation and amortization |

|

3,491 |

|

|

|

1,696 |

|

|

|

6,620 |

|

|

|

3,121 |

|

|

Deferred income tax provision |

|

12 |

|

|

|

12 |

|

|

|

24 |

|

|

|

24 |

|

|

Accretion of discount in acquisition holdback |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

Loss on disposal of fixed assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

(Recovery from) provision for doubtful accounts |

|

(73 |

) |

|

|

28 |

|

|

|

(32 |

) |

|

|

117 |

|

|

Amortization of debt issuance costs |

|

18 |

|

|

|

18 |

|

|

|

35 |

|

|

|

35 |

|

|

Gain on early extinguishment of other financing obligations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,427 |

) |

|

Changes in other operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

1,575 |

|

|

|

383 |

|

|

|

13,278 |

|

|

|

5,662 |

|

|

Inventories |

|

95 |

|

|

|

(137 |

) |

|

|

51 |

|

|

|

1,111 |

|

|

Prepaid expenses, other current assets, other assets |

|

(2,623 |

) |

|

|

(2,518 |

) |

|

|

(2,794 |

) |

|

|

(3,445 |

) |

|

Accounts payable and other accrued payables |

|

(1,214 |

) |

|

|

(1,766 |

) |

|

|

(7,763 |

) |

|

|

(6,255 |

) |

|

Accrued compensation and benefits |

|

(2,913 |

) |

|

|

129 |

|

|

|

(5,967 |

) |

|

|

(235 |

) |

|

Contract liabilities |

|

(210 |

) |

|

|

(1,065 |

) |

|

|

(944 |

) |

|

|

(307 |

) |

|

Other current liabilities |

|

(610 |

) |

|

|

(614 |

) |

|

|

(916 |

) |

|

|

(1,091 |

) |

|

Net cash used in operating activities |

|

(7,990 |

) |

|

|

(4,113 |

) |

|

|

(8,340 |

) |

|

|

(4,213 |

) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Capitalized software development costs |

|

(3,113 |

) |

|

|

(4,398 |

) |

|

|

(6,315 |

) |

|

|

(8,198 |

) |

|

Purchase of investment |

|

(2,150 |

) |

|

|

— |

|

|

|

(3,000 |

) |

|

|

— |

|

|

Purchases of property and equipment |

|

(235 |

) |

|

|

(47 |

) |

|

|

(332 |

) |

|

|

(270 |

) |

|

Net cash used in investing activities |

|

(5,498 |

) |

|

|

(4,445 |

) |

|

|

(9,647 |

) |

|

|

(8,468 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Payments under finance lease obligations |

|

(426 |

) |

|

|

(392 |

) |

|

|

(842 |

) |

|

|

(775 |

) |

|

Payment of tax withholding related to net share settlement of

equity awards |

|

— |

|

|

|

(64 |

) |

|

|

(430 |

) |

|

|

(1,584 |

) |

|

Proceeds from exercise of stock options |

|

104 |

|

|

|

— |

|

|

|

104 |

|

|

|

— |

|

|

Payment of DFT holdback amount |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(564 |

) |

|

Repurchase of common stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(139 |

) |

|

Payments for debt issuance costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(114 |

) |

|

Net cash used in financing activities |

|

(322 |

) |

|

|

(456 |

) |

|

|

(1,168 |

) |

|

|

(3,176 |

) |

|

Net change in cash, cash equivalents, and restricted cash |

|

(13,810 |

) |

|

|

(9,014 |

) |

|

|

(19,155 |

) |

|

|

(15,857 |

) |

|

Cash, cash equivalents, and restricted cash, beginning of

period |

|

94,051 |

|

|

|

112,595 |

|

|

|

99,396 |

|

|

|

119,438 |

|

|

Cash, cash equivalents, and restricted cash, end of period |

$ |

80,241 |

|

|

$ |

103,581 |

|

|

$ |

80,241 |

|

|

$ |

103,581 |

|

|

NON-GAAP FINANCIAL MEASURES |

|

(Unaudited) |

|

|

|

Reconciliation of Net Loss and Net Loss Margin to EBITDA,

Adjusted EBITDA, EBITDA Margin and Adjusted EBITDA

Margin |

| |

For the Three Months Ended |

|

For the Six Months Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

| |

Amount |

|

Margin |

|

Amount |

|

Margin |

|

Amount |

|

Margin |

|

Amount |

|

Margin |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(dollars in thousands) |

|

Net loss |

$ |

(7,757 |

) |

|

(27.2)% |

|

$ |

(8,024 |

) |

|

(24.4)% |

|

$ |

(15,135 |

) |

|

(26.0)% |

|

$ |

(18,770 |

) |

|

(27.5)% |

|

Other income |

|

(1,064 |

) |

|

(3.7)% |

|

|

(1,649 |

) |

|

(5.0)% |

|

|

(2,316 |

) |

|

(4.0)% |

|

|

(4,145 |

) |

|

(6.1)% |

|

Interest expense |

|

160 |

|

|

0.5% |

|

|

184 |

|

|

0.5% |

|

|

335 |

|

|

0.5% |

|

|

433 |

|

|

0.6% |

|

Provision for income taxes |

|

17 |

|

|

0.1% |

|

|

22 |

|

|

0.1% |

|

|

34 |

|

|

0.1% |

|

|

45 |

|

|

0.1% |

|

Depreciation and amortization |

|

3,491 |

|

|

12.2% |

|

|

1,696 |

|

|

5.2% |

|

|

6,620 |

|

|

11.4% |

|

|

3,121 |

|

|

4.5% |

|

EBITDA (Non-GAAP) |

|

(5,153 |

) |

|

(18.1)% |

|

|

(7,771 |

) |

|

(23.6)% |

|

|

(10,462 |

) |

|

(18.0)% |

|

|

(19,316 |

) |

|

(28.4)% |

|

Stock-based compensation expense(1) |

|

2,219 |

|

|

7.8% |

|

|

7,745 |

|

|

23.5% |

|

|

5,203 |

|

|

8.9% |

|

|

17,244 |

|

|

25.3% |

|

Restructuring (adjustments) expenses(2) |

|

— |

|

|

—% |

|

|

(3 |

) |

|

—% |

|

|

(10 |

) |

|

—% |

|

|

1,197 |

|

|

1.8% |

|

Adjusted EBITDA (Non-GAAP) |

$ |

(2,934 |

) |

|

(10.3)% |

|

$ |

(29 |

) |

|

(0.1)% |

|

$ |

(5,269 |

) |

|

(9.1)% |

|

$ |

(875 |

) |

|

(1.3)% |

(1) The stock-based compensation expense to EBITDA

is made up of stock-based compensation expense for the awarded

RSUs, PSUs, and stock options, and other sources. Stock-based

compensation expense for the awarded RSUs, PSUs and stock options

was $2.4 million and $4.1 million for the three and six months

ended June 30, 2024, respectively, and $5.7 million and $13.6

million, for the three and six months ended June 30, 2023,

respectively. Stock-based compensation (adjustments) expense from

other sources was $(0.2) million and $1.1 million for the

three and six months ended June 30, 2024, respectively and

$2.1 million and $3.7 million for the three and six months

ended June 30, 2023, respectively. The other sources of stock-based

compensation consist of accrued compensation, which the Company

intends to settle in shares of the Company's common stock. However,

it is the Company’s discretion whether this compensation will

ultimately be paid in stock or cash. The Company has the right to

dictate the form of these payments up until the date at which they

are paid. Any change to the expected payment form would result in

out of quarter adjustments to this add back to Adjusted EBITDA.

(2) The restructuring (adjustments) expenses

include severance and other related benefit costs (including

outplacement services and continuing health insurance coverage),

external consulting and advisory fees related to implementing the

restructuring plan.

|

Reconciliation of Net Loss and GAAP EPS to Non-GAAP

Adjusted Net Loss and Adjusted EPS |

|

|

For the Three Months Ended |

|

For the Six Months Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

| |

AdjustedNet Loss |

|

Adjusted Earnings Per Share |

|

AdjustedNet Loss |

|

Adjusted Earnings Per Share |

|

AdjustedNet Loss |

|

Adjusted Earnings Per Share |

|

AdjustedNet Loss |

|

Adjusted Earnings Per Share |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(in thousands, except per share data) |

|

Net loss |

$ |

(7,757 |

) |

|

$ |

(0.11 |

) |

|

$ |

(8,024 |

) |

|

$ |

(0.12 |

) |

|

$ |

(15,135 |

) |

|

$ |

(0.21 |

) |

|

$ |

(18,770 |

) |

|

$ |

(0.27 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

(1,064 |

) |

|

|

(0.01 |

) |

|

|

(1,649 |

) |

|

|

(0.02 |

) |

|

|

(2,316 |

) |

|

|

(0.03 |

) |

|

|

(4,145 |

) |

|

|

(0.06 |

) |

|

Stock-based compensation expense(1) |

|

2,219 |

|

|

|

0.03 |

|

|

|

7,745 |

|

|

|

0.11 |

|

|

|

5,203 |

|

|

|

0.07 |

|

|

|

17,244 |

|

|

|

0.25 |

|

|

Restructuring (adjustments) expenses(2) |

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

(10 |

) |

|

|

— |

|

|

|

1,197 |

|

|

|

0.01 |

|

|

Adjusted net loss (Non-GAAP measure) |

$ |

(6,602 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1,931 |

) |

|

$ |

(0.03 |

) |

|

$ |

(12,258 |

) |

|

$ |

(0.17 |

) |

|

$ |

(4,474 |

) |

|

$ |

(0.07 |

) |

|

Weighted-average shares of common stock outstanding, basic |

|

72,017 |

|

|

|

|

|

69,424 |

|

|

|

|

|

71,323 |

|

|

|

|

|

68,804 |

|

|

|

(1) The stock-based compensation expense to net

loss is made up of stock-based compensation expense for the awarded

RSUs, PSUs, and stock options, and other sources. Stock-based

compensation expense for the awarded RSUs, PSUs and stock options

was $2.4 million and $4.1 million for the three and six months

ended June 30, 2024, respectively, and $5.7 million and $13.6

million, for the three and six months ended June 30, 2023,

respectively. Stock-based compensation (adjustments) expense from

other sources was $(0.2) million and $1.1 million for the

three and six months ended June 30, 2024, respectively and

$2.1 million and $3.7 million for the three and six months

ended June 30, 2023, respectively. The other sources of stock-based

compensation consist of accrued compensation, which the Company

intends to settle in shares of the Company's common stock. However,

it is the Company’s discretion whether this compensation will

ultimately be paid in stock or cash. The Company has the right to

dictate the form of these payments up until the date at which they

are paid. Any change to the expected payment form would result in

out of quarter adjustments to this add back to Adjusted Net (Loss)

Income.

(2) The restructuring (adjustments) expenses

include severance and other related benefit costs (including

outplacement services and continuing health insurance coverage),

external consulting and advisory fees related to implementing the

restructuring plan.

|

Reconciliation of Gross Profit to Cash Gross Profit; Gross

Margin to Cash Gross Margin |

| |

For the Three Months Ended |

|

For the Six Months Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

| |

Amount |

|

Margin |

|

Amount |

|

Margin |

|

Amount |

|

Margin |

|

Amount |

|

Margin |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(dollars in thousands) |

|

Gross profit |

$ |

9,707 |

|

34.1% |

|

$ |

12,359 |

|

37.6% |

|

$ |

20,668 |

|

35.6% |

|

$ |

25,841 |

|

37.9% |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense — cost of sales |

|

228 |

|

0.8% |

|

|

225 |

|

0.7% |

|

|

485 |

|

0.8% |

|

|

551 |

|

0.8% |

|

Depreciation and amortization — cost of sales |

|

2,039 |

|

7.1% |

|

|

170 |

|

0.5% |

|

|

3,317 |

|

5.7% |

|

|

346 |

|

0.5% |

|

Cash gross profit (Non-GAAP) |

$ |

11,974 |

|

42.0% |

|

$ |

12,754 |

|

38.8% |

|

$ |

24,470 |

|

42.1% |

|

$ |

26,738 |

|

39.2% |

|

Reconciliation of Net Cash Used in Operating Activities to

Free Cash Flow |

| |

For the Three Months Ended |

|

For the Six Months Ended |

| |

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

|

|

|

|

|

| |

(in thousands) |

|

Net cash used in operating activities |

$ |

(7,990 |

) |

|

$ |

(4,113 |

) |

|

$ |

(8,340 |

) |

|

$ |

(4,213 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(235 |

) |

|

|

(47 |

) |

|

|

(332 |

) |

|

|

(270 |

) |

|

Capitalized software development costs |

|

(3,113 |

) |

|

|

(4,398 |

) |

|

|

(6,315 |

) |

|

|

(8,198 |

) |

|

Free cash flow (Non-GAAP) |

$ |

(11,338 |

) |

|

$ |

(8,558 |

) |

|

$ |

(14,987 |

) |

|

$ |

(12,681 |

) |

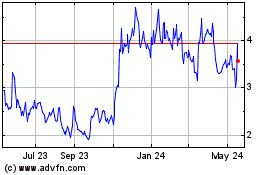

Telos (NASDAQ:TLS)

Historical Stock Chart

From Dec 2024 to Jan 2025

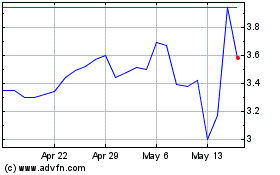

Telos (NASDAQ:TLS)

Historical Stock Chart

From Jan 2024 to Jan 2025