Monday.com Sets IPO at 3.7 Million Shares; Sees Pricing at $125-$140 Each

01 June 2021 - 10:46PM

Dow Jones News

By Colin Kellaher

Monday.com Ltd. on Tuesday said it plans to sell 3.7 million

shares at between $125 and $140 apiece in its initial public

offering.

The Tel Aviv project-management software provider also said

Salesforce Ventures LLC, the venture arm of business-software giant

Salesforce.com Inc., and Zoom Video Communications Inc. have each

agreed to invest $75 million in a private placement at the IPO

price.

At the $132.50 midpoint of the expected price range, monday.com

said it expects net proceeds of about $596.6 million from the IPO

and private placements, or roughly $642.3 million if the

underwriters exercise an option to buy an additional 370,000

shares.

In a filing with the U.S. Securities and Exchange Commission,

monday.com said it would have about 44.1 million shares outstanding

after the IPO and private placements, assuming exercise of the

overallotment option, for a market capitalization of around $5.84

billion at the $132.50-a-share pricing midpoint.

Monday.com said it has applied to list its shares on the Nasdaq

Global Select Market under the symbol MNDY.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

June 01, 2021 08:36 ET (12:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

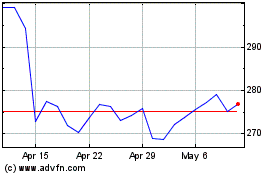

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2024 to May 2024

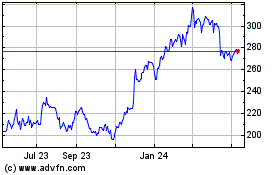

Salesforce (NYSE:CRM)

Historical Stock Chart

From May 2023 to May 2024