UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-10691

DIAGEO plc

(Translation

of registrant’s name into English)

16 Great Marlborough Street, London, United Kingdom, W1F 7HS

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F X

Form

40-F

List identifying information required to be furnished

by Diageo plc pursuant to Rule 13a-16 or 15d-16 of

The Securities Exchange Act 1934

|

Information

Public

Announcements/Press

|

Required by/when

The

Stock Exchange, London

|

|

|

|

|

Announcement

Total Voting Rights

01

August 2024

|

Announcement

Director Declaration

06

August 2024

|

|

Announcement

Director/PDMR Shareholding

12

August 2024

|

Announcement

Director/PDMR Shareholding

12

August 2024

|

|

Announcement

Publication of a Prospectus

16

August 2024

|

Announcement

Director/PDMR Shareholding

22

August 2024

|

|

Announcement

Director/PDMR Shareholding

23

August 2024

|

Announcement

Notice of AGM

23

August 2024

|

|

Announcement

Diageo prices €1,900m euro-denominated bonds

28

August 2024

|

Announcement

Publication of Final Terms

30

August 2024

|

Diageo PLC – Total Voting Rights

Dated 1 August 2024

Diageo plc

LEI: 213800ZVIELEA55JMJ32

Total Voting Rights and Capital

In conformity with Paragraph 5.6.1R of the Disclosure Guidelines

and Transparency Rules and Article 15 of the Transparency

Directive, Diageo plc (the "Company") would like to notify the

market of the following:

The Company's issued capital as at 31 July 2024 consisted

of 2,432,411,924 Ordinary Shares of 28 101/108 pence each

("Ordinary Shares"), with voting rights. 209,245,891 Ordinary

Shares were held in Treasury, in respect of which, voting rights

were not exercised.

Therefore, the total number of voting rights in the Company was

2,223,166,033 and this figure may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidelines and

Transparency Rules.

James Edmunds

Deputy Company Secretary

1 August 2024

Diageo PLC – Director Declaration

Dated

6 August 2024

Diageo plc

LEI: 213800ZVIELEA55JMJ32

Director Declaration

Diageo plc announces in accordance with LR 9.6.14(R) that Alan

Stewart, non-executive director, has been appointed non-executive

director of Haleon

plc with effect from

1 September 2024.

James Edmunds

Deputy Company Secretary

6 August 2024

Diageo PLC – Director/PDMR Shareholding

Dated

12 August 2024

Diageo plc

LEI: 213800ZVIELEA55JMJ32

Director/PDMR Shareholding

On 12 August 2024, Javier Ferrán purchased shares under an

arrangement with the Company.

The notification below, which has been made in accordance with the

requirement of the UK Market Abuse Regulation, provides further

details.

James Edmunds

Deputy Company Secretary

12 August 2024

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Javier Ferrán

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Chairman

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

Share purchase under an arrangement with the Company

|

|

c)

|

Price(s) and volume(s)

|

Price(s)

|

Volume(s)

|

|

£24.44

|

339

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-12

|

|

f)

|

Place of transaction

|

London Stock Exchange (XLON)

|

Diageo PLC – Director/PDMR Shareholding

Dated

12 August 2024

Diageo

plc

LEI: 213800ZVIELEA55JMJ32

Director/PDMR Shareholding

On 12 August 2024, the following transactions took place in

relation to the Diageo 2001 Share Incentive Plan:

1.

purchase of partnership shares using deductions from salary;

and

2.

award of one matching share for every two partnership shares

purchased.

The notifications below, which have been made in accordance with

the requirement of the UK Market Abuse Regulation, provide further

details.

James Edmunds

Deputy Company Secretary

12 August 2024

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Ewan Andrew

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Purchase of partnership shares under the Diageo 2001 Share

Incentive Plan

2.

Award of matching shares under the Diageo 2001 Share Incentive

Plan

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£24.428

|

5

|

|

2.

|

Nil

|

2

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-12

|

|

f)

|

Place of transaction

|

1.

London Stock Exchange (XLON)

2.

Outside a trading venue

|

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Lavanya Chandrashekar

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Chief Financial Officer

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Purchase of partnership shares under the Diageo 2001 Share

Incentive Plan

2.

Award of matching shares under the Diageo 2001 Share Incentive

Plan

|

|

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£24.428

|

6

|

|

2.

|

Nil

|

3

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-12

|

|

f)

|

Place of transaction

|

1.

London Stock Exchange (XLON)

2.

Outside a trading venue

|

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Cristina Diezhandino

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Purchase of partnership shares under the Diageo 2001 Share

Incentive Plan

2.

Award of matching shares under the Diageo 2001 Share Incentive

Plan

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£24.428

|

6

|

|

2.

|

Nil

|

3

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-12

|

|

f)

|

Place of transaction

|

1. London Stock Exchange (XLON)

2. Outside a trading venue

|

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Daniel Mobley

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Purchase of partnership shares under the Diageo 2001 Share

Incentive Plan

2.

Award of matching shares under the Diageo 2001 Share Incentive

Plan

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£24.428

|

6

|

|

2.

|

Nil

|

3

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-12

|

|

f)

|

Place of transaction

|

1.

London Stock Exchange (XLON)

2.

Outside a trading venue

|

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Dayalan Nayager

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Purchase of partnership shares under the Diageo 2001 Share

Incentive Plan

2.

Award of matching shares under the Diageo 2001 Share Incentive

Plan

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£24.428

|

6

|

|

2.

|

Nil

|

3

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-12

|

|

f)

|

Place of transaction

|

1.

London Stock Exchange (XLON)

2.

Outside a trading venue

|

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Louise Prashad

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Purchase of partnership shares under the Diageo 2001 Share

Incentive Plan

2.

Award of matching shares under the Diageo 2001 Share Incentive

Plan

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£24.428

|

6

|

|

2.

|

Nil

|

3

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-12

|

|

f)

|

Place of transaction

|

1. London Stock Exchange (XLON)

2. Outside a trading venue

|

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Tom Shropshire

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Purchase of partnership shares under the Diageo 2001 Share

Incentive Plan

2.

Award of matching shares under the Diageo 2001 Share Incentive

Plan

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£24.428

|

6

|

|

2.

|

Nil

|

3

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-12

|

|

f)

|

Place of transaction

|

1. London Stock Exchange (XLON)

2. Outside a trading venue

|

Diageo PLC – Publication of a Prospectus

Dated

16 August 2024

16 August 2024

Publication of Prospectus 2024

NOT FOR DISTRIBUTION TO ANY U.S. PERSON (AS DEFINED IN REGULATION S

UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED) OR TO ANY PERSON

LOCATED OR RESIDENT IN THE UNITED STATES OF AMERICA, ITS

TERRITORIES AND POSSESSIONS OR INTO ANY OTHER JURISDICTION OR TO

ANY OTHER PERSON WHERE OR TO WHOM IT IS UNLAWFUL TO DISTRIBUTE THIS

DOCUMENT.

Diageo plc, Diageo Finance plc and Diageo Capital B.V. announce

that, as part of the annual renewal of their European debt issuance

programme, the following prospectus was approved by the Financial

Conduct Authority on 16 August 2024 (the "Prospectus") and is available for

viewing:

Programme for the Issuance of Debt Instruments of Diageo plc, as

Issuer and Guarantor, and Diageo Finance plc and Diageo Capital

B.V., as Issuers.

To view the full document, please paste the following URL into the

address bar of your browser:

http://www.rns-pdf.londonstockexchange.com/rns/8155A_1-2024-8-16.pdf

A copy of the Prospectus has been submitted to the National Storage

Mechanism and will shortly be available for inspection

at: https://data.fca.org.uk/#/nsm/nationalstoragemechanism

ENDS

For further information, please contact:

|

Investor relations:Durga

DoraisamyAndy RyanBrian Shipman

|

+44 (0) 7902 126 906+44 (0) 7803 854 842+1 (0) 917 710

3007investor.relations@diageo.com

|

|

Media relations:Brendan

O'Grady

Clare CavanaIsabel Batchelor

|

+44 (0) 7812 183 750

+44 (0) 7751 742 072+44 (0) 7731 988

857press@diageo.com

|

DISCLAIMER - INTENDED ADDRESSEES

The Debt Instruments described in the Prospectus have not been and

will not be registered under the United States Securities Act of

1933, as amended (the "Securities

Act"), or any relevant

securities law of any state of the United States and are subject to

U.S. tax law requirements. Subject to certain exceptions, Debt

Instruments issued under the programme may not be offered, sold or

delivered within the United States or to, or for the account or

benefit of, U.S. persons except in certain transactions permitted

by U.S. tax regulations.

The Prospectus does not constitute an offer to sell or the

solicitation of an offer to buy any Debt Instruments in any

jurisdiction to any person to whom it is unlawful to make the offer

or solicitation in such jurisdiction. The distribution of the

Prospectus and the offer or sale of Debt Instruments under the

programme may be restricted by law in certain

jurisdictions.

Persons into whose possession the Prospectus or any Debt

Instruments issued under the programme may come must inform

themselves about, and observe, any such restrictions on the

distribution of the Prospectus and the offering and sale of Debt

Instruments. In particular, please note that the information

contained in this announcement may be addressed to and/or targeted

at persons who are residents of particular countries only and is

not intended for use and should not be relied upon by any person

outside these countries. Your right to access this service is

conditional upon complying with the above requirement.

About Diageo

Diageo is a global leader in beverage alcohol with an outstanding

collection of brands including Johnnie Walker, Crown Royal, J&B

and Buchanan's whiskies, Smirnoff, Cîroc and Ketel One vodkas,

Captain Morgan, Baileys, Don Julio, Tanqueray and

Guinness.

Diageo is a global company, and our products are sold in nearly 180

countries around the world. The company is listed on both the

London Stock Exchange (DGE) and the New York Stock Exchange (DEO).

For more information about Diageo, our people, our brands, and

performance, visit us at www.diageo.com.

Visit Diageo's global responsible drinking

resource, www.DRINKiQ.com for

information, initiatives, and ways to share best

practice.

Diageo plc

LEI: 213800ZVIELEA55JMJ32

Diageo Finance plc

LEI: BPF79TJMIH3DK8XCKI50

Diageo Capital B.V.

LEI: 213800YHFC48VOL6JY40

Diageo PLC – Director/PDMR Shareholding

Dated

22 August 2024

Director/PDMR Shareholding

The Company has been notified of the following dealings by Dayalan

Nayager on 21 August 2024:

●

exercise of options under The

Diageo 2014 Long Term Incentive Plan; and

●

sale of Ordinary

Shares

The notifications below, which have been made in accordance with

the requirement of the UK Market Abuse Regulation, provide further

details.

James Edmunds

Deputy Company Secretary

22 August 2024

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Dayalan Nayager

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary Shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Exercise of options over Ordinary Shares under The Diageo 2014

Long Term Incentive Plan

2.

Sale of Ordinary Shares

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£17.88

|

7,959

|

|

2.

|

£24.58

|

7,615

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-21

|

|

f)

|

Place of transaction

|

1.

Outside a trading venue

2.

London Stock Exchange (XLON)

|

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Dayalan Nayager

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary Shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Exercise of options over Ordinary Shares under The Diageo 2014

Long Term Incentive Plan

2.

Sale of Ordinary Shares

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£17.09

|

1,755

|

|

2.

|

£24.58

|

1,228

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-21

|

|

f)

|

Place of transaction

|

1.

Outside a trading venue

2.

London Stock Exchange (XLON)

|

Diageo PLC – Director/PDMR Shareholding

Dated

23 August 2024

Director/PDMR Shareholding

The Company has been notified of the following dealings by Louise

Prashad on 23 August 2024:

●

exercise of options under The

Diageo 2014 Long Term Incentive Plan; and

●

sale of Ordinary

Shares

The notification below, which have been made in accordance with the

requirement of the UK Market Abuse Regulation, provides further

details.

James Edmunds

Deputy Company Secretary

23 August 2024

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

|

1.

|

Details of the person discharging managerial

responsibilities/person closely associated

|

|

a)

|

Name

|

Louise Prashad

|

|

2.

|

Reason for the notification

|

|

a)

|

Position / status

|

Member of the Executive Committee

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

|

|

a)

|

Name

|

Diageo plc

|

|

b)

|

LEI

|

213800ZVIELEA55JMJ32

|

|

4.

|

Details of the transaction(s): section to be repeated for (i) each

type of instrument; (ii) each type of transaction; (iii) each date;

and (iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial instrument

Identification code

|

Ordinary Shares of 28 101/108 pence

GB0002374006

|

|

b)

|

Nature of the transaction

|

1.

Exercise of options over Ordinary Shares under The Diageo 2014

Long Term Incentive Plan

2.

Sale of Ordinary Shares

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

|

1.

|

£17.88

|

5,038

|

|

2.

|

£25.25

|

4,045

|

|

d)

|

Aggregated information

- Aggregated volume

- Price

|

N/A

|

|

e)

|

Date of transaction

|

2024-08-23

|

|

f)

|

Place of transaction

|

1.

Outside a trading venue

2.

London Stock Exchange (XLON)

|

Diageo PLC – Notice of AGM

Dated

23 August 2024

Notice of Annual General Meeting 2024

The Company announces that it has today made available to

shareholders the Notice of Annual General Meeting 2024 (the

"Notice"), and the Form of Proxy/Letter of Direction for the Annual

General Meeting.

The Company's 2024 Annual General Meeting ("AGM") will be held on

Thursday, 26 September 2024 at 2.30 pm at Hilton London Tower

Bridge, 5 More London Place, Tooley Street, London, SE1 2BY. The

AGM will be held as a combined physical and electronic meeting via

a live webcast using the Lumi platform with an additional telephone

facility for questions. Details of how to attend the AGM are

provided in the Notice.

The Notice and the Form of Proxy/Letter of Direction have

been submitted to the National Storage Mechanism and will shortly

be available for inspection at https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

The Notice and the Form of Proxy/Letter of Direction are also

available to view on the Company's website at www.diageo.com.

James Edmunds

Deputy Company Secretary

23 August 2024

Enquiries:

Investor relations:

Durga

Doraisamy

+44 (0) 7902 126 906

Andy

Ryan

+44 (0) 7803 854 842

investor.relations@diageo.com

|

Media relations:

Brendan

O'Grady

Clare Cavana

Isabel Batchelor

|

+44 (0) 7812 183 750

+44 (0) 7751 742 072

+44 (0) 7731 988 857

press@diageo.com

|

About Diageo

Diageo is a global leader in beverage alcohol with an outstanding

collection of brands including Johnnie Walker, Crown Royal, J&B

and Buchanan's whiskies, Smirnoff, Cîroc and Ketel One vodkas,

Captain Morgan, Baileys, Don Julio, Tanqueray and

Guinness.

Diageo is a global company, and our products are sold in nearly 180

countries around the world. The company is listed on both the

London Stock Exchange (DGE) and the New York Stock Exchange (DEO).

For more information about Diageo, our people, our brands, and

performance, visit us at www.diageo.com.

Visit Diageo's global responsible drinking

resource, www.DRINKiQ.com,

for information, initiatives, and ways to share best

practice.

LEI: 213800ZVIELEA55JMJ32

Diageo PLC – Diageo

prices €1,900m euro-denominated bondsz

Dated

28 August 2024

28 August

2024

Diageo prices € 1,900 million in aggregate of fixed rate

euro-denominated bonds

Diageo, a global leader in beverage alcohol, yesterday priced in

aggregate €1,900 million of fixed rate euro-denominated bonds

under its European Debt Issuance Programme. The issuer will be

Diageo Finance plc, and the payment of principal and interest will

be fully guaranteed by Diageo plc.

The drawdowns will consist of the issue of three series of bonds:

(i) €700 million bonds due 28 February 2031 with a coupon of

3.125% per annum; (ii) €700 million bonds due 30 August 2035

with a coupon of 3.375% per annum; and (iii) €500 million

bonds due 30 August 2044 with a coupon of 3.750% per annum.

Proceeds from each issuance will be used for general corporate

purposes. Banco Santander, S.A., Citigroup Global Markets Limited,

Morgan Stanley & Co. International Plc and NatWest Markets Plc

have been appointed as active joint lead managers, and HSBC

Continental Europe and UBS AG London Branch have been appointed as

passive joint lead managers.

Relevant stabilisation regulations

including FCA/ICMA apply. Manufacturer target market (EU MIFID II

and UK MiFIR product governance) is eligible counterparties and

professional clients only (all distribution channels). No EU PRIIPS

or UK PRIIPs key information document ("KID") has been prepared as the securities will not be

available to retail in EEA or the UK.

The bonds are being offered and sold pursuant to an exemption from

the registration requirements of the U.S. Securities Act, outside

the United States in offshore transactions, in reliance on, and in

compliance with Regulation S under the U.S. Securities Act. This

announcement has been prepared for use in connection with the offer

and sale of the bonds and does not constitute an offer to any

person in the United States. Distribution of this announcement to

any person within the United States is unauthorised.

In member states of the EEA, this

announcement is directed only at persons who are "qualified

investors" within the meaning of Regulation (EU) 2017/1129 (the

"EU

Prospectus Regulation").

In the UK, this announcement is

directed only at persons who are "qualified investors" within the

meaning of Regulation (EU) 2017/1129 as it forms part of the

domestic law of the UK by virtue of the European Union (Withdrawal)

Act 2018, as amended (the "UK Prospectus

Regulation").

This announcement is an advertisement

and does not constitute a prospectus for the purposes of the UK

Prospectus Regulation or offering memorandum or an offer to acquire

any securities and is not intended to provide the basis for any

credit or any other third party evaluation of the securities (the

"Securities") or the transaction (the "Transaction") and should not be considered as a

recommendation that any investor should subscribe for or purchase

any of the Securities. This announcement shall not be deemed to

constitute an offer of or an invitation to purchase or subscribe

the Securities. This announcement does not constitute an offer to

sell, exchange or transfer any securities and is not soliciting an

offer to purchase, exchange or transfer any securities in any

jurisdiction where such offer, sale, exchange or transfer is not

permitted or is unlawful.

Any investor who acquires the Securities must rely solely on the

final base prospectus dated 16 August 2024 and the final terms in

connection with each series of bonds (together, the

"Final

Terms") published

by Diageo plc ("the

Company"), on the

basis of which alone, purchases of or subscription for the

Securities may be made. Each of the Base Prospectus and the Final

Terms, when published, will be available at https://www.londonstockexchange.com/.

For further information, please contact:

Investor relations:

Durga Doraisamy

+44 (0) 7902 126 906

Andy

Ryan

+44 (0) 7803 854 842

Brian

Shipman

+1 (0) 917 710 3007

investor.relations@diageo.com

Media relations:

Brendan

O'Grady

+44 (0) 7902 126 906

Clare Cavana

+44 (0) 7751 742 072

Isabel

Batchelor

+44 (0) 7731 988 857

press@diageo.com

About Diageo

Diageo is a global leader in beverage alcohol with an outstanding

collection of brands across spirits and beer categories. These

brands include Johnnie Walker, Crown Royal, J&B and Buchanan's

whiskies, Smirnoff, Cîroc and Ketel One vodkas, Captain

Morgan, Baileys, Don Julio, Tanqueray and Guinness.

Diageo is a global company, and our products are sold in more than

180 countries around the world. The company is listed on both the

London Stock Exchange (DGE) and the New York Stock Exchange (DEO).

For more information about Diageo, our people, our brands, and

performance, visit us at www.diageo.com.

Visit Diageo's global responsible drinking

resource, www.DRINKiQ.com for

information, initiatives, and ways to share best

practice.

Celebrating life, every day, everywhere.

Diageo plc

LEI: 213800ZVIELEA55JMJ32

Diageo Finance plc

LEI: BPF79TJMIH3DK8XCKI50

Diageo PLC – Publication of Final

Terms

Dated

30 August 2024

30 August 2024

Publication of Final Terms

The Final Terms dated 27 August 2024 relating to the issuance by

Diageo Finance plc ("the Issuer") of (i) EUR 3.125% Fixed Rate Instruments due 28

February 2031, (ii) EUR 3.375% Fixed Rate Instruments due 30 August

2035, and (iii) EUR 3.75% Fixed Rate Instruments due 30 August 2044

(together the "Instruments"), guaranteed by Diageo plc (the

"Guarantor") are available for viewing.

The Instruments have been issued under the European Debt Issuance

Programme established by the Issuer and the Guarantor (the

"Programme").

The Final Terms should be read and construed in

conjunction with the base prospectus dated 16 August 2024 in

relation to the Programme (the "Base

Prospectus").

To

view the full documents, please paste the following URLs into the

address bar of the browser:

http://www.rns-pdf.londonstockexchange.com/rns/3807C_1-2024-8-30.pdf

http://www.rns-pdf.londonstockexchange.com/rns/3807C_2-2024-8-30.pdf

http://www.rns-pdf.londonstockexchange.com/rns/3807C_3-2024-8-30.pdf

Copies

of the Final Terms have been submitted to the National Storage

Mechanism and will shortly be available for inspection

at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information, please contact:

Investor relations:

Durga

Doraisamy

+44 (0) 7902 126 906

Andy

Ryan

+44 (0) 7803 854 842

Brian

Shipman

+1 (0) 917 710 3007

investor.relations@diageo.com

Media relations:

Brendan

O'Grady

+44 (0) 7902 126 906

Clare

Cavana

+44 (0) 7751 742 072

Isabel

Batchelor

+44

(0) 7731 988 857

press@diageo.com

About Diageo

Diageo

is a global leader in beverage alcohol with an outstanding

collection of brands across spirits and beer categories. These

brands include Johnnie Walker, Crown Royal, J&B and Buchanan's

whiskies, Smirnoff, Cîroc and Ketel One vodkas, Captain

Morgan, Baileys, Don Julio, Tanqueray and Guinness.

Diageo is a global company, and our products are

sold in more than 180 countries around the world. The company is

listed on both the London Stock Exchange (DGE) and the New York

Stock Exchange (DEO). For more information about Diageo, our

people, our brands, and performance, visit us

at www.diageo.com. Visit

Diageo's global responsible drinking

resource, www.DRINKiQ.com for

information, initiatives, and ways to share best

practice.

Celebrating life, every day, everywhere.

Diageo plc

LEI: 213800ZVIELEA55JMJ32

Diageo Finance plc

LEI: BPF79TJMIH3DK8XCKI50

IMPORTANT: You must read the following before

continuing: The following applies to the Final Terms available by

clicking on the link above, and you are therefore advised to read

this carefully before reading, accessing or making any other use of

the Final Terms. In accessing the Final Terms, you agree to be

bound by the following terms and conditions, including any

modifications to them, any time you receive any information from us

as a result of such access.

THE FINAL TERMS MAY NOT BE FORWARDED OR

DISTRIBUTED OTHER THAN AS PROVIDED BELOW AND MAY NOT BE REPRODUCED

IN ANY MANNER WHATSOEVER. THE FINAL TERMS MAY ONLY BE DISTRIBUTED

OUTSIDE THE UNITED STATES TO PERSONS THAT ARE NOT U.S. PERSONS AS

DEFINED IN, AND IN RELIANCE ON, REGULATION S UNDER THE U.S.

SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES

ACT"). ANY FORWARDING,

DISTRIBUTION OR REPRODUCTION OF THE FINAL TERMS IN WHOLE OR IN PART

IS PROHIBITED. FAILURE TO COMPLY WITH THIS NOTICE MAY RESULT IN A

VIOLATION OF THE SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER

JURISDICTIONS. NOTHING IN THIS ELECTRONIC PUBLICATION CONSTITUTES

AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION. ANY NOTES

ISSUED OR TO BE ISSUED PURSUANT TO THE FINAL TERMS HAVE NOT BEEN,

AND WILL NOT BE, REGISTERED UNDER THE SECURITIES ACT OR THE

SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR OTHER

JURISDICTION. ANY INSTRUMENTS ISSUED OR TO BE ISSUED PURSUANT TO

THE FINAL TERMS MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE

TRANSFERRED EXCEPT IN AN OFFSHORE TRANSACTION TO A PERSON THAT IS

NOT A U.S. PERSON IN ACCORDANCE WITH REGULATION S UNDER THE

SECURITIES ACT.

Please

note that the information contained in the Final Terms may be

addressed to and/or targeted at persons who are residents of

particular countries (specified in the Final Terms and the Base

Prospectus) only and is not intended for use and should not be

relied upon by any person outside these countries and/or to whom

the offer contained in the Final Terms is not addressed.

Prior to relying on the information contained in the Final Terms

you must ascertain from the Base Prospectus whether or not you are

part of the intended addressees of the information contained

therein.

The

Final Terms do not constitute, and may not be used in connection

with, an offer or solicitation in any place where

offers or solicitations are not permitted by law. If a

jurisdiction requires that the offering be made by a licensed

broker or dealer and the underwriters or any

affiliate

of the underwriters is a licensed broker or dealer in that

jurisdiction, the offering shall be deemed to be made by the

underwriters or such affiliate on behalf of the issuer in such

jurisdiction. Under no circumstances shall the Final Terms

constitute an offer to sell, or the solicitation of an

offer to buy, nor shall there be any sale of any Instruments

issued or to be issued pursuant to the Final Terms, in any

jurisdiction in which such offer, solicitation or sale would

be unlawful.

The

Final Terms have been made available to you in an electronic form.

You are reminded that documents transmitted via this medium may be

altered or changed during the process of electronic transmission

and consequently none of the Issuers, the Guarantor, their advisers

nor any person who controls any of them nor any director, officer,

employee nor agent of it or affiliate of any such person accepts

any liability or responsibility whatsoever in respect of any

difference between the Final Terms made available to you in

electronic format and the hard copy version available to you on

request.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

Diageo plc

|

|

|

(Registrant)

|

|

|

|

|

Date:

03 September 2024

|

|

|

|

|

|

|

By:___/s/

James Edmunds

|

|

|

|

|

|

James Edmunds

|

|

|

Deputy Company Secretary

|

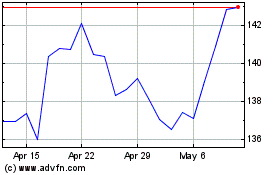

Diageo (NYSE:DEO)

Historical Stock Chart

From Aug 2024 to Sep 2024

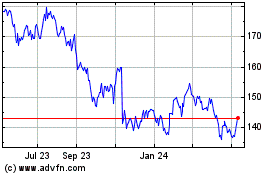

Diageo (NYSE:DEO)

Historical Stock Chart

From Sep 2023 to Sep 2024