Delivered 4.6% Organic Revenue Growth in

2023

Increased 2023 Net Income 25.9% to $135.7

Million, or $0.92 Per Diluted Share, with Adjusted EPS of $0.94

Achieved 2023 Adjusted EBITDA of $285.6

Million, Up 25.9% Year-over-Year

Realized 2023 Free Cash Flow Conversion of

Non-GAAP Adjusted Net Income of 142%

Initiates Full-year 2024 Revenue and Adjusted

EBITDA Guidance

Reaffirms Long-Term Outlook for Sustained

Organic Growth and Margin Expansion with Best in Class Offerings

and Continued Relentless Focus on Execution

Janus International Group, Inc. (NYSE: JBI) (“Janus” or the

“Company”), a leading provider of access control technologies and

building product solutions for the self-storage and other

commercial and industrial sectors, today announced financial

results for its fiscal fourth quarter and full year ended December

30, 2023.

Fourth Quarter 2023 Highlights

- Revenue of $263.7 million, a 5.7% decrease compared to $279.7

million for the fourth quarter of 2022, as total Self-Storage

revenues were up 2.5% which was more than offset by declines in

Commercial and Other of 20.2%.

- Net income was $35.8 million, or $0.24 per diluted share,

compared to $32.7 million, or $0.22 per diluted share, in the

fourth quarter of 2022.

- Adjusted Net Income (defined as net income plus the

corresponding tax-adjusted add-backs shown in the Adjusted EBITDA

reconciliation tables below) of $35.9 million, up 9.8% compared to

$32.7 million in the fourth quarter of 2022. Adjusted earnings per

diluted share was $0.24, compared to $0.22 in the fourth quarter of

2022.

- Adjusted EBITDA of $74.3 million, an 8.9% increase compared to

$68.2 million for the fourth quarter of 2022, driven by increased

revenue in Self-Storage, and cost containment measures which more

than offset increases in general and administrative expenses.

Adjusted EBITDA as a percentage of revenues was 28.2%, an increase

of 3.8% from the prior year period due primarily to the positive

impacts of commercial actions and product mix, partially offset by

increased labor costs as the business scales for continued

growth.

Full Year 2023 Highlights

- Revenue was $1,066.4 million, a 4.6% increase compared to

$1,019.5 million in full year 2022. The improvement was driven

primarily by total Self-Storage revenues up 13.2%, partially offset

by a 10.2% decrease in Commercial and Other.

- Net income was $135.7 million, or $0.92 per diluted share,

compared to $107.7 million, or $0.73 per diluted share in full year

2022.

- Adjusted Net Income was $138.4 million, a 26.6% increase

compared to $109.2 million in full year 2022. Adjusted earnings per

diluted share was $0.94, compared to $0.74 in full year 2022.

- Adjusted EBITDA was $285.6 million, a 25.9% increase compared

to $226.9 million for full year 2022 driven by increased revenue in

the Self-Storage sales channels, which more than offset increases

in general and administrative expenses. As a percent of revenues,

Adjusted EBITDA was 26.8% as compared to 22.3% in the prior year,

primarily due to the positive impacts of commercial actions and

product mix, partially offset by increased labor and logistics

costs.

- Operating cash flow of $215.0 million compared to $88.5 million

in full year 2022. Free cash flow conversion of Non-GAAP Adjusted

Net Income of 142% in full year 2023.

- Year-end net leverage ratio of 1.6x – a decrease of 1.2x from

the fourth quarter of 2022.

Ramey Jackson, Chief Executive Officer, stated, “A relentless

focus on execution and strong demand fundamentals in our end

markets drove another year of record results in 2023. We are proud

of all we accomplished including the pay down and refinancing of

our term loan, the opening of our Atlanta software center and

migration of the Nokē cloud provider to Amazon Web Services, and

the opening of our manufacturing facility in Poland. Supported by

our leading market position in self-storage, we generated solid

organic growth, a 450-basis point improvement in adjusted EBITDA

margin, substantial free cash flow generation, and another

meaningful decrease in net leverage to 1.6x.”

Mr. Jackson continued, “Supported by the resilience of our

business model, the strength in our cash generation profile, and

our ongoing commitment to delivering shareholder value through a

thoughtful approach to capital allocation, we are announcing our

inaugural $100 million share repurchase program. We are also

pleased to introduce our full-year 2024 revenue and adjusted EBITDA

guidance and reiterate the goals we laid out a year ago in our

long-term outlook.”

2024 Financial Outlook:

Based on the Company’s current business outlook, Janus is

providing initial full year 2024 guidance as follows:

- Revenue in a range of $1.092 billion to $1.125 billion, which

represents a 4.0% increase at the midpoint as compared to 2023

levels.

- Adjusted EBITDA in a range of $286 million to $310 million,

which represents a 4.3% increase at the midpoint as compared to

2023 levels.

The estimates set forth above and under Long Term Financial

Targets below were prepared by the Company’s management and are

based upon a number of assumptions. See “Forward-Looking

Statements.” The Company has excluded a quantitative reconciliation

with respect to the Company’s 2024 guidance under the “unreasonable

efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See

“Non-GAAP Financial Measures” below for additional information.

Reaffirms Long Term Financial Targets

The Company’s long-term outlook includes the following financial

objectives:

- Delivering annual organic revenue growth in the range of 4% to

6%

- Sustaining Adjusted EBITDA margin in a range of 25% to 27%

- Continuing significant cash flow generation, including free

cash flow conversion of adjusted net income in a range of 75% -

100%

- Maintaining strong balance sheet with net leverage in a range

of 2.0x to 3.0x

Share Repurchase Program

The Board of Directors has authorized a share repurchase

program, pursuant to which the Company is authorized to purchase up

to $100 million of its common stock. The repurchase authorization

does not have an expiration date and may be terminated by the

Company’s Board of Directors at any time.

The Company may repurchase shares from time to time through open

market transactions, certain of which may be made pursuant to a

trading plan meeting the requirements of Rule 10b-18 under the

Securities Exchange Act of 1934, as amended, in compliance with

applicable state and federal securities laws. The timing, as well

as the number and value of shares repurchased under the program,

will be determined by the Company at its discretion and will depend

on a variety of factors, including our assessment of the intrinsic

value of the Company’s common stock, the market price of the

Company’s common stock, general market and economic conditions,

available liquidity, compliance with the Company’s debt and other

agreements, applicable legal requirements, the nature of other

investment opportunities available to the Company, and other

considerations. The Company is not obligated to purchase any shares

under the repurchase program, and the program may be suspended,

modified, or discontinued at any time without prior notice. No

assurance can be given that any particular amount of common stock

will be repurchased. The Company expects to fund the repurchases by

using cash on hand and expected free cash flow to be generated in

the future.

About Janus International Group

Janus International Group, Inc. (www.JanusIntl.com) is a leading

global manufacturer and supplier of turn-key self-storage,

commercial and industrial building solutions, including: roll-up

and swing doors, hallway systems, relocatable storage units and

facility and door automation technologies. The Janus team operates

out of several U.S. locations and six locations

internationally.

Conference Call and Webcast

The Company will host a conference call and webcast to review

results, discuss long-term outlook and conduct a

question-and-answer session on Wednesday, February 28, 2024, at

10:00 a.m. Eastern time. The live webcast and archived replay of

the conference call can be accessed on the Investors section of the

Company’s website at www.janusintl.com. For those unable to access

the webcast, the conference call will be accessible domestically or

internationally, by dialing 1-877-407-0789 or 1-201-689-8562,

respectively. Upon dialing in, please request to join the Janus

International Group Fourth Quarter 2023 Earnings Conference Call.

To access the replay of the call, dial 1-844-512-2921 (Domestic)

and 1- 412-317-6671 (International) with pass code 13743925.

Forward Looking Statements

Certain statements in this communication, including the

estimated guidance provided under “2024 Financial Outlook” and

under “Reaffirms Long Term Financial Targets” herein, may be

considered “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. All

statements other than statements of historical fact included in

this communication are forward-looking statements, including, but

not limited to statements regarding Janus’s belief regarding the

demand outlook for Janus’s products and the strength of the

industrials markets. When used in this communication, words such as

“may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,”

“believe,” “estimate,” “continue,” or the negative of such terms or

other similar expressions, as they relate to the management team,

identify forward-looking statements. Such forward-looking

statements are based on the current beliefs of Janus’s management,

based on currently available information, as to the outcome and

timing of future events, and involve factors, risks, and

uncertainties that may cause actual results in future periods to

differ materially from such statements. In addition to factors

previously disclosed in Janus’s reports filed with the SEC and

those identified elsewhere in this communication, the following

factors, among others, could cause actual results to differ

materially from forward-looking statements or historical

performance: (i) risks of the self-storage industry; (ii) the

highly competitive nature of the self-storage industry and Janus’s

ability to compete therein; (iii) litigation, complaints, and/or

adverse publicity; (iv) cyber incidents or directed attacks that

could result in information theft, data corruption, operational

disruption, and/or financial loss; (v) the risk that our share

repurchase program will be fully consummated or that it will

enhance shareholder value; and (vi) the risk that the demand

outlook for Janus’s products may not be as strong as anticipated.

There can be no assurance that the events, results, trends or

guidance regarding financial outlook identified in these

forward-looking statements will occur or be achieved.

Forward-looking statements speak only as of the date they are made,

and Janus is not under any obligation and expressly disclaims any

obligation, to update, alter, or otherwise revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by law. This

communication is not intended to be all-inclusive or to contain all

the information that a person may desire in considering an

investment in Janus and is not intended to form the basis of an

investment decision in Janus. All subsequent written and oral

forward-looking statements concerning Janus or other matters and

attributable to Janus or any person acting on its behalf are

expressly qualified in their entirety by the cautionary statements

above and under the heading “Risk Factors” in Janus’s most recently

filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q,

as updated from time to time in amendments and its subsequent

filings with the SEC.

Non-GAAP Financial Measures

Janus uses measures of performance that are not required by or

presented in accordance with GAAP in the United States. Non-GAAP

financial performance measures are used to supplement the financial

information presented on a GAAP basis. These non-GAAP financial

measures should not be considered in isolation or as a substitute

for the relevant GAAP measures and should be read in conjunction

with information presented on a GAAP basis.

Adjusted EBITDA and Adjusted Net Income are non-GAAP financial

measures used by Janus to evaluate its operating performance,

generate future operating plans, and make strategic decisions,

including those relating to operating expenses and the allocation

of internal resources. Accordingly, Janus believes Adjusted EBITDA

and Adjusted Net Income provide useful information to investors and

others in understanding and evaluating Janus’s operating results in

the same manner as its management and board of directors and in

comparison with Janus’s peer group companies. In addition, Adjusted

EBITDA and Adjusted Net Income provide useful measures for

period-to-period comparisons of Janus’s business, as they remove

the effect of certain non-recurring events and other non-recurring

charges, such as acquisitions, and certain variable or

non-recurring charges. Adjusted EBITDA is defined as net income

excluding interest expense, income taxes, depreciation expense,

amortization, and other non-operational, non-recurring items.

Adjusted Net Income is defined as net income plus the corresponding

tax-adjusted add-backs shown in the Adjusted EBITDA

reconciliation.

Please note that the Company has not provided the most directly

comparable GAAP financial measure, or a quantitative reconciliation

thereto, for the Adjusted EBITDA forward-looking guidance for 2024

and long-term outlook included in this communication in reliance on

the "unreasonable efforts" exception provided under Item

10(e)(1)(i)(B) of Regulation S-K. Providing the most directly

comparable GAAP financial measure, or a quantitative reconciliation

thereto, cannot be done without unreasonable effort due to the

inherent uncertainty and difficulty in predicting certain non-cash,

material and/or non-recurring expenses or benefits, legal

settlements or other matters, and certain tax positions. Because

these adjustments are inherently variable and uncertain and depend

on various factors that are beyond the Company's control, the

Company is also unable to predict their probable significance. The

variability of these items could have an unpredictable, and

potentially significant, impact on our future GAAP financial

results.

Adjusted EBITDA and Adjusted Net Income should not be considered

in isolation of, or as an alternative to, measures prepared in

accordance with GAAP. There are a number of limitations related to

the use of Adjusted EBITDA and Adjusted Net Income rather than net

income (loss), which is the nearest GAAP equivalent of Adjusted

EBITDA and Adjusted Net Income. These limitations include that the

non-GAAP financial measures: exclude depreciation and amortization,

and although these are non-cash expenses, the assets being

depreciated may be replaced in the future; do not reflect interest

expense, or the cash requirements necessary to service interest on

debt, which reduces cash available; do not reflect the provision

for or benefit from income tax that may result in payments that

reduce cash available; exclude non-recurring items (i.e., the

extinguishment of debt); and may not be comparable to similar

non-GAAP financial measures used by other companies, because the

expenses and other items that Janus excludes in the calculation of

these non-GAAP financial measures may differ from the expenses and

other items, if any, that other companies may exclude from these

non-GAAP financial measures when they report their operating

results. Because of these limitations, these non-GAAP financial

measures should be considered along with other operating and

financial performance measures presented in accordance with

GAAP.

Janus International Group, Inc.

Consolidated Statements of Operations

and Comprehensive Income (Loss)

(In millions except share and per share

data)

Three Months Ended

(Unaudited)

Year Ended

December 30, 2023

December 31, 2022

December 30, 2023

December 31, 2022

REVENUES

Product revenues

$

223.7

$

236.4

$

909.8

$

890.9

Service revenues

40.0

43.3

156.6

128.6

Total Revenues

$

263.7

$

279.7

$

1,066.4

$

1,019.5

Product cost of revenues

120.3

138.2

500.8

557.1

Service cost of revenues

29.1

33.9

115.9

97.5

Cost of Revenues

$

149.4

$

172.1

$

616.7

$

654.6

GROSS PROFIT

$

114.3

$

107.6

$

449.7

$

364.9

OPERATING EXPENSE

Selling and marketing

16.2

16.1

65.5

58.3

General and administrative

34.2

32.9

138.5

119.1

Operating Expenses

$

50.4

$

49.0

$

204.0

$

177.4

INCOME FROM OPERATIONS

$

63.9

$

58.6

$

245.7

$

187.5

Interest expense

(14.7

)

(13.4

)

(60.0

)

(42.0

)

Loss on extinguishment and modification of

debt

—

—

(3.9

)

—

Other income (expense)

—

0.1

1.0

(0.2

)

Other Expense, Net

$

(14.7

)

$

(13.3

)

$

(62.9

)

$

(42.2

)

INCOME BEFORE TAXES

$

49.2

$

45.3

$

182.8

$

145.3

Provision for Income Taxes

13.4

12.6

47.1

37.6

NET INCOME

$

35.8

$

32.7

$

135.7

$

107.7

Other Comprehensive Income (Loss), net

of tax

$

—

$

3.1

$

1.9

$

(3.9

)

COMPREHENSIVE INCOME

$

35.8

$

35.8

$

137.6

$

103.8

Net income attributable to common

stockholders

$

35.8

$

32.7

$

135.7

$

107.7

Weighted-average shares outstanding,

basic and diluted

Basic

146,831,705

146,647,897

146,782,101

146,606,197

Diluted

147,010,309

146,876,935

146,882,057

146,722,866

Net income per share, basic and

diluted

Basic

$

0.24

$

0.22

$

0.92

$

0.73

Diluted

$

0.24

$

0.22

$

0.92

$

0.73

Janus International Group, Inc.

Consolidated Balance Sheets*

(In millions except share and per share

data)

December 30,

December 31,

2023

2022

ASSETS

Current Assets

Cash

$

171.7

$

78.4

Accounts receivable, less allowance for

credit losses of $3.6 and $4.6 as of December 30, 2023 and December

31, 2022, respectively

174.1

155.4

Contract assets

49.7

39.3

Inventories

48.4

67.7

Prepaid expenses

8.4

9.1

Other current assets

10.8

13.3

Total current assets

$

463.1

$

363.2

Right of-use assets, net

50.9

44.3

Property, plant and equipment, net

52.4

42.1

Intangible assets, net

375.3

404.4

Goodwill

368.6

368.2

Deferred tax asset, net

36.8

46.6

Other assets

2.9

1.8

Total assets

$

1,350.0

$

1,270.6

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities

Accounts payable

$

59.8

$

52.3

Billings in excess of costs

26.7

21.4

Current maturities of long-term debt

7.3

8.3

Accrued expenses and other current

liabilities

80.3

70.6

Total current liabilities

$

174.1

$

152.6

Long-term debt, net

607.7

699.9

Deferred tax liability, net

1.7

1.9

Other long-term liabilities

46.9

40.9

Total liabilities

$

830.4

$

895.3

Commitments and Contingencies (Note

20)

STOCKHOLDERS’ EQUITY

Common Stock, 825,000,000 shares

authorized, $0.0001 par value, 146,861,489 and 146,703,894 shares

issued and outstanding at December 30, 2023 and December 31, 2022,

respectively

$

—

$

—

Treasury stock, at cost, 34,297 and zero

shares at December 30, 2023 and December 31, 2022, respectively

(0.4

)

—

Additional paid in capital

289.0

281.9

Accumulated other comprehensive loss

(2.9

)

(4.8

)

Retained earnings

233.9

98.2

Total stockholders’ equity

$

519.6

$

375.3

Total liabilities and stockholders’

equity

$

1,350.0

$

1,270.6

Janus International Group, Inc.

Consolidated Statements of Cash

Flows

(In millions)

Year Ended

December 30, 2023

December 31, 2022

Cash Flows Provided by Operating

Activities

Net income

$

135.7

$

107.7

Adjustments to reconcile net income to

net cash provided by operating activities

Depreciation of property, plant and

equipment

9.3

7.9

Noncash lease expense

6.3

5.4

(Reversal of) provision for inventory

obsolescence

—

(0.7

)

Amortization of intangibles

29.8

29.7

Deferred finance fee amortization

3.6

3.7

(Reversal of) provision for losses on

accounts receivable

(0.7

)

1.7

Share-based compensation

7.1

4.1

Loss on extinguishment of debt

1.6

—

Loss (gain) on sale of assets

0.1

(0.1

)

Loss on abandonment of lease

—

0.6

(Gain) loss on equity method

investment

—

(0.2

)

Deferred income taxes, net

9.5

13.5

Changes in operating assets and

liabilities

Accounts receivable

(17.4

)

(50.1

)

Contract assets

(10.3

)

(16.1

)

Inventories

19.4

(10.3

)

Prepaid expenses and other current

assets

4.1

(8.5

)

Other long-term assets

(1.9

)

(12.3

)

Accounts payable

7.3

(2.7

)

Billings in excess of costs

5.0

(1.8

)

Accrued expenses and other current

liabilities

10.0

7.7

Other long-term liabilities

(3.5

)

9.3

Net Cash Provided by Operating

Activities

$

215.0

$

88.5

Cash Flows Used in Investing

Activities

Proceeds from sale of equipment

$

0.1

$

0.1

Purchases of property and equipment

(19.0

)

(8.8

)

Cash paid for acquisitions, net of cash

acquired

(1.0

)

—

Net Cash Used in Investing

Activities

$

(19.9

)

$

(8.7

)

Cash Flows (Used in) Financing

Activities

(Payments on) proceeds from line of

credit

$

—

$

(6.4

)

Principal payments on long-term debt

(428.5

)

(8.1

)

Principal payments on finance lease

obligations

(0.7

)

(0.2

)

Proceeds from issuance of long-term

debt

337.6

—

Payments for deferred financing fees

(10.8

)

—

Cash (Used in) Financing

Activities

$

(102.4

)

$

(14.7

)

Effect of exchange rate changes on

cash

$

0.6

$

0.1

Net Increase in Cash

$

93.3

$

65.2

Cash, Beginning of Fiscal Year

$

78.4

$

13.2

Cash, End of Fiscal Year

$

171.7

$

78.4

Supplemental Cash Flows

Information

Interest paid

$

43.4

$

40.9

Income taxes paid

$

33.9

$

33.4

Cash paid for operating leases included in

operating activities

$

8.4

$

7.7

Non-cash investing and financing

activities

Right-of-use assets obtained in exchange

for operating lease obligations

$

9.5

$

48.4

Right-of-use assets obtained in exchange

for finance lease obligations

$

3.1

$

1.2

RSU Shares withheld related to employee

taxes

$

0.4

$

—

Property, plant and equipment obtained in

exchange for operating lease obligations

$

1.6

$

—

Janus International Group, Inc.

Revenue by Sales Channel

(In millions)

Quarter Ended

Quarter Ended

Variance

December 30, 2023

% of revenues

December 31, 2022

% of revenues

$

%

New Construction - Self Storage

$

103.1

39.1

%

$

90.2

32.2

%

$

12.9

14.3

%

R3 - Self Storage

82.4

31.2

%

90.7

32.4

%

(8.3

)

(9.1

) %

Self Storage

$

185.5

70.3

%

$

181.0

64.7

%

$

4.5

2.5

%

Commercial and Other

78.2

29.7

%

98.7

35.3

%

(20.5

)

(20.8

) %

Total

$

263.7

100.0

%

$

279.7

100.0

%

$

(16.0

)

(5.7

) %

Year Ended

Year Ended

Variance

December 30, 2023

% of revenues

December 31, 2022

% of revenues

$

%

New Construction - Self Storage

$

394.9

37.0

%

$

323.4

31.7

%

$

71.5

22.1

%

R3 - Self Storage

334.9

31.4

%

321.1

31.5

%

13.8

4.3

%

Self Storage

$

729.8

68.4

%

$

644.5

63.2

%

$

85.3

13.2

%

Commercial and Other

336.6

31.6

%

375.0

36.8

%

(38.4

)

(10.2

) %

Total

$

1,066.4

100.0

%

$

1,019.5

100.0

%

$

46.9

4.6

%

Janus International Group, Inc.

Reconciliation of Net Income to

Adjusted EBITDA*

(In millions)

Three Months Ended

Variance

December 30, 2023

December 31, 2022

$

%

Net Income

$

35.8

$

32.7

$

3.1

9.5

%

Interest expense

14.7

13.4

1.3

9.7

%

Income taxes

13.4

12.6

0.8

6.3

%

Depreciation

2.7

2.1

0.6

28.6

%

Amortization

7.5

7.4

0.1

1.4

%

EBITDA

$

74.1

$

68.2

$

5.9

8.7

%

Restructuring charges(3)

0.2

—

0.2

100.0

%

Adjusted EBITDA

$

74.3

$

68.2

$

6.1

8.9

%

Year Ended

Variance

December 30, 2023

December 31, 2022

$

%

Net Income

$

135.7

$

107.7

$

28.0

26.0

%

Interest expense

60.0

42.0

18.0

42.9

%

Income taxes

47.1

37.6

9.5

25.3

%

Depreciation

9.3

7.9

1.4

17.7

%

Amortization

29.8

29.7

0.1

0.3

%

EBITDA

$

281.9

$

224.9

$

57.0

25.3

%

Loss on extinguishment and modification of

debt(1)

3.9

—

3.9

100.0

%

COVID-19 related expenses(2)

—

0.1

(0.1

)

(100.0

) %

Restructuring charges(3)

1.2

1.1

0.1

9.1

%

Acquisition expense(4)

(1.4

)

0.8

(2.2

)

(275.0

) %

Adjusted EBITDA

$

285.6

$

226.9

$

58.7

25.9

%

(1)

Adjustment for loss on

extinguishment and modification of debt regarding the write off of

unamortized fees and third-party fees as a result of the debt

modification completed in August 2023.

(2)

Adjustment consists of signage,

cleaning and supplies to maintain work environments necessary to

adhere to CDC guidelines during the COVID-19 pandemic.

(3)

Adjustments consist of the

following: 1) facility relocations, and 2) severance and hiring

costs associated with our strategic transformation, including

executive leadership team changes, strategic business assessment

and transformation projects.

(4)

Income or expenses related to the

transition services agreement and legal settlement for an

acquisition.

*Janus uses measures of

performance that are not required by or presented in accordance

with GAAP in the United States. Non-GAAP financial performance

measures are used to supplement the financial information presented

on a GAAP basis. These non-GAAP financial measures should not be

considered in isolation or as a substitute for the relevant GAAP

measures and should be read in conjunction with information

presented on a GAAP basis.

Janus International Group, Inc.

Reconciliation of Net Income to

Non-GAAP Adjusted Net Income*

(In millions)

Three Months Ended

December 30, 2023

December 31, 2022

Net Income

$

35.8

$

32.7

Net Income Adjustments(1)

0.2

—

Tax Effect Non-GAAP on Net Income

Adjustments(2)

(0.1

)

—

Non-GAAP Adjusted Net Income

$

35.9

$

32.7

Year Ended

December 30, 2023

December 31, 2022

Net Income

$

135.7

$

107.7

Net Income Adjustments(1)

3.7

2.0

Tax Effect Non-GAAP on Net Income

Adjustments(2)

(1.0

)

(0.5

)

Non-GAAP Adjusted Net Income

$

138.4

$

109.2

(1)

Refer to SEC public filings for

detailed breakout. This amount reconciles to the EBITDA

Adjustments/Non-GAAP Adjustments in the Reconciliation of Net

Income to Adjusted EBITDA table above.

(2)

Tax effected for the net income

adjustments. Used effective tax rates 27.2% and 27.8% for the three

months ended December 30, 2023 and December 31, 2022, respectively,

and 25.8% and 25.9% for the years ended December 30, 2023 and

December 31, 2022, respectively.

Janus International Group, Inc.

Non-GAAP Adjusted EPS*

(In Millions)

Three Months Ended

December 30, 2023

December 31, 2022

Numerator:

GAAP Net Income

$

35.8

$

32.7

Non-GAAP Adjusted Net Income

$

35.9

$

32.7

Denominator:

Weighted average number of shares:

Basic

146,831,705

146,647,897

Adjustment for Dilutive Securities

178,604

229,038

Diluted

147,010,309

146,876,935

GAAP Basic EPS

$

0.24

$

0.22

GAAP Diluted EPS

$

0.24

$

0.22

Non-GAAP Adjusted Basic EPS

$

0.24

$

0.22

Non-GAAP Adjusted Diluted EPS

$

0.24

$

0.22

*Janus uses measures of performance that

are not required by or presented in accordance with GAAP in the

United States. Non-GAAP financial performance measures are used to

supplement the financial information presented on a GAAP basis.

These non-GAAP financial measures should not be considered in

isolation or as a substitute for the relevant GAAP measures and

should be read in conjunction with information presented on a GAAP

basis.

Year Ended

December 30, 2023

December 31, 2022

Numerator:

GAAP Net Income

$

135.7

$

107.7

Non-GAAP Adjusted Net Income

$

138.4

$

109.2

Denominator:

Weighted average number of shares:

Basic

146,782,101

146,606,197

Adjustment for Dilutive Securities

99,956

116,669

Diluted

146,882,057

146,722,866

GAAP Basic EPS

$

0.92

$

0.73

GAAP Diluted EPS

$

0.92

$

0.73

Non-GAAP Adjusted Basic EPS

$

0.94

$

0.74

Non-GAAP Adjusted Diluted EPS

$

0.94

$

0.74

Janus International Group, Inc.

Non-GAAP Free Cash Flow

Conversion*

(In thousands)

Three Months Ended

December 30, 2023

December 31, 2022

Cash flow from operating

activities

$

68.5

$

25.9

Less: capital expenditure

(5.5

)

(1.0

)

Free cash flow

$

63.0

$

24.9

Non-GAAP Adjusted Net Income

$

35.9

$

32.7

Free cash flow conversion of Non-GAAP

Adjusted Net Income

175

%

76

%

Year Ended

December 30, 2023

December 31, 2022

Cash flow from operating

activities

$

215.0

$

88.5

Less: capital expenditure

(19.0

)

(8.8

)

Free cash flow

$

196.0

$

79.7

Non-GAAP Adjusted Net Income

$

138.4

$

109.2

Free cash flow conversion of Non-GAAP

Adjusted Net Income

142

%

73

%

*Janus uses measures of performance that

are not required by or presented in accordance with GAAP in the

United States. Non-GAAP financial performance measures are used to

supplement the financial information presented on a GAAP basis.

These non-GAAP financial measures should not be considered in

isolation or as a substitute for the relevant GAAP measures and

should be read in conjunction with information presented on a GAAP

basis.

Source: Janus International Group, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240228505958/en/

Investor Contact John Rohlwing Vice President, Investor

Relations FP&A & M&A, Janus International

IR@janusintl.com (770) 562- 6399

Media Contact Suzanne Reitz Vice President of Marketing,

Janus International 770-746-9576 Marketing@Janusintl.com

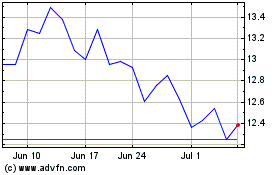

Janus (NYSE:JBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Janus (NYSE:JBI)

Historical Stock Chart

From Nov 2023 to Nov 2024