Filed

pursuant to Rule 424(b)(3)

Registration

Statement No. 333-281065

Prospectus

Supplement No. 1

(To

Prospectus dated August 29, 2024)

Up

to 10,000,000 Ordinary Shares

This

prospectus supplement is being filed to update and supplement the information contained in the prospectus dated August 29, 2024 (as supplemented

or amended from time to time, the “Prospectus”), which forms a part of our Registration Statement on Form F-1 (Registration

No. 333-281065), as amended and supplemented, with the information contained in our Report on Form 6-K, furnished with the Securities

and Exchange Commission on August 30, 2024. The Prospectus relates to the issuance by VivoPower International PLC of up to 10,000,000

Ordinary Shares in a best efforts offering.

This

prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered

or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should

be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus

supplement, you should rely on the information in this prospectus supplement.

Our

Ordinary Shares are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “VVPR.” The last sale price

of our Ordinary Shares on Nasdaq on August 29, 2024 was $2.10 per share.

We

may further amend or supplement the Prospectus and this prospectus supplement from time to time by filing amendments or supplements as

required. You should read the entire Prospectus, this prospectus supplement and any amendments or supplements carefully before you make

your investment decision.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of the Prospectus for a discussion

of information that should be considered in connection with an investment in our securities.

Neither

the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined

if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is August 30, 2024.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

August

30, 2024

Commission

File Number 001-37974

VIVOPOWER

INTERNATIONAL PLC

(Translation

of registrant’s name into English)

The

Scalpel, 18th Floor, 52 Lime Street

London

EC3M 7AF

United

Kingdom

+44-794-116-6696

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form

20- F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On

August 30, 2024, VivoPower International PLC (the “Company”) issued a press release announcing its preliminary estimated

unaudited financial results for the year ended June 30, 2024. The press release is attached hereto as Exhibit 99.1.

The

information in this Report on Form 6-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the

Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

EXHIBIT

INDEX

Exhibit

99.1 — Press Release

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

August 30, 2024 |

VivoPower

International PLC |

| |

|

| |

/s/

Kevin Chin |

| |

Kevin

Chin |

| |

Executive

Chairman |

Exhibit

99.1

VivoPower

International PLC Reports Preliminary Estimated Unaudited Financial Results for the Fiscal Year Ended June 30, 2024

Annual

consolidated revenue of $11.8 million down 22% year-on-year (“y-o-y”) reflecting a strategic focus towards the Electric Vehicle

and Sustainable Energy Solutions business units and discontinuation and sale of Critical Power business units in Australia

Underlying

consolidated adjusted EBITDA1 from continuing operations declined slightly to a ($5.9) million loss from a ($5.7) million

loss in FY23

Cash

balance at June 30, 2024 was $0.8m in comparison to $0.6m at June 30, 2023

Tembo

E-LV, a subsidiary of VivoPower executed a definitive Business Combination Agreement with CCTS for a combined enterprise value of US$904

million

Kenshaw

Electrical, one of the Company’s Critical Power business units, was sold for approximately A$5.0 million in July 2024, as part

of previously announced strategic focus on Electric Vehicles and Sustainable Energy Solutions

LONDON,

August 30, 2024 (GLOBE NEWSWIRE) — VivoPower International PLC (Nasdaq: VVPR) (“VivoPower” or the “Company”)

today announced its preliminary estimated unaudited results for the fiscal year ended June 30, 2024.

Financial

Highlights for the Fiscal Year Ended June 30, 2024

| ● | Annual

consolidated revenue declined 22% y-o-y to $11.8 million, reflecting a strategic shift towards

prioritizing profitable revenue streams, particularly within the Critical Power Services

business unit, and adverse foreign exchange movements related to the Australian

dollar relative to the USD, and an intensified effort to scale up the Electric Vehicle

business unit. |

| ● | Annual

consolidated gross profit from continuing operations increased 170% y-o-y to $1.6

million from ($2.3) million gross loss in fiscal year 2023 (“FY23”). This positive

turnaround reflects a focus on higher margin revenue streams and operational efficiencies,

as well as cessation of any weather related losses from solar projects in Australia that

impacted the company in the last financial year; |

| ● | Annual

underlying net after-tax loss was ($25.1) million, with an earnings per share (“EPS”) of ($8.01), reflecting a decline

from net loss of ($20.1) million) from continuing operations) and ($0.82) EPS in FY23. Annual adjusted net after-tax

loss2 remained unchanged at ($14.2) million compared to FY23 despite the decline in revenues and increasing headcount for

Tembo. This was aided by the focus on higher margin revenues as well as technology and outsourcing driven efficiency savings and

reduced non-recurring costs. However, the adjusted underlying EPS2 worsened to ($4.53) per share, down from ($0.58) per

share in FY23. It is important to note that the FY24 per share figures account for the 10-to-1 reverse stock split implemented by

the company during the year. |

| ● | Annual

underlying consolidated adjusted EBITDA loss from continuing operations was ($5.9) million,

representing a slight decrease y-o-y to ($5.7) million adjusted EBITDA loss from continuing

operations for FY23. |

| ● | Consolidated

cash balance increased to $0.8 million at June 30, 2024 (excluding restricted cash balances, bank guarantee deposits and other cash

equivalents) in comparison to $0.6 million at June 30, 2023. |

1 Adjusted EBITDA is not calculated

in accordance with International Financial Reporting Standards (“IFRS”). See “About Non-IFRS Financial Measures”

below for a discussion of the non-IFRS measures used in this release and a reconciliation to their most comparable IFRS measure.

2

Adjusted net after tax loss and adjusted EPS are not calculated in accordance with IFRS. See “About Non-IFRS Financial Measures”

below for a discussion of the non-IFRS measures used in this release and a reconciliation to their most comparable IFRS measure.

Business

Highlights for the Fiscal Year Ended June 30, 2024

| ● | On

2 April, 2024, VivoPower signed a heads of agreement for a business combination between Tembo

and Nasdaq-listed Cactus Acquisition Corp. 1 Limited (“CCTS”) at a pre-money

equity value of US$838 million (such transaction, the “Tembo Business Combination”).

Should the Tembo Business Combination be consummated, it would result in Tembo becoming a

separate listed company on Nasdaq. However, it is expected that VivoPower will continue to

be the major shareholder in the post-Tembo Business Combination company, and, on that basis,

Tembo would continue to be a controlled subsidiary of VivoPower and consolidated in its financial

statements. |

| ● | On

3 July, 2024, Tembo agreed to a one-month extension of its exclusive heads of agreement with

CCTS until July 31, 2024. This was further extended on 30 July, 2024, extending the exclusivity

period to August 31, 2024. |

| ● | On

29 June 2024, VivoPower’s major shareholder agreed to amend and extend its US$34m shareholder

loan financing agreement. The agreement consolidated all shareholder loans into a single

tranche and reclassified them as non-current, further de-risking the Company’s balance

sheet. |

| ● | During

the fiscal year ended 30 June 2024, Tembo, achieved several key milestones: |

| - | Commenced

delivery of its next-generation electric utility vehicle (“EUV”) powertrain conversion

kits, following successful testing programs. |

| - | Entered

into a definitive joint venture with Francisco Motor Corporation in the Philippines, to deliver

electrification kits for a new generation of electric jeepneys. |

| - | Executed

a joint venture with Geminum to design, test, and implement digital twins of Tembo’s

EUVs and ancillary sustainable energy solutions. |

| - | Established

a robust supply chain across Asia, partnering with key players in the Philippines, Thailand,

China, and India. |

| - | Introduced

[and launched] a fully electric OEM pickup utility vehicle, the “Tembo Tusker”

to enable customers and partners to choose between a conversion or a new electric pick up

truck. |

| - | Honoured

with the electrical vehicle innovation of the year award at the Tech Innovation Awards 2023

hosted in Dubai. |

Subsequent

Events

| ● | On

August 29, 2024, Tembo executed a definitive Business Combination Agreement at a combined

enterprise value of US$904m with CCTS. An independent third-party fairness opinion was satisfactorily

completed, and the BCA was signed after a four-month period of due diligence. |

| ● | On

7 July, 2024, VivoPower completed the sale of one of its non-core business units,

Kenshaw Electrical, to ARA Group Limited for approximately A$5.0 million. This divestment

aligns with VivoPower’s strategy to reinvest in its high-growth businesses, particularly

its Electric Vehicle business unit. |

Executive

Chairman, Kevin Chin, reflected on the fiscal year ended June 30, 2024, noting the year was marked by both challenges and significant

progress. “Fiscal year 2024 was a year of executing on our strategy to focus on the business units with the largest total addressable

markets and tailwinds, these being our electrical vehicle and sustainable energy solutions business units. At the same time, we battled

through a difficult macroeconomic environment which made fund raising very challenging, as well as inflationary, labour market and forex

pressures in Australia, that adversely impacted our Critical Power business units. After the fiscal year end, we consummated the sale

our Kenshaw Electrical business in accordance with this strategic refocus.

Notwithstanding

these challenges, we were able to make significant progress with our Tembo electric vehicle business in particular. This

includes:

| ● | the

execution of a definitive Business Combination Agreement at a combined enterprise value of

US$904m with Cactus Acquisition Corp. 1 Limited. This transaction, if completed, will result

in Tembo becoming a separate NASDAQ listed entity, with its own funding avenues. VivoPower

is expected to remain the majority shareholder of the post-Tembo Business Combination entity. |

| ● | delivery

of Tembo’s next-generation electric utility vehicle (“EUV”) powertrain

conversion kits, following successful testing programs. |

| ● | entering

into a definitive joint venture with Francisco Motor Corporation in the Philippines, to deliver

electrification kits for a new generation of electric jeepneys. |

| ● | executing

a joint venture with Geminum to design, test, and implement digital twins of Tembo’s

EUVs and ancillary sustainable energy solutions. |

| ● | establishing

a robust supply chain across Asia, partnering with key players in the Philippines, Thailand,

China, and India. |

| ● | introducing

and launching a fully electric OEM pickup utility vehicle, the “Tembo Tusker”

to enable customers and partners to choose between a conversion or a new electric pick up

truck. |

As

we move into fiscal year 2025, we are optimistic about the opportunities ahead, particularly with the continued growth opportunities

for Tembo and the anticipated completion of the Tembo Business Combination and separate listing of Tembo. The VivoPower team remains

steadfast in our mission to deliver sustainable energy solutions and drive long-term value creation for our stakeholders.”

About

Non-IFRS Financial Measures

Our

preliminary estimated unaudited results include certain non-IFRS financial measures, including adjusted EBITDA, adjusted net after-tax

loss and adjusted EPS. Management believes that the use of these non-IFRS financial measures provides consistency and comparability with

our past financial performance, facilitates period-to-period comparisons of our results of operations, and also facilitates comparisons

with peer companies, many of which use similar non-IFRS or non-GAAP (“Generally Accepted Accounting Principles”) financial

measures to supplement their IFRS or GAAP results. Non-IFRS results are presented for supplemental informational purposes only to aid

in understanding our results of operations. The non-IFRS results should not be considered a substitute for financial information presented

in accordance with IFRS and may be different from non-IFRS or non-GAAP measures used by other companies.

The

tables included in this press release titled “Reconciliation of Adjusted (Underlying) EBITDA for Continuing Operations to IFRS

Financial Measures” and “Reconciliation of Adjusted (Underlying) Net After-Tax Loss for Continuing Operations and Adjusted

(Underlying) EPS to IFRS Financial Measures” provide reconciliations of non-IFRS financial measures to the most recent directly

comparable financial measures calculated and presented in accordance with IFRS.

Adjusted

(Underlying) EBITDA equates to earnings before interest, taxes, depreciation and amortization, non-cash-based share compensation, impairment

of assets, impairment of goodwill, and restructuring and other non-recurring costs. See the reconciliation of non-IFRS measures below.

Adjusted

(Underlying) net after-tax loss equates to net after-tax loss adjusted for restructuring and other non-recurring costs and cost of sales

– nonrecurring. See the reconciliation of non-IFRS measures below.

Adjusted

(Underlying) EPS equates to earnings per share adjusted for restructuring and other non-recurring costs and cost of sales - nonrecurring.

See the reconciliation of non-IFRS measures below.

Reconciliation

of Adjusted (Underlying) EBITDA for Continuing Operations to IFRS Financial Measures

| | |

Year

ended June 30 | |

| (US

dollars in thousands) | |

2024 | | |

2023 | |

| Net after-tax loss | |

| (25,114 | ) | |

| (24,355 | ) |

| Loss from discontinued

operations | |

| - | | |

| 4,207 | |

| Net after-tax Loss from continuing operations | |

| (25,114 | ) | |

| (20,148 | ) |

| Income tax | |

| 1,164 | | |

| 540 | |

| Net finance expense | |

| 5,797 | | |

| 6,210 | |

| Share based compensation expense | |

| - | | |

| 148 | |

| Restructuring & other

non-recurring costs1 | |

| 10,913 | | |

| 2,084 | |

| Depreciation and amortisation | |

| 1,348 | | |

| 1,581 | |

| Non-recurring

cost of sales 2 | |

| - | | |

| 3,850 | |

| Adjusted (Underlying)

EBITDA for continuing operations | |

| (5,891 | ) | |

| (5,735 | ) |

Note:

| (1) | 2024

amounts include $10.9 million of non-recurring, non-operational costs, consisting of a $10.8 million asset impairment charge mainly pertaining

to Aevitas and Caret. 2023 amounts include $2.1 million of non-recurring, non-operational costs, consisting of a $1.8 million one-time

provision for UK tax refunds on prior year receivables that were either received or due to be received by the Company for recoverable

UK taxes paid between 2020 and 2022 but which have since been disputed and are being reclaimed by the UK fiscal department and $0.2 million

of restructuring activities. |

| | (2) | 2023

amounts include $3.9 million in non-recurring costs resulting from increased costs and delays

on Aevitas Solar’s Edenvale project due to unprecedented high levels of rainfall (both

in terms of frequency and amount versus historical averages) across Western Australia in

FY2023. The rainfall damaged many of the trenches dug across the 6km interconnection works,

which led to significant delays in completion of the project and required additional labour

and material costs to fix and then complete the project within the project deadline. |

Reconciliation

of Adjusted (Underlying) Net After-Tax Loss for Continuing Operations and Adjusted (Underlying) EPS to IFRS Financial Measures

| | |

Year

ended June 30 | |

| (US dollars in thousands

except per share amounts) | |

2024 | | |

2023 | |

| Net after-tax loss from continuing

operations | |

| (25,114 | ) | |

| (20,148 | ) |

| Restructuring & other

non-recurring costs1 | |

| 10,913 | | |

| 2,084 | |

| Non-recurring

cost of sales 2 | |

| - | | |

| 3,850 | |

| Adjusted (Underlying)

net after-tax loss from continuing operations | |

| (14,200 | ) | |

| (14,215 | ) |

| | |

| | | |

| | |

| Loss from continuing operations – per

share | |

| (8.01 | ) | |

| (0.82 | ) |

| Restructuring & other non-recurring – per share | |

| 3.48 | | |

| 0.08 | |

| Non-recurring cost of sales

1 – per share | |

| 0.00 | | |

| 0.16 | |

| Adjusted (Underlying)

continuing EPS | |

| (4.53 | ) | |

| (0.58 | ) |

Note:

| (1) | 2024

amounts include $10.9 million of non-recurring, non-operational costs, consisting of a $10.8 million asset impairment charge mainly pertaining

to Aevitas and Caret. 2023 amounts include $2.1 million of non-recurring, non-operational costs, consisting of a $1.8 million one-time

provision for UK tax refunds on prior year receivables that were either received or due to be received by the Company for recoverable

UK taxes paid between 2020 and 2022 but which have since been disputed and are being reclaimed by the UK fiscal department and $0.2 million

of restructuring activities. |

| | (2) | 2023

amounts include $3.9 million in non-recurring costs resulting from increased costs and delays

on Aevitas Solar’s Edenvale project due to unprecedented high levels of rainfall (both

in terms of frequency and amount versus historical averages) across Western Australia in

FY2023. The rainfall damaged many of the trenches dug across the 6km interconnection works,

which led to significant delays in completion of the project and required additional labour

and material costs to fix and then complete the project within the project deadline. |

About

VivoPower

VivoPower

is an award-winning global sustainable energy solutions B Corporation company focused on electric solutions for customised and ruggedised

fleet applications, battery and microgrids, solar and critical power technology and services. The Company’s core purpose is to

provide its customers with turnkey decarbonisation solutions that enable them to move toward net-zero carbon status. VivoPower has operations

and personnel in Australia, Canada, the Netherlands, the United Kingdom, the United States, the Philippines, and the United Arab Emirates.

Statement

Regarding Preliminary Unaudited Financial Results

The

unaudited financial information published herein is preliminary and subject to potential adjustments. Potential adjustments to operational

and consolidated financial information may be identified from further work performed during the Company’s year-end review, which

could result in differences from the unaudited financial information published herein. For the avoidance of doubt, the preliminary unaudited

financial information published herein should not be considered a substitute for the further financial information contained within the

Annual Report on Form 20-F for the fiscal year ended June 30, 2024 to be filed by the Company with the Securities and Exchange Commission.

Forward-Looking

Statements

This

communication includes certain statements that may constitute “forward-looking statements” for purposes of the U.S. federal

securities laws. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other

characterisations of future events or circumstances, including any underlying assumptions, information regarding the future economic

performance and financial condition of the Company, the plans and objectives of the Company’s management, and the Company’s

assumptions regarding such performance and plans. The words “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “would”

and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements may include, for example, statements about the achievement of performance hurdles, or the

benefits of the events or transactions described in this communication and the expected returns therefrom, including the Tembo Business

Combination. These statements are based on VivoPower’s management’s current expectations or beliefs and are subject to risk,

uncertainty, and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein

due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation

of VivoPower’s business. These risks, uncertainties and contingencies include changes in business conditions, fluctuations in customer

demand, changes in accounting interpretations, management of rapid growth, intensity of competition from other providers of products

and services, changes in general economic conditions, geopolitical events and regulatory changes, and other factors set forth in VivoPower’s

filings with the United States Securities and Exchange Commission. The information set forth herein should be read in light of such risks.

VivoPower is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements whether

as a result of new information, future events, changes in assumptions or otherwise.

Contact

Shareholder

Enquiries

shareholders@vivopower.com

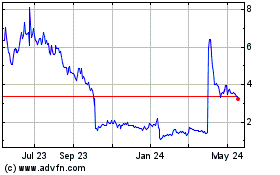

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

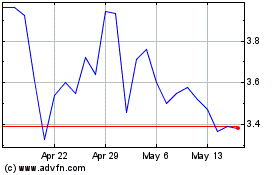

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Nov 2023 to Nov 2024