0001463972

false

0001463972

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

August 8, 2023

VUZIX CORPORATION

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-35955 |

04-3392453 |

| (Commission File Number) |

(IRS Employer Identification No.) |

25

Hendrix Road, Suite A

West

Henrietta, New York 14586

(Address of principal executive offices)

(Zipcode)

(585) 359-5900

(Registrant’s Telephone Number, Including

Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered: |

| Common Stock, par value $0.001 |

|

VUZI |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations

and Financial Condition.

On August 8, 2023, Vuzix Corporation

(the “Company”) issued a press release announcing the Company’s financial results for the period ended June 30, 2023. The

press release is attached hereto as Exhibit 99.1.

In accordance with General Instruction

B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Date: August 10, 2023 |

VUZIX CORPORATION |

| |

|

|

| |

By: |

/s/ Grant Russell |

| |

|

Grant Russell

Chief Financial Officer |

Exhibit 99.1

|

Press Release |

Vuzix Reports Q2-2023 Operating Results Driven

by Record Smart Glasses Sales

- Total Q2 2023 revenue rose 56% year-over-year and 12% quarter-over-quarter

ROCHESTER, N.Y., August 8, 2023 - Vuzix® Corporation

(NASDAQ: VUZI) (“Vuzix” or the “Company”), a leading supplier of Smart Glasses and Augmented Reality (AR) technologies

and products, today reported its second quarter results for the three months ended June 30, 2023.

“During the second quarter we achieved record

smart glasses sales, which drove total sales growth of 56% year-over-year and 12% quarter-over-quarter, largely due to sales channel growth

through additional salesforce resources and increased customer adoption of our products in Japan and the rest of Asia. First half revenue

for 2023 increased 61% year-over-year led by consecutive record quarterly sales of smart glasses,” said Paul Travers, President

and CEO. “We also continued to make strong progress in terms of product development, technology advancement and new business engagements.

On the OEM side of our business, we continue to see an influx of customer interest, including a growing number of requests for quotes

associated with defense, consumer and enterprise focused customers, all of whom are interested in our waveguide and display engine solutions.

We are thrilled with the ongoing build-out of our new facility for such opportunities and are pleased to report that all build-out efforts

remain on target for our grand opening in H2 2023.”

The following

table compares condensed elements of the Company’s unaudited summarized Consolidated Statements of Operations data for the three

months ended June 30, 2023 and 2022, respectively:

| | |

For Three Months Ended June 30 | |

| | |

($000s except per share amounts) | |

| | |

2023 | | |

2022 | |

| Sales: | |

| | | |

| | |

| Sales of Products | |

$ | 4,425 | | |

$ | 2,899 | |

| Sales of Engineering Services | |

| 266 | | |

| 109 | |

| Total Sales | |

| 4,691 | | |

| 3,008 | |

| | |

| | | |

| | |

| Total Cost of Sales | |

| 3,718 | | |

| 2,742 | |

| | |

| | | |

| | |

| Gross Profit | |

| 972 | | |

| 265 | |

| Gross Profit % | |

| 21 | % | |

| 9 | % |

| | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | |

| Research and Development | |

| 2,837 | | |

| 2,996 | |

| Selling and Marketing | |

| 2,510 | | |

| 1,851 | |

| General and Administrative | |

| 4,260 | | |

| 5,040 | |

| Depreciation and Amortization | |

| 973 | | |

| 380 | |

| Total Operating Expenses | |

| 10,580 | | |

| 10,266 | |

| | |

| | | |

| | |

| Loss from Operations | |

| (9,608 | ) | |

| (10,001 | ) |

| | |

| | | |

| | |

| Total Other Income (Expense) | |

| 562 | | |

| (21 | ) |

Net Loss | |

| (9,045 | ) | |

| (10,022 | ) |

| | |

| | | |

| | |

| Loss per Common Share | |

$ | (0.14 | ) | |

$ | (0.16 | ) |

Second Quarter 2023 Financial Results

For the

three months ended June 30, 2023 total revenues increased by 56% to $4.7 million versus $3.0 million for the comparable period in 2022.

The increase in total revenues was primarily due to higher product sales and specifically, significantly higher unit sales of our M400

smart glasses. Engineering services revenues for the three months ended June 30, 2023 were $0.3 million versus $0.1 million in the prior

comparable period.

There was

an overall gross profit of $1.0 million or 21% of revenues for the three months ended June 30, 2023 as compared to $0.3 million or 9%

for the same period in 2022. This improvement was due to significantly higher product sales which enabled greater absorption of fixed

manufacturing overhead.

Research

and Development expense was $2.8 million for the three months ended June 30, 2023, versus $3.0 million for the comparable 2022 period,

a decrease of approximately 5%. The decrease was largely due to a reduction in external development expenses and consultants related to

new products.

Selling

and Marketing expense was $2.5 million for the three months ended June 30, 2023, versus $1.9 million for the comparable 2022 period, an

increase of approximately 36%. This increase was primarily due to higher salary and benefits expenses associated with increased headcount

as compared to the previous year’s period.

General

and Administrative expense for the three months ended June 30, 2023 was $4.3 million versus $5.0 million for the comparable 2022 period,

a decrease of approximately 15%. The decline was primarily due to a decrease in non-cash stock-based compensation expense.

The net

loss decreased for the three months ended June 30, 2023 to $9.0 million or $0.14 cents per share versus a net loss of $10.0 million or

$0.16 for the comparable period in 2022.

The net

cash flows used in operating activities for the second quarter of 2023 was $7.9 million as compared to a loss of $4.6 million for the

second quarter of 2022 with the increase entirely due to a $3.5 million rise in accounts receivable. As of June 30, 2023, the Company

maintained cash and cash equivalents of $48.6 million and an overall working capital position of $61.5 million with no long-term debt.

Management Outlook

“Our overall outlook for the remainder

of 2023 remains unchanged and filled with enthusiasm. For the second-half of 2023, we have a strong book of business with identified

opportunities, representing large deals and cornerstone customers on the enterprise and OEM side of our business that we expect to

convert over the course of the current calendar year. We also see substantial opportunities on the OEM/engineering services side of

our business related to new programs for defense, consumer and enterprise. As a result, we expect to continue to see strength in our

overall revenues for the balance of 2023 fueled by stronger sales of core smart glasses, and engineering services and OEM components

that we expect will confirm record revenues for all of calendar 2023,” said Mr. Travers.

“Although we are less than halfway through

Q3, we are currently expecting another strong quarter that should result in robust year-over-year growth in smart glasses products and

solution sales in Q3. Our OEM business, which includes engineering services and waveguide and display engine sales, continues to gain

momentum with new programs expected to kick-off in Q3, that should positively contribute to our top-line in Q3 and OEM program order book.

In support of our growing OEM waveguide business opportunities, Vuzix highly anticipates the upcoming opening and commissioning of our

new waveguide plant, which will be dedicated to the volume production of enhanced waveguides and will allow us to address both Vuzix’

and our OEM customers’ growing needs,” concluded Mr. Travers.

Conference Call Information

Date: Tuesday, August 8, 2023

Time: 4:30 p.m. Eastern Time (ET)

Dial-in Number for U.S. & Canadian Callers: 877-709-8150

Dial-in Number for International Callers (Outside of the U.S. &

Canada): 201-689-8354

A live and archived

webcast of the conference call will be available on the investor relations page of the Company's website at: https://ir.vuzix.com/

or directly at: https://event.choruscall.com/mediaframe/webcast.html?webcastid=Q4kpaEe4

Participating on the call will be Vuzix’

Chief Executive Officer and President Paul Travers and Chief Financial Officer Grant Russell, who together will discuss operational and

financial highlights for the quarter ended June 30, 2023.

To join the live conference call, please dial

into the above referenced telephone numbers five to ten minutes prior to the scheduled conference call time.

A telephonic replay will be available for 30 days,

starting on August 8, 2023, at approximately 5:30 p.m. (ET). To access this replay, please dial 877-660-6853 within the U.S. or Canada,

or 201-612-7415 for international callers. The conference replay ID# is 13740246.

About Vuzix Corporation

Vuzix is a leading designer, manufacturer and

marketer of Smart Glasses and Augmented Reality (AR) technologies and products for the enterprise, medical, defense and consumer markets.

The Company’s products include head-mounted smart personal display and wearable computing devices that offer users a portable high-quality

viewing experience, provide solutions for mobility, wearable displays and augmented reality, as well OEM waveguide optical components

and display engines. Vuzix holds more than 325 patents and patents pending and numerous IP licenses in the fields of optics, head-mounted

displays, and augmented reality Video Eyewear field. Moviynt, an SAP Certified ERP SaaS logistics solution provider, is a Vuzix wholly

owned subsidiary. The Company has won Consumer Electronics Show (or CES) awards for innovation for the years 2005 to 2023 and several

wireless technology innovation awards among others. Founded in 1997, Vuzix is a public company (NASDAQ: VUZI) with offices in: Rochester,

NY; Oxford, UK; Munich, Germany; and Kyoto and Tokyo, Japan. For more information, visit the Vuzix website,

Twitter and Facebook pages.

Forward-Looking Statements Disclaimer

Certain statements contained in this news release

are "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Forward-looking statements contained in this release relate to, among other things, the timing of new product releases,

opportunities related to market disruptions, R&D project successes, smart glasses pilot to roll-out conversion rates, existing and

new engineering services and conversion to volume production OEM programs, future operating results, and the Company's leadership in

the Smart Glasses and AR display industry. They are generally identified by words such as "believes," "may," "expects,"

"anticipates," "should" and similar expressions. Readers should not place undue reliance on such forward-looking

statements, which are based upon the Company's beliefs and assumptions as of the date of this release. The Company's actual results could

differ materially due to risk factors and other items described in more detail in the Company's Annual Reports and other filings with

the United States Securities and Exchange Commission and applicable Canadian securities regulators (copies of which may be obtained at

www.sedar.com or www.sec.gov). Subsequent events and developments may cause these forward-looking statements to change.

The Company specifically disclaims any obligation or intention to update or revise these forward-looking statements as a result of changed

events or circumstances that occur after the date of this release, except as required by applicable law.

Investor Relations Contact

Ed McGregor, Director of Investor Relations

Vuzix Corporation

ed_mcgregor@vuzix.com

Tel: (585) 359-5985

Vuzix Corporation, 25 Hendrix Road, West Henrietta, NY 14586 USA,

Investor Information – IR@vuzix.com www.vuzix.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

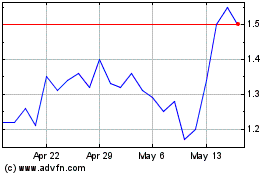

Vuzix (NASDAQ:VUZI)

Historical Stock Chart

From Apr 2024 to May 2024

Vuzix (NASDAQ:VUZI)

Historical Stock Chart

From May 2023 to May 2024