0001603923false00016039232024-06-062024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 6, 2024

Weatherford International plc

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Ireland | 001-36504 | 98-0606750 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | |

| 2000 St. James Place | , | Houston, | | Texas | | | 77056 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: 713.836.4000

| | | | | | | | |

| N/A |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Ordinary shares, $0.001 par value per share | WFRD | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

Item 1.01 | Entry into a Material Definitive Agreement. |

The information set forth in Item 2.03 of this Current Report on Form 8-K is incorporated herein by reference.

| | | | | |

Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

As previously disclosed, Weatherford International Ltd. (“WIL-Bermuda”), Weatherford International, LLC (“WIL-Delaware”), Weatherford Canada Ltd. (“WIL-Canada”), and WOFS International Finance GmbH, a Swiss limited liability company (“WIL-Switzerland” and, together with WIL-Bermuda, WIL-Delaware and WIL-Canada, the “Borrowers”), as borrowers, and Weatherford International plc (“Weatherford”), as parent, entered into an amended and restated credit agreement (as amended and supplemented to date, the “Credit Agreement”) with the lenders party thereto and Wells Fargo Bank, National Association, as administrative agent (in such capacity, the “Administrative Agent”), on October 17, 2022. Capitalized terms not defined herein shall have the meanings set forth in the Credit Agreement.

On June 6, 2024, the Borrowers, Weatherford, the lenders party thereto and the Administrative Agent entered into the Sixth Amendment to the Credit Agreement (the “Sixth Amendment”), which, among other things, permits, upon satisfaction of certain conditions, future incremental increases in the commitments under the Credit Agreement such that, after giving effect to all such future increases, the Aggregate Commitments shall not exceed $1 billion. As of June 6, 2024, there were approximately $270.5 million of outstanding letters of credit issued in connection with the Performance LC Commitments, $48.2 million of outstanding letters of credit issued in connection with the Revolving Credit Commitments and no outstanding loans in connection with the Revolving Credit Commitments.

The foregoing description of the Sixth Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Sixth Amendment, which is filed as Exhibit 10.1 to this Form 8-K.

| | | | | |

Item 8.01 | Other Information. |

On June 6, 2024, the Borrowers and Weatherford exercised a $40 million incremental increase to the Borrowers’ revolving credit facility (resulting in an aggregate credit facility size of $720 million) by entering into an additional lender supplement to the Credit Agreement (the “Additional Lender Supplement”) with a certain additional lender (the “Additional Lender”), the Administrative Agent and the issuing banks party thereto, whereby the Additional Lender (or its affiliates) became a Lender under the Credit Agreement and provided aggregate additional commitments of $40 million comprised of (i) approximately $18 million for the issuance of bid and performance letters of credit for the Borrowers and certain subsidiaries and (ii) approximately $22 million for revolving loans and the issuance of bid, performance and financial letters of credit for the Borrowers and certain subsidiaries.

The foregoing description of the Additional Lender Supplement does not purport to be complete and is qualified in its entirety by reference to the full text of the Lender Supplement, which is furnished as Exhibit 10.2 to this Form 8-K.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | | | | | | | |

| Exhibit Number | Exhibit Description |

| Sixth Amendment to Amended and Restated Credit Agreement, dated as of June 6, 2024, by and among Weatherford International Ltd., Weatherford International, LLC, Weatherford Canada Ltd., WOFS International Finance GmbH, Weatherford International plc, the lenders party thereto and Wells Fargo Bank, National Association, as administrative agent. |

| Additional Lender Supplement, dated as of June 6, 2024, by and among Weatherford International Ltd., Weatherford International, LLC, Weatherford Canada Ltd., WOFS International Finance GmbH, Weatherford International plc, Arab Banking Corporation (B.S.C.) New York Branch, as an Additional Lender, the other Issuing Banks party thereto and Wells Fargo Bank, National Association, as administrative agent. *Schedules and similar attachments have been omitted pursuant to Regulation S-K Item 601(a)(5). Weatherford agrees to furnish a supplemental copy of any omitted schedule or attachment to the Securities and Exchange Commission upon request. |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Weatherford International plc |

Date: June 11, 2024 | |

| /s/ Arunava Mitra |

| Arunava Mitra |

| Executive Vice President and Chief Financial Officer |

Exhibit 10.1

Execution Version

SIXTH AMENDMENT TO

AMENDED AND RESTATED CREDIT AGREEMENT

This SIXTH AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”), dated as of June 6, 2024, is entered into among WEATHERFORD INTERNATIONAL LTD., a Bermuda exempted company (“WIL-Bermuda”), WEATHERFORD CANADA LTD., an Alberta corporation (“WIL-Canada”), WEATHERFORD INTERNATIONAL, LLC, a Delaware limited liability company (“WIL-Delaware”), WOFS INTERNATIONAL FINANCE GMBH, a Swiss limited liability company (“WIL-Switzerland” and together with WIL-Bermuda, WIL-Canada and WIL-Delaware, the “Borrowers”), WEATHERFORD INTERNATIONAL PLC, as Parent (“Parent”), WELLS FARGO BANK, NATIONAL ASSOCIATION, as administrative agent for the Lenders (the “Administrative Agent”), and the Lenders party hereto.

RECITALS

WHEREAS, the Borrowers, Parent, the Administrative Agent, and the Lenders and Issuing Banks party thereto from time to time are party to that certain Amended and Restated Credit Agreement, dated as of October 17, 2022 (as amended, supplemented or otherwise modified prior to the date hereof, the “Existing Credit Agreement”, and as amended by this Amendment and as may be further amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”);

WHEREAS, Parent and the Borrowers have requested certain amendments and modifications be made to the Existing Credit Agreement; and

WHEREAS, subject to the terms and conditions contained herein, the Administrative Agent, the Lenders party hereto, Parent and the Borrowers have agreed to amend the Existing Credit Agreement as hereinafter set forth to address the foregoing.

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Defined Terms; Section References. Capitalized terms used herein but not otherwise defined herein shall have the meanings provided to such terms in the Credit Agreement.

2.Amendments to Existing Credit Agreement.

(a)The following terms are hereby added to Section 1.01 of the Existing Credit Agreement:

“Available Incremental Amount” has the meaning specified in Section 4.13(a).

“Increase Effective Date” has the meaning specified in Section 4.13(b).

“Sixth Amendment” means that certain Sixth Amendment to Amended and Restated Credit Agreement, dated as of June 6, 2024, among the Borrowers, Parent, the Administrative Agent and the Lenders party thereto.

“Sixth Amendment Effective Date” has the meaning specified in the Sixth Amendment.

(b)Section 4.13(a) of the Existing Credit Agreement is hereby amended to delete the stricken text (indicated textually in the same manner as the following example: stricken text) and to add the double-underlined text (indicated textually in the same manner as the following example: double-underlined text) as set forth below:

(a)Borrowers’ Request. Subject to the terms and conditions set forth herein, the Borrowers may, by written notice to the Administrative Agent, and, with respect to any Incremental Increase to be provided by an Additional Lender, with the consent of each Issuing Bank, elect to request at any time and from time to time (but not more than three times in any calendar year, or, in the case of the calendar year ending December 31, 2024, not more than three times following the Sixth Amendment Effective Date) on or after the Fourth Amendment Effective Date but prior to the Maturity Date an increase to the aggregate Performance LC Commitments and/or the Revolving Credit Commitments (each such increase, an “Incremental Increase”; each additional commitment provided in respect of the Performance LC Commitments pursuant to such Incremental Increase, an “Incremental Performance LC Commitment”; and each additional commitment provided in respect of the Revolving Credit Commitments, an “Incremental Revolving Credit Commitment”); provided that (i)after giving effect to all such Incremental Increases, the Aggregate Commitments shall not exceed $1,000,000,000 (the incremental availability under this proviso being the “Available Incremental Amount”)the aggregate amount of all Incremental Increases provided on or after the Fourth Amendment Effective Date under this Agreement shall not exceed $200,000,000 (such amount, the “Incremental Increase Cap”); (ii) the aggregate amount of Incremental Performance LC Commitments that may be requested to be provided on the Fourth Amendment Effective Date shall not exceed $50,000,000; and (iii) no Incremental Revolving Credit Commitments shall be made available to the Borrowers until the aggregate outstanding principal amount of the Senior Secured Notes or any Permitted Refinancing Indebtedness in respect thereof (other than such Permitted Refinancing Indebtedness that is unsecured) is less than or equal to $200,000,000. Each such notice shall specify (A) the date on which the Borrowers propose that the applicable Incremental Increase shall be effective, which shall be a date not less than ten (10) Business Days (or such shorter period as may be agreed by the Administrative Agent) after the date on which such notice is delivered to the Administrative Agent and (B) the identity of each Person to whom the Borrowers propose any portion of such Incremental Increase be allocated and the amount of the corresponding Incremental Performance LC

Commitment and/or Incremental Revolving Credit Commitment of such Person; provided, further, that (1) any existing Lender approached to provide an Incremental Increase may elect or decline, in its sole discretion, to provide such Incremental Increase (any existing Lender electing to provide an Incremental Increase, an “Increasing Lender”), (2) any Person approached to provide an Incremental Increase that is not already a Lender shall meet the requirements to be an assignee under Section 12.05(b) (subject to such consents, if any, as may be required under Section 12.05(b)) and shall deliver all applicable forms and documents required by clauses (D), (E), (F) and (H) of Section 12.05(b)(ii) (any such Person agreeing to provide all or any portion of an Incremental Increase that is not already a Lender, an “Additional Lender”), (3) if any Increasing Lender is providing an Incremental Increase, then the Borrowers and such Increasing Lender shall execute an Increasing Lender Supplement, and (D) if any Additional Lender is providing an Incremental Increase, then the Borrowers and such Additional Lender shall execute an Additional Lender Supplement. Each Incremental Increase shall be in an aggregate amount of $5,000,000 or any whole multiple of $1,000,000 in excess thereof unless otherwise agreed by the Administrative Agent and the Borrowers (provided that the amount of an Incremental Increase may be less than $5,000,000 if such amount represents the all remaining availability under the Available Incremental Amountthe Incremental Increase Cap).

(c)A new section 4.13(d) is hereby added to the Existing Credit Agreement as set forth below:

(d) Reallocation. The aggregate outstanding Loans and LC Exposure will be reallocated by the Administrative Agent on the applicable Increase Effective Date among the Lenders (including the Additional Lenders and/or Increasing Lenders providing such Incremental Increase) in accordance with their applicable Commitments (and the Lenders (including the Additional Lenders and/or Increasing Lenders providing such Incremental Increase) agree to make all payments and adjustments necessary to effect such reallocation, provided that, for the avoidance of doubt, the Borrowers shall not be required to pay any costs pursuant to Section 4.07 in connection with such reallocation), and the Fronting Commitment, if any, Applicable Percentage (Total), Performance LC Commitment, Applicable Percentage (LCs) – Performance LCs, Revolving Credit Commitment, Applicable Percentage (Loans) and Applicable Percentage (LCs) – Revolving LCs of each Lender after giving effect to such Incremental Increase and reallocation shall be set forth on a revised Schedule 2.01, which the Administrative Agent agrees to deliver to the Lenders and the Borrowers promptly following the applicable Increase Effective Date.

3.Conditions Precedent. The effectiveness of this Amendment is subject to the satisfaction, or waiver, of each of the following conditions (the date of the satisfaction or waiver of all such conditions, the “Sixth Amendment Effective Date”):

(a)The Administrative Agent shall have received duly executed counterparts of this Amendment from Parent, each of the Borrowers, the Administrative Agent and Lenders constituting at least the Required Lenders.

(b)The Borrowers shall have paid to the extent invoiced at or before 1:00 p.m., New York City time, on the Business Day immediately prior to the Sixth Amendment Effective Date, all reasonable and documented out-of-pocket expenses required to be reimbursed or paid by the Borrowers pursuant to Section 12.03 of the Credit Agreement.

(c)The representations and warranties set forth in Section 4(a) shall be true and correct and no Default or Event of Default shall have occurred and be continuing, in each case, as of the Sixth Amendment Effective Date.

(d)The Administrative Agent shall have received a certificate of a Responsible Officer of Parent, dated as of the Sixth Amendment Effective Date, certifying as to the matters set forth in Section 3(c).

The Administrative Agent is hereby authorized and directed to declare this Amendment to be effective when it has received documents confirming or certifying, to the satisfaction of the Administrative Agent, compliance with the conditions set forth in this Section 3 or the waiver of such conditions as permitted hereby. Such declaration shall be final, conclusive and binding upon all parties to the Credit Agreement (including as amended hereby) for all purposes.

4.Representations and Warranties. Parent and each of the Borrowers represents and warrants to the Administrative Agent and the Lenders that, as of the Sixth Amendment Effective Date:

(a)the representations and warranties set forth in Article VII of the Credit Agreement and in the other Loan Documents are true and correct in all material respects (except to the extent qualified by materiality or reference to Material Adverse Effect, in which case such applicable representation and warranty shall be true and correct in all respects) as of, and as if such representations and warranties were made on, such date (unless such representation and warranty expressly relates to an earlier date, in which case such representation and warranty shall continue to be true and correct in all material respects (except to the extent qualified by materiality or reference to Material Adverse Effect, in which case such applicable representation and warranty shall be true and correct in all respects) as of such earlier date);

(b)no Default or Event of Default has occurred and is continuing as of such date; and

(c)this Amendment constitutes the legal, valid and binding obligation of each of the Obligors party hereto, enforceable against each such Obligor in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency,

rescue process or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles of general applicability.

5.Reaffirmation; Reference to and Effect on the Loan Documents.

(a)From and after the Sixth Amendment Effective Date, each reference in the Credit Agreement to “hereunder,” “hereof,” “this Agreement” or words of like import and each reference in the other Loan Documents to “Credit Agreement,” “thereunder,” “thereof” or words of like import shall, unless the context otherwise requires, mean and be a reference to the Credit Agreement as amended by this Amendment. This Amendment is a Loan Document.

(b)The Loan Documents, and the obligations of the Borrowers and the Obligors under the Loan Documents, are hereby ratified and confirmed and shall remain in full force and effect according to their terms.

(c)Each of Parent and the Borrowers, on their own behalf and on behalf of each other Obligor that is a Subsidiary thereof, (i) acknowledges and consents to all of the terms and conditions of this Amendment, (ii) affirms all of its obligations under the Loan Documents, including the Guaranty Agreements, to which it is a party, (iii) agrees that this Amendment and all documents executed in connection herewith do not operate to reduce or discharge its obligations under the Loan Documents, (iv) agrees that the Collateral Documents to which it is a party continue to be in full force and effect and are not impaired or adversely affected by this Amendment, (v) confirms its grant of security interests pursuant to the Collateral Documents to which it is a party as Collateral for the Secured Obligations and (vi) acknowledges that all Liens granted (or purported to be granted) by it pursuant to the Loan Documents remain and continue in full force and effect in respect of, and to secure, the Secured Obligations.

(d)The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents.

(e)In the event of any conflict between the terms of this Amendment and the terms of the Credit Agreement or the other Loan Documents, the terms hereof shall control.

6.Governing Law; Jurisdiction; Consent to Service of Process; Waiver of Jury Trial, Etc.

(a)This Amendment shall be construed in accordance with and governed by the law of the State of New York (whether based on contract, tort or otherwise and in law or equity), without regard to conflict of laws principles thereof to the extent such principles would cause the application of the law of another state.

(b)EACH PARTY HERETO HEREBY AGREES AS SET FORTH IN SECTION 12.15 (SUBMISSION TO JURISDICTION; CONSENT TO SERVICE OF PROCESS) AND SECTION 12.16 (WAIVER OF JURY TRIAL) OF THE CREDIT AGREEMENT AS IF SUCH SECTIONS WERE SET FORTH IN FULL HEREIN.

7.Amendments; Headings; Severability. This Amendment may not be amended nor may any provision hereof be waived except pursuant to a writing signed by the parties hereto. The Section headings used herein are for convenience of reference only, are not part of this Amendment and are not to affect the construction of, or to be taken into consideration in interpreting this Amendment. Any provision of this Amendment held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof or thereof, and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction.

8.Execution in Counterparts. This Amendment may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. This Amendment, the Credit Agreement, the other Loan Documents and any separate letter agreements with respect to fees payable to the Administrative Agent or the Lenders constitute the entire contract among the parties relating to the subject matter hereof and supersede any and all previous agreements and understandings, oral or written, relating to the subject matter hereof. Delivery of an executed counterpart of a signature page to this Amendment by facsimile transmission or electronic transmission (in .pdf format) shall be effective for all purposes as delivery of a manually executed counterpart of this Amendment to the extent permitted by applicable law. The words “execution”, “signed”, “signature”, “delivery”, and words of like import in or relating to any document to be signed in connection with this Amendment and the Transactions shall be deemed to include Electronic Signatures, deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

[remainder of page intentionally left blank]

Each of the parties hereto has caused a counterpart of this Amendment to be duly executed and delivered as of the date first above written.

BORROWERS:

WIL-BERMUDA:

WEATHERFORD INTERNATIONAL LTD.,

a Bermuda exempted company

By: /s/ Maximiliano A. Kricorian

Name: Maximiliano A. Kricorian

Title: Vice President and Treasurer

WIL-DELAWARE:

WEATHERFORD INTERNATIONAL, LLC,

a Delaware limited liability company

By: /s/ Maximiliano A. Kricorian

Name: Maximiliano A. Kricorian

Title: Vice President and Treasurer

WIL-CANADA:

WEATHERFORD CANADA LTD,

an Alberta corporation

By: /s/ Pamela M. Webb

Name: Pamela M. Webb

Title: Director

WIL-SWITZERLAND:

WOFS INTERNATIONAL FINANCE GMBH,

a Swiss limited liability company

By: /s/ Mathias Neuenschwander

Name: Mathias Neuenschwander

Title: Managing Officer

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

PARENT:

WEATHERFORD INTERNATIONAL PLC

By: /s/ Maximiliano A. Kricorian

Name: Maximiliano A. Kricorian

Title: Vice President and Treasurer

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

ADMINISTRATIVE AGENT:

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as Administrative Agent and a Lender

By: /s/ Kevin Pang

Name: Kevin Pang

Title: Vice President

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

LENDERS:

DEUTSCHE BANK AG NEW YORK BRANCH, as a Lender

By: /s/ Philip Tancorra

Name: Philip Tancorra

Title: Director

By: /s/ Lauren Danbury

Name: Lauren Danbury

Title: Vice President

DEUTSCHE BANK AG NEW YORK BRANCH, as a Lender

By: /s/ Chandan Kumar

Name: Chandan Kumar

Title: Director

By: /s/ Anthony Reyna

Name: Anthony Reyna

Title: Vice President

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

LENDERS:

BARCLAYS BANK PLC, as a Lender

By: /s/ Sydney G. Dennis

Name: Sydney G. Dennis

Title: Director

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

LENDERS:

CITIBANK, N.A., as a Lender

By: /s/ Derrick Lenz

Name: Derrick Lenz

Title: Vice President

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

LENDERS:

JPMORGAN CHASE BANK, N.A., as a Lender

By: /s/ Sofia Barrera Jaime

Name: Sofia Barrera Jaime

Title: Vice President

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

LENDERS:

Morgan Stanley Senior Funding, Inc., as a Lender

By: /s/ Karina Rodriguez

Name: Karina Rodriguez

Title: Vice President

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

LENDERS:

STANDARD CHARTERED BANK, as a Lender

By: /s/ Roy Kuruvilla

Name: Roy Kuruvilla

Title: Managing Director, Leveraged & Acquisition Finance

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

LENDERS:

DNB Capital LLC, as a Lender

By: /s/ Andrew J. Shohet

Name: Andrew J. Shohet

Title: SVP & Head of Ocean Industries, North America

By: /s/ Sybille Andaur

Name: Sybille Andaur

Title: Senior Vice President

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

ATB FINANCIAL,

as a Lender

By: /s/ Kevin Kynoch

Name: Kevin Kynoch

Title: Managing Director

By: /s/ Davinder Jhutty

Name: Davinder Jhutty

Title: Associate Director

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

WOODFOREST NATIONAL BANK, as a Lender

By: /s/ Wesley Gerren

Name: Wesley Gerren

Title: Vice President

[Signature Page – Sixth Amendment to Amended and Restated Credit Agreement]

ADDITIONAL LENDER SUPPLEMENT

ADDITIONAL LENDER SUPPLEMENT, dated as of June 6, 2024 (this “Supplement”), by and among each of the signatories hereto, to the Amended and Restated Credit Agreement, dated as of October 17, 2022 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”), among Weatherford International Ltd., a Bermuda exempted company (“WIL-Bermuda”), Weatherford Canada Ltd., an Alberta corporation (“WIL-Canada”), Weatherford International, LLC, a Delaware limited liability company (“WIL-Delaware”), WOFS International Finance GmbH, a Swiss limited liability company (“WIL-Switzerland” and, together with WIL-Bermuda, WIL-Canada and WIL-Delaware, the “Borrowers”), Weatherford International plc, an Irish public limited company (“Parent”), the Lenders from time to time party thereto, Wells Fargo Bank, National Association, as administrative agent for the Lenders, and the Issuing Banks from time to time party thereto. Capitalized terms used but not otherwise defined herein shall have the respective meanings specified therefor in the Credit Agreement.

W I T N E S S E T H

WHEREAS, pursuant to Section 4.13 of the Credit Agreement, the Borrowers have the right, subject to the terms and conditions thereof, to effectuate from time to time an increase in the aggregate Commitments under the Credit Agreement by requesting one or more Persons meeting the qualifications set forth in such Section 4.13 to provide an Incremental Increase;

WHEREAS, the Credit Agreement provides in Section 4.13 thereof that any Person providing an Incremental Increase must meet the requirements set forth in such Section 4.13;

WHEREAS, immediately prior to giving effect to this Supplement, Arab Banking Corporation (B.S.C.) (“ABC” and the “Additional Lender”) was not a Lender under the Credit Agreement, but now desires to become a party thereto as a Lender thereunder;

NOW, THEREFORE, each of the parties hereto hereby agrees as follows:

1.The Additional Lender agrees to be bound by the provisions of the Credit Agreement as a Lender thereunder and agrees that it shall, as of the date of this Supplement, become a Lender for all purposes of the Credit Agreement to the same extent as if originally a party thereto, with an aggregate Commitment equal to $40,000,000.

2.The Additional Lender (a) represents and warrants that (i) it has full power and authority, and has taken all action necessary, to execute and deliver this Supplement and to consummate the transactions contemplated hereby and to become a Lender under the Credit Agreement, (ii) it has delivered to Parent and/or the Administrative Agent, as applicable, an Administrative Questionnaire, the forms required under Sections 5.02(c) and 5.02(e) of the Credit Agreement and an Assignee Certificate, in each case duly completed and executed by the Additional Lender and (iii) it is not subject under current law to any withholding tax on

amounts payable to it under the Credit Agreement; (b) confirms that it has received a copy of the Credit Agreement, together with copies of the most recent financial statements delivered pursuant to Section 8.01 thereof, and has reviewed such other documents and information as it has deemed appropriate to make its own credit analysis and decision to enter into this Supplement; (c) agrees that it will, independently and without reliance upon the Administrative Agent or any other Lender and based on such documents and information as it shall deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Credit Agreement or any other instrument or document furnished pursuant hereto or thereto; (d) irrevocably designates, appoints and authorizes the Administrative Agent as the agent of such Lender under the Credit Agreement and the other Loan Documents; (e) irrevocably authorizes the Administrative Agent to take such actions on its behalf under the provisions of the Credit Agreement and the other Loan Documents, including execution of the other Loan Documents, and to exercise such powers and perform such duties as are expressly delegated to the Administrative Agent by the terms of the Credit Agreement and of the other Loan Documents, together with such actions and powers as are reasonably incidental thereto; and (f) agrees that it will be bound by the provisions of the Credit Agreement and will perform in accordance with its terms all the obligations which by the terms of the Credit Agreement are required to be performed by it as a Lender.

3.The undersigned’s address for notices for the purposes of the Credit Agreement is as follows:

Arab Banking Corporation (B.S.C.), New York Branch

140 East 45th Street, 38th Floor

New York, NY, 10017, USA

Tel: 212-583-4791

Fax: 212-583-0921

Email: NYLoans@bank-abc.com

4.The Borrowers hereby represent and warrant that no Default or Event of Default has occurred and is continuing on and as of the date hereof both immediately before and after giving effect to the increase in Commitments contemplated herein.

5.Terms defined in the Credit Agreement shall have their respective defined meanings when used herein.

6.This Supplement and all other documents executed in connection herewith and the rights and obligations of the parties hereto and thereto shall be construed in accordance with and governed by the law of the State of New York (whether based on tort, contract or otherwise and in law or equity).

7.This Supplement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same document. This Supplement, the other Loan Documents and any separate letter agreements with respect to fees payable to the Administrative Agent constitute the entire contract among the parties relating to the subject matter hereof and supersede any and all previous agreements and understandings, oral or written, relating to the subject matter hereof. Delivery of an executed counterpart of a signature page to this Supplement by facsimile transmission or electronic transmission (in .pdf format) shall be effective for all purposes as delivery of a manually executed counterpart of this Supplement. The words “execution”, “signed”, “signature”, “delivery”, and words of like import in or relating to any document to be signed in connection with this Supplement and the transactions contemplated hereby shall be deemed to include Electronic Signatures, deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act; provided that nothing herein shall require the Administrative Agent to accept electronic signatures in any form or format without its prior written consent.

8.Each of the Administrative Agent, the Borrowers and the Additional Lender hereby agrees that, on and after the date of this Supplement, the Applicable Percentage (LCs) (including as related to both Performance Letters of Credit and Revolving Letters of Credit), Applicable Percentage (Loans), Applicable Percentage (Total), Revolving Credit Commitment, Performance LC Commitment and Fronting Commitment of the Additional Lender shall be as set forth on Schedule 2.01 attached hereto, which Schedule 2.01 supersedes and replaces Schedule 2.01 to the Credit Agreement.

9.Each of the Issuing Banks hereby consents to the joinder of the Additional Lender as a Lender under the Credit Agreement.

10.This Supplement is a Loan Document. Sections 12.06, 12.15 and 12.16 of the Credit Agreement are hereby incorporated herein, mutatis mutandis.

[Remainder of this page intentionally left blank.]

IN WITNESS WHEREOF, each of the undersigned has caused this Supplement to be executed and delivered by a duly authorized officer on the date first above written.

Arab Banking Corporation (B.S.C.) New York Branch, as an Additional Lender

By: /s/ Gautier Strub

Name: Gautier Strub

Title: Senior Relationship Manager

By: /s/ David Giacalone

Name: David Giacalone

Title: Chief Risk Officer

[Signature Page – Additional Lender Supplement]

Accepted and agreed to as of the date first written above:

WIL-BERMUDA:

WEATHERFORD INTERNATIONAL LTD.,

a Bermuda exempted company

By: /s/ Maximiliano A. Kricorian

Name: Maximiliano A. Kricorian

Title: Vice President and Treasurer

WIL-DELAWARE:

WEATHERFORD INTERNATIONAL, LLC,

a Delaware limited liability company

By: /s/ Maximiliano A. Kricorian

Name: Maximiliano A. Kricorian

Title: Vice President and Treasurer

WIL-CANADA:

WEATHERFORD CANADA LTD.,

an Alberta corporation

By: /s/ Pamela M. Webb

Name: Pamela M. Webb

Title: Director

WIL-SWITZERLAND:

WOFS INTERNATIONAL FINANCE GMBH,

a Swiss limited liability company

By: /s/ Mathias Neuenschwander

Name: Mathias Neuenschwander

Title: Managing Officer

[Signature Page – Additional Lender Supplement]

PARENT:

WEATHERFORD INTERNATIONAL PLC

By: /s/ Maximiliano A. Kricorian

Name: Maximiliano A. Kricorian

Title: Vice President and Treasurer

[Signature Page – Additional Lender Supplement]

Consented to and acknowledged as of the date first written above:

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as Administrative Agent and an Issuing Bank

By: /s/ Kevin Pang

Name: Kevin Pang

Title: Vice President

[Signature Page – Additional Lender Supplement]

DEUTSCHE BANK AG NEW YORK BRANCH,

as an Issuing Bank

By: /s/ Philip Tancorra

Name: Philip Tancorra

Title: Director

By: /s/ Lauren Danbury

Name: Lauren Danbury

Title: Vice President

DEUTSCHE BANK AG NEW YORK BRANCH,

as an Issuing Bank

By: /s/ Chandan Kumar

Name: Chandan Kumar

Title: Director

By: /s/ Anthony Reyna

Name: Anthony Reyna

Title: Vice President

[Signature Page – Additional Lender Supplement]

BARCLAYS BANK PLC,

as an Issuing Bank

By: /s/ Sydney G. Dennis

Name: Sydney G. Dennis

Title: Director

[Signature Page – Additional Lender Supplement]

CITIBANK N.A.,

as an Issuing Bank

By: /s/ Derrick Lenz

Name: Derrick Lenz

Title: Vice President

[Signature Page – Additional Lender Supplement]

JPMORGAN CHASE BANK, N.A, as an Issuing Bank

By: /s/ Sofia Barrera Jaime

Name: Sofia Barrera Jaime

Title: Vice President

[Signature Page – Additional Lender Supplement]

MORGAN STANLEY SENIOR FUNDING, INC.,

as an Issuing Bank

By: /s/ Karina Rodriguez

Name: Karina Rodriquez

Title: Vice President

[Signature Page – Additional Lender Supplement]

STANDARD CHARTERED BANK,

as an Issuing Bank

By: /s/ Roy Kuruvilla

Name: Roy Kuruvilla

Title: Managing Director, Leveraged & Acquisition Finance

[Signature Page – Additional Lender Supplement]

DNB BANK ASA, NEW YORK BRANCH, as an Issuing Bank

By: /s/ Sybille Andaur

Name: Sybille Andaur

Title: Senior Vice President

By: /s/ Mita Zalavadia

Name: Mita Zalavadia

Title: Vice President

[Signature Page – Additional Lender Supplement]

ATB FINANCIAL,

as an Issuing Bank

By: /s/ Kevin Kynoch

Name: Kevin Kynoch

Title: Managing Director

By: /s/ Davinder Jhutty

Name: Davinder Jhutty

Title: Associate Director

[Signature Page – Additional Lender Supplement]

Document and Entity Information

|

Jun. 06, 2024 |

| Document Information [Line Items] |

|

| Document Period End Date |

Jun. 06, 2024

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 06, 2024

|

| Entity Registrant Name |

Weatherford International plc

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

001-36504

|

| Entity Tax Identification Number |

98-0606750

|

| Entity Address, Address Line One |

2000 St. James Place

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State |

TX

|

| Entity Address, Postal Zip Code |

77056

|

| City Area Code |

713

|

| Local Phone Number |

836.4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary shares, $0.001 par value per share

|

| Trading Symbol |

WFRD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001603923

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

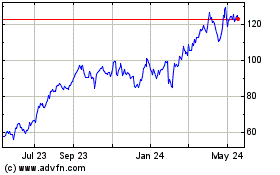

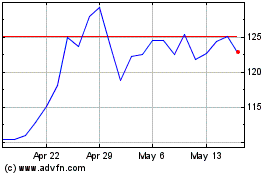

Weatherford (NASDAQ:WFRD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Weatherford (NASDAQ:WFRD)

Historical Stock Chart

From Dec 2023 to Dec 2024