- The average annual property insurance premium among mortgaged

single-family homes rose by a record +$276 (+14%) to $2,290 in

2024, capping a five-year rise of +$872 (+61%)

- Seattle (+22%), Salt Lake City (+22%) and Los Angeles (+20%)

saw the largest percentage increases in 2024, while the largest

increases by dollar amount were in Dallas (+$606) and Houston

($515)

- Property insurance premiums in Florida increased by less than

half the national average on a percentage basis, but rates there

remain among the highest in the country

- A record 11.4% of borrowers switched carriers in 2024, up 2

percentage points from 2023, likely due to a combination of rising

nonrenewal activity and borrowers shopping for lower premiums

- Homeowners are opting for higher deductibles in exchange for

premium savings, with new borrowers having 19% ($390) higher

deductibles and 12% ($284) lower premiums than the market at

large

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global

provider of technology and data, today released its March 2025 ICE

Mortgage Monitor Report, based on the company’s robust mortgage,

real estate and public records datasets. This month’s Mortgage

Monitor analyzes the latest trends shaping the housing market in

early 2025, with a special emphasis on rising insurance costs and

the ways borrowers are adapting to protect what, for many, may be

their most valuable asset.

Property insurance costs for mortgaged single-family homes rose

by a record $276 (+14%) to $2,290 in 2024 with average premiums now

up 61% over the past 5 years. Seattle (+22%), Salt Lake City (+22%)

and Los Angeles (+20%) saw the largest percentage increases in

2024, while the largest increases by dollar amount were in Dallas

(+$606) and Houston ($515). Premiums in Florida increased by less

than half the national average on a percentage basis, but rates

there remain among the highest in the country.

“While it’s no surprise that insurance costs are rising, we’re

beginning to see emerging trends in terms of how homeowners are

responding to the higher cost environment,” said Andy Walden, Head

of Mortgage and Housing Market Research for Intercontinental

Exchange. “We’re seeing increases in both the share of borrowers

switching policies and borrowers taking on higher deductibles as a

way to combat rising premiums.”

“ICE loan-level data shows that a record 11.4% of borrowers

switched insurance providers in 2024, up from 9.4% in 2023 and less

than 8% historically,” Walden added. “While this has undoubtedly

been driven by rising non-renewal rates, it may also be a sign of

borrowers switching providers in search of lower premiums.”

Markets with the highest insurance costs, which have also been

the focal point of non-renewal activity in recent years,

unsurprisingly have the highest percentage of borrowers switching

providers. Nearly a quarter of mortgage holders in Miami, for

example, switched insurance providers in 2024, the highest share of

any major market, followed by New Orleans and Orlando (both

23%).

“The average borrower switching policies in Miami paid slightly

more, but in most markets with higher-than-average turnover,

borrowers who switched are paying less than those that stayed put,”

Walden said. “For example, in Jacksonville, Dallas, San Antonio and

Denver, homeowners who switched paid at least 10% less, on average

than borrowers who remained with their old carrier.”

“California, where insurers have been reducing their footprint

due to strict regulations and rising wildfire risk, stands out as a

notable exception,” Walden said. “Borrowers who switched providers

in San Diego, Sacramento, San Francisco, Los Angeles and San Jose

all paid at least 15% more, on average, than those who stayed

put.”

Separate research from the ICE Climate team suggests borrowers

taking out mortgages in recent years may also be taking on higher

deductibles to help offset rising premiums. Homeowners who took out

mortgages in 2024, for example, had a 19% ($390) higher deductible

than the average single-family mortgage holder. That same group had

12% ($284) lower annual insurance premiums than the market at

large.

“As borrowers become more interested in shopping for the best

insurance rates, there is an emerging opportunity for lenders and

servicers to meet this need with embedded insurance comparison

tools both at the front end of the pipeline and for people with

existing mortgages,” Walden said. “ICE’s integrations with

insurance providers in both our origination and servicing platforms

have been aimed at exactly this opportunity as part of our

continuing goal of making home finance as simple and transparent as

possible.”

Further information on this and other topics can be found in

this month’s Mortgage Monitor.

About Mortgage Monitor

ICE manages the nation’s leading repository of loan-level

residential mortgage data and performance information covering the

majority of the overall market, including tens of millions of loans

across the spectrum of credit products and more than 160 million

historical records. The combined insight of the ICE Home Price

Index and Collateral Analytics’ home price and real estate data

provides one of the most complete, accurate and timely measures of

home prices available, covering 95% of U.S. residential properties

down to the zip code level. In addition, the company maintains one

of the most robust public property records databases available,

covering 99.9% of the U.S. population and households from more than

3,100 counties.

ICE’s research experts carefully analyze this data to produce a

summary supplemented by dozens of charts and graphs that reflect

trend and point-in-time observations for the monthly Mortgage

Monitor Report. To review the full report, visit:

https://mortgagetech.ice.com/resources/data-reports

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds, and operates digital networks that

connect people to opportunity. We provide financial technology and

data services across major asset classes helping our customers

access mission-critical workflow tools that increase transparency

and efficiency. ICE’s futures, equity, and options exchanges --

including the New York Stock Exchange -- and clearing houses help

people invest, raise capital and manage risk. We offer some of the

world’s largest markets to trade and clear energy and environmental

products. Our fixed income, data services and execution

capabilities provide information, analytics and platforms that help

our customers streamline processes and capitalize on opportunities.

At ICE Mortgage Technology, we are transforming U.S. housing

finance, from initial consumer engagement through loan production,

closing, registration and the long-term servicing relationship.

Together, ICE transforms, streamlines, and automates industries to

connect our customers to opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for certain

products covered by the EU Packaged Retail and Insurance-based

Investment Products Regulation can be accessed on the relevant

exchange website under the heading “Key Information Documents

(KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2024, as

filed with the SEC on February 6, 2025.

Source: Intercontinental Exchange

Category: Mortgage Technology

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303971478/en/

ICE Media Contact Brad Kuhn brad.kuhn@ice.com +1 (904)

248-6341

ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com +1 (678) 981-3882

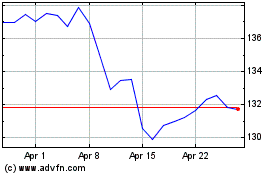

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Mar 2025