First BanCorp Announces Strategic Reorganization

31 January 2025 - 11:30PM

Business Wire

First BanCorp. (the “Corporation”) (NYSE: FBP), the bank holding

company for FirstBank Puerto Rico, announced today a strategic

reorganization aligned with its corporate succession plan aimed at

improving operational efficiency, enhancing customer experience,

and driving business transformation to align resources for future

growth and success.

“We are pleased to announce this reorganization, which reflect

our commitment to fostering the continued development of our

internal talent and aligns our organizational structure with our

strategic goals. We believe that these changes will position us for

continued success, driven by a highly energized team committed to

responsible growth, delivering for our clients, communities, and

shareholders,” said Aurelio Alemán, President and CEO of the

Corporation.

Retirement of Key Executives

- Cassan Pancham, Executive Vice President and Business Group

Executive, will retire from his position at the Corporation

effective May 15, 2025. As Business Group Executive, Mr. Pancham

currently oversees the Mortgage and Insurance lines of business and

the Eastern Caribbean Region’s commercial business and

administration affairs.

- Carlos Power, Executive Vice President and Business Group

Executive, will retire from his position at the Corporation

effective May 2, 2025. As Business Group Executive, Mr. Power

currently oversees the Unsecured Consumer Lending, Auto, and

Leasing lines of business.

“We acknowledge the significant contributions of Cassan and

Carlos. Their dedication and leadership over 40 years have been

crucial to our success. We extend our gratitude and wish them well

in their future endeavors,” said Aurelio Alemán, President and CEO.

“Cassan and Carlos will continue to engage with us in an orderly

transition, supporting the Corporation's success.”

New Appointments and Expanded Leadership Roles

In light of these changes, effective April 1st, the Corporation

will implement the following new appointments and expand key

leadership roles. Some leaders will be designated as Senior Vice

President Division Directors (“SVP Division Director”), a new

corporate title, reflecting their increased scope and complexity of

responsibilities.

- Nayda Rivera-Batista, current Executive Vice President

and Chief Risk Officer, will be appointed to the newly created

position of Executive Vice President and Chief Consumer Officer. In

this role, she will lead and oversee the Mortgage, Unsecured

Consumer Lending, Auto, Leasing, and Insurance lines of business.

This newly created position leverages Mrs. Rivera’s proven track

record of exceptional leadership, people management skills, and

strategic vision during her tenure at the Corporation. In

connection with this change, Luzmarie Vélez, Senior Vice President

and Mortgage Banking Director, and Alexis Colon, Senior Vice

President and Auto Business Director, will be appointed SVP

Division Directors reporting directly to Mrs. Rivera.

Additionally, Mrs. Rivera will also be appointed Corporate Chief

of Staff, where she will continue to oversee the Corporation’s

human capital strategic plan, ensuring that the Corporation remains

focused on attracting, developing, and retaining talent across the

Corporation’s regions.

- Sara Alvarez, Executive Vice President, General Counsel

and Secretary of the Board, will have increased responsibilities at

the Corporation, including managing and overseeing Regulatory

Compliance and Bank Secrecy Act (BSA) business units, reinforcing

the dedication to regulatory adherence. In connection with this

change, Carmen Pagan, Senior Vice President and Compliance

Director, will be appointed SVP Division Director reporting

directly to Mrs. Alvarez.

- Juan Carlos Pavia, Executive Vice President and Chief

Credit Officer, will have increased responsibilities, including

overseeing the Portfolio Risk Management functions of the

Corporation.

- Lillian Diaz, Executive Vice President and Business

Group Executive, will have increased responsibilities, including

overseeing the entire Eastern Caribbean Region (ECR), adding the

ECR’s commercial business and administration affairs to her current

branch oversight scope.

- Myrna Rivera, current Senior Vice President and

Enterprise Risk Management and Operational Risk Director, will be

appointed SVP Division Director and Chief Risk Officer (CRO),

reporting directly to Orlando Berges, Executive Vice President and

Chief Financial Officer, and to the Board of Director’s Risk

Committee. Myrna’s extensive experience in risk management will be

instrumental in navigating the challenges ahead.

- Said Ortiz, Senior Vice President and Chief Accounting

Officer, will also be appointed SVP Division Director with

increased responsibilities, including overseeing Controllership and

Financial Credit Risk (CECL) units. Said will continue to report to

Orlando Berges.

About First BanCorp.

First BanCorp. is the parent corporation of FirstBank Puerto

Rico, a state-chartered commercial bank with operations in Puerto

Rico, the U.S. and British Virgin Islands and Florida, and of

FirstBank Insurance Agency, LLC. Among the subsidiaries of

FirstBank Puerto Rico is First Federal Finance Limited Liability

Company, a small loans company. First BanCorp’s shares of common

stock trade on the New York Stock Exchange under the symbol

“FBP.”

Safe Harbor

This press release may contain “forward-looking statements”

concerning the Corporation. The words or phrases “expect,”

“anticipate,” “intend,” “look forward,” “should,” “would,”

“believes” and similar expressions are meant to identify

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and are subject to the

safe harbor created by such sections. Such forward-looking

statements include, but are not limited to, statements regarding

the Corporation’s ability to improve operational efficiency,

maximize customer service, and drive business transformation.

Forward-looking statements involve known and unknown risks,

uncertainties and contingencies that may cause actual results to

differ materially from the expectations expressed or implied by

such forward-looking statements. These risks, uncertainties and

contingencies include, but are not limited to the factors described

in the Corporation’s most recent Annual Report on Form 10-K, in its

Quarterly Reports on Form 10-Q and in our other filings with the

Securities and Exchange Commission. The Corporation undertakes no

obligation to update any “forward-looking statements” to reflect

occurrences or unanticipated events or circumstances after the date

of such statements, except as required by securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131242051/en/

First BanCorp. Ramon Rodríguez Senior Vice President

Corporate Strategy and Investor Relations (787) 729-8200 Ext. 82179

ramon.rodriguez@firstbankpr.com

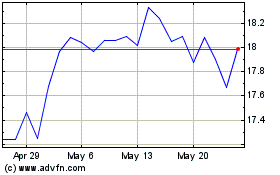

First Bancorp (NYSE:FBP)

Historical Stock Chart

From Jan 2025 to Feb 2025

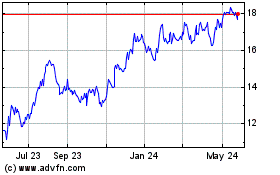

First Bancorp (NYSE:FBP)

Historical Stock Chart

From Feb 2024 to Feb 2025