Equity Commonwealth Announces $150 Million Share Repurchase Authorization

14 June 2023 - 6:37AM

Business Wire

Equity Commonwealth (NYSE: EQC) today announced that its Board

of Trustees authorized the repurchase, from July 1, 2023 through

June 30, 2024, of up to an additional $150 million of its

outstanding common shares under the company’s existing share

repurchase program. The company still has $120 million remaining

under its prior authorization that expires on June 30, 2023.

Year-to-date through June 13, 2023 the company has not

repurchased any shares.

Purchases made pursuant to the program will be made from time to

time, at the company’s discretion, in the open market, through

privately negotiated transactions or through other manners as

permitted by federal securities laws. The timing, manner, price and

amount of any repurchases will be determined by the company and

will be subject to economic and market conditions, stock price,

applicable legal requirements and other factors. The program may be

suspended or discontinued at any time.

About Equity Commonwealth

Equity Commonwealth (NYSE: EQC) is a Chicago based, internally

managed and self-advised real estate investment trust (REIT) with

commercial office properties in the United States. EQC’s portfolio

is comprised of 4 properties totaling 1.5 million square feet.

Regulation FD Disclosures

We use any of the following to comply with our disclosure

obligations under Regulation FD: press releases, SEC filings,

public conference calls, or our website. We routinely post

important information on our website at www.eqcre.com, including

information that may be deemed to be material. We encourage

investors and others interested in the company to monitor these

distribution channels for material disclosures.

Forward-Looking Statements

Some of the statements contained in this press release

constitute forward-looking statements within the meaning of the

federal securities laws. Any forward-looking statements contained

in this press release are intended to be made pursuant to the safe

harbor provisions of Section 21E of the Securities Exchange Act of

1934, as amended. Forward-looking statements relate to

expectations, beliefs, projections, future plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. You can identify

forward-looking statements by the use of forward-looking

terminology, including but not limited to, “may,” “will,” “should,”

“could,” “would,” “expects,” “intends,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” or “potential” or the negative

of these words and phrases or similar words or phrases which are

predictions of or indicate future events or trends and which do not

relate solely to historical matters. You can also identify

forward-looking statements by discussions of strategy, plans or

intentions.

The forward-looking statements contained in this press release

reflect our current views about future events and are subject to

numerous known and unknown risks, uncertainties, assumptions and

changes in circumstances that may cause our actual results to

differ significantly from those expressed in any forward-looking

statement. We do not guarantee that the transactions and events

described will happen as described (or that they will happen at

all). We disclaim any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, of new information, data or methods, future

events or other changes. For a further discussion of these and

other factors that could cause our future results to differ

materially from any forward-looking statements, see the section

entitled “Risk Factors” in our most recent Annual Report on Form

10-K and subsequent quarterly reports on Form 10-Q.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230613054919/en/

Bill Griffiths, (312) 646-2801

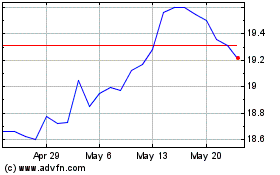

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Nov 2024 to Dec 2024

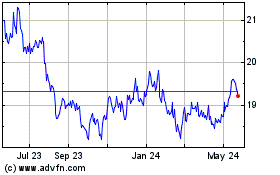

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Dec 2023 to Dec 2024