Essex Property Trust, Inc. (NYSE: ESS) (the “Company”) announced

today its third quarter 2024 earnings results and related business

activities.

Net Income, Funds from Operations (“FFO”), and Core FFO per

diluted share for the quarter ended September 30, 2024 are detailed

below.

Three Months Ended

September 30,

Nine Months Ended September

30,

%

%

2024

2023

Change

2024

2023

Change

Per Diluted

Share

Net Income

$1.84

$1.36

35.3%

$7.54

$5.30

42.3%

Total FFO

$3.81

$3.69

3.3%

$12.30

$11.37

8.2%

Core FFO

$3.91

$3.78

3.4%

$11.68

$11.21

4.2%

Third Quarter 2024

Highlights:

- Reported Net Income per diluted share for the third quarter of

2024 of $1.84, compared to $1.36 in the third quarter of 2023. The

increase is largely attributable to gains on remeasurements of

co-investments recognized in the third quarter of 2024.

- Grew Core FFO per diluted share by 3.4% compared to the third

quarter of 2023, exceeding the midpoint of the Company’s guidance

range by $0.04. The outperformance was primarily driven by

favorable same-property revenue growth.

- Achieved same-property revenue and net operating income (“NOI”)

growth of 3.5% and 2.6%, respectively, compared to the third

quarter of 2023. On a sequential basis, same-property revenues

improved 1.2%.

- Issued $200.0 million of 10-year senior unsecured notes due in

April 2034 at an effective yield of 5.1%.

- Acquired and consolidated two joint venture apartment home

communities located in San Jose, CA at a combined valuation of

$290.5 million on a gross basis.

- Raised full-year 2024 guidance range as detailed in the table

below:

Full-Year 2024 Revised Guidance

Revised

Range

Revised

Midpoint

Change at Midpoint

Net Income per diluted share

$8.66 - $8.78

$8.72

+$0.37

Core FFO per diluted share

$15.50 - $15.62

$15.56

+$0.06

Same-Property Revenues

3.10% to 3.40%

3.25%

+0.25%

Same-Property Operating Expenses

4.50% to 5.00%

4.75%

Unchanged

Same-Property NOI

2.30% to 2.90%

2.60%

+0.30%

Same-Property Operations

Same-property operating results exclude any properties that are

not comparable for the periods presented. The table below

illustrates the percentage change in same-property gross revenues

for the quarter ended September 30, 2024 compared to the quarter

ended September 30, 2023, and the sequential percentage change for

the quarter ended September 30, 2024 compared to the quarter ended

June 30, 2024, by submarket for the Company:

Q3 2024 vs. Q3 2023

Q3 2024 vs. Q2 2024

% of Total

Revenue Change

Revenue Change

Q3 2024 Revenues

Southern California

Los Angeles County

2.5%

1.0%

18.6%

Orange County

5.2%

1.5%

10.7%

San Diego County

5.3%

1.5%

9.1%

Ventura County

6.3%

1.6%

4.2%

Total Southern California

4.1%

1.3%

42.6%

Northern California

Santa Clara County

2.4%

1.0%

19.6%

Alameda County

1.8%

1.1%

7.7%

San Mateo County

3.2%

1.1%

4.5%

Contra Costa County

3.3%

0.9%

5.4%

San Francisco

5.0%

1.4%

2.5%

Total Northern California

2.7%

1.0%

39.7%

Seattle Metro

3.8%

1.1%

17.7%

Same-Property Portfolio

3.5%

1.2%

100.0%

The table below illustrates the components that drove the change

in same-property revenue on a year-over-year basis for the three-

and nine-month periods ended September 30, 2024 and on a sequential

basis for the quarter ended September 30, 2024.

Same-Property Revenue

Components

Q3 2024 vs. Q3

2023

YTD 2024 vs. YTD

2023

Q3 2024 vs. Q2

2024

Scheduled Rents

1.7%

1.9%

0.9%

Delinquencies

1.3%

1.1%

0.2%

Cash Concessions

0.0%

0.1%

0.0%

Vacancy

-0.3%

-0.4%

0.0%

Other Income

0.8%

0.8%

0.1%

2024 Same-Property Revenue

Growth

3.5%

3.5%

1.2%

Year-Over-Year Change

Year-Over-Year Change

Q3 2024 compared to Q3

2023

YTD 2024 compared to YTD

2023

Revenues

Operating

Expenses

NOI

Revenues

Operating

Expenses

NOI

Southern California

4.1%

4.3%

4.0%

4.3%

4.1%

4.3%

Northern California

2.7%

6.8%

0.9%

2.8%

5.6%

1.6%

Seattle Metro

3.8%

5.4%

3.1%

3.2%

5.7%

2.1%

Same-Property Portfolio

3.5%

5.5%

2.6%

3.5%

5.0%

2.9%

Sequential Change

Q3 2024 compared to Q2

2024

Revenues

Operating

Expenses

NOI

Southern California

1.3%

4.7%

0.0%

Northern California

1.0%

7.5%

-1.7%

Seattle Metro

1.1%

3.6%

0.0%

Same-Property Portfolio

1.2%

5.6%

-0.7%

Financial Occupancies

Quarter Ended

9/30/2024

6/30/2024

9/30/2023

Southern California

95.9%

95.7%

96.3%

Northern California

96.4%

96.3%

96.6%

Seattle Metro

96.6%

97.1%

96.3%

Same-Property Portfolio

96.2%

96.2%

96.4%

Investment Activity

Acquisitions

In July, the Company acquired its joint venture partner’s 49.9%

common equity interest in Patina at Midtown, a 269-unit apartment

home community built in 2021 and located in San Jose, CA, for a

total contract price of $117.0 million on a gross basis. This

reflects an attractive valuation of $435,000 per unit. Concurrent

with the closing, the Company repaid a $95.0 million secured

mortgage encumbering the property and was fully redeemed on a

preferred equity investment affiliated with the partnership. The

Company recorded a gain on remeasurement of co-investments of $2.2

million, which has been excluded from Total and Core FFO.

In September, the Company acquired its joint venture partner’s

50% common equity interest in Century Towers, a 376-unit apartment

home community built in 2017 and located in San Jose, CA, for a

total contract price of $173.5 million on a gross basis. This

reflects an attractive valuation of $458,000 per unit. Concurrent

with the closing, the Company repaid a $110.5 million secured

mortgage encumbering the property and was fully redeemed on a

preferred equity investment affiliated with the partnership. The

Company issued approximately $25.0 million of Operating Partnership

Units (“OP Units”) to the seller at $305 per unit. The Company

recorded a gain on remeasurement of co-investments of $29.4

million, which has been excluded from Total and Core FFO.

Subsequent to quarter end, the Company acquired its joint

venture partner’s 49.9% interest in the BEX II portfolio,

comprising of four communities totaling 871 apartment homes, for a

total contract price of $337.5 million on a gross basis. Concurrent

with the closing, the Company assumed $95.0 million of secured

mortgages.

Dispositions

Subsequent to quarter end, the Company sold its 81.5% interest

in a 76-year-old apartment home community located in San Mateo, CA

for a total contract price of $252.4 million on a gross basis. The

697-unit apartment home community was unencumbered and was

classified as held for sale on the balance sheet as of September

30, 2024.

Other Investments

In July, the Company received cash proceeds of $40.1 million

from the full redemption of a subordinated loan investment yielding

an 11.5% rate of return.

Subsequent to quarter end, the Company received cash proceeds of

$55.8 million from the full and partial redemptions of two

structured finance investments yielding a 9.6% weighted average

rate of return. Year-to-date through October, the Company has

received cash proceeds of $106.2 million from redemptions of

structured finance investments yielding a 10.4% weighted average

rate of return.

Liquidity and Balance Sheet

Common Stock

Year-to-date through October 28, 2024, the Company has not

issued any shares of common stock through its equity distribution

program or repurchased any shares through its stock repurchase

plan.

Balance Sheet

In August, the Company issued $200.0 million of 10-year senior

unsecured notes due in April 2034 bearing an interest rate of 5.50%

per annum and an effective yield of 5.11%. The notes were issued as

additional notes to the previous offering conducted in March

2024.

In September, the Company extended the maturity date of its $1.2

billion unsecured line of credit facility to mature in January 2029

with two additional six-month extension options, exercisable at the

Company’s option. The underlying interest rate on the line of

credit is unchanged at Adjusted SOFR plus 0.765%, which is based on

a tiered rate structure tied to the Company’s corporate ratings and

further adjusted by the facility’s Sustainability Metric Adjustment

feature.

As of October 28, 2024, the Company had approximately $1.2

billion in liquidity via undrawn capacity on its unsecured credit

facilities, cash and cash equivalents, and marketable

securities.

Guidance

For the third quarter of 2024, the Company exceeded the midpoint

of the guidance range provided in its second quarter 2024 earnings

release for Core FFO by $0.04 per diluted share. The outperformance

primarily relates to favorable same-property revenue growth.

The following table provides a reconciliation of third quarter

2024 Core FFO per diluted share to the midpoint of the guidance

provided in the Company’s second quarter 2024 earnings release.

Per Diluted

Share

Guidance midpoint of Core FFO per diluted

share for Q3 2024

$

3.87

NOI from Consolidated Communities

0.04

FFO from Co-Investments

0.01

G&A and Other

(0.01)

Core FFO per diluted share for Q3 2024

reported

$

3.91

The table below provides key updates to the Company’s 2024

full-year assumptions for Net Income, Total FFO, Core FFO per

diluted share, and same-property growth. For additional details

regarding the Company’s 2024 Core FFO guidance range, please see

page S-13 of the accompanying supplemental financial

information.

2024 Full-Year and Fourth

Quarter Guidance

Previous Range

Previous Midpoint

Revised Range

Revised Midpoint

Change at the Midpoint

Per Diluted Share

Net Income

$8.23 - $8.47

$8.35

$8.66 - $8.78

$8.72

+$0.37

Total FFO

$15.93 - $16.17

$16.05

$15.86 - $15.98

$15.92

($0.13)

Core FFO

$15.38 - $15.62

$15.50

$15.50 - $15.62

$15.56

+$0.06

Q4 2024 Core FFO

-

-

$3.82 - $3.94

$3.88

N/A

Same-Property Growth on a Cash-Basis (1)

Revenues

2.70% to 3.30%

3.00%

3.10% to 3.40%

3.25%

+0.25%

Operating Expenses

4.50% to 5.00%

4.75%

4.50% to 5.00%

4.75%

Unchanged

NOI

1.80% to 2.80%

2.30%

2.30% to 2.90%

2.60%

+0.30%

(1)

The midpoint of the Company’s

same-property revenues and NOI on a GAAP basis are 3.40% and 2.90%,

respectively, representing a 0.20% and 0.40% increase to the

Company’s previous guidance midpoints.

Conference Call with Management

The Company will host an earnings conference call with

management to discuss its quarterly results on Wednesday, October

30, 2024 at 10:00 a.m. PT (1:00 p.m. ET), which will be broadcast

live via the Internet at www.essex.com, and accessible via phone by

dialing toll-free, (877) 407-0784, or toll/international, (201)

689-8560. No passcode is necessary.

A rebroadcast of the live call will be available online for 30

days and digitally for 7 days. To access the replay online, go to

www.essex.com and select the third quarter 2024 earnings link. To

access the replay, dial (844) 512-2921 using the replay pin number

13749248. If you are unable to access the information via the

Company’s website, please contact the Investor Relations Department

at investors@essex.com or calling (650) 655-7800.

Upcoming Events

The Company is scheduled to participate in the National

Association of Real Estate Investment Trusts (“NAREIT”) REITWorld

Conference held at the Wynn Las Vegas in Las Vegas, NV on November

19, 2024. A copy of any materials provided by the Company at the

conference will be made available on the Investors section of the

Company’s website at www.essex.com.

Corporate Profile

Essex Property Trust, Inc., an S&P 500 company, is a fully

integrated real estate investment trust (REIT) that acquires,

develops, redevelops, and manages multifamily residential

properties in selected West Coast markets. Essex currently has

ownership interests in 254 apartment communities comprising

approximately 62,000 apartment homes. Additional information about

the Company can be found on the Company’s website at

www.essex.com.

This press release and accompanying supplemental financial

information has been furnished to the Securities and Exchange

Commission electronically on Form 8-K and can be accessed from the

Company’s website at www.essex.com. If you are unable to obtain the

information via the Web, please contact the Investor Relations

Department at (650) 655-7800.

FFO Reconciliation

FFO, as defined by the National Association of Real Estate

Investment Trusts (“NAREIT”), is generally considered by industry

analysts as an appropriate measure of performance of an equity

REIT. Generally, FFO adjusts the net income of equity REITs for

non-cash charges such as depreciation and amortization of rental

properties, impairment charges, gains on sales of real estate and

extraordinary items. Management considers FFO and FFO which

excludes non-core items, which is referred to as “Core FFO,” to be

useful supplemental operating performance measures of an equity

REIT because, together with net income and cash flows, FFO and Core

FFO provide investors with additional bases to evaluate the

operating performance and ability of a REIT to incur and service

debt and to fund acquisitions and other capital expenditures and to

pay dividends. By excluding gains or losses related to sales of

depreciated operating properties and land and excluding real estate

depreciation (which can vary among owners of identical assets in

similar condition based on historical cost accounting and useful

life estimates), FFO can help investors compare the operating

performance of a real estate company between periods or as compared

to different companies. By further adjusting for items that are not

considered part of the Company’s core business operations, Core FFO

allows investors to compare the core operating performance of the

Company to its performance in prior reporting periods and to the

operating performance of other real estate companies without the

effect of items that by their nature are not comparable from period

to period and tend to obscure the Company’s actual operating

results. FFO and Core FFO do not represent net income or cash flows

from operations as defined by U.S. generally accepted accounting

principles (“GAAP”) and are not intended to indicate whether cash

flows will be sufficient to fund cash needs. These measures should

not be considered as alternatives to net income as an indicator of

the REIT's operating performance or to cash flows as a measure of

liquidity. FFO and Core FFO do not measure whether cash flow is

sufficient to fund all cash needs including principal amortization,

capital improvements and distributions to stockholders. FFO and

Core FFO also do not represent cash flows generated from operating,

investing or financing activities as defined under GAAP. Management

has consistently applied the NAREIT definition of FFO to all

periods presented. However, there is judgment involved and other

REITs’ calculation of FFO may vary from the NAREIT definition for

this measure, and thus their disclosures of FFO may not be

comparable to the Company’s calculation.

The following table sets forth the Company’s calculation of

diluted FFO and Core FFO for the three and nine months ended

September 30, 2024 and 2023 (in thousands, except for share and per

share amounts):

Three Months Ended September

30,

Nine Months Ended September

30,

Funds from Operations attributable to

common stockholders and unitholders

2024

2023

2024

2023

Net income available to common

stockholders

$

118,424

$

87,282

$

484,069

$

340,434

Adjustments:

Depreciation and amortization

146,439

137,357

431,785

410,422

Gains not included in FFO

(31,583)

-

(169,909)

(59,238)

Casualty loss

-

-

-

433

Impairment loss from unconsolidated

co-investments

-

-

3,726

-

Depreciation and amortization from

unconsolidated co-investments

16,417

18,029

52,267

53,486

Noncontrolling interest related to

Operating Partnership units

4,206

3,072

17,075

11,982

Depreciation attributable to third party

ownership and other

(370)

(371)

(1,149)

(1,095)

Funds from Operations attributable to

common stockholders and unitholders

$

253,533

$

245,369

$

817,864

$

756,424

FFO per share – diluted

$

3.81

$

3.69

$

12.30

$

11.37

Expensed acquisition and investment

related costs

$

-

$

31

$

68

$

375

Tax (benefit) expense on unconsolidated

co-investments (1)

(441)

404

(1,199)

1,237

Realized and unrealized (gains) losses on

marketable securities, net

(5,697)

4,577

(10,645)

(4,294)

Provision for credit losses

(182)

17

(116)

51

Equity income from non-core co-investments

(2)

(555)

(538)

(6,282)

(1,422)

Co-investment promote income

-

-

(1,531)

-

Income from early redemption of preferred

equity investments and notes receivable

-

-

-

(285)

General and administrative and other,

net

13,956

1,743

22,403

2,570

Insurance reimbursements, legal

settlements, and other, net (3)

(612)

(283)

(43,912)

(9,082)

Core Funds from Operations attributable

to common stockholders and unitholders

$

260,002

$

251,320

$

776,650

$

745,574

Core FFO per share – diluted

$

3.91

$

3.78

$

11.68

$

11.21

Weighted average number of shares

outstanding diluted (4)

66,551,838

66,445,256

66,500,412

66,537,111

(1)

Represents tax related to net unrealized

gains or losses on technology co-investments.

(2)

Represents the Company's share of

co-investment income or loss from technology co-investments.

(3)

Includes legal settlement gains of $42.5

million and $7.7 million for the nine months ended September 30,

2024 and 2023, respectively.

(4)

Assumes conversion of all outstanding

limited partnership units in Essex Portfolio, L.P. (the “Operating

Partnership”) into shares of the Company’s common stock and

excludes DownREIT limited partnership units.

Net Operating Income (“NOI”) and

Same-Property NOI Reconciliations

NOI and Same-Property NOI are considered by management to be

important supplemental performance measures to earnings from

operations included in the Company’s consolidated statements of

income. The presentation of same-property NOI assists with the

presentation of the Company’s operations prior to the allocation of

depreciation and any corporate-level or financing-related costs.

NOI reflects the operating performance of a community and allows

for an easy comparison of the operating performance of individual

communities or groups of communities. In addition, because

prospective buyers of real estate have different financing and

overhead structures, with varying marginal impacts to overhead by

acquiring real estate, NOI is considered by many in the real estate

industry to be a useful measure for determining the value of a real

estate asset or group of assets. The Company defines same-property

NOI as same-property revenues less same-property operating

expenses, including property taxes. Please see the reconciliation

of earnings from operations to NOI and same-property NOI, which in

the table below is the NOI for stabilized properties consolidated

by the Company for the periods presented (dollars in

thousands):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Earnings from operations

$

128,790

$

131,784

$

398,599

$

454,001

Adjustments:

Corporate-level property management

expenses

12,150

11,504

36,004

34,387

Depreciation and amortization

146,439

137,357

431,785

410,422

Management and other fees from

affiliates

(2,563)

(2,785)

(7,849)

(8,328)

General and administrative

29,067

14,611

67,374

43,735

Expensed acquisition and investment

related costs

-

31

68

375

Casualty loss

-

-

-

433

Gain on sale of real estate and land

-

-

-

(59,238)

NOI

313,883

292,502

925,981

875,787

Less: Non-same property NOI

(26,431)

(12,390)

(66,748)

(40,504)

Same-Property NOI

$

287,452

$

280,112

$

859,233

$

835,283

Safe Harbor Statement Under The Private

Litigation Reform Act of 1995:

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are statements which are not

historical facts, including statements regarding the Company's

expectations, estimates, assumptions, hopes, intentions, beliefs

and strategies regarding the future. Words such as “expects,”

“assumes,” “anticipates,” “may,” “will,” “intends,” “plans,”

“projects,” “believes,” “seeks,” “future,” “estimates,” and

variations of such words and similar expressions are intended to

identify such forward-looking statements. Such forward-looking

statements include, among other things, statements regarding the

Company’s fourth quarter and full-year 2024 guidance (including net

income, Total FFO and Core FFO, same-property growth and related

assumptions) and anticipated yield on certain investments. While

the Company's management believes the assumptions underlying its

forward-looking statements are reasonable, such forward-looking

statements involve known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s control, which

could cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. The Company cannot assure the future

results or outcome of the matters described in these statements;

rather, these statements merely reflect the Company’s current

expectations of the approximate outcomes of the matters

discussed.

Factors that might cause the Company’s actual results,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements include,

but are not limited to, the following: assumptions related to our

fourth quarter and full-year 2024 guidance; occupancy rates and

rental demand may be adversely affected by competition and local

economic and market conditions; there may be increased interest

rates, inflation, escalated operating costs and possible

recessionary impacts; geopolitical tensions and regional conflicts,

and the related impacts on macroeconomic conditions, including,

among other things, interest rates and inflation; the terms of any

refinancing may not be as favorable as the terms of existing

indebtedness; the Company’s inability to maintain our investment

grade credit rating with the rating agencies; the Company may be

unsuccessful in the management of its relationships with its

co-investment partners; the Company may fail to achieve its

business objectives; time of actual completion and/or stabilization

of development and redevelopment projects; estimates of future

income from an acquired property may prove to be inaccurate; future

cash flows may be inadequate to meet operating requirements and/or

may be insufficient to provide for dividend payments in accordance

with REIT requirements; changes in laws or regulations and the

anticipated or actual impact of future changes in laws or

regulations; unexpected difficulties in leasing of future

development projects; volatility in financial and securities

markets; the Company’s failure to successfully operate acquired

properties; unforeseen consequences from cyber-intrusion;

government approvals, actions and initiatives, including the need

for compliance with environmental requirements; and those further

risks, special considerations, and other factors referred to in the

Company’s annual report on Form 10-K for the year ended December

31, 2023, quarterly reports on Form 10-Q, and those risk factors

and special considerations set forth in the Company's other filings

with the SEC which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. All forward-looking statements are

made as of the date hereof, the Company assumes no obligation to

update or supplement this information for any reason, and

therefore, they may not represent the Company’s estimates and

assumptions after the date of this press release.

Definitions and Reconciliations

Non-GAAP financial measures and certain other capitalized terms,

as used in this earnings release, are defined and further explained

on pages S-17.1 through S-17.4, "Reconciliations of Non-GAAP

Financial Measures and Other Terms," of the accompanying

supplemental financial information. The supplemental financial

information is available on the Company's website at

www.essex.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029198114/en/

Loren Rainey Director, Investor Relations (650) 655-7800

lrainey@essex.com

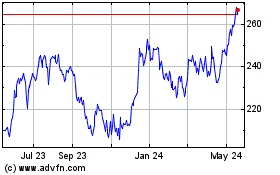

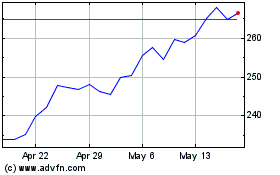

Essex Property (NYSE:ESS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Essex Property (NYSE:ESS)

Historical Stock Chart

From Mar 2024 to Mar 2025