Revenue Growth of 17.5% Year-over-Year

Emerald Holding, Inc. (NYSE: EEX) (“Emerald” or the “Company”),

America’s largest producer of trade shows and their associated

conferences, content and commerce, today reported financial results

for the fourth quarter and full year ended December 31, 2023.

Financial Highlights

- Revenues of $382.8 million for 2023, an increase of $56.9

million, or 17.5% over 2022, primarily due to growth in events, new

launches and acquisitions.

- Organic Revenues, a non-GAAP measure, which takes into account

the impact of acquisitions and scheduling adjustments, of $370.1

million for 2023, an increase of $47.0 million, or 14.5%, from

$323.1 million for 2022 (Refer to Schedule 1 for a reconciliation

to revenues, the most directly comparable GAAP measure)

- Net loss of $8.2 million for 2023, compared to net income of

$130.8 million for 2022

- Adjusted EBITDA, a non-GAAP measure, of $97.8 million for 2023,

compared to $239.6 million for 2022; Adjusted EBITDA excluding

insurance proceeds, a non-GAAP measure, of $95.0 million for 2023,

compared to $56.8 million for 2022 (Refer to Schedule 3 for a

reconciliation to net (loss) income, the most directly comparable

GAAP measure)

- $204.2 million in cash and full availability of its $110.0

million revolving credit facility

- For the full year 2024, the Company expects to generate between

$415 million and $425 million of revenue and between $110 million

and $115 million of Adjusted EBITDA

Operational Highlights

- Emerald’s core trade show business is strong with

year-over-year growth in revenue driven by increases in exhibitors,

attendees and pricing

- Expanded portfolio into the consumer live events market in FY

2023 with the acquisition of Lodestone Events’ Overland Expo show,

and the launch of a brand new event, NBA Con, with the National

Basketball Association

Hervé Sedky, Emerald’s President and Chief Executive Officer,

said, “We delivered another year of strong results in 2023. As a

highly diversified and scaled platform, Emerald continues to

benefit from the extended post-Covid recovery with strong demand

from exhibitors and attendees alike. Improvements in our customers’

supply chains and the removal of international travel restrictions

are driving higher exhibitor attendance at our trade shows and

contributing to increases in attendees and pricing. Our highlights

in 2023 include the acquisition of Lodestone Events and their

Overland Expo show, the successful launch of the Cocina Sabrosa

Latin food expo in September, and the largest ever edition of

Advertising Week New York, which we hosted in October. Our recent

performance demonstrates the exceptional and durable value that

trade shows offer to buyers and sellers alike. We are excited for

2024 and beyond as we continue to grow our portfolio of must-attend

events and deliver greater value to our exhibitors, attendees, and

shareholders. In the end, we are guided by our deep commitment to

the communities we serve. Our mission is to serve and inspire,

empowering both buyers and sellers to succeed. Their continued

return for more is a testament to the value they find in what we

offer and the knowledge that our steadfast dedication to our

community is what truly sets us apart.”

David Doft, Emerald’s Chief Financial Officer, added, “We

achieved substantial top and bottom line growth in 2023 on the back

of positive attendance and pricing trends as our customers continue

to see our trade shows as instrumental in growing their own

businesses, generating leads, and discovering new products. For the

full year 2023, we grew revenue more than 17% and Adjusted EBITDA

more than 67%, excluding insurance proceeds, over the prior year.

The performance of our media content business was muted in 2023 as

many companies in the tech sector took a more cautious approach to

advertising spend, which slightly detracted from the otherwise

strong performance in our core live events business. Looking ahead,

we have positioned Emerald to be an engine of sustained growth

through our strategy of organically growing attendance and pricing

as well as through acquisitions and new show launches. Our guidance

for 2024 implies another double-digit percentage increase in

EBITDA, supported by positive trends in our industry, operational

and scale efficiencies, and a large and growing portfolio of

industry-leading events.”

Fourth Quarter

and Full Year Ended December 31, 2023 Financial Performance and

Highlights

Three Months Ended December

31,

Year Ended December

31,

2023

2022

Change

% Change

2023

2022

Change

% Change

(unaudited, dollars in

millions, except percentages and per share data)

Revenues

$

101.5

$

93.6

$

7.9

8.4

%

$

382.8

$

325.9

$

56.9

17.5

%

Net (loss) income

$

(17.9

)

$

22.4

$

(40.3

)

NM

$

(8.2

)

$

130.8

$

(139.0

)

NM

Net cash provided by (used in) operating

activities

$

15.6

$

(23.6

)

$

39.2

NM

$

40.3

$

175.1

$

(134.8

)

(77.0

%)

Diluted income (loss) per share

$

(0.46

)

$

0.06

$

(0.52

)

NM

$

(0.78

)

$

0.46

$

(1.24

)

NM

Non-GAAP measures:

Adjusted EBITDA

$

35.8

$

25.0

$

10.8

43.2

%

$

97.8

$

239.6

$

(141.8

)

(59.2

%)

Adjusted EBITDA excluding event

cancellation insurance proceeds

$

35.8

$

25.0

$

10.8

43.2

%

$

95.0

$

56.8

$

38.2

67.3

%

Free Cash Flow

$

13.5

$

(26.4

)

$

39.9

NM

$

28.8

$

164.8

$

(136.0

)

(82.5

%)

Free cash flow excluding event

cancellation insurance proceeds, net

$

13.5

$

(1.4

)

$

14.9

NM

$

26.0

$

6.9

$

19.1

276.8

%

- In connection with the consolidation of the Company’s media

assets completed in 2023, Emerald realigned its reporting segments

beginning with the fourth quarter and full year ended December 31,

2023:

- The Connections segment, which includes Emerald’s portfolio of

live events, accounted for approximately 89% of 2023 revenues.

- The All Other category, which includes Emerald’s content and

software-as-a-service (SaaS) assets, accounted for approximately

11% of 2023 revenues.

- Fourth quarter 2023 revenues were $101.5 million, an increase

of $7.9 million or 8.4% versus the fourth quarter 2022, driven

primarily by organic revenue growth of $5.2 million as well as $1.7

million in revenue from acquisitions. In addition, scheduling

adjustments of $1.1 million contributed to higher revenue in the

fourth quarter 2023. Full year 2023 revenues were $382.8 million,

an increase of $56.9 million or 17.5% versus the full year 2022,

driven primarily by organic growth of $47.0 million as well as

$12.7 million in revenue from acquisitions. This growth was offset

by prior year discontinued event revenues of $2.8 million.

- Fourth quarter 2023 Organic Revenues from the Connections

reportable segment were $87.5 million, an increase of $5.7 million

or 7.0% versus the fourth quarter 2022, due primarily to a $4.4

million increase in recurring revenues and $1.3 million from newly

launched events. Full year 2023 Organic Revenues from the

Connections reportable segment were $327.5 million, an increase of

$47.7 million or 17.0% versus the full year 2022, due primarily to

a $41.8 million increase in recurring revenues and $5.9 million

from newly launched events.

- Fourth quarter 2023 Organic Revenues from the All Other

category were $11.2 million, a decrease of $0.5 million or 4.3%

versus the fourth quarter 2022, due primarily to a $0.9 million

decrease in Content revenues offset by a $0.4 million increase in

Commerce revenues. Full year 2023 Organic Revenues from the All

Other category were $42.6 million, a decrease of $0.7 million or

1.6% versus the full year 2022, due primarily to a $4.4 million

decrease in Content revenues offset by a $3.7 million increase in

Commerce revenues.

- Fourth quarter 2023 Adjusted EBITDA was $35.8 million, compared

to $25.0 million for the fourth quarter 2022. Excluding event

cancellation insurance proceeds, fourth quarter 2023 Adjusted

EBITDA was $35.8 million, compared to Adjusted EBITDA ex-insurance

of $25.0 million for the fourth quarter 2022. Full year 2023

Adjusted EBITDA was $97.8 million, compared to $239.6 million for

the full year 2022. Excluding event cancellation insurance

proceeds, Adjusted EBITDA for the full year 2023 was $95.0 million,

compared to Adjusted EBITDA ex-insurance of $56.8 million for the

full year 2022.

- Fourth quarter 2023 net loss was $17.9 million, compared to net

income of $22.4 million for the fourth quarter 2022 principally as

a result of higher provision for income taxes, lower reversal of

contingent consideration liability and higher interest expense,

offset by increased Adjusted EBITDA and lower depreciation and

amortization expense. Full year 2023 net loss was $8.2 million,

compared to net income of $130.8 million for the full year

2022.

For a discussion of the Company’s presentation of Organic

revenues and Adjusted EBITDA, which are non-GAAP measures, see

below under the heading “Non-GAAP Financial Information.” Refer to

Schedule 1 for a reconciliation of Organic revenues to revenues

(discussed in the first paragraph of this section), the most

directly comparable GAAP measure, and refer to Schedule 3 for a

reconciliation of Adjusted EBITDA to net (loss) income (discussed

in the second paragraph of this section), the most directly

comparable GAAP measure.

Cash Flow

- Fourth quarter 2023 net cash provided by operating activities

was $15.6 million, compared to cash used in operating activities of

$23.6 million in the fourth quarter 2022. Full year 2023 net cash

provided by operating activities was $40.3 million, compared to

$175.1 million for the full year 2022.

- Fourth quarter 2023 capital expenditures were $2.1 million,

compared to $2.8 million in the fourth quarter 2022. Full year 2023

capital expenditures were $11.5 million, compared to $10.3 million

for the full year 2022.

- Fourth quarter 2023 Free Cash Flow excluding event cancellation

insurance proceeds, net, which the Company defines as net cash

provided by operating activities less capital expenditures, event

cancellation insurance proceeds and taxes paid on event

cancellation insurance proceeds, was $13.5 million, compared to

negative $1.4 million in the fourth quarter 2022. The calculation

of fourth quarter 2023 Free Cash Flow excluding event cancellation

insurance proceeds, net, includes non-recurring acquisition related

transaction costs of $0.8 million, acquisition integration,

restructuring-related transition costs of $2.1 million, and

non-recurring legal, audit and consulting fees of $1.1 million. The

calculation of fourth quarter 2022 Free Cash Flow excluding event

cancellation insurance proceeds, net, includes acquisition related

transaction costs of $0.3 million, integration-related transition

costs of $1.2 million, and non-recurring legal and consulting fees

of $0.6 million. The total of these items is $4.0 million and $2.1

million for the quarters ended December 31, 2023 and 2022,

respectively.

- Full year 2023 Free Cash Flow excluding event cancellation

insurance proceeds, net, was $26.0 million, compared to $6.9

million in the full year 2022. The calculation of 2023 Free Cash

Flow excluding event cancellation insurance proceeds, net, includes

non-recurring acquisition related transaction costs of $2.6

million, acquisition integration, restructuring-related transition

costs of $6.1 million, and non-recurring legal, audit and

consulting fees of $4.1 million. The calculation of 2022 Free Cash

Flow excluding event cancellation insurance proceeds, net, includes

insurance settlement expenses of $7.9 million, acquisition related

transaction costs of $3.6 million, integration-related transition

costs of $3.1 million, contingent consideration paid in excess of

the original estimate of $2.1 million, and non-recurring legal and

consulting fees of $1.7 million. The total of these items is $12.8

million and $18.4 million for the years ended December 31, 2023 and

2022, respectively.

For a review of the Company’s presentation of Free Cash Flow,

which is a non-GAAP measure, see below under the heading “Non-GAAP

Financial Information.” Refer to Schedule 4 for a reconciliation of

Free Cash Flow to net cash provided by operating activities

(discussed in the first paragraph of this section), the most

directly comparable GAAP measure.

Conference Call Webcast

Details

As previously announced, the Company’s leadership will hold a

conference call to discuss its fourth quarter 2023 results at 8:30

am EDT on Thursday, February 29, 2024.

The conference call can be accessed by dialing 1-888-886-7786

(domestic) or 1-416-764-8658 (international). A telephonic replay

will be available approximately two hours after the call by dialing

1-844-512-2921, or for international callers, 1-412-317-6671. The

passcode for the replay is 01439625. The replay will be available

until 11:59 pm (Eastern Time) on March 07, 2024.

Interested investors and other parties can access the webcast of

the live conference call by visiting the Investors section of

Emerald’s website at http://investor.emeraldx.com. An online replay

will be available on the same website immediately following the

call.

About Emerald

Emerald’s talented and experienced team grows our customers’

businesses 365 days a year through connections, content, and

commerce. We expand connections that drive new business

opportunities, product discovery, and relationships with over 140

annual events, matchmaking, and lead-gen services. We create

content to ensure that our customers are on the cutting edge of

their industries and are continually developing their skills. And

we power commerce through efficient year-round buying and selling.

We do all this by seamlessly integrating in-person and digital

platforms and channels. Emerald is immersed in the industries we

serve and committed to supporting the communities in which we

operate. As true partners, we create experiences that inspire,

amaze, and deliver breakthrough results. For more:

http://www.emeraldx.com/.

Non-GAAP Financial

Information

This press release presents certain “non-GAAP” financial

measures. The components of these non-GAAP measures are computed by

using amounts that are determined in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”). A reconciliation of non-GAAP financial measures used in

this press release to their nearest comparable GAAP financial

measures is included in the schedules attached hereto.

Organic Revenue

We define “Organic revenue growth” and “Organic revenue decline”

as the growth or decline, respectively, in our revenue from one

period to the next, adjusted for the revenue impact of: (i)

acquisitions and dispositions, (ii) discontinued events and (iii)

material show scheduling adjustments. We disclose changes in

Organic revenue because we believe it assists investors and

analysts in comparing Emerald’s operating performance across

reporting periods on a consistent basis by excluding items that we

do not believe provide a fair comparison of the trends underlying

our existing event portfolio given changes in timing or strategy.

Management and Emerald’s board of directors evaluate changes in

Organic revenue to evaluate our historical and prospective

financial performance and understand underlying revenue trends of

our events.

Adjusted EBITDA

We use Adjusted EBITDA because we believe it assists investors

and analysts in comparing Emerald’s operating performance across

reporting periods on a consistent basis by excluding items that we

do not believe are indicative of our core operating performance.

Management and Emerald’s board of directors use Adjusted EBITDA to

assess our financial performance and believe it is helpful in

highlighting trends because it excludes the results of decisions

that are outside the control of management, while other measures

can differ significantly depending on long-term strategic decisions

regarding capital structure, the tax jurisdictions in which we

operate, and capital investments. Adjusted EBITDA should not be

considered as an alternative to net income as a measure of

financial performance or to cash flows from operations as a

liquidity measure.

We define Adjusted EBITDA as net (loss) income before (i)

interest expense, (ii) income tax benefit, (iii) depreciation and

amortization, (iv) stock-based compensation, (v) deferred revenue

adjustment, (vi) goodwill and other intangible asset impairment

charges, and (vii) other items that management believes are not

part of our core operations.

We have also presented Adjusted EBITDA excluding event

cancellation insurance proceeds in order to illustrate the amount

of Adjusted EBITDA from continuing operations.

Note: Schedule 3 provides reconciliations for 2023 and 2022

Adjusted EBITDA to net (loss) income, however, it is not possible,

without unreasonable efforts, to estimate the impacts of show

scheduling adjustments, acquisitions and the amount and timing of

receipt of event cancellation insurance proceeds and certain other

special items that may occur in 2024 as these items are inherently

uncertain and difficult to predict. As a result, the Company is

unable to quantify certain amounts that would be included in a

reconciliation of 2024 projected Adjusted EBITDA to projected net

income without unreasonable efforts and has not provided

reconciliations for these forward-looking non-GAAP financial

measures.

Free Cash Flow

We present Free Cash Flow because we believe it is a useful

indicator of liquidity that provides information to management and

investors about the amount of cash generated from our core

operations that, after capital expenditures, can be used to

maintain and grow our business, for the repayment of indebtedness,

payment of dividends and to fund strategic opportunities. Free Cash

Flow is a supplemental non-GAAP measure of liquidity and is not

based on any standardized methodology prescribed by GAAP. Free Cash

Flow should not be considered in isolation or as an alternative to

cash flows from operating activities or other measures determined

in accordance with GAAP.

We have also presented Free Cash Flow excluding event

cancellation insurance proceeds, net in order to illustrate the

amount of Free Cash Flow from continuing operations.

Other companies may compute these measures differently. No

non-GAAP metric should be considered as an alternative to any other

measure derived in accordance with GAAP.

Cautionary Statement Concerning

Forward-Looking Statements

This press release contains and our earnings call will contain

certain forward-looking statements, including, but not limited to,

our ability to return our business to pre-COVID levels; our

guidance with respect to estimated revenues and Adjusted EBITDA;

our ability or inability to obtain insurance coverage relating to

event cancellations or interruptions; and our ability to

successfully identify and acquire acquisition targets; our

expectations arising from the ongoing impact of COVID-19 on our

business; and how we integrate and grow acquired businesses. These

statements involve risks and uncertainties, including, but not

limited to, economic, competitive, governmental and technological

factors outside of the Company’s control that may cause its

business, industry, strategy, financing activities or actual

results to differ materially. See “Risk Factors” and “Cautionary

Note Regarding Forward-Looking Statements” in the Company’s most

recently filed periodic reports on Form 10-K and Form 10-Q and

subsequent filings. The Company undertakes no obligation to update

or revise any of the forward-looking statements contained herein,

whether as a result of new information, future events or

otherwise.

Emerald Holding, Inc.

Condensed Consolidated

Statements of (Loss) Income and Comprehensive (Loss) Income

(unaudited, dollars in

millions, share data in thousands, except loss per share

data)

Three Months Ended December

31, 2023

Three Months Ended December

31, 2022

Year Ended December 31,

2023

Year Ended December 31,

2022

Revenues

$

101.5

$

93.6

$

382.8

$

325.9

Other income, net

—

—

2.8

182.8

Cost of revenues

35.7

33.2

137.6

116.5

Selling, general and administrative

expense

36.1

17.4

168.3

145.0

Depreciation and amortization expense

9.8

16.5

45.0

59.5

Goodwill impairment charge

—

—

—

6.3

Intangible asset impairment charge

—

—

—

1.6

Operating income

19.9

26.5

34.7

179.8

Interest expense

11.8

9.0

43.3

24.5

Interest income

3.2

1.7

8.2

2.7

Loss on extinguishment of debt

—

—

2.3

—

Other (income) expense

(0.1

)

(0.1

)

—

—

Loss on disposal of fixed assets

—

—

0.2

—

Income (loss) before income taxes

11.4

19.3

(2.9

)

158.0

Provision for (benefit from) income

taxes

29.3

(3.1

)

5.3

27.2

Net (loss) income and comprehensive (loss)

income attributable to Emerald Holding, Inc.

$

(17.9

)

$

22.4

$

(8.2

)

$

130.8

Accretion to redemption value of

redeemable convertible preferred stock

(10.8

)

(10.1

)

(42.0

)

(38.8

)

Participation rights on if-converted

basis

—

(8.2

)

—

(60.2

)

Net (loss) income and comprehensive (loss)

income attributable to Emerald Holding, Inc. common

stockholders

$

(28.7

)

$

4.1

$

(50.2

)

$

31.8

Basic (loss) income per share

(0.46

)

0.06

(0.78

)

0.46

Diluted (loss) income per share

(0.46

)

0.06

(0.78

)

0.46

Basic weighted average common shares

outstanding

62,896

67,599

63,959

69,002

Diluted weighted average common shares

outstanding

62,896

67,943

63,959

69,148

Emerald Holding, Inc.

Condensed Consolidated Balance

Sheets

(dollars in millions, share

data in thousands, except par value)

December 31, 2023

December 31, 2022

(unaudited)

Assets

Current assets

Cash and cash equivalents

$

204.2

$

239.1

Trade and other receivables, net of

allowances of $1.4 million and $1.5 million, as of December 31,

2023 and December 31, 2022, respectively

85.2

74.9

Prepaid expenses and other current

assets

21.5

17.8

Total current assets

310.9

331.8

Noncurrent assets

Property and equipment, net

1.5

2.2

Intangible assets, net

175.1

204.8

Goodwill, net

553.9

545.5

Right-of-use assets

8.8

10.6

Other noncurrent assets

3.7

3.5

Total assets

$

1,053.9

$

1,098.4

Liabilities, Redeemable Convertible

Preferred Stock and Stockholders’ Deficit

Current liabilities

Accounts payable and other current

liabilities

$

46.6

$

58.1

Income taxes payable

0.2

1.2

Cancelled event liabilities

0.6

3.3

Deferred revenues

174.3

151.2

Contingent consideration

0.2

3.5

Right-of-use liabilities, current

portion

4.0

4.9

Term loan, current portion

4.2

—

Total current liabilities

230.1

222.2

Noncurrent liabilities

Term loan, net of discount and deferred

financing fees

398.7

413.9

Deferred tax liabilities, net

3.1

1.8

Right-of-use liabilities, noncurrent

portion

8.9

10.4

Other noncurrent liabilities

8.5

10.8

Total liabilities

649.3

659.1

Commitments and contingencies

Redeemable convertible preferred stock

7% Series A Redeemable Convertible

Participating Preferred Stock, $0.01 par value; authorized shares

at December 31, 2023 and December 31, 2022: 80,000; 71,403 and

71,417 shares issued and outstanding; aggregate liquidation

preference of $492.6 million and $475.9 million at December 31,

2023 and December 31, 2022, respectively

497.1

472.4

Stockholders’ deficit

Common stock, $0.01 par value; authorized

shares at December 31, 2023 and December 31, 2022: 800,000; 62,915

and 67,588 shares issued and outstanding at December 31, 2023 and

December 31, 2022, respectively

0.6

0.7

Additional paid-in capital

559.2

610.3

Accumulated deficit

(652.3

)

(644.1

)

Total stockholders’ deficit

(92.5

)

(33.1

)

Total liabilities, redeemable convertible

preferred stock and stockholders’ deficit

$

1,053.9

$

1,098.4

Schedule

1

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF

REVENUES TO ORGANIC REVENUES

Three Months Ended December

31,

Change

Year Ended December

31,

Change

Consolidated

2023

2022

$

%

2023

2022

$

%

(dollars in millions)

(unaudited)

Revenues

$

101.5

$

93.6

$

7.9

8.4

%

$

382.8

$

325.9

$

56.9

17.5

%

Deduct:

Acquisition revenues

(1.7

)

—

(12.7

)

—

Discontinued events

—

(0.1

)

—

(2.8

)

Scheduling adjustments(1)

(1.1

)

—

—

—

Organic revenues

$

98.7

$

93.5

$

5.2

5.6

%

$

370.1

$

323.1

$

47.0

14.5

%

Connections

Three Months Ended December

31,

Change

Year Ended December

31,

Change

2023

2022

$

%

2023

2022

$

%

(dollars in millions)

(unaudited)

Revenues

$

90.3

$

81.9

$

8.4

10.3

%

$

340.2

$

282.6

$

57.6

20.4

%

Deduct:

Acquisition revenues

(1.7

)

—

(12.7

)

—

Discontinued events

—

(0.1

)

—

(2.8

)

Scheduling adjustments(1)

(1.1

)

—

—

—

Organic revenues

$

87.5

$

81.8

$

5.7

7.0

%

$

327.5

$

279.8

$

47.7

17.0

%

All Other

Three Months Ended December

31,

Change

Year Ended December

31,

Change

2023

2022

$

%

2023

2022

$

%

(dollars in millions)

(unaudited)

Revenues

$

11.2

$

11.7

$

(0.5

)

(4.3

%)

$

42.6

$

43.3

$

(0.7

)

(1.6

%)

Deduct:

Acquisition revenues

—

—

—

—

Discontinued events

—

—

—

—

Scheduling adjustments

—

—

—

—

Organic revenues

$

11.2

$

11.7

$

(0.5

)

(4.3

%)

$

42.6

$

43.3

$

(0.7

)

(1.6

%)

Notes:

- For the three months ended December 31, 2023, represents

revenues from one event that staged in the third quarter of fiscal

2022, but staged in the fourth quarter in fiscal 2023.

Schedule

2

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF

REVENUES TO DISAGGREGATED REVENUES

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

(dollars in millions)

(unaudited)

Connections

$

90.3

$

81.9

$

340.2

$

282.6

Content

6.2

7.1

23.5

27.9

Commerce

5.0

4.6

19.1

15.4

Total Revenues

$

101.5

$

93.6

$

382.8

$

325.9

Schedule

3

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF

NET (LOSS) INCOME TO ADJUSTED EBITDA

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

(dollars in millions)

(unaudited)

Net (loss) income

$

(17.9

)

$

22.4

$

(8.2

)

$

130.8

Add (deduct):

Interest expense, net

8.6

7.3

35.1

21.8

Loss on extinguishment of debt

—

—

2.3

—

(Benefit from) provision for income

taxes

29.3

(3.1

)

5.3

27.2

Goodwill impairment charge(1)

—

—

—

6.3

Intangible asset impairment charge(2)

—

—

—

1.6

Depreciation and amortization

9.8

16.5

45.0

59.5

Stock-based compensation

1.8

0.8

7.8

5.8

Deferred revenue adjustment

—

—

—

0.6

Other items(3)

4.2

(18.9

)

10.5

(14.0

)

Adjusted EBITDA

$

35.8

$

25.0

$

97.8

$

239.6

Deduct:

Event cancellation insurance proceeds

—

—

2.8

182.8

Adjusted EBITDA excluding event

cancellation insurance proceeds

$

35.8

$

25.0

$

95.0

$

56.8

Notes:

- For the year ended December 31, 2022, represents non-cash

charges of $6.3 million for goodwill in connection with the

Company’s interim testing of goodwill for impairment resulting from

the change in operating segments and reporting units that occurred

in the first quarter of 2022.

- Intangible asset impairment charges for the year ended December

31, 2022, represent non-cash charges of $1.6 million for certain

indefinite-lived intangible assets in connection with the Company’s

interim testing of intangibles for impairment.

- Other items for the three months ended December 31, 2023

included: (i) $0.8 million in acquisition-related transaction

costs; (ii) $2.1 million in acquisition integration and

restructuring-related transition costs, including one-time

severance expense of $0.2 million; (iii) $1.1 million in

non-recurring legal, audit and consulting fees and (iv) $0.2

million in expense related to the remeasurement of contingent

consideration. Other items for the three months ended December 31,

2022 included: (i) $24.0 million in gains related to the

remeasurement of contingent consideration; (ii) $0.6 million in

non-recurring legal, audit and consulting fees; (iii) $0.3 million

in acquisition-related transaction costs and (iv) $4.2 million in

transition expenses, including $3.0 million in non-cash lease

abandonment charges. Other items for the twelve months ended

December 31, 2023 included: (i) $2.6 million in acquisition-related

transaction costs; (ii) $6.1 million in acquisition integration and

restructuring-related transition costs, including one-time

severance expense of $1.5 million; (iii) $4.1 million in

non-recurring legal, audit and consulting fees and (iv) $2.3

million in gains related to the remeasurement of contingent

consideration. Other items for the twelve months ended December 31,

2022 included: (i) $33.3 million in gains related to the

remeasurement of contingent consideration; (ii) $1.7 million in

non-recurring legal, audit and consulting fees; (iii) $3.6 million

in acquisition-related transaction costs; (iv) $6.1 million in

transition expenses, including $3.0 million in non-cash lease

abandonment charges and (v) $7.9 million in insurance settlement

related expenses.

Schedule

4

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF

NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

(dollars in millions)

(unaudited)

Net Cash Provided by (Used in)

Operating Activities

$

15.6

$

(23.6

)

$

40.3

$

175.1

Less:

Capital expenditures

2.1

2.8

11.5

10.3

Free Cash Flow

$

13.5

$

(26.4

)

$

28.8

$

164.8

Event cancellation insurance proceeds

—

—

(2.8

)

(183.5

)

Taxes paid on event cancellation insurance

proceeds

—

25.0

—

25.6

Free cash flow excluding event

cancellation insurance proceeds, net

$

13.5

$

(1.4

)

$

26.0

$

6.9

Schedule

5

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF

REPORTABLE SEGMENTS RESULTS TO INCOME (LOSS) BEFORE TAXES

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

(dollars in millions)

(unaudited)

Revenues

Connections

$

90.3

$

81.9

$

340.2

$

282.6

All Other

11.2

11.7

42.6

43.3

Total revenues

$

101.5

$

93.6

$

382.8

$

325.9

Other income, net

Connections

$

—

$

—

$

2.8

$

34.2

All Other

—

—

—

—

Total other income, net

$

—

$

—

$

2.8

$

34.2

Adjusted EBITDA

Connections

$

39.7

$

30.3

$

136.8

$

133.0

All Other

1.6

0.1

3.6

0.2

Adjusted EBITDA (excluding General

corporate expenses)

$

41.3

$

30.4

$

140.4

$

133.2

General corporate expenses

(5.5

)

(5.4

)

(42.6

)

(42.2

)

Other income, net

—

—

—

148.6

Interest expense, net

(8.6

)

(7.3

)

(35.1

)

(21.8

)

Loss on extinguishment of debt

—

—

(2.3

)

—

Goodwill impairment charges

—

—

—

(6.3

)

Intangible asset impairment charges

—

—

—

(1.6

)

Depreciation and amortization expense

(9.8

)

(16.5

)

(45.0

)

(59.5

)

Stock-based compensation expense

(1.8

)

(0.8

)

(7.8

)

(5.8

)

Deferred revenue adjustment

—

—

—

(0.6

)

Other items

(4.2

)

18.9

(10.5

)

14.0

Income (loss) before taxes

$

11.4

$

19.3

$

(2.9

)

$

158.0

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240229262364/en/

Emerald Holding, Inc. Investor Relations

investor.relations@emeraldx.com 1-866-339-4688 (866EEXINVT)

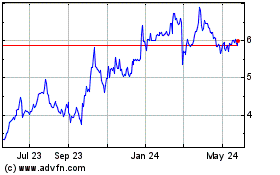

Emerald (NYSE:EEX)

Historical Stock Chart

From Nov 2024 to Dec 2024

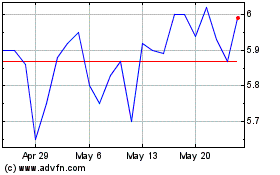

Emerald (NYSE:EEX)

Historical Stock Chart

From Dec 2023 to Dec 2024