Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

17 January 2025 - 8:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number: 001-41563

Brookfield Asset Management Ltd.

(Translation of registrant's name into English)

Brookfield Place, Suite 100, 181 Bay Street, P.O. Box 762 Toronto, Ontario, Canada M5J 2T3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Brookfield Asset Management Ltd. |

| | | (Registrant) |

| | | |

| | | |

| Date: January 16, 2025 | | /s/ Hadley Peer Marshall |

| | | Hadley Peer Marshall |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Brookfield Appoints Bruce Flatt as Chair of Brookfield Asset Management

Appointment comes as Mark Carney departs to enter Canadian Liberal Party leadership race

NEW YORK, Jan. 16, 2025 (GLOBE NEWSWIRE) -- Brookfield Asset Management (“Brookfield”), a leading global alternative asset manager headquartered in New York with over $1 trillion of assets under management, announced today the appointment of Bruce Flatt as Chair of the Board of Directors, in addition to his role as Chief Executive Officer. He replaces Mark Carney, who today announced his candidacy for the leadership of the Liberal Party of Canada. Concurrent with the launch of Mr. Carney’s campaign, Brookfield has accepted his resignation from the company.

In discussing Mark Carney’s decision, Mr. Flatt said, “Mark has been a tremendous partner to the firm since he joined nearly five years ago, both in his role as Chair of Brookfield Asset Management for the past two years, and notably in establishing Brookfield as the leading private capital investor in the energy transition. We are sorry to see him leave, but he does so to fulfill his deep sense of public service to Canada and we wish him all the best in his new pursuit.”

He continued, “Under Connor Teskey’s leadership, our deep bench of experienced investment and operating professionals will continue to steer Brookfield’s world-leading transition investing activities. We are proud to have been named the world’s largest impact investor for two years running, thanks to more than $30 billion of dedicated transition capital raised in less than four years.”

About Brookfield Asset Management

BAM is a leading global alternative asset manager with over $1 trillion of assets under management across renewable power and transition, infrastructure, private equity, real estate, and credit. BAM invests client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. BAM offers a range of alternative investment products to investors around the world — including public and private pension plans, endowments and foundations, sovereign wealth funds, financial institutions, insurance companies and private wealth investors. BAM draws on Brookfield’s heritage as an owner and operator to invest for value and generate strong returns for its clients, across economic cycles.

For more information, please visit BAM’s website at www.bam.brookfield.com or contact:

Media:

Kerrie McHugh

Tel: (212) 618-3469

Email: kerrie.mchugh@brookfield.com | Investor Relations:

Jason Fooks

Tel: (212) 417-2442

Email: jason.fooks@brookfield.com

|

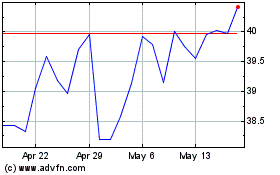

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Dec 2024 to Jan 2025

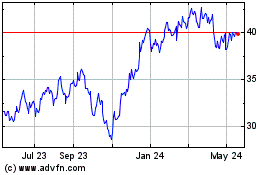

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Jan 2024 to Jan 2025