false

0001748790

0001748790

2024-09-05

2024-09-05

0001748790

amcr:OrdinarySharesParValue0.01PerShareMember

2024-09-05

2024-09-05

0001748790

amcr:Sec1.125GuaranteedSeniorNotesDue2027Member

2024-09-05

2024-09-05

0001748790

amcr:Sec5.450GuaranteedSeniorNotesDue2029Member

2024-09-05

2024-09-05

0001748790

amcr:Sec3.950GuaranteedSeniorNotesDue2032Member

2024-09-05

2024-09-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 5, 2024

AMCOR

PLC

(Exact

name of registrant as specified in its charter)

| Jersey |

001-38932 |

98-1455367 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 83 Tower Road North |

|

| Warmley, Bristol |

|

| United Kingdom |

BS30 8XP |

| (Address of principal executive offices) |

(Zip Code) |

+44 117 9753200

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

symbol(s) |

Name

of each exchange on which registered |

| Ordinary Shares, par value $0.01 per share |

AMCR |

New York Stock Exchange |

| 1.125%

Guaranteed Senior Notes Due 2027 |

AUKF/27 |

New York Stock Exchange |

| 5.450% Guaranteed Senior Notes Due 2029 |

AMCR/29 |

New York Stock Exchange |

| 3.950% Guaranteed Senior Notes Due 2032 |

AMCR/32 |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

September 5, 2024, Amcor plc (the “Company”) announced that Fred Stephan, the

Company’s President, Amcor Flexibles North America, will become Chief Operating Officer

of the Company (the “COO”), effective immediately.

Mr. Stephan,

59, has served as President of Amcor Flexibles North America and a member of the Global Management Team, since joining Amcor

in June 2019 with the acquisition of Bemis Company, where he was President of Bemis North America. Mr. Stephan has also had

oversight of the Amcor Flexibles Latin America business since April 2024. From 2004 to 2017, Mr. Stephan served in senior executive

and commercial roles at Johns Manville, a Berkshire Hathaway company, including as Senior Vice President and General Manager, Insulation

Systems. Previously, Mr. Stephan spent five years at General Electric, ultimately serving as President and CEO of GE Lighting Systems.

He began his career at GE Plastics. Mr. Stephan earned his B.S. in Electrical and Electronics Engineering from Purdue University.

Mr. Stephan

is a party to an employment agreement with the Company, dated June 21, 2019 (the “Original Employment Agreement”). On

September 5, 2024, in connection with Mr. Stephan’s appointment to the COO role, he entered into a letter agreement with

the Company, dated as of such date (the “COO Letter Agreement”) that sets forth employment and compensation terms relating

to his role as the COO, and which incorporates certain terms of the Original Employment Agreement. Pursuant to the terms of the COO Letter

Agreement, Mr. Stephan will receive an annualized base salary of USD 1,150,000. He will

continue to participate in the Management Incentive Plan (the “MIP”) including a target percentage of 100% of base salary

and payouts ranging from 0 to 200% of base salary based on individual and Company performance. Mr. Stephan will continue to participate

in the Company’s Equity Management Incentive Plan (the “EMIP”), with an annual grant valued at 50% of the cash MIP payout

paid to him and delivered in the form of time-based restricted share units (“RSUs”). He will also continue to participate

in the Long-Term Incentive Plan with grants made to him based on a grant date fair value of 225% of his base salary.

If

the Company were to terminate Mr. Stephan other than for cause (as set forth in his Original Employment Agreement) while he is serving

as COO, then he would be entitled to severance equivalent to twelve month’s base salary. Mr. Stephan’s restrictive covenants,

as set forth in his Original Employment Agreement, continue for twelve months following termination of employment. The notice period

for Mr. Stephan to terminate his employment as identified under his Original Employment Agreement is changed to six months’

written notice.

There are no transactions

since the beginning of the Company’s last fiscal year in which the Company is a participant and in which Mr. Stephan

or any members of his immediate family have any interest that are required to be reported under Item 404(a) of Regulation S-K. No

family relationships exist between Mr. Stephan and any of the Company’s directors

or executive officers. The appointment of Mr. Stephan was not pursuant to any arrangement

or understanding between him and any person, other than a director or executive officer of the Company acting in his or her official capacity.

The

foregoing descriptions of the COO Letter Agreement and the Original Employment Agreement are not complete and are in summary form only

and are qualified in their entirety by reference to the full text of the COO Letter Agreement and the Original Employment Agreement, which

are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K, respectively. A copy of the press release announcing the

appointment of Mr. Stephan to the role of COO is filed as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

* This exhibit is a management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

|

AMCOR PLC |

|

| |

|

|

|

| Date |

September 5, 2024 |

/s/ Damien Clayton |

|

| |

|

Name: |

Damien Clayton |

| |

|

Title: |

Company Secretary |

Exhibit 10.1

Strictly Private and Confidential

August 19, 2024 |  |

Fred Stephan

-- delivered electronically --

Appointment as Chief Operating Officer (“COO”)

Dear Fred,

On behalf of Amcor (the “Company”),

I am pleased to provide this letter confirming your appointment as COO, reporting to me. The terms set forth in your Employment Agreement

dated June 2019 (the “Employment Agreement”) will be amended as described below.

| 1. | Position. As COO, your duties and responsibilities are subject to change depending on the needs

of the Company. Your legal employing entity will continue to be Amcor Flexibles North America. |

| 2. | Compensation. While serving as COO: |

| a. | Your annualized base salary will be USD 1,150,000. |

| b. | You will continue to participate in the Management Incentive Plan (the “MIP”) with an incentive

opportunity at target of 100% of your salary with payouts ranging from 0% to 200% based on individual and company performance. |

| c. | You will continue to participate in the Equity Management Incentive Plan (the “EMIP”) with an annual

grant valued at 50% of the cash MIP paid to you and delivered in the form of time-based restricted share units (RSUs). |

| d. | You will continue to participate in the Long Term Incentive Plan (the “LTIP”) based on a grant

date fair value equal to 225% of your base salary. |

| e. | The restricted share unit grant provided to you under the Senior Executive Retention Share Plan (“SERSP”) will continue

unchanged. |

| f. | The terms of the MIP, EMIP, LTIP and SERSP are described in the relevant governing documents, including

the 2019 Omnibus Management Share Plan, and may be modified by Amcor from time to time. |

| 3. | Termination. The following change will apply to this clause of your Employment Agreement: |

| a. | The period of notice required for you to terminate your employment is amended from “…3 months’

written notice…” to read “…6 months’ written notice…”. |

Except as set forth above, all of the terms of

your Employment Agreement will continue to apply, including but not limited to the confidentiality obligations contained therein. Please

sign below to indicate your acceptance of the terms described in this letter, including the amendments made to your Employment Agreement.

As of September 5, 2024

Peter Konieczny, CEO

Agreed to this 22 day of August, 2024

Fred Stephan

Exhibit 10.2

| Strictly Private and Confidential |

|

| |

|

| Fred Stephan |

June 2019 |

-- By email/ in-person –

Offer of employment

Dear Fred,

I am pleased to confirm the terms and conditions

of your offer.

Position: You will be employed by

Bemis Company, Inc. (“Amcor”) as Business Group President, Amcor Flexibles North America, reporting to me and

be based in Oshkosh, Wisconsin initially although it is anticipated that this role will migrate to the Chicago area around 18 months after

close.

Start Date: Your first day of employment

with Amcor will be 11th June 2019.

Salary: Your base salary will be

US$800,000 annually, which will be paid in accordance with Amcor’s standard payroll practices. Your salary will be reviewed annually

on a date selected by Amcor. Salaries are adjusted at Amcor’s sole discretion to take into account the company performance, your

individual performance and market and industry conditions.

Management Incentive Plan (MIP):

You will be eligible to participate in the MIP (annual cash bonus plan) during each Amcor fiscal year, which begins on July 1st annually.

Your incentive opportunity is targeted at 75% of your salary with payouts ranging from 0% to 150% based on individual and company performance.

The terms of the MIP are described in the relevant governing documents applicable to that plan, and may be modified by Amcor from time

to time in its sole discretion.

Management Incentive Plan – Equity

(EMIP): You will be also be eligible to participate in the EMIP which provides an award of time restricted share rights (rights

to Amcor plc shares) to the value of 50% of the cash MIP paid to you each year. Under the terms of the EMIP as currently in effect, these

share rights become available to you two years from the date of grant, provided you remain employed with Amcor through the vesting date.

The terms of the EMIP are described in the relevant governing documents applicable to that plan, including the 2019 Omnibus Incentive

Plan (the “Omnibus Incentive Plan”), and may be modified by Amcor from time to time in accordance with the EMIP.

Long term Incentive Plan (LTIP):

You will be eligible to participate in the LTIP (annual executive equity plan). The number of shares subject to the LTIP grant made to

you will have a grant date fair value equal to 200% of your salary and will consist of a grant of share options and performance shares.

The vesting of these awards is subject to certain performance conditions and you remaining with Amcor during the period of the plan through

the vesting date. The terms of the LTIP are described in the relevant terms applicable to that plan, including the 2019 Omnibus Incentive

Plan, and may be modified by Amcor from time to time in accordance with the LTIP.

Benefits: Your current benefits

will remain unchanged throughout 2019. These benefits will be reviewed in due course. You will be informed of any changes at the time.

Company Car: You will be eligible

to receive a company car or car allowance in accordance with the rules of the Company Car Program. You will be responsible for any

personal income tax obligations arising on this allowance.

Vacation: You will be eligible for

vacation consistent with the policy at your primary work location.

Holidays: You will observe and be

paid for holidays recognized at your primary work location

Tax Matters, Withholding: Unless

otherwise noted, all forms of compensation referred to in this letter agreement are subject to reduction to reflect applicable withholding

and payroll taxes and other deductions required by law.

Compliance with policies: As a condition

of your employment, Amcor expects you to comply with all standards, policies and procedures (as amended from time to time) including,

but not limited to, anti-bribery and corruption, behavioural standards and governance, competition compliance, code of conduct and ethics,

health and safety, use of confidential information, intellectual property, minimum shareholding, share trading, privacy and other policies.

These policies will be made available to you through the intranet.

Restrictive Covenants: As a condition

of your employment and participation in various incentive plans, you will be asked to sign the Employee Confidentiality, Loyalty, Non-Compete

and Invention Agreement attached hereto.

Termination: You may terminate your

employment by giving not less than 3 months’ written notice, unless Amcor agrees to accept a shorter period of notice (although

no payment will be made to you on account of any period waived). Amcor may terminate your employment at any time, with or without notice

or Cause. However, in the event your employment is terminated by Amcor, other than for Cause or following your Disability (each as defined

in the Severance Plan, a copy of which is provided with this offer letter) or following your death, you will be eligible to participate

in Amcor’s Severance Plan, and be eligible to receive severance benefits equivalent to 12 months’ base salary. Any severance

benefits will be payable subject to your execution of a general release and such other documents as the company may reasonably request

and your compliance with the terms of this offer letter and any obligations under the Severance Plan.

Sincerely,

| /s/ Ron Delia |

|

|

Ron Delia

Chief Executive Officer

For and on behalf of Amcor |

|

| · | OFFER ACKNOWLEDGEMENT AND ACCEPTANCE |

I hereby acknowledge receipt of this employment

offer and attachment and accept the position as Business Group President – Amcor Flexibles North America with Bemis Company, Inc.

(“Amcor”). I acknowledge that this employment offer letter (along with the final form of any referenced documents)

represents the entire agreement between Amcor and I, and that no verbal or written agreements, promises or representations that are not

specifically stated in this employment offer letter, are or will be binding upon Amcor.

| /s/ Fred Stephan |

|

6-21-19 |

|

| Fred Stephan |

|

Date |

|

ATTACHMENT 1

EMPLOYEE CONFIDENTIALITY, LOYALTY, NON- COMPETE

AND INVENTION AGREEMENT

I understand that this Agreement covers a number

of matters of vital importance to Amcor Plc (“AMCOR”) and its parent, subsidiaries, and affiliates (all of which, together

with AMCOR, are referred to as the “Company”), enabling it to protect its competitive interests and also the interests of

all employees of the Company. I also understand that my employment, access to confidential information, continued and future employment

and compensation, and consideration for future increases in compensation are dependent on my agreement to the terms and conditions set

forth below. Accordingly, I agree as follows:

| 1. | Confidentiality. I agree that during my employment by AMCOR and after my employment terminates

with AMCOR for any reason, I will not disclose to any person or entity or to the public, and I will not use for my own personal benefit

or the benefit of anyone else, including but not limited to a competitor or customer of the Company, any of the following information

that I become aware of during my employment by AMCOR, which is hereafter referred to as “Confidential or Protected Information”:

(a) confidential, proprietary, or trade secret information of the Company, including but not limited to all information which is

related in any fashion to the Company’s business, operations, finances, products, machinery and equipment, suppliers, customers,

manufacturing processes and technology, research, development, prototype or developmental bottle and/or preform samples, engineering,

marketing or sales; (b) other information related in any fashion to the Company where such information is of significant value to

the Company, or is regarded by the Company as confidential, or where the law protects such information from disclosure; and (c) confidential,

proprietary or trade secret information of another person or entity provided to the Company. I understand this description of “Confidential

or Protected Information” includes all such information in any and all forms, whether written, oral or electronic, or on a computer,

tape, disk or in any other form, and includes all originals, copies, portions, and summaries of all such information. I understand that

the only exceptions to the provisions set forth in this paragraph are: (i) where necessary for me to faithfully perform my duties

as an employee of AMCOR or for other Company employees to faithfully perform their duties for the Company; (ii) where such information

is widely known in the industry; and (iii) where I have the express, prior written permission of AMCOR’s Vice President and

General Counsel. Moreover, the provisions of this paragraph shall not apply if a disclosure of Confidential or Protected Information is

necessary for me to comply with any legal obligation in which event I will notify AMCOR’s Vice President and General Counsel prior

to any such disclosure. I also agree not to use or disclose any confidential information of any of my prior employers for the benefit

of the Company and to continue to abide by all confidentiality agreements I may have with my prior employers. I further agree not to bring

onto the Company’s premises, or electronically transmit, any documents incorporating confidential information of any prior employer. |

| 2. | Company Property. I agree not to remove from the Company’s premises, or electronically

transmit, any Company property, including but not limited to documents, records, or materials containing any Confidential or Protected

Information. Upon termination of my employment with the Company for any reason, I will return to the Company all Company property

in my possession, custody, or control. Company property includes, but is not limited to, my work product and the work product of other

Company employees as well as all documents, records, and materials (whether originals, copies, portions, or summaries) containing any

Confidential or Protected Information. I understand that the only exceptions to these prohibitions are: (a) when necessary for me

to faithfully perform my duties as an employee of AMCOR or for other Company employees to faithfully perform their duties for the Company;

and (b) with the express, prior written authorization of AMCOR’s Vice President and General Counsel. |

ATTACHMENT 1

| 3. | Inventions. I agree to communicate at once to AMCOR, all inventions, ideas and improvements

(including those in the formative stages) which I conceive, make or discover (whether alone or in conjunction with others) during the

period of my employment by AMCOR that may relate in any way to the business, processes, manufacturing operations, products, research,

product development, engineering, machinery or plans of the Company (hereafter referred to as “Inventions”). Such Inventions

shall be the exclusive property of AMCOR without any obligation on the part of AMCOR or the Company to make any payment to me in addition

to my regular salary or wages. I will, at the request of AMCOR either during or after termination of my employment, execute patent and

copyright applications, powers of attorney, and assignments relating to such Inventions and will take all such other actions as AMCOR

or the Company may reasonably request to maintain and protect them. AMCOR will pay all costs and charges incurred in protecting such inventions

and improvements if it desires to protect them. I understand that this paragraph does not require the assignment of any invention which

meets all of the following conditions: (i) no equipment, supplies, facilities or Confidential or Protected Information of the Company

was used in its development; (ii) it was developed entirely on my own time; (iii) it does not relate to the Company’s

business or to the Company’s actual or clearly anticipated research and development programs; and (iv) it does not result from

any work performed by me for the Company. I understand that I am obligated to disclose to AMCOR before commencing my employment and upon

signing this Agreement, any inventions that I made prior to my employment by AMCOR and that were not assigned to my prior employer. I

will disclose to AMCOR promptly, and in any event prior to any publication, any publishable articles or public presentations that I write

or prepare during my employment or that relate to Inventions that I made during my employment. I may not publish such articles or give

such presentations without the prior written approval of AMCOR’s Vice President and General Counsel. The Company shall have the

exclusive copyright to any such articles and presentations, unless a third party in receipt of my article or presentation requires its

own exclusive copyright, in which case the Company must give its consent to such publication. |

| 4. | Non-Sollicitation and Non-Competition. (a) I agree that during my employment with AMCOR, I

will communicate with the Company’s customers and suppliers only for the benefit of the Company and not for my own personal benefit

or the benefit of any other person or entity. I further agree that for a period of twelve (12) months after my employment terminates with

AMCOR for any reason, I will not directly or indirectly: (i) solicit, accept or help others to accept, the packaging business

of any customer of the Company; (ii) induce or seek to influence any customer or supplier of the Company to discontinue, modify,

or reduce its business relationship with the Company; (iii) assist or cause any person or entity to engage in any of the above actions.

(b) I also agree that during my employment with the Company and for a period of twelve (12) months after my employment terminates

for any reason, I will not directly or indirectly: (i) solicit or contact any of the Company’s employees for the purpose

of employing them or causing them to leave the employ of the Company or to become employed by another person or entity; (ii) employ

or engage any employee of the Company; or (iii) become employed by, consult with or render services to: (a) any business entity

that develops, produces or sells packaging, or has plans to do so within such twelve (12) month period, in any country in which the Company

develops, produces or sells flexible packaging, when such position involves any similar responsibilities to any position I occupied at

AMCOR or where it is likely that I will use or disclose Amcor’s confidential information or trade secrets in such position, or (b) any

customer that you or any of your direct reports solicited, serviced, or were assigned to or responsible for, during the three years preceding

the termination of your employment with the Company for any reason. If you are uncertain whether a particular customer is covered by this

provision, you may contact the Company for clarification. |

| 5. | Injunction. I acknowledge that any breach of any of the provisions of this Agreement would

cause irreparable harm to the Company. Accordingly, in the event of such a breach or threatened breach, the Company shall be entitled

to a temporary restraining order and other forms of injunctive and equitable relief from a court of law without the requirement of posting

a bond or other security in court in addition to any other rights and remedies, including compensatory and punitive damages |

ATTACHMENT 1

| 6. | Jurisdiction; forum selection; choice of laws. In any judicial proceeding for a breach or

threatened breach of this agreement, I consent to the jurisdiction of the state and federal courts in the state of Wisconsin, agree

not to commence an action relating to this agreement in any state other than Wisconsin or in any other location or country, agree not

to seek to move or transfer a judicial proceeding brought by Amcor or the company to a different court, waive my right to trial by jury,

and agree that service of legal process and other legal papers by ordinary mail or overnight express courier to my residence or work address

shall be good and sufficient service. I also agree that the validity, interpretation, construction, performance, and enforcement of this

agreement will be governed solely by the internal laws of Wisconsin and not by the laws of any other state, territory, province, or country. |

| 7. | No Conflicting Obligations. I represent that I am not a party to any agreements that conflict

with the rights of the Company under this Agreement. I will advise the Company of any such agreement with a prior employer before I commence

employment with the Company or, if I have already commenced employment, before I sign this Agreement. I agree to abide by and honor any

such agreement with a prior employer to the full extent such agreement is enforceable. |

| 8. | Miscellaneous Provisions. The provisions of this Agreement shall survive the termination

of my employment and govern my conduct and actions after my employment with AMCOR has terminated for any reason. If any provision of this

Agreement is declared by a court to be invalid or unreasonable, I agree that the court should interpret or modify the provision in

a manner that affords the Company the most protection allowed by law. If any provision of this Agreement is declared by a court to be

void, illegal or invalid for any other reason, such provision shall be severed from this Agreement and the remaining provisions shall

remain in full force and effect. If I become employed by any subsidiary or affiliate of AMCOR or by its parent corporation or any of the

subsidiaries or affiliates of AMCOR’s parent, or if I become employed by a successor of AMCOR’s business, I agree that

this Agreement shall be binding upon me in all respects and that the new employer’s name shall be substituted for AMCOR throughout

this Agreement, unless I execute a new agreement with such new employer which specifically amends, terminates or supersedes this Agreement.

This Agreement may not be modified, waived, or terminated unless such modification, waiver, or termination is agreed to in a writing signed

by me and AMCOR. The failure of the Company to enforce any provision of this Agreement or to act promptly after a breach shall not be

deemed a waiver of any of AMCOR’s or the Company’s rights. This Agreement is for the benefit of and is binding upon AMCOR’s

and the Company’s agents, successors and assigns, as well as my heirs, executors, representatives, and agents. This is the entire

agreement of the parties and supersedes all prior and contemporaneous agreements, understandings, and representations of the parties pertaining

to the subject matter set forth in this Agreement. The titles of each section of this Agreement are for the convenience of the parties

only and are not part of the Agreement. The provisions of this Agreement are in addition to my duties of loyalty imposed by law. |

ACKNOWLEDGEMENT AND ACCEPTANCE

I have read this Agreement and I acknowledge,

understand, and agree to all of the terms, conditions, and representations.

|

/s/ Fred Stephan |

|

6-21-2019 |

|

| Fred Stephan |

|

Date |

|

Exhibit 99.1

Amcor announces senior executive appointments

to accelerate organic growth

Names Fred Stephan Chief Operating Officer and

David Clark Chief Sustainability Officer

ZURICH, September 5, 2024 – Amcor (NYSE: AMCR; ASX: AMC),

a global leader in developing and producing responsible packaging solutions, today announced senior executive appointments designed to

help accelerate organic growth in the business.

Fred Stephan, previously President, Amcor Flexibles North America,

has been appointed to the newly introduced role of Chief Operating Officer. Fred will report to the Chief Executive Officer and will be

responsible for enhancing the Company’s ability to leverage and accelerate profitable growth opportunities across the global flexible

packaging businesses, ensuring coordinated execution between business operations and commercial teams.

David Clark, previously Amcor Vice President, Sustainability, has been

appointed to the new Chief Sustainability Officer role. In this role David will report directly to the Chief Executive Officer and have

responsibility for Amcor’s sustainability strategies and policies, overseeing their implementation across the Company.

Peter Konieczny, Chief Executive Officer said, “Amcor is an outstanding

Company that has become a very strong and well positioned global business with significant growth potential. At this stage in the Company’s

evolution, we have a valuable opportunity to accelerate organic growth by leveraging our global footprint and scale more effectively.”

“By introducing the Chief Operating Officer role, we are evolving

our organization structure to help facilitate greater collaboration and drive faster growth across our flexibles business. At the same

time, aligned with our purpose, we are elevating sustainability by creating the Chief Sustainability Officer role. This enables us to

further increase our focus on the significant growth opportunity we can continue to unlock by commercializing solutions that drive the

industry toward a circular economy for packaging, while reducing carbon footprint.”

“Fred and David are world class, respected leaders with extensive

experience. I look forward to their contributions to realizing our growth potential and delivering industry leading value for our customers,

our shareholders and the environment.”

About Fred Stephan

Fred Stephan, based in Deerfield, Illinois, has served as President

of Amcor's Flexibles North America and a member of the Global Management Team, since joining Amcor in June 2019 with the acquisition of

Bemis Company, where he was President of Bemis North America. Mr. Stephan has also had oversight of the Amcor Flexibles Latin America

business since April 2024. From 2004 to 2017, Mr. Stephan served in senior executive and commercial roles at Johns Manville, a Berkshire

Hathaway company, including as Senior Vice President and General Manager, Insulation Systems. Previously, Mr. Stephan spent five years

at General Electric, ultimately serving as President and CEO of GE Lighting Systems. He began his career at GE Plastics. Mr. Stephan earned

his B.S. in Electrical and Electronics Engineering from Purdue University.

About David Clark

David Clark, based in Ann Arbor, Michigan, joined Amcor in 2004 and

has played a key role in advancing Amcor’s sustainability agenda for the last 20 years, most recently serving as Vice President

of Sustainability. Previously Mr. Clark was Vice President, Safety, Environment & Sustainability from 2007 to 2018 and Director Sustainability

from 2005 to 2007. Prior to these roles Mr. Clark served in Amcor Plant Manager roles and had oversight of an Amcor owned recycling plant

in 2004. Before joining Amcor, Mr. Clark worked in the high-tech manufacturing and laser optics industries, with roles in the U.S. and

Europe. Mr. Clark holds a B.S., Physics, from the University of Michigan and an MBA from Pepperdine University.

About Amcor

Amcor is a global leader in developing and producing responsible packaging

solutions across a variety of materials for food, beverage, pharmaceutical, medical, home and personal-care, and other products. Amcor

works with leading companies around the world to protect products, differentiate brands, and improve supply chains. The company offers

a range of innovative, differentiating flexible and rigid packaging, specialty cartons, closures and services. The company is focused

on making packaging that is increasingly recyclable, reusable, lighter weight and made using an increasing amount of recycled content.

In fiscal year 2024, 41,000 Amcor people generated $13.6 billion in annual sales from operations that span 212 locations in 40 countries.

NYSE: AMCR; ASX: AMC

www.amcor.com│LinkedIn│Facebook│YouTube

Contact Information

| Investors |

|

|

|

|

| Tracey Whitehead |

|

Damien Bird |

|

Damon Wright |

| Global Head of Investor Relations |

|

Vice President Investor Relations

Asia Pacific |

|

Vice President Investor Relations

North America |

| Amcor |

|

Amcor |

|

Amcor |

| +61 408 037 590 |

|

+61 481 900 499 |

|

+1 224 313 7141 |

| tracey.whitehead@amcor.com |

|

damien.bird@amcor.com |

|

damon.wright@amcor.com |

| |

|

|

|

|

| Media - Australia |

|

Media - Europe |

|

Media - North America |

| James Strong |

|

Ernesto Duran |

|

Julie Liedtke |

| Managing Director |

|

Head of Global Communications |

|

Director, Media Relations |

| Sodali & Co |

|

Amcor |

|

Amcor |

| +61 448 881 174 |

|

+41 78 698 69 40 |

|

+1 847 204 2319 |

| james.strong@sodali.com |

|

ernesto.duran@amcor.com |

|

julie.liedtke@amcor.com |

v3.24.2.u1

Cover

|

Sep. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 05, 2024

|

| Entity File Number |

001-38932

|

| Entity Registrant Name |

AMCOR

PLC

|

| Entity Central Index Key |

0001748790

|

| Entity Tax Identification Number |

98-1455367

|

| Entity Incorporation, State or Country Code |

Y9

|

| Entity Address, Address Line One |

83 Tower Road North

|

| Entity Address, City or Town |

Warmley, Bristol

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

BS30 8XP

|

| Country Region |

+44

|

| City Area Code |

117

|

| Local Phone Number |

9753200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Ordinary Shares, par value $0.01 per share[Member] |

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.01 per share

|

| Trading Symbol |

AMCR

|

| Security Exchange Name |

NYSE

|

| 1.125% Guaranteed Senior Notes Due 2027 [Member] |

|

| Title of 12(b) Security |

1.125%

Guaranteed Senior Notes Due 2027

|

| Trading Symbol |

AUKF/27

|

| Security Exchange Name |

NYSE

|

| 5.450% Guaranteed Senior Notes Due 2029 [Member] |

|

| Title of 12(b) Security |

5.450% Guaranteed Senior Notes Due 2029

|

| Trading Symbol |

AMCR/29

|

| Security Exchange Name |

NYSE

|

| 3.950% Guaranteed Senior Notes Due 2032 [Member] |

|

| Title of 12(b) Security |

3.950% Guaranteed Senior Notes Due 2032

|

| Trading Symbol |

AMCR/32

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_OrdinarySharesParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec1.125GuaranteedSeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec5.450GuaranteedSeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec3.950GuaranteedSeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

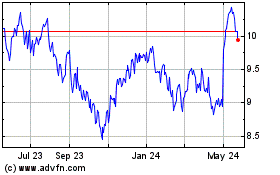

Amcor (NYSE:AMCR)

Historical Stock Chart

From Dec 2024 to Jan 2025

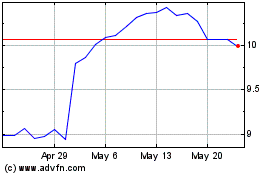

Amcor (NYSE:AMCR)

Historical Stock Chart

From Jan 2024 to Jan 2025