Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) (“Brookfield

Asset Management”) today announced it has received the requisite

approval for the renewal of its normal course issuer bid providing

the option to purchase up to 37,123,295 Class A Limited Voting

Shares (“Class A Shares”), representing approximately 10% of the

public float of Brookfield Asset Management’s outstanding Class A

Shares. Purchases under the bid will be made on the open market

through the facilities of the New York Stock Exchange (“NYSE”),

Toronto Stock Exchange (“TSX”), and/or alternative trading systems.

The period of the normal course issuer bid will extend from January

13, 2025 to January 12, 2026, or an earlier date should Brookfield

Asset Management complete its purchases. Brookfield Asset

Management will pay the market price at the time of acquisition for

any Class A Shares purchased or such other price as may be

permitted.

As at December 31, 2024, the number of Class A

Shares issued and outstanding totaled 443,135,746 of which

371,232,957 shares represented the public float. The maximum daily

purchase on the TSX under this bid will be 251,030 Class A Shares,

which is 25% of 1,004,122 (the average daily trading volume for

Class A Shares on the TSX for the six-months ended December 31,

2024).

Of the 34,605,494 Class A Shares approved for

purchase under Brookfield Asset Management’s prior normal course

issuer bid that commenced on January 11, 2024 and will expire on

January 10, 2025, Brookfield Asset Management has not made any

purchases of its Class A Shares as of January 6, 2025.

Brookfield Asset Management is renewing its

normal course issuer bid to retain the option to acquire its Class

A Shares where this aligns with its investment and capital

allocation strategies. All Class A Shares acquired by Brookfield

Asset Management under this bid will be cancelled and/or purchased

by a non-independent trustee pursuant to the terms of Brookfield

Asset Management’s long-term incentive plans.

Brookfield Asset Management also announced that

it has entered into an automatic purchase plan in relation to the

normal course issuer bid. The automatic purchase plan allows for

the potential purchase of Class A Shares during the term of the

normal course issuer bid, subject to certain trading parameters, at

times when Brookfield Asset Management ordinarily would not be

active in the market due to its own internal trading black-out

period, insider trading rules or otherwise. Outside of these

periods, Class A Shares will be repurchased in accordance with

management’s discretion and in compliance with applicable law.

About Brookfield Asset Management

Brookfield Asset Management Ltd. (NYSE: BAM,

TSX: BAM) is a leading global alternative asset manager with over

$1 trillion of assets under management across renewable power and

transition, infrastructure, private equity, real estate, and

credit. We invest client capital for the long-term with a focus on

real assets and essential service businesses that form the backbone

of the global economy. We offer a range of alternative investment

products to investors around the world — including public and

private pension plans, endowments and foundations, sovereign wealth

funds, financial institutions, insurance companies and private

wealth investors. We draw on Brookfield’s heritage as an owner and

operator to invest for value and generate strong returns for our

clients, across economic cycles.

Please note that Brookfield Asset Management’s

returns and reports will be filed on EDGAR and SEDAR+ and can also

be found in the investor section of its website at

https://bam.brookfield.com. Hard copies of annual and quarterly

reports can be obtained free of charge upon request.

For more information, please visit our website at

https://bam.brookfield.com or contact:

| Media:Simon

MaineTel: +44 739 890 9278Email: simon.maine@brookfield.com |

|

Investor

Relations: Jason Fooks Tel: (866) 989-0311Email:

jason.fooks@brookfield.com |

Forward Looking Statements

Information in this press release that is not a

historical fact is “forward-looking information”. This press

release contains “forward-looking information” within the meaning

of Canadian provincial securities laws and “forward-looking

statements” within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of

the U.S. Securities Act of 1933,

the U.S. Securities Exchange Act of 1934, and “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995 and in any applicable Canadian

securities regulations. Forward-looking statements are typically

identified by words such as “expect”, “anticipate”, “believe”,

“foresee”, “could”, “estimate”, “goal”, “intend”, “plan”, “seek”,

“strive”, “will”, “may” and “should” and similar expressions.

Forward-looking statements reflect current estimates, beliefs and

assumptions, which are based on Brookfield Asset Management’s

perception of historical trends, current conditions and expected

future developments, as well as other factors management believes

are appropriate in the circumstances. Brookfield Asset Management’s

estimates, beliefs and assumptions are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and as such, are subject

to change. Brookfield Asset Management can give no assurance that

such estimates, beliefs and assumptions will prove to be

correct.

In particular, the forward-looking information

contained in this news release includes statements referring to

potential future purchases by Brookfield Asset Management of its

Class A Shares pursuant to the company’s normal course issuer bid

and automatic purchase plan. Although Brookfield Asset Management

believes that the anticipated future results, performance or

achievements expressed or implied by the forward-looking statements

and information are based upon reasonable assumptions and

expectations, the reader should not place undue reliance on

forward-looking statements and information because they involve

known and unknown risks, uncertainties and other factors, many of

which are beyond Brookfield Asset Management’s control, which may

cause the actual results, performance or achievements of Brookfield

Asset Management to differ materially from anticipated future

results, performance or achievement expressed or implied by such

forward-looking statements and information.

Other factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: (i)

investment returns that are lower than target; (ii) the impact or

unanticipated impact of general economic, political and market

factors in the countries in which Brookfield Asset Management does

business including as a result of COVID-19 and the related global

economic disruptions; (iii) the behavior of financial markets,

including fluctuations in interest and foreign exchange rates; (iv)

global equity and capital markets and the availability of equity

and debt financing and refinancing within these markets; (v)

strategic actions including dispositions; the ability to complete

and effectively integrate acquisitions into existing operations and

the ability to attain expected benefits; (vi) changes in accounting

policies and methods used to report financial condition (including

uncertainties associated with critical accounting assumptions and

estimates); (vii) the ability to appropriately manage human

capital; (viii) the effect of applying future accounting changes;

(ix) business competition; (x) operational and reputational risks;

(xi) technological change; (xii) changes in government regulation

and legislation within the countries in which Brookfield Asset

Management operates; (xiii) governmental investigations; (xiv)

litigation; (xv) changes in tax laws; (xvi) ability to collect

amounts owed; (xvii) catastrophic events, such as earthquakes,

hurricanes and epidemics/pandemics; (xviii) the possible impact of

international conflicts and other developments including terrorist

acts and cyberterrorism; (xix) the introduction, withdrawal,

success and timing of business initiatives and strategies; (xx) the

failure of effective disclosure controls and procedures and

internal controls over financial reporting and other risks; (xxi)

health, safety and environmental risks; (xxii) the maintenance of

adequate insurance coverage; (xxiii) the existence of information

barriers between certain businesses within Brookfield Asset

Management; and (xxiv) factors detailed from time to time in

documents filed by Brookfield Asset Management with the securities

regulators in Canada and the United States. Other factors, risks

and uncertainties not presently known to Brookfield Asset

Management or that Brookfield Asset Management currently believes

are not material could also cause actual results or events to

differ materially from those expressed or implied by statements

containing forward-looking information. Readers are cautioned not

to place undue reliance on statements containing forward-looking

information that are included in this press release, which are made

as of the date of this press release, and not to use such

information for anything other than their intended purpose.

Brookfield Asset Management disclaims any obligation or intention

to update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

required by applicable law.

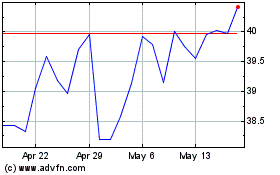

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Dec 2024 to Jan 2025

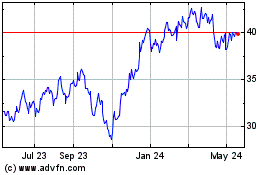

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Jan 2024 to Jan 2025