0001866226

false

0001866226

2023-09-11

2023-09-11

0001866226

WTMA:UnitsEachConsistingOfOneShareOfCommonStock0.0001ParValueAndOneRightToReceiveOnetenthOfOneShareOfCommonStockMember

2023-09-11

2023-09-11

0001866226

WTMA:CommonStock0.0001ParValuePerShareMember

2023-09-11

2023-09-11

0001866226

WTMA:RightsEachExchangeableIntoOnetenthOfOneShareOfCommonStockMember

2023-09-11

2023-09-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United

States

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

September

11, 2023 (September 11, 2023)

Date

of Report (Date of earliest event reported)

Welsbach

Technology Metals Acquisition Corp.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41183 |

|

87-1006702 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

160 S Craig Place

Lombard, Illinois 60148 |

| (Address

of Principal Executive Offices, including zip code) |

Registrant’s

telephone number, including area code: (217) 615-1216

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Units,

each consisting of one share of Common Stock, $0.0001 par value, and one Right to receive one-tenth of one share of Common Stock |

|

WTMAU |

|

The

Nasdaq Stock Market LLC |

| Common

Stock, $0.0001 par value per share |

|

WTMA |

|

The

Nasdaq Stock Market LLC |

| Rights,

each exchangeable into one-tenth of one share of Common Stock |

|

WTMAR |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure.

On

September 11, 2023, Welsbach Technology Metals Acquisition Corp. (the “Company” or “WTMA”), a

blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or

similar business combination with one or more businesses, issued a press release to announce that it had entered into a non-binding

letter of intent with a target in the critical materials space (the “Target”) for a potential business combination. There

can be no assurance that a definitive agreement will be entered into or that the proposed transaction will be consummated. A copy of

the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

The

information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that

section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act, or the Exchange

Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission

as to the materiality of any information of the information in this Item 7.01, including Exhibit 99.1.

Important

Information and Where to Find It

If

a legally binding definitive agreement with respect to the proposed business combination is executed, WTMA intends to file with the SEC

a registration statement, which will include a preliminary proxy statement/prospectus (a “Proxy Statement/Prospectus”). A

definitive Proxy Statement/Prospectus will be mailed to WTMA’s stockholders as of a record date to be established for voting on

the proposed business combination. In addition, as previously disclosed, the Company has filed a definitive proxy statement (the “Extension

Proxy”) to be used at the forthcoming special meeting of its stockholders (the “Extension Meeting”) to approve, among

other things, amendments to the Company’s amended and restated certificate of incorporation to extend the time it has to complete

an initial business combination.

Investors

and security holders will be able to obtain free copies of the Extension Proxy and, when available, the Proxy Statement/Prospectus, the

proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by WTMA through the website maintained

by the SEC at www.sec.gov.

This

communication may be deemed to be offering or solicitation material in respect of the proposed business combination and in respect of

the Extension, which will be submitted to the stockholders of WTMA for their consideration. WTMA urges investors, stockholders and other

interested persons to carefully read the Extension Proxy and, when available, the preliminary and definitive Proxy Statement/Prospectus

as well as other documents filed with the SEC (including any amendments or supplements to the Extension Proxy and/or the Proxy Statement/Prospectus,

as applicable), in each case, before making any investment or voting decision with respect to the Extension and/or the proposed business

combination, because these documents will contain important information about WTMA, the Target, the proposed business combination and

the Extension.

Participants

in the Solicitation

WTMA

and its directors and executive officers may be deemed to be participants in the solicitation of proxies with respect to the proposed

business combination described herein under the rules of the SEC. Information about the directors and executive officers of WTMA and

a description of their interests in WTMA and the proposed business combination and will be set forth in the Proxy Statement/Prospectus,

if and when it is filed with the SEC. Information about the Target’s directors and executive officers and a description of their

interests in the Target and the proposed business combination will be set forth in the Proxy Statement/Prospectus, if and when it is

filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Information

about the directors and executive officers of WTMA and a description of their interests in WTMA and the proposed business combination

and will be set forth in the Proxy Statement/Prospectus, if and when it is filed with the SEC. Information about the Target’s directors

and executive officers and a description of their interests in the Target and the proposed business combination will be set forth in

the Proxy Statement/Prospectus, if and when it is filed with the SEC. These documents can be obtained free of charge from the sources

indicated above.

No

Offer or Solicitation

This

Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or

in respect of any business combination or the Extension. This Current Report on Form 8-K shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such

offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act,

or an exemption therefrom.

Cautionary

Statement Regarding Forward-Looking Statements

Certain

statements made in this Current Report on Form 8-K are “forward looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the

words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,”

“intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,”

“propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are

intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions

or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are

outside WTMA’s and Target’s control, that could cause actual results or outcomes to differ materially from those discussed

in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the ability of

WTMA to enter into a definitive agreement with respect to a business combination with Target within the time provided in WTMA’s

second amended and restated certificate of incorporation; WTMA’s ability to obtain the Extension; WTMA’s ability to obtain

the financing necessary to consummate the potential business combination; the performance of Target’s business; the timing, success

and cost of Target’s development activities; assuming the definitive agreement is executed, the ability to consummate the proposed

business combination, including risk that WTMA’s stockholder approval is not obtained; failure to realize the anticipated benefits

of the proposed business combination, including as a result of a delay in consummating the proposed business combination; the amount

of redemption requests made by WTMA’s stockholders and the amount of funds remaining in WTMA’s trust account after the Extension

and the vote to approve the proposed business combination; WTMA’s and Target’s ability to satisfy the conditions to closing

the proposed business combination, once documented in a definitive agreement; and those factors discussed in the Annual Report under

the heading “Risk Factors,” and the other documents filed, or to be filed, by WTMA with the SEC. Neither WTMA or Target undertake

any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Dated:

September 11, 2023

Welsbach

Technology Metals Acquisition Corp.

| By: |

/s/

Christopher Clower |

|

| Name: |

Christopher

Clower |

|

| Title: |

Chief

Operating Officer and Director |

|

3

Exhibit 99.1

Welsbach Technology

Metals Acquisition Corp. Announce Non-Binding Letter of Intent for a Business Combination

Chicago, IL,

Sept. 11, 2023 (GLOBE NEWSWIRE) -- Welsbach Technology Metals Acquisition Corp. (NASDAQ: WTMA) (“WTMAC”) today

announced that it has signed a non-binding letter of intent (“LOI”) with respect to a business combination transaction

(the “Transaction”) with a target in the critical materials space (the “Target”). The Transaction is

intended to result in WTMAC’s successor listed company owning 100% of the Target. The Transaction structure is yet to be

determined based on the due diligence findings as well as business, legal, tax, accounting and other considerations.

WTMAC and Target, if

approval to proceed by the Board of WTMAC and Target is obtained, would announce any additional details regarding the Transaction if a

definitive agreement for the business combination were to be executed. The parties are currently considering the specific terms of any

business combination. Any transaction will be subject to, among other things, tax review, as well as other auditing, corporate, regulatory

and stock exchange requirements.

About WTMAC

WTMAC is a blank check company formed for the

purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination

with one or more businesses. While WTMAC may pursue an acquisition in any business industry or sector, it intends to concentrate its efforts

on targets in the technology metals and energy transition materials industry. WTMAC is led by Chief Executive Officer Daniel Mamadou and

Chief Operating Officer Chris Clower.

Important Information and Where to Find

It

If a legally binding definitive agreement

with respect to the proposed Transaction is executed, the parties intend to file with the Securities and Exchange Commission (the “SEC”)

a registration statement relating to the Transaction. In addition, WTMAC has filed a definitive proxy statement to be used at its special

meeting of stockholders to approve an extension of the time in which it must complete an initial business combination or liquidate the

trust account that holds the proceeds of WTMAC’s initial public offering (the “Extension”), which was mailed to stockholders

of WTMAC as of the record date established for voting on the Extension. WTMAC’s stockholders and other interested persons are advised

to read the definitive proxy statement filed by WTMAC in connection with the Extension and, when available the preliminary proxy statements

and the amendments thereto and the definitive proxy statement relating to the proposed Transaction, as these materials will contain important

information about WTMAC, Target, the proposed Transaction and the Extension. When available, the definitive proxy statement and other

relevant materials for the proposed Transaction will be mailed to stockholders of WTMAC as of a record date to be established for voting

on the proposed Transaction. Stockholders will also be able to obtain copies of the above referenced documents and other documents filed

with the SEC in connection with the Extension and the proposed business combination, without charge, once available, at the SEC’s

web site at www.sec.gov, or by directing a request to: Welsbach Technology Metals Acquisition Corp., 160 S Craig Place, Lombard, Illinois

60148.

Participants in the Solicitation

WTMAC and Target and each of their directors

and executive officers may be considered participants in the solicitation of proxies with respect to the Extension and the proposed Transaction

under the rules of the SEC. Information about the directors and executive officers of WTMAC and a description of their interests in WTMAC

and the Extension is contained in WTMA’s Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the

SEC on February 21, 2023 (the “Annual Report”) and the definitive proxy statement relating the Extension.

Information about WTMAC’s directors

and executive officer’s interests in the Transaction, as well as information about Target’s directors and executive officers

and a description of their interests in Target and the proposed Transaction will be set forth in the proxy statement relating to the proposed

Transaction, when it is filed with the SEC. When available, the above referenced documents can be obtained free of charge from the sources

indicated above.

No Offer or Solicitation

This press release shall not constitute

a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the Extension or the proposed Transaction.

This press release shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Forward Looking-Statements

Certain statements made in this press release

are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,”

“expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,”

“seeks,” “may,” “will,” “should,” “future,” “propose” and variations

of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking

statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of

known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside WTMAC’s and Target’s

control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important

factors, among others, that may affect actual results or outcomes include: the ability of WTMAC to enter into a definitive agreement with

respect to a business combination with Target within the time provided in WTMAC’s second amended and restated certificate of incorporation;

WTMAC’s ability to obtain the Extension; WTMAC’s ability to obtain the financing necessary to consummate the potential Transaction;

the performance of Target’s business; the timing, success and cost of Target’s development activities; assuming the definitive

agreement is executed, the ability to consummate the proposed Transaction, including risk that WTMAC’s stockholder approval is not

obtained; failure to realize the anticipated benefits of the proposed Transaction, including as a result of a delay in consummating the

proposed Transaction; the amount of redemption requests made by WTMAC’s stockholders and the amount of funds remaining in WTMAC’s

trust account after the Extension and the vote to approve the proposed Transaction; WTMAC’s and Target’s ability to satisfy

the conditions to closing the proposed Transaction, once documented in a definitive agreement; and those factors discussed in the Annual

Report under the heading “Risk Factors,” and the other documents filed, or to be filed, by WTMAC with the SEC. Neither WTMAC

or Target undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by law.

Contact:

Daniel Mamadou, CEO of Welsbach Technology

Metals Acquisition Corp.

daniel@welsbach.sg

v3.23.2

Cover

|

Sep. 11, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 11, 2023

|

| Entity File Number |

001-41183

|

| Entity Registrant Name |

Welsbach

Technology Metals Acquisition Corp.

|

| Entity Central Index Key |

0001866226

|

| Entity Tax Identification Number |

87-1006702

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

160 S Craig Place

|

| Entity Address, City or Town |

Lombard

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60148

|

| City Area Code |

217

|

| Local Phone Number |

615-1216

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Common Stock, $0.0001 par value, and one Right to receive one-tenth of one share of Common Stock |

|

| Title of 12(b) Security |

Units,

each consisting of one share of Common Stock, $0.0001 par value, and one Right to receive one-tenth of one share of Common Stock

|

| Trading Symbol |

WTMAU

|

| Security Exchange Name |

NASDAQ

|

| Common Stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

WTMA

|

| Security Exchange Name |

NASDAQ

|

| Rights, each exchangeable into one-tenth of one share of Common Stock |

|

| Title of 12(b) Security |

Rights,

each exchangeable into one-tenth of one share of Common Stock

|

| Trading Symbol |

WTMAR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WTMA_UnitsEachConsistingOfOneShareOfCommonStock0.0001ParValueAndOneRightToReceiveOnetenthOfOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WTMA_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WTMA_RightsEachExchangeableIntoOnetenthOfOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

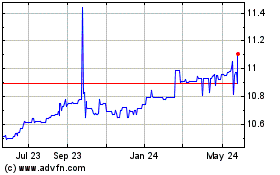

Welsbach Technology Meta... (NASDAQ:WTMA)

Historical Stock Chart

From Jan 2025 to Feb 2025

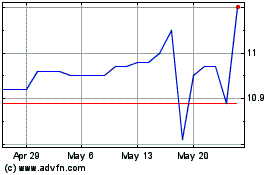

Welsbach Technology Meta... (NASDAQ:WTMA)

Historical Stock Chart

From Feb 2024 to Feb 2025