KeyCorp Hikes Dividend - Analyst Blog

21 May 2013 - 12:30AM

Zacks

Following the approval its capital

plan in Mar 2013, KeyCorp (KEY) announced a 10%

hike in its quarterly dividend. The Federal Reserve had sanctioned

the company’s capital plan under the 2013 Comprehensive Capital

Analysis and Review (CCAR).

KeyCorp declared a quarterly cash dividend of 5.5 cents per share.

The dividend will be paid on Jun 14 to shareholders of record on

May 28.

Moreover, KeyCorp’s capital plan includes share repurchase program

worth $426 million. The company intends to complete the buyback of

shares by the end of first-quarter 2014, through either the open

market or privately-negotiated transactions.

Further, KeyCorp declared that it received the Fed’s approval for

additional capital deployment through share purchases from the sale

of Victory Capital Management and Victory Capital Advisors to

Crestview Partners – a private equity firm. The divestiture,

announced in Feb 2013, will likely be completed by third

quarter-end. Of the total sale price, $201 million is in cash,

while the remaining $45 million is a seller note, whose final value

will be determined by the end of the year.

The Fed’s consent pertains to the after-tax net gain on the cash

amount of the sale. KeyCorp anticipates after-tax gain to range

from $120–$125 million. The company plans to request for more

capital deployment on the after-tax gains related to the final

value of the seller’s note in 2014.

Concurrently, KeyCorp announced a dividend of $1.9375 per share on

7.750% Non-Cumulative Perpetual Convertible Preferred Stock, Series

A. This dividend will be paid on Jun 17, to shareholders of record

as of May 31, for the period from Mar 15 to Jun 15.

Apart from KeyCorp, other banks that increased their dividends

after the Fed’s approval include SunTrust Banks,

Inc. (STI), Capital One Financial

Corporation (COF) and Zions Bancorp.

(ZION). Capital One hiked its dividend 500% to 30 cents per share,

SunTrust 100% to 10 cents and Zions 300% to 4 cents.

We believe that the latest boost in KeyCorp’s dividend reflects its

commitment to return value to shareholders through its strong cash

generation capabilities. Moreover, the company has a healthy

capital and liquidity level.

Currently, KeyCorp carries a Zacks Rank #3 (Hold).

CAPITAL ONE FIN (COF): Free Stock Analysis Report

KEYCORP NEW (KEY): Free Stock Analysis Report

SUNTRUST BKS (STI): Free Stock Analysis Report

ZIONS BANCORP (ZION): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

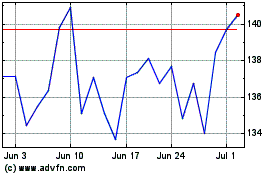

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Sep 2023 to Sep 2024