BILL Survey Finds 85% of SMBs Are Enthusiastic About Using AI in Financial Operations

05 March 2024 - 12:55AM

Business Wire

Businesses view AI as a beneficial tool for

both strategic planning and everyday operations

BILL (NYSE: BILL), a leading financial operations platform for

small and midsize businesses (SMBs), today unveiled The BILL

2024 State of Financial Automation Report which provides an

in-depth look at emerging trends in SMB financial management and

operations. Conducted by SMB Group, the survey results demonstrate

that SMBs believe innovative technology such as AI and automation

are beneficial capabilities for their financial operations. SMBs

are looking to AI and automation to help them increase efficiency

and empower them to redeploy staff to more strategic tasks that can

foster innovation and growth.

Key findings of the survey include:

- SMBs see business benefits of AI: SMBs want to use AI

for their business, both for strategic and tactical financial

operations.

- Automation is important to financial operations: The

majority of SMBs agree that automation is essential to enhancing

business efficiency, decision-making, and employee attraction and

retention.

- Integrated financial management solutions provide value:

Almost two-thirds of SMBs said that integrated financial management

solutions would provide high value to the financial operations of

their business.

“Advances in AI present a new opportunity for SMBs. AI can help

them make better decisions and bring powerful efficiency and

productivity outcomes to improve their business,” said Ken Moss,

Chief Technology Officer at BILL. “For SMBs, choosing the right

technology and AI partner for their business is essential to their

long term success. It’s not just about being innovative. SMBs need

accessible, trusted and useful technology that can actually

transform their business.”

SMBs See an Opportunity to Leverage AI to Improve Their

Business

Automation is already transforming financial operations,

offering SMBs better accuracy and efficiency when it comes to

managing their cash flow. With new innovation and advancements in

AI, it presents even more opportunities to enhance their business.

Many SMBs want to embrace AI, with 85% of SMBs responding that they

are enthusiastic about using AI for their business. They view AI as

a beneficial tool for strategic planning and everyday operations of

their business. SMBs identified decision-making and analytics

benefits as the top advantages that AI can contribute to financial

operations. They also cited practical benefits such as giving

employees time to focus on more important tasks, detecting

irregularities, summarizing data, and streamlining routine

activities as key advantages.

SMBs View Financial Automation as Essential to Business

Success

Automating financial operations enables SMBs to free up valuable

time they need for their business. It helps them focus more on the

strategic aspects of the business and improves both accuracy and

efficiency. For example, BILL’s integrated financial operations

platform leverages automation for functions like invoice extraction

and bill creation, duplicate invoice detection, and expense

management automation. 90% of SMBs agree that automation is key to

improving business efficiency. 84% also feel that automated

financial operations can help provide the insights needed to

improve decision-making. A majority believe that automation aids in

employee attraction and retention.

SMBs See Benefits of Deploying Integrated Financial

Management Solutions

SMBs want the benefits of AI without adding to their tech stack.

In addition, most SMBs want to leverage AI capabilities integrated

in the financial applications they currently use or intend to

deploy. This can help SMBs reap the benefits of AI without the need

for extensive new infrastructure.

SMBs believe integrated solutions can help them gain the

operational efficiency and more of a strategic edge to compete more

effectively in the marketplace. They rank gaining real-time

insights into cash flow, the cost-effectiveness of integrating

various financial processes, and the convenience of consolidating

financial information into a single platform as three of the top

benefits of this approach.

More comprehensive and integrated solutions such as the BILL

Financial Operations Platform are helping to give SMBs greater

visibility into more of their cash flow.

BILL Delivers the Right Technology to Address SMB Financial

Operations Needs

BILL helps hundreds of thousands of SMBs, and their accountant

partners, to remove the complexities of financial operations,

making paying bills, getting paid, and managing expenses

simpler.

As an early adopter of AI and automation, BILL continues to

harness innovation and leverage expertise in developing AI

capabilities to make solutions easier to use, more automated, and

increasingly predictive for SMBs to thrive. Tens of millions of

transactions flow through BILL’s network each year. This creates a

valuable data asset, which when applied to BILL's AI engine,

enables BILL to develop better customer experiences such as auto

matching businesses and suppliers, auto populating invoices,

preventing payment fraud, and providing payment or funding choices

for customers and network members.

SMBs and Accountants Speak to the Value of AI and Automation

from BILL

- “AI capabilities from BILL have saved our finance team two days

out of every work week. BILL’s AI pulls all the information for you

and it makes it so much easier. You just review. It's easier to

cross reference than to actually key everything in.” - Sarah

Sanders, Senior Controller, Repurpose

- “BILL AI auto-reads, extracts data, and enters it all

automatically. It’s a huge time saver and maintains data accuracy.”

- Manoj Bhutani, Chief Customer Officer, Furey

About the Study

The BILL 2024 State of Financial

Automation Report, conducted by SMB Group, was fielded

in December 2023. 750 SMB financial decision-makers in the U.S.

with 10-500 employees were surveyed. The survey sample was not

drawn from a list of BILL customers. Where appropriate, we compared

these findings with data from our 2023 State of Financial

Automation study, conducted the previous year.

About SMB Group

SMB Group is a research, analysis, and consulting firm focused

on technology adoption and trends among small and medium (1-999

employee size) and mid-market (1,000-2,500 employee size)

businesses. Founded in 2009, SMB Group helps clients understand and

segment the SMB market, identify and act on trends and

opportunities, develop more compelling messaging, and more

effectively serve SMB customers.

About BILL

BILL (NYSE: BILL) is a leading financial operations platform for

small and midsize businesses (SMBs). As a champion of SMBs, we are

automating the future of finance so businesses can thrive. Our

integrated platform helps businesses to more efficiently control

their payables, receivables and spend and expense management.

Hundreds of thousands of businesses rely on BILL’s proprietary

member network of millions to pay or get paid faster. Headquartered

in San Jose, California, BILL is a trusted partner of leading U.S.

financial institutions, accounting firms, and accounting software

providers. For more information, visit bill.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240304429803/en/

Press Contact: John Welton john.welton@hq.bill.com

IR Contact: Karen Sansot ksansot@hq.bill.com

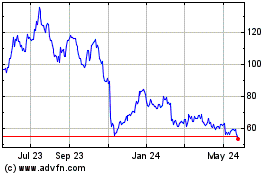

BILL (NYSE:BILL)

Historical Stock Chart

From Dec 2024 to Jan 2025

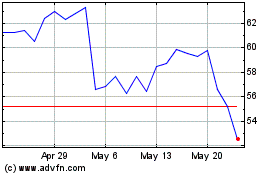

BILL (NYSE:BILL)

Historical Stock Chart

From Jan 2024 to Jan 2025