0000717720

VALUE LINE INC

false

--04-30

FY

2024

false

false

false

false

4,136

7,240

31

36

0.10

0.10

30,000,000

30,000,000

10,000,000

10,000,000

577,517

565,460

39,928

0

55,805,000

5,820,000

0

0

http://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNet

http://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNet

3.72

http://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNet

1,499,000

1,499,000

1

Reported within Long-Term Assets on the Consolidated Condensed Balance Sheets.

At July 31, 2023 and April 30, 2023, EAM's total liabilities included a payable to VLI for its accrued non-voting revenues interest and non-voting profits interest of $2,833,000 and $2,601,000, respectively.

Were acquired during the $2 million repurchase program authorized in July 2021 and the $2 million repurchase program authorized in March 2022.

Were acquired during the $3 million repurchase program authorized in May 2022 and the $3 million repurchase program authorized in October 2022.

Represents EAM's net income, after giving effect to Value Line’s non-voting revenues interest, but before distributions to voting profits interest holders and to the Company in respect of its 50% non-voting profits interest.

Were acquired during the $2 million repurchase program authorized in April 2020.

0.22

0.22

0.22

0.25

0.25

0.25

0.25

0.28

0.28

0.28

0.28

0.30

00007177202023-05-012024-04-30

iso4217:USD

00007177202023-10-31

xbrli:shares

00007177202024-06-30

thunderdome:item

00007177202024-04-30

00007177202023-04-30

iso4217:USDxbrli:shares

0000717720us-gaap:SubscriptionAndCirculationMember2023-05-012024-04-30

0000717720us-gaap:SubscriptionAndCirculationMember2022-05-012023-04-30

0000717720us-gaap:SubscriptionAndCirculationMember2021-05-012022-04-30

0000717720us-gaap:LicenseMember2023-05-012024-04-30

0000717720us-gaap:LicenseMember2022-05-012023-04-30

0000717720us-gaap:LicenseMember2021-05-012022-04-30

00007177202022-05-012023-04-30

00007177202021-05-012022-04-30

00007177202022-04-30

00007177202021-04-30

0000717720us-gaap:CommonStockMember2021-04-30

0000717720us-gaap:AdditionalPaidInCapitalMember2021-04-30

0000717720us-gaap:TreasuryStockCommonMember2021-04-30

0000717720us-gaap:RetainedEarningsMember2021-04-30

0000717720us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-30

0000717720us-gaap:RetainedEarningsMember2021-05-012022-04-30

0000717720us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-05-012022-04-30

0000717720us-gaap:TreasuryStockCommonMember2021-05-012022-04-30

0000717720us-gaap:CommonStockMember2022-04-30

0000717720us-gaap:AdditionalPaidInCapitalMember2022-04-30

0000717720us-gaap:TreasuryStockCommonMember2022-04-30

0000717720us-gaap:RetainedEarningsMember2022-04-30

0000717720us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-30

0000717720us-gaap:RetainedEarningsMember2022-05-012023-04-30

0000717720us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-012023-04-30

0000717720us-gaap:TreasuryStockCommonMember2022-05-012023-04-30

0000717720us-gaap:CommonStockMember2023-04-30

0000717720us-gaap:AdditionalPaidInCapitalMember2023-04-30

0000717720us-gaap:TreasuryStockCommonMember2023-04-30

0000717720us-gaap:RetainedEarningsMember2023-04-30

0000717720us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-30

0000717720us-gaap:RetainedEarningsMember2023-05-012024-04-30

0000717720us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-012024-04-30

0000717720us-gaap:TreasuryStockCommonMember2023-05-012024-04-30

0000717720us-gaap:CommonStockMember2024-04-30

0000717720us-gaap:AdditionalPaidInCapitalMember2024-04-30

0000717720us-gaap:TreasuryStockCommonMember2024-04-30

0000717720us-gaap:RetainedEarningsMember2024-04-30

0000717720us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-30

xbrli:pure

0000717720srt:MinimumMembervalu:EulavAssetManagementLLCMember2023-05-012024-04-30

0000717720srt:MaximumMembervalu:EulavAssetManagementLLCMember2023-05-012024-04-30

0000717720valu:EulavAssetManagementLLCMember2023-05-012024-04-30

0000717720us-gaap:FairValueInputsLevel1Member2024-04-30

0000717720us-gaap:FairValueInputsLevel2Member2024-04-30

0000717720us-gaap:FairValueInputsLevel3Member2024-04-30

0000717720us-gaap:FairValueInputsLevel1Member2023-04-30

0000717720us-gaap:FairValueInputsLevel2Member2023-04-30

0000717720us-gaap:FairValueInputsLevel3Member2023-04-30

0000717720valu:EulavAssetManagementLLCMember2024-04-30

0000717720valu:EulavAssetManagementLLCMember2023-04-30

0000717720valu:ReimbursementForPaymentsAndServicesMembervalu:ABAndCoMember2023-05-012024-04-30

0000717720valu:ReimbursementForPaymentsAndServicesMembervalu:ABAndCoMember2022-05-012023-04-30

0000717720valu:ABAndCoMember2024-04-30

0000717720valu:ABAndCoMember2023-04-30

0000717720valu:ABAndCoMember2023-05-012024-04-30

0000717720valu:ABAndCoMember2022-05-012023-04-30

0000717720valu:ABAndCoMember2021-05-012022-04-30

0000717720us-gaap:ExchangeTradedFundsMember2024-04-30

0000717720us-gaap:ExchangeTradedFundsMember2023-04-30

0000717720us-gaap:FixedIncomeSecuritiesMember2023-05-012024-04-30

0000717720us-gaap:FixedIncomeSecuritiesMember2022-05-012023-04-30

0000717720us-gaap:FixedIncomeSecuritiesMember2024-04-30

0000717720us-gaap:FixedIncomeSecuritiesMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-04-30

0000717720us-gaap:FixedIncomeSecuritiesMember2023-04-30

0000717720us-gaap:FixedIncomeSecuritiesMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-04-30

0000717720valu:EulavAssetManagementLLCMember2022-05-012023-04-30

0000717720us-gaap:InvestmentAdviceMembervalu:EulavAssetManagementLLCMember2023-05-012024-04-30

0000717720us-gaap:InvestmentAdviceMembervalu:EulavAssetManagementLLCMember2022-05-012023-04-30

0000717720us-gaap:InvestmentAdviceMembervalu:EulavAssetManagementLLCMember2021-05-012022-04-30

0000717720us-gaap:DistributionAndShareholderServiceMembervalu:EulavAssetManagementLLCMember2023-05-012024-04-30

0000717720us-gaap:DistributionAndShareholderServiceMembervalu:EulavAssetManagementLLCMember2022-05-012023-04-30

0000717720us-gaap:DistributionAndShareholderServiceMembervalu:EulavAssetManagementLLCMember2021-05-012022-04-30

0000717720valu:EulavAssetManagementLLCMember2021-05-012022-04-30

0000717720valu:EulavAssetManagementLLCMember2024-04-30

0000717720valu:EulavAssetManagementLLCMember2023-04-30

0000717720us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembervalu:EulavAssetManagementLLCMember2024-04-30

0000717720us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembervalu:EulavAssetManagementLLCMember2023-04-30

00007177202018-05-012019-04-30

0000717720us-gaap:DomesticCountryMember2024-04-30

0000717720us-gaap:DomesticCountryMember2023-04-30

0000717720us-gaap:StateAndLocalJurisdictionMember2024-04-30

0000717720us-gaap:StateAndLocalJurisdictionMember2023-04-30

0000717720valu:AssetManagementAndMutualFundDistributionSubsidiariesMember2023-05-012024-04-30

0000717720valu:FormerEmployeeMember2024-04-30

0000717720valu:SubleaseToAmericanBuildingMaintenanceIndustriesIncorporatedMember2016-11-30

0000717720valu:SubleaseToAmericanBuildingMaintenanceIndustriesIncorporatedMember2016-11-302016-11-30

0000717720valu:SubleaseToAmericanBuildingMaintenanceIndustriesIncorporatedMember2016-10-30

0000717720valu:SubleaseToAmericanBuildingMaintenanceIndustriesIncorporatedMember2021-10-03

0000717720valu:SeagisPropertyGroupLpTheLandlordMembervalu:ValueLineDistributionCenterVldcMember2016-02-29

0000717720valu:SeagisPropertyGroupLpTheLandlordMembervalu:ValueLineDistributionCenterVldcMember2016-02-292016-02-29

00007177202019-05-01

utr:Y

0000717720us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembervalu:OneSingleCustomerMember2023-05-012024-04-30

0000717720us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembervalu:OneSingleCustomerMember2022-05-012023-04-30

0000717720us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembervalu:OneSingleCustomerMember2021-05-012022-04-30

0000717720srt:MinimumMember2024-04-30

0000717720srt:MaximumMember2024-04-30

00007177202022-10-21

00007177202019-04-30

00007177202019-05-012020-04-30

00007177202020-04-30

00007177202020-05-012021-04-30

00007177202021-07-31

00007177202022-03-31

00007177202022-05-31

00007177202022-10-31

0000717720valu:CashSecuringALetterOfCreditIssuedAsSecurityDepositMember2024-04-30

0000717720valu:CashSecuringALetterOfCreditIssuedAsSecurityDepositMember2022-04-30

0000717720valu:CashSecuringALetterOfCreditIssuedAsSecurityDepositMember2022-01-31

0000717720valu:ClosingOfSignatureBankMembervalu:CashSecuringALetterOfCreditIssuedAsSecurityDepositMember2023-03-12

0000717720us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:NonUsMember2023-05-012024-04-30

0000717720valu:PaycheckProtectionProgramCaresActMember2022-08-012022-10-31

00007177202021-05-012021-07-31

00007177202021-08-012021-10-31

00007177202021-11-012022-01-31

00007177202022-02-012022-04-30

00007177202022-05-012022-07-31

00007177202022-08-012022-10-31

00007177202022-11-012023-01-31

00007177202023-02-012023-04-30

00007177202023-05-012023-07-31

00007177202023-08-012023-10-31

00007177202023-11-012024-01-31

00007177202024-02-012024-04-30

0000717720valu:PaycheckProtectionProgramCaresActMember2023-05-012024-04-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended April 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 0-11306

VALUE LINE, INC.

(Exact name of registrant as specified in its charter)

| New York | 13-3139843 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 551 Fifth Avenue, New York, New York | 10176-0001 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code (212) 907-1500

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Name of each Exchange on which registered |

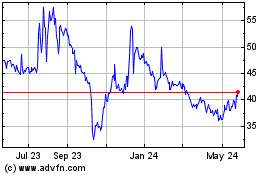

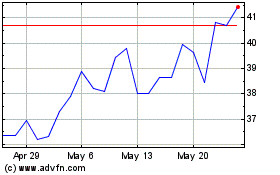

| Common stock, $0.10 par value per share | VALU | The Nasdaq Capital Market |

Securities registered pursuant to Section 12 (g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark whether the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ Yes ☐ No

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐ Yes ☒ No

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recover analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the registrant's voting and non-voting common stock held by non-affiliates at October 31, 2023 was $32,483,588.

There were 9,418,839 shares of the registrant’s Common Stock outstanding at June 30, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to the registrant’s 2024 Annual Meeting of Shareholders, to be held on

October 08, 2024, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

TABLE OF CONTENTS

| PART I |

| Item 1 |

Business |

5 |

| Item 1A |

Risk Factors |

15 |

| Item 1B |

Unresolved Staff Comments |

18 |

| Item 2 |

Properties |

18 |

| Item 3 |

Legal Proceedings |

19 |

| Item 4 |

Mine Safety Disclosures |

19 |

| |

| PART II |

| Item 5 |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

19 |

| Item 6 |

[Reserved] |

|

| Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 |

| Item 7A |

Quantitative and Qualitative Disclosures About Market Risk |

35 |

| Item 8 |

Financial Statements and Supplementary Data |

37 |

| Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

38 |

| Item 9A |

Controls and Procedures |

38 |

| Item 9B |

Other Information |

39 |

| |

| PART III |

| Item 10 |

Directors, Executive Officers, and Corporate Governance |

40 |

| Item 11 |

Executive Compensation |

41 |

| Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

42 |

| Item 13 |

Certain Relationships and Related Transactions and Director Independence |

42 |

| Item 14 |

Principal Accounting Fees and Services |

43 |

| |

| PART IV |

| Item 15 |

Exhibits and Financial Statement Schedules |

44 |

Value Line, the Value Line logo, The Most Trusted Name In Investment Research, “Smart research. Smarter investing”, The Value Line Investment Survey, Value Line Select, Timeliness and Safety are trademarks or registered trademarks of Value Line Inc. and/or its affiliates in the United States and other countries. All other trademarks are the property of their respective owners.

Cautionary Statement Regarding Forward-Looking Information

In this report, “Value Line,” “we,” “us,” “our” refers to Value Line, Inc. and “the Company” refers to Value Line and its subsidiaries unless the context otherwise requires.

This report contains statements that are predictive in nature, depend upon or refer to future events or conditions (including certain projections and business trends) accompanied by such phrases as “believe”, “estimate”, “expect”, “anticipate”, “will”, “intend” and other similar or negative expressions, that are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, as amended. Actual results for Value Line, Inc. (“Value Line” or “the Company”) may differ materially from those projected as a result of certain risks and uncertainties, including but not limited to the following:

| |

● |

maintaining revenue from subscriptions for the Company’s digital and print published products; |

| |

● |

changes in investment trends and economic conditions, including global financial issues; |

| |

● |

changes in Federal Reserve policies affecting interest rates and liquidity along with resulting effects on equity markets; |

| |

● |

stability of the banking system, including the success of U.S. government policies and actions in regard to banks with liquidity or capital issues, along with the associated impact on equity markets; |

| |

● |

continuation of orderly markets for equities and corporate and governmental debt securities; |

| |

● |

problems protecting intellectual property rights in Company methods and trademarks; |

| |

● |

protecting confidential information including customer confidential or personal information that we may possess; |

| |

● |

dependence on non-voting revenues and non-voting profits interests in EULAV Asset Management, a Delaware statutory trust (“EAM” or “EAM Trust”), which serves as the investment advisor to the Value Line Funds and engages in related distribution, marketing and administrative services; |

| |

● |

fluctuations in EAM’s and third party copyright assets under management due to broadly based changes in the values of equity and debt securities, sectoral variations, redemptions by investors and other factors; |

| |

● |

possible changes in the valuation of EAM’s intangible assets from time to time; |

| |

● |

possible changes in future revenues or collection of receivables from significant customers; |

| |

● |

dependence on key executive and specialist personnel; |

| |

● |

risks associated with the outsourcing of certain functions, technical facilities, and operations, including in some instances outside the U.S.; |

| |

● |

competition in the fields of publishing, copyright and investment management, along with associated effects on the level and structure of prices and fees, and the mix of services delivered; |

| |

● |

the impact of government regulation on the Company’s and EAM’s businesses; |

| |

● |

the availability of free or low cost investment information through discount brokers or generally over the internet; |

| |

● |

the economic and other impacts of global political and military conflicts; |

| |

● |

continued availability of generally dependable energy supplies and transportation facilities in the geographic areas in which the company and certain suppliers operate; |

| |

● |

terrorist attacks, cyber attacks and natural disasters; |

| |

● |

insufficiency in our business continuity plans or systems in the event of anticipated or unpredictable disruption; |

| |

● |

the coronavirus pandemic, which has drastically affected markets, employment, and other economic conditions, and may have additional unpredictable impacts on employees, suppliers, customers, and operations; |

| |

● |

other possible epidemics; |

| |

● |

changes in prices and availability of materials and other inputs and services, such as freight and postage, required by the Company; |

| |

● |

other risks and uncertainties, including but not limited to the risks described in Part I, Item 1A, herein, “Risk Factors” of this Annual Report on Form 10-K for the year ended April 30, 2024 and other risks and uncertainties arising from time to time. |

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors which may involve external factors over which we may have no control or changes in our plans, strategies, objectives, expectations or intentions, which may happen at any time at our discretion, could also have material adverse effects on future results. Except as otherwise required to be disclosed in periodic reports required to be filed by public companies with the SEC pursuant to the SEC's rules, we have no duty to update these statements, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks and uncertainties, current plans, anticipated actions, and future financial conditions and results may differ from those expressed in any forward-looking information contained herein.

Explanatory Notes

References in this Annual Report on Form 10-K for the fiscal year ending April 30, 2024, to “the Company”, “Value Line”, “we”, “us” and “our” refer to Value Line, Inc. and its consolidated subsidiaries, unless the context otherwise requires. In addition, unless the context otherwise requires, references to:

“fiscal 2024” are to the twelve month period from May 1, 2023 to April 30, 2024;

“fiscal 2023” are to the twelve month period from May 1, 2022 to April 30, 2023;

“fiscal 2022” are to the twelve month period from May 1, 2021 to April 30, 2022;

the “Adviser” or “EAM” are to EULAV Asset Management Trust, a Delaware business statutory trust;

the “Distributor” or “ES” are to EULAV Securities LLC, a Delaware limited liability company wholly owned by EAM;

the “EAM Declaration of Trust” are to the EAM Declaration of Trust dated December 23, 2010;

the capital structure of EAM is established so that the Company owns only non-voting revenue and non-voting profits interests of EAM, and each of five individuals Trustees owns a profits interest with 20% of the voting power; and

the “Value Line Funds” or the “Funds” are to the Value Line Mutual Funds registered under the Investment Company Act of 1940 for which EAM serves as investment adviser.

Part I

Item 1. BUSINESS.

Value Line, Inc. is a New York corporation headquartered in New York City and formed in 1982. The Company's core business is producing investment periodicals and their underlying research and making available certain Value Line copyrights, Value Line trademarks and Value Line Proprietary Ranks and other proprietary information, to third parties under written agreements for use in third-party managed and marketed investment products and for other purposes. Value Line markets under well-known brands including Value Line®, the Value Line logo®, The Value Line Investment Survey®, Smart Research, Smarter Investing™ and The Most Trusted Name in Investment Research®. The name "Value Line" as used to describe the Company, its products, and its subsidiaries, is a registered trademark of the Company. Effective December 23, 2010, EULAV Asset Management Trust (“EAM”) was established to provide investment management services to the Value Line Funds accounts and provides distribution, marketing, and administrative services to the Value Line Funds. Value Line holds substantial non-voting revenues and non-voting profits interests in EAM.

The Company is the successor to substantially all of the operations of Arnold Bernhard & Co, Inc. ("AB&Co."). AB&Co. is the controlling shareholder of the Company and, as of April 30, 2024, owns 91.63% of the outstanding shares of the common stock of the Company.

A. Investment Related Periodicals & Publications

The investment periodicals and related publications offered by Value Line Publishing LLC (“VLP”), a wholly-owned entity of the Company, cover a broad spectrum of investments including stocks, mutual funds, ETFs and options. The Company’s periodicals and related publications and services are marketed to individual and professional investors, as well as to institutions including municipal and university libraries and investment firms.

The services generally fall into four categories:

| |

● |

Comprehensive reference periodical publications |

| |

● |

Targeted, niche periodical newsletters |

| |

● |

Investment analysis software |

| |

● |

Current and historical financial databases |

The comprehensive research services (The Value Line Investment Survey, The Value Line Investment Survey - Small and Mid-Cap, The Value Line 600, and The Value Line Fund Advisor Plus) provide both statistical and text coverage of a large number of investment securities, with an emphasis placed on Value Line’s proprietary research, analysis and statistical ranks. The Value Line Investment Survey is the Company’s flagship service, published each week in print and daily on the web.

The niche newsletters (Value Line Select®, Value Line Select: Dividend Income & Growth, Value Line Select: ETFs, The Value Line Special Situations Service®, The Value Line M&A Service, The Value Line Climate Change Investing Service, and The Value Line Information You Should Know Wealth Newsletter) provide information on a less comprehensive basis for securities that the Company believes will be of particular interest to subscribers and may include topics of interest on markets and the business environment. Value Line Select® is a targeted service with an emphasis on Value Line’s proprietary in-depth research analysis and statistical selections, highlighting monthly a stock with strong return potential and reasonable risk. Value Line Select: Dividend Income & Growth represents Value Line's targeted coverage of dividend paying stocks with good growth potential. Value Line Select: ETFs recommends a new ETF for purchase each month. The Value Line Special Situations Service provides in-depth research analysis on selected small and mid-cap stocks. The Value Line M&A Service recommends stocks of companies that Value Line thinks may be acquired by other corporations or private equity firms. The Value Line Climate Change Investing Service recommends stocks that should benefit from addressing the challenge of climate change. The Value Line Information You Should Know Wealth Newsletter provides insightful information on various personal finance topics.

Value Line offers digital versions of most of its products through the Company’s website, www.valueline.com. Subscribers to the print versions have, in some cases, received free access to the corresponding digital versions, although digital subscribers do not receive a free print edition. The most comprehensive of the Company’s online platforms is The Value Line Research Center, which allows subscribers to access most of the Company’s research and publications at a packaged price via the Internet.

Investment analysis software (The Value Line Investment Analyzer and The Value Line ETFs Service) includes data sorting and filtering tools. In addition, for institutional and professional subscribers, VLP offers current and historical financial databases (DataFile, Estimates & Projections, and Mutual Funds) via the Internet.

The print and digital services include, but are not limited to the following:

The Value Line Investment Survey

The Value Line Investment Survey is an investment periodical research service providing both timely articles on economic, financial and investment matters and analysis and ranks for equity securities. Two of the evaluations for covered equity securities are "Timeliness™" and "Safety™”. “Timeliness” Ranks relate to the probable relative price performance of one stock over the next six to twelve months, as compared to the rest of the stock coverage universe. Ranks are updated each week and range from Rank 1 for the expected best performing stocks to Rank 5 for the expected poorest performers. "Safety" Ranks are a measure of risk and are based on the issuer's relative Financial Strength and its stock's Price Stability. "Safety" ranges from Rank 1 for the least risky stocks to Rank 5 for the riskiest. VLP employs analysts and statisticians who prepare articles of interest for each periodical and who evaluate stock performance and provide future earnings estimates and quarterly written evaluations with more frequent updates when relevant. The Value Line Investment Survey is comprised of three parts: The "Summary & Index" provides updated Timeliness and Safety Ranks, selected financial data, and "screens" of key financial measures; the "Ratings & Reports" section contains the updated reports on stocks each week; and the “Selection & Opinion” section provides economic commentary and data, articles, and model portfolios managed by analysts covering a range of investment approaches.

The Value Line Investment Survey - Small and Mid-Cap

The Value Line Investment Survey - Small and Mid-Cap is an investment research tool introduced in 1995 that provides short descriptions of and extensive data for small and medium-capitalization stocks, many listed on The NASDAQ Exchange, beyond the equity securities of generally larger-capitalization companies covered in The Value Line Investment Survey. Like The Value Line Investment Survey, the Small and Mid-Cap has its own "Summary & Index" providing updated performance ranks and other data, as well as "screens" of key financial measures and two model portfolios. The print portion of the service is issued monthly. The 400 stocks of the Small & Mid-Cap universe selected for inclusion in the print component of the service are those of most importance to subscribers and are mailed to subscribers in updated monthly groups. Each stock is covered 4 times per year – once per quarterly cycle. The Digital component of the service remains unchanged -- updated weekly with the complete stock coverage universe available for review. The Performance Rank is designed to predict relative price performance over the next six to twelve months.

The Value Line Fund Advisor Plus

The Value Line Mutual Fund Ranking System was introduced in 1993. It is the system utilized in the Fund Advisor Plus, featuring load, no-load, and low-load open-end mutual funds. Each issue offers strategies for maximizing total return, and highlights of specific mutual funds. It also includes information about retirement planning and industry news. A full statistical review, including latest performance, ranks, and sector weightings, is updated each month on approximately 800 leading load, no-load and low-load funds. Included with this product is online access to Value Line’s database of approximately 20,000 mutual funds, including screening tools and full-page printable reports on each fund. Four model portfolios are also part of the service. One recommends specific U.S. mutual funds from different objective groups, while the other highlights similar exchange traded funds (ETFs). The remaining two highlight mutual funds and ETFs globally. The Value Line Fund Advisor Plus contains data on approximately 20,000 no-load and low-load funds and a digital screener.

The Value Line Special Situations Service

The Value Line Special Situations Service’s core focus is on smaller companies whose equity securities are perceived by Value Line’s analysts as having exceptional appreciation potential. This publication was introduced in 1951.

The Value Line Daily Options Survey

The Value Line Daily Options Survey is a daily digital service that evaluates and ranks approximately 600,000 U.S. equity and equity index options. Features include an interactive database, spreadsheet tools, and a weekly email newsletter. This product is only offered as an online subscription.

Value Line Select

Value Line Select is a monthly stock selection service and was first published in 1998. It focuses each month on a single company that the Value Line Research Department has selected from a group of high-quality companies whose stocks are viewed as having a superior risk/reward ratio. Recommendations are backed by in-depth research and are subject to ongoing monitoring by research personnel.

Value Line Select: Dividend Income & Growth

Value Line Select: Dividend Income & Growth (formerly Value Line Dividend Select), a monthly stock selection service, was introduced in June 2011. This product focuses on companies with dividend yields greater than the average of all stocks covered by Value Line, with a preference for companies that have consistently increased their dividends above the rate of inflation over the longer term and, based on Value Line analysis, have the financial strength both to support and increase dividend payments in the future.

Value Line Select: ETFs

In May 2017, we launched Value Line Select: ETFs, a monthly ETF selection service. This product focuses on ETFs that appear poised to outperform the broader market. The selection process utilizes an industry approach, with the same data-focused analysis that is the hallmark of Value Line.

The Value Line ETFs Service

In September 2019, we introduced this service entitled The Value Line ETFs Service. This online-only, web based analysis software provides data, analysis, and screening capabilities on more than 2,700 publicly traded ETFs. Almost all of the ETFs tracked in the product are ranked by The Value Line ETF Ranking System, a proprietary estimate with the goal of predicting an ETF’s future performance relative to all other ranked ETFs. The screener includes more than 30 fields, and each ETF has its own full PDF report. All data and information can be downloaded, exported, and printed.

The Value Line 600

The Value Line 600 is a monthly publication, which contains full-page research reports on approximately 600 equity securities. Its reports provide information on many actively traded, larger capitalization issues as well as some smaller growth stocks. It offers investors who want the same type of analysis provided in The Value Line Investment Survey, but who do not want or need coverage of all the companies covered by that product a suitable alternative. Readers also receive supplemental reports as well as a monthly Index, which includes updated statistics, including proprietary ranks and ratings.

Value Line Information You Should Know Wealth Newsletter

This is a monthly service that started in January 2020. It is a general interest publication focusing on useful and actionable investing and financial information. It is a succinct 4 page newsletter covering topics such as. “How Can I Avoid Probate? And Should I?”, “How to Handle Your Investments in a Bear Market”. It is available as a print product or as a PDF delivered via email. The newsletter is marketed via a variety of channels including as an add-on in select direct mail campaigns and email.

The Value Line M&A Service

This is a monthly service that was launched in September 2020. The objective of the service is to identify companies that possess characteristics, such as a successful product lineup, market position or important technology that would interest larger corporations or private equity firms. The main feature of the M&A Service consists of a detailed, multipage highlight on a stock that Value Line thinks is a good acquisition candidate. New recommendations are then added to the M&A Model Portfolio.

The Value Line Climate Change Investing Service

This monthly service was introduced in April 2021. This publication, designed for the climate-conscious, profit-oriented investor, seeks to provide key climate news alongside a managed portfolio of twenty stocks, chosen by our analysts, which stand to benefit from responses to climate change. Selections are vetted based not only on time-tested financial measures, but also the potential impact of climate change and measures taken to combat it on their business. Our selections fall into two main groups: businesses that are focused on providing environmental solutions, and those that are likely to thrive in a changing climate. Every issue features new updates to our portfolio.

Value Line Investment Analyzer

Value Line Investment Analyzer is a powerful menu-driven software program with fast filtering, ranking, reporting and graphing capabilities utilizing more than 230 data fields for various industries and indices and for the stocks covered in VLP’s flagship publication, The Value Line Investment Survey. Value Line Investment Analyzer allows subscribers to apply numerous charting and graphing variables for comparative research, and is integrated with the Value Line databases via the Internet. Value Line Investment Analyzer Professional is a more comprehensive product which covers nearly 5,500 stocks and allows subscribers to create customized screens.

Value Line DataFile Products

For our institutional customers, Value Line offers both current and historical data for equities, mutual funds and exchange traded funds (“ETFs”). Value Line DataFile products are offered via an FTP site. Below is a listing of the DataFile products:

Fundamental DataFile I and II

The Value Line Fundamental DataFile I contains fundamental data (both current and historical) on nearly 5,500 publicly traded companies that follow U.S. generally accepted accounting principles (“GAAP”). This data product provides annual data from 1955, quarterly data from 1963, and full quarterly data as reported to the SEC from 1985. Value Line also offers historical data on over 9,500 companies that no longer exist in nearly 100 industries via our “Dead Company” File. The Fundamental DataFile has over 400 annual and over 80 quarterly fields for each of the companies included in the database. DataFile is sold primarily to the institutional and academic markets. Value Line also offers a scaled down DataFile product, Fundamental DataFile II, which includes a limited set of historical fundamental data.

Estimates and Projections DataFile

This DataFile offering contains the proprietary estimates and projections from Value Line analysts on a wide range of the stocks traded on U.S. exchanges. Data includes earnings, sales, cash flow, book value, margin, and other popular fields. Estimates are for the current year and next year, while projections encompass the three to five year period.

Mutual Fund DataFile

The Value Line Mutual Fund DataFile covers approximately 20,000 mutual funds with up to 20 years of historical data with more than 200 data fields. The Mutual Fund DataFile provides monthly pricing, basic fund information, weekly performance data, sector weights, and many other important mutual fund data fields. This file is updated monthly and delivered via FTP.

Value Line Research Center

The Value Line Research Center provides on-line access to select Company investment research services covering stocks, mutual funds, options, ETFs, and special situations stocks. This service includes full digital subscriptions to The Value Line Investment Survey, The Value Line Fund Advisor Plus, The Value Line Daily Options Survey, The Value Line Investment Survey - Small and Mid-Cap, The New Value Line ETFs Service and The Value Line Special Situations Service. For our library subscribers, the Research Center also includes the Value Line Climate Change Investing Service. Users can screen more than 250 data fields, create graphs using multiple different variables, and access technical history.

Digital Services

The Value Line Investment Survey - Smart Investor offers digital access to full page reports, analyst commentary and Value Line proprietary ranks with coverage on stocks that comprise over 90% of the value of all stocks that trade on U.S. exchanges. Online tools include a screener, alerts, watch-lists and charting. Print capabilities are included.

The Value Line Investment Survey - Savvy Investor offers digital access to full page reports and Value Line proprietary ranks on the stocks of both The Investment Survey (Smart Investor) and The Small Cap Investor. Online tools include a screener, alerts, watch-lists and charting. Print capabilities are included.

The Value Line Investment Survey - Small Cap Investor offers digital access to full page reports and Value Line proprietary ranks and short descriptions of and extensive data for small and medium-capitalization stocks generally with market capitalizations under $10 billion. One year of history is included. Online tools include a screener, alerts, watch-lists and charting. Print capabilities are included.

The Value Line Investment Survey - Investor 600, equivalent to The Value Line 600 print, offers digital access to full page reports, analyst commentary and Value Line proprietary ranks on approximately 600 selected stocks covering the same variety of industries as The Value Line Investment Survey. Online tools include a screener, alerts, watch-lists and charting. Print capabilities are included.

Value Line Pro Premium digital service includes The Value Line Investment Survey® and The Value Line Investment Survey® — Small & Mid-Cap. This equity package monitors more than 3,300 companies with market values ranging from less than $1 billion to nearly $3 trillion across 100 industries. There are over 250 data fields that can be screened to help make informed decisions. Features of the service include three years of historical reports and data, customizable modules, alerts and screening.

Value Line Pro Basic digital service covers the stocks included in The Value Line Investment Survey®, drawn from nearly 100 industries, and representing 90% of total U.S. daily trading volume on stocks drawn from 100 industries. There are over 200 data fields that can be screened to help make informed decisions. Features of the service include three years of historical reports and data, customizable modules, alerts and screening.

Value Line Pro Elite digital service includes The Value Line Investment Survey® and The Value Line Investment Survey® — Small & Mid-Cap. Pro Elite service package aimed at professional industry includes digital access to full page reports and Value Line proprietary ranks. In addition, our database of mostly microcap firms adds more than 2,000 additional names. Five years’ history is included. Online tools include a screener, alerts, watch-lists and charting. Downloading and print capabilities are included.

The Value Line Investment Survey – Library Basic has coverage on stocks that comprise over 90% of the value of all stocks that trade on U.S. exchanges included in The Value Line Investment Survey, drawn from nearly 100 industries. There are over 200 data fields that can be applied to help you make more informed decisions. Value Line has led its subscribers towards financial success by satisfying the demand for actionable insights and tools to manage equity investments.

The Value Line Investment Survey – Library Elite offers libraries digital access to full reports, analyst commentary and Value Line proprietary ranks. This equity package monitors more than 3,300 companies. Online tools include a screener, and charting. Print capabilities are included.

The Value Line Pro Equity Research Center is an equities-only package that includes access to exclusive premium services and provides online access to all of Value Line’s equity products. This service offered both to financial advisers and high-net-worth individuals, includes full online subscriptions to The Value Line Investment Survey, The Value Line Investment Survey – Small & Mid-Cap, Value Line Select, Value Line Select: Dividend Income and Growth, The Value Line Special Situations Service, The Value Line M&A Service, and The Value Line Pro ETF Package. Users can screen more than 250 data fields, create graphs using multiple different variables, and access technical history. The Value Line Pro Equity Research Center has the ability to track model portfolios (large, small and mid-cap) as well as providing ranks and news.

Value Line Library Research Center

The Value Line Library Research Center provides on-line access to select Company investment research services covering stocks, mutual funds, options, special situations stocks, and climate change investing. This service includes full digital subscriptions to The Value Line Investment Survey, The Value Line Fund Advisor Plus, The Value Line Daily Options Survey, The Value Line Investment Survey - Small and Mid-Cap, The New Value Line ETFs Service, The Value Line Special Situations Service, and The Value Line Climate Change Investing Service. Users can screen more than 250 data fields, create graphs using multiple different variables, and access technical history. Value Line Library Research Center has the ability to track model portfolios (large, small and mid-cap) as well as providing ranks and news.

Quantitative Strategies

Value Line Quantitative Strategy Portfolios are developed based on our renowned proprietary Ranking Systems for TimelinessTM, Performance and SafetyTM, Financial Strength Ratings, and a comprehensive database of fundamental research and analysis. All of these quantitative investment products have a solid theoretical foundation and have demonstrated superior empirical results. These strategies are available for licensing by Financial Professionals such as RIAs and Portfolio Managers.

All the digital services have Charting features, including many options to chart against popular indexes with the ability to save settings and print. Products offer an Alerts Hub which allows the user to set up alerts for up to 25 companies, with delivery via text or email.

B. Copyright Programs

The Company’s available copyright services, which include certain proprietary Ranking System results and other proprietary information are made available for use in third party products, such as unit investment trusts, variable annuities, managed accounts and exchange traded funds. The sponsors of these products act as wholesalers and distribute the products generally by syndicating them through an extensive network of national and regional brokerage firms. The sponsors of these products will typically receive Proprietary Ranking System results, which may include Value Line Timeliness, Safety, Technical and Performance ranks, as screens for their portfolios. The sponsors are also given permission to associate Value Line’s trademarks with the products. Value Line collects a copyright fee from each of the product sponsors/managers primarily based upon the market value of assets invested in each product’s portfolio utilizing the Value Line proprietary data. Since these fees are based on the market value of the respective portfolios using the Value Line proprietary data, the payments to Value Line, which are typically received on a quarterly basis, will fluctuate.

Value Line’s primary copyright products are structured as ETFs and Unit Investment Trusts, all of which have in common some degree of reliance on the Value Line Ranking System for their portfolio creation. These products are offered and distributed by independent sponsors.

C. Investment Management Services

Pursuant to the EAM Declaration of Trust, the Company receives an interest in certain revenues of EAM and a portion of the residual profits of EAM but has no voting authority with respect to the election, removal or replacement of the trustees of EAM. The business of EAM is managed by five individual trustees and a Delaware resident trustee (collectively, the “Trustees”) and by its officers subject to the direction of the Trustees.

Collectively, the holders of the voting profits interests in EAM are entitled to receive 50% of the residual profits of the business, subject to temporary adjustments in certain circumstances. Value Line holds a non-voting profits interest representing 50% of residual profits, subject to temporary adjustments in certain circumstances, and has no power to vote for the election, removal or replacement of the trustees of EAM. Value Line also has a non-voting revenues interest in EAM pursuant to which it is entitled to receive a portion of the non-distribution revenues of the business ranging from 41% at non-distribution fee revenue levels of $9 million or less to 55% at such revenue levels of $35 million or more. In the event the business is sold or liquidated, the first $56.1 million of net proceeds plus any additional capital contributions (Value Line or any holder of a voting profits interest, at its discretion, may make future contributions to its capital account in EAM), which contributions would increase its capital account but not its percentage interest in operating profits, will be distributed in accordance with capital accounts; 20% of the next $56.1 million will be distributed to the holders of the voting profits interests and 80% to the holder of the non-voting profits interests (currently, Value Line); and the excess will be distributed 45% to the holders of the voting profits interests and 55% to the holder of the non-voting profits interest (Value Line). EAM has elected to be taxed as a pass-through entity similar to a partnership.

Also, pursuant to the EAM Declaration of Trust, Value Line (1) granted each Fund use of the name “Value Line” so long as EAM remains the Fund’s adviser and on the condition that the Fund does not alter its investment objectives or fundamental policies from those in effect on the date of the investment advisory agreement with EAM, provided also that the Funds do not use leverage for investment purposes or engage in short selling or other complex or unusual investment strategies that create a risk profile similar to that of so-called hedge funds, (2) agreed to provide EAM its proprietary Ranking System information without charge or expense on as favorable basis as to Value Line’s best institutional customers and (3) agreed to capitalize the business with $7 million of cash and cash equivalents at inception.

EAM is organized as a Delaware statutory trust and has no fixed term. However, in the event that control of the Company’s majority shareholder changes, or in the event that the majority shareholder no longer beneficially owns 5% or more of the voting securities of the Company, then the Company has the right, but not the obligation, to buy the voting profits interests in EAM at a fair market value to be determined by an independent valuation firm in accordance with the terms of the EAM Declaration of Trust.

Value Line also has certain consent rights with respect to extraordinary events involving EAM, such as a proposed sale of all or a significant part of EAM, material acquisitions, entering into businesses other than asset management and fund distribution, paying compensation in excess of the mandated limit of 22.5%-30% of non-distribution fee revenues (depending on the level of such revenues), declaring voluntary bankruptcy, making material changes in tax or accounting policies or making substantial borrowings, and entering into related party transactions. These rights were established to protect Value Line’s non-voting revenues and non-voting profits interests in EAM.

EAM acts as the Adviser to the Value Line Funds. EULAV Securities acts as the Distributor for the Value Line Funds. State Street Bank, an unaffiliated entity, is the custodian of the assets of the Value Line Funds and provides them with fund accounting and administrative services. Shareholder services for the Value Line Funds are provided by SS&C.

The Company maintains a significant interest in the cash flows generated by EAM and will continue to receive ongoing payments in respect of its non-voting revenues and non-voting profits interests, as discussed below. Total assets in the Value Line Funds managed and/or distributed by EAM at April 30, 2024, were $4.17 billion, which is $1.08 billion, or 35.0%, above total assets of $3.09 billion in the Value Line Funds managed and/or distributed by EAM at April 30, 2023.

| Total net assets of the Value Line Funds at April 30, 2024, were: |

|

| |

|

($ in thousands) |

|

| |

|

|

|

|

| Value Line Asset Allocation Fund |

|

$ |

909,517 |

|

| Value Line Capital Appreciation Fund |

|

|

427,755 |

|

| Value Line Mid Cap Focused Fund |

|

|

1,462,284 |

|

| Value Line Small Cap Opportunities Fund |

|

|

587,214 |

|

| Value Line Select Growth Fund |

|

|

417,967 |

|

| Value Line Larger Companies Focused Fund |

|

|

332,473 |

|

| Value Line Core Bond Fund |

|

|

35,837 |

|

| |

|

|

|

|

| Total EAM managed net assets |

|

$ |

4,173,047 |

|

Investment management fees and distribution service fees (“12b-1 fees”) vary among the Value Line Funds and may be subject to certain limitations. Certain investment strategies among the equity funds include, but are not limited to, reliance on the Value Line Timeliness ™ Ranking System (the “Ranking System”) and/or the Value Line Performance Ranking System in selecting securities for purchase or sale. Each Ranking System seeks to compare the estimated probable market performance of each stock during the next six to twelve months to that of all stocks under review in each system and ranks stocks on a scale of 1 (highest) to 5 (lowest). All the stocks followed by the Ranking System are listed on U.S. stock exchanges or traded in the U.S. over-the-counter markets. Prospectuses and annual reports for each of the Value Line open end mutual funds are available on the Funds’ website www.vlfunds.com. Each mutual fund may use "Value Line" in its name only to the extent permitted by the terms of the EAM Declaration of Trust.

D. Wholly-Owned Operating Subsidiaries

Wholly-owned operating subsidiaries of the Company as of April 30, 2024 include the following:

| |

1. |

Value Line Publishing LLC (“VLP”) is the publishing unit for the investment related periodical publications and copyrights. |

| |

2. |

Vanderbilt Advertising Agency, Inc. places advertising on behalf of the Company's publications. |

| |

3. |

Value Line Distribution Center, Inc. (“VLDC”) distributed Value Line’s print publications through April 30, 2024. Operations were outsourced to a third party in the United States effective May 1, 2024. |

E. Trademarks

The Company holds trademark and service mark registrations for various names and logos in multiple countries. Value Line believes that these trademarks and service marks provide significant value to the Company and are an important factor in the marketing of its products and services, as well as in the marketing of the Value Line Funds, now managed by EAM. The Company maintains registrations of all active and eligible trademarks.

F. Investments

As of April 30, 2024 and April 30, 2023, the Company held total investment assets (excluding its interests in EAM) with a fair market value of $63,955,000 and $54,474,000, respectively, including equity securities and available-for-sale fixed income securities on the Consolidated Balance Sheets. As of April 30, 2024 and April 30, 2023, the Company held equity securities, which consist of investments in the SPDR Series Trust S&P Dividend ETF (SDY), First Trust Value Line Dividend Index ETF (FVD), ProShares Trust S&P 500 Dividend Aristocrats ETF (NOBL), IShares DJ Select Dividend ETF (DVY) and other Exchange Traded Funds and common stock equity securities. As of April 30, 2024 and April 30, 2023, the Company held fixed income securities classified as available-for-sale, that consist of securities issued by United States federal government and bank certificates of deposit within the United States.

G. Employees

At April 30, 2024, the Company and its subsidiaries employed 122 people.

The Company and its affiliates, officers, directors and employees may from time to time own securities which are also held in the portfolios of the Value Line Funds or recommended in the Company's publications. Value Line analysts are not permitted to own securities of the companies they cover. The Company has adopted rules requiring reports of securities transactions by employees for their respective accounts. The Company has also established policies restricting trading in securities whose ranks are about to change in order to avoid possible conflicts of interest.

H. Principal Business Segments

The information with respect to revenues from external customers and profit and loss of the Company's identifiable principal business segments is incorporated herein by reference to Note 18 of the Notes to the Company's Consolidated Financial Statements included in this Form 10-K.

I. Competition

The investment information and publishing business conducted by the Company and the investment management business conducted by EAM are very competitive. There are many competing firms and a wide variety of product offerings. Some of the firms in these industries are substantially larger and have greater financial resources than the Company and EAM. The Internet continues to increase the amount of competition in the form of free and paid online investment research. With regard to the investment management business conducted by EAM, the prevalence of broker supermarkets or platforms permitting easy transfer of assets among mutual funds, mutual fund families, and other investment vehicles tends to increase the speed with which shareholders can leave or enter the Value Line Funds based, among other things, on short-term fluctuations in performance.

J. Executive Officers of the Registrant

The following table lists the names, ages (at June 30, 2024), and principal occupations and employment during the past five years of the Company's Executive Officers. All officers are elected to terms of office for one year. Except as noted, each of the following has held an executive position with the companies indicated for at least five years.

| Name |

Age |

Principal Occupation or Employment |

| |

|

|

| Howard A. Brecher |

70 |

Chairman and Chief Executive Officer since October 2011; Acting Chairman and Acting Chief Executive Officer from November 2009 to October 2011; Chief Legal Officer; Vice President and Secretary until January 2010; Vice President and Secretary of each of the Value Line Funds from June 2008 to December 2010; Secretary of EAM LLC from February 2009 until December 2010; Director and General Counsel of AB&Co. Mr. Brecher has been an officer of the Company for more than 20 years. |

| |

|

|

| Stephen R. Anastasio |

65 |

Vice President since December 2010; Director since February 2010; Treasurer since 2005. Mr. Anastasio has been an officer of the Company for more than 10 years. |

WEBSITE ACCESS TO SEC REPORTS

The Company’s Internet site address is www.valueline.com. The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports are made available on the “Corporate Filings” page under the “About Value Line” tab on the Company’s website @www.valueline.com/About/corporate_filings.aspx. free of charge as soon as reasonably practicable after the reports are filed electronically with the SEC. All of the Company’s SEC reports are also available on the SEC Internet site, www.sec.gov.

ITEM 1A. RISK FACTORS

In addition to the risks referred to elsewhere in this Form 10-K, the following risks, among others, sometimes may have affected, and in the future could affect, the Company’s businesses, financial condition or results of operations and/or the investment management business conducted by EAM and consequently, the amount of revenue we receive from EAM. The risks described below are not the only ones we face. Additional risks not discussed or not presently known to us or that we currently deem insignificant, may also impact our businesses.

The Company and its subsidiaries are dependent on the efforts of its executives and professional staff.

The Company’s future success relies upon its ability to retain and recruit qualified professionals and executives. The Company’s executive officers do not have employment agreements with the Company and the Company does not maintain “key man” insurance policies on any of its executive officers. The loss of the services of key personnel could have an adverse effect on the Company.

A decrease in the revenue generated by EAM’s investment management business could adversely affect the Company’s cash flow and financial condition.

The Company derives a significant portion of its cash flow from its non-voting revenues and non-voting profits interests in EAM. A decrease in the revenue generated by EAM’s investment management business, whether resulting from performance, competitive, regulatory or other reasons, would reduce the amount of cash flow received by the Company from EAM, which reduction could adversely affect the Company’s cash flow and financial condition.

EAM’s assets under management, which impact EAM’s revenue, and consequently the amount of the cash flow that the Company receives from EAM, are subject to fluctuations based on market conditions and individual fund performance.

Financial market declines and/or adverse changes in interest rates would generally negatively impact the level of EAM’s assets under management and consequently its revenue and net income. Major sources of investment management revenue for EAM (i.e., investment management and service and distribution fees) are calculated as percentages of assets under management. A decline in securities prices or in the sale of investment products or an increase in fund redemptions would reduce fee income. A prolonged recession or other economic or political events could also adversely impact EAM’s revenue if it led to decreased demand for products, a higher redemption rate, or a decline in securities prices. Good performance of managed assets relative to both competing products and benchmark indices generally assists in both retention and growth of assets, and may result in additional revenues. Conversely, poor performance of managed assets relative to competing products or benchmark indices tends to result in decreased sales and increased redemptions with corresponding decreases in revenues to EAM. Poor performance could therefore reduce the amount of cash flow that the Company receives from EAM, which reduction could adversely affect the Company’s financial condition.

EAM derives nearly all of its investment management fees from the Value Line Funds.

EAM is dependent upon management contracts and service and distribution contracts with the Value Line Funds under which these fees are paid. As required by the Investment Company Act of 1940 (the “1940 Act”), the Trustees/Directors of the Funds, all of whom are independent of the Company and EAM (except for the CEO of EAM), have the right to terminate such contracts. If any of these contracts are terminated, not renewed, or amended to reduce fees, EAM’s financial results, and consequently, the amount of cash flow received by the Company from EAM, and the Company’s financial condition, may be adversely affected.

A decrease in the revenue generated by a significant customer could adversely affect the Company’s cash flow and financial condition.

The Company derives a significant portion of its cash flow and publishing revenues from a single significant customer.

If the Company does not maintain its subscriber base, its operating results could suffer.

A substantial portion of the Company’s revenue is generated from print and digital subscriptions, which are paid in advance by subscribers. Unearned revenues are accounted for on the Consolidated Balance Sheets of the Company within current and long-term liabilities. The backlog of orders is primarily generated through renewals and new subscription marketing efforts as the Company deems appropriate. Future results will depend on the renewal of existing subscribers and obtaining new subscriptions for the investment periodicals and related publications. The availability of competitive information on the Internet at low or no cost has had and may continue to have a negative impact on the demand for our products.

The Company believes that the negative trend in retail print subscription revenue experienced in recent years is likely to continue.

During recent years, the Company has experienced a negative trend in retail print subscription revenue. While circulation of some print publications has increased, others have experienced a decline in circulation or in average yearly price realized. It is expected that print revenues will continue to decline long-term, while the Company emphasizes digital offerings. The Company has established the goal of maintaining competitive digital products and marketing them through traditional and digital channels to retail and institutional customers. However, the Company is not able to predict whether revenues from digital retail publications will grow more than print revenues decline.

Loss of copyright clients or decline in their customers, or assets managed by third party sponsors could reduce the Company’s revenues.

Copyright agreements are based on market interest in the respective proprietary information. The Company believes this part of the business is dependent upon the desire of third parties to use the Value Line trademarks and proprietary research for their products, competition and on fluctuations in segments of the equity markets. If the fees from proprietary information decline, the Company’s operating results could suffer.

Failure to protect its intellectual property rights and proprietary information could harm the Company’s ability to compete effectively and could negatively affect operating results.

The Company’s trademarks are important assets to the Company. Although its trademarks are registered in the United States and in certain foreign countries, the Company may not always be successful in asserting global trademark protection. In the event that other parties infringe on its intellectual property rights and it is not successful in defending its intellectual property rights, the result may be a dilution in the value of the Company’s brands in the marketplace. If the value of the Company’s brands becomes diluted, such developments could adversely affect the value that its customers associate with its brands, and thereby negatively impact its sales. Any infringement of our intellectual property rights would also likely result in a commitment of Company resources to protect these rights through litigation or otherwise. In addition, third parties may assert claims against our intellectual property rights and we may not be able successfully to resolve such claims. The Company is utilizing all of its trademarks and properly maintaining registrations for them.

The Company and EAM face significant competition in their respective businesses.

Both the investment information and publishing business conducted by the Company and the investment management business conducted by EAM are very competitive. There are many competing firms and a wide variety of product offerings. Some of the firms in these industries are substantially larger and have greater financial resources than the Company and EAM. With regard to the investment information and publishing business, barriers to entry have been reduced by the minimal cost structure of the Internet and other technologies. With regard to the investment management business, the absence of significant barriers to entry by new investment management firms in the mutual fund industry increases competitive pressure. Competition in the investment management business is based on various factors, including business reputation, investment performance, quality of service, marketing, distribution services offered, the range of products offered and fees charged. Access to mutual fund distribution channels has also become increasingly competitive.

Government regulations, any changes to government regulations, and regulatory proceedings and litigation may adversely impact the business.

Changes in legal, regulatory, accounting, tax and compliance requirements could have an effect on EAM’s operations and results, including but not limited to increased expenses and restraints on marketing certain funds and other investment products. EAM is registered with the SEC under the Investment Advisers Act of 1940 (the “Advisers Act”). The Advisers Act imposes numerous obligations on registered investment advisers, including fiduciary, record keeping, operational and disclosure obligations. ES is registered as a broker-dealer under the Securities Exchange Act of 1934 and is a member of the Financial Industry Regulatory Authority, also known as “FINRA”. Each Value Line Fund is a registered investment company under the 1940 Act. The 1940 Act requires numerous compliance measures, which must be observed, and involves regulation by the SEC. Each fund and its shareholders may face adverse tax consequences if the Value Line Funds are unable to maintain qualification as registered investment companies under the Internal Revenue Code of 1986, as amended. Those laws and regulations generally grant broad administrative powers to regulatory agencies and bodies such as the SEC and FINRA. If these agencies and bodies believe that EAM, ES or the Value Line Funds have failed to comply with their laws and regulations, these agencies and bodies have the power to impose sanctions. EAM, ES and the Value Line Funds, like other companies, can also face lawsuits by private parties. Regulatory proceedings and lawsuits are subject to uncertainties, and the outcomes are difficult to predict. Changes in laws, regulations or governmental policies, and the costs associated with compliance, could adversely affect the business and operations of the EAM, ES and the Value Line Funds. An adverse resolution of any regulatory proceeding or lawsuit against the EAM or ES could result in substantial costs or reputational harm to them or to the Value Line Funds and have an adverse effect on their respective business and operations. An adverse effect on the business and operations of EAM, ES and/or the Value Line Funds could reduce the amount of cash flow that the Company receives in respect of its non-voting revenues and non-voting profits interests in EAM and, consequently, could adversely affect the Company’s cash flows, results of operations and financial condition.

Terrorist attacks could adversely affect the Company and EAM.

A terrorist attack, including biological or chemical weapons attacks, and the response to such terrorist attacks, could have a significant impact on the New York City area, the local economy, the United States economy, the global economy, and U.S. and/or global financial markets, and could also have a material adverse effect on the Company’s business and on the investment management business conducted by EAM.

Future pandemic outbreaks could disrupt the Company’s operations.

A substantial recurrence of infections of the COVID-19 virus or its variants could disrupt Company printing and distribution operations, or supplies of materials and services needed for the print publishing business. While the Company believes that its office, editorial, and administrative operations, and those of its suppliers of data and other services, are adequately backed-up for fully remote operations if needed, likewise a future pandemic outbreak could interfere with the continuity of printing and distribution operations, as well as endangering personnel of the Company and its supply chain partners.

Our controlling stockholder exercises voting control over the Company and has the ability to elect or remove from office all of our directors.

As of April 30, 2024, AB&Co., Inc. beneficially owned 91.63% of the outstanding shares of the Company’s voting stock. AB&Co. is therefore able to exercise voting control with respect to all matters requiring stockholder approval, including the election or removal from office of all of our directors.

We are not subject to most of the listing standards that normally apply to companies whose shares are quoted on NASDAQ.

Our shares of common stock are quoted on the NASDAQ Capital Market (“NASDAQ”). Under the NASDAQ listing standards, we are deemed to be a “controlled company” by virtue of the fact that AB&Co. has voting power with respect to more than 50% of our outstanding shares of voting stock. A controlled company is not required to have a majority of its board of directors comprised of independent directors. Director nominees are not required to be selected or recommended for the board’s selection by a majority of independent directors or a nomination committee comprised solely of independent directors, nor do the NASDAQ listing standards require a controlled company to certify the adoption of a formal written charter or board resolution, as applicable, addressing the nominations process. A controlled company is also exempt from NASDAQ’s requirements regarding the determination of officer compensation by a majority of the independent directors or a compensation committee comprised solely of independent directors. Although we currently comply with certain of the NASDAQ listing standards that do not apply to controlled companies, our compliance is voluntary, and there can be no assurance that we will continue to comply with these standards in the future.

We are subject to cyber risks and may incur costs in connection with our efforts to enhance and ensure security from cyber attacks.

Substantial aspects of our business depend on the secure operation of our computer systems and e-commerce websites. Security breaches could expose us to a risk of loss or misuse of sensitive information, including our own proprietary information and that of our customers and employees. While we devote substantial resources to maintaining adequate levels of cyber security, our resources and technical sophistication may not be adequate to prevent all of the rapidly evolving types of cyber attacks. Anticipated attacks and risks may cause us to incur increasing costs for technology, personnel, insurance and services to enhance security or to respond to occurrences. We maintain cyber risk insurance, but this insurance may not be sufficient to cover all of our losses from any possible future breaches of our systems.

Changes to existing accounting pronouncements or taxation rules or practices may affect how we conduct our business and affect our reported results of operations.

New accounting pronouncements or tax rules and varying interpretations of accounting pronouncements or taxation practice have occurred and may occur in the future. A change in accounting pronouncements or interpretations or taxation rules or practices can have a significant effect on our reported results and may even affect our reporting of transactions completed before the change is effective. Changes to existing rules and pronouncements, future changes, if any, or the questioning of current practices or interpretations may adversely affect our reported financial results or the way we conduct our business.

Item 1B. UNRESOLVED STAFF COMMENTS.

None.

Item 2. PROPERTIES.

The Company leases 24,726 square feet of office space at 551 Fifth Avenue in New York, NY. In addition to the New York office space, the Company leased a warehouse facility with 24,110 square feet in New Jersey until April 30, 2024. Value Line Distribution Center, Inc. (“VLDC”) distributed Value Line’s print publications prior to April 30, 2024. Operations were outsourced to a third party in the United States prior to April 30, 2024.