Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

16 October 2024 - 9:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-40876

IHS Holding Limited

(Translation of registrant’s name into English)

1 Cathedral Piazza

123 Victoria Street

London SW1E 5BP

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

IHS Holding Limited Enters into a $439 Million Equivalent Five Year

Term Loan

October 16, 2024, London: IHS Holding

Limited (NYSE: IHS) (“IHS Towers”), one of the largest independent owners, operators, and developers of shared communications

infrastructure in the world by tower count, has, on October 7, 2024, entered into a new $439 million equivalent, dual-tranche, five

year bullet term loan, split across a $255 million US$ tranche and a South African Rand (ZAR) 3,246 million tranche. The terms of the

loan for the US$ and ZAR tranches carry an interest rate of 4.50% plus three-month SOFR and 4.50% plus three-month JIBAR, respectively.

Proceeds from the facility, which has been fully

drawn down, are expected to be used to fully repay the $430 million IHS Holding Limited term loan entered into in October 2022, and

that is due to mature in October 2025. The new financing is therefore expected to be leverage neutral to IHS Towers.

The Initial Mandated Lead Arranger, Coordinator

and Bookrunner of this transaction was Rand Merchant Bank, with continued support from IHS Towers’ key relationship banks.

This new term loan further enhances IHS Towers’

balance sheet in line with the company’s stated desire to extend its maturity profile and shift more of its debt into local currency.

---

Cautionary Language Regarding Forward-Looking

Statements

This document contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All

statements, other than statements of historical facts, included in this document that address activities, events or developments that

we expect, believe or anticipate will or may occur in the future are forward-looking statements. In some cases, you can identify forward-looking

statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “targets,” “projects,” “contemplates," “believes,”

“estimates,” “forecast,” “predicts,” “potential” or “continue” or the negative

of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections

about future events and financial trends that we believe may affect our business, financial condition and results of operations, and while

we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements

should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information.

These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. You should read this document

and the documents that we reference in this document with the understanding that our actual future results, performance and achievements

may be materially different from what we expect. Further information on such assumptions, risks and uncertainties is available in our

filings with the US Securities and Exchange Commission, including our Annual Report on Form 20-F for the fiscal year ended December 31,

2023. We qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as

of the date of this document. Except as required by applicable law, we do not assume, and expressly disclaim, any obligation to publicly

update or revise any forward-looking statements contained in this document, whether as a result of any new information, future events

or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

IHS Holding Limited |

| |

|

| Date: October 16, 2024 |

By: |

/s/ Steve Howden |

| |

|

Steve Howden |

| |

|

Executive Vice President and |

| |

|

Chief Financial Officer |

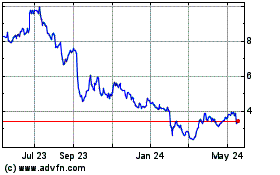

IHS (NYSE:IHS)

Historical Stock Chart

From Dec 2024 to Jan 2025

IHS (NYSE:IHS)

Historical Stock Chart

From Jan 2024 to Jan 2025