Revenues from sales decreased by 2 % to

AR$ 46,554 million in 4Q22, against AR$ 47,624 million in 4Q21. This is mainly due to the tariff delay in an inflationary context partially

offset by the volume levels of energy sold.

Energy purchases increased by 20% to AR$

35,865 million in 4Q22, against AR$ 29,998 million for the same period in 2021. The reference seasonal price for residential customers

is still subsidized by the Federal Government.

The gross margin corresponding to 4Q22 was

AR$ 10,689 million, which represents a fall of 39% compared to the same period of the previous year. The accumulated gross margin as of

December 31, 2022 was AR$ 62,607 million, which represents a fall of 26% compared to the same period of the previous year, mainly due

to the tariff delay in an inflationary context partially offset by the volume levels of energy sold.

By means of Resolution No. 313/2022, the

ENRE approved the Tariff Scheme to be applied as of September 1, 2022 to Level 1 Residential users and other tariff categories of EDENOR.

For Levels 2 and 3, the Tariff Scheme provided for in ENRE Resolution No. 222/2022 continues to be in force.

On February 28, 2023, through Resolution No. 241/2023, the ENRE approved

the new rate charts, being 108%, as of April 1, and an additional 74% for June 1, 2023.

| | | |

Edenor S.A – Earnings Release 4Q22 | 5 | |

| |

12 Months 2022 |

12 Months 2021 |

Variation |

| |

GWh |

Part. % |

Customers |

GWh |

Part. % |

Customers |

% GWh |

% Customers |

| Residential * |

10,361 |

45.4% |

2,886,189 |

9,868 |

45.5% |

2,853,455 |

5.0% |

1.1% |

| Small commercial |

2,056 |

9.0% |

339,470 |

1,839 |

8.5% |

337,797 |

11.8% |

0.5% |

| Medium commercial |

1,529 |

6.7% |

30,825 |

1,447 |

6.7% |

30,863 |

5.7% |

(0.1%) |

| Industrial |

3,714 |

16.3% |

7,050 |

3,492 |

16.1% |

6,900 |

6.3% |

2.2% |

| Wheeling System |

3,776 |

16.5% |

686 |

3,703 |

17.1% |

684 |

2.0% |

0.3% |

| Others |

|

|

|

|

|

|

|

|

| Public lighting |

634 |

2.8% |

21 |

665 |

3.1% |

21 |

(4.6%) |

0.0% |

| Shantytowns and others |

755 |

3.3% |

588 |

695 |

3.2% |

563 |

8.5% |

4.4% |

| Total |

22,826 |

100% |

3,264,829 |

21,710 |

100% |

3,230,283 |

5.1% |

1.1% |

| |

|

|

|

|

|

|

|

|

| |

4Q 2022 |

4Q 2021 |

Variation |

| |

GWh |

Part. % |

Customers |

GWh |

Part. % |

Customers |

% GWh |

% Customers |

| Residential * |

2,393 |

43.8% |

2,886,189 |

2,267 |

43.3% |

2,853,455 |

5.5% |

1.1% |

| Small commercial |

497 |

9.1% |

339,470 |

466 |

8.9% |

337,797 |

6.6% |

0.5% |

| Medium commercial |

383 |

7.0% |

30,825 |

370 |

7.1% |

30,863 |

3.5% |

(0.1%) |

| Industrial |

924 |

16.9% |

7,050 |

898 |

17.1% |

6,900 |

2.9% |

2.2% |

| Wheeling System |

958 |

17.6% |

686 |

948 |

18.1% |

684 |

1.1% |

0.3% |

| Others |

|

|

|

|

|

|

|

|

| Public lighting |

138 |

2.5% |

21 |

146 |

2.8% |

21 |

(5.6%) |

0.0% |

| Shantytowns and others |

165 |

3.0% |

588 |

146 |

2.8% |

563 |

13.1% |

4.4% |

| Total |

5,457 |

100% |

3,264,829 |

5,241 |

100% |

3,230,283 |

4.1% |

1.1% |

| |

|

|

|

|

|

|

|

|

| * 561.090 customers benefit from Social Tariff |

Volume of Energy Sales

The volume of energy sales increased by

4.1 %, reaching 5,457 GWh in 4Q22, against 5,241 GWh for the same period of 2021.

Furthermore, edenor’s customer

base rose by 1.1 % compared to the same period of the previous year, reaching more than 3.264,829 million of customers, mainly on account

of the increase in residential customers and small commercials as a result of the market discipline actions and the installation of 41

integrated energy meters during the last quarter that were mainly intended for the regularization of clandestine connections.

Operating Expenses

| In million of pesos |

12 months |

4Q |

| in constant purchising power |

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

| Salaries, social security taxes |

(32,731) |

(30,464) |

7% |

(8,868) |

(7,608) |

17% |

| Pensions Plans |

(1,202) |

(1,471) |

(18%) |

(78) |

40 |

(297%) |

| Communications expenses |

(1,289) |

(1,633) |

(21%) |

(223) |

(372) |

(40%) |

| Allowance for the imp. of trade and other receivables |

(2,199) |

(3,822) |

(42%) |

(254) |

(1,096) |

(77%) |

| Supplies consumption |

(3,587) |

(4,824) |

(26%) |

(440) |

(1,302) |

(66%) |

| Leases and insurance |

(1,127) |

(997) |

13% |

(305) |

(246) |

24% |

| Security service |

(1,428) |

(1,298) |

10% |

(504) |

(361) |

40% |

| Fees and remuneration for services |

(22,625) |

(22,447) |

1% |

(6,117) |

(6,760) |

(10%) |

| Amortization of assets by right of use |

(1,033) |

(892) |

16% |

(269) |

112 |

(341%) |

| Public relations and marketing |

(1,896) |

(226) |

739% |

(730) |

(207) |

252% |

| Advertising and sponsorship |

(977) |

(117) |

735% |

(376) |

(108) |

250% |

| Depreciation of property, plant and equipment |

(18,193) |

(17,728) |

3% |

(4,517) |

(4,470) |

1% |

| Directors and Sup. Committee members’ fees |

(69) |

(69) |

0% |

(50) |

(15) |

234% |

| ENRE penalties |

(4,868) |

(3,982) |

22% |

(474) |

(1,154) |

(59%) |

| Taxes and charges |

(3,366) |

(3,577) |

(6%) |

(857) |

(934) |

(8%) |

| Other |

(46) |

(55) |

(16%) |

(8) |

(14) |

(39%) |

| Total |

(96,638) |

(93,604) |

3% |

(24,072) |

(24,497) |

(2%) |

Operating expenses accumulated as of December

increased by 3 %, reaching ARS 96,638 million during 2022, against AR$ 93,604 million in 2021.

Financial Results

Financial results experienced a higher loss

in the amount of ARS 28,280 million in 4Q 2022, an increase of 75 %. This difference is mainly due to higher interest accrued on the debt

incurred with CAMMESA. As of December 2022, accumulated losses were AR$ 89,138.

| | | |

Edenor S.A – Earnings Release 4Q22 | 6 | |

Net Income

Net income decreased by 11 %, reaching losses

for AR$ 14,368 million in 4Q22, against AR$ 12,935 million for the same period in 2021. There was a higher loss in the operating income,

higher financial charges due to the deferral of the payment of obligations with the Wholesale Electricity Market and a higher positive

result for exposure to changes in purchasing power (RECPAM).

EBITDA

| In millon of Pesos |

12 months |

4Q |

| in constant purchising power |

2022 |

2021 |

Δ% |

2022 |

2021 |

Δ% |

| Net operating income |

(31,249) |

(8,563) |

265% |

(8,848) |

(7,454) |

19% |

| Depreciation of property, plant and equipment |

19,226 |

18,620 |

3% |

4,786 |

4,358 |

10% |

| Act of agrrement cammesa |

18,136 |

- |

- |

18,136 |

- |

- |

| EBITDA |

6,113 |

10,057 |

n/a |

14,074 |

(3,096) |

n/a |

EBITDA had a positive result of ARS 14,074 in 4Q22, taking into account

the effects of the Obligations Regularization Agreement Act with cammesa with a gain of ARS18,136. The accumulated EBITDA for 2022 was

ARS 6,114

Capital Expenditures

During the twelve months of 2022, edenor´s

capital expenditures totaled ARS 33,900 million, against ARS 31,653 million in 2021, an increase of 7 % in real terms compared to

the same period of the previous year.

Investments for the 4Q2022 were as follows:

| · | AR$ 10,863.3 million in Electricity-related

activities |

| · | AR$ 1,735.6 million in Systems

and others |

| · | AR$ 1,349.0 million in Projects

Staff Cost |

In order to meet demand, improve service quality

and reduce non-technical losses, most of the investments were assigned to the increase in capacity, installation of remote control equipment

in the medium voltage network, connection of new supplies and installation of

self-managed energy meters. All investments are made prioritizing the protection of the environment and safety on public roads.

| | | |

Edenor S.A – Earnings Release 4Q22 | 7 | |

Quality Standards

The investment plan executed in recent years

continues to show results that are reflected in a continuous improvement in the quality of service, by reducing the duration and frequency

of outages since 2014, and thus exceeding the regulatory requirements set forth.

Quality standards are measured based on

the duration and frequency of service outages using SAIDI and SAIFI indicators. SAIDI refers to the duration of outages, and measures

the number of outage hours a user experiences per year. SAIFI refers to the frequency of outages, and measures the number of times a user

experiences an outage during a year.

At the closing of the fourth quarter of

2022, SAIDI and SAIFI indicators for the last 12 months were 8.6 hours and 3.6 outages on average per client per year, registering records

levels and evidencing a 19% and 13% improvement, respectively, compared to the same period of the previous year. This recovery in service

levels is mainly due to the investment plan devised by the Company since 2014, the different improvements implemented in the operating

processes, and the adoption of technology applied to the grid´s operation and management.

SAIDI

| | | |

Edenor S.A – Earnings Release 4Q22 | 8 | |

SAIFI

Energy Losses

In 4Q22, energy losses experienced a 15.6 % decrease, against

16,6 % for the same period of the previous year.

The works of multidisciplinary teams to

develop new solutions to energy losses continued, as well as Market Discipline (DIME) actions aiming to reduce them. Analytical and artificial

intelligence tools were used to enhance effectiveness in the routing of inspections, and DIME actions continued with the objective of

detecting and normalizing irregular connections, fraud and energy theft.

In addition, during the period from October

to December 2022, 83,141 inspections of Tariff 1 (Residential and General users) were conducted with a 56.5 % efficiency, while for the

same period of the previous year 123,486 inspections had been conducted with a 45.1%. efficiency. Moreover, 15,086 Integrated Energy Meters

(MIDE) were installed during 2022.

Regarding the recovery of energy, besides

the normalization of customers with MIDE meters, clandestine customers with conventional meters were also put back to normal. Moreover,

a new energy balance system was implemented, as well as the development of micro-balances in private neighborhoods. In all cases, a rate

of recidivism in fraud has been observed.

| | | |

Edenor S.A – Earnings Release 4Q22 | 9 | |

Energy Losses

Indebtedness

As of December 31, 2022, the outstanding principal

of our dollar-denominated financial debt amounts to USD 85 million, whereas the cash position net of financial debt amounts to USD -88

million.

As a subsequent event, on October 25, 2022,

the company completed the cancellation and voluntary exchange of 9.75% Class 9 Corporate Bonds Financial Debt, for a total of USD 98.05

million.

The operation included a debt exchange that

had the support of 77.35% of the holders (USD 75,855,000), in two stages, through which new Class 1 Corporate Bonds (under NY Law) were

issued for the part in kind, for a total of USD 55,244,538, which expires on May 2025.

On September 22, Series 2 was issued for USD

30,000,000 (hard dollar under Argentine Law), with maturity date November 2024. As a result of the above, the corporate debt horizon was

resolved.

In turn, on March 3, Class 2 Additional Corporate

Bonds up to USD 30 million (hard dollar under Argentine law) were launched, also expiring on November 2024.

The terms and conditions Class 1 Senior Notes

due 2025 impose restrictions on the Company´s ability to go into debt.

Such terms and conditions provide that the

Company may not incur new Indebtedness, except for certain Permitted Indebtedness or when the Indebtedness ratio is greater than 3.75

or less than 0 and the Financial Expenses Coverage ratio is less than 2.

This situation does not trigger any Payment

Default Event and the Company may incur in certain Permitted Indebtedness as established in the terms and conditions of the Notes (including

the refinancing of its outstanding Notes)

Sustainability

At Edenor, we are committed to the Sustainable

Development Goals. We especially make concrete and measurable contributions to 3 of these goals: Affordable and Clean Energy, Quality

Education and Gender Equality.

During 2022, the eighth sustainability report

was issued, corresponding to year 2021. As from this edition, it will be made annually in both Spanish and English.

| | | |

Edenor S.A – Earnings Release 4Q22 | 10 | |

About edenor

Empresa Distribuidora y Comercializadora Norte

S.A. (edenor) is the largest electricity distribution company in Argentina in terms of number of customers and electricity sold

(in GWh). Through a concession, edenor distributes electricity exclusively to the northwestern zone of the greater Buenos Aires

metropolitan area and the northern part of the City of Buenos Aires, which has a population of approximately 11 million people and an

area of 4,637 sq. km. In the fourth quarter, edenor sold 5,547 GWh of energy and purchased 6,475 GWh (including wheeling system

demands), with revenue from sales in the amount of AR$ 205,835 billion adjusted by inflation as of December 2022. In turn, the company

had negative net results in the amount of AR$ 17,893 billion.

Disclaimer

This press release may contain forward-looking

statements. These statements are not historical facts, and are based on management’s current view and estimates of future economic

circumstances, industry conditions, Company performance and financial results. The words “anticipates”, “believes”,

“estimates”, “expects”, “plans” and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and

uncertainties, including those identified in the documents filed by the Company with the U.S. Securities and Exchange Commission. There

is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors,

including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

Edenor S.A.

Avenida del Libertador 6363, Piso 12º

(C1428ARG) Buenos Aires, Argentina

Tel: 5411.4346.5511

investor@edenor.com

www.edenor.com

| | | |

Edenor S.A – Earnings Release 4Q22 | 11 | |

Condensed Interim Statements of Financial Position

As of December 31, 2022 and 2021

Values expressed on a constant currency basis

In million of Argentine Pesos

in constant purchising power |

12.31.2022 |

|

12.31.2021 |

|

|

12.31.2022 |

|

12.31.2021 |

| ARS |

ARS |

|

ARS |

ARS |

| |

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

EQUITY |

|

|

|

| |

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

Share capital |

875 |

|

875 |

| Property, plant and equipment |

329,390 |

|

324,471 |

|

Adjustment to share capital |

92,562 |

|

92,553 |

| Interest in joint ventures |

19 |

|

23 |

|

Additional paid-in capital |

1,280 |

|

1,272 |

| Deferred tax asset |

830 |

|

706 |

|

Treasury stock |

31 |

|

31 |

| Other receivables |

3 |

|

12 |

|

Adjustment to treasury stock |

1,983 |

|

1,992 |

| Financial assets at amortized cost |

- |

|

- |

|

Adquisition cost of own shares |

(7,651) |

|

(7,651) |

| Total non-current assets |

330,242 |

|

325,212 |

|

Legal reserve |

6,467 |

|

6,467 |

| |

|

|

|

|

Opcional reserve |

62,625 |

|

62,625 |

| Current assets |

|

|

|

|

Other comprehensive loss |

(330) |

|

(330) |

| Inventories |

4,875 |

|

5,714 |

|

Accumulated losses |

(53,554) |

|

(35,447) |

| Other receivables |

7,478 |

|

3,541 |

|

TOTAL EQUITY |

104,288 |

|

122,387 |

| Trade receivables |

26,652 |

|

29,168 |

|

|

|

|

|

| Financial assets at amortized cost |

- |

|

404 |

|

LIABILITIES |

|

|

|

| Cash and cash equivalents |

7,137 |

|

5,268 |

|

Non-current liabilities |

|

|

|

| Total current assets |

70,026 |

|

69,755 |

|

|

|

|

|

| |

|

|

|

|

Trade payables |

825 |

|

1,097 |

| |

|

|

|

|

Other payables |

15,002 |

|

15,700 |

| TOTAL ASSETS |

400,268 |

|

394,967 |

|

Borrowings |

11,662 |

|

- |

| |

|

|

|

|

Deferred revenue |

1,654 |

|

2,803 |

| |

|

|

|

|

Salaries and social security payable |

615 |

|

662 |

| |

|

|

|

|

Benefit plans |

1,454 |

|

1,655 |

| |

|

|

|

|

Deferred tax liability |

90,737 |

|

82,105 |

| |

|

|

|

|

Provisions |

5,779 |

|

6,611 |

| |

|

|

|

|

Total non-current liabilities |

127,728 |

|

110,633 |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

Current liabilities |

|

|

|

| |

|

|

|

|

Trade payables |

148,619 |

|

126,511 |

| |

|

|

|

|

Other payables |

6,369 |

|

6,604 |

| |

|

|

|

|

Borrowings |

4,084 |

|

17,042 |

| |

|

|

|

|

Derivative financial instruments |

12 |

|

- |

| |

|

|

|

|

Deferred revenue |

44 |

|

73 |

| |

|

|

|

|

Salaries and social security payable |

6,604 |

|

7,500 |

| |

|

|

|

|

Benefit plans |

131 |

|

217 |

| |

|

|

|

|

Tax payable |

- |

|

2,082 |

| |

|

|

|

|

Tax liabilities |

1,103 |

|

1,027 |

| |

|

|

|

|

Provisions |

1,286 |

|

891 |

| |

|

|

|

|

Total current liabilities |

168,252 |

|

161,947 |

| |

|

|

|

|

TOTAL LIABILITIES |

295,980 |

|

272,580 |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

400,268 |

|

394,967 |

| | | |

Edenor S.A – Earnings Release 4Q22 | 12 | |

Condensed Interim Statements of Comprehensive

Income

for the twelve-month period ended on December 31, 2022 and 2021

Values expressed on a constant

currency basis

In millon of Argentine Pesos

in constant purchising power |

|

12.31.2022 |

|

12.31.2021 |

| ARS |

ARS |

| |

|

|

|

|

| Continuing operations |

|

|

|

|

| Revenue |

|

205,835 |

|

221,091 |

| Electric power purchases |

|

(143,228) |

|

(135,966) |

| Subtotal |

|

62,607 |

|

85,125 |

| Transmission and distribution expenses |

|

(55,108) |

|

(56,708) |

| Gross loss |

|

7,499 |

|

28,417 |

| Selling expenses |

|

(23,669) |

|

(22,391) |

| Administrative expenses |

|

(17,861) |

|

(14,505) |

| Other operating income |

|

10,354 |

|

9,431 |

| Other operating expense |

|

(7,566) |

|

(9,515) |

| Operating Profit (Loss) |

|

(31,243) |

|

(8,563) |

| Labilities regularization agreement |

|

- |

|

- |

| Financial income |

|

65 |

|

127 |

| Financial expenses |

|

(87,773) |

|

(52,517) |

| Other financial expense |

|

(1,430) |

|

3,391 |

| Net financial expense |

|

(89,138) |

|

(48,999) |

| RECPAM |

|

99,617 |

|

46,440 |

| Profit (Loss) before taxes |

|

(20,764) |

|

(11,122) |

| |

|

|

|

|

| Income tax |

|

(14,834) |

|

(30,455) |

| Profit (Loss) for the period |

|

(35,598) |

|

(41,577) |

| |

|

|

|

|

| Basic and diluted earnings Profit (Loss) per share: |

|

|

|

| Basic and diluted earnings profit (loss) per share |

(3.22) |

|

(1.16) |

| | | |

Edenor S.A – Earnings Release 4Q22 | 13 | |

Condensed Interim Statements of Comprehensive

Income

for the twelve-month period ended on December 31, 2022 and 2021

Values expressed at historical values

In millon of Argentine Pesos

in constant purchising power |

|

12.31.2022 |

|

12.31.2022 |

| ARS |

ARS |

| |

|

|

|

|

| Continuing operations |

|

|

|

|

| Revenue |

|

19,009 |

|

9,725 |

| Electric power purchases |

|

(13,920) |

|

(5,802) |

| Subtotal |

|

5,088 |

|

3,923 |

| Transmission and distribution expenses |

|

(3,630) |

|

(1,713) |

| Gross loss |

|

1,459 |

|

2,210 |

| Selling expenses |

|

(2,374) |

|

(810) |

| Administrative expenses |

|

(1,794) |

|

(736) |

| Other operating expense, net |

|

47 |

|

(48) |

| Operating Profit (Loss) |

|

(2,663) |

|

616 |

| Financial income |

|

0 |

|

3 |

| Other financial expense |

|

6,315 |

|

191 |

| Net financial expense |

|

(4,907) |

|

(2,511) |

| |

|

|

|

|

| RECPAM |

|

0 |

|

0 |

| Profit (Loss) before taxes |

|

(7,570) |

|

(1,684) |

| |

|

|

|

|

| Income tax |

|

874 |

|

8 |

| Profit (Loss) for the period |

|

(6,696) |

|

(1,675) |

| |

|

|

|

|

| Basic and diluted earnings Profit (Loss) per share: |

|

|

|

|

| Basic and diluted earnings Profit (Loss) per share |

|

(7.65) |

|

(1.91) |

| | | |

Edenor S.A – Earnings Release 4Q22 | 14 | |

Condensed Interim Statements of Cash Flows

For the twelve-month period ended on December

31, 2022 and 2021

Values expressed

on a constant currency basis

In millon of Argentine Pesos

in constant purchising power |

|

12.31.2022 |

|

12.31.2021 |

| ARS |

ARS |

| |

|

|

|

|

| Cash flows from operating activities |

|

|

|

|

| Loss (Profit) for the period |

|

(17,468) |

|

(41,577) |

| Adjustments to reconcile net (loss) profit to net cash flows provided by operating activities: |

|

10,367 |

|

58,054 |

| |

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

| Increase in trade receivables |

|

(6,535) |

|

(5,236) |

| Increase in trade payables |

|

62,072 |

|

35,525 |

| Income tax payment |

|

(96) |

|

- |

| Cammesa Commercial Financing |

|

- |

|

- |

| Others |

|

(14,938) |

|

(5,180) |

| |

|

|

|

|

| Net cash flows provided by operating activities |

|

33,402 |

|

41,586 |

| |

|

|

|

|

| Net cash flows used in investing activities |

|

(32,690) |

|

(49,760) |

| |

|

|

|

|

| Net cash flows used in financing activities |

|

1,316 |

|

(2,801) |

| |

|

|

|

|

| Net (decrease) increase in cash and cash equivalents |

|

2,028 |

|

(10,975) |

| |

|

|

|

|

| Cash and cash equivalents at beginning of year |

|

6,179 |

|

12,821 |

| Exchange differences in cash and cash equivalents |

|

2,136 |

|

4,340 |

| Result for exposure to inflation in cash and cash equivalents |

|

15 |

|

(8) |

| Net decrease in cash and cash equivalents |

|

(6,700) |

|

(10,975) |

| Cash and cash equivalents at the end of period |

|

1,630 |

|

6,178 |

| |

|

|

|

|

| Supplemental cash flows information |

|

|

|

|

| Non-cash operating, investing and financing activities |

|

|

|

|

| Labilities regularization agreement |

|

|

|

- |

| Acquisitions of property, plant and equipment through increased trade payables |

|

(2,170) |

|

(2,959) |

| Acquisitions of assets for rights of use through an increase in other debts |

|

(912) |

|

(1,050) |

| | | |

Edenor S.A – Earnings Release 4Q22 | 15 | |

|

Investor Relations Contacts:

German Ranftl

Chief Financial Officer

Silvana Coria

Investor Relations Manager |

|

investor@edenor.com | Tel: +54 (11) 4346-5511 |

| | | |

Edenor S.A – Earnings Release 4Q22 | 16 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Germán Ranftl |

|

|

Germán Ranftl |

|

|

Chief Financial Officer |

Date:

March 9, 2023

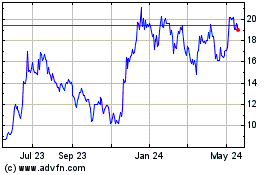

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Dec 2024 to Jan 2025

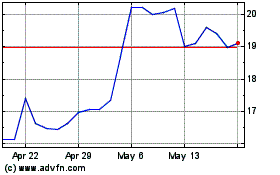

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jan 2024 to Jan 2025