Visteon to Record Non-Cash Charge to Write-Down Deferred Tax Assets

10 September 2004 - 7:30AM

PR Newswire (US)

Visteon to Record Non-Cash Charge to Write-Down Deferred Tax Assets

DEARBORN, Mich., Sept. 9 /PRNewswire-FirstCall/ -- Visteon

Corporation (NYSE:VC) today announced that it would record a

non-cash charge to write- down its deferred tax assets in the third

quarter of 2004. The charge is currently estimated to be in the

range of $825 million to $900 million. The decision to record the

charge was reached following an analysis of the anticipated impact

of Ford's announcement of lower than expected North American

production estimates for fourth quarter and full year 2004. (Logo:

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO ) As a

result of this analysis, and considering Visteon's losses in 2002

and 2003, the timing of when Visteon will be able to generate

sufficient taxable income in the United States and other affected

jurisdictions to utilize the company's deferred tax assets is now

unclear. In these circumstances, a write-down of Visteon's deferred

tax assets is required under accounting standards. This non-cash

write-down includes deferred tax assets as of the beginning of the

year and income tax benefits recorded during the first half of

2004, offset by a release of related tax reserves. In addition, as

a result of the write-down of deferred tax assets, Visteon will

cease recording income tax benefits against operating results in

the affected jurisdictions beginning July 1, 2004 and for the

foreseeable future. Although Visteon has made significant progress

in diversifying its sales base, declining production volumes on

vehicles on which Visteon has significant content continue to

adversely affect financial performance. "As the U.S. economy reacts

to the uncertainty of oil prices, interest rates and the job

market, it is difficult to clearly predict the impact of these

items on our customers. Given that difficulty, we recognize we need

to take aggressive actions to structure our business in the U.S. so

that we can be successful in an uncertain market," said Mike

Johnston, president and chief executive officer. "Our top priority

over the coming months will be to explore and pursue strategic and

structural changes to our business to achieve a sustainable and

competitive business. These changes will involve Ford and our

legacy businesses. While solutions are being pursued, we will not

diminish our focus on meeting our commitments to all our customers

for on-time delivery of quality parts." Visteon expects its

financial performance for the second half of 2004 and for the full

year will be significantly below previously forecasted results due

to the impact of lower than anticipated Ford North American volume,

the write-down of deferred tax assets, increased steel and fuel

costs, which Visteon has not been able to recover fully, and delays

in the benefits that were expected to be achieved from labor

strategies, such as flowbacks and plant-level operating agreements.

As a result of these factors, Visteon expects to evaluate

additional fixed assets for impairment, and may as a result of this

evaluation, be required to write-down certain assets in the second

half of 2004. Due to the uncertainty regarding this asset review,

as well as the uncertainty on the outcome of Ford discussions,

Visteon is withdrawing its prior guidance for third quarter and

full-year 2004 revenues, earnings and cash flows. Visteon is

scheduled to release its third quarter earnings on Thursday,

October 21, 2004. At that time, updates will be provided on other

company matters. Visteon Corporation is a leading full-service

supplier that delivers consumer-driven technology solutions to

automotive manufacturers worldwide and through multiple channels

within the global automotive aftermarket. Visteon has approximately

72,000 employees and a global delivery system of more than 200

technical, manufacturing, sales and service facilities located in

25 countries. This press release contains forward-looking

statements within the meaning of the Private Securities Reform Act

of 1995. Words such as "anticipate," "estimate," "expect,"

"projects," "outlook" and similar words and phrases signify

forward-looking statements. Forward-looking statements are not

guarantees of future results and conditions but rather are subject

to various factors, risks, and uncertainties which could cause our

results to differ materially from those expressed in these

forward-looking statements. These factors, risks and uncertainties

include the automotive vehicle production volumes and schedules of

our customers, unexpected developments arising from discussions

with Ford Motor Company and the related strategic cost structure

review, the effect of pension and other post-employment benefit

obligations, our ability to recover material surcharges from our

customers, the need to recognize restructuring, impairment and

other special items, our ability to reduce costs in accordance with

the company's plans, as well as those factors identified in our

filings with the Securities and Exchange Commission (including our

Annual Report on Form 10-K for the year-ended December 31, 2003).

We assume no obligation to update these forward-looking statements.

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO DATASOURCE:

Visteon Corporation CONTACT: Media Inquiries: Kimberly A. Welch,

+1-313-755-3537, , Jim Fisher, +1-313-755-0635, , or Investor

Inquiries: Derek Fiebig, +1-313-755-3699, , all of Visteon

Corporation Web site: http://www.visteon.com/

Copyright

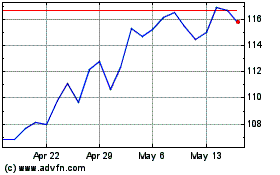

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

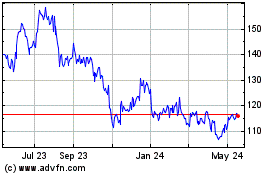

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024