Abaxx Technologies Inc. (CBOE:ABXX)(OTCQX:ABXXF)

(“

Abaxx” or the “

Company”), a

financial software and market infrastructure company, indirect

majority shareholder of Abaxx Singapore Pte Ltd. (“

Abaxx

Singapore”), the owner of Abaxx Commodity Exchange and

Clearinghouse (individually, “

Abaxx Exchange” and

“

Abaxx Clearing”), and producer of the

SmarterMarkets™ Podcast, today announced the launch of Abaxx

Commodity Futures Exchange and Clearinghouse, with trading

commencing in its physically-deliverable liquified natural gas

(LNG) and carbon futures contracts.

Five new centrally-cleared,

physically-deliverable commodity futures contracts in LNG and

Carbon are now available for trading on Abaxx Commodity Futures

Exchange and Clearinghouse in Singapore. Full clearing and

execution are currently accessible through our two clearing members

StoneX and KGI Securities, while execution and broking services can

be sourced from our execution brokers Marex, Eagle Commodities,

Evolution Markets, Salamander Broking, SSY, TP ICAP and Venture

Commodities Partners, along with introducing broker, Sweet

Futures.1

Abaxx is introducing these markets to establish

physically-deliverable benchmarks for the global LNG and voluntary

carbon markets, and to be followed shortly by solutions for battery

metals. These will provide the price discovery and risk management

tools required to meet the commercial needs of market participants

and essential to unlocking investment capital required for the

transition to a low-carbon economy.

Partnering with leading technology providers

including Exberry, Baymarkets and Eventus, Abaxx offers robust,

scalable, secure trading and clearing solutions. In addition, Abaxx

provides industry-leading tools and services for market

participants, who are supported by our exchange and clearing

Independent Software Vendors (ISVs), which include Fidelity

Information Services Ltd. (FIS®), ION, Trading Technologies (TT),

and CQG.

“Singapore is the most vital global commodities

trading hub in Asia, and with the opening of Abaxx Exchange and

Clearinghouse, we are excited to support this leadership in the

futures and derivatives markets,” said Abaxx Exchange CEO, Nancy

Seah. “Our team, comprised of industry veterans from Goldman Sachs,

NYMEX, CME, and SGX, is committed to developing the next generation

of commodities futures contracts benchmarks for the energy

transition. We look forward to providing our clients with

innovative risk management tools and better price discovery for

smarter commodities markets.”

Josh Crumb, CEO of Abaxx, said: “Today’s first

trades are the culmination of years of dedicated efforts by our

team, working groups, and partners to build smarter markets. We've

collaborated with industry leaders and technology partners to

create innovative solutions that meet the evolving needs of the

commodities marketplace. This marks the first step in developing

new liquid benchmark futures contracts for the energy transition

and beyond. We are committed to providing market participants with

the tools and infrastructure necessary to navigate and capitalize

on the monumental changes in global energy and resource supply

chains.”Abaxx’s initial suite of futures contracts for LNG and

carbon are open for trading 14 hours a day, Monday through Friday.

It is intended that additional products including nickel sulphate

futures will be introduced soon. Visit

abaxx.exchange/resources-directory for a full list of clearing

members and execution brokers.

About Abaxx TechnologiesAbaxx

is building Smarter Markets — markets empowered by better financial

technology and market infrastructure to address our biggest

challenges, including the energy transition. In addition to

developing and deploying financial technologies that make

communication, trade, and transactions easier and more secure,

Abaxx is an indirect majority-owner of subsidiaries Abaxx Exchange

and Abaxx Clearing, recognized by MAS as a “recognised market

operator” (RMO) and “approved clearing house” (ACH),

respectively.

Abaxx Exchange and Abaxx Clearing are a

Singapore-based commodity futures exchange and clearinghouse,

introducing centrally cleared, physically deliverable commodities

futures and derivatives to provide better price discovery and risk

management tools for the commodities critical to our transition to

a lower-carbon economy.

For more information please

visit abaxx.tech, abaxx.exchange

and smartermarkets.media.

For more information about this press

release, please contact:

Steve Fray, CFOTel: +1 647-490-1590

Media and investor

inquiries:

Abaxx Technologies Inc.Investor Relations

TeamTel: +1 246 271 0082E-mail: ir@abaxx.tech

Cautionary Statement Regarding Forward-Looking

Information

This press release includes certain

“forward-looking statements” which do not consist of historical

facts. Forward-looking statements include estimates and statements

that describe Abaxx’s future plans, objectives, or goals, including

words to the effect that Abaxx expects a stated condition or result

to occur. Forward-looking statements may be identified by such

terms as “seeking”, “should”, “intend”, “predict”, “potential”,

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, “continue”, “plan” or the negative of these terms

and similar expressions. Since forward-looking statements are based

on current expectations and assumptions and address future events

and conditions, by their very nature they involve inherent risks

and uncertainties. Although these statements are based on

information currently available to Abaxx, Abaxx does not provide

any assurance that actual results will meet respective management

expectations. Risks, uncertainties, assumptions, and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects, and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Forward-looking information related to

Abaxx in this press release includes but is not limited to, Abaxx’s

objectives, goals, future plans, the ability to utilize the ACH and

RMO licenses to launch a regulated trading marketplace on an

economic basis, the delivery of commodities subject to futures

contracts, the addition of futures contracts for battery metals,

including nickel sulphate contracts, development of risk management

tools and expectations related to price discovery, development of

new products and expectations related to the operation of Abaxx

Exchange and Abaxx Clearing.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material

estimates and assumptions related to the factors set forth below

that, while considered reasonable by Abaxx as at the date of this

press release in light of management’s experience and perception of

current conditions and expected developments, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. Such factors impacting

forward-looking information include, among others: risks relating

to the global economic climate and extreme weather events;

dilution; Abaxx’s limited operating history; future capital needs

and uncertainty of additional financing; the competitive nature of

the industry; currency exchange risks; the need for Abaxx to manage

its planned growth and expansion; the effects of product

development and need for continued technology change; protection of

proprietary rights; the effect of government regulation and

compliance on Abaxx and the industry; regulatory risks in Singapore

and Canada; the ability to list Abaxx’s securities on stock

exchanges in a timely fashion or at all; network security risks;

the ability of Abaxx to maintain properly working systems; reliance

on key personnel; global economic and financial market

deterioration impeding access to capital or increasing the cost of

capital; taxation; resource shortages; damage to the Company’s

reputation due to the actual or perceived occurrence of any number

of events, including negative publicity with respect to the

Company’s operations, whether true or not; risk of loss due to acts

of war, terrorism, sabotage and civil disturbances; the impact of

inflation, including global energy cost increases; and volatile

securities markets impacting security pricing unrelated to

operating performance. In addition, particular factors which could

impact future results of the business of Abaxx include but are not

limited to: operations in foreign jurisdictions, protection of

intellectual property rights, contractual risk, third-party risk;

clearinghouse risk, malicious actor risks, third-party software

license risk, system failure risk, risk of technological change;

dependence of technical infrastructure; changes in the price of

commodities, capital market conditions and restriction on labor and

international travel and supply chains. Abaxx has also assumed that

no significant events occur outside of Abaxx’s normal course of

business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated, or intended. When

relying on forward-looking statements and information to make

decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Readers are cautioned that forward-looking statements are not

guarantees of future performance. Abaxx has assumed that the

material factors referred to in the previous paragraphs will not

cause such forward-looking statements and information to differ

materially from actual results or events. However, the list of

these factors is not exhaustive and is subject to change and there

can be no assurance that such assumptions will reflect the actual

outcome of such items or factors. The forward-looking statements

and information contained in this press release represents the

expectations of Abaxx as of the date of this press release and,

accordingly, is subject to change after such date. Abaxx undertakes

no obligation to update or revise any forward-looking statements

and information, whether as a result of new information, future

events or otherwise, except as required by law. Accordingly,

readers are cautioned not to place undue reliance on these

forward-looking statements and information. Cboe Canada does not

accept responsibility for the adequacy or accuracy of this press

release.

1 U.S. based Introducing Brokers, including

Sweet Futures, are CFTC-registered brokers that execute trades on

Abaxx using a non-U.S. intermediary. Such Introducing Brokers do

not have direct access to trade on Abaxx.

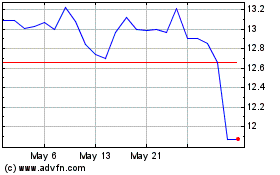

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Nov 2023 to Nov 2024