FIS Launches Its New Revenue Insight Solution to Transform Accounts Receivable Management and Optimize Collections

07 February 2025 - 12:00AM

Business Wire

Key Facts

- The FIS Revenue Insight solution harnesses artificial

intelligence (AI) as it seeks to provide a comprehensive tool for

giving actionable insights into cash at risk without manual,

error-prone processes.

- The patented solution enables finance teams across any industry

to identify high-risk accounts, prioritize collection efforts and

proactively manage cash flow across the money lifecycle.

- The FIS Revenue Insight product empowers businesses to turn the

office of the CFO from a cost center to a true strategic advantage

by removing friction in money movement and creating revenue

opportunities to help businesses grow.

FIS® (NYSE: FIS), a global leader in financial technology across

the full money lifecycle, today announced the launch of FIS Revenue

Insight, a predictive analytics solution designed to help

businesses optimize collections. Through proprietary patented

technology powered by artificial intelligence (AI), FIS Revenue

Insight aims to deliver actionable insights into cash at risk,

enabling companies to proactively identify risks, accelerate

revenue and drive business growth.

The FIS Revenue Insight solution is part of the FIS Automated

Finance suite, which delivers data-driven receivables automation,

payables automation and revenue optimization solutions for the

office of the CFO in any industry, enabling the seamless flow of

money in motion.

Why Revenue Insight Matters

Today’s finance leaders across industries face growing pressure

to modernize their accounts receivable management. According to a

recent survey,1 81% of businesses have experienced an increase in

delayed payments, with 50% experiencing late payments from

customers and 77% of AR teams falling behind on their metrics. Even

the best finance departments face questions about which accounts

will or will not pay, and who will self-correct or who will go into

severe delinquency.

The FIS Revenue Insight product can help CFOs bring technology

harmony to the money lifecycle, employing AI to analyze customer

data, identify high-risk accounts and address potential issues

before they escalate. This tool uncovers patterns and trends that

might go unnoticed by human analysis, allowing finance teams to

shift from manual tasks to strategic activities and reduce days

sales outstanding. Additionally, when paired with FIS’

award-winning GETPAID™ credit-to-cash solution, users may see

enhanced cash flow and working capital optimization, deeper

insights into portfolio risk and greater levels of automation. With

the proprietary Revenue Insight scoring model, businesses can

prioritize accounts that are at the highest risk of payment delays,

ensuring their collection efforts are more targeted and

efficient.

“Revenue Insight, as part of the FIS Automated Finance suite,

can revolutionize the way CFOs manage cash flow in today’s

fast-paced environment. Our vision is to provide systems that turn

finance from a cost center into a growth partner, taking the

friction out of finance through visibility, real-time insights and

innovation that maximizes revenue and strengthens customer

relationships,” said Seamus Smith, group president of Automated

Finance, FIS. “A data-driven, proactive approach to accounts

receivable management is critical for our clients to balance money

in motion while maintaining a competitive edge and financial

stability. With the help of Revenue Insight, our clients can take

the guesswork out of collections.”

FIS Revenue Insight’s versatile application can benefit a broad

range of sectors, including accounts receivables, financial

institutions, supply chain financing, debt collectors, insurance

premiums and utilities.

For more information on Revenue Insight, visit

www.fisglobal.com/products/automated-finance.

About FIS

FIS is a financial technology company providing solutions to

financial institutions, businesses and developers. We unlock

financial technology to the world across the money lifecycle

underpinning the world’s financial system. Our people are dedicated

to advancing the way the world pays, banks and invests, by helping

our clients to confidently run, grow and protect their businesses.

Our expertise comes from decades of experience helping financial

institutions and businesses of all sizes adapt to meet the needs of

their customers by harnessing where reliability meets innovation in

financial technology. Headquartered in Jacksonville, Florida, FIS

is a member of the Fortune 500® and the Standard & Poor’s 500®

Index. To learn more, visit FISglobal.com. Follow FIS on LinkedIn,

Facebook and X.

1 American Express, Meeting the Growing Need for AR

Modernization - The B2B and Digital Payments Tracker® Series

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206592455/en/

Kim Snider, 904.438.6278 Senior Vice President FIS Global

Marketing and Communications kim.snider@fisglobal.com

Fidelity National Inform... (NYSE:FIS)

Historical Stock Chart

From Jan 2025 to Feb 2025

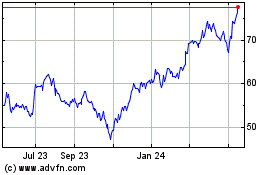

Fidelity National Inform... (NYSE:FIS)

Historical Stock Chart

From Feb 2024 to Feb 2025