SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of April, 2014

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

(5541) 3222-2027

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

|

|

|

|

|

|

|

|

|

|

|

|

2013 Results

Curitiba, Brazil, March 17, 2014

–

Companhia Paranaense de Energia - COPEL (BM&FBovespa: CPLE3, CPLE5, CPLE6 / NYSE: ELP / LATIBEX: XCOP), a company that generates, transmits, distributes and sells power, announces its 2013 results.

COPEL’s consolidated balance sheet presents the figures of its wholly owned subsidiaries, controlled companies, investees and consortium. The consolidated financial statements were prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), and with the accounting practices adopted in Brazil.

Highlights

|

|

|

4Q13

|

3Q13

|

4Q12

|

Var. %

|

2013

|

2012

|

Var. %

|

|

|

(1)

|

(2)

|

(3)

|

(1/3)

|

(4)

|

(5)

|

(4/5)

|

|

Operating Revenues (R$ million)

|

2,444

|

2,255

|

2,401

|

1.8

|

9,180

|

8,493

|

8.1

|

|

Operating Income (R$ million)

|

147

|

399

|

(195)

|

175.1

|

1,507

|

973

|

54.9

|

|

Net Income (Loss) (R$ million)

|

178

|

273

|

(97)

|

282.8

|

1,101

|

727

|

51.6

|

|

Earnings per share (R$)

|

0.65

|

1.00

|

-

|

-

|

4.02

|

2.65

|

51.6

|

|

EBITDA (R$ million)

|

262

|

463

|

56

|

364.3

|

1,829

|

1,549

|

18.1

|

|

Return on Shareholders' Equity (annualized)

|

5.6%

|

9.1%

|

-

|

-

|

8.5%

|

5.9%

|

45.0

|

|

Energy Supply (GWh)

|

6,878

|

6,727

|

6,310

|

9.0

|

27,008

|

24,652

|

9.6

|

|

Capex¹

|

573

|

369

|

859

|

(33.3)

|

1,937

|

1,903

|

1.8

|

Values subject to rounding adjustments.

¹ Includes contributions and advances for future investments

|

|

|

|

|

|

|

|

|

|

|

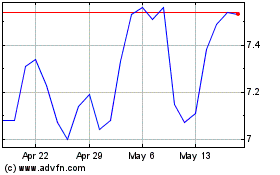

The Company’s shares and main indexes presented the following variations in the period:

|

|

|

Ticker

|

Price

12/31/2013

|

Var. %

year

|

Index

|

Points

12/31/2013

|

Var. %

year

|

|

|

CPLE3 (common / BM&FBovespa)

|

R$ 22.30

|

(11.5)

|

Ibovespa

|

51,507

|

(15.5)

|

|

|

CPLE6 (preferred B / BM&FBovespa)

|

R$ 30.53

|

(3.7)

|

IEE

|

26,250

|

(8.8)

|

|

|

ELP (ADS / Nyse)

|

US$ 13.14

|

(14.4)

|

Dow Jones

|

16,577

|

26.5

|

|

|

XCOP (preferred B / Latibex)

|

€ 9.50

|

(18.2)

|

Latibex

|

2,076

|

(20.0)

|

*

Amounts

subject to roundings.

LIST OF CONTENTS

|

|

|

|

1. General Information

|

3

|

|

2. 2013 Income Statement

|

6

|

|

2.1 Operating Revenue

|

6

|

|

2.2 Operating Costs and Expenses

|

7

|

|

2.3 Equity in the Earnings of Subsidiaries

|

9

|

|

2.4 EBITDA

|

9

|

|

2.5 Financial Result

|

10

|

|

2.6 Consolidated Net Income

|

10

|

|

3. Balance Sheet and Investment Program

|

10

|

|

3.1 Assets

|

10

|

|

3.1.1 Current and Non-current Assets

|

10

|

|

3.1.2 Cash, Cash Equivalents and Bonds Securities

|

11

|

|

3.1.3 CRC Transferred to the State of Paraná

|

11

|

|

3.1.4 Accounts Receivable Related to the Concession Extension

|

12

|

|

3.2 Liabilities

|

13

|

|

3.2.1 Current and Non-current Liabilities

|

13

|

|

3.2.2 Debt and Shareholders’ Equity

|

13

|

|

3.2.3 Payables related to the Concession – Use of Public Property

|

14

|

|

3.2.4 Provisions for Legal Claims

|

15

|

|

3.3 Investment Program

|

16

|

|

4. Shareholding Structure

|

17

|

|

5. Consolidated Financial Statements

|

18

|

|

5.1 Assets

|

18

|

|

5.2 Liabilities

|

19

|

|

5.3 Income Statement

|

20

|

|

5.4 Cash Flow

|

21

|

|

6. Financial Statements – Wholly Owned Subsidiaries

|

22

|

|

6.1 Assets

|

22

|

|

6.2 Liabilities

|

23

|

|

6.3 Income Statement – Copel Geração e Transmissão

|

24

|

|

6.4 Income Statement – Copel Distribuição

|

25

|

|

6.5 Income Statement – Copel Telecom

|

26

|

|

7. Financial Statements – Segregated by Company

|

27

|

|

7.1 Assets

|

27

|

|

7.2 Liabilities

|

29

|

|

7.3 Income Statement

|

31

|

|

8. Power Market

|

33

|

|

8.1 Captive Market

|

33

|

|

8.2 Grid Market (TUSD)

|

34

|

|

9. Supplementary Information

|

37

|

|

9.1 Tariffs

|

37

|

|

9.2 Main Operational Indicators on December 31, 2013

|

39

|

|

9.3 Main Financial Indicators on December 31, 2013

|

40

|

|

9.4 2013 Results Conference Call

|

40

|

*

Amounts

subject to roundings.

2

1. General Information

COPEL’s net income totaled R$1,101.4 million in 2013, 51.6% up on the R$726.5 million recorded in 2012, chiefly due to (i) higher revenue from electricity sales to final customers and distributors, and (ii) lower costs related to personnel and charges for the use of the main distribution and transmission grid in the period. The increase in the financial result also contributed to the period upturn in net income. For further information, please refer to item 2.

The table below summarizes the highlights for the period:

|

|

|

|

|

|

|

|

|

|

|

4Q13

|

3Q13

|

4Q12

|

Var. %

|

2013

|

2012

|

Var. %

|

|

Consolidated Result - Effect CVA (R$ million)

|

(1)

|

(2)

|

(3)

|

(1/3)

|

(4)

|

(5)

|

(4/5)

|

|

Gross CVA Effect

|

298

|

(18)

|

177

|

68.1

|

394

|

143

|

176.3

|

|

Net CVA Effect ¹

|

196

|

(12)

|

117

|

68.1

|

260

|

94

|

176.3

|

|

EBITDA

|

262

|

463

|

56

|

364.3

|

1,829

|

1,549

|

18.1

|

|

Adjusted EBITDA by Regulatory Assets and Liabilities

|

560

|

445

|

234

|

139.8

|

2,224

|

1,692

|

31.4

|

|

Net Income

|

178

|

273

|

(97)

|

282.8

|

1,101

|

727

|

51.6

|

|

Adjusted Net Income by Regulatory Assets and Liabilities²

|

375

|

261

|

19

|

-

|

1,362

|

821

|

65.9

|

|

|

|

|

4Q13

|

3Q13

|

4Q12

|

Var. %

|

2013

|

2012

|

Var. %

|

|

Economic and Financial Indicators

|

(1)

|

(2)

|

(3)

|

(1/3)

|

(4)

|

(5)

|

(4/5)

|

|

EBITDA Margin

|

10.7%

|

20.5%

|

2.4%

|

356.1

|

19.9%

|

18.2%

|

9.6

|

|

Adjusted EBITDA Margin

|

22.9%

|

19.7%

|

9.7%

|

135.5

|

24.2%

|

19.9%

|

21.6

|

|

Operating Margin

|

6.0%

|

17.7%

|

-

|

-

|

16.4%

|

11.5%

|

43.3

|

|

Net Margin

|

7.3%

|

12.1%

|

-

|

-

|

12.0%

|

8.6%

|

40.3

|

|

Adjusted Net Margin

|

15.3%

|

11.6%

|

0.8%

|

-

|

14.8%

|

9.7%

|

53.5

|

¹ Estimated net value: gross value minus 34%of inco me tax.

² Adjusted by net CVA effect.

|

The table below shows the trends for the main indicators:

|

|

|

|

|

|

|

|

|

Average Rates (BRL / MWh)

|

Dec/13

|

Sep/13

|

Jun/13

|

Mar/13

|

Dec/12

|

Sep/12

|

|

Power Purchase Average Rate - Copel Distribuição

|

132.65

|

132.57

|

129.59

|

121.99

|

115.08

|

115.04

|

|

Retail Average Rate - Copel Distribuição

|

225.33

|

227.53

|

206.15

|

205.68

|

245.80

|

243.80

|

|

Sales to Distributors Average Rate - Copel GeT

|

127.42

|

126.19

|

120.84

|

118.38

|

98.69

|

97.70

|

|

|

|

Indicators

|

Dec/13

|

Sep/13

|

Jun/13

|

Mar/13

|

Dec/12

|

Sep/12

|

|

Equity

|

12,929

|

13,116

|

12,942

|

12,757

|

12,362

|

12,800

|

|

Net debt

|

2,280

|

1,370

|

1,066

|

1,409

|

1,038

|

919

|

|

Book Value per Share

|

47.24

|

47.93

|

47.29

|

46.62

|

45.17

|

46.77

|

|

Net debt/ Shareholders' Net Equity

|

35.1%

|

26.8%

|

25.2%

|

25.6%

|

26.4%

|

17.4%

|

|

Current Liquidity

|

1.40

|

1.45

|

1.57

|

1.64

|

1.65

|

1.55

|

*

Amounts

subject to roundings.

3

Economic Sustainability Plan – Copel Distribuição

In October, Copel Distribuição submitted to Aneel an Action Plan that will underpin the financial rebalancing and economic sustainability of the distribution segment's concession. The Plan includes annual reductions of 6% in Copel Distribuição’s costs with personnel, materials, services and others between 2013 and 2017. Operating costs are expected to decrease by R$ 300.0 million by 2015.

In 2013, the cost savings achieved, excluding the non-recurring effect of accounting physical adjustments, was R$ 111,1 million. The main contribution to this result is due to the reduction in personnel expenses (including post employment benefits), which reached R$ 108.4 million in 2013, the result (a) reduction through Voluntary Redundancy Program, 638 employees, equivalent to 8.9% in the staff of the Subsidiary, and (b) the elimination of 163 managerial positions as a result of the restructuring implemented by Copel Distribuição as of April 2013.

We expect savings of R$ 100 million for 2014, due to the reduction in the workforce and maintenance of the Voluntary Redundancy Program and initiatives to reduce costs with materials, services and others.

In order to improve Subsidiary capital structure, the CRC credits that Copel Distribuição held jointly with the Government were transferred to COPEL (Holding Company), upon the settlement of a loan between the Companies and the transfer of funds equivalent to R$ 468.3 million to the Distributor’s cash, to be made in 1Q14. This guarantees a solid capital structure to the Subsidiary in the coming years.

Changes in the Board of Executive Officers’ COPEL

On March 12, 2014 , Mr. Antonio Sergio de Souza Guetter took over as Director of Finance and Investor Relations Officer of COPEL. Mr. Guetter is civil engineer, graduated from the Federal University of Paraná and was the Chief Executive Officer of Copel Renováveis S.A. He made his career at COPEL, has an Executive MBA in Finance (from ISPG) and in Administration (from PUC/ISAD). Between 2011 and 2013, worked at Fundação Copel de Previdência e Assistência Social, an social security entity linked to COPEL, where he was Chief Executive Officer and Chief Administration and Security Officer.

On the same date, Mr. Luiz Antonio Leprevost took over as Chief Executive Officer of the Copel Renováveis. Lawyer, Mr. Leprevost served as Deputy Director of the same company.

As early as February 10, 2014, Mr. Sergio Luiz Lamy took over as the new Chief Executive Officer of Copel Geração e Transmissão (Copel GeT). Electrical engineer career within the Company, Mr. Lamy also as superintendent of the Consórcio Cruzeiro do Sul, responsible for construction Mauá HPP.

Wind Farms – Acquisition of the Wind Farm Portfolio

The 143

th

Board of Directors’ Meeting held on December 11, 2013 approved the acquisition for R$ 160 million of Galvão Energia e Participações S.A.’s wind farm portfolio, totaling 553 MW, including a 50.1% interest in São Bento Energia (94 MW) – in the operational stage – and the Cutia Wind Farm Complex projects (129 MW), projects in which COPEL already had a 49.9% interest.

*

Amounts

subject to roundings.

4

The acquisition represents the consolidation of a Wind Farm Complex 100% owned by COPEL in Rio Grande do Norte State, composed by 11 wind farms already built or at the construction stage, totaling an installed capacity of 277.6 MW, as shown below:

|

|

|

|

|

|

|

|

|

|

|

Wind Farm

|

Assured

Power

(Average

MW)

|

Installed

Capacity

(MW)

|

Price ¹

|

Start up

|

CAPEX

(R$ million)

|

Premium

Value

(R$ million)

|

Wind farm location

|

Expiration of

Authorization

|

|

2º LFA 2010 ²

|

98.5

|

202.0

|

134.98

|

|

782.3

|

340.6

|

|

|

|

Boa Vista

3,4

|

6.3

|

14.0

|

137.99

|

Sep/13

|

382.4

|

123.5

|

São Bento do Norte

|

4/26/2046

|

|

Olho d'Água

3,4

|

15.3

|

30.0

|

133.97

|

São Bento do Norte

|

5/21/2046

|

|

São Bento do Norte

3,4

|

14.6

|

30.0

|

133.97

|

São Bento do Norte

|

5/18/2046

|

|

Farol

3,4

|

10.1

|

20.0

|

133.97

|

São Bento do Norte

|

4/19/2046

|

|

Nova Euros IV

|

13.7

|

27.0

|

135.40

|

Mar/15

|

399.9

|

217.1

|

Touros

|

4/27/2046

|

|

Nova As a Branca I

|

13.2

|

27.0

|

135.40

|

S. Mi guel Gostoso

|

4/25/2046

|

|

Nova As a Branca II

|

12.8

|

27.0

|

135.40

|

Parazinho

|

5/31/2046

|

|

Nova As a Branca III

|

12.5

|

27.0

|

135.40

|

Parazinho

|

5/31/2046

|

|

4º LER 2011

5

|

40.7

|

75.6

|

101.81

|

|

286.6

|

68.9

|

|

|

|

Santa Maria

|

15.7

|

29.7

|

101.98

|

Jul/14

|

286.6

|

68.9

|

João Câmara

|

5/8/2047

|

|

Santa Helena

|

16.0

|

29.7

|

101.98

|

João Câmara

|

4/4/2047

|

|

Ventos de Santo Uriel

|

9.0

|

16.2

|

101.19

|

Mar/15

|

João Câmara

|

4/9/2047

|

|

Total

|

139.2

|

277.6

|

125.28

|

|

1,068.9

|

409.5

|

|

|

CDE (Energy Development Account) Funds

The Brazilian government issued Decree 7945/2013, which establishes the transfer of CDE funds to cover costs arising from: (a) exposure to the spot market, limited to the amount not covered by the allocation of quotas; (b) the hydrological risk of the quotas; (c) System Service Charges – ESS (dispatch of thermal power plants for energy security); and (d) the positive result from the account for compensation of Portion A – CVA in the tariff processes in the twelve months subsequent to March 8, 2013. The amounts contributed by CDE were recognized as compensation of electricity costs and charges for the use of the main distribution and transmission grid, as detailed in notes 31.1 and 31.2 of our Financial Statements (DFs).

In 2013, the Company received R$ 827.3 million in CDE funds, being (a) R$ 294.1 million related to the compensation of electricity costs, (b) R$ 319.6 million related to the compensation of charges for the use of the main distribution and transmission grid, e (c) R$ 213.6 million to cover tariff discounts, as set forth by Decree 7891/2013.

On March 7, 2014, the Brazilian government issued Decree 8203, amending Decree 7945/2013 and allowing the transfer of CDE funds to cover costs arising from the involuntary exposure of distributors in January 2014. Pursuant to Aneel Order 515/14, R$ 114.6 million were transferred to Copel Distribuição.

*

Amounts

subject to roundings.

5

Araucária Thermal Power Plant – Lease Agreement

On January 31, 2014, the lease agreement for the Araucária Thermal Power Plant, entered into between UEG Araucária and PETROBRAS expired and was not renewed.

As a result, since February 1, 2014, the plant’s operation has been under the responsibility of UEGA, a subsidiary of COPEL, which retains 80% of its capital (the remaining 20% is held by PETROBRAS).

The Araucária Thermal Power Plant does not have an availability agreement and operates under the merchant model, in which revenue depends on the plant’s operation.

The plant's unit variable cost is R$ 695.81/MWh, as approved by Aneel Order 476, of February 27, 2014.

Accounting Changes

As of the fiscal year begun on January 1, 2013, new rules are being applied to the preparation of financial statements, with effects mainly on (a) investments in investees, controlled companies and jointly controlled companies, and (b) employee benefits. For detailed information on these changes, please refer to note 3 of our DFs.

2. 2013 Income Statement

2.1 Operating Revenue

In 2013, “operating revenue” reached R$ 9,180.2 million, 8.1% up on the R$ 8,493.3 million recorded in 2012. The most important variations were:

(i) the 27.4% increase in revenue from “electricity sales to final customers”, which reflects only actual sales revenues, excluding the distribution grid tariff (TUSD), chiefly due to (a) the 9.55% tariff increase as of June 24, 2013, and (b) the effects of Copel Distribuição’s tariff revision, on June 24, 2012, which led to a change in the tariff structure, increasing the percentage of revenue booked under “electricity sales to final customers”, reducing the percentage booked under “use of the main distribution and transmission grid”, and (c) the 190.8% upturn in Copel GeT’s electricity sales in the free market;

*

Amounts

subject to roundings.

6

(ii) the 19.0% increase in "electricity sales to distributors”, resulting from (a) higher power allocation to the spot market (CCEE), and (b) the increased volume of bilateral agreements, partially offset by lower revenue from CCEAR, due to the maturity of agreements in the regulated environment;

(iii) the 28.3% decline in “use of the main distribution and transmission grid” (TUSD and TUST revenue), due to (a) Copel Distribuição’s periodic tariff revision, in effect as of June 24, 2012, and (b) the extension of the agreements for transmission assets, which led to a reduction of approximately R$ 189 million in Copel GeT’s Annual Permitted Revenue, partially offset by the 4.2% upturn in Copel Distribuição’s grid market;

(iv) the 43.5% increase in “construction revenue”, due to the booking of investments in construction services and improvements to electricity distribution and transmission infrastructure;

(v) the 12.5% upturn in “revenues from telecommunications”, due to the expansion of the area of operations and the provision of services to new customers, especially in the individual segment. In 2013, the customer base increased by 163.3%, from 3,141 in December 2012 to 8,270 in December 2013;

(vi) the 13.4% increase in “distribution of piped gas” (supplied by Compagas), following tariff adjustments (8.0% as of August 2012 and 6.5% as of March 2013); and

(vii) the 35.2% expansion in “other operating revenues”, mainly due to, (a) higher revenue from the lease of the Araucária Thermal Power Plant, due to its higher dispatch in 2013 over the same period in the previous year, and (b) revenue from the reimbursement of the cost of electricity acquired by Copel Distribuição, arising from the generation companies’ failure to comply with their obligations.

|

|

|

|

|

|

|

|

|

|

R$ '000

|

|

Income Statement

|

4Q13

(1)

|

3Q13

(2)

|

4Q12

(3)

|

Var.%

(1/3)

|

2013

(4)

|

2012

(5)

|

Var.%

(4/5)

|

|

Electricity sales to final customers

|

906,872

|

881,003

|

801,571

|

13.1

|

3,344,649

|

2,625,509

|

27.4

|

|

Electricity sales to distributors

|

454,569

|

408,001

|

392,998

|

15.7

|

1,932,262

|

1,623,507

|

19.0

|

|

Us e of the main distribution and transmission grid

|

538,527

|

513,046

|

629,618

|

(14.5)

|

2,028,976

|

2,830,633

|

(28.3)

|

|

Construction revenue

|

364,793

|

251,663

|

381,865

|

(4.5)

|

1,076,141

|

749,763

|

43.5

|

|

Revenues from telecommunications

|

38,760

|

36,263

|

33,048

|

17.3

|

141,315

|

125,565

|

12.5

|

|

Distribution of piped gas

|

89,631

|

103,361

|

85,390

|

5.0

|

368,620

|

325,012

|

13.4

|

|

Other operating revenues

|

50,890

|

61,293

|

76,111

|

(33.1)

|

288,251

|

213,263

|

35.2

|

|

Operating revenue

|

2,444,042

|

2,254,630

|

2,400,601

|

1.8

|

9,180,214

|

8,493,252

|

8.1

|

2.2 Operating Costs and Expenses

In 2013, operating costs and expenses totaled R$ 8,067.6 million, 7.6% up on the R$ 7,500.8 million recorded in 2012. The main variations were:

(i) the 18.8% increase in “electricity purchased for resale”, chiefly due to higher costs with energy

acquisition from auctions (CCEARs), Itaipu, and bilateral agreements, arising from (a) higher costs from thermal power agreements, (b) the appreciation of the dollar and (c)

the monetary restatement of agreements based on period inflation. Costs from energy purchases in the spot market were partially offset by CDE funds, which totaled R$ 294.1 million in 2013;

*

Amounts

subject to roundings.

7

|

|

|

|

|

|

|

|

|

|

R$'000

|

|

Electricity Purchased for Resale

|

4Q13

|

3Q13

|

4Q12

|

Var. %

|

2013

|

2012

|

Var. %

|

|

|

(1)

|

(2)

|

(3)

|

(1/3)

|

(4)

|

(5)

|

(4/5)

|

|

Itaipu

|

160,308

|

164,942

|

138,719

|

15.6

|

610,404

|

503,335

|

21.3

|

|

CCEAR (Auction)

|

646,765

|

540,229

|

542,351

|

19.3

|

2,305,809

|

1,927,903

|

19.6

|

|

Bilateral

|

56,098

|

54,933

|

53,023

|

5.8

|

217,069

|

203,115

|

6.9

|

|

CCEE

|

203,571

|

103,498

|

145,961

|

39.5

|

663,936

|

312,125

|

112.7

|

|

(-) Transfer CDE - CCEE

|

(29,883)

|

9,928

|

-

|

-

|

(294,085)

|

-

|

-

|

|

Proinfa

|

41,598

|

41,668

|

36,075

|

15.3

|

166,653

|

143,587

|

16.1

|

|

(-) Pis / Pasep and Cofins

|

(91,824)

|

(81,652)

|

(79,119)

|

16.1

|

(333,427)

|

(282,330)

|

18.1

|

|

TOTAL

|

986,633

|

833,546

|

837,010

|

17.9

|

3,336,359

|

2,807,735

|

18.8

|

(ii) the 47.3% reduction in “use of the main distribution and transmission grid”, due to lower costs from charges for the use of the system as a result of Law 12738/13, which extended transmission concessions, and the transfer of CDE funds (R$ 319.6 million in 2013) to offset the costs with charges;

|

|

|

|

|

|

|

|

|

|

R$ '000

|

|

Use of the main distribution and transmission grid

|

4Q13

(1)

|

3Q13

(2)

|

4Q12

(3)

|

Var. %

(1/3)

|

2013

(4)

|

2012

(5)

|

Var. %

(4/5)

|

|

System Service Charges - ESS

|

22,709

|

589

|

48,617

|

(53.3)

|

308,864

|

75,485

|

309.2

|

|

(-) Transfer CDE - ESS

|

-

|

(721)

|

-

|

-

|

(319,624)

|

-

|

-

|

|

System usage charges – distribution

|

57,493

|

50,918

|

138,743

|

(58.6)

|

216,683

|

544,597

|

(60.2)

|

|

System usage charges – basic network and connection

|

45,443

|

47,387

|

35,250

|

28.9

|

177,846

|

145,099

|

22.6

|

|

Itaipu transportation charges

|

12,823

|

13,425

|

11,726

|

9.4

|

51,188

|

45,217

|

13.2

|

|

Charge reserve energy - EER

|

-

|

2,989

|

9,002

|

-

|

16,672

|

49,228

|

(66.1)

|

|

(-) PIS / Pasep and Cofins taxes on charges for use of power grid

|

(13,015)

|

(11,898)

|

(30,151)

|

(56.8)

|

(44,312)

|

(87,265)

|

(49.2)

|

|

TOTAL

|

125,453

|

102,689

|

213,187

|

(41.2)

|

407,317

|

772,361

|

(47.3)

|

(iii)

“personnel and management” totaled R$ 1,096.3 million, 12.0% down on 2012, due to (a) lower provisions for severance pay related to the Voluntary Redundancy Program, and (b) lower expenses with compensation and related charges. This amount

already includes the wage increases of 5.6% as of October 2012, 1.0% as of May 2013, and 7.0% in October 2013;

(iv) the 3.7% decline in “pension and healthcare plans”, which reflects the accrual of amounts related to the private pension and healthcare plans, calculated in accordance with CVM Resolution 695/2012, reflecting the reduction in healthcare plan costs, in accordance with the actuarial calculation made by the independent actuary;

(v) the “materials and supplies for energy production” line includes expenses with the acquisition of coal for the Figueira Thermal Power Plant;

*

Amounts

subject to roundings.

8

(vi) the 19.3% upturn in “natural gas and supplies for the gas business", as a result of the higher prices for the natural gas acquired by Compagas to supply third parties, which increased mainly due to the recent depreciation of the real, and the adjustment of the oil basket, which determines the gas acquisition price;

(vii) the 3.6% upturn in “third-party services”, chiefly due to higher expenses with facility maintenance and with communications and data processing, partially offset by lower expenses with consulting services;

(viii) the 8.8% reduction in “provisions and reversals”, mainly due to (a) the recording of tax reversals, and (b) lower provisions for litigation related to civil and administrative law claims;

(ix) the 48.4% increase in “construction costs”, as a result of investments in power distribution and transmission in the period; and

(x) the 44.4% upturn in “other costs and expenses”, chiefly due to (a) increased costs with financial compensation, as a result of higher hydro power generation in the period and (b) losses from the physical and accounting reconciliation of assets.

|

|

|

|

|

|

|

|

|

|

R$ '000

|

|

Operating Costs and Expenses

|

4Q13

(1)

|

3Q13

(2)

|

4Q12

(3)

|

Var.%

(1/3)

|

013

(4)

|

2012

(5)

|

Var.%

(4/5)

|

|

Electricity purchased for resale

|

986,633

|

833,546

|

837,010

|

17.9

|

3,336,359

|

2,807,735

|

18.8

|

|

Use of main distribution and transmission grid

|

125,453

|

102,689

|

213,187

|

(41.2)

|

407,317

|

772,361

|

(47.3)

|

|

Personnel and management

|

384,917

|

224,458

|

458,045

|

(16.0)

|

1,096,347

|

1,245,651

|

(12.0)

|

|

Pension and healthcare plans

|

43,055

|

47,443

|

61,286

|

(29.7)

|

176,196

|

182,878

|

(3.7)

|

|

Materials and supplies

|

19,118

|

15,963

|

17,303

|

10.5

|

70,478

|

69,787

|

1.0

|

|

Materials and supplies for power eletricity

|

6,859

|

5,847

|

6,948

|

(1.3)

|

27,187

|

25,511

|

6.6

|

|

Natural gas and supplies for the gas business

|

72,669

|

82,531

|

64,682

|

12.3

|

295,671

|

247,770

|

19.3

|

|

Third-party services

|

116,465

|

107,918

|

105,825

|

10.1

|

423,459

|

408,878

|

3.6

|

|

Depreciation and amortization

|

162,591

|

148,200

|

138,666

|

17.3

|

603,203

|

549,855

|

9.7

|

|

Provisions and reversals

|

50,831

|

16,605

|

105,002

|

(51.6)

|

199,555

|

218,796

|

(8.8)

|

|

Construction cost

|

370,995

|

253,204

|

370,444

|

0.1

|

1,088,275

|

733,577

|

48.4

|

|

Other cost and expenses

|

61,290

|

126,234

|

60,928

|

0.6

|

343,580

|

237,960

|

44.4

|

|

TOTAL

|

2,400,876

|

1,964,638

|

2,439,326

|

(1.6)

|

8,067,627

|

7,500,759

|

7.6

|

2.3 Equity in the Earnings of Subsidiaries

Equity in the earnings of subsidiaries reflects gains and losses from investments in COPEL’s investees. In 2013,

equity in the earnings of subsidiaries totaled R$ 113.6 million, comprising gains of R$ 96.6 million from Dominó Holdings (Sanepar), R$ 9.0 million from Dona Francisca Energética, R$ 10.3 million from Foz do Chopim Energética, R$ 13.6 million loss from Sercomtel Telecom due to losses recorded by the company in the period, the energy transmission SPCs and other partnership generated gains of R$ 11.3 million.

2.4 EBITDA

In 2013, EBITDA (earnings before interest, taxes depreciation and amortization) totaled R$ 1,829.4 million, 18.1% higher than the R$ 1,549.0 million reported in the same period in the previous year.

*

Amounts

subject to roundings.

9

2.5 Financial Result

In 2013, financial revenues totaled R$ 652.4 million, 0.6% up on 2012, due to

the monetary restatement of indemnifications related to the extension of transmission concessions (restatement by the IPCA + 5.59% p.a.), partially offset by the lower monetary restatement of assets pegged to the IGP-DI and IGP-M inflation indices.

Financial expenses totaled R$ 372.1 million, 44.9% lower than in 2012, chiefly due to the non-recurring recognition of the remeasurement of the fair value of Copel Distribuição’s financial assets in 2012.

The 2013 financial result was a positive R$ 280.3 million, versus the negative R$ 26.7 million recorded in 2012.

2.6 Consolidated Net Income

In 2013, COPEL recorded net income of R$ 1,101.4 million, 51.6% more than in 2012 (R$ 726.5 million).

3. Balance Sheet and Investment Program

The main lines and variations in the Balance Sheet in relation to December 2012 are described below.

Please refer to the notes in our DFs for additional information.

3.1 Assets

On December 31, 2013, COPEL’s assets totaled R$ 23,111.4 million, 9.0% up on December 31, 2012.

3.1.1 Current and Non-current Assets

The main variations in current assets were:

(i) the 19.4% increase in “cash and cash equivalents”, chiefly due to the R$ 856.9 million loan with the BNDES, most of which allocated to the construction of the Colíder HPP, received on December 26, 2013, partially offset by disbursements related to the Company’s investment program, and (b) the payment of advance amount of dividends and interest on capital, occurred on December 16, 2013;

(ii) the 38.8% decline in “bonds and securities”, chiefly due to capital transfers and advances for future capital increases in new transmission projects in the pre-operational stage;

(iii) the 94.6% reduction in “collaterals and escrow accounts”, due to the redemption of guarantees linked to the CCEAR agreements that expired in December 2012;

(iv) the 9.4% decline “customers”, chiefly due to the decline in accounts receivable related to (a) Copel Distribuição’s captive market, (b) CCEAR agreements, and (c) charges for the use of the main distribution and transmission grid; and

(v) the 68.5% increase in "other current receivables”, mainly referring to advances to suppliers.

The main variations in non-current assets were:

*

Amounts

subject to roundings.

10

(i) the 17.6% upturn in “judicial deposits” related to tax and labor claims;

(ii) the 31.7% increase in “accounts receivable related to concession”, equivalent to R$ 838.4 million, chiefly due to the capitalization of intangible assets in progress (investments) and the monetary restatement (IGP-M) of the assets related to the distribution and transmission concessions; and

(iii) the 49.1% decline in “accounts receivable related to the extension of the concession”, as a result of the transfer of R$ 352.2 million to current assets.

3.1.2

Cash, Cash Equivalents and Bonds Securities

On December 31, 2013, the cash, cash equivalents and bonds securities of COPEL’s wholly owned subsidiaries and controlled companies totaled R$ 2,251.4 million and were mostly invested in Bank Deposit Certificates (CDBs) and repo transactions. The investments earned an average yield of 101.4% of the period variation in the Interbank Deposit Certificate (CDI) rate.

3.1.3 CRC Transferred to the State of Paraná

Through the fourth addendum signed on January 21, 2005, the Company renegotiated the CRC balance on December 31, 2004 with the State of Paraná at R$ 1,197.4 million, in 244 monthly installments recalculated by the Price amortization system, restated by the IGP-DI inflation index plus annual interest of 6.65%. The first installment was due on January 30, 2005, with subsequent and consecutive maturities. The current CRC balance is R$ 1,380.6 million.

The State of Paraná has been paying the renegotiated installments pursuant to the fourth addendum, whose amortizations are guaranteed by dividends.

On December 31, 2013, the CRC balance was transferred from Copel Distribuição to COPEL, as permitted by Aneel (Order 4222, of December 11, 2013), with the settlement of a loan between the Companies and the transfer of financial balance remaining to be effected in 1Q14, totaling R$ 468.3 million.

*

Amounts

subject to roundings.

11

3.1.4 Accounts Receivable Related to the Concession Extension

Following COPEL’s acceptance of the conditions established by the government agency for the anticipation of the extension of the transmission assets (Provisional Measure 579), on November 1, 2012, through Ordinances 578 and 579 and Interministerial Ordinance 580, the Ministry of Mines and Energy announced the indemnification the Company is entitled to under Transmission Concession Agreement 060/2001, in the amount of R$ 893.9 million (considering only the assets that began operating after May 2000). On December 31, the amount recorded in this account totaled R$ 717.8 million, R$ 356.1 million lower than in December 2012, due to amortizations in the period.

With the enactment of Law 12783, on January 11, 2013, the government agency reconsidered the right of indemnification for the assets existing on May 31, 2000, and article 1 of Aneel Resolution 589, of December 13, 2013, established that the indemnification would be calculated based on the New Replacement Value (VNR), which is calculated in line with the Company's price bank, based on information on purchases in the last five years. If there is no proof of the acquisition of the assets, the Company will consider, in order, (a) Aneel's Price Bank and (b) the restatement of the carrying amount based on

the application of the IPA-OG wholesale price index, calculated by the Getulio Vargas Foundation. After the NRV is defined, the asset depreciation rate will be applied.

*

Amounts

subject to roundings.

12

3.2 Liabilities

3.2.1 Current and Non-current Liabilities

The main variations in current liabilities were:

(i) the 37.6% decline in “payroll, social charges and accruals”, thanks to voluntary redundancy;

(ii) the 270.3% increase in “loans, financing and debentures”, chiefly due to transfers received from the long term and charges related to the period; and;

(iii) the 52.6% increase in “other accounts payable”, chiefly due to the increase in costs with financial compensation, as a result of higher hydro power generation in the period.

The main variations in non-current liabilities were:

(i) the 17.7% increase in “loans, financing and debentures”, due to period funding, including a R$ 856.9 million loan with the BNDES, most of which allocated to the construction of the Colíder HPP, received on December 26, 2013, partially offset by transfers to the short term; and

(ii) the 38.8% upturn in “post-employment benefits”, chiefly due to actuarial losses in the healthcare plan, recorded under other comprehensive income, in shareholders’ equity, with no impact on the results.

3.2.2 Debt and Shareholders’ Equity

COPEL’s consolidated debt totaled R$ 4,531.7 million on December 31, 2013,

representing 35.1% of its consolidated shareholders’ equity, which closed the period at R$ 12,928.8 million, equivalent to R$ 47.24 per share (value per share).

The breakdown of loans, financing and debentures is shown in the table below:

|

|

|

|

|

|

|

|

|

|

|

R$'000

|

|

|

|

Short term

|

Long term

|

Total

|

|

Foreign Currency

|

Na tional Treasury

|

2,154

|

62,661

|

64,815

|

|

Eletrobras

|

7

|

-

|

7

|

|

Total

|

2,161

|

62,661

|

64,822

|

|

Domestic Currency

|

Eletrobras - COPEL

|

49,329

|

130,427

|

179,756

|

|

FINEP

|

6,935

|

33,624

|

40,559

|

|

BNDES

|

20,776

|

1,104,333

|

1,125,109

|

|

Banco do Brasil S/A and other

|

877,905

|

1,035,634

|

1,913,539

|

|

Debentures

|

57,462

|

1,150,482

|

1,207,944

|

|

Total

|

1,012,407

|

3,454,500

|

4,466,907

|

|

TOTAL

|

|

1,014,568

|

3,517,161

|

4,531,729

|

*

Amounts

subject to roundings.

13

Loans, financing and debentures maturities are presented below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R$'000

|

|

|

Short Term

|

|

|

Long Term

|

|

|

|

|

2014

|

2015

|

2016

|

2017

|

2018

|

After 2018

|

|

Domestic Currency

|

1,014,56,568

|

698,037

|

933,837

|

675,679

|

153,839

|

993,108

|

|

Foreign Currency

|

-

|

-

|

-

|

-

|

-

|

62,661

|

|

TOTAL

|

1,014 568

|

698,037

|

933,837

|

675,679

|

153,839

|

1,055,769

|

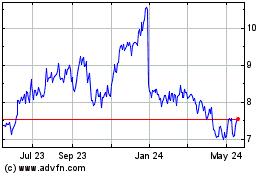

COPEL’s consolidated net debt (loans, financing and debentures less cash and cash equivalents) and the net debt/EBITDA ratio are shown in the following chart:

3.2.3 Payables related to the Concession – Use of Public Property

It refers to the concession charges for the use of public property incurred since the execution of the project’s concession agreement until the end of the concession.

|

|

|

|

|

|

|

|

|

|

|

|

|

R$'000

|

|

|

Elejor

|

Mauá

|

Colíder

|

SP *

|

Total

|

|

Current liabilities

|

49,686

|

913

|

118

|

764

|

51,481

|

|

Noncurrent liabilities

|

388,546

|

12,613

|

17,091

|

2,043

|

420,293

|

|

* Relative to SPP Cavernoso, Apucaraninha, Chopim I e Chaminé.

|

*

Amounts

subject to roundings.

14

3.2.4 Provisions for Legal Claims

The Company is involved in a series of lawsuits in different courts and instances. COPEL’s management, based on its legal advisors’ opinion, maintains a provision for legal claims for those cases assessed as probable losses. The balances of provisions for legal claims are as follows:

|

|

|

|

|

|

|

R$ '000

|

|

Probable Losses - Consolidated

|

Dec/13

(1)

|

Sep/13

(1)

|

Dec/12

(2)

|

Var %

(1 / 3)

|

|

Tax

|

287,239

|

285,349

|

294,576

|

(2.5)

|

|

Labor suits

|

196,054

|

181,444

|

154,990

|

26.5

|

|

Employees and Benefits

|

94,809

|

118,358

|

78,670

|

20.5

|

|

Civil

|

636,346

|

611,688

|

576,354

|

10.4

|

|

Suppliers

|

64,775

|

65,900

|

68,630

|

(5.6)

|

|

Civil a nd administrative claims

|

197,838

|

187,110

|

176,811

|

11.9

|

|

Easements

|

10,639

|

7,239

|

5,96

4

|

78.4

|

|

Condemnations and property

|

353,461

|

341,812

|

317,472

|

11.3

|

|

Customers

|

9,633

|

9,627

|

7,47

7

|

28.8

|

|

Environmental claims

|

211

|

203

|

193

|

9.3

|

|

Regulatory

|

51,468

|

46,208

|

50,925

|

1.1

|

|

TOTAL

|

1,266,127

|

1,243,250

|

1,155,708

|

9.6

|

Possible Losses

The cases classified as possible losses, as estimated by the Company and its controlled companies at the end of 2013, totaled R$ 2,886.1 million, 22.5% up on December 2012, distributed in lawsuits of the following natures: tax - R$ 1,384.1 million; civil - R$ 1,004.9 million; labor - R$ 342.9 million; employee benefits - R$ 98.0 million; and regulatory - R$ 56.2 million.

*

Amounts

subject to roundings.

15

3.3 Investment Program

COPEL’s investments in 2013 and the maximum investment forecast for 2014 are presented below:

|

|

|

|

|

|

|

|

|

R$ million

|

|

|

Carried out

|

Scheduled

|

Scheduled

|

|

|

2013

|

2013

|

2014

|

|

Generation and Transmission

|

478.7

|

866.5

|

1,308.7

|

|

HPP Colider

|

260.4

|

449.0

|

409.8

|

|

HPP Baixo Iguaçu

|

-

|

-

|

316.0

|

|

SHP Cavernoso II

|

20.0

|

8.3

|

-

|

|

TL Araraquara / Ta ubaté

|

28.3

|

132.8

|

182.8

|

|

SE Cerquilho

|

46.2

|

37.8

|

8.3

|

|

TL Figueira-Londrina / Foz do Chopim-Salto Osório

|

-

|

-

|

42.9

|

|

SE Paraguaçu Paulista

|

-

|

-

|

25.6

|

|

SE Curitiba Norte

|

-

|

-

|

8.7

|

|

Other

|

123.8

|

238.6

|

314.6

|

|

Distribution

|

977.1

|

986.4

|

895.9

|

|

Telecommunications

|

74.1

|

69.9

|

80.0

|

|

Holding

|

-

|

-

|

0.3

|

|

Participation in new businesses*

|

407.1

|

647.4

|

331.8

|

|

TOTAL

|

1,937.0

|

2,570.2

|

2,616.7

|

|

¹ São Bento Energia, Cutia Empreendimentos Eólicos, Costa Oeste Transmissora, M arumbi Transmissora, Transmisso ra Sul Brasileira, Caiuá

Transmissora, Integração Maranhense Transmissora, Matrinchã Transmissora de Energia, Guaraciaba Transmissora de Energia, Paranaíba Transmissora e Mata de Santa Genebra).

|

*

Amounts

subject to roundings.

16

4. Shareholding Structure

On December 31, 2013, paid-up capital stock totaled R$ 6,910.0 million. The classes of shares (with no par value) and main shareholders are presented below:

|

|

|

|

|

|

|

|

|

|

|

Thousand shares

|

|

Shareholders

|

Common

|

%

|

Preferred "A"

|

%

|

Preferred "B"

|

%

|

TOTAL

|

%

|

|

State of Paraná

|

85,029

|

58.6

|

-

|

-

|

14

|

-

|

85,043

|

31.1

|

|

BNDESPAR

|

38,299

|

26.4

|

-

|

-

|

27,282

|

21.3

|

65,581

|

24.0

|

|

Eletrobras

|

1,531

|

1.1

|

-

|

-

|

-

|

-

|

1,531

|

0.6

|

|

Free Floating

|

19,877

|

13.7

|

129

|

33.9

|

100,905

|

78.7

|

120,911

|

44.2

|

|

BM&FBovespa

|

19,785

|

13.6

|

129

|

33.9

|

66,921

|

52.2

|

86,835

|

31.7

|

|

NYSE

|

92

|

0.1

|

-

|

-

|

33,925

|

26.5

|

34,017

|

12.4

|

|

LATIBEX

|

-

|

-

|

-

|

-

|

59

|

-

|

59

|

-

|

|

Other

|

295

|

0.2

|

252

|

66.1

|

42

|

-

|

589

|

0.1

|

|

TOTAL

|

145,031

|

100.0

|

381

|

100.0

|

128,243

|

100.0

|

273,655

|

100.0

|

*

Amounts

subject to roundings.

17

5. Consolidated Financial Statements

5.1 Assets

|

|

|

|

|

|

|

|

R$'000

|

|

Assets

|

Dec/13

|

Sep/13

|

Dec/12

|

Var.%

|

Var.%

|

|

|

(1)

|

(2)

|

(3)

|

(1/2)

|

(1/3)

|

|

CURRENT

|

4,680,284

|

4,634,676

|

4,681,692

|

1.0

|

-

|

|

Cash a nd cash equivalents

|

1,741,632

|

1,531,816

|

1,459,217

|

13.7

|

19.4

|

|

Bonds a nd s ecurities

|

389,222

|

509,183

|

635,501

|

(23.6)

|

(38.8)

|

|

Collaterals and escrow accounts

|

1,976

|

2,054

|

36,808

|

(3.8)

|

(94.6)

|

|

Customers

|

1,337,628

|

1,355,849

|

1,489,173

|

(1.3)

|

(10.2)

|

|

Dividends receivable

|

9,500

|

8,174

|

18,064

|

16.2

|

(47.4)

|

|

CRC transferred to the State Government of Paraná

|

85,448

|

82,009

|

75,930

|

4.2

|

12.5

|

|

Account receivable related to concession

|

4,396

|

4,463

|

5,319

|

(1.5)

|

(17.4)

|

|

Accounts receivable related to the concession extension

|

352,161

|

352,161

|

356,085

|

-

|

-

|

|

Other current receivables

|

395,890

|

346,674

|

234,951

|

14.2

|

68.5

|

|

Inventories

|

139,278

|

134,293

|

124,809

|

3.7

|

11.6

|

|

Income tax a nd social contribution

|

133,158

|

212,012

|

191,544

|

(37.2)

|

(30.5)

|

|

Other current recoverable taxes

|

70,013

|

72,845

|

49,490

|

(3.9)

|

41.5

|

|

Prepaid expenses

|

19,982

|

23,143

|

4,801

|

(13.7)

|

316.2

|

|

NON-CURRENT

|

18,431,161

|

17,531,439

|

16,527,211

|

5.1

|

11.5

|

|

Long Term Assets

|

7,224,241

|

6,539,100

|

6,297,317

|

10.5

|

14.7

|

|

Bonds a nd s ecurities

|

120,536

|

106,943

|

128,515

|

12.7

|

(6.2)

|

|

Collaterals and escrow accounts

|

45,371

|

44,309

|

43,246

|

2.4

|

4.9

|

|

Customers

|

132,686

|

44,635

|

26,171

|

197.3

|

407.0

|

|

CRC transferred to the State Government of Paraná

|

1,295,106

|

1,296,240

|

1,308,354

|

(0.1)

|

(1.0)

|

|

Judicial deposits

|

675,225

|

599,661

|

574,371

|

12.6

|

17.6

|

|

Account receivable related to concession

|

3,484,268

|

3,106,098

|

2,645,826

|

12.2

|

31.7

|

|

Accounts receivable related to the concession extension

|

365,645

|

453,685

|

717,805

|

(19.4)

|

(49.1)

|

|

Other non-current receivables

|

29,435

|

26,382

|

22,728

|

11.6

|

29.5

|

|

Income tax a nd social contribution

|

197,659

|

8,495

|

19,995

|

2,226.8

|

-

|

|

Other non-current recoverable taxes

|

124,498

|

119,169

|

120,189

|

4.5

|

3.6

|

|

Deferred i ncome tax and s ocial contribution

|

753,413

|

733,065

|

681,285

|

2.8

|

10.6

|

|

Prepaid expenses

|

399

|

418

|

8,832

|

(4.5)

|

(95.5)

|

|

Investments

|

1,187,927

|

936,235

|

568,989

|

26.9

|

108.8

|

|

Property, plant and equipment, net

|

7,983,632

|

7,931,436

|

7,871,753

|

0.7

|

1.4

|

|

Intangible assets

|

2,035,361

|

2,124,668

|

1,789,152

|

(4.2)

|

13.8

|

|

TOTAL

|

23,111,445

|

22,166,115

|

21,208,903

|

4.3

|

9.0

|

*

Amounts

subject to roundings.

18

5.2 Liabilities

|

|

|

|

|

|

|

|

R$'000

|

|

Liabilities

|

Dec/13

(1)

|

Sep/13

(2)

|

Dec/12

(3)

|

Var.%

(1/2)

|

Var.%

(1/3)

|

|

CURRENT

|

3,347,885

|

3,194,842

|

2,833,444

|

4.8

|

18.2

|

|

Payroll, s ocial charges and accruals

|

239,685

|

324,174

|

008

|

(26.1)

|

(37.6)

|

|

Suppliers

|

1,092,239

|

958,615

|

1,131,782

|

13.9

|

(3.5)

|

|

Income tax and social contribution payable

|

297,620

|

325,082

|

189

|

(8.4)

|

74.9

|

|

Other taxes due

|

300,731

|

234,272

|

480

|

28.4

|

4.2

|

|

Loans, financing and debentures

|

1,014,568

|

855,521

|

009

|

18.6

|

270.3

|

|

Minimum compulsory dividend payable

|

18,713

|

83,433

|

780

|

(77.6)

|

(90.9)

|

|

Post employment benefits

|

29,983

|

25,996

|

25,819

|

15.3

|

16.1

|

|

Customer charges due

|

37,994

|

47,227

|

56,498

|

(19.6)

|

(32.8)

|

|

Research and development and energy efficiency

|

127,860

|

145,055

|

599

|

(11.9)

|

(19.9)

|

|

Accounts Payable related to concession - Use of Public Property

|

51,481

|

49,246

|

48,477

|

4.5

|

6.2

|

|

Other accounts payable

|

137,011

|

146,221

|

89,803

|

(6.3)

|

52.6

|

|

NON-CURRENT

|

6,834,808

|

5,854,796

|

6,013,569

|

16.7

|

13.7

|

|

Suppliers

|

50,121

|

57,769

|

908

|

(13.2)

|

(50.3)

|

|

Tax liabilities

|

68,402

|

-

|

-

|

-

|

-

|

|

Deferred income tax and social contribution

|

420,501

|

458,637

|

536

|

(8.3)

|

(28.8)

|

|

Loans, financing and debentures

|

3,517,161

|

2,662,531

|

2,987,546

|

32.1

|

17.7

|

|

Post employment benefits

|

937,249

|

867,725

|

230

|

8.0

|

38.8

|

|

Research and development and energy efficiency

|

154,721

|

149,178

|

561

|

3.7

|

48.0

|

|

Accounts Payable related to concession - Use of Public Property

|

420,293

|

415,474

|

080

|

1.2

|

5.3

|

|

Other accounts payable

|

233

|

232

|

-

|

0.4

|

-

|

|

Tax, social security, labor and civil provisions

|

1,266,127

|

1,243,250

|

1,155,708

|

1.8

|

9.6

|

|

EQUITY

|

12,928,752

|

13,116,477

|

12, 1,890

|

(1.4)

|

4.6

|

|

Attributed to controlling shareholders

|

12,651,339

|

12,828,375

|

12, 7,384

|

(1.4)

|

4.6

|

|

Share capital

|

6,910,000

|

6,910,000

|

6,910,000

|

-

|

-

|

|

Equity valuation adjustments

|

983,159

|

1,033,924

|

1,214,394

|

(4.9)

|

(19.0)

|

|

Lega l reserves

|

624,849

|

571,221

|

221

|

9.4

|

9.4

|

|

Retained earnings

|

3,897,833

|

3,337,295

|

3,337,295

|

16.8

|

16.8

|

|

Additional proposed dividends

|

235,498

|

-

|

64,474

|

-

|

265.26

|

|

Accrued earnings

|

-

|

975,935

|

-

|

-

|

-

|

|

Attributable to non-controlling interest

|

277,413

|

288,102

|

506

|

(3.7)

|

4.9

|

|

TOTAL

|

23,111,445

|

22,166,115

|

21, 8,903

|

4.3

|

9.0

|

*

Amounts

subject to roundings.

19

5.3 Income Statement

|

|

|

|

|

|

|

|

|

|

R$'000

|

|

Income Statement

|

4Q13

(1)

|

3Q13

(2)

|

4Q12

(3)

|

Var.%

(1/3)

|

2013

(4)

|

2012

(5)

|

var %

(4/5)

|

|

OPERATING REVENUES

|

2,444,042

|

2,254,630

|

2,400,601

|

1.8

|

9,180,214

|

8,493,252

|

8.1

|

|

Electricity sales to final customers

|

906,872

|

881,003

|

801,571

|

13.1

|

3,344,649

|

2,625,509

|

27.4

|

|

Electricity sales to distributors

|

454,569

|

408,001

|

392,998

|

15.7

|

1,932,262

|

1,623,507

|

19.0

|

|

Use of the main distribution and transmission grid

|

538,527

|

513,046

|

629,618

|

(14.5)

|

2,028,976

|

2,830,633

|

(28.3)

|

|

Construction revenue

|

364,793

|

251,663

|

381,865

|

(4.5)

|

1,076,141

|

749,763

|

43.5

|

|

Revenues from telecommunications

|

38,760

|

36,263

|

33,048

|

17.3

|

141,315

|

125,565

|

12.5

|

|

Distribution of piped gas

|

89,631

|

103,361

|

85,390

|

5.0

|

368,620

|

325,012

|

13.4

|

|

Other operating revenues

|

50,890

|

61,293

|

76,111

|

(33.1)

|

288,251

|

213,263

|

35.2

|

|

OPERATING COSTS AND EXPENSES

|

(2,400,876)

|

(1,964,638)

|

(2,439,326)

|

(1.6)

|

(8,067,627)

|

(7,500,759)

|

7.6

|

|

Electricity purchased for resale

|

(986,633)

|

(833,546)

|

(837,010)

|

17.9

|

(3,336,359)

|

(2,807,735)

|

18.8

|

|

Use of the main distribution and transmission grid

|

(125,453)

|

(102,689)

|

(213,187)

|

(41.2)

|

(407,317)

|

(772,361)

|

(47.3)

|

|

Personnel a nd management

|

(384,917)

|

(224,458)

|

(458,045)

|

(16.0)

|

(1,096,347)

|

(1,245,651)

|

(12.0)

|

|

Pension a nd healthcare plans

|

(43,055)

|

(47,443)

|

(61,286)

|

(29.7)

|

(176,196)

|

(182,878)

|

(3.7)

|

|

Materials and supplies

|

(19,118)

|

(15,963)

|

(17,303)

|

10.5

|

(70,478)

|

(69,787)

|

1.0

|

|

Materials and supplies for power eletricity

|

(6,859)

|

(5,847)

|

(6,948)

|

(1.3)

|

(27,187)

|

(25,511)

|

6.6

|

|

Natural ga s and supplies for the gas business

|

(72,669)

|

(82,531)

|

(64,682)

|

12.3

|

(295,671)

|

(247,770)

|

19.3

|

|

Third-party services

|

(116,465)

|

(107,918)

|

(105,825)

|

10.1

|

(423,459)

|

(408,878)

|

3.6

|

|

Depreciation and amortiza tion

|

(162,591)

|

(148,200)

|

(138,666)

|

17.3

|

(603,203)

|

(549,855)

|

9.7

|

|

Provisions and reversals

|

(50,831)

|

(16,605)

|

(105,002)

|

(51.6)

|

(199,555)

|

(218,796)

|

(8.8)

|

|

Construction cost

|

(370,995)

|

(253,204)

|

(370,444)

|

0.1

|

(1,088,275)

|

(733,577)

|

48.4

|

|

Other cost a nd expenses

|

(61,290)

|

(126,234)

|

(60,928)

|

0.6

|

(343,580)

|

(237,960)

|

44.4

|

|

EQUITY IN EARNINGS OF SUBSIDIARIES

|

56,574

|

25,062

|

(43,444)

|

-

|

113,606

|

6,685

|

-

|

|

PROFIT BEFORE FINANCIAL RESULTS AND TAXES

|

99,740

|

315,054

|

(82,169)

|

-

|

1,226,193

|

999,178

|

22.7

|

|

FINANCIAL RESULTS

|

47,090

|

84,265

|

(113,263)

|

-

|

280,311

|

(26,650)

|

-

|

|

Financial income

|

175,693

|

175,715

|

124,708

|

40.9

|

652,363

|

648,321

|

0.6

|

|

Financial expenses

|

(128,603)

|

(91,450)

|

(237,971)

|

(46.0)

|

(372,052)

|

(674,971)

|

(44.9)

|

|

OPERATIONAL EXPENSES/ INCOME

|

146,830

|

399,319

|

(195,432)

|

175.1

|

1,506,504

|

972,528

|

54.9

|

|

INCOME TAX AND SOCIAL CONTRIBUTION ON PROFIT

|

31,383

|

(126,368)

|

97,943

|

(68.0)

|

(405,069)

|

(246,008)

|

64.7

|

|

Income tax and social contribution on profit

|

12,536

|

(128,316)

|

(24,436)

|

151.3

|

(554,520)

|

(458,257)

|

21.0

|

|

Deferred income tax and social contribution on profi t

|

18,847

|

1,948

|

122,379

|

(84.6)

|

149,451

|

212,249

|

(29.6)

|

|

NET INCOME (LOSS)

|

178,213

|

272,951

|

(97,489)

|

282.8

|

1,101,435

|

726,520

|

51.6

|

|

Attributed to controlling shareholders

|

174,062

|

266,037

|

(105,675)

|

264.7

|

1,072,560

|

700,688

|

53.1

|

|

Attributed to non-controlling interest

|

4,151

|

6,914

|

8,186

|

(49.3)

|

28,875

|

25,832

|

11.8

|

|

EBITDA

|

262,331

|

463,254

|

56,497

|

364.3

|

1,829,396

|

1,549,033

|

18.1

|

*

Amounts

subject to roundings.

20

5.4 Cash Flow

|

R$'000

|

|

Consolidated Cash Flow

|

2013

|

2012

|

|

Cash flow from operating activities

|

|

|

|

Net income for the period

|

1,101,435

|

726,520

|

|

Adjustments to reconcile net income with the cash provided by operating activities

|

1,431,541

|

1,229,301

|

|

Depreciation

|

366,016

|

331,330

|

|

Amortization of intangible assets - concession

|

229,804

|

214,022

|

|

Amortization of intangible assets - other

|

6,627

|

3,748

|

|

Amortization of investiments - concession rigths

|

755

|

755

|

|

Unrealized monetary and exchange variations, net

|

27,600

|

(90,669)

|

|

Accounts receivable tied to the concession fair value´s update

|

-

|

|

|

Remuneration of accounts receivable related to the concession

|

(33,974)

|

(396,168)

|

|

Equity in earnings of subsidiaries

|

(113,606)

|

(6,685)

|

|

Income Tax and Social Contribution

|

554,520

|

458,257

|

|

Deferred Income Tax and Social Contribution

|

(149,451)

|

(212,249)

|

|

Provision for doubtful accounts

|

47,458

|

22,826

|

|

Provision for tax credit losses

|

274

|

(3,135)

|

|

Reversal of provision for losses from devaluation of investments

|

(7,887)

|

-

|

|

Provision (reversal) for legal claims

|

154,178

|

199,105

|

|

Provisions for post employment benefits

|

195,673

|

196,087

|

|

Provision for research and development and energy efficiency

|

79,961

|

74,464

|

|

Write off of intangible assets related to concession - goodwill

|

45,795

|

24,313

|

|

Write off of property, plant, and equipment

|

9,794

|

3,871

|

|

Write off of intangible assets

|

18,004

|

8,325

|

|

Decrese (increase) in assets

|

239,484

|

33,706

|

|

Increase (reduction) of liabilities

|

(1,434,849)

|

(570,164)

|

|

Net cash generated by operating activities

|

1,337,611

|

1,419,363

|

|

Cash flow from investing activities

|