Where Food Comes From, Inc. (WFCF) (Nasdaq: WFCF), the most trusted

resource for independent, third-party verification of food

production practices in North America, today announced financial

results for its fourth quarter and full-year ended December 31,

2023.

“We closed the year with a very strong fourth quarter,

highlighted by a 17% increase in core verification services revenue

and a 58% increase in net income year over year,” said John

Saunders, chairman and CEO. “This solid performance enabled us to

overcome industry headwinds in the form of inflation and cyclical

herd contraction and deliver another full year of revenue and

profit growth. We are also pleased to report that SG&A expenses

were flat for both the fourth quarter and full year, reflecting our

continued focus on carefully managing overhead costs. We anticipate

macro headwinds will persist in the near future but believe we can

offset the impact through continued customer growth, expansion of

service offerings and addition of new revenue streams.

“In 2023 we continued to diversify our business mix with a

number of transactions and partnerships that give our customers

additional options to differentiate and add value to their

products,” Saunders added. “These moves include multiple seafood

initiatives, another exclusive verifier designation and acquisition

of the industry’s leading upcycled food program. As we continue to

expand on what is already the industry’s largest solutions set, we

widen our competitive moat while affording customers convenience

and price advantages through services bundling.”

Fourth Quarter Results – 2023 vs. 2022Total

revenue in the fourth quarter ended December 31, 2023, increased

10% to $6.7 million from $6.1 million.

Revenue mix included:

- Verification and certification services, up 17% to $5.5 million

from $4.7 million.

- Product revenue, flat at $0.9 million

- Professional services revenue of $0.4 million vs. $0.5

million.

Gross profit in the third quarter increased to $3.0 million from

$2.8 million.

Selling, general and administrative expense was flat at $2.1

million.

Operating income was 44% higher at $0.9 million vs. $0.6

million.

Net income increased 58% to $776,000, or $0.14 per diluted

share, from $490,000, or $0.08 per diluted share.

Adjusted EBITDA in the fourth quarter increased 31% to $1.3

million from $1.0 million.

The Company bought back more than $1.0 million of its common

stock in the fourth quarter, or 76,109 shares.

Full Year Results – 2023 vs. 2022Total revenue

for 2023 increased slightly to $25.1 million from $24.8 million in

the prior year when the Company booked a $0.9 million non-recurring

order.

Revenue mix included:

- Verification and certification services, up 10% to $19.4

million from $17.6 million.

- Product revenue, down 8% to $4.0 million from $4.4

million.

- Professional services revenue of $1.7 million compared to $2.9

million in the prior year due to the aforementioned $0.9 million,

non-recurring order from a Japanese government entity.

Gross profit for the full year was flat at $10.5 million.

Selling, general and administrative expense was also flat at

$7.8 million, reflecting management’s commitment to controlling

overhead costs.

Operating income was flat at $2.7 million.

Net income for the year increased 8% to $2.2 million, or $0.39

per diluted share, compared to net income of $2.0 million, or $0.33

per diluted share, in the prior year.

Adjusted EBITDA for the year was flat at $3.8 million.

The Company generated $2.8 million in cash from operations in

2023 compared to $2.7 million in 2022.

The cash and cash equivalents balance at December 31, 2023,

declined to $2.6 million from $4.4 million at 2022 year-end due

primarily to the Company’s investment in its share repurchase

program. In 2023, the Company bought back more than $3.9 million of

its shares.

In 2023, the Company realized $320,000 in dividend income from

the Progressive Beef (PB) ownership interest – a 28% increase over

$250,000 in PB dividend income in the prior year. Since buying a

10% membership interest in PB in 2018 for $900,000 in cash and

50,340 shares of stock, the Company has earned $1,140,000 in

dividends.

The Company will conduct a conference call today at 10:00 a.m.

Mountain Time.

Call-in numbers for the conference

call:Domestic Toll Free: 1-877-407-8289International:

1-201-689-8341Conference Code: 13744489

Phone replay:A telephone replay

of the conference call will be available through February 29, 2024,

as follows:Domestic Toll Free: 1-877-660-6853International:

1-201-612-7415Conference Code: 13744489

About Where Food Comes From, Inc.Where Food

Comes From, Inc. is America’s trusted resource for third party

verification of food production practices. Through

proprietary technology and patented business processes, the

Company estimates that it supports more than 17,500 farmers,

ranchers, vineyards, wineries, processors, retailers, distributors,

trade associations, consumer brands and restaurants with a wide

variety of value-added services. Through its IMI Global,

Validus Verification Services, SureHarvest, WFCF Organic, and

Postelsia units, Where Food Comes From solutions are used to verify

food claims, optimize production practices and enable food supply

chains with analytics and data driven insights. In addition,

the Company’s Where Food Comes From® retail and restaurant labeling

program uses web-based customer education tools to connect

consumers to the sources of the food they purchase, increasing

meaningful consumer engagement for our clients.

*Note on non-GAAP Financial Measures This press

release and the accompanying tables include a discussion of EBITDA

and Adjusted EBITDA, which are non-GAAP financial measures provided

as a complement to the results provided in accordance with

generally accepted accounting principles ("GAAP"). The term

"EBITDA" refers to a financial measure that we define as earnings

(net income or loss) plus or minus net interest plus taxes,

depreciation and amortization. Adjusted EBITDA excludes from EBITDA

stock-based compensation and, when appropriate, other items that

management does not utilize in assessing WFCF’s operating

performance (as further described in the attached financial

schedules). None of these non-GAAP financial measures are

recognized terms under GAAP and do not purport to be an alternative

to net income as an indicator of operating performance or any other

GAAP measure. We have reconciled Adjusted EBITDA to GAAP net income

in the Consolidated Statements of Income table at the end of this

release. We intend to continue to provide these

non-GAAP financial measures as part of our future earnings

discussions and, therefore, the inclusion of these non-GAAP

financial measures will provide consistency in our financial

reporting.

CAUTIONARY STATEMENTThis news release contains

"forward-looking statements" within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995, based on current

expectations, estimates and projections that are subject to risk.

Forward-looking statements are inherently uncertain, and actual

events could differ materially from the Company’s predictions.

Important factors that could cause actual events to vary from

predictions include those discussed in our SEC filings.

Specifically, statements in this news release about industry

leadership, expectations for offsetting industry headwinds, ability

to continue expanding on the solutions set, widening the

competitive moat and providing customers with convenience and price

advantages, and demand for, and impact and efficacy of, the

Company’s products and services on the marketplace are

forward-looking statements that are subject to a variety of

factors, including availability of capital, personnel and other

resources; competition; governmental regulation of the agricultural

industry; the market for beef and other commodities; and other

factors. Financial results for 2023 and the Company’s pace of stock

buybacks are not necessarily indicative of future results. Readers

should not place undue reliance on these forward-looking

statements. The Company assumes no obligation to update its

forward-looking statements to reflect new information or

developments. For a more extensive discussion of the Company’s

business, please refer to the Company’s SEC filings at

www.sec.gov.

Company Contacts:

John SaundersChief Executive Officer303-895-3002

Jay PfeifferDirector, Investor

Relations303-880-9000jpfeiffer@wherefoodcomesfrom.com

|

|

|

|

|

|

|

|

|

|

|

Where Food Comes From, Inc. |

|

|

|

|

|

|

|

|

|

Statements of Income (Unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three months ended December 31, |

|

Year ended December 31, |

|

|

(Amounts in thousands, except per share amounts) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

| |

Verification and certification service revenue |

$ |

5,469 |

|

|

$ |

4,693 |

|

|

$ |

19,413 |

|

|

$ |

17,610 |

|

|

| |

Product sales |

|

871 |

|

|

|

891 |

|

|

|

4,001 |

|

|

|

4,364 |

|

|

| |

Professional services |

|

391 |

|

|

|

509 |

|

|

|

1,721 |

|

|

|

2,871 |

|

|

| |

|

Total revenues |

|

6,731 |

|

|

|

6,093 |

|

|

|

25,135 |

|

|

|

24,845 |

|

|

|

Costs of revenues: |

|

|

|

|

|

|

|

|

| |

Costs of verification and certification services |

|

2,931 |

|

|

|

2,487 |

|

|

|

10,986 |

|

|

|

9,748 |

|

|

| |

Costs of products |

|

468 |

|

|

|

448 |

|

|

|

2,272 |

|

|

|

2,333 |

|

|

| |

Costs of professional services |

|

325 |

|

|

|

397 |

|

|

|

1,355 |

|

|

|

2,296 |

|

|

| |

|

Total costs of revenues |

|

3,724 |

|

|

|

3,332 |

|

|

|

14,613 |

|

|

|

14,377 |

|

|

| |

Gross profit |

|

3,007 |

|

|

|

2,761 |

|

|

|

10,522 |

|

|

|

10,468 |

|

|

|

Selling, general and administrative expenses |

|

2,084 |

|

|

|

2,119 |

|

|

|

7,825 |

|

|

|

7,816 |

|

|

|

Income from operations |

|

923 |

|

|

|

642 |

|

|

|

2,697 |

|

|

|

2,652 |

|

|

|

Other income/(expense): |

|

|

|

|

|

|

|

|

| |

Dividend income from Progressive Beef |

|

170 |

|

|

|

100 |

|

|

|

320 |

|

|

|

250 |

|

|

| |

Gain on sale of assets |

|

2 |

|

|

|

12 |

|

|

|

7 |

|

|

|

12 |

|

|

| |

Loss on foreign currency exchange |

|

(1 |

) |

|

|

(3 |

) |

|

|

(7 |

) |

|

|

(38 |

) |

|

| |

Impairment of digital assets |

|

- |

|

|

|

(20 |

) |

|

|

- |

|

|

|

(62 |

) |

|

| |

Other income, net |

|

17 |

|

|

|

3 |

|

|

|

53 |

|

|

|

5 |

|

|

| |

Interest expense |

|

(2 |

) |

|

|

(1 |

) |

|

|

(5 |

) |

|

|

(3 |

) |

|

|

Income before income taxes |

|

1,109 |

|

|

|

733 |

|

|

|

3,065 |

|

|

|

2,816 |

|

|

|

Income tax expense |

|

333 |

|

|

|

243 |

|

|

|

913 |

|

|

|

822 |

|

|

| |

Net income |

$ |

776 |

|

|

$ |

490 |

|

|

$ |

2,152 |

|

|

$ |

1,994 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Per share - net income: |

|

|

|

|

|

|

|

|

| |

Basic |

$ |

0.14 |

|

|

$ |

0.08 |

|

|

$ |

0.39 |

|

|

$ |

0.34 |

|

|

| |

Diluted |

$ |

0.14 |

|

|

$ |

0.08 |

|

|

$ |

0.39 |

|

|

$ |

0.33 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

| |

Basic |

|

5,539 |

|

|

|

5,814 |

|

|

|

5,485 |

|

|

|

5,955 |

|

|

| |

Diluted |

|

5,597 |

|

|

|

5,889 |

|

|

|

5,548 |

|

|

|

6,035 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Where Food Comes From, Inc. |

|

|

|

|

|

|

|

|

Calculation of Adjusted EBITDA* |

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

|

Three months ended December 31, |

|

Year ended December 31, |

|

|

(Amounts in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

776 |

|

$ |

490 |

|

$ |

2,152 |

|

$ |

1,994 |

|

|

Adjustments to EBITDA: |

|

|

|

|

|

|

|

|

| |

Interest expense |

|

2 |

|

|

1 |

|

|

5 |

|

|

3 |

|

| |

Income tax expense |

|

333 |

|

|

243 |

|

|

913 |

|

|

822 |

|

| |

Depreciation and amortization |

|

146 |

|

|

182 |

|

|

634 |

|

|

765 |

|

|

EBITDA* |

|

1,257 |

|

|

916 |

|

|

3,704 |

|

|

3,584 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

| |

Impairment |

|

- |

|

|

20 |

|

|

- |

|

|

62 |

|

| |

Stock-based compensation |

|

39 |

|

|

52 |

|

|

78 |

|

|

154 |

|

|

ADJUSTED EBITDA* |

$ |

1,296 |

|

$ |

988 |

|

$ |

3,782 |

|

$ |

3,800 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| *Use of Non-GAAP

Financial Measures: Non-GAAP results are presented only as a

supplement to the financial statements and for use within

management's discussion and analysis based on U.S. generally

accepted accounting principles (GAAP). The non-GAAP financial

information is provided to enhance the reader's understanding of

the Company's financial performance, but non-GAAP measures should

not be considered in isolation or as a substitute for financial

measures calculated in accordance with GAAP. Reconciliations of the

most directly comparable GAAP measures to non-GAAP measures are

provided herein. |

|

| |

|

| All of the items

included in the reconciliation from net income to EBITDA and from

EBITDA to Adjusted EBITDA are either (i) non-cash items (e.g.,

depreciation, amortization of purchased intangibles, stock-based

compensation, etc.) or (ii) items that management does not consider

to be useful in assessing the Company's ongoing operating

performance (e.g., M&A costs, income taxes, gain on sale of

investments, loss on disposal of assets, etc.). In the case of the

non-cash items, management believes that investors can better

assess the Company's operating performance if the measures are

presented without such items because, unlike cash expenses, these

adjustments do not affect the Company's ability to generate free

cash flow or invest in its business. |

|

| |

|

| We use, and we believe

investors benefit from the presentation of, EBITDA and Adjusted

EBITDA in evaluating our operating performance because it provides

us and our investors with an additional tool to compare our

operating performance on a consistent basis by removing the impact

of certain items that management believes do not directly reflect

our core operations. We believe that EBITDA is useful to investors

and other external users of our financial statements in evaluating

our operating performance because EBITDA is widely used by

investors to measure a company's operating performance without

regard to items such as interest expense, taxes, and depreciation

and amortization, which can vary substantially from company to

company depending upon accounting methods and book value of assets,

capital structure and the method by which assets were

acquired. |

|

| |

|

| Because not all

companies use identical calculations, the Company's presentation of

non-GAAP financial measures may not be comparable to other

similarly titled measures of other companies. However, these

measures can still be useful in evaluating the Company's

performance against its peer companies because management believes

the measures provide users with valuable insight into key

components of GAAP financial disclosures. |

|

| Where Food

Comes From, Inc. |

|

| Balance Sheets

(Audited) |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

December

31, |

|

December

31, |

|

|

(Amounts in thousands, except per share amounts) |

2023 |

|

2022 |

|

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

| |

Cash and cash equivalents |

$ |

2,641 |

|

|

$ |

4,368 |

|

|

| |

Accounts receivable, net of allowance |

|

2,128 |

|

|

|

2,172 |

|

|

| |

Inventory |

|

1,109 |

|

|

|

888 |

|

|

| |

Prepaid expenses and other current assets |

|

335 |

|

|

|

463 |

|

|

| |

|

Total current assets |

|

6,213 |

|

|

|

7,891 |

|

|

|

Property and equipment, net |

|

844 |

|

|

|

998 |

|

|

|

Right-of-use assets, net |

|

2,296 |

|

|

|

2,607 |

|

|

|

Equity investments |

|

1,191 |

|

|

|

991 |

|

|

|

Intangible and other assets, net |

|

2,303 |

|

|

|

2,340 |

|

|

|

Goodwill, net |

|

2,946 |

|

|

|

2,946 |

|

|

|

Deferred tax assets, net |

|

493 |

|

|

|

523 |

|

|

|

Total assets |

$ |

16,286 |

|

|

$ |

18,296 |

|

|

| |

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

| |

Accounts payable |

$ |

567 |

|

|

$ |

640 |

|

|

| |

Accrued expenses and other current liabilities |

|

615 |

|

|

|

769 |

|

|

| |

Deferred revenue |

|

1,485 |

|

|

|

1,278 |

|

|

| |

Current portion of finance lease obligations |

|

14 |

|

|

|

9 |

|

|

| |

Current portion of operating lease obligations |

|

298 |

|

|

|

341 |

|

|

| |

|

Total current liabilities |

|

2,979 |

|

|

|

3,037 |

|

|

|

Finance lease obligations, net of current portion |

|

41 |

|

|

|

37 |

|

|

|

Operating lease obligation, net of current portion |

|

2,447 |

|

|

|

2,745 |

|

|

|

Total liabilities |

|

5,467 |

|

|

|

5,819 |

|

|

| |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

| |

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

| |

Preferred stock, $0.001 par value; 5,000 shares authorized; |

|

|

|

|

| |

|

none issued or outstanding |

|

- |

|

|

|

- |

|

|

| |

Common stock, $0.001 par value; 95,000 shares authorized; |

|

|

|

|

| |

|

6,516 (2023) and 6,501 (2022) shares issued, and |

|

|

|

|

| |

|

5,503 (2023) and 5,775 (2022) shares outstanding |

|

7 |

|

|

|

6 |

|

|

| |

Additional paid-in-capital |

|

12,290 |

|

|

|

12,145 |

|

|

| |

Treasury stock of 1,014 (2023) and 727 (2022) shares |

|

(11,219 |

) |

|

|

(7,263 |

) |

|

| |

Retained earnings |

|

9,741 |

|

|

|

7,589 |

|

|

|

Total equity |

|

10,819 |

|

|

|

12,477 |

|

|

|

Total liabilities and stockholders' equity |

$ |

16,286 |

|

|

$ |

18,296 |

|

|

| |

|

|

|

|

|

|

|

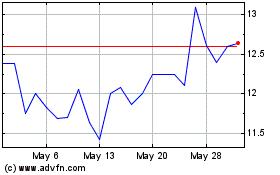

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Nov 2023 to Nov 2024