- Reported Q1 2024 earnings of $0.55 per diluted share on a GAAP

basis and a non-GAAP earnings per diluted share (“non-GAAP EPS”)

basis

- Announced filing of Houston Electric’s first Texas System

Resiliency Plan, a first of its kind, with potential opportunity of

up to $500 million of incremental capital investment

- Reiterated 2024 non-GAAP EPS guidance range of $1.61-$1.63,

which represents 8% growth over full-year 2023 non-GAAP EPS and

further maintains non-GAAP EPS growth target through 2030 of the

mid-to-high end of 6%-8% annually1

CenterPoint Energy, Inc. (NYSE: CNP) or “CenterPoint” today

reported income available to common shareholders of $350 million,

or $0.55 per diluted share on a GAAP basis for the first quarter of

2024, compared to $0.49 per diluted share in the comparable period

of 2023.

Non-GAAP EPS for the first quarter 2024 was $0.55, a 10%

increase to the comparable quarter of 2023. These strong first

quarter results were primarily driven by growth and regulatory

recovery, which contributed $0.09 per share of favorability.

Additionally, weather and usage were $0.02 favorable when compared

to the first quarter of 2023. These favorable drivers were

partially offset by an unfavorable variance of $0.06 per share

attributable to increased financing costs of $0.04 and increased

operating and maintenance expense of $0.02 over the comparable

quarter of 2023.

“The strong first quarter of 2024 further demonstrates not only

the strength of what I believe is one of the most tangible

long-term growth plans in the industry but also this management

team’s ability to execute it. We continue to explore ways to

thoughtfully enhance this already great plan for all stakeholders,”

said Jason Wells, President & CEO of CenterPoint.

“I am excited about the opportunity to further collaborate with

various stakeholders on the first of its kind System Resiliency

Plan in Texas for a range of investments of $2.2 billion to $2.7

billion over the next three years. This management team has been

focused on investing in a more modern, resilient grid over the last

few years and we look forward to discussing our plan to further

advance the resiliency of our system and enhance the customer

experience,” said Wells.

_______________ 1 CenterPoint is unable to present a

quantitative reconciliation of forward-looking non-GAAP diluted

earnings per share without unreasonable effort because changes in

the value of ZENS (as defined herein) and related securities,

future impairments, and other unusual items are not estimable and

are difficult to predict due to various factors outside of

management’s control.

Earnings Outlook

In addition to presenting its financial results in accordance

with GAAP, including presentation of income (loss) available to

common shareholders and diluted earnings (loss) per share,

CenterPoint provides guidance based on non-GAAP income and non-GAAP

diluted earnings per share. Generally, a non-GAAP financial measure

is a numerical measure of a company’s historical or future

financial performance that excludes or includes amounts that are

not normally excluded or included in the most directly comparable

GAAP financial measure.

Management evaluates CenterPoint’s financial performance in part

based on non-GAAP income and non-GAAP earnings per share.

Management believes that presenting these non-GAAP financial

measures enhances an investor’s understanding of CenterPoint’s

overall financial performance by providing them with an additional

meaningful and relevant comparison of current and anticipated

future results across periods. The adjustments made in these

non-GAAP financial measures exclude items that management believes

do not most accurately reflect the company’s fundamental business

performance. These excluded items are reflected in the

reconciliation tables of this news release, where applicable.

CenterPoint’s non-GAAP income and non-GAAP diluted earnings per

share measures should be considered as a supplement to, and not as

a substitute for, or superior to, income available to common

shareholders and diluted earnings per share, which respectively are

the most directly comparable GAAP financial measures. These

non-GAAP financial measures also may be different than non-GAAP

financial measures used by other companies.

2023 and 2024 non-GAAP EPS; 2024 non-GAAP EPS guidance range

- 2023 and 2024 non-GAAP EPS and 2024 non-GAAP EPS guidance

excludes:

- Earnings or losses from the change in value of CenterPoint’s

2.0% Zero-Premium Exchangeable Subordinated Notes due 2029 (“ZENS”)

and related securities; and

- Gain and impact, including related expenses, associated with

mergers and divestitures, such as the divestiture of Energy Systems

Group, LLC and our Louisiana and Mississippi natural gas local

distribution company (“LDC”) businesses.

In providing 2023 and 2024 non-GAAP EPS and 2024 non-GAAP EPS

guidance, CenterPoint does not consider the items noted above and

other potential impacts such as changes in accounting standards,

impairments, or other unusual items, which could have a material

impact on GAAP reported results for the applicable guidance period.

The 2024 non-GAAP EPS guidance ranges also consider assumptions for

certain significant variables that may impact earnings, such as

customer growth and usage including normal weather, throughput,

recovery of capital invested, effective tax rates, financing

activities and related interest rates, and regulatory and judicial

proceedings. To the extent actual results deviate from these

assumptions, the 2024 non-GAAP EPS guidance ranges may not be met,

or the projected annual non-GAAP EPS growth rate may change.

CenterPoint is unable to present a quantitative reconciliation of

forward-looking non-GAAP diluted earnings per share without

unreasonable effort because changes in the value of ZENS and

related securities, future impairments, and other unusual items are

not estimable and are difficult to predict due to various factors

outside of management’s control.

Reconciliation of consolidated income

(loss) available to common shareholders and diluted earnings (loss)

per share (GAAP) to non-GAAP income and non-GAAP diluted earnings

per share

Quarter Ended

March 31, 2024

Dollars in millions

Diluted EPS (1)

Consolidated income (loss) available to

common shareholders and diluted EPS

$

350

$

0.55

ZENS-related mark-to-market (gains)

losses:

Equity securities (net of taxes of $17)

(2)(3)

66

0.10

Indexed debt securities (net of taxes of

$17) (2)

(68

)

(0.11

)

Impacts associated with mergers and

divestitures (net of taxes of $5) (2)

2

0.00

Consolidated on a non-GAAP basis

(4)

$

350

$

0.55

1)

Quarterly diluted EPS on both a GAAP and

non-GAAP basis are based on the weighted average number of shares

of common stock outstanding during the quarter, and the sum of the

quarters may not equal year-to-date diluted EPS.

2)

Taxes are computed based on the impact

removing such item would have on tax expense.

3)

Comprised of common stock of AT&T

Inc., Charter Communications, Inc. and Warner Bros. Discovery,

Inc.

4)

The calculation on a per-share basis may

not add down due to rounding.

Reconciliation of consolidated income

(loss) available to common shareholders and diluted earnings (loss)

per share (GAAP) to non-GAAP income and non-GAAP diluted earnings

per share

Year-to-Date Ended

December 31, 2023

Dollars in millions

Diluted EPS (1)

Consolidated income (loss) available to

common shareholders and diluted EPS

$

867

$

1.37

ZENS-related mark-to-market (gains)

losses:

Equity securities (net of taxes of $7)

(2)(3)

(25

)

(0.04

)

Indexed debt securities (net of taxes of

$6) (2)

21

0.03

Impacts associated with mergers and

divestitures (net of taxes of $64) (2) (4)

89

0.14

Consolidated on a non-GAAP

basis

$

952

$

1.50

1)

Quarterly diluted EPS on both a GAAP and

non-GAAP basis are based on the weighted average number of shares

of common stock outstanding during the quarter, and the sum of the

quarters may not equal year-to-date diluted EPS.

2)

Taxes are computed based on the impact

removing such item would have on tax expense. Taxes related to the

operating results of Energy Systems Group, as well as cash taxes

payable and other tax impacts related to the sale of Energy Systems

Group, are excluded from non-GAAP EPS.

3)

Comprised of common stock of AT&T

Inc., Charter Communications, Inc., and Warner Bros. Discovery,

Inc.

4)

Includes $4.4 million of pre-tax operating

loss related to Energy Systems Group, a divested non-regulated

business, as well as the $13 million loss on sale and approximately

$2 million of other indirect related transaction costs associated

with the divestiture.

Reconciliation of consolidated income

(loss) available to common shareholders and diluted earnings (loss)

per share (GAAP) to non-GAAP income and non-GAAP diluted earnings

per share

Quarter Ended

March 31, 2023

Dollars in millions

Diluted EPS (1)

Consolidated income (loss) available to

common shareholders and diluted EPS

$

313

$

0.49

ZENS-related mark-to-market (gains)

losses:

Equity securities (net of taxes of $8)

(2)(3)

(31

)

(0.05

)

Indexed debt securities (net of taxes of

$8) (2)

31

0.05

Impacts associated with mergers and

divestitures (net of taxes of $1) (2)

1

0.00

Consolidated on a non-GAAP basis

(4)

$

314

$

0.50

1)

Quarterly diluted EPS on both a GAAP and

non-GAAP basis are based on the weighted average number of shares

of common stock outstanding during the quarter, and the sum of the

quarters may not equal year-to-date diluted EPS.

2)

Taxes are computed based on the impact

removing such item would have on tax expense.

3)

Comprised of common stock of AT&T

Inc., Charter Communications, Inc. and Warner Bros. Discovery,

Inc.

4)

The calculation on a per-share basis may

not add down due to rounding.

Filing of Form 10-Q for CenterPoint Energy, Inc.

Today, CenterPoint Energy, Inc. filed with the Securities and

Exchange Commission (“SEC”) its Quarterly Report on Form 10-Q for

the quarter ended March 31, 2024. A copy of that report is

available on the company’s website, under the Investors section.

Investors and others should note that we may announce material

information using SEC filings, press releases, public conference

calls, webcasts, and the Investor Relations page of our website. In

the future, we will continue to use these channels to distribute

material information about the company and to communicate important

information about the company, key personnel, corporate

initiatives, regulatory updates, and other matters. Information

that we post on our website could be deemed material; therefore, we

encourage investors, the media, our customers, business partners

and others interested in our company to review the information we

post on our website.

Webcast of Earnings Conference Call

CenterPoint’s management will host an earnings conference call

on April 30, 2024, at 7:00 a.m. Central time / 8:00 a.m. Eastern

time. Interested parties may listen to a live audio broadcast of

the conference call on the company’s website under the Investors

section. A replay of the call can be accessed approximately two

hours after the completion of the call and will be archived on the

website for at least one year.

About CenterPoint Energy, Inc.

As the only investor owned electric and gas utility based in

Texas, CenterPoint Energy, Inc. (NYSE: CNP) is an energy delivery

company with electric transmission and distribution, power

generation and natural gas distribution operations that serve more

than 7 million metered customers in Indiana, Louisiana, Minnesota,

Mississippi, Ohio and Texas. As of March 31, 2024, the company

owned approximately $40 billion in assets. With approximately 9,000

employees, CenterPoint Energy and its predecessor companies have

been in business for more than 150 years. For more information,

visit CenterPointEnergy.com.

Forward-looking Statements

This news release includes, and the earnings conference call

will include, forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. When used in this

news release, the words "anticipate," "believe," "continue,"

"could," "estimate," "expect," "forecast," "goal," "intend," "may,"

"objective," "plan," "potential," "predict," "projection,"

"should," "target," "will" or other similar words are intended to

identify forward-looking statements. These forward-looking

statements are based upon assumptions of management which are

believed to be reasonable at the time made and are subject to

significant risks and uncertainties. Actual events and results may

differ materially from those expressed or implied by these

forward-looking statements. Examples of forward-looking statements

in this news release or on the earnings conference call include

statements regarding capital investments (including with respect to

incremental capital opportunities, deployment of capital,

renewables projects, and financing of such projects), the timing of

and projections for rate cases for CenterPoint and its

subsidiaries, the timing and extent of CenterPoint’s regulatory

recovery, including with regards to its generation transition plans

and projects, projects included in CenterPoint’s Natural Gas

Innovation Plan and Texas System Resiliency Plan filing, and

projects included under its 10-year capital plan, the extent of

anticipated benefits from new legislation, the pending sale of

CenterPoint’s Natural Gas LDC businesses in Louisiana and

Mississippi, future earnings and guidance, including long-term

growth rate, customer charges, operations and maintenance expense

reductions, financing plans (including the timing of any future

equity issuances, securitization, credit metrics and parent level

debt), the timing and anticipated benefits of our generation

transition plan, including our planned exit from coal and our

10-year capital plan, the ZENS and impacts of the maturity of ZENS,

tax planning opportunities, future financial performance and

results of operations, including with respect to regulatory actions

and recoverability of capital investments, customer rate

affordability, value creation, opportunities and expectations,

expected customer growth, sustainability strategy, including our

net zero and carbon emissions reduction goals, and any other

statements that are not historical facts are forward-looking

statements. Each forward-looking statement contained in this news

release or discussed on the earnings conference call speaks only as

of the date of this release or the earnings conference call.

Important factors that could cause actual results to differ

materially from those indicated by the provided forward-looking

information include, but are not limited to, risks and

uncertainties relating to: (1) CenterPoint’s business strategies

and strategic initiatives, restructurings, joint ventures and

acquisitions or dispositions of assets or businesses, including the

announced sale of our Louisiana and Mississippi natural gas LDC

businesses, and the completed sale of Energy Systems Group, LLC,

which we cannot assure you will have the anticipated benefits to

us; (2) industrial, commercial and residential growth in

CenterPoint’s service territories and changes in market demand; (3)

CenterPoint’s ability to fund and invest planned capital, and the

timely recovery of its investments; (4) financial market and

general economic conditions, including access to debt and equity

capital and inflation, interest rates and instability of banking

institutions, and their effect on sales, prices and costs; (5)

disruptions to the global supply chain and volatility in commodity

prices; (6) actions by credit rating agencies, including any

potential downgrades to credit ratings; (7) the timing and impact

of regulatory proceedings and actions and legal proceedings,

including those related to Houston Electric’s mobile generation and

the February 2021 winter storm event; (8) legislative decisions,

including tax and developments related to the environment such as

global climate change, air emissions, carbon, waste water

discharges and the handling of coal combustion residuals, among

others, and CenterPoint’s net zero and carbon emissions reduction

goals; (9) the impact of pandemics; (10) weather variations and

CenterPoint’s ability to mitigate weather impacts, including the

approval and timing of securitization issuances; (11) the impact of

potential wildfires; (12) changes in business plans; (13)

CenterPoint’s ability to execute on its initiatives, targets and

goals, including its net zero and carbon emissions reduction goals

and operations and maintenance goals; and (14) other factors

discussed CenterPoint’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023 and CenterPoint’s Quarterly Report on

Form 10-Q for the quarter ended March 31, 2024, including in the

“Risk Factors” and “Cautionary Statement Regarding Forward-Looking

Information” sections of such reports, and other reports

CenterPoint or its subsidiaries may file from time to time with the

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430076825/en/

Media: Communications

Media.Relations@CenterPointEnergy.com Investors: Jackie

Richert / Ben Vallejo Phone 713.207.6500

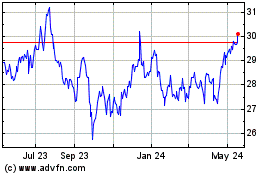

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Nov 2024 to Dec 2024

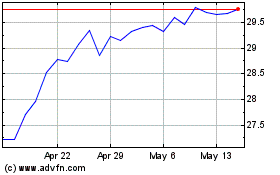

CenterPoint Energy (NYSE:CNP)

Historical Stock Chart

From Dec 2023 to Dec 2024