ICE Launches New Suite of Physical Climate Risk Municipal Indices Integrating ICE Climate Risk Scores

24 September 2024 - 10:30PM

Business Wire

Five new indices to track performance of

securities of obligors exposed to climate risk, uses ICE Climate

Risk Scores

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, today announced that it has

launched a new suite of climate risk municipal indices, using the

ICE Climate Risk Score, aimed at tracking the performance of

securities selected based on exposure to acute climate risks.

The new suite of climate risk municipal indices is a

collaboration between ICE’s Climate and Index teams. The indices,

using ICE Climate Risk data, track the performance of securities

issued by obligors with different projected vulnerability to a

range of climate risks, including hurricanes, wildfires and

floods.

The new index family includes:

- ICE US High Physical Climate Risk Municipal Index

(MUNIHICR)

- ICE US Low Physical Climate Risk Municipal Index

(MUNILOCR)

- ICE US High Physical Wildfire Risk Municipal Index

(MUNIWFCR)

- ICE US High Physical Flood Risk Municipal Index (MUNIFLCR)

- ICE US High Physical Hurricane Risk Municipal Index

(MUNIHRCR)

“ICE indices have helped market participants capture exposure to

some of the most dynamic trends that shape the global economy, and

climate risk has increasingly become an important factor in the

investment decision-making process,” said Preston Peacock, Head of

ICE Data Indices, administrator of the new indices. “This new suite

of climate indices will be an effective tool to track advancements

in the repricing of climate risk in bond markets for researchers

and investors.”

The ICE Climate Risk Score serves as a singular assessment,

ranging from 0.0 to 5.0, amalgamating all the ICE Sustainable

Finance Platform's climate hazard models. It provides a

comprehensive, relative measure of estimated total property risk

stemming from physical climate hazards for a specific location, or

a collection of locations related to the obligor.

“ICE research shows that, despite accelerating economic damages

from severe weather, physical climate risk is not yet being priced

into municipal bonds," said Evan Kodra, Head of Climate R&D at

ICE. "That lack of pricing signal could obscure the true risk and

perpetuate complacency around climate in the market. We are pleased

to assist in the launch of new indices that can help address this,

giving investors a consistent pulse on the climate-yield

relationship and a benchmark for managing portfolio risk.”

These new climate risk municipal indices join ICE’s fixed income

index offering, which includes approximately 6,000 standard indices

tracking more than $100 trillion in debt spanning the global bond

markets, with debt represented across 51 currencies.

For more information, please visit:

https://www.ice.com/fixed-income-data-services/index-solutions/fixed-income-indices

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges –

including the New York Stock Exchange – and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology, we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines and automates industries to

connect our customers to opportunity.

The indices referenced herein are administered by ICE Data

Indices, LLC. Additional important information regarding the

indices (including methodology, limitations, and disclaimers) is

available at indices.ice.com. Trademarks of ICE and/or its

affiliates include Intercontinental Exchange, ICE, ICE block

design, NYSE and New York Stock Exchange. Information regarding

additional trademarks and intellectual property rights of

Intercontinental Exchange, Inc. and/or its affiliates is located

here. Key Information Documents for certain products covered by the

EU Packaged Retail and Insurance-based Investment Products

Regulation can be accessed on the relevant exchange website under

the heading “Key Information Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 – Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2023, as

filed with the SEC on February 8, 2024.

Category: Fixed Income and Data Services

SOURCE: Intercontinental Exchange

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240924483027/en/

ICE Media Contact Isabella Bezzone +1 212 748 3948

isabella.bezzone@ice.com media@theice.com ICE Investor Relations

Contact Katia Gonzalez +1 678 981 3882 katia.gonzalez@ice.com

investors@ice.com

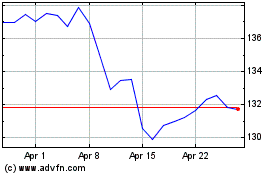

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Dec 2023 to Dec 2024