Form 8-K - Current report

07 November 2024 - 8:05AM

Edgar (US Regulatory)

0001824920false0001824920ionq:CommonStockParValue00001PerShareMember2024-11-062024-11-0600018249202024-11-062024-11-060001824920ionq:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember2024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2024 |

IonQ, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39694 |

85-2992192 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4505 Campus Drive |

|

College Park, Maryland |

|

20740 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 301 298-7997 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 per share |

|

IONQ |

|

New York Stock Exchange |

Warrants, each exercisable for one share of common stock for $11.50 per share |

|

IONQ WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, IonQ, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information provided in this Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

IonQ, Inc. |

|

|

|

|

Date: |

November 6, 2024 |

By: |

/s/ Stacey Giamalis |

|

|

|

Stacey Giamalis

Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

IonQ Announces Third Quarter 2024 Financial Results

•Exceeds High End of Guidance Range with Third Quarter Revenue of $12.4 Million, Representing 102% Year-Over-Year Growth

•Raises Full Year Revenue Guidance to Between $38.5 Million and $42.5 Million

•Secures $63.5 Million in Third Quarter Bookings, Including Largest 2024 U.S. Quantum Contract Award of $54.5 Million with United States Air Force Research Lab

•Signs Definitive Agreement to Acquire Qubitekk, Furthering Leadership in Quantum Networking

•Enters New Era of Quantum Networking Commercialization, with Significant Government Backing

•Announces Plan to Partner with AstraZeneca to Accelerate Drug Discovery and Development

•Announces Partnership with Ansys to Bring the Power of Quantum to the $10 Billion Computer-Aided Engineering Industry

•Signs $9 Million Partnership with University of Maryland to Drive Quantum Innovation

COLLEGE PARK, Md.--(BUSINESS WIRE)-- IonQ (NYSE: IONQ), a leader in the quantum computing industry, today announced financial results for the quarter ended September 30, 2024.

“We had yet another banner quarter at IonQ, booking $63.5 million and exceeding the high end of our revenue range. We won a $54.5 million deal with the United States Air Force Research Lab (AFRL) to develop and deliver hardware that enables the scaling and networking of quantum systems,” said Peter Chapman, President and CEO of IonQ. “We have entered a new era of commercialization for quantum networking, as demonstrated by the AFRL deal, today's announcement of the Qubitekk acquisition, and last quarter’s networking win with ARLIS. These announcements advance our position as a market leader in quantum networking, in addition to our pole position in quantum computing.”

“For the first time in IonQ’s history, we are announcing a plan to partner on the development of quantum applications for a production use case with AstraZeneca,” said Chapman. “We believe this monumental collaboration will be the first step to validate the years of pioneering research we have conducted in quantum chemistry.”

Financial Highlights

•IonQ recognized revenue of $12.4 million for the third quarter, which is above the high end of the previously provided range and represents 102% growth compared to $6.1 million in the prior year period.

•IonQ achieved $63.5 million in new bookings for the third quarter.

•Cash, cash equivalents, and investments were $382.8 million as of September 30, 2024.

•Net loss was $52.5 million and Adjusted EBITDA loss was $23.7 million for the third quarter.* Exclusions from Adjusted EBITDA include a non-cash loss of $3.9 million related to the change in the fair value of IonQ’s warrant liabilities.

*Adjusted EBITDA is a non-GAAP financial measure defined under “Non-GAAP Financial Measures,” and is reconciled to net loss, its closest comparable GAAP measure, at the end of this release.

Q3 and Recent Commercial Highlights

•IonQ announced a $54.5 million contract with the United States Air Force Research Lab (AFRL) to design, develop, and deliver technology and hardware that enables the scaling, networking, and deployability of quantum systems. The project will help advance quantum networking compatibility with existing telecommunications infrastructure, interoperability with different quantum systems and devices, and deployability of systems suitable for various environments. The contract is IonQ’s third with AFRL and will be delivered over four years.

•IonQ announced a $9 million agreement with the University of Maryland (UMD) to expand their partnership to provide state-of-the-art quantum computing access at the National Quantum Lab at Maryland (QLab). QLab provides

UMD-affiliated students, faculty, researchers, staff, and partners with an unprecedented opportunity to work closely with IonQ’s scientists and engineers as they gain experience with industry-leading trapped ion quantum computers.

•IonQ signed a definitive agreement to acquire substantially all of the assets and team of Qubitekk, Inc., a Vista, CA-based quantum networking company. As part of the transaction, which IonQ anticipates closing within the next six months, IonQ will fortify its leading position in the quantum networking industry by bringing on Qubitekk's team, customer base, and technology portfolio of 118 U.S. and international granted patents in the areas of quantum networking hardware and quantum network security and protection.

•IonQ announced the creation of a new quantum application development center in collaboration with AstraZeneca. IonQ will be leveraging the power of its quantum experts and AstraZeneca’s world-class scientists to develop applications in their innovation BioVentureHub in Gothenburg, Sweden.

•IonQ announced a partnership with Ansys to accelerate simulation, expand high-fidelity design exploration, and reduce product development timelines, enabling faster market entry for more innovative products. The partnership is aimed at making simulation accessible to both quantum experts and non-experts by allowing seamless integration between Ansys software and IonQ computers.

Technical Highlights

•IonQ demonstrated remote ion-ion entanglement, the second of four significant milestones required to develop at-scale photonic interconnects. The IonQ team achieved remote entanglement by developing a system to collect photons from two trap wells and route them to a single detection hub. This critical “point-to-point” step established a quantum communication link, an essential element in scaling quantum systems.

•IonQ announced a partnership with NKT Photonics to develop next-generation laser systems to power future quantum computers. The partnership includes NKT Photonics developing and delivering three prototype optical subsystems to IonQ in 2025, designed to support the commercialization of IonQ’s data center-ready quantum computers – such as IonQ Tempo and future barium-based systems.

•IonQ announced a partnership with imec – a world-renowned R&D center in nanoelectronics and digital technologies – to develop photonic integrated circuits and chip-scale ion trap technology. With these ground-breaking technologies, IonQ aims to reduce overall hardware system size and cost, increase qubit count, and improve system performance and scale.

2024 Financial Outlook

•For the full year 2024, IonQ is raising its revenue expectations to between $38.5 million and $42.5 million, with between $7.1 million and $11.1 million for the fourth quarter.

•For the full year 2024, IonQ is reiterating its previously stated bookings range of between $75 million and $95 million.

Third Quarter 2024 Conference Call

IonQ will host a conference call today at 4:30 p.m. Eastern time to review the Company’s financial results for the third quarter ended September 30, 2024 and to provide a business update. The call will be accessible by telephone at 877-407-4078 (domestic) or +1-201-689-8471 (international). The call will also be available live via webcast on the Company’s website here, or directly here. A telephone replay of the conference call will be available approximately three hours after its conclusion at 844-512-2921 (domestic) or 412-317-6671 (international) with access code 13748910 and will be available until 11:59 p.m. Eastern time, November 20, 2024. An archive of the webcast will also be available here shortly after the call and will remain available for one year.

Non-GAAP Financial Measures

To supplement IonQ’s condensed consolidated financial statements presented in accordance with GAAP, IonQ uses non-GAAP measures of certain components of financial performance. Adjusted EBITDA is a financial measure that is not required by or presented in accordance with GAAP. Management believes that this measure provides investors an additional meaningful method to evaluate certain aspects of the Company’s results period over period. Adjusted EBITDA is defined as net loss before interest income, interest expense, income tax expense, depreciation and amortization expense, stock-based compensation, change in fair value of assumed warrant liabilities, and other non-recurring non-operating income and expenses. IonQ uses Adjusted EBITDA to measure the

operating performance of its business, excluding specifically identified items that it does not believe directly reflect its core operations and may not be indicative of recurring operations. The presentation of non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the financial results prepared in accordance with GAAP, and IonQ’s non-GAAP measures may be different from non-GAAP measures used by other companies. IonQ shows a reconciliation of GAAP to non-GAAP financial measures at the end of this release.

About IonQ

IonQ, Inc. is a leader in quantum computing that delivers high-performance systems capable of solving the world’s largest and most complex commercial and research use cases. IonQ’s current generation quantum computer, IonQ Forte, is the latest in a line of cutting-edge systems, boasting 36 algorithmic qubits. The Company’s innovative technology and rapid growth were recognized in Fast Company’s 2023 Next Big Things in Tech List and Deloitte’s 2023 Technology Fast 500™ List, respectively. Available through all major cloud providers, IonQ is making quantum computing more accessible and impactful than ever before. Learn more at IonQ.com.

IonQ Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Some of the forward-looking statements can be identified by the use of forward-looking words. Statements that are not historical in nature, including the words “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast,” “offers,” and other similar expressions are intended to identify forward-looking statements. These statements include those related to IonQ’s position in the quantum networking sector; its planned partnership with AstraZeneca to develop production applications; the expected progress of IonQ’s application development collaborations; the closing of its transaction to acquire substantially all of the assets of Qubitekk, Inc., including its patents; the expected hiring of Qubitekk employees; the delivery of hardware and technology by IonQ under its contract with AFRL; advancement of quantum networking technology; the expected delivery to IonQ of components for its next generation systems; IonQ’s development of applications in AstraZeneca’s BioVentureHub; the Company’s technology driving commercial applications in the future; the Company’s future financial and operating performance, including our preliminary outlook and guidance; the appearance of new applications of IonQ’s products and services; the ability for third parties to implement IonQ’s offerings to solve their problems and increase their quantum computing capabilities; expansion of IonQ’s sales pipeline; IonQ’s quantum computing capabilities and plans; future deliveries of and access to IonQ’s quantum computers and services; future purchases of IonQ’s offerings by customers using congressionally-appropriated funds from the U.S. government; IonQ’s performance of existing contracts in the future, including anticipated timing of completion of research, development and manufacturing by IonQ; IonQ receiving additional revenues under planned subsequent phases of customer contracts; and the scalability and reliability of IonQ’s quantum computing offerings. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: changes in the competitive industries in which IonQ operates, including development of competing technologies; our ability to sell effectively to government entities and large enterprises; changes in laws and regulations affecting IonQ’s and its suppliers’ businesses; IonQ’s ability to implement its business plans, forecasts, and other expectations, to identify and realize partnerships and opportunities, and to engage new and existing customers; its inability to effectively enter new markets; IonQ’s ability to deliver services and products within currently anticipated timelines; its inability to attract and retain key personnel; the conditions for closing the asset purchase transaction with Qubitekk not being met, including the entry into certain contracts and amendments to contracts; IonQ’s customers deciding or declining to extend contracts into new phases; the inability of its suppliers to deliver components that meet expectations timely; changes in U.S. government spending or policy that may affect IonQ’s customers; changes to U.S. government goals and metrics of success with regard to implementation of quantum computing and quantum networking; and risks associated with U.S. government sales, including availability of funding and provisions that allow the government to unilaterally terminate or modify contracts for convenience. You should carefully consider the foregoing factors and the other risks and uncertainties disclosed in the Company’s filings, including but not limited to those described in the “Risk Factors'' section of IonQ’s most recent Quarterly Report on Form 10-Q and other documents filed by IonQ from time to time with the Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and IonQ assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. IonQ does not give any assurance that it will achieve its expectations.

IonQ, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

$ |

12,400 |

|

|

$ |

6,136 |

|

|

$ |

31,363 |

|

|

$ |

15,936 |

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue (excluding depreciation and amortization) |

|

|

6,515 |

|

|

|

2,008 |

|

|

|

15,552 |

|

|

|

4,945 |

|

Research and development |

|

|

33,178 |

|

|

|

24,599 |

|

|

|

96,750 |

|

|

|

60,701 |

|

Sales and marketing |

|

|

6,630 |

|

|

|

5,047 |

|

|

|

19,468 |

|

|

|

11,289 |

|

General and administrative |

|

|

14,322 |

|

|

|

13,927 |

|

|

|

41,395 |

|

|

|

35,438 |

|

Depreciation and amortization |

|

|

4,890 |

|

|

|

2,749 |

|

|

|

13,150 |

|

|

|

6,869 |

|

Total operating costs and expenses |

|

|

65,535 |

|

|

|

48,330 |

|

|

|

186,315 |

|

|

|

119,242 |

|

Loss from operations |

|

|

(53,135 |

) |

|

|

(42,194 |

) |

|

|

(154,952 |

) |

|

|

(103,306 |

) |

Gain (loss) on change in fair value of warrant liabilities |

|

|

(3,868 |

) |

|

|

(7,640 |

) |

|

|

11,398 |

|

|

|

(26,787 |

) |

Interest income, net |

|

|

4,508 |

|

|

|

5,007 |

|

|

|

14,108 |

|

|

|

14,115 |

|

Other income (expense), net |

|

|

15 |

|

|

|

55 |

|

|

|

(164 |

) |

|

|

150 |

|

Loss before income tax expense |

|

|

(52,480 |

) |

|

|

(44,772 |

) |

|

|

(129,610 |

) |

|

|

(115,828 |

) |

Income tax benefit (expense) |

|

|

(16 |

) |

|

|

(39 |

) |

|

|

(39 |

) |

|

|

(39 |

) |

Net loss |

|

$ |

(52,496 |

) |

|

$ |

(44,811 |

) |

|

$ |

(129,649 |

) |

|

$ |

(115,867 |

) |

Net loss per share attributable to common stockholders—

basic and diluted |

|

$ |

(0.24 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.61 |

) |

|

$ |

(0.57 |

) |

Weighted average shares used in computing net loss per share

attributable to common stockholders—basic and diluted |

|

|

214,305,053 |

|

|

|

203,390,383 |

|

|

|

211,378,045 |

|

|

|

201,656,916 |

|

IonQ, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

30,172 |

|

|

$ |

35,665 |

|

Short-term investments |

|

|

335,538 |

|

|

|

319,776 |

|

Accounts receivable |

|

|

4,137 |

|

|

|

11,467 |

|

Prepaid expenses and other current assets |

|

|

25,553 |

|

|

|

23,081 |

|

Total current assets |

|

|

395,400 |

|

|

|

389,989 |

|

Long-term investments |

|

|

17,131 |

|

|

|

100,489 |

|

Property and equipment, net |

|

|

49,454 |

|

|

|

37,515 |

|

Operating lease right-of-use assets |

|

|

10,029 |

|

|

|

4,613 |

|

Intangible assets, net |

|

|

17,487 |

|

|

|

15,077 |

|

Goodwill |

|

|

727 |

|

|

|

742 |

|

Other noncurrent assets |

|

|

7,683 |

|

|

|

5,155 |

|

Total Assets |

|

$ |

497,911 |

|

|

$ |

553,580 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

4,854 |

|

|

$ |

5,599 |

|

Accrued expenses |

|

|

15,657 |

|

|

|

18,376 |

|

Current portion of operating lease liabilities |

|

|

3,089 |

|

|

|

710 |

|

Unearned revenue |

|

|

8,332 |

|

|

|

12,087 |

|

Current portion of stock option early exercise liabilities |

|

|

392 |

|

|

|

392 |

|

Total current liabilities |

|

|

32,324 |

|

|

|

37,164 |

|

Operating lease liabilities, net of current portion |

|

|

15,214 |

|

|

|

7,395 |

|

Unearned revenue, net of current portion |

|

|

60 |

|

|

|

447 |

|

Stock option early exercise liabilities, net of current portion |

|

|

154 |

|

|

|

448 |

|

Warrant liabilities |

|

|

11,607 |

|

|

|

23,004 |

|

Other noncurrent liabilities |

|

|

2,869 |

|

|

|

128 |

|

Total liabilities |

|

$ |

62,228 |

|

|

$ |

68,586 |

|

Stockholders’ Equity: |

|

|

|

|

|

|

Common stock |

|

$ |

22 |

|

|

$ |

20 |

|

Additional paid-in capital |

|

|

917,048 |

|

|

|

839,014 |

|

Accumulated deficit |

|

|

(481,722 |

) |

|

|

(352,073 |

) |

Accumulated other comprehensive income (loss) |

|

|

335 |

|

|

|

(1,967 |

) |

Total stockholders’ equity |

|

|

435,683 |

|

|

|

484,994 |

|

Total Liabilities and Stockholders’ Equity |

|

$ |

497,911 |

|

|

$ |

553,580 |

|

IonQ, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(129,649 |

) |

|

$ |

(115,867 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

13,150 |

|

|

|

6,869 |

|

Non-cash research and development arrangements |

|

|

390 |

|

|

|

390 |

|

Stock-based compensation |

|

|

67,607 |

|

|

|

38,549 |

|

(Gain) loss on change in fair value of warrant liabilities |

|

|

(11,398 |

) |

|

|

26,787 |

|

Amortization of premiums and accretion of discounts on available-for-sale securities |

|

|

(7,086 |

) |

|

|

(7,287 |

) |

Other, net |

|

|

3,901 |

|

|

|

1,036 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

7,341 |

|

|

|

946 |

|

Prepaid expenses and other current assets |

|

|

(9,899 |

) |

|

|

(7,545 |

) |

Accounts payable |

|

|

(463 |

) |

|

|

975 |

|

Accrued expenses |

|

|

612 |

|

|

|

8,066 |

|

Unearned revenue |

|

|

(4,232 |

) |

|

|

(4,944 |

) |

Other assets and liabilities |

|

|

3,471 |

|

|

|

(156 |

) |

Net cash provided by (used in) operating activities |

|

$ |

(66,255 |

) |

|

$ |

(52,181 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(14,399 |

) |

|

|

(6,544 |

) |

Capitalized software development costs |

|

|

(3,064 |

) |

|

|

(3,134 |

) |

Intangible asset acquisition costs |

|

|

(1,201 |

) |

|

|

(1,057 |

) |

Purchases of available-for-sale securities |

|

|

(241,162 |

) |

|

|

(230,350 |

) |

Maturities of available-for-sale securities |

|

|

318,192 |

|

|

|

285,665 |

|

Net cash provided by (used in) investing activities |

|

$ |

58,366 |

|

|

$ |

44,580 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from stock options exercised |

|

|

2,270 |

|

|

|

775 |

|

Other financing, net |

|

|

144 |

|

|

|

9 |

|

Net cash provided by (used in) financing activities |

|

$ |

2,414 |

|

|

$ |

784 |

|

Effect of foreign exchange rate changes on cash, cash equivalents and restricted cash |

|

|

4 |

|

|

|

3 |

|

Net change in cash, cash equivalents and restricted cash |

|

|

(5,471 |

) |

|

|

(6,814 |

) |

Cash, cash equivalents and restricted cash at the beginning of the period |

|

|

38,081 |

|

|

|

46,367 |

|

Cash, cash equivalents and restricted cash at the end of the period |

|

$ |

32,610 |

|

|

$ |

39,553 |

|

IonQ, Inc.

Reconciliation of Net Loss to Adjusted EBITDA

(unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net loss |

|

$ |

(52,496 |

) |

|

$ |

(44,811 |

) |

|

$ |

(129,649 |

) |

|

$ |

(115,867 |

) |

Interest income, net |

|

|

(4,508 |

) |

|

|

(5,007 |

) |

|

|

(14,108 |

) |

|

|

(14,115 |

) |

Interest expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Income tax (benefit) expense |

|

|

16 |

|

|

|

39 |

|

|

|

39 |

|

|

|

39 |

|

Depreciation and amortization |

|

|

4,890 |

|

|

|

2,749 |

|

|

|

13,150 |

|

|

|

6,869 |

|

Stock-based compensation |

|

|

24,567 |

|

|

|

16,977 |

|

|

|

67,607 |

|

|

|

38,549 |

|

(Gain) loss on change in fair value of warrant liabilities |

|

|

3,868 |

|

|

|

7,640 |

|

|

|

(11,398 |

) |

|

|

26,787 |

|

Adjusted EBITDA |

|

$ |

(23,663 |

) |

|

$ |

(22,413 |

) |

|

$ |

(74,359 |

) |

|

$ |

(57,738 |

) |

IonQ Media Contact:

Tyler Ogoshi

press@ionq.com

IonQ Investor Contact:

investors@ionq.com

v3.24.3

Document And Entity Information

|

Nov. 06, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

IonQ, Inc.

|

| Entity Central Index Key |

0001824920

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39694

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-2992192

|

| Entity Address, Address Line One |

4505 Campus Drive

|

| Entity Address, City or Town |

College Park

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20740

|

| City Area Code |

301

|

| Local Phone Number |

298-7997

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock Par Value 0.0001 Per Share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

IONQ

|

| Security Exchange Name |

NYSE

|

| Warrants Each Whole Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of 11.50 Per Share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock for $11.50 per share

|

| Trading Symbol |

IONQ WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ionq_CommonStockParValue00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ionq_WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

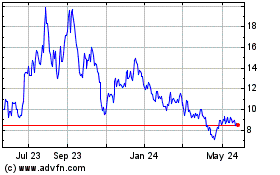

IonQ (NYSE:IONQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

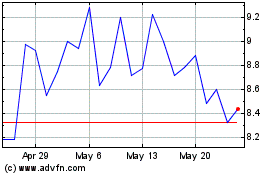

IonQ (NYSE:IONQ)

Historical Stock Chart

From Dec 2023 to Dec 2024