0001673985false00016739852024-09-122024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

Form 8-K

_____________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 12, 2024

ADVANSIX INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware (State or other jurisdiction of incorporation) |

| 1-37774 (Commission File Number) |

| 81-2525089 (I.R.S. Employer Identification No.) |

300 Kimball Drive, Suite 101

Parsippany, New Jersey 07054

(Address of principal executive offices)

Registrant’s telephone number, including area code: (973) 526-1800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | ASIX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously reported, on May 20, 2024, AdvanSix Inc. (the “Company”) announced that Michael Preston will retire as the Company’s Senior Vice President and Chief Financial Officer following many years of distinguished service. Mr. Preston’s retirement from this position will be effective as of October 1, 2024, but he will remain at the Company through year-end 2024 to help facilitate the transition of his responsibilities to his successor. The Company extends its gratitude to Mr. Preston for his service and contributions to the Company.

Effective as of October 1, 2024, the Board of Directors has appointed Sidd Manjeshwar as Senior Vice President and Chief Financial Officer to succeed Mr. Preston. Mr. Manjeshwar, age 48, previously served as Vice President, Corporate Treasurer and Investor Relations at Air Products. Prior to that, Mr. Manjeshwar served as Chief Financial Officer at FirstLight Power from 2018 through 2021, as Vice President, Corporate Finance and M&A, and Treasurer at Dynegy Inc. from 2012 through 2018, and in investment banking roles at Deutsche Bank Securities, Inc. and Barclays Capital/Lehman Brothers from 2005 through 2012.

In his new role as Senior Vice President and Chief Financial Officer, Mr. Manjeshwar will earn an annual base salary of $525,000. He will be entitled to participate in the Company’s short-term incentive program with a target bonus of 70% of his base salary (prorated for 2024), and will be eligible for grants of equity-based awards under the Company’s long-term incentive program, with his initial annual award to be made as part of the 2025 cycle. The annual award is expected to have a value of $800,000 and to be granted as a mix of restricted stock units (RSUs) and performance stock units consistent with the terms of the Company’s long-term incentive program for executive officers. In consideration of equity grants from his previous employer forfeited as a result of his departure and as a sign-on inducement, following his start date, Mr. Manjeshwar will (i) receive a cash payment of $25,000, subject to repayment if he does not complete two years of employment with the Company, and (ii) a sign-on grant of RSUs with an award value of $800,000 vesting on the third anniversary of the grant date. Mr. Manjeshwar will also be eligible for other benefits to which executive officers are entitled, as described in the Company’s most recent proxy statement filed with the Securities and Exchange Commission on April 26, 2024.

There are no family relationships between Mr. Manjeshwar and any director or executive officer of the Company, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

A copy of the Company’s press release announcing the retirement of Mr. Preston and the appointment of Mr. Manjeshwar is furnished herewith as Exhibit 99.1.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number |

| Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 12, 2024

| | | | | | | | |

| AdvanSix Inc. |

|

|

|

| By: | /s/ Achilles B. Kintiroglou |

| Name: | Achilles B. Kintiroglou |

| Title: | Senior Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

News Release

ADVANSIX APPOINTS SIDD MANJESHWAR AS SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

Parsippany, N.J., September 12, 2024 – AdvanSix (NYSE: ASIX), a diversified chemistry company, announced today the appointment of Sidd Manjeshwar as Senior Vice President and Chief Financial Officer, effective October 1st. In this role, Mr. Manjeshwar will have global responsibility for controllership, treasury, investor relations, procurement, internal audit, commercial finance, tax and financial planning and analysis for the enterprise. Mr. Manjeshwar will report directly to Erin Kane, President and CEO of AdvanSix, and be a member of the Company’s executive leadership team.

“We are thrilled to welcome Sidd to AdvanSix and look forward to adding his expertise as we continue to accelerate into our next chapter as a diversified chemistry company,” said Erin Kane, President and CEO of AdvanSix. “Sidd’s proven track record of establishing corporate and financial strategies that accelerate growth and profitability makes him well positioned to play a leading role in advancing our strategic priorities to deliver long-term, sustainable shareholder value.”

Mr. Manjeshwar most recently served as Vice President, Corporate Treasurer and Investor Relations at Air Products and Chemicals, Inc. He has more than twenty-five years of experience in investment banking and corporate leadership roles, including as Chief Financial Officer at FirstLight Power with responsibility for strategic and financial functions. He has also served as Vice President, Corporate Finance and M&A, and Treasurer at Dynegy Inc. and in investment banking roles at Deutsche Bank, Barclays Capital, and Lehman Brothers. He holds a B.E. in Electronics from the University of Mumbai, an M.S. in Computer Science from James Madison University and an MBA from The McDonough School of Business at Georgetown University.

“AdvanSix is in an exciting stage of transformation, and I am honored to join the team at this pivotal time,” said Mr. Manjeshwar. “AdvanSix offers a compelling investment thesis and its diverse product portfolio is well positioned to meet its current and future customer needs. I am looking forward to joining the AdvanSix leadership team to drive accelerated profitable growth in support of the company’s long-term, sustainable performance.”

Earlier this year, Michael Preston announced his anticipated retirement as Senior Vice President and Chief Financial Officer. As part of the company’s succession plan, starting

October 1st, Mr. Preston will serve in an advisory role through year-end 2024 with the executive team to facilitate a smooth transition of his responsibilities to Mr. Manjeshwar.

“Mike has made significant contributions to the success of AdvanSix as our founding CFO importantly establishing the critical finance, procurement and supply chain functions to meet our compliance and reporting requirements as a public company at spin. Throughout his nearly twenty-five year tenure at AdvanSix, including at our predecessor company, Mike has been widely admired and respected among our teammates, stockholders and all of our key stakeholders. On behalf of the entire organization, we express our gratitude for Mike’s leadership, service and invaluable contributions to AdvanSix. We wish him well on his retirement,” said Kane.

About AdvanSix

AdvanSix is a diversified chemistry company that produces essential materials for our customers in a wide variety of end markets and applications that touch people’s lives. Our integrated value chain of our five U.S.-based manufacturing facilities plays a critical role in global supply chains and enables us to innovate and deliver essential products for our customers across building and construction, fertilizers, agrochemicals, plastics, solvents, packaging, paints, coatings, adhesives, electronics and other end markets. Guided by our core values of Safety, Integrity, Accountability and Respect, AdvanSix strives to deliver best-in-class customer experiences and differentiated products in the industries of nylon solutions, plant nutrients, and chemical intermediates. More information on AdvanSix can be found at http://www.advansix.com.

Forward Looking Statements

This release contains certain statements that may be deemed “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, that address activities, events or developments that our management intends, expects, projects, believes or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements may be identified by words such as "expect," "anticipate," "estimate," “outlook,” "project," "strategy," "intend," "plan," "target," "goal," "may," "will," "should" and "believe" and other variations or similar terminology and expressions. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risks, uncertainties and other factors, many of which are beyond our control and difficult to predict, which may cause the actual results or performance of the Company to be materially different from any future results or performance expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: general economic and financial conditions in the U.S. and globally; the potential effects of inflationary pressures, labor market shortages and supply chain issues; instability or volatility in financial markets or other unfavorable economic or business conditions caused by geopolitical concerns, including as a result of the conflict between Russia and Ukraine, the conflict in Israel and Gaza, and the possible expansion of such conflicts; the effect of the foregoing on our customers’ demand for our products and our suppliers’ ability to manufacture and deliver our raw materials, including implications of reduced refinery utilization in the U.S.; our ability to sell and provide our goods and services; the ability of our customers to pay for our products; any closures of our and our customers’ offices and facilities; risks associated with increased phishing, compromised business emails and other cybersecurity attacks, data privacy incidents and disruptions to our technology infrastructure; risks associated with operating with a reduced workforce; risks associated with our indebtedness including compliance with financial and restrictive covenants, and our ability to access capital on reasonable terms, at a reasonable cost, or at all, due to economic conditions or otherwise; the impact of scheduled turnarounds and significant unplanned downtime and interruptions of production or logistics operations as a result of mechanical issues or other unanticipated events such as fires, severe weather conditions, natural disasters, pandemics and geopolitical conflicts and related events; price fluctuations, cost increases and supply of raw materials; our operations and growth projects requiring substantial capital; growth rates and cyclicality of the industries we serve including global changes in supply and demand; failure to develop and commercialize new products or technologies; loss of significant customer relationships; adverse trade and tax policies; extensive environmental, health and safety laws that apply to our operations; hazards associated with chemical manufacturing, storage and transportation; litigation associated with chemical manufacturing and our business operations generally; inability to acquire and integrate businesses, assets, products or technologies; protection of our intellectual property and proprietary information; prolonged work stoppages as a result of labor difficulties or otherwise; failure to maintain effective internal controls; our ability to declare and pay quarterly cash dividends and the amounts and timing of any future dividends; our ability to repurchase our common stock and the amount and timing of any future repurchases; disruptions in supply chain, transportation and logistics; potential for uncertainty regarding qualification for tax treatment of our spin-off; fluctuations in our stock price; and changes in laws

or regulations applicable to our business. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Such forward-looking statements are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by such forward-looking statements. We identify the principal risks and uncertainties that affect our performance in our filings with the Securities and Exchange Commission (SEC), including the risk factors in Part 1, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023, as updated in subsequent reports filed with the SEC.

# # #

Contacts:

Media Investors

Janeen Lawlor Adam Kressel

(973) 526-1615 (973) 526-1700

janeen.lawlor@advansix.com adam.kressel@advansix.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

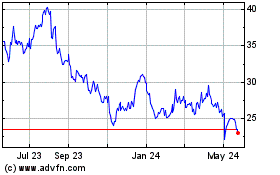

AdvanSix (NYSE:ASIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

AdvanSix (NYSE:ASIX)

Historical Stock Chart

From Nov 2023 to Nov 2024