Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 November 2023 - 4:51AM

Edgar (US Regulatory)

Portfolio of Investments (unaudited)

As of September 30, 2023

The India Fund, Inc.

|

| Shares

| Value

|

| COMMON STOCKS—101.1%

|

|

| INDIA—101.1%

|

| Communication Services—6.8%

|

|

|

|

| Affle India Ltd.(a)

|

| 386,766

| $ 5,139,320

|

| Bharti Airtel Ltd.

|

| 2,135,010

| 23,791,560

|

| Info Edge India Ltd.

|

| 98,700

| 4,946,681

|

|

|

|

| 33,877,561

|

| Consumer Discretionary—8.2%

|

|

|

|

| Mahindra & Mahindra Ltd.

|

| 638,136

| 11,927,946

|

| Maruti Suzuki India Ltd.

|

| 136,952

| 17,421,955

|

| Titan Co. Ltd.

|

| 299,882

| 11,343,650

|

|

|

|

| 40,693,551

|

| Consumer Staples—11.7%

|

|

|

|

| Hindustan Unilever Ltd.

|

| 929,372

| 27,600,425

|

| ITC Ltd.

|

| 2,708,277

| 14,441,091

|

| Nestle India Ltd.

|

| 37,500

| 10,124,859

|

| Tata Consumer Products Ltd.

|

| 550,000

| 5,800,927

|

|

|

|

| 57,967,302

|

| Energy—2.9%

|

|

|

|

| Aegis Logistics Ltd.

|

| 3,595,288

| 14,261,411

|

| Financials—28.9%

|

|

|

|

| Aptus Value Housing Finance India Ltd.

|

| 2,446,358

| 8,625,757

|

| Axis Bank Ltd.

|

| 1,378,855

| 17,166,113

|

| HDFC Bank Ltd.

|

| 2,150,542

| 39,429,093

|

| ICICI Bank Ltd.

|

| 3,647,684

| 41,839,076

|

| Kotak Mahindra Bank Ltd.

|

| 486,294

| 10,138,162

|

| PB Fintech Ltd.(a)

|

| 829,965

| 7,621,908

|

| SBI Life Insurance Co. Ltd.(b)

|

| 1,182,396

| 18,612,558

|

|

|

|

| 143,432,667

|

| Health Care—7.9%

|

|

|

|

| Fortis Healthcare Ltd.

|

| 2,928,200

| 11,991,424

|

| JB Chemicals & Pharmaceuticals Ltd.

|

| 395,661

| 7,051,553

|

| Syngene International Ltd.(b)

|

| 1,166,661

| 11,259,781

|

| Vijaya Diagnostic Centre Pvt Ltd.

|

| 1,501,100

| 9,008,453

|

|

|

|

| 39,311,211

|

| Industrials—9.3%

|

|

|

|

| ABB India Ltd.

|

| 181,709

| 8,952,881

|

| Container Corp. Of India Ltd.

|

| 711,515

| 6,121,960

|

| KEI Industries Ltd.

|

| 222,500

| 7,085,452

|

|

| Shares

| Value

|

|

|

|

|

|

| Larsen & Toubro Ltd.

|

| 535,837

| $ 19,484,278

|

| Siemens Ltd.

|

| 99,300

| 4,374,677

|

|

|

|

| 46,019,248

|

| Information Technology—8.6%

|

|

|

|

| Infosys Ltd.

|

| 1,409,444

| 24,123,868

|

| Tata Consultancy Services Ltd.

|

| 438,538

| 18,549,711

|

|

|

|

| 42,673,579

|

| Materials—7.5%

|

|

|

|

| Asian Paints Ltd.

|

| 193,242

| 7,356,319

|

| Coromandel International Ltd.

|

| 55,027

| 756,782

|

| Hindalco Industries Ltd.

|

| 1,335,673

| 7,889,527

|

| UltraTech Cement Ltd.

|

| 216,134

| 21,498,629

|

|

|

|

| 37,501,257

|

| Real Estate—3.9%

|

|

|

|

| Godrej Properties Ltd.(a)

|

| 554,915

| 10,361,125

|

| Prestige Estates Projects Ltd.

|

| 1,269,469

| 9,200,774

|

|

|

|

| 19,561,899

|

| Utilities—5.4%

|

|

|

|

| Power Grid Corp. of India Ltd.

|

| 8,845,578

| 21,279,854

|

| ReNew Energy Global PLC, Class A(a)

|

| 991,812

| 5,385,539

|

|

|

|

| 26,665,393

|

| Total India

|

| 501,965,079

|

| Total Common Stocks

|

| 501,965,079

|

| SHORT-TERM INVESTMENT—0.1%

|

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.29%(c)

|

| 687,152

| 687,152

|

| Total Short-Term Investment

|

| 687,152

|

Total Investments

(Cost $323,897,524)—101.2%

| 502,652,231

|

| Liabilities in Excess of Other Assets—(1.2%)

| (5,894,327)

|

| Net Assets—100.0%

| $496,757,904

|

| (a)

| Non-income producing security.

|

| (b)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (c)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of September 30, 2023.

|

| PLC

| Public Limited Company

|

See accompanying

Notes to Portfolio of Investments.

Notes to Portfolio of Investments

September 30, 2023 (unaudited)

1. Summary of Significant

Accounting Policies

a. Security Valuation:

The Fund values its

securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined in the Fund's Valuation and Liquidity Procedures as the price that could be received to sell an asset

or paid to transfer a liability in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule 2a-5 under the 1940 Act, the Board of Directors

(the "Board") designated abrdn Asia Limited (“abrdn Asia” or the “Investment Manager”) as the valuation designee ("Valuation Designee") for the Fund to perform the fair value

determinations relating to Fund investments for which market quotations are not readily available.

Equity securities that are

traded on an exchange are valued at the last quoted sale price or the official close price on the principal exchange on which the security is traded at the “Valuation Time” subject to application, when

appropriate, of the valuation factors described in the paragraph below. Under normal circumstances, the Valuation Time is as of the close of regular trading on the New York Stock Exchange ("NYSE") (usually 4:00 p.m.

Eastern Time). In the absence of a sale price, the security is valued at the mean of the bid/ask price quoted at the close on the principal exchange on which the security is traded. Securities traded on NASDAQ are

valued at the NASDAQ official closing price.

Foreign equity securities that

are traded on foreign exchanges that close prior to the Valuation Time are valued by applying valuation factors to the last sale price or the mean price as noted above. Valuation factors are provided by an independent

pricing service provider. These valuation factors are used when pricing the Fund's portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund values such foreign

securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs, exchange rates, and local exchange opening and closing prices of each security. When prices

with the application of valuation factors are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their primary markets. A security that

applies a valuation factor is determined to be a Level 2 investment because the exchange-traded price has been adjusted. Valuation factors are not utilized if the independent pricing service provider is unable to

provide a valuation factor or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment.

Short-term investments are

comprised of cash and cash equivalents invested in short-term investment funds which are redeemable daily. The Fund sweeps available cash into the State Street Institutional U.S. Government Money Market Fund,

which has elected to qualify as a “government money market fund” pursuant to Rule 2a-7 under the 1940 Act, and has an objective, which is not guaranteed, to maintain a $1.00 per share NAV. Registered

investment companies are valued at their NAV as reported by such company. Generally, these investment types are categorized as Level 1 investments.

In the event that a

security’s market quotations are not readily available or are deemed unreliable (for reasons other than because the foreign exchange on which it trades closes before the Valuation Time), the security is valued

at fair value as determined by the Valuation Designee, taking into account the relevant factors and surrounding circumstances using valuation policies and procedures approved by the Board. A security that has been

fair valued by the Manager may be classified as Level 2 or Level 3 depending on the nature of the inputs.

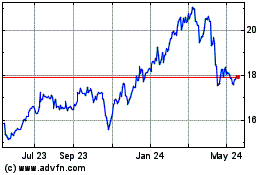

India (NYSE:IFN)

Historical Stock Chart

From Dec 2024 to Jan 2025

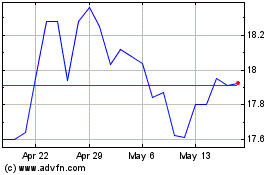

India (NYSE:IFN)

Historical Stock Chart

From Jan 2024 to Jan 2025