Nasdaq Private Market (NPM), a leading provider of

secondary liquidity solutions to private companies, employees, and

investors, announced today that it has added

Bank of

America as an investor. NPM’s existing investor consortium

of premier global financial institutions has helped drive the

company’s success since its spinout from Nasdaq in 2021.

This announcement comes following the January

2024 closing of the company’s $62.4 million Series B financing

round led by Nasdaq with participation from

Allen & Company, Citi, and

Goldman Sachs, and with new investments from

BNP Paribas, DRW Venture Capital,

UBS, and Wells Fargo. NPM plans

to leverage Bank of America’s investment to accelerate new product

development and global growth.

“We are incredibly proud to welcome Bank of

America as an investor. Bank of America and NPM share a vision of

creating a more fair, transparent, and efficient private market,”

said Tom Callahan, Chief Executive Officer, Nasdaq Private

Market. “They join a prestigious consortium of 10 of the

world’s most influential financial institutions with a common goal

of bringing this $3.5 trillion asset class into the modern age of

efficient electronic markets. Together, we are working to ensure

entrepreneurs and risk capital can meet more efficiently so the

American innovation economy can grow and prosper.”

NPM operates as an independent entity with

strong support from its industry-backed consortium of investors.

Collectively, the company serves private companies, employees and

investors with a high-integrity trading, settlement, data, and

wealth platform. Today, the company services some of the world’s

most innovative private companies with solutions for the liquidity

needs of their employees and institutional investors. The company

has executed more than $50 billion in transactional value across

760 company-sponsored liquidity programs and block trades since

inception.

“We are pleased to join the consortium of

investors in NPM. With the growth of private markets in recent

years, Bank of America has been keenly focused on supporting

evolution in this space as an active member of the NPM platform. We

look forward to developing further scale and electronic

efficiencies in this market segment with our clients and partners,”

said Sonali Theisen, Head of FICC

Electronic Trading and Global Markets Strategic Investments at Bank

of America.

NPM’s primary business lines include Company

Solutions, SecondMarket™ Trading Marketplace, Transfer and

Settlement, Tape D™ Data and Analytics, as well as Wealth

Solutions. Its Company Solutions supports private companies using

proprietary technology to facilitate tenders, auctions, and

pre-direct listing programs. The SecondMarket™ Trading

Marketplace is bringing transparency and efficiency to the block

trading of private shares with a model fully aligned with the

interests of private companies. Its patent-pending Transfer and

Settlement technology streamlines the complex, burdensome process

of post-match workflows for companies and trading counterparties.

Tape D™ Data and Analytics delivers actionable insights into

trading activity and private companies for investors. Wealth

Solutions is connecting clients with resources to manage their

newly earned funds and support tax requirements.

“Bank of America’s investment in NPM builds on

the momentum from this year’s Series B fundraising round,

underscoring the important role NPM plays as a liquidity solutions

provider to private companies,” said Gary Offner, Senior

Vice President and Head of Nasdaq Ventures, Nasdaq, and

Chairman of the Board of Managers, Nasdaq Private

Market. “The board and I are pleased to welcome Bank of

America to the NPM consortium, and we look forward to working with

them to modernize private markets for the benefit of private

companies, their investors, and employees.”

About Nasdaq Private

MarketNasdaq Private Market provides liquidity solutions

for private companies, employees, and investors throughout each

stage of the pre-IPO lifecycle. In 2013, the company was founded

within Nasdaq, Inc. Today it is an independent company with

strategic investments from Nasdaq, Allen & Company, BNP

Paribas, Citi, DRW Venture Capital, Goldman Sachs, HiJoJo Partners,

Morgan Stanley, UBS, and Wells Fargo.

Learn more at www.nasdaqprivatemarket.com. Visit

LinkedIn and X @npm for the latest company news.

About Bank of AmericaBank of

America is one of the world’s leading financial institutions,

serving individual consumers, small and middle-market businesses

and large corporations with a full range of banking, investing,

asset management and other financial and risk management products

and services. The company provides unmatched convenience in the

United States, serving approximately 69 million consumer and small

business clients with approximately 3,800 retail financial centers,

approximately 15,000 ATMs (automated teller machines) and

award-winning digital banking with approximately 58 million

verified digital users. Bank of America is a global leader in

wealth management, corporate and investment banking and trading

across a broad range of asset classes, serving corporations,

governments, institutions and individuals around the world. Bank of

America offers industry-leading support to approximately 4 million

small business households through a suite of innovative,

easy-to-use online products and services. The company serves

clients through operations across the United States, its

territories and more than 35 countries. Bank of America Corporation

stock is listed on the New York Stock Exchange (NYSE: BAC).

AdvisorsJefferies LLC acted as

financial advisor and placement agent to Nasdaq Private Market, and

Cooley LLP served as legal advisor.

Media Contacts

Nasdaq Private MarketAmanda

GoldAmanda.Gold@npm.com

Bank of AmericaTom

RottcherThomas.F.Rottcher@bofa.com

Forward-Looking StatementsThis

press release contains forward-looking statements, within the

meaning of the Private Securities Litigation Reform Act of 1995,

including statements with respect to the joint venture among Nasdaq

Private Market, Nasdaq, Allen & Company, Citi, Goldman Sachs,

Morgan Stanley, BNP Paribas, DRW Venture Capital, UBS, Wells Fargo,

and HiJoJo Partners and the benefits of the joint venture, and

statements about Nasdaq Private Market, Nasdaq, Allen &

Company, Citi, Goldman Sachs, Morgan Stanley, BNP Paribas, DRW

Venture Capital, UBS, Wells Fargo, and HiJoJo Partners and their

respective products and offerings. We caution that these statements

are not guarantees of future performance. Actual results may differ

materially from those expressed or implied in the forward-looking

statements. Forward-looking statements involve a number of risks,

uncertainties, or other factors beyond the control of the joint

venture participants. These factors include, but are not limited

to, factors detailed in each joint venture participant’s annual

report on Form 10-K and periodic reports filed with the U.S.

Securities and Exchange Commission. The joint venture participants

undertake no obligation to release any revisions to any

forward-looking statements.

Disclosures and DisclaimersNPM

is not: (a) a registered exchange under the Securities Exchange Act

of 1934; (b) a registered investment adviser under the Investment

Advisers Act of 1940; or (c) a financial or tax planner and does

not offer legal or financial advice to any user of the NPM website

or its services. Securities-related services are offered through

NPM Securities, LLC, a registered broker-dealer and alternative

trading system, and member FINRA/SIPC. Transactions in securities

conducted through NPM Securities, LLC are not listed or traded on

The Nasdaq Stock Market LLC, nor are the securities subject to the

same listing or qualification standards applicable to securities

listed or traded on The Nasdaq Stock Market LLC.

Please read these other important disclosures and disclaimers

about NPM found here:

https://www.nasdaqprivatemarket.com/disclosures-disclaimer/

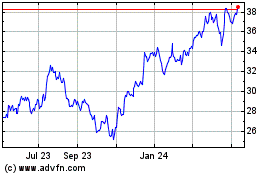

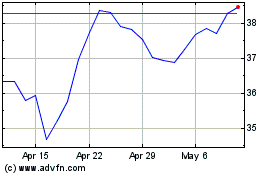

Bank of America (NYSE:BAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bank of America (NYSE:BAC)

Historical Stock Chart

From Nov 2023 to Nov 2024