Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

19 September 2024 - 5:14AM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

Dated September 18, 2024

Commission File Number 1-14878

GERDAU S.A.

(Translation of Registrant’s Name into English)

Av. Dra. Ruth Cardoso, 8,501 – 8° andar

São Paulo, São Paulo - Brazil CEP

05425-070

(Address of principal executive

offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Exhibit Index

| Exhibit |

Description of Exhibit |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: September 18, 2024

| |

GERDAU S.A. |

| |

|

| |

By: |

/s/ Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President Investor Relations Director |

Exhibit 99.1

GERDAU S.A.

Corporate

Tax ID (CNPJ/MF): 33.611.500/0001-19

Registry (NIRE): 35300520696

NOTICE TO THE MARKET

Gerdau S.A. (B3:

GGBR / NYSE: GGB) announces to its shareholders and the general market that, on September 17, 2024, Gerdau Ameristeel US Inc.,

subsidiary of Gerdau in North America, signed an agreement to acquire the assets of Dales Recycling Partnership, a company engaged

in the operation, processing, and recycling of ferrous scrap. The investment of approximately US$ 60 million includes land,

inventory, and fixed assets associated with Dales Recycling’s operations in Tennessee, Kentucky, and Missouri, in the United

States. This acquisition aims to increase capture of captive ferrous scrap by Gerdau through proprietary channels, supplying raw

material to its operations at a competitive cost.

The closing of

the transaction is subject to the satisfaction of customary conditions precedent for operations of this nature.

Gerdau clarifies

that this acquisition is aligned with its strategy of growth and competitiveness of operations, through assets with greater potential

for long-term value generation and expansion of its presence in more profitable markets for its business.

São Paulo, September 18,

2024.

Rafael Dorneles Japur

Executive Vice-President and

Investor Relations Officer

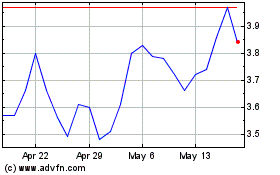

Gerdau (NYSE:GGB)

Historical Stock Chart

From Nov 2024 to Dec 2024

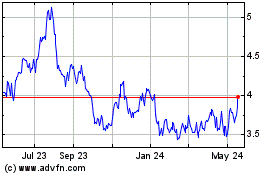

Gerdau (NYSE:GGB)

Historical Stock Chart

From Dec 2023 to Dec 2024