Broadstone Net Lease Provides an Update on Recent Business Activity and Announces Participation at the Wells Fargo 13th Annual Net Lease REIT Forum

09 September 2024 - 8:30PM

Business Wire

Broadstone Net Lease, Inc. (NYSE: BNL) (“Broadstone,” “BNL,” the

“Company,” “we,” “our,” or “us”), today provided an update on its

recent business activity through September 8, 2024. Additionally,

the Company announced that BNL’s CEO, John Moragne, and CFO, Kevin

Fennell, will be participating in the Wells Fargo 13th Annual Net

Lease REIT Forum in New York, NY, on Monday, September 9, 2024.

SEPTEMBER 2024 BUSINESS UPDATE

- Invested $375.6 million year-to-date, including $234.3 million

in new property acquisitions, $86.1 million in development

fundings, $52.2 million in transitional capital, and $3.0 million

in revenue generating capital expenditures. Total investments

consist of $248.6 million in industrial properties, $124.0 million

in retail and restaurant properties, and $3.0 million in an animal

health services property.

- Committed $453.7 million to fund developments and $8.0 million

to fund revenue generating capital expenditures with existing

tenants as of September 8, 2024. Our commitments to fund

developments include $446.0 million of industrial properties and

$7.7 million of restaurant properties with varying construction

start dates through 2024. We anticipate delivery and corresponding

rent commencement by the end of 2025 for approximately one-third of

those commitments, with the remaining two-thirds occurring in the

first half of 2026.

- In conjunction with our growing development funding pipeline,

we sold, on a forward basis, 2.0 million shares of our common stock

for gross proceeds of approximately $36.5 million under our

at-the-market common equity offering (“ATM Program”), none of which

has settled. These sales may be settled, at our discretion, at any

time prior to September 2025.

- Commenced contractually scheduled rent with our build-to-suit

tenant, United Natural Foods, Inc. (“UNFI”), based on the

substantial completion of construction in early September 2024. On

a pro forma basis, including up to approximately $25.1 million of

additional development closeout expenses expected to be funded

during the fourth quarter of 2024, UNFI will become our number two

tenant based on annualized base rent.

- Resolved ongoing negotiations with Red Lobster in connection

with its bankruptcy proceedings, resulting in the assumption of our

master lease agreement and continued operation of all 18 of our Red

Lobster locations, representing 1.6% of ABR as of June 30,

2024.

MANAGEMENT COMMENTARY

“BNL’s positive momentum continues to build with an attractive,

long-term investment pipeline and accretive capital through our ATM

program,” said John Moragne, BNL’s Chief Executive Officer. “Our

$453.7 million development funding pipeline will provide accretive

growth in 2025 and beyond and is a critical piece of our

differentiated strategy to maximize current and future earnings for

our investors through our four core building blocks of growth:

best-in-class portfolio rent escalations, revenue generating

capital expenditures with existing tenants, development funding

opportunities, and a diversified acquisition pipeline. I’m proud of

what we have accomplished to date and excited for what we are

building for the future.”

About Broadstone Net Lease, Inc. BNL is an

industrial-focused, diversified net lease REIT that invests in

primarily single-tenant commercial real estate properties that are

net leased on a long-term basis to a diversified group of tenants.

Utilizing an investment strategy underpinned by strong fundamental

credit analysis and prudent real estate underwriting, as of June

30, 2024, BNL’s diversified portfolio consisted of 777 individual

net leased commercial properties with 770 properties located in 44

U.S. states and seven properties located in four Canadian provinces

across the industrial, restaurant, healthcare, retail, and office

property types.

Forward-Looking Statements This press release contains

“forward-looking” statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, regarding, among other

things, our plans, strategies, and prospects, both business and

financial. Such forward-looking statements can generally be

identified by our use of forward-looking terminology such as

“outlook,” “potential,” “may,” “will,” “should,” “could,” “seeks,”

“approximately,” “projects,” “predicts,” “expect,” “intends,”

“anticipates,” “estimates,” “plans,” “would be,” “believes,”

“continues,” or the negative version of these words or other

comparable words. Forward-looking statements, including our 2024

guidance and assumptions, involve known and unknown risks and

uncertainties, which may cause BNL’s actual future results to

differ materially from expected results, including, without

limitation, risks and uncertainties related to general economic

conditions, including but not limited to increases in the rate of

inflation and/or interest rates, local real estate conditions,

tenant financial health, property investments and acquisitions, and

the timing and uncertainty of completing these property investments

and acquisitions, and uncertainties regarding future distributions

to our stockholders. These and other risks, assumptions, and

uncertainties are described in Item 1A “Risk Factors” of the

Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, which was filed with the SEC on February 22,

2024, which you are encouraged to read, and will be available on

the SEC’s website at www.sec.gov. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

indicated or anticipated by such forward-looking statements.

Accordingly, you are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date they

are made. The Company assumes no obligation to, and does not

currently intend to, update any forward-looking statements after

the date of this press release, whether as a result of new

information, future events, changes in assumptions, or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909587151/en/

Company Contact: Brent Maedl Director, Corporate Finance

& Investor Relations brent.maedl@broadstone.com

585.382.8507

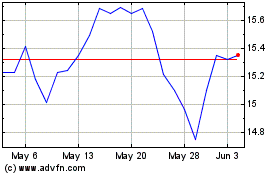

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Broadstone Net Lease (NYSE:BNL)

Historical Stock Chart

From Jan 2024 to Jan 2025