Mixed NCO & Delinquency in October - Analyst Blog

17 November 2011 - 4:20AM

Zacks

Some regulatory filings by major credit card companies have

disclosed mixed results in credit card defaults and delinquency

rate for October 2011. According to these filings, three of the

nation's top six credit card companies reported a decline in card

defaults, while four of them recorded lower delinquency rates.

Bank of America Corporation (BAC),

Citigroup Inc. (C) and Discover Financial

Services (DFS) recorded a fall in their respective credit

card defaults while JPMorgan Chase & Co.

(JPM), American Express Company (AXP) and

Capital One Financial Corp. (COF) reported a surge

for the same.

Card companies usually write off the loans that are 180 days

past due, assuming those as uncollectible. For BofA, on an

annualized basis, net charges-off (NCO) rate fell to 5.98% in

October 2011 as against 5.99% in September 2011 and 10.15% in

October 2010.

However, on an annualized basis, Capital One’s NCO rate surged

from 3.90% in the prior month but decreased from 7.26% in the

prior-year month to 3.96% in October 2011. Also, JPMorgan reported

a surge in NCO rate to 4.18% of its total loan balance in October

2011 compared with 4.13% in September 2011 and 7.0% in October

2010.

In October 2011, delinquency rate, indicating the future rate of

default, dropped for BofA, Citigroup, American Express and Discover

Financial, while it increased for JPMorgan and Capital One.

For BofA, delinquency rate for 30 days or more (on an annualized

basis) dropped from 3.99% in September 2011 and 5.6% in October

2010 to 3.97% in the month under review.

However, JPMorgan’s delinquency rate for 30 days or more (on an

annualized basis) was 2.55% compared with 2.53% in September 2011

and 3.81% in October 2010. The delinquency rate for 30 days or more

(on an annualized basis) for Capital One inched up from 3.65% in

September 2011 but declined from 4.45% in October 2010 to 3.73% in

October 2011.

In Conclusion

For now, this steady decline in default and late payment rates

has taken a backseat, owing to seasonality. Customers are prone to

making late payments during fall and making up for these lapses

later in the year.

Earlier, declining default rates largely emanated from

defaulting card holders’ inability to get cards with large credit

limits. Also, various regulatory reforms undertaken by the Federal

Reserve, like putting a limit on fees that banks can charge and

restricting the pace at which they can raise their interest rates,

are also enabling card owners to lower their balances.

However, the recent data from the credit reporting agency

TransUnion shows that in the September quarter, a significant

number of cards were issued to those customers who had some

payment-related issues in the past.

Therefore, this indicates that once these customers start using

their cards, there might be defaults leading to higher NCOs and

delinquencies. So, we remain concerned about this trend going

forward.

Currently, Discover Financial retains a Zacks #2 Rank, which

translates into a short-term Buy rating, while JPMorgan, American

Express, Capital One, Citigroup and BofA retain a Zacks #3 Rank,

which implies a short-term Hold rating.

AMER EXPRESS CO (AXP): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

CAPITAL ONE FIN (COF): Free Stock Analysis Report

DISCOVER FIN SV (DFS): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

Zacks Investment Research

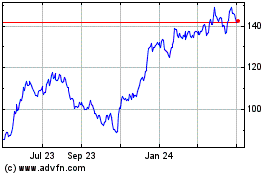

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

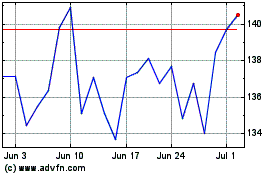

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024