CubeSmart (NYSE: CUBE) today announced its operating results for

the three and nine months ended September 30, 2024.

“The third quarter saw a continuation of trends as we remain in

a competitive environment for new customer rental rates while the

existing customer remains very resilient,” commented President and

Chief Executive Officer Christopher P. Marr. “This month, we

celebrated our 20th anniversary as a public company. While it’s

exciting to celebrate our accomplishments over the past two

decades, we remain keenly focused on our culture of innovation and

enhancing our position as an industry leader.”

Key Highlights for the Third Quarter

- Reported diluted earnings per share (“EPS”) attributable to the

Company’s common shareholders of $0.44.

- Reported funds from operations (“FFO”), as adjusted, per

diluted share of $0.67.

- Same-store (598 stores) net operating income (“NOI”) decreased

3.1% year over year, resulting from a 0.8% decrease in revenues and

a 5.3% increase in operating expenses.

- Same-store occupancy averaged 90.8% during the quarter, ending

at 90.2%.

- Added 24 stores to our third-party

management platform, bringing our total third-party managed store

count to 893.

Financial Results

Net income attributable to the Company’s common shareholders was

$100.8 million for the third quarter of 2024, compared with $102.6

million for the third quarter of 2023. Diluted EPS attributable to

the Company’s common shareholders decreased to $0.44 for the third

quarter of 2024, compared with $0.45 for the same period last

year.

FFO, as adjusted, was $153.0 million for the third quarter of

2024, compared with $154.0 million for the third quarter of 2023.

FFO, as adjusted, per diluted share decreased 1.5% to $0.67 for the

third quarter of 2024, compared with $0.68 for the same period last

year.

Investment Activity

Acquisition Activity

The Company is under contract to acquire two stores in Oregon

(1) and Pennsylvania (1) for an aggregate purchase price of

approximately $22.0 million. These acquisitions are expected to

close during the fourth quarter of 2024.

Development Activity

The Company has agreements with developers for the construction

of self-storage properties in high-barrier-to-entry locations. As

of September 30, 2024, the Company had two joint venture

development properties under construction. The Company anticipates

investing a total of $36.9 million related to these projects and

had invested $9.1 million of that total as of September 30, 2024.

Both stores are located in New York and are expected to open during

the third quarter of 2025.

Third-Party Management

As of September 30, 2024, the Company’s third-party management

platform included 893 stores totaling 58.3 million rentable square

feet. During the three and nine months ended September 30, 2024,

the Company added 24 stores and 131 stores, respectively, to its

third-party management platform.

Same-Store Results

The Company’s same-store portfolio as of September 30, 2024

included 598 stores containing 43.0 million rentable square feet,

or approximately 96.7% of the aggregate rentable square feet of the

Company’s 615 consolidated stores. These same-store properties

represented approximately 97.5% of the Company’s property NOI for

the three months ended September 30, 2024.

Same-store physical occupancy as of September 30, 2024 and 2023

was 90.2% and 91.3%, respectively. Same-store total revenues for

the third quarter of 2024 decreased 0.8% and same-store operating

expenses increased 5.3% compared to the same quarter in 2023.

Same-store NOI decreased 3.1% from the third quarter of 2023 to the

third quarter of 2024.

Operating Results

As of September 30, 2024, the Company’s total consolidated

portfolio included 615 stores containing 44.4 million rentable

square feet and had physical occupancy of 89.7%.

Total revenues increased $3.0 million and property operating

expenses increased $4.3 million in the third quarter of 2024, as

compared to the same period in 2023. Increases in revenues were

primarily attributable to increases in property management fees and

other fee revenue, increases in customer storage protection plan

participation at our owned and managed stores, and revenues

generated from property acquisitions and recently opened

development properties. Increases in property operating expenses

were primarily attributable to an increase in advertising costs

within the same-store portfolio and increased expenses generated

from property acquisitions and recently opened development

properties.

Interest expense decreased from $23.2 million during the

three months ended September 30, 2023 to $22.8 million during the

three months ended September 30, 2024, a decrease of $0.4 million.

The decrease was attributable to a decrease in the average

outstanding debt balance and lower interest rates during the 2024

period compared to the 2023 period. The average outstanding debt

balance decreased from $3.00 billion during the three months ended

September 30, 2023 to $2.94 billion during the three months ended

September 30, 2024. The weighted average effective interest rate on

our outstanding debt decreased from 3.04% during the three months

ended September 30, 2023 to 2.99% for the three months ended

September 30, 2024.

Financing Activity

During the three months ended September 30, 2024, the Company

sold 0.6 million common shares of beneficial interest through its

at-the-market (“ATM”) equity program at an average sales price of

$54.20 per share, resulting in net proceeds of $32.8 million, after

deducting offering costs. As of September 30, 2024, the Company had

5.2 million shares available for issuance under the existing equity

distribution agreements.

Quarterly Dividend

On July 23, 2024, the Company declared a quarterly dividend of

$0.51 per common share. The dividend was paid on October 15, 2024

to common shareholders of record on October 1, 2024.

2024 Financial Outlook

“During the quarter, we found a select number of attractive

investment opportunities as the transaction market became more

constructive,” commented Chief Financial Officer Tim Martin. “We

raised a modest amount of equity capital and are excited to put our

well-capitalized balance sheet to work.”

The Company estimates that its fully diluted earnings per share

for 2024 will be between $1.72 and $1.76, and that its fully

diluted FFO per share, as adjusted, for 2024 will be between $2.62

and $2.66. Due to uncertainty related to the timing and terms of

transactions, the impact of any potential future speculative

investment activity is excluded from guidance. For 2024, the

same-store pool consists of 598 properties totaling 43.0 million

rentable square feet.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Current

Ranges for |

|

Current

Ranges for |

| 2024

Full Year Guidance Range Summary |

Current

Ranges for Annual Assumptions |

|

Prior

Guidance (1) |

| Same-store

revenue growth |

|

(0.75 |

%) |

|

to |

|

0.25 |

% |

|

(0.75 |

%) |

|

to |

|

0.25 |

% |

| Same-store

expense growth |

|

4.50 |

% |

|

to |

|

6.00 |

% |

|

|

4.50 |

% |

|

to |

|

6.00 |

% |

| Same-store

NOI growth |

|

(3.00 |

%) |

|

to |

|

(1.00 |

%) |

|

|

(3.00 |

%) |

|

to |

|

(1.00 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition

of consolidated operating properties |

$ |

100.0M |

|

to |

$ |

200.0M |

|

$ |

100.0M |

|

to |

$ |

200.0M |

| Dilution

from properties in lease-up |

$ |

(0.02 |

) |

|

to |

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

to |

$ |

(0.03 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property

management fee income |

$ |

40.5M |

|

to |

$ |

42.5M |

|

$ |

40.5M |

|

to |

$ |

42.5M |

| General and

administrative expenses |

$ |

59.5M |

|

to |

$ |

61.5M |

|

$ |

59.5M |

|

to |

$ |

61.5M |

| Interest and

loan amortization expense |

$ |

97.0M |

|

to |

$ |

99.0M |

|

$ |

97.0M |

|

to |

$ |

99.0M |

| Full year

weighted average shares and units |

|

228.2M |

|

|

|

228.2M |

|

|

227.7M |

|

|

|

227.7M |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted

earnings per share attributable to common shareholders |

$ |

1.72 |

|

|

to |

$ |

1.76 |

|

|

$ |

1.71 |

|

|

to |

$ |

1.77 |

|

|

Plus: real estate depreciation and amortization |

|

0.90 |

|

|

|

|

|

0.90 |

|

|

|

0.90 |

|

|

|

|

|

0.90 |

|

| FFO,

as adjusted, per diluted share |

$ |

2.62 |

|

|

to |

$ |

2.66 |

|

|

$ |

2.61 |

|

|

to |

$ |

2.67 |

|

|

(1) Prior guidance as included in our second

quarter earnings release dated August 1, 2024. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4th

Quarter 2024 Guidance |

|

|

Range |

| Diluted earnings per

share attributable to common shareholders |

|

$ |

0.45 |

|

|

to |

$ |

0.48 |

|

| Plus: real

estate depreciation and amortization |

|

|

|

|

|

|

|

|

|

0.22 |

|

|

|

|

|

0.22 |

|

| FFO,

as adjusted, per diluted share |

|

|

|

|

|

|

|

$ |

0.67 |

|

|

to |

$ |

0.70 |

|

Conference Call

Management will host a conference call at 11:00 a.m. ET on

Friday, November 1, 2024 to discuss financial results for the three

months ended September 30, 2024.

A live webcast of the conference call will be available online

from the investor relations page of the Company’s corporate website

at investors.cubesmart.com. Telephone participants may join on the

day of the call by dialing 1 (800) 715-9871 using conference ID

number 4783436.

After the live webcast, the webcast will be available on

CubeSmart’s website. In addition, a telephonic replay of the call

will be available through November 15, 2024 by dialing 1 (800)

770-2030 using conference ID number 4783436.

Supplemental operating and financial data as of September 30,

2024 is available in the investor relations section of the

Company’s corporate website.

About CubeSmart

CubeSmart is a self-administered and self-managed real estate

investment trust. The Company's self-storage properties are

designed to offer affordable, easily accessible and, in most

locations, climate-controlled storage space for residential and

commercial customers. According to the 2024 Self-Storage Almanac,

CubeSmart is one of the top three owners and operators of

self-storage properties in the United States.

Non-GAAP Financial Measures

Funds from operations (“FFO”) is a widely used performance

measure for real estate companies and is provided here as a

supplemental measure of operating performance. The April 2002

National Policy Bulletin of the National Association of Real Estate

Investment Trusts (the “White Paper”), as amended, defines FFO as

net income (computed in accordance with GAAP), excluding gains (or

losses) from sales of real estate and related impairment charges,

plus real estate depreciation and amortization, and after

adjustments for unconsolidated partnerships and joint ventures.

Management uses FFO as a key performance indicator in evaluating

the operations of the Company's stores. Given the nature of its

business as a real estate owner and operator, the Company considers

FFO a key measure of its operating performance that is not

specifically defined by accounting principles generally accepted in

the United States. The Company believes that FFO is useful to

management and investors as a starting point in measuring its

operational performance because FFO excludes various items included

in net income that do not relate to or are not indicative of its

operating performance such as gains (or losses) from sales of real

estate, gains from remeasurement of investments in real estate

ventures, impairments of depreciable assets, and depreciation,

which can make periodic and peer analyses of operating performance

more difficult. The Company’s computation of FFO may not be

comparable to FFO reported by other REITs or real estate

companies.

FFO should not be considered as an alternative to net income

(determined in accordance with GAAP) as an indication of the

Company’s performance. FFO does not represent cash generated from

operating activities determined in accordance with GAAP and is not

a measure of liquidity or an indicator of the Company’s ability to

make cash distributions. The Company believes that to further

understand its performance, FFO should be compared with its

reported net income and considered in addition to cash flows

computed in accordance with GAAP, as presented in its consolidated

financial statements.

FFO, as adjusted represents FFO as defined above, excluding the

effects of acquisition related costs, gains or losses from early

extinguishment of debt, and other non-recurring items, which the

Company believes are not indicative of the Company’s operating

results.

The Company defines net operating income, which it refers to as

“NOI,” as total continuing revenues less continuing property

operating expenses. NOI also can be calculated by adding back to

net income (loss): interest expense on loans, loan procurement

amortization expense, loss on early extinguishment of debt,

acquisition related costs, equity in losses of real estate

ventures, other expense, depreciation and amortization expense,

general and administrative expense, and deducting from net income

(loss): equity in earnings of real estate ventures, gains from

sales of real estate, net, other income, gains from remeasurement

of investments in real estate ventures and interest income. NOI is

a measure of performance that is not calculated in accordance with

GAAP.

Management uses NOI as a measure of operating performance at

each of its stores, and for all of its stores in the aggregate. NOI

should not be considered as a substitute for net income, cash flows

provided by operating, investing and financing activities, or other

income statement or cash flow statement data prepared in accordance

with GAAP. The Company believes NOI is useful to investors in

evaluating operating performance because it is one of the primary

measures used by management and store managers to evaluate the

economic productivity of the Company’s stores, including the

ability to lease stores, increase pricing and occupancy, and

control property operating expenses. Additionally, NOI helps the

Company’s investors meaningfully compare the results of its

operating performance from period to period by removing the impact

of its capital structure (primarily interest expense on outstanding

indebtedness) and depreciation of the basis in its assets from

operating results.

Forward-Looking Statements

This presentation, together with other statements and

information publicly disseminated by CubeSmart (“we,” “us,” “our”

or the “Company”), contain certain forward-looking statements

within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, or the “Exchange Act.” Forward-looking

statements include statements concerning the Company’s plans,

objectives, goals, strategies, future events, future revenues or

performance, capital expenditures, financing needs, plans or

intentions relating to acquisitions and other information that is

not historical information. In some cases, forward-looking

statements can be identified by terminology such as “believes,”

“expects,” “estimates,” “may,” “will,” “should,” “anticipates,” or

“intends” or the negative of such terms or other comparable

terminology, or by discussions of strategy. Such statements are

based on assumptions and expectations that may not be realized and

are inherently subject to risks, uncertainties and other factors,

many of which cannot be predicted with accuracy and some of which

might not even be anticipated. Although we believe the expectations

reflected in these forward-looking statements are based on

reasonable assumptions, future events and actual results,

performance, transactions or achievements, financial and otherwise,

may differ materially from the results, performance, transactions

or achievements expressed or implied by the forward-looking

statements. As a result, you should not rely on or construe any

forward-looking statements in this presentation, or which

management or persons acting on their behalf may make orally or in

writing from time to time, as predictions of future events or as

guarantees of future performance. We caution you not to place undue

reliance on forward-looking statements, which speak only as of the

date of this presentation or as of the dates otherwise indicated in

such forward-looking statements. All of our forward-looking

statements, including those in this presentation, are qualified in

their entirety by this statement.

There are a number of risks and uncertainties that could cause

our actual results to differ materially from the forward-looking

statements contained in or contemplated by this presentation. Any

forward-looking statements should be considered in light of the

risks and uncertainties referred to in Item 1A. “Risk Factors” in

our Annual Report on Form 10-K and in our other filings with the

Securities and Exchange Commission (“SEC”).

These risks include, but are not limited to, the following:

- adverse changes in economic

conditions in the real estate industry and in the markets in which

we own and operate self-storage properties;

- the effect of competition from

existing and new self-storage properties and operators on our

ability to maintain or raise occupancy and rental rates;

- the failure to execute our business

plan;

- adverse impacts from pandemics,

quarantines and stay at home orders, including the impact on our

ability to operate our self-storage properties, the demand for

self-storage, rental rates and fees and rent collection

levels;

- reduced availability and increased

costs of external sources of capital;

- increases in interest rates and

operating costs;

- financing risks, including the risk

of over-leverage and the corresponding risk of default on our

mortgage and other debt and potential inability to refinance

existing or future debt;

- counterparty non-performance related

to the use of derivative financial instruments;

- risks related to our ability to

maintain our qualification as a real estate investment trust

(“REIT”) for federal income tax purposes;

- the failure of acquisitions and

developments to close on expected terms, or at all, or to perform

as expected;

- increases in taxes, fees and

assessments from state and local jurisdictions;

- the failure of our joint venture

partners to fulfill their obligations to us or their pursuit of

actions that are inconsistent with our objectives;

- reductions in asset valuations and

related impairment charges;

- cybersecurity breaches, cyber or

ransomware attacks or a failure of our networks, systems or

technology, which could adversely impact our business, customer and

employee relationships or result in fraudulent payments;

- changes in real estate, zoning, use

and occupancy laws or regulations;

- risks related to or consequences of

earthquakes, hurricanes, windstorms, floods, other natural

disasters or acts of violence, pandemics, active shooters,

terrorism, insurrection or war that impact the markets in which we

operate;

- potential environmental and other

material liabilities;

- governmental, administrative and

executive orders, regulations and laws, which could adversely

impact our business operations and customer and employee

relationships;

- uninsured or uninsurable losses and

the ability to obtain insurance coverage, indemnity or recovery

from insurance against risks and losses;

- our ability to attract and retain

talent in the current labor market;

- other factors affecting the real

estate industry generally or the self-storage industry in

particular; and

- other risks identified in Item 1A of

our Annual Report on Form 10-K and, from time to time, in

other reports that we file with the SEC or in other documents that

we publicly disseminate.

Given these uncertainties, we caution readers not to place undue

reliance on forward-looking statements. We undertake no obligation

to publicly update or revise these forward-looking statements,

whether as a result of new information, future events or otherwise

except as may be required in securities laws.

Contact:

CubeSmartJosh SchutzerVice President, Finance(610) 535-5700

|

CUBESMART AND SUBSIDIARIESCONSOLIDATED

BALANCE SHEETS(in thousands, except share data) |

| |

|

September 30, |

|

December 31, |

| |

|

2024 |

|

2023 |

| |

|

(unaudited) |

|

|

|

| |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

Storage properties |

|

$ |

7,422,281 |

|

|

$ |

7,367,613 |

|

| Less: Accumulated

depreciation |

|

|

(1,544,603 |

) |

|

|

(1,416,377 |

) |

| Storage properties, net

(includes VIE amounts of $189,516 and $180,615, respectively) |

|

|

5,877,678 |

|

|

|

5,951,236 |

|

| Cash and cash equivalents

(includes VIE amounts of $1,856 and $3,002, respectively) |

|

|

43,507 |

|

|

|

6,526 |

|

| Restricted cash |

|

|

1,848 |

|

|

|

1,691 |

|

| Loan procurement costs, net of

amortization |

|

|

3,048 |

|

|

|

3,995 |

|

| Investment in real estate

ventures, at equity |

|

|

92,161 |

|

|

|

98,288 |

|

| Other assets, net |

|

|

174,173 |

|

|

|

163,284 |

|

|

Total assets |

|

$ |

6,192,415 |

|

|

$ |

6,225,020 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

| Unsecured senior notes,

net |

|

$ |

2,779,596 |

|

|

$ |

2,776,490 |

|

| Revolving credit facility |

|

|

— |

|

|

|

18,100 |

|

| Mortgage loans and notes

payable, net |

|

|

94,788 |

|

|

|

128,186 |

|

| Lease liabilities - finance

leases |

|

|

65,677 |

|

|

|

65,714 |

|

| Accounts payable, accrued

expenses and other liabilities |

|

|

223,516 |

|

|

|

201,419 |

|

| Distributions payable |

|

|

116,420 |

|

|

|

115,820 |

|

| Deferred revenue |

|

|

39,786 |

|

|

|

38,483 |

|

|

Total liabilities |

|

|

3,319,783 |

|

|

|

3,344,212 |

|

| |

|

|

|

|

|

|

| Noncontrolling interests in

the Operating Partnership |

|

|

66,330 |

|

|

|

60,276 |

|

| |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

Common shares $.01 par value, 400,000,000 shares authorized,

226,002,624 and 224,921,053 shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively |

|

|

2,260 |

|

|

|

2,249 |

|

|

Additional paid-in capital |

|

|

4,195,449 |

|

|

|

4,142,229 |

|

|

Accumulated other comprehensive loss |

|

|

(351 |

) |

|

|

(411 |

) |

|

Accumulated deficit |

|

|

(1,411,850 |

) |

|

|

(1,345,239 |

) |

|

Total CubeSmart shareholders’ equity |

|

|

2,785,508 |

|

|

|

2,798,828 |

|

|

Noncontrolling interests in subsidiaries |

|

|

20,794 |

|

|

|

21,704 |

|

|

Total equity |

|

|

2,806,302 |

|

|

|

2,820,532 |

|

|

Total liabilities and equity |

|

$ |

6,192,415 |

|

|

$ |

6,225,020 |

|

|

CUBESMART AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands, except per share

data)(unaudited) |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

230,954 |

|

|

$ |

232,468 |

|

|

$ |

682,935 |

|

|

$ |

681,962 |

|

|

Other property related income |

|

|

29,268 |

|

|

|

25,857 |

|

|

|

84,542 |

|

|

|

76,001 |

|

|

Property management fee income |

|

|

10,668 |

|

|

|

9,551 |

|

|

|

31,028 |

|

|

|

27,246 |

|

|

Total revenues |

|

|

270,890 |

|

|

|

267,876 |

|

|

|

798,505 |

|

|

|

785,209 |

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses |

|

|

81,868 |

|

|

|

77,546 |

|

|

|

242,002 |

|

|

|

223,494 |

|

|

Depreciation and amortization |

|

|

51,210 |

|

|

|

49,985 |

|

|

|

152,962 |

|

|

|

150,672 |

|

|

General and administrative |

|

|

14,265 |

|

|

|

14,060 |

|

|

|

44,512 |

|

|

|

43,059 |

|

|

Total operating expenses |

|

|

147,343 |

|

|

|

141,591 |

|

|

|

439,476 |

|

|

|

417,225 |

|

| OTHER (EXPENSE)

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense on loans |

|

|

(22,750 |

) |

|

|

(23,204 |

) |

|

|

(68,436 |

) |

|

|

(70,439 |

) |

|

Loan procurement amortization expense |

|

|

(986 |

) |

|

|

(1,030 |

) |

|

|

(3,031 |

) |

|

|

(3,111 |

) |

|

Equity in earnings of real estate ventures |

|

|

418 |

|

|

|

1,141 |

|

|

|

1,688 |

|

|

|

4,482 |

|

|

Other |

|

|

721 |

|

|

|

(119 |

) |

|

|

744 |

|

|

|

382 |

|

|

Total other expense |

|

|

(22,597 |

) |

|

|

(23,212 |

) |

|

|

(69,035 |

) |

|

|

(68,686 |

) |

| NET

INCOME |

|

|

100,950 |

|

|

|

103,073 |

|

|

|

289,994 |

|

|

|

299,298 |

|

|

Net income attributable to noncontrolling interests in the

Operating Partnership |

|

|

(551 |

) |

|

|

(640 |

) |

|

|

(1,616 |

) |

|

|

(1,870 |

) |

|

Net loss attributable to noncontrolling interests in

subsidiaries |

|

|

398 |

|

|

|

212 |

|

|

|

910 |

|

|

|

662 |

|

| NET INCOME

ATTRIBUTABLE TO THE COMPANY |

|

$ |

100,797 |

|

|

$ |

102,645 |

|

|

$ |

289,288 |

|

|

$ |

298,090 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share

attributable to common shareholders |

|

$ |

0.45 |

|

|

$ |

0.46 |

|

|

$ |

1.28 |

|

|

$ |

1.32 |

|

| Diluted earnings per share

attributable to common shareholders |

|

$ |

0.44 |

|

|

$ |

0.45 |

|

|

$ |

1.28 |

|

|

$ |

1.32 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average basic shares

outstanding |

|

|

226,166 |

|

|

|

225,467 |

|

|

|

225,941 |

|

|

|

225,380 |

|

| Weighted average diluted

shares outstanding |

|

|

227,149 |

|

|

|

226,210 |

|

|

|

226,805 |

|

|

|

226,206 |

|

|

Same-Store Results (598 stores)(in thousands,

except percentages and per square foot data)(unaudited) |

| |

|

Three Months Ended |

|

|

|

Nine Months Ended |

|

|

|

| |

|

September 30, |

|

Percent |

September 30, |

|

Percent |

|

|

|

2024 |

|

2023 |

|

Change |

2024 |

|

2023 |

|

Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

224,958 |

|

|

$ |

227,926 |

|

|

(1.3 |

) |

% |

$ |

665,743 |

|

|

$ |

669,257 |

|

|

(0.5 |

) |

% |

|

Other property related income |

|

|

11,067 |

|

|

|

9,927 |

|

|

11.5 |

|

% |

|

31,927 |

|

|

|

29,497 |

|

|

8.2 |

|

% |

|

Total revenues |

|

|

236,025 |

|

|

|

237,853 |

|

|

(0.8 |

) |

% |

|

697,670 |

|

|

|

698,754 |

|

|

(0.2 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property taxes (1) |

|

|

25,168 |

|

|

|

24,859 |

|

|

1.2 |

|

% |

|

76,871 |

|

|

|

75,072 |

|

|

2.4 |

|

% |

|

Personnel expense |

|

|

13,890 |

|

|

|

13,443 |

|

|

3.3 |

|

% |

|

41,566 |

|

|

|

40,144 |

|

|

3.5 |

|

% |

|

Advertising |

|

|

8,095 |

|

|

|

6,036 |

|

|

34.1 |

|

% |

|

17,737 |

|

|

|

16,103 |

|

|

10.1 |

|

% |

|

Repair and maintenance |

|

|

2,755 |

|

|

|

2,770 |

|

|

(0.5 |

) |

% |

|

8,405 |

|

|

|

7,743 |

|

|

8.5 |

|

% |

|

Utilities |

|

|

6,481 |

|

|

|

6,382 |

|

|

1.6 |

|

% |

|

17,613 |

|

|

|

17,436 |

|

|

1.0 |

|

% |

|

Property insurance |

|

|

3,334 |

|

|

|

3,117 |

|

|

7.0 |

|

% |

|

9,690 |

|

|

|

7,927 |

|

|

22.2 |

|

% |

|

Other expenses |

|

|

9,297 |

|

|

|

8,949 |

|

|

3.9 |

|

% |

|

28,386 |

|

|

|

26,587 |

|

|

6.8 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

|

69,020 |

|

|

|

65,556 |

|

|

5.3 |

|

% |

|

200,268 |

|

|

|

191,012 |

|

|

4.8 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net operating income (2) |

|

$ |

167,005 |

|

|

$ |

172,297 |

|

|

(3.1 |

) |

% |

$ |

497,402 |

|

|

$ |

507,742 |

|

|

(2.0 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin |

|

|

70.8 |

|

% |

|

72.4 |

|

% |

|

|

|

71.3 |

|

% |

|

72.7 |

|

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period end occupancy |

|

|

90.2 |

|

% |

|

91.3 |

|

% |

|

|

|

90.2 |

|

% |

|

91.3 |

|

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period average occupancy |

|

|

90.8 |

|

% |

|

92.0 |

|

% |

|

|

|

90.9 |

|

% |

|

92.0 |

|

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total rentable square feet |

|

|

42,990 |

|

|

|

|

|

|

|

|

42,990 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized annual rent per occupied square foot (3) |

|

$ |

23.05 |

|

|

$ |

23.06 |

|

|

0.0 |

|

% |

$ |

22.73 |

|

|

$ |

22.57 |

|

|

0.7 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of

Same-Store Net Operating Income to Operating Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Same-store net operating

income (2) |

|

$ |

167,005 |

|

|

$ |

172,297 |

|

|

|

|

$ |

497,402 |

|

|

$ |

507,742 |

|

|

|

|

| Non same-store net operating

income (2) |

|

|

4,268 |

|

|

|

2,902 |

|

|

|

|

|

11,867 |

|

|

|

8,123 |

|

|

|

|

| Indirect property overhead

(4) |

|

|

17,749 |

|

|

|

15,131 |

|

|

|

|

|

47,234 |

|

|

|

45,850 |

|

|

|

|

| Depreciation and

amortization |

|

|

(51,210 |

) |

|

|

(49,985 |

) |

|

|

|

|

(152,962 |

) |

|

|

(150,672 |

) |

|

|

|

| General and administrative

expense |

|

|

(14,265 |

) |

|

|

(14,060 |

) |

|

|

|

|

(44,512 |

) |

|

|

(43,059 |

) |

|

|

|

| Interest expense on loans |

|

|

(22,750 |

) |

|

|

(23,204 |

) |

|

|

|

|

(68,436 |

) |

|

|

(70,439 |

) |

|

|

|

| Loan procurement amortization

expense |

|

|

(986 |

) |

|

|

(1,030 |

) |

|

|

|

|

(3,031 |

) |

|

|

(3,111 |

) |

|

|

|

| Equity in earnings of real

estate ventures |

|

|

418 |

|

|

|

1,141 |

|

|

|

|

|

1,688 |

|

|

|

4,482 |

|

|

|

|

| Other |

|

|

721 |

|

|

|

(119 |

) |

|

|

|

|

744 |

|

|

|

382 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

100,950 |

|

|

$ |

103,073 |

|

|

|

|

$ |

289,994 |

|

|

$ |

299,298 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) For comparability purposes, certain amounts

related to the expiration of certain real estate tax abatements

have been excluded from the same-store portfolio results ($178k and

$571k for the three and nine months ended September 30, 2024,

respectively).

(2) Net operating income (“NOI”) is a non-GAAP

(“generally accepted accounting principles”) financial measure. The

above table reconciles same-store NOI to GAAP Net income.

(3) Realized annual rent per occupied square

foot is calculated by dividing annualized rental income by the

weighted average occupied square feet for the period.

(4) Includes property management income earned

in conjunction with managed properties.

|

Non-GAAP Measure – Computation of Funds From

Operations(in thousands, except percentages and per share

and unit data)(unaudited) |

| |

|

Three Months Ended |

|

Nine Months Ended |

|

| |

|

September 30, |

|

September 30, |

|

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to the Company's common shareholders |

|

$ |

100,797 |

|

$ |

102,645 |

|

$ |

289,288 |

|

$ |

298,090 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Real estate depreciation and

amortization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real property |

|

|

49,639 |

|

|

48,404 |

|

|

148,324 |

|

|

146,218 |

|

|

|

Company's share of unconsolidated real estate ventures |

|

|

2,025 |

|

|

2,104 |

|

|

6,163 |

|

|

6,353 |

|

|

| Loss (gain) from sales of real

estate, net (1) |

|

|

— |

|

|

236 |

|

|

— |

|

|

(1,477 |

) |

|

| Net income attributable to

noncontrolling interests in the Operating Partnership |

|

|

551 |

|

|

640 |

|

|

1,616 |

|

|

1,870 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO attributable to the

Company's common shareholders and third-party OP unitholders |

|

$ |

153,012 |

|

$ |

154,029 |

|

$ |

445,391 |

|

$ |

451,054 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share

attributable to common shareholders |

|

$ |

0.45 |

|

$ |

0.46 |

|

$ |

1.28 |

|

$ |

1.32 |

|

|

| Diluted earnings per share

attributable to common shareholders |

|

$ |

0.44 |

|

$ |

0.45 |

|

$ |

1.28 |

|

$ |

1.32 |

|

|

| FFO per diluted share and

unit |

|

$ |

0.67 |

|

$ |

0.68 |

|

$ |

1.95 |

|

$ |

1.98 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average basic shares

outstanding |

|

|

226,166 |

|

|

225,467 |

|

|

225,941 |

|

|

225,380 |

|

|

| Weighted average diluted

shares outstanding |

|

|

227,149 |

|

|

226,210 |

|

|

226,805 |

|

|

226,206 |

|

|

| Weighted average diluted

shares and units outstanding |

|

|

228,386 |

|

|

227,614 |

|

|

228,067 |

|

|

227,621 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend per common share and

unit |

|

$ |

0.51 |

|

$ |

0.49 |

|

$ |

1.53 |

|

$ |

1.47 |

|

|

| Payout ratio of FFO |

|

|

76.1 |

% |

|

72.1 |

% |

|

78.5 |

% |

|

74.2 |

|

% |

(1) For the three months ended September 30, 2023,

represents a loss related to the sale of the California Yacht Club,

which was acquired in 2021 as part of the Company's acquisition of

LAACO, Ltd. This amount is included in the component of other

(expense) income designated as Other within our consolidated

statements of operations. For the nine months ended September 30,

2023, includes distributions received in excess of our investment

in HVPSE. This amount is included in Equity in earnings of real

estate ventures within our consolidated statements of

operations.

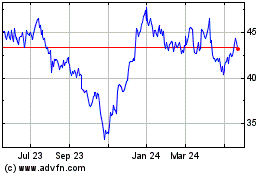

CubeSmart (NYSE:CUBE)

Historical Stock Chart

From Nov 2024 to Dec 2024

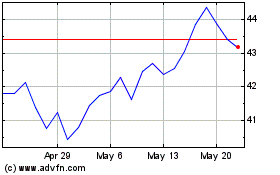

CubeSmart (NYSE:CUBE)

Historical Stock Chart

From Dec 2023 to Dec 2024