Blackstone Real Estate Income Trust Completes $5.8 Billion Acquisition of Preferred Apartment Communities, Inc.

24 June 2022 - 4:28AM

Business Wire

Blackstone (NYSE: BX) and Preferred Apartments Communities, Inc.

(NYSE: APTS) (“PAC” or the “Company”) today announced that

Blackstone Real Estate Income Trust, Inc. (“BREIT”) has completed

its previously announced acquisition of PAC for $25.00 per share of

common stock, without interest, in an all-cash transaction valued

at approximately $5.8 billion. The holders of each series of PAC’s

preferred stock will receive the $1,000 per share liquidation

preference for each share of preferred stock plus accrued but

unpaid dividends thereon, without interest. As a result of the

transaction, PAC’s common stock will no longer be listed on any

public market.

Joel T. Murphy, PAC’s Chairman and Chief Executive Officer,

said, “Today’s closing of BREIT’s acquisition of PAC marks the

beginning of an exciting new chapter for PAC. This outcome, with

over 99% of voting stockholders supporting the acquisition,

reinforces the merits of this transaction and the value of the hard

work our team has done leading up to and throughout this process. I

would like to thank the Blackstone team for being so collaborative

as we worked together to achieve this result. We look forward to

the next phase for PAC.”

Jacob Werner, Co-Head of Americas Acquisitions for Blackstone

Real Estate, said, “We are pleased to complete this acquisition on

behalf of our BREIT investors and welcome the talented PAC team to

Blackstone. Inclusive of this transaction, approximately half of

BREIT’s portfolio comprises residential properties largely located

in the West and South regions of the U.S., which are seeing robust

demand and stable occupancy. PAC’s portfolio of high-quality

multifamily in key SunBelt markets and grocery anchored retail

centers is a complementary addition to BREIT’s portfolio of

stabilized, income-generating assets, and we look forward to being

long-term owners of these properties.”

Jones Lang LaSalle Limited, BofA Securities, Lazard Frères &

Co. LLC and Wells Fargo Securities LLC served as BREIT’s financial

advisors, and Simpson Thacher & Bartlett LLP acted as BREIT’s

legal counsel.

Goldman Sachs & Co. LLC served as PAC’s lead financial

advisor. KeyBanc Capital Markets, Inc. and JonesTrading

Institutional Services, LLC. also served as financial advisors to

PAC. King & Spalding LLP and Vinson & Elkins LLP served as

the Company’s legal counsel.

The transaction was announced on February 16, 2022.

About Preferred Apartment Communities, Inc.

Preferred Apartment Communities, Inc. (NYSE: APTS) is a real

estate investment trust engaged primarily in the ownership and

operation of Class A multifamily properties, with select

investments in grocery-anchored shopping centers. Preferred

Apartment Communities’ investment objective is to generate

attractive, stable returns for stockholders by investing in

income-producing properties and acquiring or originating real

estate loans. As of March 31, 2022, the Company owned or was

invested in 113 properties in 13 states, predominantly in the

Southeast region of the United States. Learn more at

www.pacapts.com.

About Blackstone Real Estate Income Trust, Inc.

Blackstone Real Estate Income Trust, Inc. (“BREIT”) is a

perpetual-life, institutional quality real estate investment

platform that brings private real estate to income focused

investors. BREIT invests primarily in stabilized, income-generating

U.S. commercial real estate across key property types and to a

lesser extent in real estate debt investments. BREIT is externally

managed by a subsidiary of Blackstone (NYSE: BX), a global leader

in real estate investing. Blackstone’s real estate business was

founded in 1991 and has approximately $298 billion in investor

capital under management. Further information is available at

www.breit.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220623005514/en/

Preferred Apartment Communities, Inc. Contacts

Investors Preferred Apartment Communities, Inc.

John A. Isakson 770-818-4109 Chief Financial Officer

jisakson@pacapts.com

Paul Cullen, Executive Vice President-Investor Relations (770)

818-4144 PCullen@pacapts.com

Media Longacre Square Partners Dan Zacchei / Joe Germani

DZacchei@longacresquare.com / JGermani@longacresquare.com

Blackstone Media Contact Jeffrey Kauth (212) 583-5395

Jeffrey.Kauth@Blackstone.com

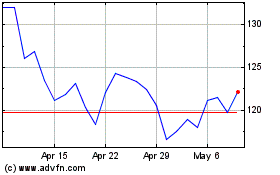

Blackstone (NYSE:BX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackstone (NYSE:BX)

Historical Stock Chart

From Apr 2023 to Apr 2024