WISeKey Announces First Half 2024

Unaudited Financial Results and Updates on Strategic Business

Initiatives

Substantial R&D investments aimed at

securing a competitive edge in the fast-approaching era of

post-quantum computing

Schedules Conference Call and Webcast for

Wednesday, October 2 at 10:00 am ET (4:00 pm CET)

Geneva, Switzerland – September 30,

2024: – Ad-Hoc announcement

pursuant to Art. 53 of SIX Listing Rules – WISeKey

International Holding Ltd. ("WISeKey") (SIX: WIHN, NASDAQ: WKEY), a

global leader in cybersecurity, digital identity and Internet of

Things (IoT) innovations operating as a holding company, today

announces its unaudited financial results for the six-month period

ending June 30, 2024 (H1 2024).

H1 2024 FINANCIAL AND OPERATIONAL

HIGHLIGHTS

WISeKey’s performance in the first half of 2024

underscores the company’s resilience and strategic adaptability

amidst rapid technological advancements.

-

$5.2 million H1 2024 revenue, reflecting the

expected slowdown in traditional semiconductor demand, with 2024

being a transitional year.

-

$26.3 million cash balance (as of June 30,

2024).

- $2.9

million Investments in R&D for the development of new projects

and technologies, including SEALSQ’s post-quantum chip,

SEALCoin, and our WISeSat satellites and next generations. This

investment is essential to support our growth in future years.

During H1 2024, the Company’s substantial

research & development investments, aimed at securing a

competitive edge in the fast-approaching era of post-quantum

computing and secure IoT transactions. With continued investments

in quantum technology, satellite communications, and secure digital

transactions, WISeKey is solidifying its position at the forefront

of the Fourth Industrial Revolution.

MOVING FORWARD

Outlook for Full Year 2024

For the remainder of 2024, WISeKey management

anticipates improved performance as compared to H1 2024, subject to

the materialization timing of previously announced project and

transitioning demand for next-generation semiconductor

products.

WISeKey’s strong pipeline of current and new

business opportunities valued at over $71 million as of September

20, 2024 is driven by the launch of the next generation of

semiconductors, which the Group expects to release in 2025, the

development of WISeSat.Space’s satellite-based security solutions

following the launch of its new picosatellite in the first quarter

of 2025, and the introduction of SEALCOIN’s machine-to-machine

(M2M) transactional IoT services (t-IoT).

Growth Strategy

WISeKey is gearing up for growth, fueled by:

- The full-scale

production of next-generation post-quantum semiconductors, with

initial pilot programs expected to begin by late 2024.

- Further

investments in space satellite technology, with a focus on

expanding WISeSat.Space's market share in the satellite

communications sector.

- The launch of

SEALCOIN, expected to drive significant growth in the t-IoT and M2M

transaction space.

- A potential

public listing of additional subsidiaries, as WISeKey continues to

mature its diverse portfolio in blockchain, cybersecurity, and

IoT.

STRATEGIC INITIATIVES BY

SUBSIDIARY

WISeKey is proactively taking steps at each of

its subsidiaries to strengthen its revenue streams and enhance

profitability.

SEALSQ

Expansion of Semiconductor

Production

SEALSQ Corp. (“SEALSQ”) (NASDAQ: LAES) secured

$20 million in additional financing during H1 2024 to expand its

production facilities. The funds are earmarked for the development

of post-quantum semiconductors, which are increasingly critical as

quantum computing poses challenges to traditional encryption

systems.

As a results, SEALSQ invested $2.4 million in

research and development initiatives, expanded its US-based sales

team, made significant progress towards the establishment of

several OSAT cybersecurity chip design and customization centers,

secured global partnerships, and made advancements in the

development of post-quantum chips. Representative of this progress,

SEALSQ is now preparing to release engineering samples of its

QS7001 Quantum-Resistant Secure Chips before the end of the

year.

New Distribution Agreements and

Partnerships

WISeKey, via SEALSQ has signed strategic

agreements with global distributors to expand the reach of its

semiconductor and cybersecurity products, notably in Asia, Europe,

and North America with both with existing clients in the healthcare

industry in the US and new customers in Asia (D-Link, HOSIDEN) and

Europe (In Lite), mostly around smart home applications.

Expectations are supported by several key growth

factors including the expansion of Matter certification, global

adoption of new IoT security standards such as the US Cyber Trust

Mark or the EU Cyber Resilience Act, and SEALSQ’s strong value

proposition on the PKI market for both IoT device makers segment

and GSMA eUICC manufacturers and service providers. This has been

reflected by significant new agreements signed in H1 2024,

WISeSat.Space

Developments & Key

Initiatives

WISeSat.Space is leading the way in utilizing

low-orbit and picosatellites for secure IoT connectivity and

climate change monitoring. The Company is working on a variety of

announced projects at the WISeSat.Space level, expected to

materialize in H2 2024 and beyond, including:

- Launch of a

constellation of 88 low-orbit satellites by the end of 2027. To

date, the company has successfully launched 17 low-orbit satellites

in collaboration with FOSSA Systems, primarily through SpaceX’s

Transporter Rideshare missions. These satellites will incorporate

SEALSQ semiconductor technology and WISeKey cryptographic keys,

ensuring secure space-based communication.

- WISeSat.Space is

also utilizing picosatellites and low-power sensors to offer a

cost-effective IoT connectivity solution. These picosatellites are

smaller and more affordable than traditional satellites, making

secure IoT connectivity accessible to a wider range of

businesses.

- The launch of a

new generation of satellites from California with SpaceX (currently

scheduled for early 2025), will enhance global IoT

connectivity and environmental monitoring, with improved

performance in areas such as climate change detection, disaster

management, and smart agriculture.

- The installation

of a satellite antenna in Switzerland, enabling more efficient

monitoring and management of the satellite constellation. This

infrastructure will ensure optimal performance for IoT connectivity

solutions, highlighting WISeSat.Space's commitment to secure

satellite operations.

- The development

of a European-based, neutral satellite constellation, aimed at

ensuring data sovereignty and enhancing international cooperation.

This constellation is crucial for reducing dependence on

non-European entities and fostering technological

independence.

- Collaboration

with the Swiss Army to leverage WISeSat.Space’s secure IoT

connectivity solutions for defense and national security purposes,

including enhancing logistics, situational awareness, and disaster

response capabilities.

WISe.ART

Launch of WISe.ART 2.0

Platform

WISeKey is also deepening its presence in the

NFT and digital assets space with the launch of the WISe.ART 2.0

platform, a highly secure environment for trading NFTs and

conducting authenticated online transactions. This platform

integrates blockchain and cybersecurity technology, positioning

WISeKey to capture a growing share of the NFT market and drive new

revenue streams.

Strategic Investment from The Hashgraph

Association

WISe.ART successfully concluded a strategic

investment round with The Hashgraph Association (THA), a Swiss

non-profit organization focused on promoting the global adoption of

the Hedera network. This partnership is expected to significantly

bolster WISe.ART's growth by leveraging Hedera's decentralized,

sustainable public ledger.

SEALCOIN AG

$50 Million Investment

Commitment

WISeKey has secured a $50 million token

investment commitment from GEM Digital Limited to support its

SEALCOIN project housed at SEALCOIN AG. By enabling

machine-to-machine (M2M) transactions without human intervention,

SEALCOIN is poised to become a key player in the Transactional IoT

(t-IoT) ecosystem.

In addition to financial backing, The Hashgraph

Group (THG) has entered into an agreement with WISeKey to provide

engineering expertise and strategic guidance in the Web3 economy,

further enhancing SEALCOIN’s capabilities.

A Proof of Concept for SEALCOIN is already

available for at https://youtu.be/daOvoOxqGvQ.

WISeID

Expansion of Post-Quantum and IoT

Solutions

WISeKey’s INeS Platform, offering “PKI as a

Service,” is gaining significant traction. The platform allows

companies to manage Device Attestation Certificates (DACs) without

the need for costly infrastructure investments. With

pre-provisioning of FIPS-certified secure elements, WISeKey

supports the rapid market entry of smart home products under the

Matter Protocol, a key standard for IoT device security.

CONFERENCE CALL

The Company will host a conference call to

review its results on Wednesday, October 2, 2024, at 10:00 am ET

(4:00 pm CET). To join, please use the following dial-in

numbers:

- Toll-Free

Dial-In Number: 877-445-9755

- International

Dial-In Number: 201-493-6744

The webcast of the call can be accessed through

the Investor Relations section of WISeKey’s website at

www.wisekey.com. An archived version of the call will also be made

available.

About WISeKeyWISeKey

International Holding Ltd (“WISeKey”, SIX: WIHN; Nasdaq: WKEY) is a

global leader in cybersecurity, digital identity, and IoT solutions

platform. It operates as a Swiss-based holding company through

several operational subsidiaries, each dedicated to specific

aspects of its technology portfolio. The subsidiaries include (i)

SEALSQ Corp (Nasdaq: LAES), which focuses on semiconductors, PKI,

and post-quantum technology products, (ii) WISeKey SA which

specializes in RoT and PKI solutions for secure authentication and

identification in IoT, Blockchain, and AI, (iii) WISeSat AG which

focuses on space technology for secure satellite communication,

specifically for IoT applications, (iv) WISe.ART Corp which focuses

on trusted blockchain NFTs and operates the WISe.ART marketplace

for secure NFT transactions, and (v) SEALCOIN AG which focuses on

decentralized physical internet with DePIN technology and house the

development of the SEALCOIN platform.Each subsidiary contributes to

WISeKey’s mission of securing the internet while focusing on their

respective areas of research and expertise. Their technologies

seamlessly integrate into the comprehensive WISeKey platform.

WISeKey secures digital identity ecosystems for individuals and

objects using Blockchain, AI, and IoT technologies. With over 1.6

billion microchips deployed across various IoT sectors, WISeKey

plays a vital role in securing the Internet of Everything. The

company’s semiconductors generate valuable Big Data that, when

analyzed with AI, enable predictive equipment failure prevention.

Trusted by the OISTE/WISeKey cryptographic Root of Trust, WISeKey

provides secure authentication and identification for IoT,

Blockchain, and AI applications. The WISeKey Root of Trust ensures

the integrity of online transactions between objects and people.

For more information on WISeKey’s strategic direction and its

subsidiary companies, please visit www.wisekey.com.

ADDITIONAL FINANCIAL & OPERATIONAL

DATA

Consolidated Statements of Comprehensive

Income/(Loss) [as reported]

|

|

Unaudited 6 months ended June 30, |

|

USD'000 |

2024 |

|

2023 |

|

|

|

|

|

| Net

sales |

5,174 |

|

15,107 |

|

Cost of sales |

(3,834) |

|

(6,924) |

|

Depreciation of production assets |

(228) |

|

(84) |

|

Gross profit |

1,112 |

|

8,099 |

|

|

|

|

|

|

Other operating income |

178 |

|

21 |

|

Research & development expenses |

(2,942) |

|

(2,151) |

|

Selling & marketing expenses |

(3,967) |

|

(3,887) |

|

General & administrative expenses |

(8,518) |

|

(7,968) |

|

Total operating expenses |

(15,249) |

|

(13,985) |

|

Operating loss |

(14,137) |

|

(5,886) |

|

|

|

|

|

|

Non-operating income |

1,129 |

|

598 |

|

Debt conversion expense |

(21) |

|

(484) |

|

Interest and amortization of debt discount |

(529) |

|

(119) |

|

Non-operating expenses |

(584) |

|

(896) |

|

Loss before income tax expense |

(14,142) |

|

(6,787) |

|

|

|

|

|

|

Income tax expense |

(1,310) |

|

(322) |

|

|

|

|

|

|

Net loss |

(15,452) |

|

(7,109) |

|

|

|

|

|

|

Less: Net loss attributable to noncontrolling interests |

(5,982) |

|

(141) |

|

Net loss attributable to WISeKey International Holding

AG |

(9,470) |

|

(6,968) |

|

|

|

|

|

|

Earnings per Class A Share (USD) |

|

|

|

|

Earnings per Class A Share |

|

|

|

|

Basic |

(0.45) |

|

(0.25) |

|

Diluted |

(0.45) |

|

(0.25) |

|

|

|

|

|

|

Earning per Class A Share attributable to WISeKey

International Holding Ltd |

|

|

|

|

Basic |

(0.27) |

|

(0.24) |

|

Diluted |

(0.27) |

|

(0.24) |

|

|

|

|

|

|

Earnings per Class B Share (USD) |

|

|

|

|

Earnings per Class B Share |

|

|

|

|

Basic |

(4.48) |

|

(2.49) |

|

Diluted |

(4.48) |

|

(2.49) |

|

|

|

|

|

|

Earning per Class B Share attributable to WISeKey

International Holding Ltd |

|

|

|

|

Basic |

(2.74) |

|

(2.44) |

|

Diluted |

(2.74) |

|

(2.44) |

| |

|

|

|

| Other

comprehensive income / (loss), net of tax: |

|

|

|

| Foreign

currency translation adjustments |

(515) |

|

(1,118) |

| Defined benefit

pension plans: |

|

|

|

| Net gain

arising during the period |

34 |

|

16 |

| Other

comprehensive loss |

(481) |

|

(1,102) |

|

Comprehensive loss |

(15,933) |

|

(8,211) |

| |

|

|

|

| Other

comprehensive income / (loss) attributable to noncontrolling

interests |

45 |

|

(63) |

| Other

comprehensive loss attributable to WISeKey International Holding

AG |

(526) |

|

(1,039) |

| |

|

|

|

| Comprehensive

loss attributable to noncontrolling interests |

(5,937) |

|

(204) |

|

Comprehensive loss attributable to WISeKey

International Holding AG |

(9,996) |

|

(8,007) |

| |

|

|

|

The notes are an integral part of our

consolidated financial statements.

Consolidated Balance Sheets [as

reported]

|

|

As at June 30, |

|

As at December 31, |

|

USD'000 |

2024 (unaudited) |

|

2023 (unaudited) |

| |

|

|

|

|

ASSETS |

|

|

|

|

Current assets |

|

|

|

| Cash and cash

equivalents |

26,293 |

|

15,311 |

| Restricted

cash, current |

111 |

|

- |

| Accounts

receivable, net of allowance for credit losses |

2,041 |

|

5,471 |

| Notes

receivable from employees and related parties |

53 |

|

63 |

|

Inventories |

2,772 |

|

5,230 |

| Prepaid

expenses |

1,669 |

|

1,290 |

| Government

assistance |

1,826 |

|

1,718 |

| Other current

assets |

759 |

|

1,008 |

| Total

current assets |

35,524 |

|

30,091 |

|

|

|

|

|

|

Noncurrent assets |

|

|

|

| Deferred

income tax assets |

1,775 |

|

3,077 |

| Deferred tax

credits |

104 |

|

15 |

| Property,

plant and equipment net of accumulated depreciation |

3,115 |

|

3,392 |

| Intangible

assets, net of accumulated amortization |

94 |

|

96 |

| Operating

lease right-of-use assets |

1,781 |

|

2,052 |

| Goodwill |

8,317 |

|

8,317 |

| Equity

securities, at cost |

471 |

|

486 |

| Other

noncurrent assets |

263 |

|

275 |

| Total

noncurrent assets |

15,920 |

|

17,710 |

| TOTAL

ASSETS |

51,444 |

|

47,801 |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

Current Liabilities |

|

|

|

| Accounts

payable |

12,492 |

|

12,863 |

| Notes

payable |

4,160 |

|

4,164 |

| Convertible

note payable, current |

49 |

|

190 |

| Deferred

revenue, current |

100 |

|

217 |

| Current

portion of obligations under operating lease liabilities |

630 |

|

638 |

| Income tax

payable |

- |

|

4 |

| Other current

liabilities |

698 |

|

832 |

| Total

current liabilities |

18,129 |

|

18,908 |

| |

|

|

|

|

Noncurrent liabilities |

|

|

|

| Bonds,

mortgages and other long-term debt |

1,863 |

|

1,820 |

| Convertible

note payable, noncurrent |

9,313 |

|

1,519 |

| Deferred

revenue, noncurrent |

22 |

|

24 |

| Operating

lease liabilities, noncurrent |

1,138 |

|

1,443 |

| Employee

benefit plan obligation |

2,963 |

|

3,001 |

| Other

noncurrent liabilities |

3 |

|

2 |

| Total

noncurrent liabilities |

15,302 |

|

7,809 |

| TOTAL

LIABILITIES |

33,431 |

|

26,717 |

| |

|

|

|

|

Commitments and contingent liabilities |

|

|

|

| |

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

| Common stock -

Class A |

16 |

|

400 |

| Par value: CHF

0.01 and CHF 0.25 |

|

|

|

| Authorized -

2,000,880 and 2,000,880 shares |

|

|

|

| Issued and

outstanding - 1,600,880 and 1,600,880 shares |

|

|

|

| Common stock -

Class B |

359 |

|

8,170 |

| Par value: CHF

0.10 and CHF 2.50 |

|

|

|

| Authorized -

6,194,267 and 6,194,267 |

|

|

|

| Issued -

3,365,560 and 3,076,150 |

|

|

|

| Outstanding -

3,292,180 and 2,954,097 |

|

|

|

| Treasury

stock, at cost (73,380 and 122,053 shares held) |

(548) |

|

(691) |

| Additional

paid-in capital |

323,973 |

|

295,716 |

| Accumulated

other comprehensive income / (loss) |

3,515 |

|

4,041 |

| Accumulated

deficit |

(290,431) |

|

(280,961) |

| Total

shareholders' equity attributable to WISeKey

shareholders |

36,884 |

|

26,675 |

| Noncontrolling

interests in consolidated subsidiaries |

(18,871) |

|

(5,591) |

| Total

shareholders' equity |

18,013 |

|

21,084 |

| TOTAL

LIABILITIES AND EQUITY |

51,444 |

|

47,801 |

| |

|

|

|

The notes are an integral part of our

consolidated financial statements.

DisclaimerThis communication

expressly or implicitly contains certain forward-looking statements

concerning WISeKey International Holding Ltd and its business. Such

statements involve certain known and unknown risks, uncertainties

and other factors, which could cause the actual results, financial

condition, performance or achievements of WISeKey International

Holding Ltd to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. WISeKey International Holding Ltd is

providing this communication as of this date and does not undertake

to update any forward-looking statements contained herein as a

result of new information, future events or otherwise.

This press release does not constitute an offer

to sell, or a solicitation of an offer to buy, any securities, and

it does not constitute an offering prospectus within the meaning of

the Swiss Financial Services Act (“FinSA”), the FinSa's predecessor

legislation or advertising within the meaning of the FinSA.

Investors must rely on their own evaluation of WISeKey and its

securities, including the merits and risks involved. Nothing

contained herein is, or shall be relied on as, a promise or

representation as to the future performance of

WISeKey.Press and Investor

Contacts

|

WISeKey International Holding LtdCompany

Contact: Carlos MoreiraChairman & CEOTel: +41 22 594

3000info@wisekey.com |

WISeKey Investor Relations (US) The Equity

Group Inc.Lena CatiTel: +1 212 836-9611 / lcati@equityny.comKatie

MurphyTel: +1 212 836-9612 / kmurphy@equityny.com |

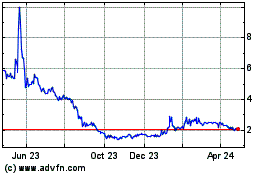

WISeKey (NASDAQ:WKEY)

Historical Stock Chart

From Dec 2024 to Jan 2025

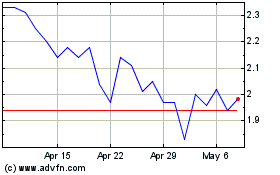

WISeKey (NASDAQ:WKEY)

Historical Stock Chart

From Jan 2024 to Jan 2025