Apple Hospitality REIT, Inc. (NYSE: APLE) (the “Company” or

“Apple Hospitality”) today announced results of operations for the

fourth quarter and full year ended December 31, 2024.

Apple Hospitality REIT,

Inc.

Selected Statistical and

Financial Data

As of and For the Three Months

and Year Ended December 31

(Unaudited) (in thousands,

except statistical and per share amounts)(1)

Three Months Ended

Year Ended

December 31,

December 31,

2024

2023

% Change

2024

2023

% Change

Net income

$29,817

$20,765

43.6%

$214,064

$177,489

20.6%

Net income per share

$0.12

$0.09

33.3%

$0.89

$0.77

15.6%

Operating income

$49,903

$38,910

28.3%

$292,759

$247,481

18.3%

Operating margin %

15.0%

12.5%

250 bps

20.5%

18.4%

210 bps

Adjusted EBITDAre

$96,590

$90,536

6.7%

$467,216

$436,895

6.9%

Comparable Hotels Adjusted Hotel

EBITDA

$108,434

$105,310

3.0%

$508,609

$506,736

0.4%

Comparable Hotels Adjusted Hotel EBITDA

Margin %

32.9%

33.3%

(40 bps)

36.0%

36.7%

(70 bps)

Modified funds from operations (MFFO)

$76,503

$72,387

5.7%

$388,511

$366,884

5.9%

MFFO per share

$0.32

$0.31

3.2%

$1.61

$1.60

0.6%

Average Daily Rate (ADR) (Actual)

$152.39

$149.88

1.7%

$158.01

$155.76

1.4%

Occupancy (Actual)

71.4%

69.6%

2.6%

75.0%

74.2%

1.1%

Revenue Per Available Room (RevPAR)

(Actual)

$108.75

$104.27

4.3%

$118.54

$115.60

2.5%

Comparable Hotels ADR

$152.97

$152.09

0.6%

$158.94

$158.09

0.5%

Comparable Hotels Occupancy

71.3%

69.9%

2.0%

75.1%

74.4%

0.9%

Comparable Hotels RevPAR

$109.14

$106.31

2.7%

$119.36

$117.67

1.4%

Distributions paid

$57,841

$55,164

4.9%

$243,722

$238,283

2.3%

Distributions paid per share

$0.24

$0.24

0.0%

$1.01

$1.04

(2.9%)

Cash and cash equivalents

$10,253

Total debt outstanding

$1,476,800

Total debt outstanding, net of cash and

cash equivalents

$1,466,547

Total debt outstanding, net of cash and

cash equivalents, to total capitalization (2)

28.5%

(1)

Explanations of and reconciliations to net

income determined in accordance with generally accepted accounting

principles (“GAAP”) of non-GAAP financial measures, Adjusted

EBITDAre, Comparable Hotels Adjusted Hotel EBITDA and MFFO, are

included below.

(2)

Total debt outstanding, net of cash and

cash equivalents ("net total debt outstanding"), divided by net

total debt outstanding plus equity market capitalization based on

the Company’s closing share price of $15.35 on December 31,

2024.

Comparable Hotels is defined as the 219

hotels owned and held for use by the Company as of December 31,

2024, and excludes one non-hotel property. For hotels acquired

during the periods noted, the Company has included, as applicable,

results of those hotels for periods prior to the Company's

ownership, and for dispositions and assets held for sale, results

have been excluded for the Company's period of ownership. Results

for periods prior to the Company's ownership have not been included

in the Company's actual Consolidated Financial Statements and are

included only for comparison purposes. Results included for periods

prior to the Company's ownership are based on information from the

prior owner of each hotel and have not been audited or

adjusted.

Justin Knight, Chief Executive Officer of Apple Hospitality,

commented, “Driven by steady improvement in business transient

demand, the ongoing strength in leisure travel and muted supply

growth, we achieved Comparable Hotels RevPAR growth of

approximately 3% for the fourth quarter and more than 1% for the

full year 2024, as compared to the same periods of 2023,

respectively. We remain intently focused on maximizing the

profitability of our hotels through strategic asset management.

Bolstered by recent acquisitions, continued strength in ADR and

moderating expense growth, we are pleased to report strong

bottom-line performance for the quarter and the full year 2024.

Although winter weather conditions tempered our performance in

January, we have seen improvement in February and expect to see

continued positive momentum in operating fundamentals as we move

through 2025.

“Our thoughts and prayers are with everyone impacted by

California's wildfires," Mr. Knight said. "We are fortunate that

our hotels did not sustain any material damage and have remained

open and operational. We commend the operating teams at our hotels

for their courage and their dedication to the well-being of our

guests and associates. As recovery from the fires moves forward, we

will continue to support the ongoing efforts of our operating teams

to care for guests, associates and their surrounding

communities.”

Mr. Knight continued, “Our disciplined approach to capital

allocation and portfolio management has defined our strategy

throughout our history and was especially evident in 2024. During

the year, we acquired two hotels for $196 million, sold six

non-core hotels for more than $63 million, repurchased

approximately $35 million in common shares and reinvested $78

million in our existing portfolio. We continue to actively seek

opportunities that will further optimize our portfolio, drive

earnings per share and maximize long-term value for our

shareholders. Our differentiated strategy of investing in a broadly

diversified portfolio of high-quality, rooms-focused hotels with

low leverage has been tested across economic cycles and

consistently yielded compelling results for our investors. We are

confident we are well positioned for continued outperformance.”

Hotel Portfolio Overview

As of December 31, 2024, Apple Hospitality owned 221 hotels with

an aggregate of 29,764 guest rooms located in 86 markets throughout

37 states and the District of Columbia, including two hotels

classified as held for sale, one of which was sold in February 2025

while the other is expected to be sold in the first quarter of

2025.

Fourth Quarter and Full Year 2024

Highlights

- Strong operating performance: Comparable Hotels ADR was

$153 for the fourth quarter 2024 and $159 for the full year 2024,

both up approximately 1% as compared to the same periods of 2023;

Comparable Hotels Occupancy was 71% for the fourth quarter 2024 and

75% for the full year 2024, up 2% and approximately 1% as compared

to the same periods of 2023, respectively; and Comparable Hotels

RevPAR was $109 for the fourth quarter 2024 and $119 for the full

year 2024, up approximately 3% and 1% as compared to the same

periods of 2023, respectively. Comparable Hotels Occupancy, ADR and

RevPAR exceeded industry averages as reported by STR for the full

year 2024. Preliminary results for the month of January 2025 show a

slight improvement in Comparable Hotels RevPAR as compared to

January 2024, driven by growth in ADR offsetting a decline in

occupancy related to extreme winter weather conditions.

- Strong bottom-line performance: The Company achieved

Comparable Hotels Adjusted Hotel EBITDA of approximately $108

million for the fourth quarter 2024 and $509 million for the full

year 2024, an improvement of 3% as compared to the fourth quarter

2023 and a slight improvement over the full year 2023. Comparable

Hotels Adjusted Hotel EBITDA Margin was approximately 32.9% for the

fourth quarter 2024 and 36.0% for the full year 2024, down 40 bps

and 70 bps to the same periods of 2023, respectively. The Company

achieved Adjusted EBITDAre of approximately $97 million for the

fourth quarter 2024 and $467 million for the full year 2024, both

up approximately 7% as compared to the same periods of 2023. The

Company achieved MFFO of approximately $77 million for the fourth

quarter 2024 and $389 million for the full year 2024, both up

approximately 6% as compared to the same periods of 2023.

- Transactional activity: As previously announced, during

the year ended December 31, 2024, the Company acquired two hotels

for a combined total purchase price of approximately $196.3 million

and sold six hotels for a combined gross sales price of

approximately $63.4 million. Subsequent to year end, in February

2025, the Company sold one additional hotel for $8.3 million. The

Company currently has one additional hotel under contract for

purchase for an anticipated total purchase price of approximately

$98.2 million and one additional hotel under contract for sale for

a gross sales price of approximately $12.7 million.

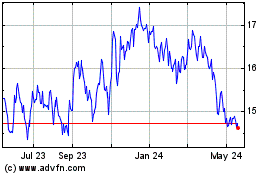

- Capital markets: During the year ended December 31,

2024, the Company purchased, under its Share Repurchase Program,

approximately 2.4 million common shares at a weighted-average

market purchase price of approximately $14.16 per common share, for

an aggregate purchase price of approximately $34.7 million.

- Balance sheet: The Company has maintained the strength

and flexibility of its balance sheet. At December 31, 2024, the

Company’s total debt to total capitalization, net of cash and cash

equivalents, was approximately 28%.

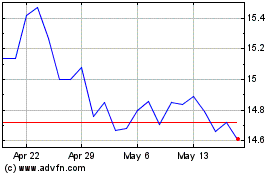

- Monthly distributions: During the three months ended

December 31, 2024, the Company paid distributions totaling $0.24

per common share. Based on the Company’s common stock closing price

of $14.76 on February 21, 2025, the current annualized regular

monthly cash distribution of $0.96 per common share represents an

annual yield of approximately 6.5%.

- Corporate Responsibility Report: In December 2024, the

Company published its annual Corporate Responsibility Report which

details the Company's performance and initiatives in this area and

features its commitment to environmental sustainability, governance

and resiliency, corporate employees, hotel associates and guests,

communities and other stakeholders. The Company's 2024 Corporate

Responsibility Report and related materials can be found on the

Corporate Responsibility section of the Company's website.

The Company is providing monthly performance detail for its

Comparable Hotels with comparisons to the respective periods of

2023. The following table highlights the Company’s Comparable

Hotels monthly performance during the fourth quarter of 2024 as

compared to the fourth quarter of 2023 (in thousands, except

statistical data):

% Change

October

November

December

October

November

December

October

November

December

2024

2024

2024

Q4 2024

2023

2023

2023

Q4 2023

2023

2023

2023

Q4 2023

ADR (Comparable Hotels)

$166.55

$148.94

$140.06

$152.97

$165.38

$149.55

$138.21

$152.09

0.7%

(0.4%)

1.3%

0.6%

Occupancy (Comparable Hotels)

80.0%

71.6%

62.4%

71.3%

77.5%

70.4%

61.8%

69.9%

3.2%

1.7%

1.0%

2.0%

RevPAR (Comparable Hotels)

$133.26

$106.66

$87.42

$109.14

$128.13

$105.34

$85.42

$106.31

4.0%

1.3%

2.3%

2.7%

Operating income (Actual)

$34,060

$13,720

$2,123

$49,903

$30,204

$11,972

$(3,266)

$38,910

12.8%

14.6%

165.0%

28.3%

Adjusted Hotel EBITDA (Actual) (1)

$53,866

$33,414

$21,703

$108,983

$49,280

$30,470

$21,988

$101,738

9.3%

9.7%

(1.3%)

7.1%

Comparable Hotels Adjusted Hotel EBITDA

(2)

$53,361

$33,278

$21,795

$108,434

$51,308

$31,210

$22,792

$105,310

4.0%

6.6%

(4.4%)

3.0%

(1)

See explanation and reconciliation of

Adjusted Hotel EBITDA to net income included below.

(2)

See explanation and reconciliation of

Comparable Hotels Adjusted Hotel EBITDA to Adjusted Hotel EBITDA

included below.

Comparable Hotels is defined as the 219

hotels owned and held for use by the Company as of December 31,

2024, and excludes one non-hotel property. For hotels acquired

during the periods noted, the Company has included, as applicable,

results of those hotels for periods prior to the Company's

ownership, and for dispositions and assets held for sale, results

have been excluded for the Company's period of ownership. Results

for periods prior to the Company's ownership have not been included

in the Company's actual Consolidated Financial Statements and are

included only for comparison purposes. Results included for periods

prior to the Company's ownership are based on information from the

prior owner of each hotel and have not been audited or

adjusted.

Portfolio Activity

2024 Acquisitions

As previously announced, during 2024, the Company acquired two

hotels for a combined total purchase price of approximately $196.3

million. The acquisitions include the following:

- In March 2024, the Company acquired the 234-room AC Hotel by

Marriott Washington DC Convention Center for a total purchase price

of approximately $116.8 million, or $499,000 per key.

- In June 2024, the Company acquired the newly built, 262-room

Embassy Suites by Hilton Madison Downtown for a total purchase

price of approximately $79.5 million, or $303,000 per key.

Contract for Potential Acquisition

As previously announced, the Company continues to have one

additional hotel under contract for purchase, a Motto by Hilton

that is under development in downtown Nashville, Tennessee, for an

anticipated total purchase price of approximately $98.2 million

with an expected 260 rooms, which the Company anticipates acquiring

in late 2025 following completion of construction. There are many

conditions to closing on this hotel that have not yet been

satisfied, and there can be no assurance that a closing on this

hotel will occur under the outstanding purchase contract.

2024 Dispositions

As previously announced, during the year ended December 31,

2024, the Company sold six hotels for a combined gross sales price

of approximately $63.4 million, resulting in a combined gain on the

sales of approximately $19.7 million, which is included in the

Company's consolidated statement of operations for the year ended

December 31, 2024. The Company's 2024 dispositions include the

following:

- In February 2024, the Company sold the 122-room Hampton Inn by

Hilton Bentonville/Rogers and the 126-room Homewood Suites by

Hilton Bentonville-Rogers in one transaction, for a combined gross

sales price of approximately $33.5 million. The Company used a

portion of the net proceeds from the sale of these two hotels to

complete a 1031 exchange with the acquisition of the AC Hotel

Washington DC Convention Center in March 2024, which resulted in

the deferral of taxable gains of $15.1 million.

- In May 2024, the Company sold the 82-room SpringHill Suites by

Marriott Greensboro for a gross sales price of approximately $7.1

million.

- In November 2024, the Company sold the 90-room Courtyard by

Marriott Wichita East for a gross sales price of approximately $3.1

million.

- In December 2024, the Company sold the 97-room TownePlace

Suites by Marriott Knoxville Cedar Bluff for a gross sales price of

approximately $9.4 million.

- In December 2024, the Company sold the 117-room Hilton Garden

Inn Austin North for a gross sales price of approximately $10.4

million.

During the year ended December 31, 2024, the Company recognized

an impairment loss of approximately $3.1 million in the aggregate

with respect to three of the properties sold.

2025 Disposition

In February 2025, the Company sold the 76-room Homewood Suites

by Hilton Chattanooga-Hamilton Place for a gross sales price of

approximately $8.3 million.

Contract for Potential Disposition

In December 2024, the Company entered into a contract for the

sale of its 130-room SpringHill Suites by Marriott Indianapolis

Fishers for a gross sales price of approximately $12.7 million. The

Company expects to complete the sale of the hotel during the first

quarter 2025. There are many conditions to closing on the sale of

this hotel that have not yet been satisfied, and there can be no

assurance that closing on the sale of this hotel will occur under

the outstanding sale agreement.

Capital Improvements

Apple Hospitality consistently reinvests in its hotels to

maintain and enhance each property’s relevance and competitive

position within its respective market. During the year ended

December 31, 2024, the Company invested approximately $78 million

in capital expenditures. The Company anticipates investing

approximately $80 million to $90 million in capital improvements

during 2025, which includes comprehensive renovation projects for

approximately 20 hotels.

Balance Sheet and

Liquidity

As of December 31, 2024, the Company had approximately $1.5

billion of total outstanding debt with a current combined

weighted-average interest rate of approximately 4.7%, cash on hand

of approximately $10 million and availability under its revolving

credit facility of approximately $568 million. Excluding

unamortized debt issuance costs and fair value adjustments, the

Company’s total outstanding debt as of December 31, 2024, was

comprised of approximately $254 million in property-level debt

secured by 14 hotels and approximately $1.2 billion outstanding

under its unsecured credit facilities. The Company continues to

maintain a strong and flexible balance sheet, and in July 2024,

amended its unsecured $85 million term loan facility, which

increased the amount of the term loan facility to $130 million,

with the additional $45 million funded at closing, and extended the

maturity date to July 25, 2026, with the optionality, subject to

certain conditions, to extend the maturity date further to July 25,

2027. Additionally, in August 2024, the Company repaid in full one

secured mortgage loan, for a total of approximately $20 million.

The number of unencumbered hotels in the Company’s portfolio as of

December 31, 2024, was 207. The Company’s total debt to total

capitalization, net of cash and cash equivalents at December 31,

2024, was approximately 28%, which provides Apple Hospitality with

financial flexibility to fund capital requirements and pursue

opportunities in the marketplace. As of December 31, 2024, the

Company’s weighted-average debt maturities were approximately three

years.

Capital Markets

Share Repurchase Program

The Company has in place a Share Repurchase Program that

provides for share repurchases in open market transactions. During

the year ended December 31, 2024, the Company purchased, under its

Share Repurchase Program, approximately 2.4 million common shares

at a weighted-average market purchase price of approximately $14.16

per common share, for an aggregate purchase price of approximately

$34.7 million. As of December 31, 2024, the Company had

approximately $301 million remaining under its Share Repurchase

Program for the repurchase of shares.

ATM Program

The Company also has in place an at-the-market offering program

(the “ATM Program”). As of December 31, 2024, the Company had $500

million remaining under its ATM Program for the issuance of shares.

No shares were sold under the current or prior ATM Program during

the three months and year ended December 31, 2024.

Shareholder

Distributions

During the three months ended December 31, 2024, the Company

paid distributions totaling $0.24 per common share. During the year

ended December 31, 2024, the Company paid distributions totaling

$1.01 per common share for a total of approximately $243.7 million.

On January 15, 2025, the Company paid a regular monthly cash

distribution of $0.08 per common share and a special cash

distribution of $0.05 per common share, for a combined distribution

of $0.13 per common share, to shareholders of record as of December

31, 2024.

Based on the Company’s common stock closing price of $14.76 on

February 21, 2025, the current annualized regular monthly cash

distribution of $0.96 per common share represents an annual yield

of approximately 6.5%. While the Company currently expects monthly

distributions to continue, each distribution is subject to approval

by the Company’s Board of Directors. The Company’s Board of

Directors, in consultation with management, will continue to

monitor the Company’s distribution rate and timing relative to the

performance of its hotels, capital improvement needs, varying

economic cycles, acquisitions, dispositions, other cash

requirements and the Company’s REIT status for federal income tax

purposes, and may make adjustments as it deems appropriate.

2025 Outlook

The Company is providing its operational and financial outlook

for 2025. This outlook, which is based on management’s current view

of both operating and economic fundamentals of the Company's

existing portfolio of hotels, does not take into account any

unanticipated developments in its business or changes in its

operating environment, nor does it take into account any

unannounced hotel acquisitions or dispositions. Comparable Hotels

RevPAR Change guidance, which is the change in Comparable Hotels

RevPAR in 2025 compared to 2024, and Comparable Hotels Adjusted

Hotel EBITDA Margin % guidance include properties acquired and

announced for acquisition by year-end 2025 as if the hotels were

owned as of January 1, 2024, exclude completed dispositions since

January 1, 2024, exclude announced dispositions anticipated to

close by year-end 2025, and exclude one non-hotel property. Results

for periods prior to the Company’s ownership are not included in

the Company’s actual Consolidated Financial Statements, are based

on information from the prior owner of each hotel, and have not

been audited or adjusted. For the full year 2025, the Company

anticipates its 2025 results will be in the following range:

2025 Guidance(1)

Low-End

High-End

Net income

$173 Million

$202 Million

Comparable Hotels RevPAR Change

1.0%

3.0%

Comparable Hotels Adjusted Hotel EBITDA

Margin %

34.2%

35.2%

Adjusted EBITDAre

$447 Million

$471 Million

Capital expenditures

$80 Million

$90 Million

(1)

Explanations of and reconciliations to net

income guidance of Adjusted EBITDAre and Comparable Hotels Adjusted

Hotel EBITDA guidance are included below.

Fourth Quarter and Full Year 2024

Earnings Conference Call

The Company will host a quarterly conference call for investors

and interested parties at 10 a.m. Eastern Time on Tuesday, February

25, 2025. The conference call will be accessible by telephone and

the internet. To access the call, participants from within the U.S.

should dial 877-407-9039, and participants from outside the U.S.

should dial 201-689-8470. Participants may also access the call via

live webcast by visiting the Investor Information section of the

Company's website at ir.applehospitalityreit.com. A replay of the

call will be available from approximately 2 p.m. Eastern Time on

February 25, 2025, through 11:59 p.m. Eastern Time on March 11,

2025. To access the replay, the domestic dial-in number is

844-512-2921, the international dial-in number is 412-317-6671, and

the passcode is 13750570. The archive of the webcast will be

available on the Company's website for a limited time.

About Apple Hospitality REIT,

Inc.

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded

real estate investment trust (“REIT”) that owns one of the largest

and most diverse portfolios of upscale, rooms-focused hotels in the

United States. Apple Hospitality’s portfolio consists of 220 hotels

with approximately 29,700 guest rooms located in 85 markets

throughout 37 states and the District of Columbia. Concentrated

with industry-leading brands, the Company’s hotel portfolio

consists of 98 Marriott-branded hotels, 117 Hilton-branded hotels

and five Hyatt-branded hotels. For more information, please visit

www.applehospitalityreit.com.

Apple Hospitality REIT Non-GAAP

Financial Measures

The Company considers the following non-GAAP financial measures

useful to investors as key supplemental measures of its operating

performance: Funds from Operations (“FFO”); Modified FFO (“MFFO”);

Earnings Before Interest, Income Taxes, Depreciation and

Amortization (“EBITDA”); Earnings Before Interest, Income Taxes,

Depreciation and Amortization for Real Estate (“EBITDAre”);

Adjusted EBITDAre; Adjusted Hotel EBITDA; Comparable Hotels

Adjusted Hotel EBITDA; and Same Store Hotels Adjusted Hotel EBITDA.

These non-GAAP financial measures should be considered along with,

but not as alternatives to, net income (loss), cash flow from

operations or any other operating GAAP measure. FFO, MFFO, EBITDA,

EBITDAre, Adjusted EBITDAre, Adjusted Hotel EBITDA, Comparable

Hotels Adjusted Hotel EBITDA and Same Store Hotels Adjusted Hotel

EBITDA are not necessarily indicative of funds available to fund

the Company’s cash needs, including its ability to make cash

distributions. Although FFO, MFFO, EBITDA, EBITDAre, Adjusted

EBITDAre, Adjusted Hotel EBITDA, Comparable Hotels Adjusted Hotel

EBITDA and Same Store Hotels Adjusted Hotel EBITDA, as calculated

by the Company, may not be comparable to FFO, MFFO, EBITDA,

EBITDAre, Adjusted EBITDAre, Adjusted Hotel EBITDA, Comparable

Hotels Adjusted Hotel EBITDA and Same Store Hotels Adjusted Hotel

EBITDA, as reported by other companies that do not define such

terms exactly as the Company defines such terms, the Company

believes these supplemental measures are useful to investors when

comparing the Company’s results between periods and with other

REITs. Reconciliations of these non-GAAP financial measures to net

income (loss) are provided in the following pages.

Forward-Looking Statements

Disclaimer

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are typically identified by use

of statements that include phrases such as “may,” “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “project,” “target,”

“goal,” “plan,” “should,” “will,” “predict,” “potential,”

“outlook,” “strategy,” and similar expressions that convey the

uncertainty of future events or outcomes. Such statements involve

known and unknown risks, uncertainties, and other factors which may

cause the actual results, performance, or achievements of the

Company to be materially different from future results, performance

or achievements expressed or implied by such forward-looking

statements.

Such factors include, but are not limited to, the ability of the

Company to effectively acquire and dispose of properties and

redeploy proceeds; the anticipated timing and frequency of

shareholder distributions; the ability of the Company to fund

capital obligations; the ability of the Company to successfully

integrate pending transactions and implement its operating

strategy; changes in general political, economic and competitive

conditions and specific market conditions (including the potential

effects of inflation or a recessionary environment); reduced

business and leisure travel due to geopolitical uncertainty,

including terrorism and acts of war; travel-related health

concerns, including widespread outbreaks of infectious or

contagious diseases in the U.S.; inclement weather conditions,

including natural disasters such as hurricanes, earthquakes and

wildfires; government shutdowns, airline strikes or equipment

failures, or other disruptions; adverse changes in the real estate

and real estate capital markets; financing risks; changes in

interest rates; litigation risks; regulatory proceedings or

inquiries; and changes in laws or regulations or interpretations of

current laws and regulations that impact the Company’s business,

assets or classification as a REIT. Although the Company believes

that the assumptions underlying the forward-looking statements

contained herein are reasonable, any of the assumptions could be

inaccurate, and therefore there can be no assurance that such

statements included in this press release will prove to be

accurate. In light of the significant uncertainties inherent in the

forward-looking statements included herein, the inclusion of such

information should not be regarded as a representation by the

Company or any other person that the results or conditions

described in such statements or the objectives and plans of the

Company will be achieved. In addition, the Company’s qualification

as a REIT involves the application of highly technical and complex

provisions of the Internal Revenue Code of 1986, as amended.

Readers should carefully review the risk factors described in the

Company’s filings with the Securities and Exchange Commission,

including but not limited to those discussed in the section titled

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2024. Any forward-looking statement

that the Company makes speaks only as of the date of this press

release. The Company undertakes no obligation to publicly update or

revise any forward-looking statements or cautionary factors, as a

result of new information, future events, or otherwise, except as

required by law.

For additional information or to receive press

releases by email, visit www.applehospitalityreit.com.

Apple Hospitality REIT,

Inc.

Consolidated Balance

Sheets

(in thousands, except share

data)

As of December 31,

2024

2023

Assets

Investment in real estate, net of

accumulated depreciation and amortization of $1,821,344 and

$1,662,942, respectively

$4,820,748

$4,777,374

Assets held for sale

17,015

15,283

Cash and cash equivalents

10,253

10,287

Restricted cash-furniture, fixtures and

other escrows

33,814

33,331

Due from third-party managers, net

34,522

36,437

Other assets, net

53,568

64,586

Total Assets

$4,969,920

$4,937,298

Liabilities

Debt, net

$1,471,452

$1,371,494

Finance lease liabilities

111,585

111,892

Accounts payable and other liabilities

121,024

129,931

Total Liabilities

1,704,061

1,613,317

Shareholders' Equity

Preferred stock, authorized 30,000,000

shares; none issued and outstanding

-

-

Common stock, no par value, authorized

800,000,000 shares; issued and outstanding 239,765,905 and

241,515,532 shares, respectively

4,771,005

4,794,804

Accumulated other comprehensive income

15,587

20,404

Accumulated Distributions greater than net

income

(1,520,733)

(1,491,227)

Total Shareholders' Equity

3,265,859

3,323,981

Total Liabilities and Shareholders'

Equity

$4,969,920

$4,937,298

Note: The Consolidated Balance

Sheets and corresponding footnotes can be found in the Company’s

Annual Report on Form 10-K for the year ended December 31,

2024.

Apple Hospitality REIT,

Inc.

Consolidated Statements of

Operations and Comprehensive Income

(in thousands, except per

share data)

Three Months Ended

Year Ended

December 31,

(Unaudited)

December 31,

2024

2023

2024

2023

Revenues:

Room

$

300,032

$

282,475

$

1,298,525

$

1,226,159

Food and beverage

17,044

14,936

65,804

56,968

Other

15,960

15,045

67,139

60,673

Total revenue

333,036

312,456

1,431,468

1,343,800

Expenses:

Hotel operating expense:

Operating

88,683

83,311

357,352

332,714

Hotel administrative

30,448

28,138

123,086

114,071

Sales and marketing

30,450

28,132

126,938

117,538

Utilities

12,094

11,151

50,065

47,422

Repair and maintenance

17,366

16,960

69,697

65,412

Franchise fees

14,773

13,908

64,017

59,315

Management fees

10,560

9,737

46,716

44,253

Total hotel operating expense

204,374

191,337

837,871

780,725

Property taxes, insurance and other

20,504

17,960

84,382

79,307

General and administrative

11,703

12,761

42,542

47,401

Impairment of depreciable real estate

159

5,644

3,055

5,644

Depreciation and amortization

47,922

45,844

190,603

183,242

Total expense

284,662

273,546

1,158,453

1,096,319

Gain on sale of real estate

1,529

-

19,744

-

Operating income

49,903

38,910

292,759

247,481

Interest and other expense, net

(19,852

)

(17,884

)

(77,748

)

(68,857

)

Income before income taxes

30,051

21,026

215,011

178,624

Income tax expense

(234

)

(261

)

(947

)

(1,135

)

Net income

$

29,817

$

20,765

$

214,064

$

177,489

Other comprehensive income

(loss):

Interest rate derivatives

10,795

(17,007

)

(4,817

)

(16,477

)

Comprehensive income

$

40,612

$

3,758

$

209,247

$

161,012

Basic and diluted net income per common

share

$

0.12

$

0.09

$

0.89

$

0.77

Weighted average common shares outstanding

- basic and diluted

239,973

230,000

241,258

229,329

Note: The Consolidated Statements

of Operations and Comprehensive Income and corresponding footnotes

can be found in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2024.

Apple Hospitality REIT,

Inc.

Comparable Hotels Operating

Metrics and Statistical Data

(Unaudited)

(in thousands, except

statistical data)

Three Months Ended

Year Ended

December 31,

December 31,

% Change

% Change

2024

2023

2023

2024

2023

2023

Operating income (Actual)

$49,903

$38,910

28.3%

$292,759

$247,481

18.3%

Operating margin % (Actual)

15.0%

12.5%

250 bps

20.5%

18.4%

210 bps

Comparable Hotels Total Revenue

$329,244

$316,088

4.2%

$1,413,801

$1,379,360

2.5%

Comparable Hotels Total Operating

Expenses

220,810

210,778

4.8%

905,192

872,624

3.7%

Comparable Hotels Adjusted Hotel

EBITDA

$108,434

$105,310

3.0%

$508,609

$506,736

0.4%

Comparable Hotels Adjusted Hotel EBITDA

Margin %

32.9%

33.3%

(40 bps)

36.0%

36.7%

(70 bps)

ADR (Comparable Hotels)

$152.97

$152.09

0.6%

$158.94

$158.09

0.5%

Occupancy (Comparable Hotels)

71.3%

69.9%

2.0%

75.1%

74.4%

0.9%

RevPAR (Comparable Hotels)

$109.14

$106.31

2.7%

$119.36

$117.67

1.4%

ADR (Actual)

$152.39

$149.88

1.7%

$158.01

$155.76

1.4%

Occupancy (Actual)

71.4%

69.6%

2.6%

75.0%

74.2%

1.1%

RevPAR (Actual)

$108.75

$104.27

4.3%

$118.54

$115.60

2.5%

Reconciliation to

Actual Results

Total Revenue (Actual)

$333,036

$312,456

$1,431,468

$1,343,800

Revenue from acquisitions prior to

ownership

-

12,245

4,775

72,855

Revenue from dispositions/assets held for

sale

(3,397)

(6,486)

(17,280)

(27,433)

Revenue from non-hotel property

(395)

(2,127)

(5,162)

(9,862)

Comparable Hotels Total Revenue

$329,244

$316,088

$1,413,801

$1,379,360

Adjusted Hotel EBITDA (AHEBITDA) (Actual)

(1)

$108,983

$101,738

$509,544

$481,892

AHEBITDA from acquisitions prior to

ownership

-

4,842

1,882

30,865

AHEBITDA from dispositions/assets held for

sale

(549)

(1,270)

(2,817)

(6,595)

AHEBITDA from non-hotel property (2)

-

-

-

574

Comparable Hotels AHEBITDA

$108,434

$105,310

$508,609

$506,736

(1)

Represents the Company's actual Adjusted

Hotel EBITDA which excludes Adjusted EBITDAre from its non-hotel

property, the Company's independent boutique hotel in New York, New

York, starting in the second half of 2023, subsequent to its lease

to a third-party hotel operator for all hotel operations (the

"non-hotel property"). As a result of the operator's failure to

make lease payments timely, the Company commenced legal proceedings

to remove the operator from possession of the hotel, which remain

ongoing.

(2)

Represents Adjusted Hotel EBITDA from the

non-hotel property in the first half of 2023, prior to its lease to

a third-party hotel operator for all hotel operations.

Note: Comparable Hotels is defined

as the 219 hotels owned and held for use by the Company as of

December 31, 2024, and excludes the non-hotel property. For hotels

acquired during the periods noted, the Company has included, as

applicable, results of those hotels for periods prior to the

Company's ownership, and for dispositions and assets held for sale,

results have been excluded for the Company's period of ownership.

Results for periods prior to the Company's ownership have not been

included in the Company's actual Consolidated Financial Statements

and are included only for comparison purposes. Results included for

periods prior to the Company's ownership are based on information

from the prior owner of each hotel and have not been audited or

adjusted.

Reconciliation of net income to non-GAAP

financial measures is included in the following pages.

Apple Hospitality REIT,

Inc.

Comparable Hotels Quarterly

Operating Metrics and Statistical Data

(Unaudited)

(in thousands, except

statistical data)

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Operating income (Actual)

$49,247

$83,029

$76,295

$38,910

$71,615

$93,515

$77,726

$49,903

Operating margin % (Actual)

15.8%

23.0%

21.3%

12.5%

21.7%

24.0%

20.5%

15.0%

Comparable Hotels Total Revenue

$322,557

$372,797

$367,918

$316,088

$327,335

$382,636

$374,586

$329,244

Comparable Hotels Total Operating

Expenses

207,615

224,444

229,787

210,778

216,063

232,186

236,133

220,810

Comparable Hotels Adjusted Hotel

EBITDA

$114,942

$148,353

$138,131

$105,310

$111,272

$150,450

$138,453

$108,434

Comparable Hotels Adjusted Hotel EBITDA

Margin %

35.6%

39.8%

37.5%

33.3%

34.0%

39.3%

37.0%

32.9%

ADR (Comparable Hotels)

$154.86

$163.18

$161.37

$152.09

$154.94

$163.65

$163.37

$152.97

Occupancy (Comparable Hotels)

72.2%

78.2%

77.4%

69.9%

72.2%

79.9%

77.0%

71.3%

RevPAR (Comparable Hotels)

$111.88

$127.65

$124.82

$106.31

$111.80

$130.74

$125.83

$109.14

ADR (Actual)

$152.01

$160.98

$159.36

$149.88

$153.18

$162.98

$162.57

$152.39

Occupancy (Actual)

72.0%

78.2%

77.1%

69.6%

72.0%

79.8%

77.0%

71.4%

RevPAR (Actual)

$109.46

$125.96

$122.91

$104.27

$110.25

$130.07

$125.10

$108.75

Reconciliation to

Actual Results

Total Revenue (Actual)

$311,454

$361,630

$358,260

$312,456

$329,512

$390,077

$378,843

$333,036

Revenue from acquisitions prior to

ownership

19,786

21,825

18,999

12,245

4,775

-

-

-

Revenue from dispositions/assets held for

sale

(5,840)

(7,778)

(7,329)

(6,486)

(4,909)

(4,938)

(4,036)

(3,397)

Revenue from non-hotel property

(2,843)

(2,880)

(2,012)

(2,127)

(2,043)

(2,503)

(221)

(395)

Comparable Hotels Total Revenue

$322,557

$372,797

$367,918

$316,088

$327,335

$382,636

$374,586

$329,244

Adjusted Hotel EBITDA (AHEBITDA) (Actual)

(1)

$106,749

$141,244

$132,161

$101,738

$109,793

$151,680

$139,088

$108,983

AHEBITDA from acquisitions prior to

ownership

8,320

9,725

7,978

4,842

1,882

-

-

-

AHEBITDA from dispositions/assets held for

sale

(923)

(2,394)

(2,008)

(1,270)

(403)

(1,230)

(635)

(549)

AHEBITDA from non-hotel property (2)

796

(222)

-

-

-

-

-

-

Comparable Hotels AHEBITDA

$114,942

$148,353

$138,131

$105,310

$111,272

$150,450

$138,453

$108,434

(1)

Represents the Company's actual Adjusted

Hotel EBITDA which excludes Adjusted EBITDAre from the non-hotel

property starting in the second half of 2023, subsequent to its

lease to a third-party hotel operator for all hotel operations.

(2)

Represents Adjusted Hotel EBITDA from the

non-hotel property in the first half of 2023, prior to its lease to

a third-party hotel operator for all hotel operations.

Note: Comparable Hotels is defined

as the 219 hotels owned and held for use by the Company as of

December 31, 2024, and excludes the non-hotel property. For hotels

acquired during the periods noted, the Company has included, as

applicable, results of those hotels for periods prior to the

Company's ownership, and for dispositions and assets held for sale,

results have been excluded for the Company's period of ownership.

Results for periods prior to the Company's ownership have not been

included in the Company's actual Consolidated Financial Statements

and are included only for comparison purposes. Results included for

periods prior to the Company's ownership are based on information

from the prior owner of each hotel and have not been audited or

adjusted.

Reconciliation of net income to non-GAAP

financial measures is included in the following pages.

Apple Hospitality REIT,

Inc.

Same Store Hotels Operating

Metrics and Statistical Data

(Unaudited)

(in thousands, except

statistical data)

Three Months Ended

Year Ended

December 31,

December 31,

% Change

% Change

2024

2023

2023

2024

2023

2023

Operating income (Actual)

$49,903

$38,910

28.3%

$292,759

$247,481

18.3%

Operating margin % (Actual)

15.0%

12.5%

250 bps

20.5%

18.4%

210 bps

Same Store Hotels Total Revenue

$306,186

$296,321

3.3%

$1,320,769

$1,296,849

1.8%

Same Store Hotels Total Operating

Expenses

205,710

198,806

3.5%

849,627

824,734

3.0%

Same Store Hotels Adjusted Hotel

EBITDA

$100,476

$97,515

3.0%

$471,142

$472,115

(0.2%)

Same Store Hotels Adjusted Hotel EBITDA

Margin %

32.8%

32.9%

(10 bps)

35.7%

36.4%

(70 bps)

ADR (Same Store Hotels)

$150.82

$150.10

0.5%

$156.87

$156.47

0.3%

Occupancy (Same Store Hotels)

71.5%

69.8%

2.4%

75.1%

74.4%

0.9%

RevPAR (Same Store Hotels)

$107.78

$104.81

2.8%

$117.82

$116.39

1.2%

ADR (Actual)

$152.39

$149.88

1.7%

$158.01

$155.76

1.4%

Occupancy (Actual)

71.4%

69.6%

2.6%

75.0%

74.2%

1.1%

RevPAR (Actual)

$108.75

$104.27

4.3%

$118.54

$115.60

2.5%

Reconciliation to

Actual Results

Total Revenue (Actual)

$333,036

$312,456

$1,431,468

$1,343,800

Revenue from acquisitions

(23,058)

(7,522)

(88,257)

(9,656)

Revenue from dispositions/assets held for

sale

(3,397)

(6,486)

(17,280)

(27,433)

Revenue from non-hotel property

(395)

(2,127)

(5,162)

(9,862)

Same Store Hotels Total Revenue

$306,186

$296,321

$1,320,769

$1,296,849

Adjusted Hotel EBITDA (AHEBITDA) (Actual)

(1)

$108,983

$101,738

$509,544

$481,892

AHEBITDA from acquisitions

(7,958)

(2,953)

(35,585)

(3,756)

AHEBITDA from dispositions/assets held for

sale

(549)

(1,270)

(2,817)

(6,595)

AHEBITDA from non-hotel property (2)

-

-

-

574

Same Store Hotels AHEBITDA

$100,476

$97,515

$471,142

$472,115

(1)

Represents the Company's actual Adjusted

Hotel EBITDA which excludes Adjusted EBITDAre from the non-hotel

property starting in the second half of 2023, subsequent to its

lease to a third-party hotel operator for all hotel operations.

(2)

Represents Adjusted Hotel EBITDA from the

non-hotel property in the first half of 2023, prior to its lease to

a third-party hotel operator for all hotel operations.

Note: Same Store Hotels is defined

as the 211 hotels owned and held for use by the Company as of

January 1, 2023, and during the entirety of the periods being

compared, and excludes the non-hotel property. This information has

not been audited.

Reconciliation of net income to non-GAAP

financial measures is included in the following pages.

Apple Hospitality REIT,

Inc.

Same Store Hotels Quarterly

Operating Metrics and Statistical Data

(Unaudited)

(in thousands, except

statistical data)

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Operating income (Actual)

$49,247

$83,029

$76,295

$38,910

$71,615

$93,515

$77,726

$49,903

Operating margin % (Actual)

15.8%

23.0%

21.3%

12.5%

21.7%

24.0%

20.5%

15.0%

Same Store Hotels Total Revenue

$302,771

$350,947

$346,810

$296,321

$306,375

$359,277

$348,931

$306,186

Same Store Hotels Total Operating

Expenses

196,149

212,332

217,447

198,806

203,982

219,216

220,719

205,710

Same Store Hotels Adjusted Hotel

EBITDA

$106,622

$138,615

$129,363

$97,515

$102,393

$140,061

$128,212

$100,476

Same Store Hotels Adjusted Hotel EBITDA

Margin %

35.2%

39.5%

37.3%

32.9%

33.4%

39.0%

36.7%

32.8%

ADR (Same Store Hotels)

$153.10

$161.56

$160.19

$150.10

$152.69

$161.53

$161.56

$150.82

Occupancy (Same Store Hotels)

72.2%

78.3%

77.3%

69.8%

72.0%

80.0%

77.0%

71.5%

RevPAR (Same Store Hotels)

$110.47

$126.46

$123.79

$104.81

$109.94

$129.16

$124.43

$107.78

ADR (Actual)

$152.01

$160.98

$159.36

$149.88

$153.18

$162.98

$162.57

$152.39

Occupancy (Actual)

72.0%

78.2%

77.1%

69.6%

72.0%

79.8%

77.0%

71.4%

RevPAR (Actual)

$109.46

$125.96

$122.91

$104.27

$110.25

$130.07

$125.10

$108.75

Reconciliation to

Actual Results

Total Revenue (Actual)

$311,454

$361,630

$358,260

$312,456

$329,512

$390,077

$378,843

$333,036

Revenue from acquisitions

-

(25)

(2,109)

(7,522)

(16,185)

(23,359)

(25,655)

(23,058)

Revenue from dispositions/assets held for

sale

(5,840)

(7,778)

(7,329)

(6,486)

(4,909)

(4,938)

(4,036)

(3,397)

Revenue from non-hotel property

(2,843)

(2,880)

(2,012)

(2,127)

(2,043)

(2,503)

(221)

(395)

Same Store Hotels Total Revenue

$302,771

$350,947

$346,810

$296,321

$306,375

$359,277

$348,931

$306,186

Adjusted Hotel EBITDA (AHEBITDA) (Actual)

(1)

$106,749

$141,244

$132,161

$101,738

$109,793

$151,680

$139,088

$108,983

AHEBITDA from acquisitions

-

(13)

(790)

(2,953)

(6,997)

(10,389)

(10,241)

(7,958)

AHEBITDA from dispositions/assets held for

sale

(923)

(2,394)

(2,008)

(1,270)

(403)

(1,230)

(635)

(549)

AHEBITDA from non-hotel property (2)

796

(222)

-

-

-

-

-

-

Same Store Hotels AHEBITDA

$106,622

$138,615

$129,363

$97,515

$102,393

$140,061

$128,212

$100,476

(1)

Represents the Company's actual Adjusted

Hotel EBITDA which excludes Adjusted EBITDAre from the non-hotel

property starting in the second half of 2023, subsequent to its

lease to a third-party hotel operator for all hotel operations.

(2)

Represents Adjusted Hotel EBITDA from the

non-hotel property in the first half of 2023, prior to its lease to

a third-party hotel operator for all hotel operations.

Note: Same Store Hotels is defined

as the 211 hotels owned and held for use by the Company as of

January 1, 2023, and during the entirety of the periods being

compared, and excludes the non-hotel property. This information has

not been audited.

Reconciliation of net income to non-GAAP

financial measures is included in the following pages.

Apple Hospitality REIT, Inc.

Reconciliation of Net Income to EBITDA, EBITDAre, Adjusted

EBITDAre and Adjusted Hotel EBITDA (Unaudited) (in

thousands)

EBITDA is a commonly used measure of performance in many

industries and is defined as net income (loss) excluding interest,

income taxes, depreciation and amortization. The Company believes

EBITDA is useful to investors because it helps the Company and its

investors evaluate the ongoing operating performance of the Company

by removing the impact of its capital structure (primarily interest

expense) and its asset base (primarily depreciation and

amortization). In addition, certain covenants included in the

agreements governing the Company’s indebtedness use EBITDA, as

defined in the specific credit agreement, as a measure of financial

compliance.

In addition to EBITDA, the Company also calculates and presents

EBITDAre in accordance with standards established by the National

Association of Real Estate Investment Trusts (“Nareit”), which

defines EBITDAre as EBITDA, excluding gains and losses from the

sale of certain real estate assets (including gains and losses from

change in control), plus real estate related impairments, and

adjustments to reflect the entity’s share of EBITDAre of

unconsolidated affiliates. The Company presents EBITDAre because it

believes that it provides further useful information to investors

in comparing its operating performance between periods and between

REITs that report EBITDAre using the Nareit definition.

The Company also considers the exclusion of non-cash

straight-line operating ground lease expense from EBITDAre useful,

as this expense does not reflect the underlying performance of the

related hotels (Adjusted EBITDAre).

The Company further excludes actual corporate-level general and

administrative expense for the Company as well as Adjusted EBITDAre

from the non-hotel property from Adjusted EBITDAre (Adjusted Hotel

EBITDA) to isolate property-level operational performance over

which the Company’s hotel operators have direct control. The

Company believes Adjusted Hotel EBITDA provides useful supplemental

information to investors regarding operating performance and it is

used by management to measure the performance of the Company’s

hotels and effectiveness of the operators of the hotels. In

addition, Adjusted EBITDAre and Adjusted Hotel EBITDA are both

components of key compensation measures of operational performance

within the Company's 2024 incentive plan.

The following table reconciles the Company’s GAAP net income to

EBITDA, EBITDAre, Adjusted EBITDAre and Adjusted Hotel EBITDA on a

quarterly basis for 2023 and 2024:

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Net income

$32,923

$65,289

$58,512

$20,765

$54,050

$73,931

$56,266

$29,817

Depreciation and amortization

45,906

45,994

45,498

45,844

46,823

47,715

48,143

47,922

Amortization of favorable and unfavorable

operating leases, net

97

85

99

102

102

102

102

102

Interest and other expense, net

16,004

17,499

17,470

17,884

17,309

19,370

21,217

19,852

Income tax expense

320

241

313

261

256

214

243

234

EBITDA

95,250

129,108

121,892

84,856

118,540

141,332

125,971

97,927

Gain on sale of real estate

-

-

-

-

(17,766)

(449)

-

(1,529)

Impairment of depreciable real estate

-

-

-

5,644

-

-

2,896

159

EBITDAre

95,250

129,108

121,892

90,500

100,774

140,883

128,867

96,557

Non-cash straight-line operating ground

lease expense

38

36

35

36

36

33

33

33

Adjusted EBITDAre

95,288

129,144

121,927

90,536

100,810

140,916

128,900

96,590

General and administrative expense

11,461

12,100

11,079

12,761

10,584

11,065

9,190

11,703

Adjusted EBITDAre from non-hotel property

(1)

-

-

(845)

(1,559)

(1,601)

(301)

998

690

Adjusted Hotel EBITDA

$106,749

$141,244

$132,161

$101,738

$109,793

$151,680

$139,088

$108,983

(1)

Includes results of the non-hotel property

subsequent to its lease to a third-party hotel operator for all

hotel operations. This property's Adjusted EBITDAre results are not

included in Adjusted Hotel EBITDA starting in the second half of

2023.

Apple Hospitality REIT, Inc.

Reconciliation of Net Income to FFO and MFFO

(Unaudited) (in thousands)

The Company calculates and presents FFO in accordance with

standards established by Nareit, which defines FFO as net income

(loss) (computed in accordance with GAAP), excluding gains and

losses from the sale of certain real estate assets (including gains

and losses from change in control), extraordinary items as defined

by GAAP, and the cumulative effect of changes in accounting

principles, plus real estate related depreciation, amortization and

impairments, and adjustments for unconsolidated affiliates.

Historical cost accounting for real estate assets implicitly

assumes that the value of real estate assets diminishes predictably

over time. Since real estate values instead have historically risen

or fallen with market conditions, most real estate industry

investors consider FFO to be helpful in evaluating a real estate

company’s operations. The Company further believes that by

excluding the effects of these items, FFO is useful to investors in

comparing its operating performance between periods and between

REITs that report FFO using the Nareit definition. FFO as presented

by the Company is applicable only to its common shareholders, but

does not represent an amount that accrues directly to common

shareholders.

The Company calculates MFFO by further adjusting FFO for the

exclusion of amortization of finance ground lease assets,

amortization of favorable and unfavorable operating leases, net and

non-cash straight-line operating ground lease expense, as these

expenses do not reflect the underlying performance of the related

hotels. The Company presents MFFO when evaluating its performance

because it believes that it provides further useful supplemental

information to investors regarding its ongoing operating

performance. In addition, MFFO is a component of a key compensation

measure of operational performance within the Company's 2024

incentive plan.

The following table reconciles the Company’s GAAP net income to

FFO and MFFO for the three months and year ended December 31, 2024

and 2023:

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Net income

$29,817

$20,765

$214,064

$177,489

Depreciation of real estate owned

47,161

45,080

187,555

180,185

Gain on sale of real estate

(1,529)

-

(19,744)

-

Impairment of depreciable real estate

159

5,644

3,055

5,644

Funds from operations

75,608

71,489

384,930

363,318

Amortization of finance ground lease

assets

760

760

3,038

3,038

Amortization of favorable and unfavorable

operating leases, net

102

102

408

383

Non-cash straight-line operating ground

lease expense

33

36

135

145

Modified funds from operations

$76,503

$72,387

$388,511

$366,884

Apple Hospitality REIT, Inc. 2025

Guidance Reconciliation of Net Income to EBITDA, EBITDAre, Adjusted

EBITDAre, Adjusted Hotel EBITDA and Comparable Hotels Adjusted

Hotel EBITDA (Unaudited) (in thousands)

The guidance of net income, EBITDA, EBITDAre, Adjusted EBITDAre,

Adjusted Hotel EBITDA and Comparable Hotels Adjusted Hotel EBITDA

(and all other guidance given) are forward-looking statements and

are not guarantees of future performance and involve known and

unknown risks, uncertainties and other factors which may cause

actual results and performance to differ materially from those

expressed or implied by these forecasts. Although the Company

believes the expectations reflected in the forecasts are based upon

reasonable assumptions, there can be no assurance that the

expectations will be achieved or that the results will not be

materially different. Risks that may affect these assumptions and

forecasts include, but are not limited to, the following: changes

in political, economic, competitive and specific market conditions;

the amount and timing of announced or future acquisitions and

dispositions of hotel properties; the level of capital expenditures

may change significantly, which will directly affect the level of

depreciation expense, interest expense and net income; the amount

and timing of debt repayments may change significantly based on

market conditions, which will directly affect the level of interest

expense and net income; the amount and timing of transactions

involving the Company's common stock may change based on market

conditions; and other risks and uncertainties associated with the

Company's business described herein and in filings with the

Securities and Exchange Commission, including the Company's Annual

Report on Form 10-K for the year ended December 31, 2024.

The following table reconciles the Company’s GAAP net income

guidance to EBITDA, EBITDAre, Adjusted EBITDAre, Adjusted Hotel

EBITDA and Comparable Hotels Adjusted Hotel EBITDA guidance for the

year ending December 31, 2025:

Year Ending December 31,

2025

Low-End

High-End

Net income

$173,214

$202,114

Depreciation and amortization

191,000

188,000

Amortization of favorable and unfavorable

leases, net

408

408

Interest and other expense, net

78,000

76,000

Income tax expense

800

1,200

EBITDA

$443,422

$467,722

Gain on sale of real estate

3,600

3,600

EBITDAre

$447,022

$471,322

Non-cash straight-line operating ground

lease expense

126

126

Adjusted EBITDAre

$447,148

$471,448

General and administrative expense

40,000

45,000

AEBITDAre from non-hotel property (1)

2,000

(2,000)

Adjusted Hotel EBITDA

$489,148

$514,448

AHEBITDA from acquisitions prior to

ownership (2)

-

-

AHEBITDA from dispositions

(48)

(48)

Comparable Hotels Adjusted Hotel

EBITDA

$489,100

$514,400

(1)

Represents Adjusted EBITDAre from the

non-hotel property.

(2)

Results for periods prior to the Company's

ownership have not been included in the Company's actual

Consolidated Financial Statements and are included only for

comparison purposes. Results included for periods prior to the

Company's ownership are based on information from the prior owner

of each hotel and have not been audited or adjusted.

Apple Hospitality REIT,

Inc.

Debt Summary

(Unaudited)

($ in thousands)

December 31, 2024

Fair Market

2025

2026

2027

2028

2029

Thereafter

Total

Value

Total debt:

Maturities

$

295,035

$

287,149

$

278,602

$

334,066

$

162,294

$

119,654

$

1,476,800

$

1,443,377

Average interest rates (1)

4.7

%

4.8

%

4.8

%

4.4

%

3.8

%

3.6

%

Variable-rate debt:

Maturities

$

225,000

$

212,500

$

275,000

$

300,000

$

85,000

$

-

$

1,097,500

$

1,097,220

Average interest rates (1)

5.0

%

5.1

%

5.1

%

4.6

%

3.3

%

n/a

Fixed-rate debt:

Maturities

$

70,035

$

74,649

$

3,602

$

34,066

$

77,294

$

119,654

$

379,300

$

346,157

Average interest rates

4.0

%

4.0

%

4.1

%

4.1

%

3.9

%

3.6

%

(1)

The average interest rate gives effect to

interest rate swaps, as applicable.

Note: See further information on

the Company’s indebtedness in the Company’s Annual Report on Form

10-K for the year ended December 31, 2024.

Apple Hospitality REIT,

Inc.

Comparable Hotels Operating

Metrics by Market

Three Months Ended December

31

(Unaudited)

Top 20 Markets

Occupancy

ADR

RevPAR

% of Adjusted Hotel

EBITDA

# of Hotels

Q4 2024

Q4 2023

% Change

Q4 2024

Q4 2023

% Change

Q4 2024

Q4 2023

% Change

Q4 2024

Top 20 Markets

Phoenix, AZ

10

81.2%

78.1%

4.0%

$151.44

$153.32

(1.2%)

$122.96

$119.78

2.7%

6.7%

Los Angeles, CA

8

81.9%

79.7%

2.8%

$182.73

$182.14

0.3%

$149.67

$145.11

3.1%

5.5%

San Diego, CA

7

69.4%

70.7%

(1.8%)

$174.96

$171.25

2.2%

$121.47

$121.02

0.4%

4.7%

Orange County, CA

6

78.3%

72.1%

8.6%

$157.05

$165.83

(5.3%)

$123.01

$119.55

2.9%

3.6%

Richmond/Petersburg, VA

3

70.8%

69.1%

2.5%

$191.00

$186.19

2.6%

$135.17

$128.70

5.0%

3.4%

Salt Lake City/Ogden, UT

5

72.8%

63.1%

15.4%

$150.02

$142.15

5.5%

$109.22

$89.75

21.7%

3.1%

Fort Worth/Arlington, TX

6

76.9%

73.1%

5.2%

$155.05

$159.39

(2.7%)

$119.19

$116.58

2.2%

3.1%

Portland, ME

3

77.6%

75.7%

2.5%

$186.05

$191.01

(2.6%)

$144.40

$144.58

(0.1%)

3.0%

Washington, DC

5

71.2%

71.8%

(0.8%)

$176.92

$172.94

2.3%

$126.02

$124.26

1.4%

3.0%

Seattle, WA

4

71.5%

78.4%

(8.8%)

$174.19

$178.22

(2.3%)

$124.56

$139.67

(10.8%)

2.7%

Chicago, IL

7

67.9%

63.5%

6.9%

$142.11

$138.67

2.5%

$96.53

$88.02

9.7%

2.6%

Melbourne, FL

3

83.5%

78.9%

5.8%

$192.55

$185.76

3.7%

$160.84

$146.57

9.7%

2.5%

Nashville, TN

5

68.3%

70.6%

(3.3%)

$152.10

$171.57

(11.3%)

$103.91

$121.06

(14.2%)

2.0%

Las Vegas, NV

1

77.0%

79.6%

(3.3%)

$205.02

$211.18

(2.9%)

$157.95

$168.21

(6.1%)

1.9%

Miami, FL

3

86.0%

89.0%

(3.4%)

$163.06

$156.70

4.1%

$140.29

$139.47

0.6%

1.9%

Orlando, FL

3

85.4%

71.8%

18.9%

$133.15

$115.88

14.9%

$113.65

$83.18

36.6%

1.9%

Louisville, KY

1

70.9%

69.4%

2.2%

$160.93

$161.28

(0.2%)

$114.16

$111.89

2.0%

1.8%

Alaska

2

76.4%

78.5%

(2.7%)

$209.66

$192.06

9.2%

$160.19

$150.73

6.3%

1.8%

Omaha, NE

4

61.3%

55.3%

10.8%

$124.95

$120.97

3.3%

$76.62

$66.89

14.5%

1.6%

Houston, TX

6

69.0%

65.6%

5.2%

$122.28

$113.64

7.6%

$84.38

$74.51

13.2%

1.5%

Top 20 Markets

92

74.5%

71.9%

3.6%

$162.00

$161.61

0.2%

$120.62

$116.26

3.8%

58.3%

All Other Markets

Indiana North

3

58.6%

52.8%

11.0%

$183.76

$165.97

10.7%

$107.71

$87.67

22.9%

1.4%

Madison, WI

2

51.3%

55.6%

(7.7%)

$204.00

$221.22

(7.8%)

$104.71

$122.97

(14.8%)

1.4%

Pittsburgh, PA

2

60.3%

59.1%

2.0%

$193.49

$177.44

9.0%

$116.66

$104.95

11.2%

1.3%

Dallas, TX

5

64.9%

66.0%

(1.7%)

$129.80

$134.67

(3.6%)

$84.21

$88.88

(5.3%)

1.2%

Alabama North

4

68.2%

66.8%

2.1%

$148.67

$143.17

3.8%

$101.45

$95.66

6.1%

1.2%

Newark, NJ

2

87.1%

81.7%

6.6%

$169.44

$172.55

(1.8%)

$147.64

$140.95

4.7%

1.2%

Boston, MA

3

75.0%

72.0%

4.2%

$155.98

$160.61

(2.9%)

$116.93

$115.69

1.1%

1.2%

Birmingham, AL

4

67.8%

70.0%

(3.1%)

$141.75

$138.73

2.2%

$96.06

$97.16

(1.1%)

1.1%

Memphis, TN

2

69.1%

62.6%

10.4%

$182.98

$194.48

(5.9%)

$126.36

$121.83

3.7%

1.1%

Kansas City, MO

4

70.2%

66.5%

5.6%

$131.21

$126.53

3.7%

$92.17

$84.13

9.6%

1.1%

North Carolina East

4

62.0%

64.8%

(4.3%)

$132.51

$128.26

3.3%

$82.12

$83.06

(1.1%)

1.1%

New Orleans, LA

1

72.3%

66.6%

8.6%

$229.44

$210.61

8.9%

$165.81

$140.24

18.2%

1.1%

Fort Lauderdale, FL

2

77.0%

79.7%

(3.4%)

$154.93

$148.03

4.7%

$119.35

$117.97

1.2%

1.1%

Syracuse, NY

2

75.4%

66.0%

14.2%

$175.37

$177.47

(1.2%)

$132.30

$117.21

12.9%

1.0%

Oklahoma City, OK

4

61.0%

70.1%

(13.0%)

$133.13

$124.66

6.8%

$81.22

$87.40

(7.1%)

1.0%

Austin, TX

6

70.9%

69.9%

1.4%

$114.83

$129.68

(11.5%)

$81.45

$90.63

(10.1%)

1.0%

Alabama South

4

64.7%

70.8%

(8.6%)

$129.75

$134.40

(3.5%)

$83.99

$95.14

(11.7%)

1.0%

Florida Central North

2

83.2%

68.1%

22.2%

$158.17

$150.76

4.9%

$131.57

$102.69

28.1%

0.9%

Knoxville, TN

2

80.1%

77.3%

3.6%

$148.28

$142.45

4.1%

$118.82

$110.09

7.9%

0.9%

Florida Panhandle

5

63.6%

62.9%

1.1%

$127.62

$138.77

(8.0%)

$81.17

$87.28

(7.0%)

0.9%

Tucson, AZ

3

75.6%

80.9%

(6.6%)

$116.76

$112.70

3.6%

$88.30

$91.14

(3.1%)

0.9%

Philadelphia, PA

3

64.8%

65.0%

(0.3%)

$140.70

$138.78

1.4%

$91.11

$90.20

1.0%

0.9%

Idaho

1

69.4%

74.2%

(6.5%)

$178.89

$168.97

5.9%

$124.21

$125.38

(0.9%)

0.8%

Atlanta, GA

3

64.7%

70.0%

(7.6%)

$150.29

$162.61

(7.6%)

$97.24

$113.82

(14.6%)

0.8%

Virginia Area

1

61.5%

68.1%

(9.7%)

$189.99

$186.75

1.7%

$116.90

$127.24

(8.1%)

0.7%

Louisiana South

2

65.8%

66.9%

(1.6%)

$126.70

$120.26

5.4%

$83.41

$80.40

3.7%

0.7%

Columbia, SC

2

78.8%

73.6%

7.1%

$130.93

$115.86

13.0%

$103.21

$85.24

21.1%

0.7%

Long Island, NY

1

84.6%

80.1%

5.6%

$150.03

$148.65

0.9%

$126.86

$119.03

6.6%

0.6%

Note: Market categorization based

on STR designation. Top 20 markets based on Comparable Hotels

Adjusted Hotel EBITDA contribution.

Apple Hospitality REIT,

Inc.

Comparable Hotels Operating

Metrics by Market

Three Months Ended December

31

(Unaudited)

All Other Markets (continued)

Occupancy

ADR

RevPAR

% of Adjusted Hotel

EBITDA

# of Hotels

Q4 2024

Q4 2023

% Change

Q4 2024

Q4 2023

% Change

Q4 2024

Q4 2023

% Change

Q4 2024

Norfolk/Virginia Beach, VA

4

57.9%

58.9%

(1.7%)

$126.08

$122.37

3.0%

$72.97

$72.07

1.2%

0.6%

San Jose/Santa Cruz, CA

1

76.2%

75.7%

0.7%

$187.02

$177.98

5.1%

$142.45

$134.69

5.8%

0.6%

Tampa, FL

1

86.6%

79.7%

8.7%

$187.52

$166.82

12.4%

$162.46

$132.96

22.2%

0.6%

Denver, CO

3

58.8%

62.5%

(5.9%)

$136.25

$147.59

(7.7%)

$80.10

$92.19

(13.1%)

0.6%

Macon/Warner Robins, GA