Form 8-K - Current report

31 January 2024 - 9:28AM

Edgar (US Regulatory)

0000936528false00009365282024-01-302024-01-300000936528us-gaap:CommonStockMember2024-01-302024-01-300000936528us-gaap:SeriesAPreferredStockMember2024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 8-K

____________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 30, 2024

____________________________________

WAFD, INC.

(Exact name of registrant as specified in its charter)

____________________________________

| | | | | | | | | | | | | | |

Washington | 001-34654 | 91-1661606 | |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| |

425 Pike Street | Seattle | Washington | 98101 | |

(Address of Principal Executive Offices) | | (Zip Code) | |

Registrant’s telephone number, including area code (206) 624-7930

Not Applicable

(Former name or former address, if changed since last report)

____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $1.00 par value per share | | WAFD | | NASDAQ Stock Market |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of 4.875% Fixed Rate Series A Non-Cumulative Perpetual Preferred Stock | | WAFDP | | NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Board of Directors

As previously disclosed, on November 13, 2022, WaFd, Inc. (f/k/a Washington Federal, Inc.), a Washington corporation (“WaFd”), entered into the Agreement and Plan of Reorganization (the “Merger Agreement”) with Luther Burbank Corporation, a California corporation (“Luther Burbank”), pursuant to which Luther Burbank will be merged with and into WaFd, with WaFd as the surviving corporation (the “Corporate Merger”). Promptly following the Corporate Merger, Luther Burbank’s banking subsidiary, Luther Burbank Savings (“LB Savings”), will be merged with and into WaFd Bank, dba Washington Federal Bank (“WaFd Bank”), the banking subsidiary of WaFd, with WaFd Bank as the surviving bank (the “Bank Merger”). The Corporate Merger and the Bank Merger are collectively referred to in this Current Report on Form 8-K as the “Merger.”

The Merger Agreement requires WaFd to take all action necessary to cause the WaFd Board of Directors (the “WaFd Board”) and the WaFd Bank Board of Directors (the “WaFd Bank Board”) to be comprised of 12 members as of the effective time of the Merger (the “Effective Time”) and to appoint or elect, effective as of the Effective Time, two new directors recommended by Luther Burbank and agreeable to WaFd. In the event any such new director is appointed to a class of directors that will be presented to WaFd’s shareholders for reelection at an annual meeting within 24 months following the Effective Time, the Merger Agreement further requires WaFd to include such individual on the list of director nominees presented by the WaFd Board and for which the WaFd Board solicits proxies, subject to certain limited exceptions.

Pursuant to the terms of the Merger Agreement and in accordance with WaFd’s Restated Articles of Incorporation, as amended, and WaFd Bank’s Articles of Incorporation, as amended, effective as of the Effective Time and subject to the closing of the Merger, the WaFd Board and the WaFd Bank Board appointed Bradley M. Shuster and M. Max Yzaguirre (the “LBC Director Appointees”), each of whom currently serve as directors of Luther Burbank and LB Savings, to serve until the next annual meeting of shareholders of WaFd at which the class of directors to which each such individual will be appointed is presented to shareholders for reelection. Each of the WaFd Board and WaFd Bank Board has not yet determined the class of directors to which each LBC Director Appointee will be appointed.

Each of the WaFd Board and WaFd Bank Board has not yet determined on which committees of the WaFd Board and the WaFd Bank Board the LBC Director Appointees will serve. Each of the LBC Director Appointees will receive the same compensation as currently paid to other WaFd Board and WaFd Bank Board members. A description of WaFd’s standard non-employee director compensation arrangement is contained under the heading “Director Compensation” in WaFd’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”) on December 20, 2023.

Other than as previously described above and in WaFd’s Registration Statement on Form S-4, as amended (File No. 333-270159) initially filed with the SEC on March 1, 2023, there are no arrangements or understandings between any of the LBC Director Appointees and any other person pursuant to which either of the LBC Director Appointees have been designated to serve on the WaFd Board and the WaFd Bank Board. Additionally, there have been no transactions and there are no proposed transactions between WaFd and either of the LBC Director Appointees that would require disclosure pursuant to Item 404(a) of Regulation S-K. Upon the Closing, the LBC Director Appointees will join the following ten (10) current directors of WaFd who will continue their service as directors of WaFd: Brent J. Beardall, Stephen M. Graham, R. Shawn Bice, Linda S. Brower, David K. Grant, Sylvia R. Hampel, S. Steven Singh, Sean B. Singleton, Mark N. Tabbutt and Randall H. Talbot.

Regulatory Approval

On January 30, 2024, WaFd and Luther Burbank issued a joint press release announcing that WaFd and Luther Burbank received the required regulatory approvals from the Federal Deposit Insurance Corporation and the Washington State Department of Financial Institutions for LB Savings to be merged with and into WaFd Bank, and from the Board of Governors of the Federal Reserve System for Luther Burbank to be merged with and into WaFd, in each case on the terms and subject to the conditions of the Merger Agreement. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(a) Not applicable

(b) Not applicable

(c) Not applicable

(d) The following exhibits are being furnished herewith:

| | | | | | | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| January 30, 2024 | | | | WAFD, INC. |

| | | |

| | | | By: | | /s/ KELLI J. HOLZ |

| | | | | | Kelli J. Holz |

| | | | | | Executive Vice President

and Chief Financial Officer |

Tuesday, January 30, 2024 FOR IMMEDIATE RELEASE WaFd, Inc. Receives Regulatory Approval for Acquisition of Luther Burbank Corporation Seattle, WA – WaFd, Inc. (NASDAQ: WaFd), the parent company of Washington Federal Bank (“WaFd Bank”), and Luther Burbank Corporation (NASDAQ: LBC, “Luther Burbank”), the parent company of Luther Burbank Savings, jointly announced today that they received the required regulatory approvals from the Federal Deposit Insurance Corporation and the Washington State Department of Financial Institutions for Luther Burbank Savings to be merged with and into Washington Federal Bank, and from the Board of Governors of the Federal Reserve System for Luther Burbank to be merged with and into WaFd, Inc., on the terms and subject to the conditions of the Agreement and Plan of Reorganization, dated as of November 13, 2022, by and between Luther Burbank and WaFd (the “Merger Agreement”). This merger will expand WaFd Bank’s footprint to nine western states with the addition of ten California branches of Luther Burbank. “Regulatory approval of this merger with Luther Burbank affirms WaFd Bank’s position as an important financial resource for the communities we serve,” said Brent Beardall, President, and Chief Executive Officer of WaFd Bank. “A lot has transpired in the fourteen months since we announced this combination, but the more we have worked with the Luther Burbank team, the more convinced we are our combined bank will create significant opportunities for current and future customers and shareholders.” The merger is expected to be completed by February 29, 2024, subject to the satisfaction or waiver of the remaining closing conditions set forth in the Merger Agreement. System and brand integration efforts are expected to be completed in the first week of March 2024 so that Luther Burbank customers can quickly and efficiently access the WaFd Bank platform and service offerings. As previously announced, WaFd will be welcoming two directors from Luther Burbank to join the WaFd, Inc. and WaFd Bank Boards of Directors. Mr. Brad Shuster and Mr. Max Yzaguirre will join the Boards following the closing. Mr. Stephen Graham, Chairman of WaFd, said “We are pleased to have the opportunity to welcome Mr. Shuster and Mr. Yzaguirre to our Boards; their depth of knowledge and industry experience is outstanding.” “Our core strength has been our deep commitment to acting with integrity,” said Simone Lagomarsino, President and Chief Executive Officer of Luther Burbank Savings. “We believe we have found a long-term partner in WaFd whose values align with ours, can offer our customers a wider range of technology- enabled financial solutions and expanded geographic footprint that will help our customers thrive.” Exhibit 99.1

Tuesday, January 30, 2024 FOR IMMEDIATE RELEASE About WaFd, Inc. WaFd, Inc. is the parent company of Washington Federal Bank, a federally insured Washington state chartered commercial bank doing business as WaFd Bank and operating in Washington, Oregon, Idaho, Utah, Nevada, Arizona, Texas and New Mexico. Established in 1917, the bank provides consumer and commercial deposit accounts, financing for small to middle-market businesses, commercial real estate, and residential real estate, including consumer mortgages, home equity loans and lines and insurance products through a subsidiary. As of December 31, 2023, the Company operated 198 branches and reported $22.6 billion in assets, $16.0 billion in deposits and $2.5 billion in shareholders’ equity. For more information, please visit www.wafdbank.com. About Luther Burbank Corporation Luther Burbank is headquartered in Santa Rosa, California, and through its subsidiary, Luther Burbank Savings, operates 10 full-service branches in California, one full-service branch in Washington, and several loan production offices located throughout California. As of December 31, 2023, Luther Burbank had total assets of $8.2 billion, total loans of $6.8 billion and total deposits of $5.8 billion. Luther Burbank Savings, an FDIC insured, California chartered bank, executes on its mission to improve the financial future of customers, employees and shareholders by providing superior, human-centered personal banking and business banking services. To find out more about Luther Burbank, please visit its website www.lutherburbanksavings.com. Luther Burbank uses its website to distribute financial and other material information about the Company. Investor Relations Contacts: WaFd, Inc. contact is Brad Goode, Chief Marketing Officer, Investor Relations, (206) 626-8178 or (844) 446-8201, Brad.Goode@wafd.com. Luther Burbank Corporation contact is Bradley Satenberg, Investor Relations, investorrelations@lbsavings.com - # # # -

v3.24.0.1

Document and Entity Information

|

Jan. 30, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 30, 2024

|

| Entity Registrant Name |

WAFD, INC.

|

| Entity Central Index Key |

0000936528

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

WA

|

| Entity File Number |

001-34654

|

| Entity Tax Identification Number |

91-1661606

|

| Entity Address, Address Line One |

425 Pike Street

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98101

|

| City Area Code |

206

|

| Local Phone Number |

624-7930

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Series A Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, Each Representing a 1/40th Interest in a Share of 4.875% Fixed Rate Series A Non-Cumulative Perpetual Preferred Stock

|

| Trading Symbol |

WAFDP

|

| Security Exchange Name |

NASDAQ

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $1.00 par value per share

|

| Trading Symbol |

WAFD

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

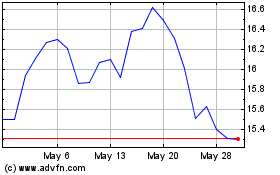

WaFd (NASDAQ:WAFDP)

Historical Stock Chart

From Apr 2024 to May 2024

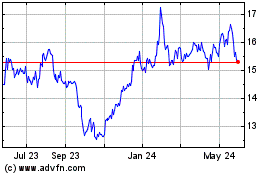

WaFd (NASDAQ:WAFDP)

Historical Stock Chart

From May 2023 to May 2024